Finance

How Much Does Cyber Insurance Cost?

Published: November 5, 2023

Learn the cost of cyber insurance and how it can protect your finances. Find out the average rates and factors affecting pricing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s digital landscape, businesses face an ever-increasing risk of cyber threats. From data breaches to ransomware attacks, the potential for financial loss and reputational damage is significant. To mitigate these risks, many organizations turn to cyber insurance, a form of coverage designed to protect against cyber-related incidents.

But before diving into the world of cyber insurance, it’s important to understand the factors that affect its cost. Cyber insurance premiums can vary widely, depending on a variety of factors such as business size, industry, cyber risk exposure, and the desired level of coverage. By exploring these factors, business owners can gain a clearer understanding of how cyber insurance pricing works and make informed decisions when it comes to protecting their organization.

In this article, we will delve into the world of cyber insurance costs, examining the factors that influence pricing, the different coverage types available, and tips for finding the right cyber insurance policy for your business.

So, if you’ve ever wondered how much cyber insurance costs and what factors drive those costs, read on to gain a deeper understanding of this essential form of protection.

Factors Affecting Cyber Insurance Costs

When it comes to determining the cost of cyber insurance, several key factors come into play. These factors influence the level of risk a business presents to insurers and help calculate the appropriate premium. Let’s take a closer look at some of the main factors that affect cyber insurance costs:

- Business Size and Revenue: The size of a business, measured by its annual revenue or employee count, is a critical factor in determining cyber insurance costs. Generally, larger businesses with higher revenues will face higher premiums due to their increased exposure to cyber risks.

- Industry: Different industries have varying levels of cyber risk due to the nature of their operations and the sensitivity of the data they handle. Industries such as healthcare, finance, and technology are typically considered high-risk and may have higher cyber insurance premiums.

- Cybersecurity Measures: Insurers assess the effectiveness of a company’s cybersecurity measures when determining premiums. Businesses with robust security measures, such as firewalls, encryption, and employee training programs, are generally viewed as lower risk and may enjoy lower insurance costs.

- Data Protection Practices: Insurers also evaluate a company’s data protection practices, such as data encryption, regular data backups, and incident response plans. Businesses with strong data protection practices may be rewarded with lower premiums.

- Previous Cyber Incidents: A company’s history of cyber incidents and claims can significantly impact the cost of cyber insurance. Businesses that have experienced data breaches or other cyber incidents in the past may face higher premiums as they are deemed higher risk.

- Geographic Location: The location of a business can also influence cyber insurance costs. Certain regions or countries may have higher rates of cybercrime, which can result in higher premiums for businesses operating in those areas.

It’s important for businesses to assess these factors and understand how they impact their insurance costs. By taking steps to improve cybersecurity practices and minimize cyber risk, businesses may be able to secure more favorable insurance premiums.

Coverage Types and Costs

When it comes to cyber insurance, there are several coverage types available to protect against different cyber risks. The cost of cyber insurance will depend on the specific coverage options chosen. Let’s explore some common coverage types and their associated costs:

- Data Breach Coverage: This coverage protects businesses in the event of a data breach, including the costs of data recovery, forensic investigations, customer notification, and potential legal fees. The cost of data breach coverage can vary based on factors such as the amount of data stored, the level of encryption used, and the industry in which the business operates.

- Network Security Liability: This coverage protects businesses if they are held liable for damages resulting from a network security breach. It covers legal expenses, settlements, and judgments. The cost of network security liability coverage depends on the perceived cyber risk of the business and its industry.

- Business Interruption: Business interruption coverage helps businesses recover lost income and extra expenses incurred due to a cyber event that disrupts operations. The cost of this coverage is influenced by factors such as the size of the business, its revenue, and the potential financial impact of a cyber incident.

- Extortion and Ransomware: This coverage protects against extortion attempts and ransomware attacks. It covers expenses related to negotiating with cybercriminals and the cost of ransom payments. The cost of this coverage will depend on factors such as the perceived likelihood of a ransomware attack and the amount of coverage desired.

- Privacy Liability: Privacy liability coverage protects businesses if they are sued for the unauthorized release of personally identifiable information. It covers legal fees, settlements, and damages. The cost of this coverage is influenced by the amount of personal data collected and stored by the business.

The cost of cyber insurance can vary greatly depending on the specific coverage options selected and the level of coverage desired. It’s essential for businesses to carefully evaluate their cyber risks and choose coverage options that adequately address their unique needs.

It’s worth noting that cyber insurance costs are typically subject to deductibles and coverage limits. Higher deductibles can lead to lower premiums, but businesses should carefully assess their ability to pay the deductible in the event of a claim. Coverage limits determine the maximum amount the insurer will pay out in the event of a covered cyber incident.

When considering the costs of cyber insurance, businesses should carefully weigh the potential financial losses and reputational damage that can result from a cyber event against the cost of insurance premiums. The right cyber insurance policy can provide peace of mind and financial protection in the face of growing cyber threats.

Average Costs of Cyber Insurance Policies

The cost of cyber insurance policies can vary significantly depending on various factors, including the size and nature of the business, the industry in which it operates, and the desired coverage limits. While it’s challenging to provide an exact average cost due to the wide range of variables involved, we can provide some general insights into typical cyber insurance premiums.

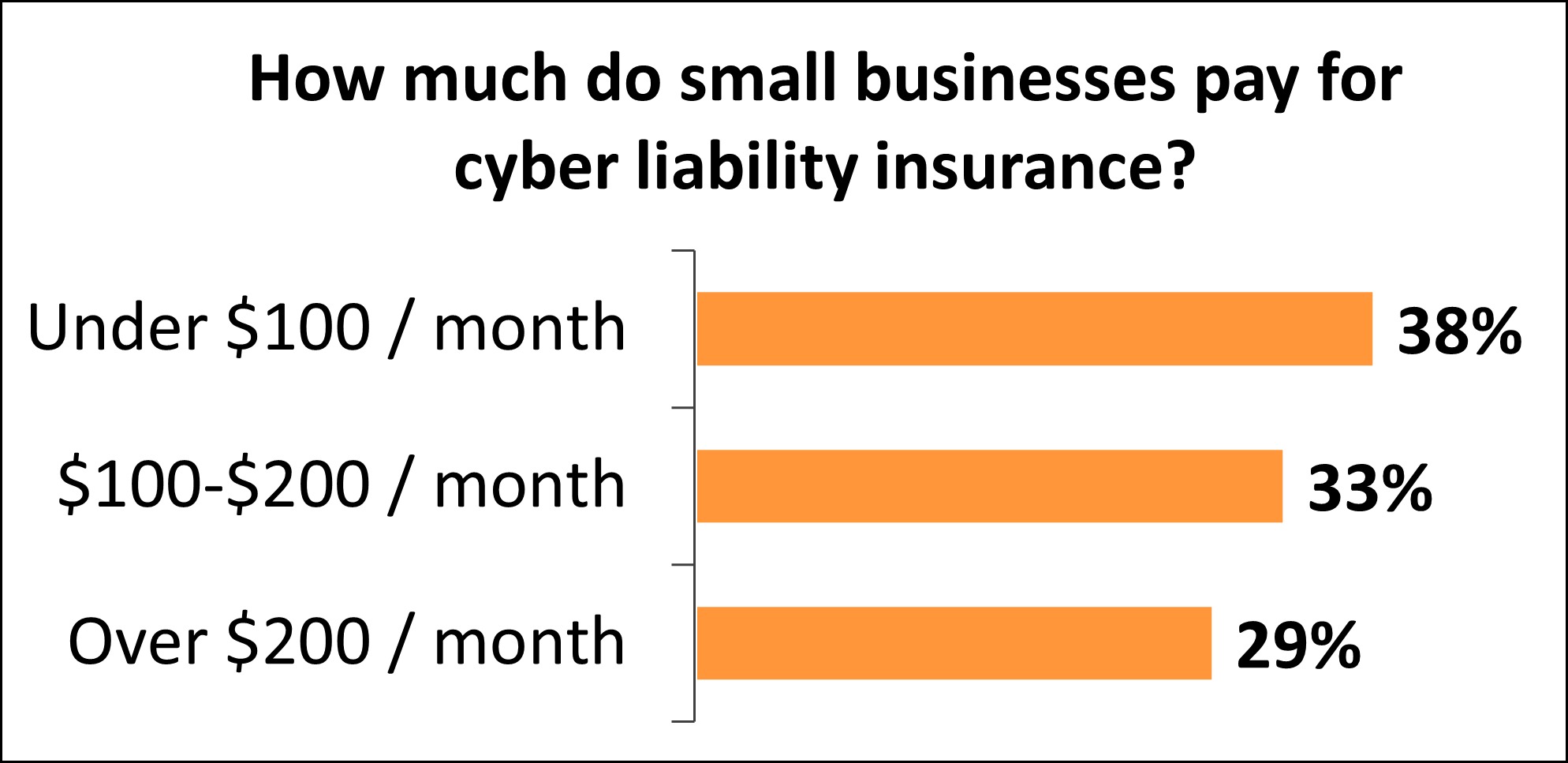

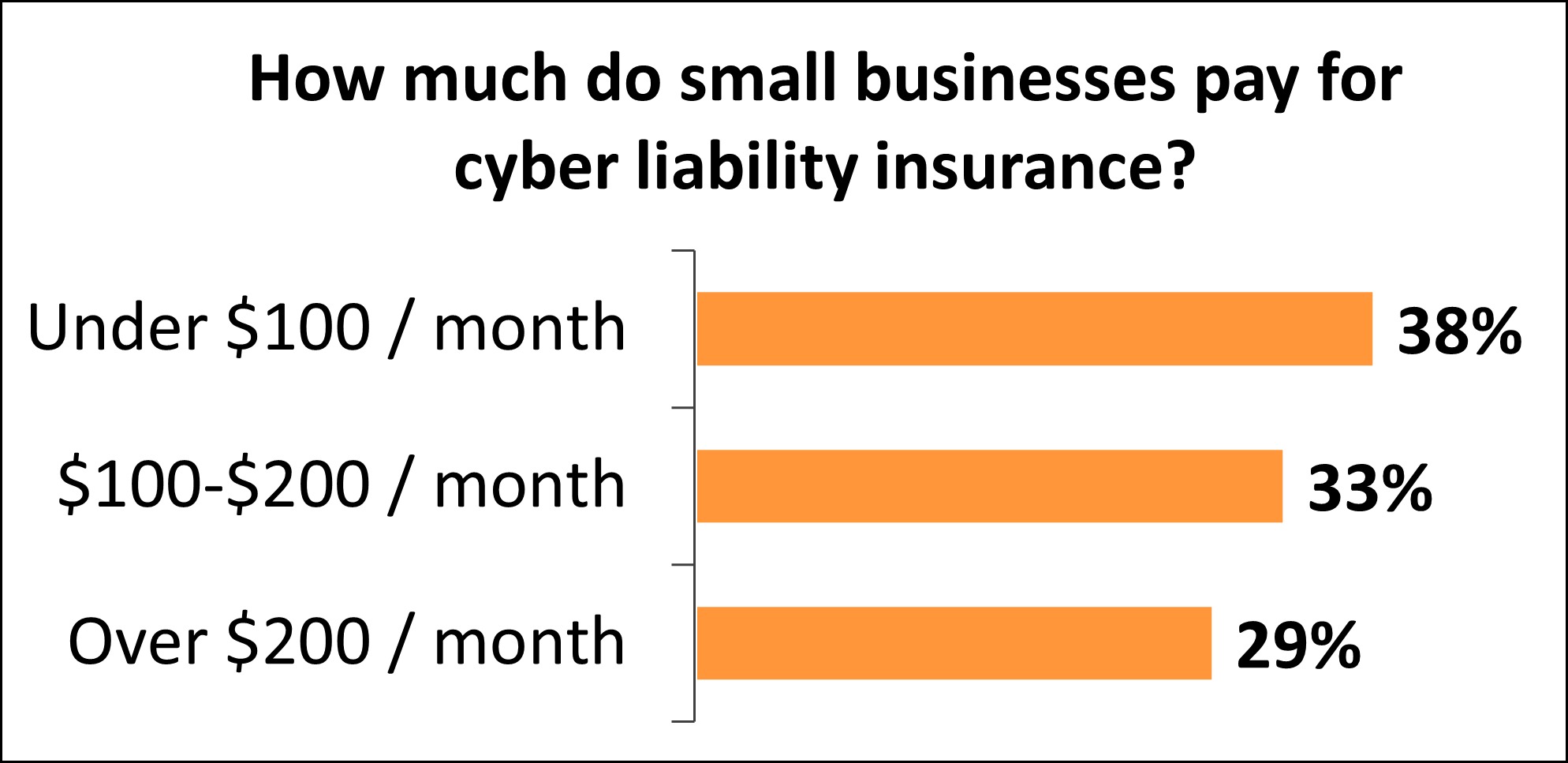

For small to medium-sized businesses (SMBs), cyber insurance policies can range anywhere from a few thousand dollars to tens of thousands of dollars per year. The cost is influenced by factors such as annual revenue, number of employees, and the types of data the business handles. On average, SMBs can expect to pay around $1,000 to $7,000 annually for a basic cyber insurance policy with coverage limits in the range of $1 million to $5 million.

For larger companies with higher revenue and a larger customer base, cyber insurance costs can increase significantly. Enterprises may pay anywhere from tens of thousands to hundreds of thousands of dollars or more per year for comprehensive cyber insurance coverage. Policies for larger businesses often have higher coverage limits, typically ranging from $5 million to $20 million or more.

It’s important to note that these figures are just rough estimates, and the actual cost of cyber insurance policies can vary widely depending on the unique characteristics of each business. Insurers evaluate multiple risk factors to determine the pricing for each policy, so it’s recommended to obtain quotes from multiple insurance providers to compare costs and coverage options.

Additionally, it’s worth noting that the increasing frequency and severity of cyber threats have led to a rise in cyber insurance premiums in recent years. As the cybersecurity landscape evolves, insurers may adjust their pricing models to account for emerging risks and the potential cost of cyber incidents.

It’s crucial for businesses to carefully review and understand the terms of the policy before purchasing cyber insurance. Consider factors such as coverage limits, deductibles, and specific exclusions or limitations. By working closely with insurance professionals who specialize in cyber insurance, businesses can ensure they have the appropriate coverage in place to protect against the specific risks they face.

Understanding Cyber Insurance Pricing Models

Cyber insurance premiums are determined using various pricing models that assess the risk exposure of a business and calculate the appropriate cost of coverage. Understanding these pricing models can provide insights into how insurers determine the cost of cyber insurance policies. Let’s explore some common cyber insurance pricing models:

- Ad Hoc Pricing: Some insurers follow an ad hoc pricing model, where they consider each business’s unique characteristics and risk profile to determine a customized premium. This approach allows insurers to assess the specific cybersecurity measures, data protection practices, industry risks, and claims history of a business to calculate a personalized premium.

- Industry Benchmarking: In this pricing model, insurers use industry-specific data and historical claims information to benchmark the risk profile of a business against others in the same industry. This approach helps insurers estimate the likelihood and severity of cyber incidents for a particular industry and set premiums accordingly.

- Size-Based Pricing: Under this model, insurance premiums are determined based on the size of the business, typically measured by annual revenue or employee count. Larger businesses with higher revenues generally face higher premiums due to increased exposure and potential financial impact in the event of a cyber incident.

- Revenue-Based Pricing: In this pricing model, premiums are calculated as a percentage of the business’s annual revenue. The percentage can vary based on the industry, risk level, and coverage requirements. Higher revenue businesses may pay higher premiums due to the potential for greater financial loss in the event of a cyber incident.

- Claims History: Insurers also consider the claims history of a business when determining premiums. A business with a history of significant cyber incidents and claims may be viewed as a higher risk and face higher premium costs. Conversely, businesses with a clean claims history may be eligible for lower premiums.

It’s important to note that each insurer may use a combination of these pricing models or have their own proprietary approach to pricing cyber insurance policies. The specific factors considered and the weight given to each factor can vary between insurers.

Business owners should review their cyber risk profile, including their cybersecurity measures, data protection practices, and claims history, to understand how insurers might perceive their risk. By addressing any areas of concern, such as strengthening cybersecurity measures or implementing incident response plans, businesses can potentially reduce their risk profile and secure more favorable insurance premiums.

It’s also essential to work with insurance professionals who are knowledgeable in cyber insurance and can provide guidance on the pricing models used by different insurers. Comparing quotes from multiple insurance providers can help businesses find the best coverage at the most competitive price.

By understanding the pricing models used in cyber insurance, businesses can make informed decisions when choosing coverage and ensure they have the appropriate protection in place against cyber risks.

Determining Factors for Cyber Insurance Premiums

When it comes to determining the premiums for cyber insurance policies, insurers consider various factors that contribute to the risk profile of a business. Understanding these factors can help businesses anticipate the pricing of their cyber insurance coverage. Let’s explore some of the key determining factors for cyber insurance premiums:

- Industry and Business Type: Certain industries, such as healthcare and finance, are more prone to cyber risks due to the sensitive nature of the data they handle. Businesses operating in these industries may face higher premiums. Additionally, the type of business and the level of exposure to cyber threats can also influence the premium. For example, an e-commerce company that processes a large volume of online transactions may be perceived as higher risk compared to a consulting firm.

- Cybersecurity Measures: The effectiveness of a business’s cybersecurity measures is a significant factor in determining premiums. Insurers assess the strength of a company’s security infrastructure, including firewalls, encryption protocols, and employee training programs. Businesses with robust cybersecurity practices and risk management strategies may enjoy lower premiums as they are considered lower risk.

- Data Protection Practices: Insurers also evaluate a business’s data protection practices, such as data encryption, access controls, and incident response plans. Companies with comprehensive data protection measures in place are viewed as less susceptible to cyber incidents and may benefit from lower premiums.

- Claims History: The claims history of a business plays a significant role in premium calculations. A company with a history of frequent cyber incidents and claims may be perceived as higher risk and face higher premiums. On the other hand, businesses with a clean claims history may be eligible for lower premiums as they demonstrate a lower likelihood of future cyber incidents.

- Business Size and Revenue: The size and revenue of a business are crucial factors in determining cyber insurance premiums. Larger businesses with higher revenues generally pay higher premiums due to their increased exposure to cyber risks and the potential for greater financial loss. The number of employees and the geographic reach of the business may also be considered.

- Geographic Location: The geographic location of a business can impact cyber insurance premiums. Certain regions may have higher rates of cybercrime or stricter data protection regulations, which can lead to higher premiums. Businesses operating in high-risk areas may need to invest more in cyber insurance coverage.

It’s important for businesses to proactively address these factors to reduce their cyber risk profile and potentially obtain lower insurance premiums. Implementing strong cybersecurity measures, conducting regular risk assessments, and maintaining a clean claims history can all contribute to a more favorable pricing outcome.

Ultimately, businesses should work closely with insurance professionals who specialize in cyber insurance and can provide guidance on how to improve their risk profile and secure competitive premiums. Comparing quotes from multiple insurers and understanding the specifics of each policy’s coverage and limitations can help businesses find the right cyber insurance policy at a reasonable cost.

By comprehensively addressing the determining factors for cyber insurance premiums, businesses can better protect themselves against cyber threats while minimizing their financial exposure.

Tips for Finding the Right Cyber Insurance Policy

Choosing the right cyber insurance policy is crucial for businesses to effectively protect themselves against cyber risks. With so many options available, it can be challenging to navigate through the complexities of cyber insurance. Here are some important tips to consider when searching for the right cyber insurance policy:

- Assess your cyber risk: Before seeking out insurance, conduct a thorough assessment of your organization’s cyber risk. Evaluate the types of data you handle, the potential impact of a cyber incident on your business operations, and the likelihood of different types of cyber threats. This assessment will help you determine the coverage and limits you need.

- Work with a specialized agent or broker: Seek guidance from insurance professionals who specialize in cyber insurance. They can help you understand the complexities of the policies, identify potential coverage gaps, and navigate through different options and pricing models available from various insurers.

- Compare multiple quotes: Obtain quotes from several reputable insurers to compare coverages and premiums. This will help you get a clear understanding of the market and ensure you are getting the best value for your coverage needs.

- Understand the coverage: Carefully review the coverage details, including the scope of coverage, limits, deductibles, and any exclusions or limitations. Ensure that the policy covers the specific risks your business faces, such as data breaches, business interruption, and liability claims.

- Consider additional coverage: Evaluate whether additional coverage options are necessary for your organization. Depending on your industry or specific cyber risks, you may need to consider specialized coverage such as social engineering fraud, third-party vendor breaches, or reputational damage.

- Read the fine print: Pay close attention to policy terms, conditions, and any warranties or requirements set by the insurer. Understand what is expected from your organization in terms of cybersecurity practices and incident reporting.

- Assess the claims process: Understand the process for filing a cyber insurance claim. Determine how prompt and efficient the insurer is in handling claims and their track record in providing support to policyholders during and after a cyber incident.

- Continuously evaluate and update: Cyber risks evolve rapidly, so regularly evaluate your insurance needs. As your business grows, changes its operations, or experiences new cyber threats, reassess your cyber insurance policy to ensure it still adequately meets your needs.

Remember, cyber insurance should not be a standalone solution. It should be part of a comprehensive cybersecurity strategy that includes implementing robust security measures, conducting employee training, and regularly assessing and updating your risk management practices.

By following these tips and working with knowledgeable professionals, you can find the right cyber insurance policy that provides the protection and peace of mind your business needs in an increasingly digital world.

Conclusion

Cyber insurance is an essential component of any comprehensive risk management strategy in today’s digital age. Understanding the factors that affect cyber insurance costs, the different coverage types available, and how insurers determine premiums is crucial for businesses seeking adequate protection against cyber threats.

Factors such as business size, industry, cybersecurity measures, and claims history all play a role in determining cyber insurance premiums. It’s important for businesses to assess their cyber risk profiles and take steps to minimize those risks, which can potentially lead to lower insurance premiums.

When selecting a cyber insurance policy, it’s vital to assess coverage options, compare quotes from multiple insurers, and work with specialized agents or brokers who can guide you through the process. Understanding the policy’s coverage limits, deductibles, and any exclusions or limitations is essential to ensure it aligns with your organization’s specific needs.

Continual evaluation and updating of your cyber insurance policy, along with a robust cybersecurity strategy, can help your business stay prepared for evolving cyber risks. Regularly reassessing your insurance needs as your business grows or faces new threats is crucial to maintain adequate coverage.

Remember, cyber insurance is just one part of the equation. It should be complemented by strong cybersecurity measures, employee training, and proactive risk management practices.

By following these guidelines and working closely with insurance professionals, businesses can find the right cyber insurance policy that not only fits their budget but also provides peace of mind against the increasing threats of the digital world.