Finance

How Much Do Pensions Pay?

Modified: March 1, 2024

Discover how much pensions pay and gain insights into finance. Learn about pension payouts and financial planning. Get the information you need to make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Pensions play a crucial role in ensuring financial security during retirement. For many individuals, the prospect of receiving regular pension payments serves as a cornerstone of their retirement planning. Understanding the intricacies of pension plans, including the factors influencing payment amounts, is essential for effectively preparing for the post-employment phase of life.

Pensions are a form of retirement income provided by an employer to employees who have dedicated a significant portion of their working years to the company. The amount of pension payments varies widely and is influenced by several factors, including the type of pension plan, years of service, salary history, and retirement age. These variables can significantly impact the financial well-being of retirees, making it imperative to comprehend the mechanics of pension plans and the determinants of payment amounts.

In this comprehensive guide, we will delve into the world of pensions, exploring the different types of pension plans, the factors that affect pension payments, and how these payments are calculated. By gaining insight into the inner workings of pensions, individuals can make informed decisions and effectively plan for a financially secure retirement. Let's embark on this journey to unravel the mysteries of pension payments and empower ourselves with the knowledge to navigate the complexities of retirement planning.

Understanding Pension Plans

Pension plans are designed to provide a steady stream of income to employees after they retire from the workforce. These plans serve as a form of retirement savings, ensuring that individuals have financial support during their non-working years. Employers typically sponsor pension plans, although some individuals may also contribute to their pensions through individual retirement accounts (IRAs) or other similar arrangements.

There are two primary types of pension plans: defined benefit plans and defined contribution plans. In a defined benefit plan, retirees receive a predetermined amount of money based on factors such as salary history, years of service, and age at retirement. This type of plan offers a predictable income stream, providing retirees with a sense of financial security. On the other hand, defined contribution plans, such as 401(k) accounts, involve contributions from both the employer and the employee, with the ultimate payout depending on the performance of the investment portfolio.

Understanding the nuances of pension plans is essential for individuals planning for retirement. By comprehending the differences between defined benefit and defined contribution plans, individuals can make informed decisions regarding their retirement savings strategies. Moreover, having a clear understanding of how pension plans operate enables individuals to assess the potential income they can expect during retirement, allowing for better financial planning and preparation.

Types of Pension Plans

Pension plans come in various forms, each with its unique features and implications for retirees. Understanding the different types of pension plans is essential for individuals navigating the landscape of retirement benefits and planning for their financial future.

1. Defined Benefit Plans: These traditional pension plans guarantee retirees a specific amount of income based on factors such as salary history, years of service, and age at retirement. The employer bears the investment risk and is responsible for funding the plan to ensure that retirees receive the promised benefits. Defined benefit plans provide a predictable income stream, offering retirees financial security during their non-working years.

2. Defined Contribution Plans: Unlike defined benefit plans, defined contribution plans do not guarantee a specific payout upon retirement. Instead, these plans, such as 401(k) accounts, involve contributions from both the employer and the employee. The ultimate payout depends on the performance of the investment portfolio, making defined contribution plans subject to market fluctuations and investment risks.

3. Cash Balance Plans: Cash balance plans combine elements of both defined benefit and defined contribution plans. These plans feature a hypothetical account balance, with contributions from the employer and sometimes the employee. The account grows through annual interest credits and may offer retirees the option to receive their benefits as a lump sum or an annuity.

4. Individual Retirement Accounts (IRAs): IRAs are personal retirement savings accounts that individuals can establish independently of their employers. Traditional IRAs offer tax-deferred growth on contributions, while Roth IRAs provide tax-free withdrawals in retirement. IRAs offer individuals flexibility and control over their retirement savings, allowing them to make contributions and investment decisions based on their unique financial goals.

By familiarizing themselves with the various types of pension plans, individuals can make informed decisions regarding their retirement savings strategies. Each type of plan has distinct features and implications, and understanding these differences empowers individuals to plan effectively for a financially secure retirement.

Factors Affecting Pension Payments

The amount of pension payments received by retirees is influenced by a multitude of factors, each playing a significant role in determining the level of financial support during retirement. Understanding these factors is crucial for individuals as they plan for their post-employment years and assess their expected income from pension plans.

1. Years of Service: The duration of an employee’s service with a company directly impacts their pension payments. In defined benefit plans, longer tenures often result in higher payouts, reflecting the individual’s commitment to the organization and the corresponding accrual of retirement benefits over time.

2. Salary History: The salary history of an employee, particularly in the years leading up to retirement, can heavily influence pension payments. Defined benefit plans often calculate payouts based on an average of the employee’s earnings over a specified period, with higher salaries translating to increased pension benefits.

3. Age at Retirement: The age at which an individual chooses to retire can affect pension payments. Early retirement may lead to reduced benefits in some pension plans, while delaying retirement could result in higher payouts due to extended years of service and continued contributions to the plan.

4. Type of Pension Plan: The type of pension plan, whether defined benefit or defined contribution, significantly impacts the level of pension payments. Defined benefit plans offer predetermined payouts based on specific formulas, while defined contribution plans yield payments based on the performance of the investment portfolio, subject to market fluctuations and investment risks.

5. Employer Contributions: In defined contribution plans, the contributions made by the employer, often in the form of matching funds, directly influence the size of the retirement nest egg. Higher employer contributions can enhance the growth of the retirement savings, potentially leading to larger pension payments upon retirement.

6. Investment Performance: For individuals with defined contribution plans, the performance of the investment portfolio is a critical factor affecting pension payments. The returns generated by the investments over the years directly impact the size of the retirement fund and, consequently, the level of pension benefits received.

By considering these factors, individuals can gain insight into the dynamics of pension payments and make informed decisions regarding their retirement planning strategies. Understanding how years of service, salary history, retirement age, and the type of pension plan impact pension payments empowers individuals to take proactive steps in securing their financial well-being during retirement.

Average Pension Payments

The average pension payment received by retirees can vary significantly based on several factors, including the type of pension plan, years of service, salary history, and retirement age. Understanding the typical range of pension payments provides valuable insight for individuals planning for retirement and seeking to gauge the level of financial support they can expect during their non-working years.

In the United States, the average pension payment for retirees enrolled in defined benefit plans ranges from approximately $4,000 to $6,000 per month. However, it is important to note that these figures are influenced by various factors, and individual pension payments may fall outside this range based on specific circumstances.

Factors such as years of service and salary history play a pivotal role in determining the average pension payment. Employees who have dedicated a substantial portion of their careers to a company and have earned higher salaries are likely to receive larger pension payments, reflecting their long-term commitment and the financial rewards associated with their service.

For retirees enrolled in defined contribution plans, the average pension payment is contingent on the performance of the investment portfolio and the individual’s contribution history. The variability of investment returns in defined contribution plans can lead to a wider range of average pension payments, influenced by market conditions and the effectiveness of the retirement savings strategy.

While these figures provide a general understanding of average pension payments, it is essential for individuals to assess their unique circumstances and retirement plan details to gain a more accurate projection of their expected pension benefits. Consulting with financial advisors and utilizing retirement planning tools can aid individuals in estimating their average pension payments and making informed decisions regarding their retirement savings strategies.

By gaining insight into the typical range of pension payments and the factors that influence these payments, individuals can effectively plan for their financial well-being during retirement, ensuring that they have the necessary resources to support their desired lifestyle and fulfill their retirement goals.

Calculating Pension Payments

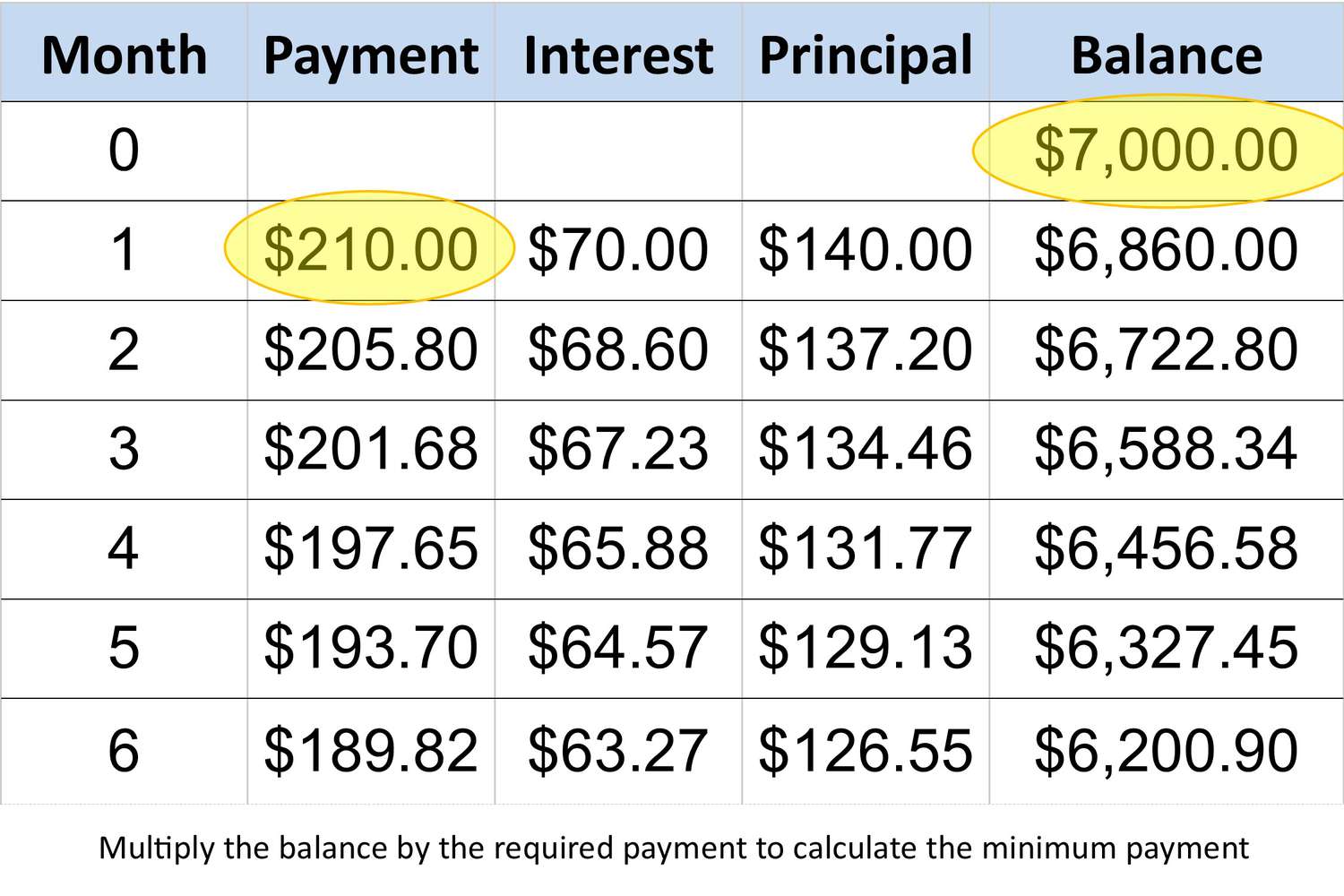

The calculation of pension payments involves a series of intricate steps that take into account various factors, including the type of pension plan, years of service, salary history, and retirement age. Understanding the methodology behind pension payment calculations is essential for individuals seeking to estimate their future retirement income and make informed decisions regarding their financial planning strategies.

For defined benefit plans, pension payments are often determined using a formula that considers the employee’s years of service and average salary over a specified period. This formula may vary between employers but typically involves multiplying the years of service by a predetermined percentage and applying this to the average salary. The result is the annual pension payment, which can then be adjusted based on the employee’s chosen retirement age and other plan-specific factors.

In contrast, calculating pension payments for defined contribution plans involves assessing the performance of the investment portfolio and determining the individual’s contributions and employer matches over the years. The total retirement savings accumulated through these contributions and investment returns form the basis for the pension payments, with retirees having the flexibility to receive their benefits as a lump sum or as regular disbursements.

Individuals can utilize online retirement calculators, provided by financial institutions and retirement planning websites, to estimate their pension payments based on their unique circumstances. These calculators take into account variables such as years of service, salary history, retirement age, and expected investment returns, providing individuals with a projected range of pension payments to aid in their financial planning.

Consulting with pension plan administrators and financial advisors can also offer valuable insights into the calculation of pension payments, enabling individuals to gain a comprehensive understanding of their expected retirement income and the strategies to optimize their pension benefits.

By familiarizing themselves with the intricacies of pension payment calculations, individuals can proactively plan for their retirement, ensuring that they have a clear understanding of the financial resources available to support their post-employment years and achieve their desired lifestyle during retirement.

Conclusion

As individuals embark on their journey towards retirement, the realm of pension payments holds significant importance in shaping their financial security during the non-working years. By delving into the intricacies of pension plans, understanding the factors influencing pension payments, and grasping the methodologies for calculating these payments, individuals can equip themselves with the knowledge necessary to make informed decisions and effectively plan for a financially secure retirement.

Throughout this exploration, it becomes evident that pension payments are influenced by a myriad of factors, including years of service, salary history, retirement age, and the type of pension plan. Defined benefit plans offer a predictable income stream based on specific formulas, while defined contribution plans hinge on the performance of the investment portfolio and individual contributions. The interplay of these factors underscores the importance of comprehending the dynamics of pension payments and their implications for retirees.

Moreover, the average pension payments received by retirees reflect the culmination of these factors, providing a general understanding of the financial support individuals can expect during retirement. By recognizing the typical range of pension payments and the variables that shape these figures, individuals can gain insight into their expected retirement income and tailor their financial strategies accordingly.

Ultimately, the calculation of pension payments involves a nuanced process that considers a multitude of variables, necessitating a comprehensive understanding of the methodologies employed. By leveraging retirement calculators, seeking guidance from financial advisors, and engaging with pension plan administrators, individuals can gain clarity on their projected pension benefits and make informed decisions to optimize their retirement income.

Armed with this knowledge, individuals can navigate the complexities of pension plans with confidence, ensuring that they are well-prepared to embrace the next chapter of their lives with financial stability and peace of mind. By proactively engaging with the intricacies of pension payments, individuals can embark on their retirement journey with a clear vision and the resources necessary to fulfill their retirement aspirations.