Home>Finance>How Much Negative Equity Will A Bank Finance On A New Car

Finance

How Much Negative Equity Will A Bank Finance On A New Car

Published: January 3, 2024

Discover how much negative equity a bank will finance on a new car. Learn about financing options and find out if you can get the funds you need.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on negative equity and how it relates to financing a new car. When considering purchasing a new vehicle, it is crucial to understand the concept of negative equity and how it can impact your ability to secure financing from a bank or lender.

Negative equity, also known as an upside-down loan or an underwater loan, occurs when the amount owed on a vehicle exceeds its current market value. This can happen for various reasons, such as depreciation, outstanding loan balances, or high interest rates.

When it comes to financing a new car, banks play a pivotal role in determining how much they are willing to finance based on the value of the vehicle and the borrower’s financial situation. Understanding the factors that influence a bank’s decision is essential in navigating the process and ensuring you secure the necessary funds for your purchase.

In this article, we will explore the various factors that banks consider when evaluating negative equity in relation to financing a new car. By having a clear understanding of these factors, you can take the necessary steps to improve your chances of securing financing and make an informed decision when purchasing a new vehicle.

Definition of Negative Equity

Negative equity refers to a situation where the outstanding balance on a loan is higher than the current market value of an asset, such as a car. In the context of car financing, negative equity occurs when the amount owed on a vehicle loan surpasses the car’s actual worth.

There are several factors that can contribute to negative equity in car financing. First and foremost, depreciation plays a significant role. As soon as a new car is driven off the lot, its value begins to decline. In the early years of ownership, a car’s value can depreciate rapidly, and if the loan term is relatively long, this can lead to negative equity.

Additionally, high-interest rates or lengthy loan terms can contribute to negative equity. If the interest rate on the loan is high or the repayment period is extended, it can result in a slower reduction of the principal balance. As a result, the car’s actual value may not keep up with the pace of the loan repayment, leading to negative equity.

It is important to note that negative equity is not inherently problematic unless you decide to sell or trade in your vehicle before paying off the loan. In such scenarios, you may find yourself in a situation where you owe more on the loan than the car is worth, causing financial difficulties.

Understanding negative equity is crucial when considering financing a new car. Banks and lenders take this into account when evaluating loan applications, as it directly impacts the risk they are taking by providing financing. By comprehending the concept of negative equity, you can strategize and make informed decisions to minimize its effect on your car financing.

Factors Influencing a Bank’s Financing Decision

When it comes to financing a new car, several factors influence a bank’s decision on how much financing they are willing to provide. Understanding these factors can help you navigate the process and increase your chances of securing the necessary funds for your purchase.

1. Loan-to-Value Ratio (LTV): The loan-to-value ratio is the ratio of the loan amount to the appraised value of the car. Banks typically have a maximum LTV ratio they are willing to finance. If the negative equity on your trade-in vehicle or the difference between the loan amount and the car’s value exceeds the bank’s LTV limit, it can affect your ability to secure financing.

2. Credit Score and History: Your credit score and credit history are crucial factors that banks consider when determining the terms of your financing. A higher credit score and a positive credit history demonstrate your ability to repay loans responsibly and increase your chances of securing better financing terms.

3. Income and Debt-to-Income Ratio: Banks assess your income and debt-to-income ratio to ensure you have the financial capacity to meet your loan obligations. A higher income and a lower debt-to-income ratio can positively influence a bank’s decision, as it demonstrates your ability to manage your finances effectively.

4. Loan Term and Interest Rate: The loan term and interest rate can impact the amount of financing a bank is willing to provide. Longer loan terms or higher interest rates may result in higher monthly payments and a longer period to repay the loan, which affects the bank’s risk assessment.

5. Down Payment and Trade-in Value: Offering a larger down payment or having a trade-in vehicle with positive equity can reduce the negative equity and improve your chances of securing financing. It demonstrates your commitment to the purchase and lowers the amount you need to borrow.

6. Manufacturer’s Incentives and Rebates: The availability of manufacturer’s incentives and rebates can impact the bank’s financing decision. These incentives can reduce the overall purchase price of the vehicle, which can help offset some of the negative equity and improve your financing options.

It’s important to note that each bank may have its own criteria and policies when it comes to financing decisions. Shopping around and comparing offers from different lenders can help you find the best financing terms tailored to your situation.

By understanding these factors and taking the necessary steps to improve your financial standing, you can increase your chances of securing favorable financing to purchase your new car.

Loan-to-Value Ratio (LTV)

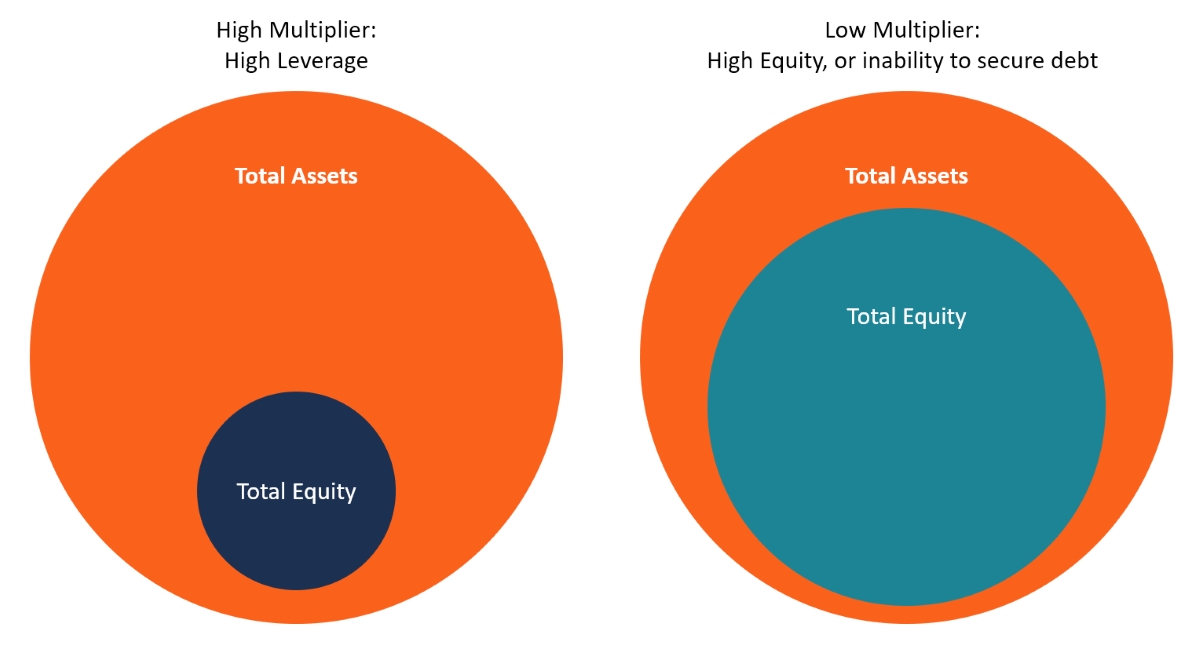

The loan-to-value ratio (LTV) is a crucial aspect that banks consider when financing a new car. LTV is the ratio of the loan amount to the appraised value of the vehicle. It helps determine the amount the bank is willing to finance based on the car’s value.

When dealing with negative equity, the LTV ratio becomes particularly important. If the amount owed on your trade-in vehicle or the difference between the loan amount and the car’s value exceeds the bank’s LTV limit, it can impact your ability to secure financing.

For example, suppose the appraised value of a car is $20,000 and the bank has an LTV limit of 80%. This means they are willing to finance up to 80% of the car’s value, which amounts to $16,000. If the outstanding loan balance or negative equity is higher than $16,000, you may have difficulty securing financing for the full amount.

In situations where the negative equity exceeds the LTV limit, you have a few options. Firstly, you can consider reducing the negative equity by making a larger down payment upfront. By contributing more money upfront, you can lower the loan amount required, thus reducing the negative equity and potentially meeting the bank’s financing requirements.

Another option is to negotiate with the bank or lender. Explain your situation, demonstrate your commitment to repaying the loan, and provide supporting documents to support your case. Some banks may be willing to make exceptions or offer alternative financing options to accommodate negative equity scenarios.

It’s important to note that the LTV ratio is not the only factor banks consider when assessing loan eligibility. Other factors, such as credit score, income, and debt-to-income ratio, also play a significant role. Maintaining a good credit standing and demonstrating financial stability can positively influence the bank’s decision, even in the presence of negative equity.

Understanding the LTV ratio and its impact on financing can help you make informed decisions when purchasing a new car. By exploring different options, negotiating with lenders, and actively working towards reducing negative equity, you can improve your chances of securing the necessary funds to purchase your desired vehicle.

Credit Score and History

When it comes to financing a new car, your credit score and credit history play a crucial role in the bank’s decision-making process. These factors help lenders assess your creditworthiness and determine the terms and conditions of the loan.

Your credit score is a numerical representation of your creditworthiness, ranging from 300 to 850 (depending on the scoring model used). Lenders use this score to evaluate the risk of lending you money. A higher credit score indicates a lower risk, increasing your chances of securing favorable financing terms.

In addition to your credit score, lenders also review your credit history. This includes information about your past and current loans, credit cards, and payment history. A positive credit history, characterized by on-time payments and responsible credit management, reflects well on your ability to repay loans.

Having a good credit score and a positive credit history can provide several benefits when financing a new car:

1. Competitive Interest Rates: Lenders typically offer lower interest rates to borrowers with higher credit scores. This can result in significant savings over the life of the loan.

2. Higher Loan Amounts: With a strong credit history, lenders may be more willing to finance a larger portion of the car’s value or consider providing a larger loan amount.

3. Better Loan Terms: A good credit standing can lead to more favorable loan terms, such as longer repayment periods or lower monthly payments.

4. Faster Loan Approval: Lenders often prioritize borrowers with good credit, resulting in a faster loan approval process and quicker access to funds.

If your credit score is less than ideal or you have a limited credit history, there are steps you can take to improve your creditworthiness:

– Pay your bills on time and in full to establish a positive payment history.

– Keep your credit card balances low and avoid maxing out your credit limits.

– Avoid applying for multiple credit cards or loans within a short period, as it can negatively impact your credit score.

– Regularly monitor your credit report for errors and dispute any inaccuracies promptly.

It is important to note that while a good credit score and history can positively influence the bank’s decision, they are not the sole determining factors. Lenders also consider other aspects, such as income, debt-to-income ratio, and the specific loan requirements.

By maintaining a good credit score and building a positive credit history, you can improve your chances of securing favorable financing options when purchasing a new car.

Income and Debt-to-Income Ratio

When it comes to financing a new car, lenders consider your income and debt-to-income ratio as key factors in determining your eligibility for a loan. These factors help lenders assess your ability to manage your existing debts and take on additional financial obligations.

Your income plays a crucial role in the bank’s decision. It demonstrates your capacity to repay the loan and covers your monthly expenses. A higher income can increase your chances of securing financing, as it provides assurance to the lender that you have the means to make timely payments.

Another factor that lenders consider is your debt-to-income ratio (DTI). This is the ratio of your monthly debt payments to your monthly income. It helps lenders gauge your financial obligations and whether you can handle the additional debt repayment associated with a car loan.

A lower debt-to-income ratio is generally more favorable, as it indicates that you have more disposable income available to meet your repayment obligations. Lenders typically prefer borrowers with a DTI ratio of 43% or lower, although this threshold may vary depending on the lender and loan program.

To calculate your DTI ratio, add up all your monthly debt payments (including credit cards, student loans, mortgages, and other loans) and divide it by your monthly gross income. For example, if your total monthly debt payments amount to $1,500 and your gross monthly income is $5,000, your DTI ratio would be 30% (1500/5000 x 100).

Having a lower DTI ratio can positively impact your financing options. However, even if your ratio is higher, you can still take steps to improve your chances of securing financing:

– Prioritize paying off high-interest debt or reducing outstanding balances to lower your monthly debt obligations.

– Increase your income through additional sources of employment or exploring ways to enhance your earning potential.

– Consider extending the loan term, which can lower your monthly payments and improve your DTI ratio.

It’s important to note that income and DTI ratio are not the only factors considered by lenders. They also evaluate your credit score, credit history, employment stability, and other financial factors. Demonstrating stability and responsible financial management can strengthen your loan application, even if your current income or DTI ratio may be higher.

By being mindful of your income, managing your debts responsibly, and working towards improving your financial standing, you can increase your chances of securing the necessary financing to purchase a new car.

Loan Term and Interest Rate

The loan term and interest rate are important factors to consider when financing a new car. These factors not only impact the total cost of the loan but also affect your monthly payments and overall financial commitment. Understanding the relationship between loan term, interest rate, and your financial goals is crucial in making an informed financing decision.

The loan term refers to the length of time you have to repay the loan. Common loan terms for car financing range from 36 to 72 months, although longer terms may also be available. A longer loan term typically results in lower monthly payments but may also lead to a higher total cost over time due to interest accumulation. Conversely, a shorter loan term can lead to higher monthly payments, but you may pay less in interest overall.

The interest rate, expressed as a percentage, determines the cost of borrowing money. The rate is influenced by factors such as your credit score, credit history, market conditions, and the lender’s policies. A lower interest rate can save you money over the life of the loan, while a higher interest rate can increase your total loan cost.

When choosing a loan term and interest rate, it is important to consider your financial circumstances and goals:

1. Affordability: Assess your monthly budget and determine the maximum amount you can comfortably afford to allocate towards loan payments. Longer loan terms can lower monthly payments, making them more manageable, but consider the total cost of the loan over time.

2. Total Cost: Calculate the total cost of the loan by considering both the principal amount and the interest paid over the loan term. Compare different loan options to identify the most cost-effective solution.

3. Financial Stability: Evaluate your job security and overall financial stability. Opting for a shorter loan term with higher monthly payments may be more suitable if you have a stable income and want to pay off the loan quicker.

4. Future Plans: Consider your future plans, such as potential changes in income, career advancements, or major life events. Assess how the term and rate will align with your long-term financial goals.

It’s important to shop around and compare loan offers from different lenders. Don’t solely focus on the interest rate but also consider other factors, such as loan terms, fees, and customer service quality.

By carefully assessing your financial situation and weighing the trade-offs between loan terms and interest rates, you can choose a financing option that aligns with your needs and helps you achieve your financial goals.

Down Payment and Trade-in Value

The down payment and trade-in value are significant factors to consider when financing a new car. They can impact the overall cost of the loan, the monthly payments, and your ability to secure financing. Understanding how these factors play a role can help you make informed decisions during the car buying process.

A down payment is a cash payment made upfront towards the purchase of the vehicle. It reduces the loan amount, which, in turn, lowers the total cost of the loan and the monthly payments. A larger down payment can also demonstrate financial stability to lenders and increase your chances of qualifying for a loan.

When deciding on a down payment amount, consider your budget and financial goals. While there may not be a set requirement, it is generally recommended to put down at least 10-20% of the car’s purchase price. However, putting down a larger down payment can provide several benefits:

1. Lower Loan Amount: A larger down payment reduces the loan amount, potentially decreasing the negative equity and improving your financing options.

2. Lower Monthly Payments: By reducing the loan amount, you can enjoy lower monthly payments, making the loan more manageable within your budget.

3. Improved Interest Rates: With a larger down payment, lenders may offer more favorable interest rates, resulting in potential interest savings over the life of the loan.

Trade-in value refers to the worth of your current vehicle, which is deducted from the purchase price of the new car. If there is positive equity in your trade-in, meaning its value exceeds the outstanding loan balance, you can use it as a down payment for your new car. On the other hand, if there is negative equity, the difference between the trade-in value and the loan balance will add to the overall loan amount.

It is crucial to research and know the trade-in value of your vehicle before heading to the dealership. Websites or resources such as Kelley Blue Book and NADA Guides can provide estimates based on factors such as make, model, year, mileage, and condition of your trade-in vehicle.

By having a clear understanding of your down payment and trade-in options, you can effectively plan and negotiate with lenders and dealerships. If you are unsure about the trade-in value or want to maximize its potential, consider getting multiple trade-in appraisals or seeking independent offers to ensure you are getting a fair assessment.

Remember, both the down payment and trade-in value contribute to your financing process, and they can significantly impact your loan terms and overall affordability. By making a well-informed decision and considering these factors, you can work towards securing favorable financing for your new car.

Manufacturer’s Incentives and Rebates

Manufacturer’s incentives and rebates are important factors to consider when financing a new car. These incentives, typically offered by car manufacturers, can significantly impact the overall cost of the vehicle and your financing options.

Manufacturers often provide incentives and rebates to encourage car sales and attract buyers. These incentives can take various forms, such as cash-back offers, discounted financing rates, or special lease terms. They can help offset the purchase price of the vehicle and potentially reduce the negative equity associated with financing a new car.

When evaluating manufacturer’s incentives and rebates, it’s important to consider the following:

1. Cash-Back Offers: Cash-back incentives provide buyers with a certain amount of money that can be applied towards the down payment or used to reduce the loan amount. This can help lower the negative equity and improve your financing terms.

2. Discounted Financing Rates: Manufacturers may offer special financing rates, such as 0% APR or low-interest financing, to eligible buyers. These rates can significantly save you money over the life of the loan and make financing more affordable.

3. Lease Specials: If you are considering leasing a vehicle, manufacturers often offer attractive lease terms and incentives. These can include lowered monthly payments, reduced upfront costs, or higher mileage allowances. Lease incentives can help mitigate negative equity concerns and make leasing an appealing option.

It is essential to research and stay informed about current manufacturer incentives and rebates. Car manufacturer websites, dealer advertisements, and automotive news sources can provide details on the latest offers and promotions available.

When negotiating with a dealer, be sure to inquire about any available incentives or rebates that may apply to your purchase. Understand the terms and eligibility requirements associated with these incentives to determine how they can positively impact your financing situation.

Keep in mind that manufacturer incentives and rebates may vary regionally or change over time. Therefore, it is advisable to check for any restrictions, expiration dates, and specific conditions that apply to the offers.

By taking advantage of manufacturer’s incentives and rebates, you can potentially reduce the overall cost of the vehicle, minimize negative equity concerns, and secure more beneficial financing terms. Be proactive in researching and utilizing these incentives, as they can provide significant savings and improve your overall car buying experience.

Negotiating with the Bank

When it comes to financing a new car, negotiating with the bank can help you secure more favorable loan terms and potentially mitigate negative equity concerns. Here are some essential tips to consider when negotiating with the bank:

1. Shop Around: Don’t settle for the first financing offer you receive. Shop around and compare loan terms, interest rates, and incentives from different banks and financial institutions. This will give you a better understanding of the options available and empower you to negotiate effectively.

2. Know Your Creditworthiness: Understand your credit score, credit history, and financial standing before approaching the bank. A good credit score demonstrates your creditworthiness and can give you more leverage during negotiations.

3. Highlight Your Positive Financial Factors: If you have positive financial factors, such as a stable income, low debt-to-income ratio, or a significant down payment, emphasize these aspects during the negotiation process. This can strengthen your position and justify more favorable loan terms.

4. Prepare Documentation: Gather all necessary documents, such as proof of income, bank statements, and credit reports, to support your case. Having these documents readily available can demonstrate your organization and financial responsibility, making a positive impression on the bank.

5. Negotiate Interest Rates: Negotiating a lower interest rate can save you a significant amount of money over the life of the loan. Use competitor offers and market research to support your request for a better rate. Be prepared to provide explanations and evidence to justify why you deserve a lower rate.

6. Discuss Loan Terms: Explore different loan term options and discuss them with the bank. Shorter loan terms can often result in lower interest rates and overall loan costs. Find the right balance between comfortable monthly payments and an optimal loan term based on your financial situation.

7. Consider Pre-Approval: Obtaining pre-approval from the bank before visiting the dealership can give you a better understanding of your financing options and strengthen your negotiating position. Pre-approval shows the dealer that you are a serious buyer and can expedite the process.

8. Be Willing to Walk Away: If the bank is unwilling to meet your negotiation requests or offers unfavorable terms, be prepared to walk away. Remember that you have the power to seek alternative financing options or explore other dealerships willing to meet your needs.

Remember, negotiating with the bank is a two-way process. Be confident, well-prepared, and willing to advocate for your best interest. By presenting yourself as a knowledgeable and responsible borrower, you can increase your chances of securing more favorable financing terms and minimizing the impact of negative equity.

Conclusion

Securing financing for a new car with negative equity can be challenging, but by understanding the factors that influence a bank’s decision, you can navigate the process more effectively. The loan-to-value ratio, credit score and history, income and debt-to-income ratio, loan term and interest rate, down payment and trade-in value, and manufacturer’s incentives and rebates all play a crucial role in determining your financing options.

By strategically managing these factors, you can improve your chances of securing favorable financing terms. Focus on reducing negative equity through a larger down payment or trade-in value, maintaining a good credit score and history, and demonstrating financial stability through income and debt-to-income ratio. Additionally, explore manufacturer’s incentives and rebates to offset the purchase price and potential negative equity.

When negotiating with the bank, shop around, know your creditworthiness, and be prepared with documentation to support your case. Negotiate interest rates and discuss loan terms that align with your financial goals. And remember, be willing to walk away if the terms offered are not satisfactory.

In conclusion, financing a new car with negative equity requires careful consideration and proactive steps to secure the best possible terms. By understanding the influencing factors, being prepared, and negotiating effectively, you can increase your chances of obtaining the necessary financing and minimize the impact of negative equity on your car purchase.