Home>Finance>How Does A License And Permit Surety Bonds Works

Finance

How Does A License And Permit Surety Bonds Works

Published: October 12, 2023

Discover how license and permit surety bonds function in the world of finance. Learn why these bonds are crucial for businesses and how they protect against financial risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding License and Permit Surety Bonds

- The Role of the Principal

- The Obligee’s Perspective

- The Surety Company’s Role

- How License and Permit Surety Bonds Work

- Application and Approval Process

- Bond Amount and Premium Calculation

- Bond Claims and Surety Company’s Responsibility

- Renewal and Termination of Bonds

- Conclusion

Introduction

When it comes to starting a business or pursuing certain professions, obtaining the necessary licenses and permits is crucial. These licenses and permits serve as legal authorizations, ensuring that the business or individual complies with regulations and requirements set by governing authorities.

However, in some cases, simply obtaining a license or permit is not enough. Many industries and professions require an additional layer of financial protection to safeguard the interests of the public and ensure compliance with legal obligations. This is where license and permit surety bonds come into play.

License and permit surety bonds are a form of financial guarantee that provides reassurance to the governing authorities and the public that the licensed individual or business will fulfill their obligations. These bonds serve as a safety net, offering financial compensation to individuals or entities that suffer damages or losses due to the actions or negligence of the bonded party.

In this article, we will delve into the concept of license and permit surety bonds, exploring how they work and the roles of the various parties involved. We will also take a closer look at the application process, bond amounts, claims, and the renewal and termination of these bonds. By understanding these key aspects, you can make informed decisions and ensure compliance with the necessary regulations in your industry.

Understanding License and Permit Surety Bonds

License and permit surety bonds are a specific type of surety bond that focuses on ensuring compliance with licensing and permitting requirements in various industries. These bonds act as a guarantee that the bonded party will adhere to the rules and regulations set by the governing authorities.

The purpose of these bonds is to protect the public and provide a financial recourse for individuals or entities that may suffer damages or losses as a result of the actions or negligence of the licensed party. They serve as a safety net, ensuring that the licensed party remains accountable for their obligations and responsibilities.

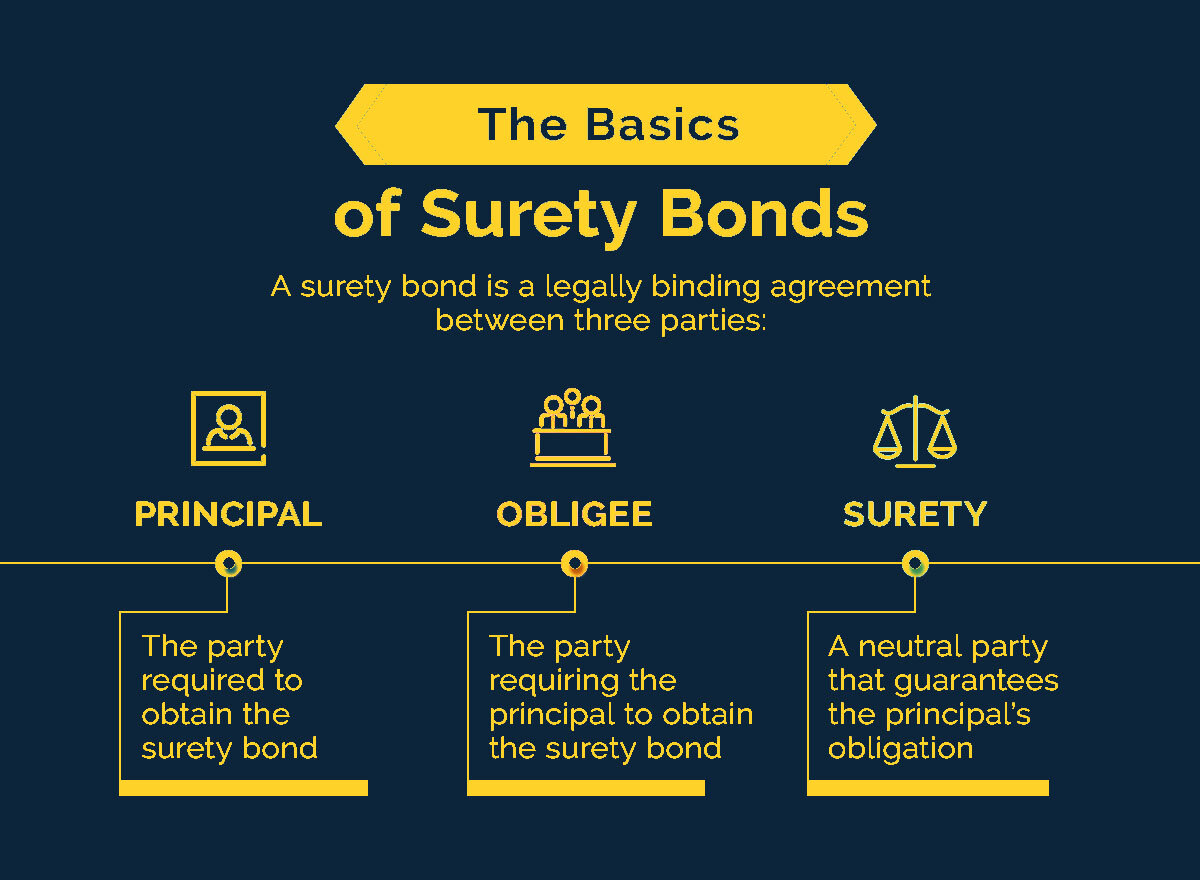

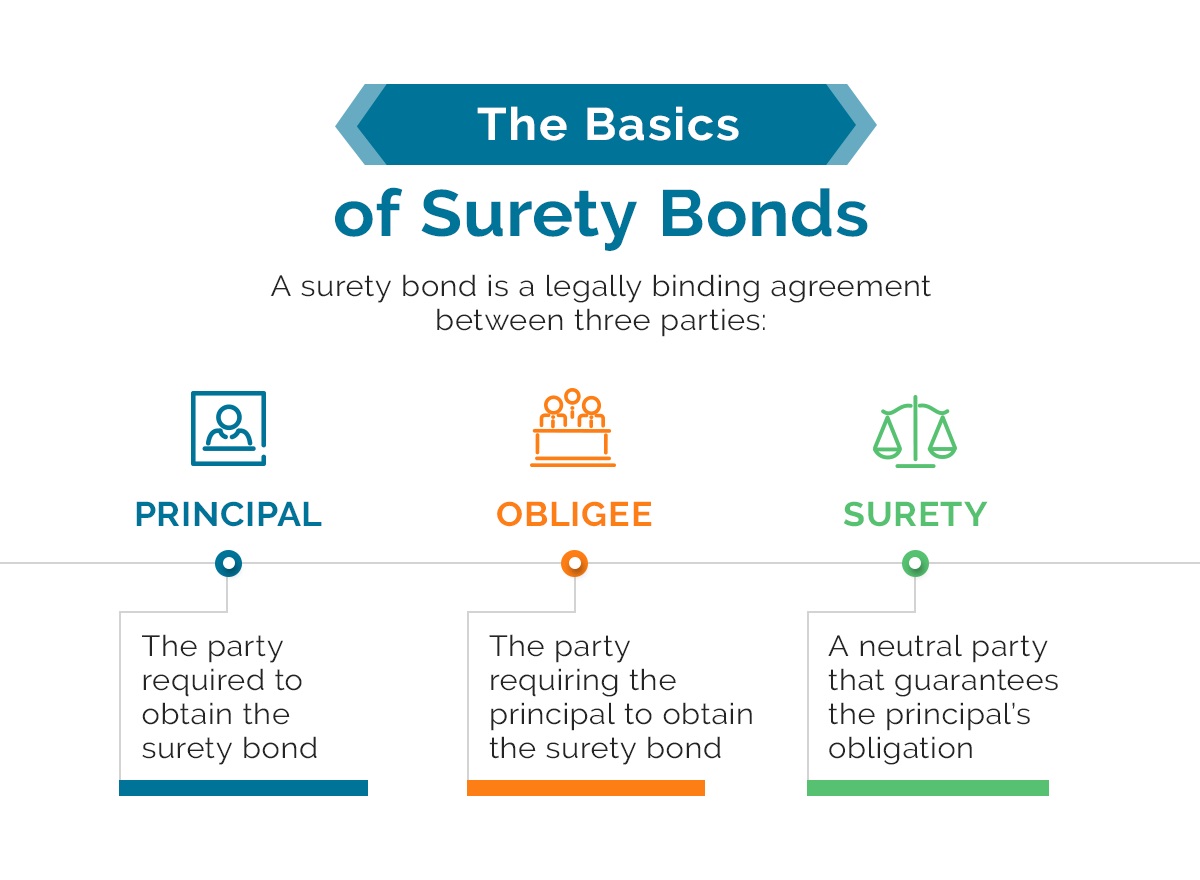

There are three main parties involved in a license and permit surety bond:

- The Principal: This is the individual or business that is required to obtain the bond. They are the party responsible for fulfilling the obligations set forth by the governing authorities.

- The Obligee: The obligee is the governing authority or the entity that requires the bond. They are the party that sets the licensing or permitting requirements and enforces compliance.

- The Surety Company: The surety company is the third party that provides the bond. They act as the financial guarantor and are responsible for ensuring that any valid claims made against the bond are resolved.

It is important to note that license and permit surety bonds are distinct from insurance. Insurance protects the insured party from unforeseen events, whereas surety bonds protect the obligee and the public from the actions or failures of the bonded party.

By requiring a license and permit surety bond, governing authorities can mitigate risks associated with certain industries or professions. These bonds provide peace of mind to the public, assuring them that the licensed party possesses the necessary qualifications and will fulfill their obligations.

Now that we have a basic understanding of license and permit surety bonds, let’s explore the roles of the principal, the obligee, and the surety company in more detail in the next section.

The Role of the Principal

When it comes to license and permit surety bonds, the principal is the individual or business that is required to obtain the bond as a condition of obtaining a license or permit. The principal’s role is crucial in ensuring compliance with the governing authorities’ regulations and requirements.

The principal is responsible for fulfilling their obligations and responsibilities under the terms of the license or permit. This includes maintaining compliance with relevant laws, following industry-specific regulations, and meeting the standards set by the obligee.

By obtaining a license and permit surety bond, the principal provides a guarantee to the obligee and the public that they will act ethically, responsibly, and within the bounds of the law. In the event of any violations, negligence, or failures on the part of the principal, the bond serves as a form of protection for those who may suffer damages or losses.

In essence, the principal’s role is to uphold the trust placed in them by the governing authorities and the public. They must conduct their business or practice their profession in a manner that ensures the safety, well-being, and satisfaction of their clients or customers.

In the context of license and permit surety bonds, the principal must also fulfill their financial obligations. This means paying any fines, penalties, or damages resulting from violations or non-compliance. Failure to do so may result in a valid claim being made against the bond.

Furthermore, the principal must maintain the surety bond throughout the duration of their license or permit. This ensures continuous protection for the obligee and the public, as any potential liabilities arising from the principal’s actions remain covered by the bond.

Overall, the principal plays a vital role in the license and permit surety bond process. By obtaining the bond and fulfilling their obligations, they demonstrate their commitment to operating within the legal framework and providing the necessary protection for those they serve.

The Obligee’s Perspective

From the obligee’s perspective, license and permit surety bonds are a critical component of ensuring compliance and protecting the interests of the public. The obligee, which is typically a governing authority or regulatory agency, plays a key role in setting the licensing or permitting requirements and enforcing compliance in various industries.

The obligee’s main objective is to ensure that licensed individuals or businesses uphold specific standards, regulations, and legal obligations. By requiring a license and permit surety bond, the obligee adds an extra layer of protection for the public and creates a financial recourse in case of any wrongdoing or failure on the part of the bonded party.

From a broader perspective, license and permit surety bonds provide the obligee with several advantages:

- Financial Protection: Surety bonds offer a financial safety net for individuals who may suffer damages or losses due to the actions or negligence of the licensed party. The bond provides a means of compensation when such incidents occur, providing relief to affected parties.

- Enhanced Compliance: The obligation to obtain a surety bond acts as an additional incentive for the principal to comply with the licensing or permitting requirements. The financial risk associated with bond claims serves as a strong motivator for the principal to uphold their obligations and act responsibly.

- Legal Remedies: In cases where the principal fails to fulfill their obligations, the obligee can leverage the surety bond to seek legal remedies. This includes filing a claim against the bond to recover any financial losses or damages suffered as a result of the principal’s actions.

- Public Confidence: Requiring license and permit surety bonds demonstrates the obligee’s commitment to protecting the public’s interests. It instills confidence in the community by ensuring that licensed individuals or businesses are financially responsible and accountable for their actions.

Overall, license and permit surety bonds enable the obligee to fulfill their regulatory duties more effectively. By incorporating these bonds into their licensing or permitting processes, the obligee ensures that the public is protected and that the licensed parties uphold their legal and ethical responsibilities.

The Surety Company’s Role

In the context of license and permit surety bonds, the surety company plays a crucial role in ensuring the financial integrity and protection of the obligee and the public. As a third-party entity, the surety company acts as the guarantor of the bond, providing financial security and backing to ensure the validity of the bond.

The surety company’s role can be broken down into several key functions:

- Evaluating the Principal: Before issuing a bond, the surety company assesses the principal’s financial and professional background. This evaluation helps determine the principal’s ability to fulfill their obligations and pay potential bond claims.

- Issuing the Bond: Once the surety company approves the principal’s application, they issue the license and permit surety bond. This bond serves as a legal contract between the principal, the obligee, and the surety company.

- Financial Security: By issuing a bond, the surety company provides a guarantee that the bonded party (the principal) has the financial capacity to compensate for any damages or losses resulting from non-compliance or negligence.

- Managing Bond Claims: In the event of a valid claim against the bond, the surety company takes responsibility for investigating and evaluating the claim. If the claim is found to be legitimate, the surety company will compensate the affected party up to the bond’s coverage limits.

- Seeking Reimbursement: After paying a bond claim, the surety company will seek reimbursement from the principal. It is the principal’s responsibility to repay the surety company for any amount paid out as a result of a claim, including legal fees and associated costs.

- Providing Support and Guidance: Throughout the bond term, the surety company acts as a resource for the principal, providing guidance and support. They may offer advice on compliance, help resolve disputes, and assist the principal in adhering to their obligations.

- Monitoring the Principal: The surety company typically monitors the principal’s activities to ensure ongoing compliance. This may include periodic reviews of the principal’s financial standing, professional conduct, and adherence to the terms outlined in the bond agreement.

Overall, the surety company plays a vital role in the license and permit surety bond process. By providing financial security and actively managing bond claims, they ensure that the obligee and the public are protected from potential risks associated with non-compliance or negligence on the part of the bonded party.

How License and Permit Surety Bonds Work

License and permit surety bonds work based on a contractual relationship between three main parties: the principal, the obligee, and the surety company. Understanding how these bonds work is essential for both those obtaining the bonds and those relying on them for protection.

Here’s an overview of how license and permit surety bonds typically operate:

1. Application and Approval Process: The principal, the entity seeking the license or permit, must apply for a surety bond from a surety company. The application process generally involves providing documentation, such as financial statements and business licenses, to assess the principal’s eligibility for the bond.

2. Bond Amount and Premium Calculation: Once the surety company evaluates the principal’s application, they determine the bond amount required based on factors such as the industry, specific obligations, and potential risk exposure. The bond amount typically represents the maximum coverage the bond provides. The principal must then pay a premium to the surety company, which is a percentage of the bond amount.

3. Bond Issuance: Once the bond amount is determined, and the premium is paid, the surety company issues the license and permit surety bond. This bond serves as a legally binding agreement among the principal, the obligee, and the surety company.

4. Bond Claims and Surety Company’s Responsibility: If the principal fails to meet their obligations or acts negligently, resulting in damages or losses to the obligee or the public, a valid claim can be made against the bond. The affected party must submit a claim to the surety company, providing evidence and documentation to support their case.

5. Claim Investigation and Resolution: Upon receiving a bond claim, the surety company undertakes a thorough investigation to determine the validity and scope of the claim. If the claim is deemed legitimate, the surety company will compensate the affected party up to the bond’s coverage limit. The surety company may seek reimbursement from the principal for the amount paid out, including any legal fees incurred.

6. Renewal and Termination of Bonds: License and permit surety bonds typically have a specified term, often corresponding to the duration of the license or permit. At the end of the bond term, the principal must renew the bond to maintain compliance with the licensing requirements. Likewise, bonds can be terminated if the principal no longer requires the license or permit or fails to meet their financial obligations to the surety company.

It is important to note that license and permit surety bonds are subject to local regulations, and specific requirements may vary based on jurisdiction and industry. Consulting with a surety bond professional can provide further guidance on the exact process and nuances related to license and permit surety bonds.

In summary, license and permit surety bonds provide financial protection and assurance to the obligee and the public. They ensure that the principal fulfills their obligations and acts responsibly, allowing for a more secure and compliant business environment.

Application and Approval Process

The application and approval process is a crucial step in obtaining a license and permit surety bond. This process involves the principal, the individual or business seeking the bond, submitting an application to a surety company. The goal of this process is to assess the principal’s eligibility and determine the terms of the bond.

Here’s an overview of the application and approval process for license and permit surety bonds:

1. Gather Required Information: The principal must gather all the necessary information and documentation to complete the bond application. This may include personal identification documents, financial statements, business licenses, and other relevant paperwork.

2. Select a Surety Company: The principal should research and choose a reputable surety company that specializes in license and permit surety bonds. It is important to work with a company that has a strong financial standing and a track record of providing reliable bond services.

3. Complete the Application: The principal fills out the bond application form provided by the surety company. The application typically requires information about the principal’s personal background, business details, financial history, and any previous bonding experience.

4. Submit Required Documents: Along with the completed application, the principal must submit the required supporting documents. These documents may vary depending on the industry, jurisdiction, and specific bond requirements. The surety company will specify the necessary documentation.

5. Evaluation of the Application: Once the application and supporting documents are submitted, the surety company evaluates the principal’s eligibility for the bond. The evaluation may include a review of the principal’s financial standing, credit history, professional qualifications, and any relevant legal or regulatory compliance issues.

6. Bond Terms and Premium Calculation: Based on the evaluation, the surety company determines the terms of the bond, including the bond amount and the premium rate. The bond amount represents the maximum coverage provided by the bond, while the premium is the fee paid by the principal to obtain the bond.

7. Bond Issuance: If the principal meets the surety company’s criteria, and the terms are agreed upon, the surety company issues the license and permit surety bond. The bond is a legally binding contract between the principal, the obligee, and the surety company, outlining their respective roles and responsibilities.

8. Bond Renewal: License and permit surety bonds typically have a specified term, often corresponding to the duration of the license or permit. When the bond approaches its expiration date, the principal may need to renew the bond to maintain compliance and coverage. The renewal process may involve updating information and paying the required premium.

It is important to note that the approval process may vary depending on the jurisdiction and the specific requirements of the bond. Certain industries or professions may have additional criteria that need to be met. Working with a knowledgeable surety bond professional can help ensure a smooth application and approval process.

In summary, the application and approval process for license and permit surety bonds involves the principal submitting an application, providing necessary documentation, and undergoing evaluation by a surety company. Upon approval, the bond is issued, providing financial protection and assurance to the obligee and the public.

Bond Amount and Premium Calculation

When acquiring a license and permit surety bond, two crucial factors to consider are the bond amount and the premium. Understanding how these are determined is vital for the principal seeking the bond and helps ensure compliance with the obligee’s requirements.

Here’s an overview of how bond amounts and premiums are typically calculated for license and permit surety bonds:

1. Bond Amount: The bond amount refers to the maximum coverage provided by the surety bond. It represents the financial responsibility that the surety company assumes on behalf of the principal. The bond amount is determined based on various factors, including industry-specific regulations, the value of potential damages or losses, and the obligee’s requirements. Different licenses and permits may have different bond amount requirements.

2. Premium Calculation: The premium is the fee that the principal pays to obtain the bond. It represents a percentage of the bond amount and is an ongoing expense for the duration of the bond. The premium is typically assessed based on the principal’s financial strength, credit history, and any associated risks. The surety company determines the premium rate by considering various risk factors specific to the principal and the bonded activity.

3. Factors Impacting Premium Rates: Several factors come into play when determining the premium rate for a license and permit surety bond. These may include but are not limited to:

– Financial Standing: The principal’s financial stability and creditworthiness contribute to the premium rate. A principal with a strong financial profile may receive more favorable premiums.

– Bond Amount: In general, higher bond amounts result in higher premiums since the surety company assumes a greater liability.

– Industry Risk: Industries with higher levels of risk or potential liabilities may have higher premium rates.

– Experience and Track Record: Principals with a proven track record of responsible business practices and compliance may enjoy lower premium rates.

– Personal Credit History: The principal’s personal credit history can impact the premium rate, as it reflects their financial reliability and ability to meet financial obligations.

4. Cost Savings: It’s important for the principal to shop around and compare premium rates from different surety companies. While it’s crucial to work with reputable and financially stable surety providers, obtaining multiple quotes can help find the most competitive premium rates, potentially resulting in cost savings.

5. Bond Riders and Additional Coverages: Depending on the specific requirements of the license or permit, the principal may need to include riders or additional coverages to enhance the bond’s protection. These can impact the overall premium rate.

It’s essential for the principal to carefully review the terms, conditions, and coverage of the bond and consult with a surety bond professional to understand the precise calculations and factors impacting the bond amount and premium.

In summary, the bond amount represents the maximum coverage provided by the license and permit surety bond, while the premium is the fee paid by the principal to obtain the bond. The bond amount is determined based on various factors related to the industry, potential risks, and obligee requirements. The premium is calculated based on the principal’s financial strength, creditworthiness, and associated risks. By understanding these calculations, the principal can secure the necessary bond and fulfill their licensing or permitting requirements.

Bond Claims and Surety Company’s Responsibility

In the context of license and permit surety bonds, bond claims play a crucial role in providing financial protection to the obligee and the public. When a valid claim arises due to the principal’s non-compliance or negligence, it is the surety company’s responsibility to investigate and address the claim.

Here is an overview of how bond claims are handled and the surety company’s responsibilities:

1. Filing a Claim: When a party, such as a customer, supplier, or the obligee, suffers damages or losses due to the principal’s actions or failures, they can file a claim against the license and permit surety bond. The claimant must submit documentation and evidence supporting their claim to the surety company.

2. Claim Investigation: Upon receiving a bond claim, the surety company initiates an investigation to assess the validity and scope of the claim. The investigation may involve gathering additional information, speaking to relevant parties, and reviewing contractual agreements and applicable laws or regulations.

3. Claim Evaluation: Based on the investigation findings, the surety company evaluates the claim to determine if it meets the criteria for compensation under the bond. The claim must align with the terms and conditions outlined in the bond agreement, and the damages or losses must be a direct result of the principal’s actions or failure to meet their obligations.

4. Compensation and Subrogation: If the claim is deemed valid, the surety company will reimburse the claimant up to the bond’s coverage limit. The surety company may also pay any legal fees or associated costs related to the claim. After compensating the claim, the surety company may seek reimbursement from the principal for the amount paid out, including any legal expenses.

5. Principal’s Responsibility: It is the principal’s responsibility to reimburse the surety company for any amounts paid out for a claim. Failure to do so may result in the principal being in default, creating difficulties in obtaining future bonds and potentially impacting their ability to continue operating within the licensed profession or industry.

6. Dispute Resolution: In cases where there is a dispute over the claim, the surety company may play a role in facilitating resolution or engaging in legal proceedings if necessary. Their involvement ensures that claims are handled fairly and in accordance with the terms of the bond agreement.

The surety company’s responsibility in handling bond claims is pivotal in upholding the financial protection provided by license and permit surety bonds. Their thorough investigation of claims and subsequent compensation ensure that the obligee and the public are safeguarded against potential damages or losses resulting from the principal’s actions or failures.

It is important for both the principal and the obligee to maintain open communication with the surety company throughout the claims process. This helps ensure that claims are handled promptly and in accordance with the terms outlined in the bond agreement.

In summary, the surety company assumes the responsibility of investigating and addressing bond claims. They evaluate the validity of the claim, compensate the claimant if appropriate, and seek reimbursement from the principal. Their involvement ensures that license and permit surety bonds fulfill their intended purpose of providing financial protection to the obligee and the public.

Renewal and Termination of Bonds

License and permit surety bonds have a specified term that typically corresponds to the duration of the associated license or permit. Understanding the process of renewal and termination is essential for both the principal and the obligee, as it ensures continuity of coverage and compliance with licensing requirements.

Here’s an overview of how the renewal and termination of license and permit surety bonds generally work:

1. Bond Expiration: License and permit surety bonds have an expiration date, which is typically specified in the bond agreement. It is crucial for the principal to keep track of the bond’s expiration date to ensure there is no lapse in coverage.

2. Bond Renewal: As the bond approaches its expiration date, the principal must take action to renew the bond. The renewal process may involve submitting updated documentation and paying the required premium. It is recommended to initiate the renewal process well in advance of the expiration date to allow for any necessary reviews and processing time.

3. Updated Information: When renewing the bond, the surety company may request updated information from the principal, such as financial statements, business licenses, or any changes to the business structure. Providing accurate and current information is crucial to maintaining compliance with the bond agreement.

4. Premium Adjustment: The premium for the renewed bond may be adjusted based on various factors, including changes in the principal’s financial standing or any updates to the bond’s terms and conditions. It is essential for the principal to review and understand any changes in the premium rate.

5. Continuity of Coverage: Renewing the bond ensures continuity of coverage, as any potential liabilities that may arise during the renewed term remain protected. This continuous coverage provides assurance to the obligee and the public that the principal maintains the necessary financial security for the duration of their license or permit.

6. Bond Termination: There may be circumstances where the principal no longer requires the license or permit, or they fail to meet their financial obligations to the surety company. In these cases, the bond can be terminated. The termination process typically involves providing notice to the surety company and may require repayment of any outstanding premiums or potential claims against the bond.

Terminating a bond prematurely or allowing a bond to expire without renewal can have significant consequences for the principal. It can result in non-compliance with the licensing requirements, potential legal complications, and difficulties in obtaining future bonds or licenses.

It is important for both the principal and the obligee to stay informed about the expiration and renewal dates of license and permit surety bonds. Keeping track of these dates and initiating the renewal process in a timely manner helps ensure continuous coverage and compliance with the licensing obligations.

In summary, the renewal and termination of license and permit surety bonds are critical aspects of maintaining compliance and continuous coverage. Renewing the bond before its expiration date guarantees ongoing protection, while termination requires proper notice and may involve repayment of outstanding premiums or addressing any potential claims. By understanding and adhering to the renewal and termination process, both principals and obligees can ensure the necessary financial security and compliance in their respective industries.

Conclusion

License and permit surety bonds play a vital role in ensuring compliance, protecting the interests of the public, and providing financial reassurance in various industries and professions. Understanding how these bonds work and the responsibilities of each party involved is crucial for both principals and obligees.

License and permit surety bonds provide a safety net for the obligee and the public, ensuring that the principal fulfills their obligations, complies with regulations, and acts responsibly. They offer financial protection to those who may suffer damages or losses due to the actions or negligence of the licensed party.

The principal’s role revolves around upholding their obligations and responsibilities, maintaining financial stability, and renewing the bond when necessary. The obligee benefits from license and permit surety bonds through enhanced compliance, financial security, and legal remedies when violations occur.

The surety company plays a critical role in the licensing and bonding process. They evaluate the principal’s eligibility, issue the bond, manage claims, and provide financial security. Their involvement ensures the validity and integrity of the bonds and helps resolve claims promptly and fairly.

In the event of a valid claim, the surety company investigates the claim and compensates the affected party, up to the bond’s coverage limit. It is the principal’s responsibility to reimburse the surety company for the amount paid out. Continuous communication and cooperation between the parties involved are essential throughout the claims process.

The renewal and termination of license and permit surety bonds ensure continuous coverage and compliance. Renewing the bond on time maintains financial protection for the obligee and the public, while termination requires proper notice and resolution of any outstanding obligations.

In conclusion, license and permit surety bonds provide the necessary financial security and reassurance for licensed individuals and businesses. They protect the obligee and the public, ensure compliance, and provide a mechanism for resolving claims. Understanding the roles and responsibilities within the framework of license and permit surety bonds is crucial for maintaining trust, fulfilling obligations, and promoting a safe and secure business environment.