Finance

How Much Is Homeowners Insurance Los Angeles

Published: November 21, 2023

Find out the cost of homeowners insurance in Los Angeles and protect your finances with affordable coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Homeowners Insurance

- Factors Affecting Homeowners Insurance Rates in Los Angeles

- Types of Homeowners Insurance Coverage

- Average Cost of Homeowners Insurance in Los Angeles

- Tips for Saving Money on Homeowners Insurance in Los Angeles

- Shopping for Homeowners Insurance in Los Angeles

- Important Factors to Consider When Choosing Homeowners Insurance

- Understanding the Claims Process for Homeowners Insurance

- Conclusion

Introduction

When it comes to protecting your most valuable asset, your home, homeowners insurance is an essential investment. Whether you own a cozy bungalow in the suburbs or a luxurious mansion in the heart of Los Angeles, having the right insurance coverage can provide you with peace of mind and financial security in the face of unexpected events.

Homeowners insurance is designed to protect you financially in the event of damages to your property or personal belongings. It can cover a range of perils such as fire, theft, vandalism, and natural disasters. In a city like Los Angeles, known for its diverse neighborhoods and varied weather patterns, having comprehensive homeowners insurance is paramount.

Understanding the intricacies of homeowners insurance can be overwhelming, especially with the myriad of options available in the market. This article aims to demystify homeowners insurance in Los Angeles, providing you with important information on factors that affect insurance rates, types of coverage, average costs, and tips for saving money on your premiums. We will also guide you through the process of shopping for homeowners insurance and highlight important factors to consider when choosing the right policy for your needs.

Whether you are a new homeowner in Los Angeles or looking to reassess your current insurance coverage, this comprehensive guide will help you navigate the complexities of homeowners insurance and make informed decisions to protect your home and belongings.

Understanding Homeowners Insurance

Before delving into the specifics of homeowners insurance in Los Angeles, it is important to have a clear understanding of what homeowners insurance entails. Essentially, homeowners insurance is a contract between you and the insurance company that provides financial protection in the event of damage or loss to your property or personal belongings.

One of the key aspects of homeowners insurance is property coverage, which typically includes coverage for the physical structure of your home, as well as any attached structures such as garages or sheds. It can also provide coverage for damage to interior components like flooring, walls, and built-in appliances. It’s important to note that the coverage limit for property can vary, so it’s essential to review your policy carefully to ensure adequate protection.

In addition to property coverage, homeowners insurance also includes personal liability coverage. This is designed to protect you if someone is injured on your property and chooses to sue you for damages. Personal liability coverage can help cover legal fees, medical expenses, and even financial settlements in such cases.

Another crucial component of homeowners insurance is personal property coverage. This covers the belongings inside your home, such as furniture, clothing, electronics, and valuables. It’s important to accurately assess the value of your personal belongings when determining the coverage limit for personal property.

It’s worth noting that homeowners insurance may also provide additional living expenses (ALE) coverage. In the event that your home becomes uninhabitable due to a covered loss, ALE coverage can help cover temporary living expenses such as hotel bills, meals, and transportation.

Note: Homeowners insurance typically does not cover damage caused by certain perils such as floods or earthquakes. If you live in an area prone to these types of events, you may need to purchase separate coverage.

Now that you have a basic understanding of homeowners insurance, let’s explore the factors that can affect the rates of homeowners insurance in Los Angeles.

Factors Affecting Homeowners Insurance Rates in Los Angeles

When it comes to determining homeowners insurance rates in Los Angeles, several factors come into play. Insurance companies consider these factors to assess the risk associated with insuring a particular property. Understanding these factors can help you anticipate how your premiums may be calculated and potentially take steps to mitigate any negative impacts.

1. Location: The location of your home is a significant factor in determining homeowners insurance rates. In Los Angeles, factors such as proximity to fire stations, crime rates, and exposure to natural disasters like earthquakes and wildfires can influence your rates. Neighborhoods with higher crime rates or a higher risk of natural disasters may have higher insurance premiums.

2. Construction and Materials: The construction and materials used in your home can impact your insurance rates. Homes made of fire-resistant materials like brick or concrete are considered less risky and may result in lower premiums. Conversely, homes with older construction or flammable materials may have higher rates.

3. Dwelling Coverage Amount: The amount of coverage you choose for the physical structure of your home, known as dwelling coverage, will affect your insurance rates. A higher dwelling coverage limit usually translates to higher premiums.

4. Age and Condition of Home: The age and condition of your home can impact insurance rates. Older homes may require more maintenance and repairs, potentially leading to higher insurance costs. Homes with updated electrical, heating, and plumbing systems may qualify for discounts.

5. Liability Coverage: The amount of personal liability coverage you choose can influence your premiums. Higher liability coverage limits mean greater financial protection for you and can result in higher premium costs.

6. Deductible: The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles can lower your premiums but come with the risk of higher out-of-pocket costs in the event of a claim.

7. Credit Score: In many states, including California, insurance companies may consider your credit score when determining insurance rates. A lower credit score may result in higher premiums.

8. Claims History: Lastly, your claims history plays a role in determining insurance rates. If you have a history of filing frequent claims, insurance companies may view you as a higher risk and charge higher premiums.

It’s important to note that these factors can vary between insurance companies, so it’s advisable to shop around and compare quotes from multiple providers to find the best coverage and rates for your specific needs. Now let’s explore the different types of homeowners insurance coverage available in Los Angeles.

Types of Homeowners Insurance Coverage

When it comes to homeowners insurance coverage in Los Angeles, there are several types of policies available, each offering different levels of protection. Understanding these different types of coverage can help you choose the policy that best suits your needs. Here are the most common types of homeowners insurance coverage:

- Dwelling Coverage: This type of coverage protects the physical structure of your home, including the walls, roof, and foundation. It typically covers damage caused by perils such as fire, windstorms, and theft. It’s important to review the policy for any limitations or exclusions.

- Personal Property Coverage: Personal property coverage provides protection for your belongings inside your home, such as furniture, appliances, clothing, and electronics. This coverage extends to items lost or damaged due to covered perils, including theft, fire, or vandalism.

- Liability Coverage: Liability coverage is essential for homeowners, as it protects you financially if someone gets injured on your property and decides to sue you for damages. This coverage can help cover legal fees, medical expenses, and any financial settlements in such cases.

- Medical Payments Coverage: Medical payments coverage, also known as MedPay, can help pay for medical expenses if a guest gets injured on your property, regardless of who is at fault. It covers basic medical expenses, such as hospital visits and doctor’s fees.

- Additional Living Expenses (ALE) Coverage: ALE coverage comes into play when your home becomes uninhabitable due to a covered loss, such as a fire or natural disaster. It helps cover temporary living expenses, including hotel bills, meals, and transportation, until your home is repaired or you find a new place to live.

It’s important to carefully review the details of each coverage option and determine the appropriate levels for your specific needs. Additionally, some insurance companies may offer optional add-ons or endorsements that provide additional protection, such as coverage for valuable items or identity theft.

Now that we have explored the various types of homeowners insurance coverage, let’s take a look at the average cost of homeowners insurance in Los Angeles.

Average Cost of Homeowners Insurance in Los Angeles

When determining the cost of homeowners insurance in Los Angeles, several factors come into play. These include the size and value of your home, the coverage limits you choose, your location, and various other risk factors. While it’s difficult to provide an exact average cost that applies to every homeowner in Los Angeles, understanding the range can help you estimate what you might expect to pay.

According to recent data, the average annual cost of homeowners insurance in Los Angeles is around $1,300 to $1,600. However, it’s important to note that these figures can vary significantly depending on your specific circumstances and the insurance provider you choose.

Factors such as the location of your home, the crime rate in your neighborhood, proximity to fire stations, and the risk of natural disasters can all impact your insurance rates. For example, if you live in an area prone to wildfires or earthquakes, you may need to purchase additional coverage, which can increase the cost of your premiums.

The size and value of your home also play a role in determining your insurance rates. Typically, larger homes with higher values require higher coverage limits, which can result in higher premiums.

Furthermore, your chosen deductible can affect your insurance costs. A higher deductible usually translates to lower premiums, but it also means you’ll have a higher out-of-pocket expense in the event of a claim.

To get an accurate estimate of the cost of homeowners insurance for your specific property, it’s advisable to obtain quotes from multiple insurance providers. By comparing quotes and evaluating the coverage and pricing options, you can find the best policy that meets your needs while staying within your budget.

Now that we have a general understanding of the average costs, let’s explore some tips on how to save money on your homeowners insurance premiums in Los Angeles.

Tips for Saving Money on Homeowners Insurance in Los Angeles

Homeowners insurance is an important investment, but that doesn’t mean you have to break the bank to get the coverage you need. Here are some tips to help you save money on your homeowners insurance premiums in Los Angeles:

- Shop Around and Compare Quotes: Insurance rates can vary significantly from one provider to another, so it’s crucial to shop around and obtain quotes from multiple insurers. Comparing prices and coverage options will help you find the best value for your money.

- Bundle Your Policies: Consider consolidating your insurance policies with one provider. Many insurers offer discounts when you bundle your homeowners insurance with other policies, such as auto insurance.

- Improve Home Security: Installing security measures like burglar alarms, deadbolts, and smoke detectors can lower your insurance premiums. These measures reduce the risk of theft and fire, making your home less risky to insure.

- Consider a Higher Deductible: Opting for a higher deductible can lower your insurance premiums. However, make sure you choose a deductible that you can comfortably afford in case of a claim. It’s important to strike a balance between savings and potential out-of-pocket expenses.

- Maintain a Good Credit Score: In many states, including California, insurance companies use credit scores to determine premiums. Maintaining a good credit score can help you qualify for lower rates.

- Update Your Home: Making improvements to your home can not only enhance its value but also lower your insurance premiums. Upgrading your plumbing, electrical systems, or roof can reduce the risk of damage and qualify you for discounts.

- Take Advantage of Discounts: Inquire about available discounts offered by insurance companies. These may include discounts for being a non-smoker, having a home security system, or being a long-term customer.

- Review Your Property Coverage: Regularly assess the value of your property coverage to ensure it aligns with current market values. Over-insuring your property can lead to unnecessarily high premiums.

- Consider a Higher Homeowners Association (HOA) Deductible: If you live in an area with a homeowners association, consider opting for a higher HOA deductible. This can lower your premiums, but be sure to understand your responsibility for any associated costs in case of a claim.

Implementing these tips can help you save money on your homeowners insurance premiums while still maintaining adequate coverage. Keep in mind that insurance rates can change over time, so it’s a good practice to review your policy annually and reassess your coverage needs.

Now that we’ve explored ways to save money, let’s discuss the process of shopping for homeowners insurance in Los Angeles.

Shopping for Homeowners Insurance in Los Angeles

When shopping for homeowners insurance in Los Angeles, it’s important to approach the process with thorough research and careful consideration. Here are some steps to help you navigate the process and find the right insurance policy for your needs:

- Evaluate Your Coverage Needs: Begin by assessing your specific coverage needs. Consider factors such as the value of your home, the cost to rebuild, the value of your personal belongings, and any additional coverage you may require. This will help you determine the appropriate coverage limits.

- Research Insurance Providers: Look for reputable insurance providers that offer homeowners insurance in Los Angeles. Consider their financial stability, customer service reputation, and policy offerings. Online reviews and recommendations from friends and family can also be helpful in your research process.

- Obtain Multiple Quotes: Reach out to multiple insurance providers and request quotes based on the coverage limits you determined. Be sure to provide accurate information to get an accurate estimate. This will allow you to compare prices and coverage options to find the best fit for your needs and budget.

- Review Policy Coverage: Carefully review the coverage details of each policy you receive. Pay attention to exclusions, deductibles, and any additional endorsements or add-ons. Ensure that the policy provides the necessary coverage for your specific needs.

- Consider Customer Service: Customer service is an important aspect to consider when choosing an insurance provider. Look for a company that has a reputation for excellent customer service and a straightforward claims process. Quick and efficient claims handling can make a significant difference during a challenging time.

- Ask About Discounts: Inquire about available discounts that may apply to you. These can include bundling discounts, home security system discounts, or discounts for being a non-smoker. Taking advantage of these discounts can help lower your premiums.

- Read and Understand the Policy: Before selecting a homeowners insurance policy, thoroughly read and understand the terms and conditions. Seek clarification from the insurance provider if you have any questions or concerns. It’s important to have a clear understanding of the coverage and responsibilities outlined in the policy.

- Finalize Your Decision: After comparing quotes, coverage, and customer service, make an informed decision on the homeowners insurance policy that best meets your needs. Contact the insurance provider to finalize the policy and secure your coverage.

- Periodically Review and Update: Over time, your insurance needs may change, and it’s important to review your policy periodically to ensure it still aligns with your circumstances. Stay informed about changes in your home’s value, personal belongings, or any additional risks that may require adjustments to your coverage.

By following these steps, you can streamline the process of shopping for homeowners insurance in Los Angeles and find the coverage that provides the most comprehensive protection for your home and personal belongings.

Now that you understand the process of shopping for homeowners insurance, let’s discuss some important factors to consider when choosing the right policy for your needs.

Important Factors to Consider When Choosing Homeowners Insurance

When selecting homeowners insurance in Los Angeles, it’s crucial to consider several factors to ensure you choose the right policy for your needs and circumstances. Here are some important factors to consider:

- Coverage Options: Evaluate the coverage options offered by each insurance provider. Ensure the policy covers perils that are relevant to your area, such as earthquakes or wildfires. Consider additional endorsements or add-ons that may provide extra protection for valuables or specific risks.

- Policy Limits and Deductibles: Review the policy limits and deductibles. Ensure that the coverage limits align with the value of your home and personal belongings. Calculate the potential out-of-pocket expenses you would incur in case of a claim based on the deductible amount.

- Financial Stability: Consider the financial stability of the insurance provider. Look for insurers with a strong rating from independent rating agencies. This ensures that the company will have the financial resources to honor its obligations in the event of a claim.

- Customer Service and Claims Handling: Assess the reputation of the insurance provider for customer service and claims handling. Look for reviews and ratings that reflect prompt and efficient claims processing. A reliable and responsive insurer can provide peace of mind during a stressful situation.

- Price and Affordability: While price should not be the sole deciding factor, it is important to consider the affordability of the premiums. Obtain quotes from multiple providers and compare prices along with the coverage and service offered. Ensure that the policy provides good value for the price you are paying.

- Discounts and Savings Opportunities: Inquire about available discounts and savings opportunities. Some insurers offer discounts for bundling policies, having security systems, or being a non-smoker. Taking advantage of these discounts can help reduce your premiums without compromising coverage.

- Policy Exclusions and Limitations: Pay close attention to policy exclusions and limitations. Understand what is specifically excluded from coverage or subject to special conditions. Be aware of any limitations that may affect your ability to make a claim in certain circumstances.

- Referrals and Recommendations: Seek referrals and recommendations from friends, family, or trusted professionals who have experience with homeowners insurance. Their firsthand experiences can provide valuable insights and help you make an informed decision.

- Policy Reviews and Updates: Regularly review and update your policy to ensure it remains relevant to your changing needs and circumstances. Periodically reassess your coverage limits, deductibles, and any possible gaps in coverage.

By considering these important factors, you can make an informed decision and select a homeowners insurance policy that provides the right coverage, service, and value for your unique needs in Los Angeles.

With a solid understanding of the factors to consider when choosing homeowners insurance, let’s explore the claims process for homeowners insurance in Los Angeles.

Understanding the Claims Process for Homeowners Insurance

When it comes to homeowners insurance, understanding the claims process is essential. In the event of damage or loss to your home or personal belongings, knowing how to navigate the claims process can help ensure a smooth and timely resolution. Here is a general overview of the claims process for homeowners insurance in Los Angeles:

- Contact Your Insurance Provider: As soon as you discover damage or loss, promptly contact your insurance provider to report the claim. Provide them with detailed information about the incident, including the date, time, and a description of the damage or loss.

- Document the Damage: Take photos or videos of the damaged areas or items to provide visual documentation of the loss. This can help support your claim and expedite the assessment process.

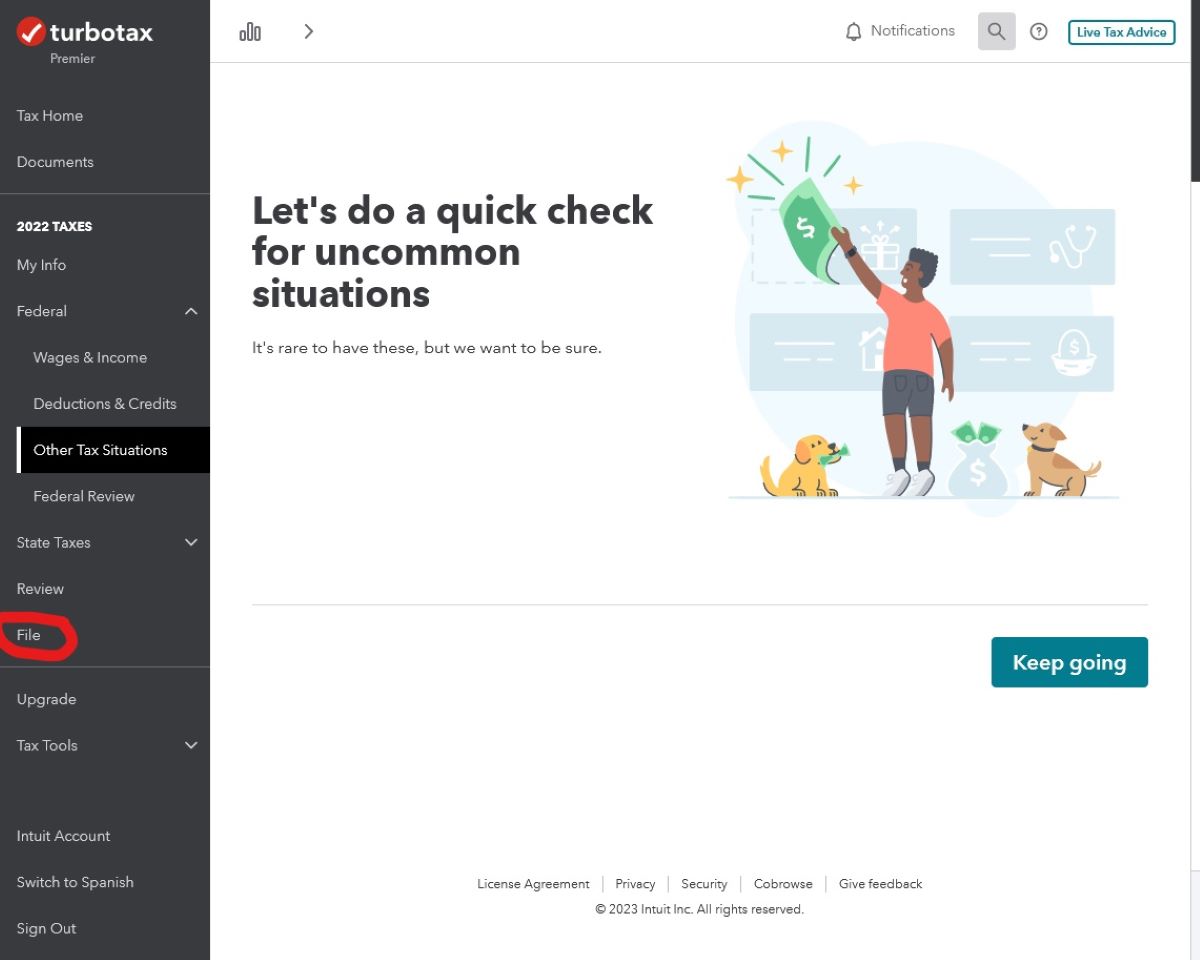

- File a Claim Form: Your insurance provider will require you to complete a claim form. Provide accurate and detailed information about the incident and the damaged property.

- Cooperate with the Claims Adjuster: An insurance claims adjuster will be assigned to evaluate the extent of the damage and determine the coverage and compensation. Cooperate fully with the adjuster and provide any necessary documents or information they request.

- Obtain Repair or Replacement Estimates: If necessary, obtain repair or replacement estimates from trusted contractors or professionals. These estimates can help support your claim and ensure a fair assessment of the damages.

- Review the Settlement Offer: Once the assessment is complete, your insurance provider will provide a settlement offer outlining the coverage and compensation. Review the offer carefully and compare it to your policy coverage limits and deductible.

- Negotiate, if Needed: If you believe the settlement offer is inadequate or unfair, you can negotiate with your insurance provider. Provide any additional evidence or documentation to support your claim and demonstrate why an adjustment is warranted.

- Accept the Settlement and Complete the Process: If you are satisfied with the settlement offer, accept it and follow any instructions provided by your insurance provider. Typically, you will be required to sign a release form to finalize the claim and receive the agreed-upon compensation.

- Make Repairs or Replace Items: With the settlement funds, proceed with repairing or replacing the damaged property. Maintain records and receipts of all related expenses for future reference or potential reimbursement.

It’s important to note that the claims process may vary slightly depending on your insurance provider and the specific details of your policy. However, understanding the general steps involved can help you navigate the process more effectively.

Remember to maintain open communication with your insurance provider throughout the claims process. Be proactive in providing requested information and documentation to ensure a smoother resolution. If you encounter any challenges or difficulties, don’t hesitate to seek guidance from your insurance agent or a claims representative.

By understanding the claims process and being prepared, you can confidently handle any unforeseen events and ensure a timely and satisfactory resolution when filing a homeowners insurance claim in Los Angeles.

Now that we have discussed the homeowners insurance claims process, let’s conclude our comprehensive guide to homeowners insurance in Los Angeles.

Conclusion

Homeowners insurance is a vital investment for protecting your home and personal belongings from unforeseen events. In Los Angeles, where diverse neighborhoods and potential risks exist, having comprehensive homeowners insurance is crucial. Throughout this guide, we have covered various aspects of homeowners insurance to help you make informed decisions that suit your needs and circumstances.

We started by establishing a clear understanding of homeowners insurance and its coverage options. By familiarizing yourself with the different types of coverage, including property, liability, and personal belongings, you can ensure that your policy adequately protects you.

Next, we explored the factors that can affect homeowners insurance rates in Los Angeles. From location and construction materials to dwelling coverage amounts and credit scores, understanding these factors allows you to anticipate potential costs and take steps to mitigate any negative impacts.

Knowing the average cost of homeowners insurance in Los Angeles provided you with a ballpark figure to help budget for this important expense. Additionally, we shared practical tips for saving money on homeowners insurance, such as shopping around for quotes, improving home security, and taking advantage of discounts.

When shopping for homeowners insurance, we emphasized the need to carefully evaluate coverage options, consider the reputation and financial stability of insurance providers, and thoroughly review policy details. By following these steps, you can select the right policy that provides the necessary protection for your home and personal belongings.

We also delved into the claims process for homeowners insurance, outlining the steps to follow when filing a claim. By understanding how to report the claim, document damages, communicate with the claims adjuster, and negotiate if needed, you can navigate the process more smoothly and ensure a fair settlement.

In conclusion, homeowners insurance in Los Angeles is a crucial investment to protect your most valuable asset. With proper research, understanding of coverage options, and consideration of important factors, you can find the right policy that offers financial security and peace of mind. Remember to periodically review and update your policy to reflect any changes in your needs or circumstances.

Whether you’re a new homeowner or reevaluating your current coverage, this comprehensive guide has provided you with the knowledge and tools to make informed decisions when it comes to homeowners insurance in Los Angeles.