Finance

How Much Does Surety Bonds Cost

Published: October 12, 2023

Learn about the cost of surety bonds in finance. Discover how much you can expect to pay for this essential financial protection.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When engaging in any financial transactions or business activities, it’s important to protect yourself and your assets. This is where surety bonds come into play. Surety bonds act as a form of financial guarantee, providing assurance that the obligations outlined in a contract will be fulfilled.

Whether you’re a business owner or an individual, understanding the cost of surety bonds is crucial in making informed decisions. Surety bond costs can vary depending on various factors, including the type of bond, the amount of coverage required, and the financial stability of the party seeking the bond.

This article aims to provide you with a comprehensive overview of surety bond costs and the factors that influence them. We’ll explore the different types of surety bonds, the pricing structure for surety bonds, and tips on how to potentially lower the overall cost. By the end, you’ll have a solid understanding of what to expect when it comes to surety bond costs.

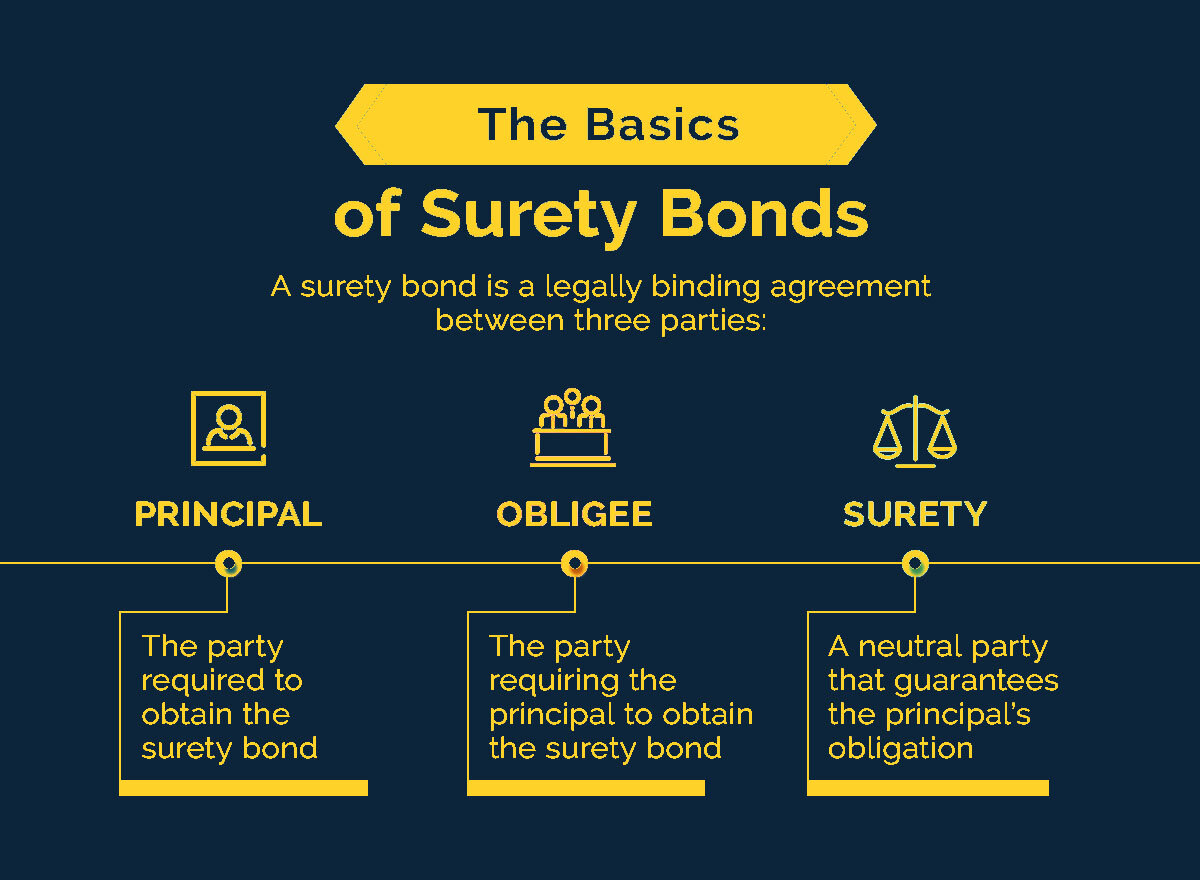

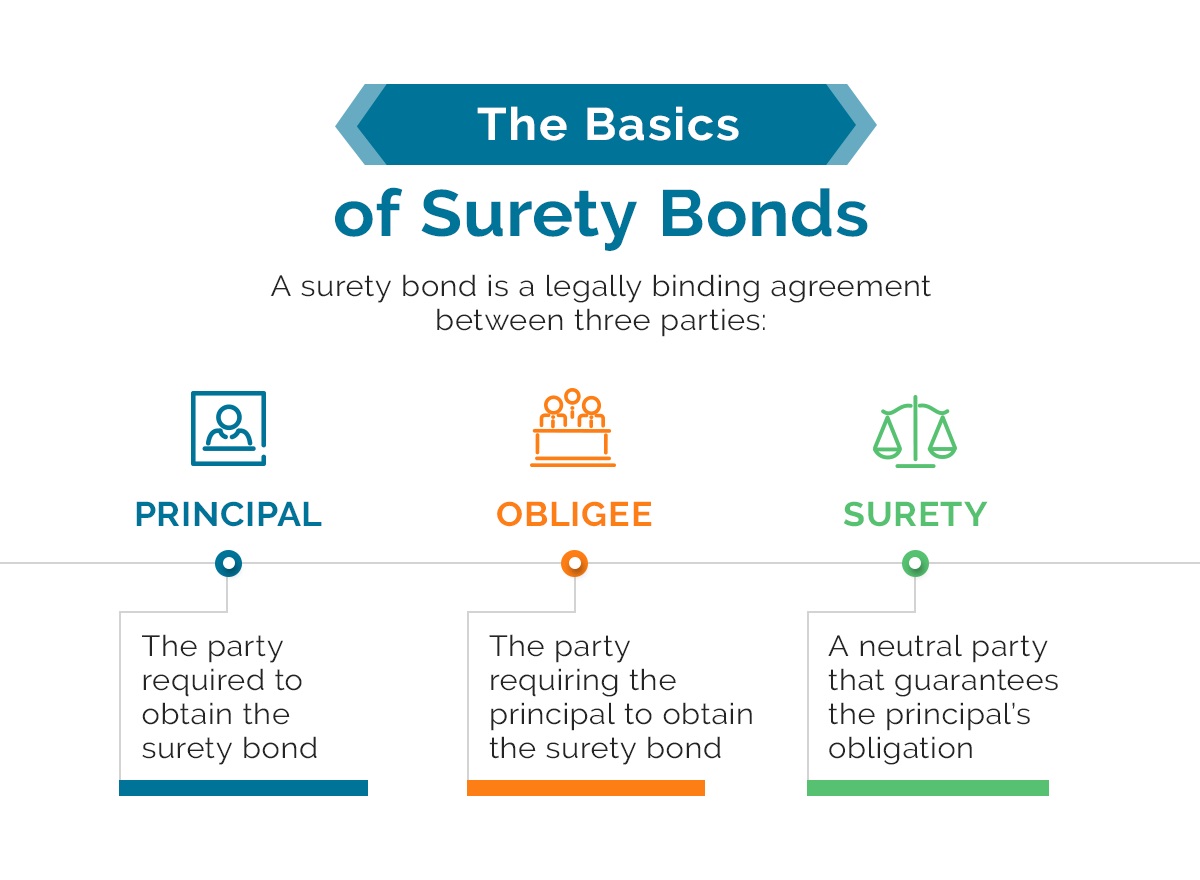

Understanding Surety Bonds

Surety bonds are a three-party agreement between the principal (the party seeking the bond), the obligee (the party requiring the bond), and the surety company (the issuer of the bond). They serve as a guarantee that the principal will fulfill their contractual obligations or compensate the obligee for any losses incurred.

There are different types of surety bonds, each serving a specific purpose. Contract bonds are commonly used in construction projects to ensure that contractors complete their work according to the contract terms and regulations. Commercial bonds, on the other hand, are required for businesses to obtain licenses and permits, ensuring compliance with legal and financial obligations.

One key aspect of surety bonds is that they provide financial protection to the obligee, while holding the principal accountable for their actions. If the principal fails to fulfill their obligations, the surety company steps in to compensate the obligee for any losses or damages.

Surety bonds are different from insurance policies in that they primarily protect the interests of the obligee, rather than the principal. While insurance policies protect the insured party against unforeseen events and losses, surety bonds protect the party that requires the bond.

It’s important to note that surety bonds are not to be confused with cash or collateral. Instead of tying up funds or assets, the principal pays a premium to the surety company, which acts as compensation in case of default or non-compliance. This allows the principal to allocate their resources elsewhere, while still fulfilling their contractual obligations.

Overall, understanding the purpose and role of surety bonds is essential for anyone engaging in contractual agreements or business activities. They provide a level of assurance and protection for all parties involved, instilling confidence and trust in the transactions.

Factors Affecting Surety Bond Costs

The cost of a surety bond can vary significantly depending on several factors. Understanding these factors will help you estimate the potential costs involved and make informed decisions regarding your bonding needs. Here are some of the key factors that affect surety bond costs:

- Bond type: The type of surety bond you require will have a direct impact on the cost. Different bonds have different levels of risk and complexity, which can affect the pricing.

- Bond amount: The amount of coverage required for the surety bond also influences the cost. Typically, the higher the bond amount, the higher the premium.

- Risk assessment: Surety bond companies assess the risk associated with providing a bond to an applicant. Factors such as credit history, financial stability, and business experience of the applicant can impact the premium.

- Industry and project specifics: Certain industries or projects may involve higher levels of risk and liability, resulting in higher bond costs. Factors such as project complexity, duration, and location can all affect the pricing.

- Bond duration: The length of time the bond is required can impact the cost. Longer-term bonds may have higher premiums due to the extended period of coverage.

- Claim history: If the principal has a history of claims or defaults on previous bonds, it can negatively impact the premium cost for future bonds.

It’s important to note that each surety bond company may have its own underwriting guidelines and risk assessment criteria, leading to variations in pricing.

Keep in mind that while surety bond costs may seem like an additional expense, they provide financial protection and demonstrate credibility to the obligee. The cost of a surety bond is a small price to pay compared to the potential financial losses and legal consequences of non-compliance or default.

Now that you understand the factors influencing surety bond costs, let’s delve into the different types of surety bonds and their specific pricing structures.

Types of Surety Bonds

Surety bonds come in various forms, each serving a specific purpose and industry. Understanding the different types of surety bonds will help you determine which one is relevant to your specific situation. Here are some common types of surety bonds:

- Contract Bonds: Contract bonds are commonly used in the construction industry. They include bid bonds, performance bonds, and payment bonds. Bid bonds provide financial assurance to project owners that the contractor will honor the terms of their bid. Performance bonds guarantee that the contractor will complete the project according to the contract specifications, while payment bonds ensure that subcontractors and suppliers are paid for their work.

- Commercial Bonds: Commercial bonds are required for business operations, licenses, and permits. These bonds protect consumers and regulators by ensuring that the business complies with legal and financial obligations. Examples of commercial bonds include license and permit bonds, mortgage broker bonds, and auto dealer bonds.

- Court Bonds: Court bonds are required in legal proceedings to protect the interests of individuals involved. These bonds ensure that all parties comply with court-ordered obligations. Examples of court bonds include probate bonds, guardian bonds, and appeal bonds.

- Customs Bonds: Customs bonds are necessary for importers and exporters dealing with international trade. These bonds provide assurance that the importer or exporter will comply with customs regulations, pay applicable duties and taxes, and fulfill their obligations. Examples of customs bonds include import bonds, export bonds, and ATA Carnet bonds.

These are just a few examples of the many types of surety bonds available. Each type has its own specific requirements and pricing structure based on the associated risks and regulations.

It’s essential to consult with a knowledgeable surety bond professional to determine the specific type of bond you need for your particular circumstances. They can guide you through the process and help you secure the appropriate bond at the best possible cost.

Now that we’ve covered the types of surety bonds, let’s explore the pricing structure for these bonds.

Pricing Structure for Surety Bonds

The pricing structure for surety bonds is usually based on a percentage of the bond amount. This percentage, known as the bond premium, is determined by several factors, including the type of surety bond, the bond amount, and the risk assessment of the principal.

Generally, the premium for surety bonds is calculated as a small percentage of the bond amount, typically ranging from 1% to 10%. For example, if you need a $100,000 surety bond with a 2% premium rate, you would pay a $2,000 premium.

However, the premium rate can vary depending on the specific circumstances. Factors such as credit history, financial stability, and industry experience of the principal can influence the premium rate. Those with a strong credit history and financial stability are likely to receive lower premium rates, as they are considered lower risk by the surety company.

In addition to the bond premium, there may be additional fees associated with the issuance and administration of the surety bond. These fees can include application fees, underwriting fees, and annual renewal fees. It’s important to review and understand all the fees involved before proceeding with obtaining a surety bond.

It’s worth noting that surety bonds are typically issued for a specified period, often one year. At the end of this period, the bond will need to be renewed. The premium for renewing a bond is usually lower than the initial premium, as the principal’s track record and bond history play a role in determining the premium rate.

When comparing prices from different surety bond providers, it’s important to consider not only the premium rate but also the reputation and financial stability of the surety company. Working with a reputable and financially secure surety company can provide additional peace of mind.

Now that you have an understanding of the pricing structure for surety bonds, let’s explore the average cost of surety bonds in different industries.

Average Cost of Surety Bonds

The cost of surety bonds can vary widely depending on factors such as the bond type, bond amount, and the risk associated with the principal. The average cost of surety bonds is influenced by these factors, as well as market conditions and industry standards. While it’s difficult to provide an exact average cost, we can give you a general idea of what to expect.

Contract bonds, which are commonly used in the construction industry, typically range from 1% to 3% of the bond amount. For example, if you need a $500,000 performance bond, you could expect to pay a premium of $5,000 to $15,000. The exact premium will depend on the risk assessment of the contractor and project specifics.

Commercial bonds, required for various business licenses and permits, tend to be more affordable. Premium rates for commercial bonds are typically lower, ranging from 0.5% to 2% of the bond amount. For example, a $50,000 license bond might have a premium of $250 to $1,000.

Court bonds, which are needed for legal proceedings, usually have fixed premium rates set by the court. These rates can range from 1% to 3% of the bond amount. The specific premium will depend on the bond type, such as probate bonds or appeal bonds, and the jurisdiction in which the bond is required.

Customs bonds, required for importers and exporters, have varying premium rates based on factors like the bond amount and the principal’s creditworthiness. The premium for customs bonds can range from 0.5% to 3% of the bond amount.

It’s important to remember that these figures are general guidelines, and the actual cost of a surety bond will depend on the specific circumstances involved. Factors such as credit history, financial stability, industry experience, and project complexity can all impact the premium rate.

When obtaining a surety bond, it’s advisable to consult with multiple surety bond companies to compare quotes and evaluate the services offered. By doing so, you can ensure you’re getting a fair price and choosing a reputable provider.

Now that we’ve explored the average cost of surety bonds, let’s look at some strategies to potentially lower the cost of obtaining a surety bond.

How to Lower Surety Bond Costs

While surety bond costs are influenced by several factors, there are strategies you can employ to potentially lower the cost of obtaining a surety bond. Here are some tips to consider:

- Improve your creditworthiness: Since surety bond premiums are often based on the creditworthiness of the principal, improving your credit score can help lower the cost. Paying bills on time, reducing debt, and resolving any negative credit issues can positively impact your creditworthiness.

- Build solid financials: Demonstrating sound financial stability can help lower surety bond costs. Maintain accurate and up-to-date financial statements and show consistent profitability to instill confidence in the surety company.

- Establish a track record: Building a positive track record with surety bond companies can lead to lower premiums over time. Consistently fulfilling your contractual obligations and avoiding claims or defaults can strengthen your bond history and lower perceived risk.

- Obtain multiple quotes: Reach out to several surety bond providers to obtain multiple quotes. Compare the premiums, fees, and services offered by different companies to ensure you’re getting the best value for your specific bonding needs.

- Work with an experienced surety agent: Collaborating with a knowledgeable surety agent can help navigate the bonding process and potentially secure better rates. They have expertise in the industry and can leverage their relationships with surety companies to negotiate more favorable terms.

- Bundle bonds: If you require multiple bonds, consider bundling them together with one surety company. Bundling bonds can often lead to discounted premiums, as it demonstrates a higher level of commitment and loyalty.

- Improve your industry knowledge: Understanding the requirements of your industry and staying up-to-date on regulations can help you present yourself as a knowledgeable and responsible party. This can positively impact the perception of the surety company and potentially lower your premium.

It’s important to note that not all strategies may be applicable to your specific situation. Working closely with a surety bond professional will help you identify the most effective strategies for lowering your surety bond costs.

By implementing these strategies, you can improve your chances of obtaining more favorable surety bond premiums and ensuring the financial protection you need without breaking the bank.

By now, you should have a solid understanding of the factors that affect surety bond costs, the different types of surety bonds, the pricing structure, and strategies to potentially lower the costs. Having this knowledge will empower you to make informed decisions regarding surety bond requirements for your specific situation.

Conclusion

Surety bonds play a vital role in providing financial protection and ensuring contractual obligations are met. Understanding the factors that influence surety bond costs, the different types of surety bonds, and the pricing structure can help you navigate the process more effectively and make informed decisions.

Factors such as the bond type, bond amount, risk assessment, and industry specifics all contribute to the overall cost of a surety bond. By understanding these factors, you can better estimate the potential costs involved and budget accordingly.

Surety bonds come in various types, including contract bonds, commercial bonds, court bonds, and customs bonds. Each type serves a specific purpose, and the pricing structure for each may vary. It’s important to work with a reputable surety bond professional and consult multiple providers to secure the most suitable bond at the best possible cost.

While surety bond costs may seem like an additional expense, they provide essential financial protection and demonstrate credibility to the obligee. Taking steps to improve your creditworthiness, maintain solid financials, and establish a positive track record can potentially lower your surety bond premiums over time.

Ultimately, working with an experienced surety agent, obtaining multiple quotes, and staying informed about industry regulations can all contribute to securing more favorable surety bond costs.

Remember, the specifics of surety bond costs will vary based on individual circumstances and industry standards. It’s essential to review your unique requirements with a surety bond professional who can guide you through the process and provide tailored advice.

With this comprehensive understanding of surety bond costs, types, pricing structure, and strategies to potentially lower costs, you can confidently navigate the world of surety bonds and protect your interests in various business and legal situations.