Finance

What Does Unapplied Credit Mean

Published: January 13, 2024

Discover the meaning of unapplied credit in finance. Learn how unapplied credit affects your financial situation and how to manage it effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where credit plays a vital role in the success of individuals and businesses alike. However, within the realm of credit management, there are various terms and concepts that can be quite confusing. One such term is “unapplied credit,” which can have significant implications for both creditors and debtors.

Unapplied credit refers to a situation where a received payment or credit is not properly allocated to a specific account or invoice. Instead of being applied to a particular outstanding debt, it remains unallocated or unapplied. This can happen due to various reasons, such as incorrect payment processing, missing or incorrect information, system errors, or even a lack of communication between the debtor and the creditor.

Understanding unapplied credit is essential for both individuals and businesses to effectively manage their finances and maintain accurate records. In this article, we will delve deeper into the definition of unapplied credit, explore the causes behind it, discuss its consequences, and provide helpful ways to address this issue.

Definition of Unapplied Credit

In the world of finance, credit is a crucial aspect of conducting business. It allows individuals and businesses to access funds or goods with the promise of payment at a later date. However, when it comes to managing credit, there are various terms that can be confusing, such as unapplied credit.

Unapplied credit refers to a situation where a payment or credit received by a creditor is not allocated or applied to a specific account or invoice. Instead of being properly assigned to a particular outstanding debt, the payment remains unallocated or unapplied. This can occur due to a variety of reasons, ranging from human errors to system glitches to missing or incorrect information.

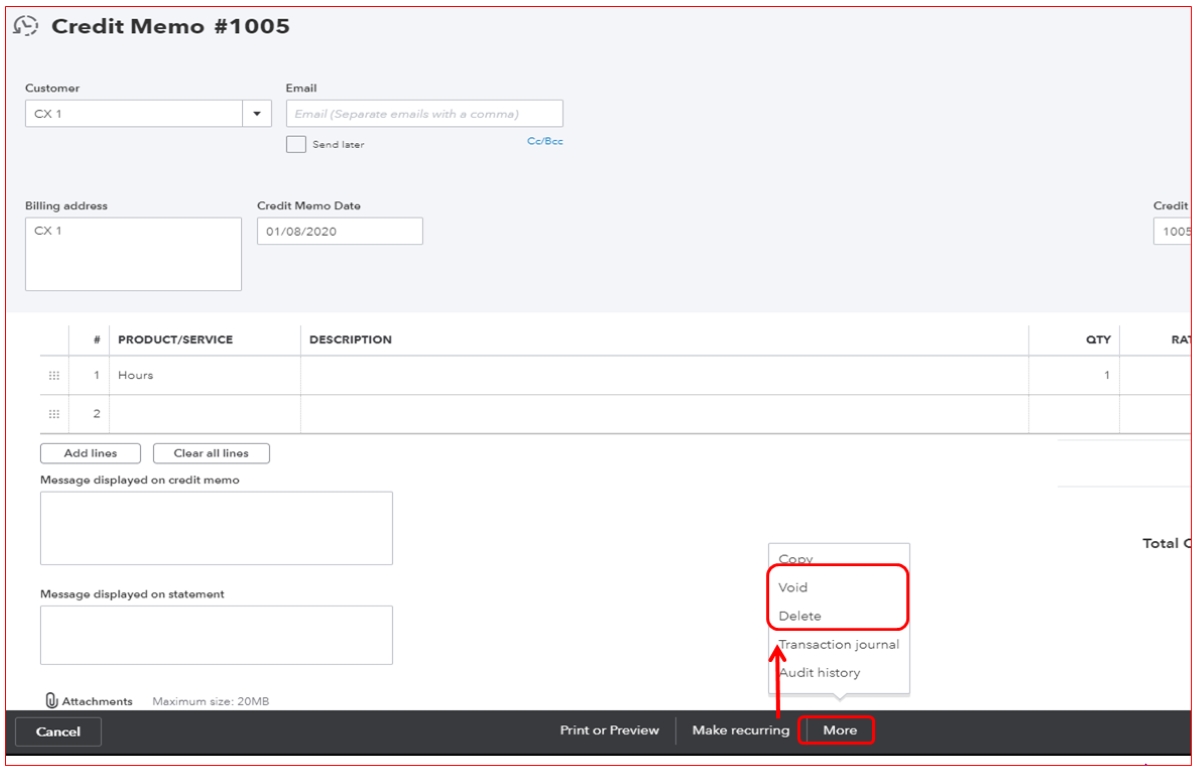

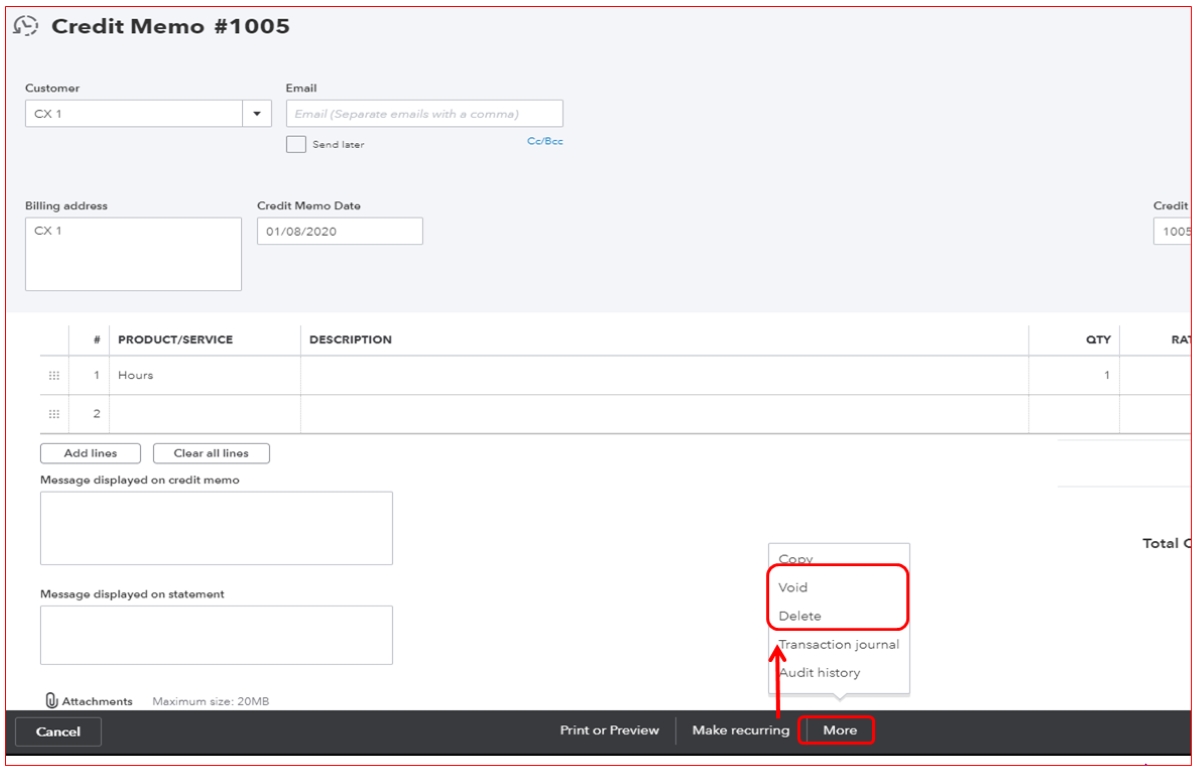

Unapplied credit can be categorized into two types: unapplied cash and unapplied credits or debits. Unapplied cash typically refers to funds received by the creditor that have not been assigned to any specific invoice. This can happen when a payment is received without any accompanying details or when the system is unable to match the payment to the appropriate account.

On the other hand, unapplied credits or debits involve situations where a credit or debit is received by the creditor but is not applied to the correct account. For example, if a customer returns a purchased item and is issued a credit, but that credit is not properly applied to their account, it would result in unapplied credit. Similarly, if a creditor mistakenly applies a debit to the wrong account, it would also fall under the category of unapplied credit.

Unapplied credit can lead to significant challenges for both creditors and debtors. For creditors, it can result in inaccurate financial records, difficulties in tracking customer balances, and potential cash flow problems. For debtors, unapplied credit can lead to confusion, disputes with the creditor, and even damage to their credit history if payments are not correctly allocated.

Understanding the definition and implications of unapplied credit is crucial for effectively managing credit and maintaining accurate financial records. In the following sections, we will explore the causes of unapplied credit and its potential consequences.

Causes of Unapplied Credit

Unapplied credit can occur due to various factors and scenarios, often leading to confusion and inefficiencies in credit management. Understanding the causes behind unapplied credit is essential for both creditors and debtors to prevent and address this issue effectively.

1. Incomplete or Incorrect Payment Information: One common cause of unapplied credit is when payments are received without sufficient information to allocate them to the correct account or invoice. This can happen when customers fail to provide necessary details such as invoice numbers or account references, making it challenging for the creditor to apply the payment accurately.

2. System Errors: In a technologically-driven world, system errors can contribute to unapplied credit. Glitches or malfunctions in payment processing systems can result in payments not being properly recorded or assigned to the correct accounts. This can cause confusion and delays in the credit management process.

3. Human Errors: Mistakes made by individuals, both on the creditor and debtor side, can also lead to unapplied credit. Data entry errors, incorrect payment allocations, or mishandling of financial documents can all contribute to payments not being correctly applied to outstanding debts.

4. Lack of Communication: Poor communication between creditors and debtors can create situations where payments are not properly allocated. If there is no clear channel for discussing or confirming payment details, misunderstandings can arise, leading to unapplied credit.

5. Merging or Splitting of Accounts: In cases where accounts are merged or split, it can create challenges in allocating payments correctly. If the creditor’s systems are not properly updated to reflect these changes, payments may end up assigned to the wrong accounts, resulting in unapplied credit.

6. Complex Payment Structures: Some businesses or industries may have complex payment structures, such as installment plans or multiple invoices for a single purchase. These complexities can increase the likelihood of unapplied credit if not carefully managed and allocated.

Addressing the causes of unapplied credit requires proactive measures from both creditors and debtors. Clear and effective communication, accurate record-keeping, and efficient payment processing systems are essential to minimize the occurrence of unapplied credit. In the next section, we will discuss the potential consequences of unapplied credit for both parties involved.

Consequences of Unapplied Credit

Unapplied credit can have significant consequences for both creditors and debtors. Understanding these consequences is essential for effectively managing credit and maintaining healthy financial relationships.

For Creditors:

- Inaccurate Financial Records: Unapplied credit can result in misleading financial records, making it challenging for creditors to assess the true financial health of their business. This can hinder decision-making processes and lead to potential financial risks.

- Difficulties in Tracking Balances: When payments are not properly allocated, it becomes difficult for creditors to accurately track customer balances. This can result in errors, such as sending unnecessary collection notices or failing to realize that payment has already been received.

- Cash Flow Problems: Unapplied credit can disrupt the cash flow of a business. If payments are not properly applied to outstanding debts, creditors may face challenges in meeting their own financial obligations, such as paying suppliers or employees.

- Customer Disputes: When payments are not correctly applied, it can lead to disputes between creditors and debtors. Customers may claim that they have already made payments that appear as unapplied credit, potentially damaging the relationship between the two parties.

For Debtors:

- Confusion and Frustration: Unapplied credit can lead to confusion and frustration for debtors. They may question why their payments have not been properly applied and feel frustrated by the lack of clarity in their financial records.

- Disputes and Miscommunication: Debtors may find themselves in disputes with creditors over unapplied credit. These disputes can arise from misunderstandings, lack of communication, or disagreements over payment allocations.

- Potential Damage to Credit History: If unapplied credit is not addressed promptly, it can have a negative impact on the debtor’s credit history. Delays in payment application or disputes can lead to late payment records or even defaults, which can harm the debtor’s creditworthiness.

- Reputation Damage: Difficulties in resolving unapplied credit can also damage the debtor’s reputation. This can occur if customers share negative experiences with others, impacting the debtor’s ability to secure credit or maintain strong business relationships.

Both creditors and debtors should take proactive measures to prevent and address unapplied credit to mitigate these consequences. In the following section, we will explore some practical ways to address and resolve this issue.

Ways to Address Unapplied Credit

Addressing unapplied credit requires proactive efforts from both creditors and debtors. By implementing the following strategies, both parties can effectively resolve unapplied credit and maintain healthy financial relationships:

- Clear Communication: Establishing clear channels of communication between creditors and debtors is crucial. This includes clearly communicating payment instructions, providing accurate and complete payment information, and promptly addressing any questions or concerns regarding payment allocations.

- Accurate Record-Keeping: Maintaining accurate and up-to-date records is essential for effectively managing unapplied credit. Creditors should ensure that all payment transactions are properly documented, including detailed information such as transaction dates, invoice or account numbers, and payment methods.

- Implement Robust Payment Processing Systems: Investing in reliable payment processing systems can greatly reduce the occurrence of unapplied credit. These systems should have built-in mechanisms to match payments to outstanding debts, automate the allocation process, and generate accurate reports and reconciliations.

- Regular Reconciliation: Creditors should conduct regular reconciliations to identify and address unapplied credit promptly. This involves comparing payment records with outstanding invoices and tracing any unapplied credit to its correct allocation.

- Prompt Follow-up: If a debtor notices unapplied credit on their account, they should immediately reach out to the creditor to seek clarification and resolution. Likewise, creditors should diligently follow up with debtors to resolve any unapplied credit discrepancies.

- Documentation and Proof of Payments: Both parties should maintain proper documentation, including receipts or proof of payments. This documentation can serve as evidence and help resolve disputes or discrepancies related to unapplied credit.

- Training and Education: Providing training and education to staff involved in credit management can help prevent and address unapplied credit issues. This can include training on proper payment allocation procedures, attention to detail, and effective communication practices.

- Seek Professional Assistance if Needed: In complex cases or situations where unapplied credit persists, it may be necessary to seek professional assistance. Creditors can consult with financial advisors, accountants, or credit management experts to help resolve the issue and implement effective systems and processes.

By adopting these strategies, both creditors and debtors can minimize the occurrence of unapplied credit and establish smoother credit management processes. It is essential to address unapplied credit promptly to maintain accurate financial records, prevent disputes, and foster trust between both parties.

Conclusion

Unapplied credit is a concept that holds significant importance in the world of finance. It refers to payments or credits that are not properly allocated to specific accounts or invoices, leading to confusion and inefficiencies in credit management. Understanding unapplied credit is crucial for both creditors and debtors to effectively manage their finances and maintain accurate records.

In this article, we explored the definition of unapplied credit, the causes behind it, the potential consequences for both creditors and debtors, and practical ways to address this issue. We discussed how incomplete or incorrect payment information, system errors, human errors, lack of communication, and complex payment structures can contribute to unapplied credit. We also highlighted the importance of clear communication, accurate record-keeping, robust payment processing systems, regular reconciliations, prompt follow-up, and documentation to address unapplied credit effectively.

By implementing these strategies, both parties can prevent unapplied credit, minimize disputes, and maintain healthy financial relationships. Clear communication, accurate record-keeping, and reliable payment processing systems are key to preventing unapplied credit. Prompt follow-up, regular reconciliations, and proper documentation help address and resolve any unapplied credit discrepancies.

Managing credit effectively requires proactive efforts from both creditors and debtors. It is essential to maintain open lines of communication, track payments accurately, and promptly address any unapplied credit issues to prevent negative consequences such as inaccurate financial records, difficulties in tracking balances, cash flow problems, disputes, and potential damage to credit history.

By understanding and addressing unapplied credit, individuals and businesses can enhance their financial management practices and foster a more efficient and transparent credit system. By taking the necessary steps to prevent and resolve unapplied credit, both creditors and debtors can maintain healthy financial relationships and foster trust in their credit processes.