Finance

How Much Does Cyber Liability Insurance Cost

Published: November 24, 2023

Find out the cost of Cyber Liability Insurance and protect your finances. Safeguard your business against cyber risks with affordable insurance options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of cyber liability insurance! In today’s digital age, the threat of cybercrime is ever-present. From data breaches to ransomware attacks, businesses of all sizes are vulnerable to costly cyber incidents. This is where cyber liability insurance comes into play – providing financial protection and peace of mind in the event of a cyber attack or data breach.

Cyber liability insurance is a specific type of insurance coverage designed to safeguard businesses against the financial repercussions of cyber threats. It helps cover the costs associated with recovering from a cyber attack, including forensic investigations, legal expenses, notification of affected parties, credit monitoring, and potential litigation or regulatory fines.

As more businesses continue to digitize their operations, the demand for cyber liability insurance has skyrocketed. A single cyber event can have devastating consequences for businesses, leading to significant financial losses and damage to their reputation. This is why it’s crucial for businesses to understand the costs associated with cyber liability insurance and ensure they have adequate coverage.

In this article, we will explore the factors that influence cyber liability insurance costs, the different policy coverage options available, the average costs businesses can expect to pay, and ways to reduce insurance costs while maintaining comprehensive coverage. By understanding the intricacies of cyber liability insurance costs, businesses can make informed decisions to protect their assets and ensure their financial well-being.

So, whether you’re a small business owner or a corporate executive, join us as we dive into the world of cyber liability insurance costs and empower yourself with the knowledge to protect your business from the ever-evolving threat of cybercrime.

Factors Affecting Cyber Liability Insurance Costs

The cost of cyber liability insurance can vary widely depending on several factors. Understanding these factors is crucial for businesses to accurately assess their insurance needs and budget accordingly. Here are some key factors that can influence the cost of cyber liability insurance:

- Size and Industry: The size and industry of a business play a significant role in determining the cost of cyber liability insurance. Generally, larger organizations with more extensive networks and higher volumes of sensitive data face greater risks and may incur higher insurance costs. Similarly, certain industries, such as healthcare and financial services, are more prone to cyber threats and may have higher premiums as a result.

- Annual Revenue: The annual revenue of a business is often used as a benchmark to gauge its exposure to cyber risks. In many cases, businesses with higher revenues are seen as more attractive targets for cybercriminals and may face higher insurance costs to adequately cover potential losses.

- Security Measures: The level of cybersecurity measures implemented by a business can impact its cyber liability insurance costs. Insurers typically assess the effectiveness of a company’s security protocols, including firewalls, encryption, access controls, and employee training. Businesses with robust security practices may enjoy lower premiums as they are deemed less vulnerable to cyber attacks.

- Prior Cyber Incidents: A business’s history of previous cyber incidents can impact the cost of cyber liability insurance. Insurers will likely consider the severity and frequency of any prior data breaches or cyber attacks. Businesses with a clean track record may benefit from lower premiums, while those with a history of incidents may face higher costs due to the perceived higher risk.

- Data Handling and Storage: The type and volume of data businesses handle and store can impact insurance costs. Organizations that process and store large amounts of sensitive customer information, such as credit card data or healthcare records, may face higher premiums. This is because the potential fallout from a data breach involving such information can be more significant, leading to increased insurance costs.

It’s important to note that these factors are not exhaustive, and various other elements can influence insurance costs. Cyber liability insurance providers will evaluate specific risk factors unique to each business when determining premiums. Therefore, businesses seeking cyber liability coverage should consult with insurers to get a comprehensive understanding of the factors influencing their specific insurance costs.

Policy Coverage Options

When it comes to cyber liability insurance, there are various coverage options available to businesses. The specific coverage depends on the insurance provider and the needs of the insured. Here are some common policy coverage options to consider:

- First-Party Coverage: This coverage focuses on the direct costs incurred by the insured business in the aftermath of a cyber incident. It typically includes expenses related to forensic investigations, data restoration, notification of affected parties, credit monitoring services for affected customers, and public relations efforts to manage the reputation damage. First-party coverage helps businesses quickly recover and minimize the financial impact of a cyber attack.

- Third-Party Coverage: This coverage protects the insured business from legal claims and associated expenses brought on by third parties affected by a cyber incident. It typically covers costs related to legal defense, settlements or judgments, regulatory fines, and penalties. Third-party coverage helps shield businesses from the financial consequences of lawsuits and regulatory actions resulting from a cyber attack.

- Business Interruption: This coverage provides compensation for lost income and extra expenses if a cyber incident disrupts regular business operations. It helps mitigate the financial impact of downtime, such as profit losses, employee wages, and ongoing operating expenses, during the recovery period. Business interruption coverage is particularly crucial for businesses heavily reliant on their digital infrastructure and online presence.

- Network Security Liability: This coverage focuses on liability arising from failures in network security, such as unauthorized access, data breaches, or transmission of malicious code. It helps protect businesses against legal claims resulting from security breaches that compromise customer data or lead to financial losses for third parties. Network security liability coverage can be vital for businesses handling sensitive customer information.

- Privacy Liability: This coverage protects against liability arising from the mishandling or unauthorized disclosure of personally identifiable information (PII). It includes coverage for legal claims resulting from data breaches, privacy violations, or wrongful collection or use of customer data. Privacy liability coverage is essential for businesses that collect and store personal information as a part of their operations.

These are just a few examples of the coverage options available in cyber liability insurance. It’s important for businesses to carefully assess their specific risks and consult with insurance providers to determine the most appropriate coverage options for their needs. Each policy may have variations and exclusions, so understanding the scope of coverage is crucial for businesses seeking comprehensive protection against cyber risks.

Average Costs of Cyber Liability Insurance

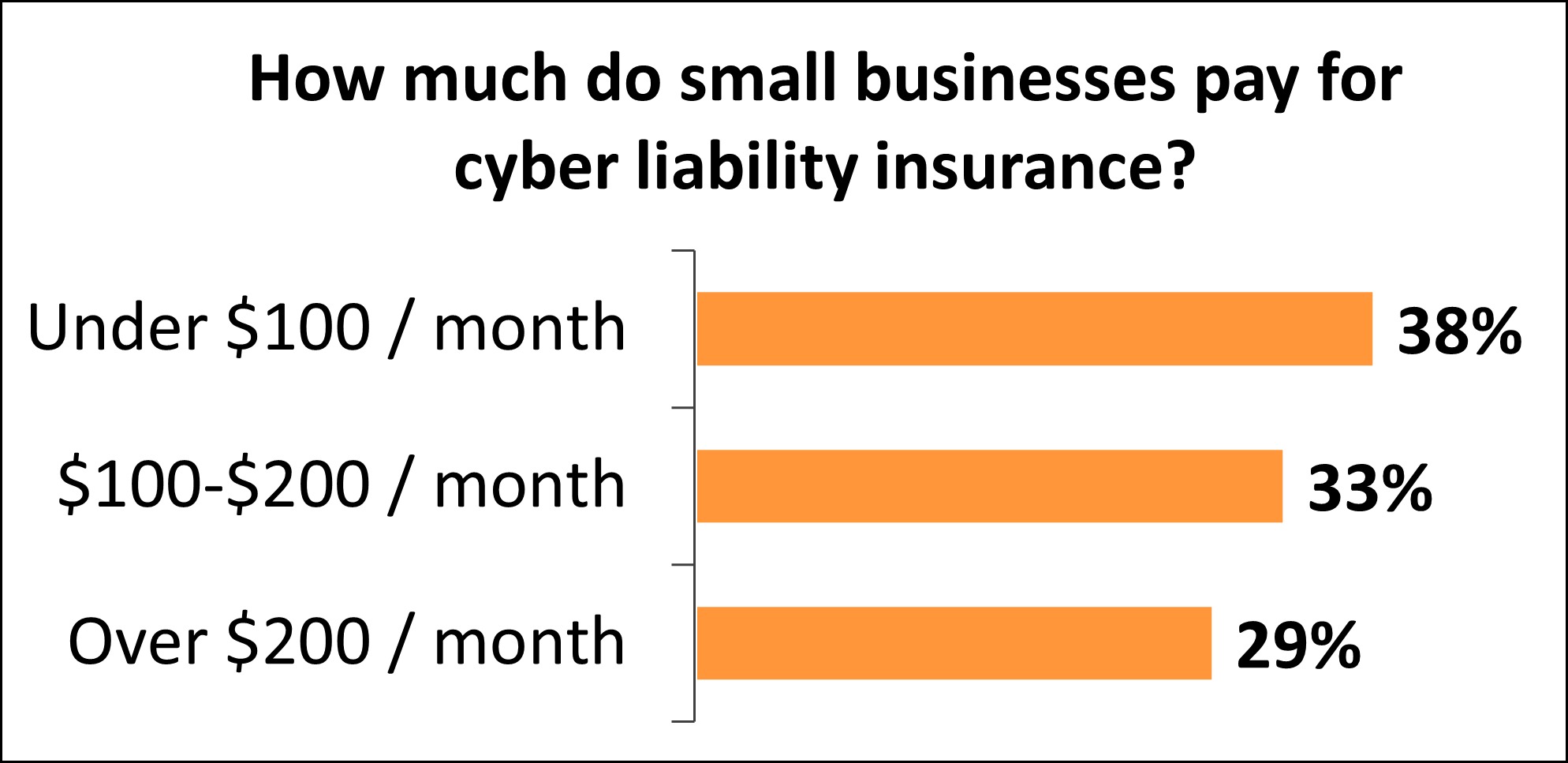

The cost of cyber liability insurance can vary significantly based on the size and risk profile of a business. Several studies provide insights into the average costs businesses can expect to pay for cyber liability insurance.

According to a 2020 study conducted by Advisen, the median cost of cyber liability insurance for small businesses with revenues under $50 million was around $1,500 per year. For mid-sized businesses with revenues between $50 million and $1 billion, the median cost increased to approximately $20,000 per year. Larger organizations with revenues over $1 billion can expect to pay even higher premiums, often in the range of $100,000 or more annually.

It’s important to note that these figures represent median costs and actual premiums can vary significantly depending on various factors such as industry, cybersecurity measures in place, prior incidents, and coverage limits. Some industries, including healthcare, financial services, and retail, tend to have higher cyber liability insurance costs due to the increased risks associated with their respective sectors.

Additionally, the coverage limits and deductibles selected by a business can also impact the cost of the insurance policy. Higher coverage limits and lower deductibles generally result in higher premiums.

In recent years, the cost of cyber liability insurance has been increasing as the frequency and severity of cyber attacks continue to rise. Insurers are facing higher costs to cover losses, improve risk management, and enhance underwriting processes. This, in turn, translates to higher premiums for businesses seeking cyber insurance coverage.

It’s important for businesses to understand that cyber liability insurance is not a one-size-fits-all solution, and each business’s specific risks and requirements will influence the cost of coverage. Working with an experienced insurance broker or consulting directly with cyber insurance providers can help businesses identify the most suitable coverage options and obtain accurate cost estimates.

Ultimately, the cost of cyber liability insurance should be viewed as an investment in protecting a business from potentially devastating financial losses. It acts as a safety net, providing businesses with the financial resources to recover and rebuild in the event of a cyber attack or data breach.

Determining Factors for Pricing

The pricing of cyber liability insurance is determined by various factors that insurers assess to calculate premiums. Understanding these factors can help businesses better comprehend how their risks and characteristics influence the cost of coverage. Here are the key determining factors for pricing cyber liability insurance:

- Industry and Business Size: Different industries face varying risks and regulations, which impact insurance pricing. Highly regulated industries such as healthcare and financial services may have higher premiums due to the stringent data protection requirements they must adhere to. Additionally, larger businesses that possess a greater volume of sensitive data or have more extensive networks may face higher premiums due to the increased exposure to cyber threats.

- Risk Profile: Insurers carefully evaluate a business’s risk profile to determine the likelihood and potential impact of a cyber incident. This includes assessing factors such as the type of data handled, security measures in place, and past cyber incidents. Businesses with riskier profiles or a history of prior breaches may face higher premiums to account for the elevated likelihood of future incidents.

- Cybersecurity Measures: The implementation of comprehensive cybersecurity measures can positively impact insurance pricing. Insurers evaluate the effectiveness of a business’s security protocols, including firewalls, encryption, employee training, and incident response plans. Businesses that demonstrate strong cybersecurity practices may receive more favorable rates as they are deemed less susceptible to cyber attacks.

- Claims History: Insurance providers consider a business’s claims history, particularly related to previous cyber incidents. Companies with a track record of frequent or severe data breaches may face higher premiums. On the other hand, businesses without any prior incidents or with a favorable claims history may enjoy more favorable rates.

- Policy Coverage and Limits: The extent of the coverage and the limits selected by a business will influence the premium. Higher coverage limits and additional coverage options come with higher costs. It is essential for businesses to evaluate their specific needs and balance the desired coverage with their budget.

- External Factors: External factors such as the overall cyber threat landscape, regulatory changes, and the frequency and severity of cyber attacks also impact insurance pricing. As cyber threats continue to evolve, insurers may adjust their rates to reflect the changing risk landscape.

Insurance providers may use proprietary models and underwriting methods to assess these factors and determine the pricing of cyber liability insurance. It’s crucial for businesses to proactively manage their cyber risks, implement robust cybersecurity measures, and collaborate with knowledgeable insurance brokers to obtain accurate pricing information and secure the most suitable coverage for their specific needs.

Industry Specific Costs

When it comes to cyber liability insurance, the costs can vary across different industries. Certain sectors face unique cyber risks and regulatory requirements, which can impact the pricing of insurance coverage. Let’s take a closer look at industry-specific costs for cyber liability insurance:

- Healthcare: The healthcare industry deals with large volumes of sensitive patient data, making it an attractive target for cybercriminals. Healthcare providers, including hospitals, medical clinics, and insurance companies, often face higher cyber liability insurance costs due to the increased risks associated with potential data breaches or privacy violations.

- Financial Services: Financial institutions, such as banks, credit unions, and investment firms, hold vast amounts of valuable financial and personal information. Given the potential monetary gains for cybercriminals, the financial services industry is highly targeted. As a result, cyber liability insurance costs for this sector are often higher compared to other industries.

- Retail: The retail industry handles a significant amount of customer data, including payment card details, making it susceptible to data breaches. The substantial amount of data processed and the large customer base often contribute to higher cyber liability insurance costs for retailers.

- Technology: While the technology sector is often at the forefront of cybersecurity measures, it is not immune to cyber risks. Technology companies that handle sensitive client information or provide cloud-based services may experience higher insurance costs due to the potential fallout from a data breach or service interruption.

- Professional Services: Businesses in professional services, such as law firms, accounting firms, and consulting companies, often handle confidential client information. This makes them desirable targets for cybercriminals seeking to gain unauthorized access to sensitive data. Consequently, cyber liability insurance costs for professional services may be higher to mitigate potential legal claims or reputational damage resulting from a cyber incident.

- Education: Educational institutions, including schools, universities, and online learning platforms, store a vast amount of student and faculty information. Cyber liability insurance costs in the education sector can vary depending on the size and scale of the institution, as well as the security measures implemented to protect sensitive data.

- Government: Government agencies and entities, including local, state, and federal organizations, often deal with sensitive citizen information and national security matters. Given the potential impact of cyber attacks on public infrastructure and personal information, cyber liability insurance costs for government entities can be significant.

These are just a few examples, and the costs can vary within each industry based on factors like organization size, cybersecurity measures in place, claims history, and overall risk profile. It’s essential for businesses within each industry to assess their specific cyber risks, understand the regulatory environment, and work with insurance providers who specialize in their field to find appropriate coverage.

By recognizing and addressing industry-specific risks, businesses can more effectively protect themselves against cyber threats and ensure they have comprehensive cyber liability insurance coverage in place.

Ways to Reduce Cyber Liability Insurance Costs

Cyber liability insurance is an essential investment for protecting businesses from the financial impact of cyber threats. However, the cost of coverage can be a concern for many organizations. Here are some strategies businesses can consider to help reduce cyber liability insurance costs:

- Implement Strong Cybersecurity Measures: Taking proactive steps to enhance your cybersecurity posture can help lower insurance costs. Implement robust security measures, such as multi-factor authentication, encryption, and regular software updates, to reduce the risk of cyber incidents and demonstrate to insurers that you are committed to mitigating potential threats.

- Conduct Regular Risk Assessments: Conducting regular risk assessments can help identify vulnerabilities and prioritize cybersecurity investments. By addressing weaknesses and implementing appropriate safeguards, you can reduce the likelihood of cyber incidents and potentially enjoy lower insurance premiums.

- Employee Training and Awareness: Invest in comprehensive training programs to educate employees about cyber risks and best practices. Well-informed employees can play a crucial role in preventing potential data breaches and cyber attacks, which insurers may view positively when determining insurance costs.

- Incident Response Planning: Develop and regularly update an incident response plan to ensure a prompt and effective response in the event of a cyber incident. Having a well-defined plan in place demonstrates preparedness and can potentially lead to lower insurance costs.

- Engage an Insurance Broker: Work with an experienced insurance broker who specializes in cyber liability insurance. They can help navigate the complex landscape of cyber insurance and negotiate favorable terms and premiums on your behalf. Their expertise and market knowledge can assist in finding the most cost-effective coverage for your specific business needs.

- Consider Higher Deductibles: Choosing a higher deductible can lower premium costs. However, it’s essential to carefully evaluate your financial capabilities to cover the deductible amount in the event of a claim. Find the right balance between a deductible that is manageable for your business and the potential cost savings on premiums.

- Review and Update Coverage: Regularly review your cyber liability insurance coverage to ensure it aligns with your evolving risks and business needs. As your cybersecurity measures improve or your risk profile changes, you may be eligible for lower premiums. Adjusting coverage accordingly can help optimize insurance costs.

- Bundle Insurance Policies: Consider bundling cyber liability insurance with other business insurance policies from the same provider. Many insurers offer discounted rates when multiple policies are purchased together, allowing you to save on overall insurance costs.

Keep in mind that while these strategies can help reduce cyber liability insurance costs, it’s crucial not to compromise on the level of coverage needed to adequately protect your business. Finding the right balance between cost savings and comprehensive coverage is key.

Remember, cyber liability insurance is an investment in the security and financial stability of your business. By implementing strong cybersecurity measures, demonstrating risk mitigation efforts, and working with knowledgeable insurance professionals, you can help reduce costs while ensuring you have the necessary coverage to safeguard your business from cyber threats.

Conclusion

Cyber liability insurance has become a vital component of risk management for businesses in today’s digital age. It provides financial protection and peace of mind in the face of evolving cyber threats and the potential for devastating data breaches. However, understanding the factors that influence the cost of cyber liability insurance is crucial for businesses to make informed decisions about their coverage needs.

Various factors, including industry and business size, security measures, claims history, and coverage options, can impact the pricing of cyber liability insurance. The average costs can vary significantly across industries, with healthcare, financial services, and retail often facing higher premiums due to unique risks and compliance requirements.

Businesses can take steps to reduce cyber liability insurance costs. Implementing strong cybersecurity measures, conducting regular risk assessments, and investing in employee training can help mitigate potential risks and demonstrate a commitment to security. Engaging an insurance broker, considering higher deductibles, reviewing and updating coverage, and bundling policies can also contribute to cost savings.

Ultimately, the cost of cyber liability insurance should be viewed as an investment in protecting a business’s financial well-being. By carefully evaluating risks, working with knowledgeable insurance professionals, and maintaining proactive cybersecurity practices, businesses can strike a balance between cost-effectiveness and comprehensive coverage.

When it comes to cyber threats, it’s not a matter of if, but when an incident may occur. Being adequately prepared with robust insurance coverage can make a significant difference in minimizing financial losses, recovering from cyber attacks, and protecting a business’s reputation. As the cyber landscape continues to evolve, businesses must adapt their insurance coverage to ensure their ongoing resilience in the face of this ever-evolving threat.