Home>Finance>What Are The Disadvantages Of Having A Checking Account

Finance

What Are The Disadvantages Of Having A Checking Account

Modified: February 21, 2024

Discover the potential disadvantages of having a checking account and how they can affect your finances. Explore the drawbacks and make informed decisions today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

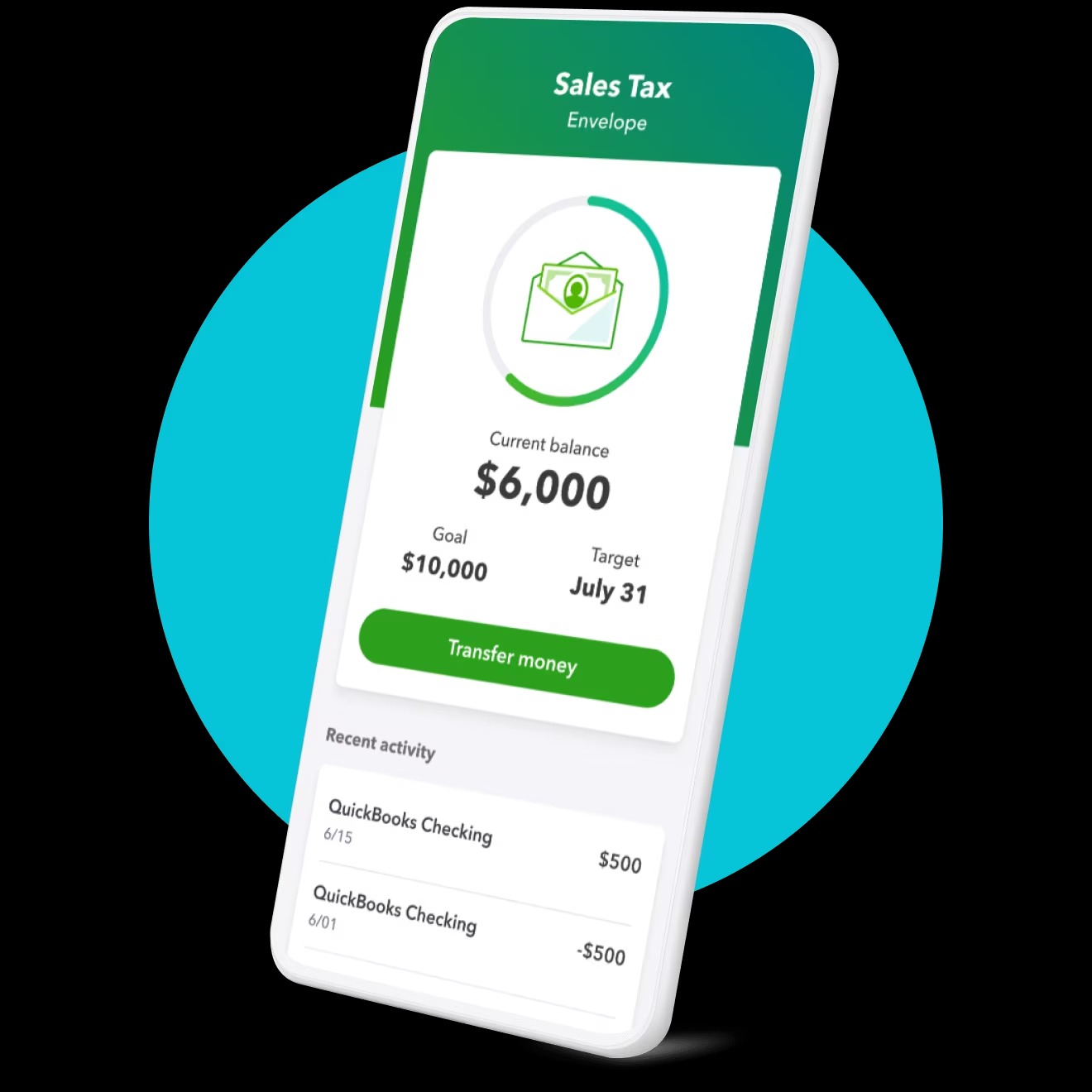

Opening a checking account is a common financial step for many individuals and families. It provides a convenient way to manage money, pay bills, and access funds. While there are numerous advantages to having a checking account, it is equally important to be aware of the potential disadvantages that come along with it. Understanding these drawbacks can help you make informed decisions about your banking needs and financial goals.

In this article, we will explore the various disadvantages of having a checking account and discuss how they can impact your personal finances. From the lack of interest on funds to the potential risk of identity theft, it’s essential to assess the drawbacks before deciding to open or maintain a checking account.

While considering these disadvantages, it is important to note that the specific details and severity may vary depending on the bank or financial institution you are dealing with. Be sure to thoroughly research the terms and conditions of any checking account you are considering before making a final decision.

Let’s now delve into the potential disadvantages of having a checking account.

Lack of Interest on Funds

One of the primary disadvantages of having a checking account is that it typically does not offer significant interest on the deposited funds. Unlike savings accounts or other investment options, checking accounts usually provide minimal or no interest on the money you hold in them. This means that your funds are not growing in value over time, which can be a missed opportunity for potential earnings.

The lack of interest can be a significant drawback, especially for individuals who consistently maintain a high balance in their checking accounts. Without the ability to earn interest, you may be missing out on potential growth and the opportunity to make your money work for you.

However, it’s important to note that some banks may offer interest-bearing checking accounts or special promotions where you can earn a small percentage of interest. It’s worth exploring these options to see if they align with your financial goals.

If growing your money is a priority, it may be beneficial to consider allocating a portion of your funds to other accounts that offer higher interest rates, such as savings accounts or certificates of deposit (CDs).

In summary, while the convenience of a checking account is undeniable, it’s crucial to acknowledge the limited interest-earning potential. If maximizing your earnings and growing your wealth is a primary objective, you may want to explore alternative financial instruments that offer more attractive interest rates.

Fees and Charges

Another significant disadvantage of having a checking account is the potential for fees and charges that can eat into your balance. While fees can vary depending on the bank and type of checking account you have, it’s essential to be aware of common charges that may apply.

Some of the most common fees associated with checking accounts include:

- Monthly maintenance fees: Many banks charge a monthly fee simply for keeping a checking account open with them. These fees can range from a few dollars to more substantial amounts, sometimes totaling over $10 per month.

- ATM fees: When you use an ATM that is not affiliated with your bank, you may incur fees for withdrawals, balance inquiries, or even for obtaining a printed receipt. These fees can add up, especially if you frequently use ATMs outside of your bank’s network.

- Overdraft fees: If you spend more money than you have available in your checking account, you may be subject to overdraft fees. These fees can be substantial, often ranging from $25 to $35 per transaction. It’s important to keep track of your balance to avoid costly overdraft fees.

- Non-sufficient funds (NSF) fees: Similar to overdraft fees, NSF fees are charged when you try to make a transaction without sufficient funds in your account. These fees can also range from $25 to $35 per transaction and can quickly accumulate if you are not careful.

- Check fees: Some banks charge fees for ordering checks or for additional check-related services, such as stop payments or check copies.

These fees and charges can significantly impact your account balance and affect your financial well-being. It’s important to carefully review the terms and conditions provided by your bank, understand their fee structure, and explore options that offer reduced fees or waivers based on certain requirements, such as maintaining a minimum balance or setting up direct deposits.

By being aware of the potential fees and charges associated with your checking account, you can make more informed decisions about your spending and avoid unnecessary expenses.

Minimum Balance Requirements

Many checking accounts come with a minimum balance requirement imposed by the bank. This means that you need to maintain a minimum amount of money in the account at all times, or else you may be subject to fees or account closure.

The minimum balance requirement can be a disadvantage for those who struggle to maintain a certain amount of funds in their checking account. It can be challenging to meet this requirement, particularly for individuals living paycheck to paycheck or facing financial constraints.

Failing to maintain the minimum balance can result in monthly maintenance fees or penalties. These fees can vary depending on the bank and the specific account. If you constantly fall below the required balance, the accumulated fees can significantly erode your account balance over time.

Additionally, some banks may impose tiered minimum balance requirements, meaning they incentivize customers to maintain higher balances by offering better interest rates or waiving certain fees. This can create a disparity between those who can meet the higher requirements and those who cannot, potentially leaving some customers at a disadvantage.

If you find it difficult to meet the minimum balance requirement, it may be worth considering alternative checking account options. Some banks offer accounts with lower or no minimum balance requirements, allowing individuals with varying financial circumstances to access the benefits of a checking account without the burden of maintaining a specific balance.

By understanding the minimum balance requirements and their potential impact on your finances, you can choose a checking account that aligns with your financial situation and goals.

Overdraft Fees

One of the potential drawbacks of having a checking account is the risk of incurring overdraft fees. An overdraft occurs when you make a transaction that exceeds the available balance in your account. For example, if you write a check or make a debit card purchase that exceeds your account balance, the bank may cover the transaction but charge you an overdraft fee.

Overdraft fees can vary widely depending on the bank, but they usually range from $25 to $35 per transaction. These fees can quickly accumulate if you have multiple transactions that result in overdrafts, potentially causing significant financial strain.

While overdraft protection is available as an option, it often comes with its own fees. This service links your checking account to another account, such as a savings account or a line of credit, to cover any overdrafts. However, utilizing overdraft protection may result in transfer fees, interest charges, or even the risk of accumulating debt if you rely on credit to cover overdrafts.

It’s important to note that some banks provide an option to opt-out of overdraft coverage, which means that if you don’t have sufficient funds to cover a transaction, it will be declined. This can help you avoid incurring costly overdraft fees. However, if you opt-out of overdraft coverage, you must closely monitor your account balance to ensure you don’t accidentally overdraw and face declined transactions.

To avoid excessive overdraft fees, it’s crucial to keep track of your account balance, set up alerts or notifications, and maintain a buffer of funds to cover unexpected expenses. Additionally, regularly reviewing your transactions and reconciling your account can help you identify potential discrepancies or fraudulent activity.

By being proactive and vigilant, you can minimize the risk of overdraft fees and protect your financial well-being.

Risk of Identity Theft

Having a checking account can expose you to the risk of identity theft, a serious concern in today’s digital age. Identity theft occurs when someone unlawfully obtains and uses your personal information, such as your Social Security number, bank account details, or credit card information, for fraudulent purposes.

While banks take various measures to protect their customers from identity theft, there are still vulnerabilities that criminals can exploit. For example, if a fraudster gains access to your online banking credentials or steals your checks, they can potentially drain your account or initiate unauthorized transactions.

In addition to financial losses, identity theft can have far-reaching consequences. It can negatively impact your credit score, lead to fraudulent charges or debts in your name, and cause significant stress and frustration as you work to resolve the issue.

To minimize the risk of identity theft, it’s important to take proactive measures. This includes:

- Using strong, unique passwords for your online banking accounts and regularly updating them.

- Avoiding sharing personal or financial information over unsecured networks or websites.

- Being cautious when providing information to unfamiliar organizations or individuals.

- Monitoring your account regularly and reporting any suspicious activity to your bank immediately.

- Keeping your checks secure and using secure mailing methods when sending payments by mail.

Additionally, many banks offer additional security features such as two-factor authentication or biometric verification, which can provide an extra layer of protection against unauthorized access to your account.

By understanding the risks of identity theft and taking proactive steps to protect your personal information, you can reduce the likelihood of falling victim to this type of fraud and safeguard your financial well-being.

Limited Access to Funds

While having a checking account provides a convenient way to access and manage your funds, there can be limitations on how and when you can access your money.

One common restriction is the availability of funds. When you deposit a check or receive a direct deposit, there is typically a hold period before the funds are available for withdrawal. This can be a few days or longer, depending on the bank’s policies and the type of deposit. This can be a disadvantage if you need immediate access to the funds, especially in urgent situations.

Additionally, some banks may have limitations on the number of transactions or withdrawals you can make from your checking account within a specific timeframe. This is usually done to prevent excessive account activity and ensure the stability of the bank’s operations. If you exceed these limitations, you may be subject to additional fees or restrictions on your account.

It’s also important to consider the availability of physical bank branches and ATMs. If your bank has limited branch locations or a sparse ATM network, it may be inconvenient to access your funds or require you to incur extra fees when using out-of-network ATMs.

However, many banks offer online and mobile banking services that can mitigate some of these limitations. With these services, you can check your account balance, transfer funds, and even deposit checks remotely. This can provide more flexibility and convenience in managing your finances.

Before choosing a checking account, it’s important to evaluate your banking needs and compare the accessibility options provided by different banks. Consider factors such as the availability of physical branches, ATM networks, and digital banking services to ensure that you can easily access your funds when needed.

By understanding the limitations on accessing your funds and selecting a checking account that aligns with your needs, you can ensure a smoother and more convenient banking experience.

Inconvenience of Writing Checks

One of the drawbacks of having a checking account is the inconvenience associated with writing and managing checks. While checks may still be used for certain transactions, they have become less common in today’s digital world.

Writing a check can be time-consuming and require multiple steps. You need to fill out the recipient’s name, the date, the amount in both numerals and words, and sign the check. You also need to keep track of the checkbook and ensure that you have enough checks available.

In addition to the time and effort required, there are potential risks associated with writing checks. For instance, if a check is lost or stolen, someone else could potentially alter the check or use the information on it for fraudulent activities. This risk is heightened when checks are mailed, as they can be intercepted or tampered with during transit.

Furthermore, writing checks can lead to errors or mistakes. If you make a mistake on a check, such as writing the wrong amount or recipient’s name, it can cause delays in processing or even result in the check being returned and the payment not being made.

Fortunately, digital payment methods such as online bill payments, mobile banking apps, and digital wallets have emerged as more convenient and secure alternatives to writing checks. These methods allow for quick and easy transfers of funds, eliminating the need for paper checks and the associated inconveniences.

However, it’s important to note that there are still situations where checks may be required or preferred, such as paying rent to a landlord or making payments to certain vendors. In these cases, it may be necessary to use checks despite the inconvenience.

Ultimately, the inconvenience of writing checks can be mitigated by embracing digital payment solutions for most of your financial transactions, while keeping a few checks on hand for those occasions where they are necessary.

Potential for Fraudulent Checks

One of the significant disadvantages of having a checking account is the potential for fraudulent checks. A fraudulent check is a counterfeit or altered check that is presented for payment without the authorized account holder’s consent. This can result in financial loss and various other complications.

Fraudsters may attempt to create fraudulent checks by using stolen checkbooks, manipulating checks from legitimate sources, or creating counterfeit checks that resemble real ones. They may then present these checks for payment, deceiving unsuspecting individuals or businesses into accepting them.

If a fraudulent check is deposited into your account, you may be held responsible for the funds, and your account may be debited accordingly. This can lead to financial hardship, especially if the amount of the fraudulent check is substantial and exceeds the available funds in your account.

It’s important to be vigilant and take steps to protect yourself against fraudulent checks. Here are some precautions you can take:

- Keep your checkbook secure and know the whereabouts of your unused checks. If any checks are lost or stolen, notify your bank immediately.

- Regularly monitor your account activity and review your bank statements carefully to identify any unauthorized transactions or unfamiliar checks.

- Use security features provided by your bank, such as security watermarks or specific check designs, which can make it more difficult for fraudsters to replicate your checks.

- Consider using electronic payment methods or online banking whenever possible, reducing the need for physical checks.

- Educate yourself about common check fraud scams and stay updated on the latest techniques used by fraudsters.

If you suspect that a check you have received or deposited might be fraudulent, it’s crucial to contact your bank immediately. They can guide you on the necessary steps to protect yourself and help prevent further financial losses.

By being proactive and vigilant, you can reduce the risks associated with fraudulent checks and protect your financial well-being.

Risk of Account Closure

Having a checking account comes with the inherent risk of account closure, which can be a significant disadvantage. While banks typically strive to maintain long-term relationships with their customers, certain circumstances can lead to the closure of a checking account.

There are several reasons why a bank may choose to close your account:

- Insufficient funds: If your account has a history of frequent overdrafts or consistently maintains a negative balance, the bank may decide to close your account due to the associated risks and costs.

- Account inactivity: Some banks have policies that allow them to close dormant or inactive accounts. If you don’t use your account for an extended period, the bank may decide to shut it down to free up resources or reduce administrative overhead.

- Violation of bank policies: If you engage in fraudulent activities, provide false information, or violate the terms and conditions of your account, the bank may take the necessary steps to close your account.

- Legal reasons: In rare cases, a bank may be compelled to close accounts due to legal actions such as suspected money laundering or involvement in illegal activities.

The closure of a checking account can have serious repercussions. It may disrupt your financial activities, make it difficult to access funds, and potentially damage your banking relationship. Additionally, if your account is closed involuntarily, it could impact your credit history and future banking opportunities.

To mitigate the risk of account closure, it’s important to maintain a positive account history, diligently manage your finances, and adhere to the terms and policies outlined by your bank. Regularly reviewing your account statements, promptly resolving any issues, and updating your contact information can also help minimize the risk of account closure.

If you anticipate a period of account inactivity, such as during extended travel or relocation, it’s advisable to inform your bank in advance and explore options to keep your account active.

Nevertheless, even with diligent account management, there may still be circumstances beyond your control that can lead to account closure. In such cases, it’s important to establish relationships with multiple financial institutions and maintain open communication with your bank to explore alternative solutions and minimize disruptions to your financial affairs.

Ultimately, understanding the potential risk of account closure and taking proactive measures can help you navigate any challenges that may arise with your checking account.

Conclusion

While having a checking account offers convenience and easy access to your funds, it’s essential to be aware of the potential disadvantages that come along with it. Understanding these drawbacks can help you make informed decisions and take necessary precautions to mitigate risks.

From the lack of interest on funds to the potential for fraudulent checks and the risk of identity theft, there are various factors to consider when weighing the pros and cons of a checking account. Additionally, fees and charges, minimum balance requirements, limited access to funds, and the inconvenience of writing checks are all factors that can impact your financial well-being and experience with a checking account.

However, it’s important to remember that not all checking accounts are created equal, and the specific disadvantages and limitations can vary depending on the bank or financial institution. They may offer alternative account options, reduced fees, or enhanced security measures that can address or mitigate some of these concerns.

Ultimately, being proactive in managing your account, staying informed about your bank’s policies, and exploring options that align with your financial goals can help you leverage the benefits of a checking account while minimizing the impact of its drawbacks.

Weigh the advantages and disadvantages carefully, considering your unique financial circumstances and banking needs. By doing so, you can make the most informed decision about whether a checking account is right for you or if alternative financial instruments could better suit your preferences.

Remember, regular evaluation of your banking relationship and adapting to changing financial circumstances is key to maintaining a healthy and productive financial journey.