Finance

How Protected Are Company Pension Funds?

Published: January 23, 2024

Discover the level of protection for company pension funds and ensure financial security for your future. Explore the finance aspect of safeguarding your retirement savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Vital Role of Pension Funds in Corporate Finance

When it comes to securing the financial well-being of employees, pension funds play a critical role in providing a stable source of income during retirement. These funds are instrumental in safeguarding the futures of hardworking individuals who dedicate their careers to contributing to the success of a company. Understanding the level of protection afforded to these funds is paramount, as it directly impacts the retirement security of countless individuals.

Exploring the intricacies of pension fund protection involves delving into the regulatory framework that governs these funds, identifying potential risks they face, and understanding the measures in place to safeguard them. By examining these aspects, we can gain a comprehensive understanding of the level of protection granted to company pension funds and the potential implications for employees and retirees.

Join us as we embark on a journey to unravel the complexities of pension fund protection, shedding light on the mechanisms designed to ensure the security of these vital financial assets.

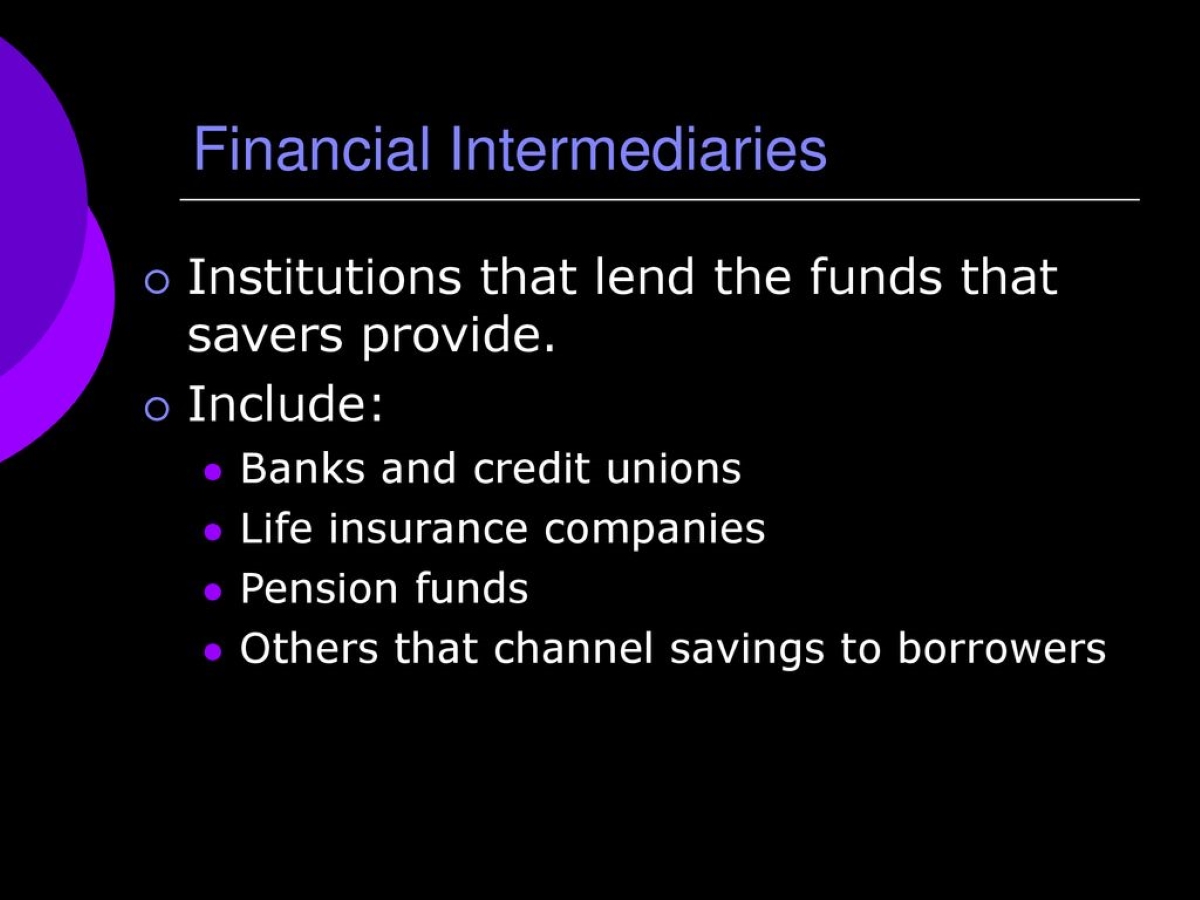

The Crucial Role of Pension Funds in Corporate Finance

Pension funds play a pivotal role in the realm of corporate finance, serving as a cornerstone of employee benefits and financial security. These funds are designed to provide a reliable source of income for employees during their retirement years, offering a means to sustain their livelihood and cover essential expenses. By contributing a portion of their earnings to pension funds throughout their careers, employees can secure a financial safety net for their post-retirement years.

From a corporate perspective, pension funds serve as a valuable tool for attracting and retaining top talent. Companies that offer robust pension plans demonstrate a commitment to the long-term well-being of their employees, fostering a sense of loyalty and stability within their workforce. This, in turn, can contribute to a positive corporate culture and bolster employee satisfaction and retention.

Furthermore, pension funds play a significant role in the broader economy by channeling funds into long-term investments. These investments, which often include stocks, bonds, and real estate, serve to fuel economic growth and development. By directing capital toward productive ventures, pension funds contribute to the expansion of businesses, infrastructure, and innovation, ultimately fostering a robust and dynamic economic landscape.

It is evident that pension funds are not only a vital component of individual financial planning but also a driving force behind corporate competitiveness and economic vitality. Understanding the critical role of pension funds underscores the importance of ensuring their protection and stability, thereby safeguarding the financial futures of employees and contributing to the overall resilience of the economy.

Regulatory Framework for Pension Funds

The protection and oversight of pension funds are governed by a robust regulatory framework aimed at safeguarding the interests of both employees and retirees. In the United States, the Employee Retirement Income Security Act (ERISA) stands as a cornerstone of pension fund regulation, setting forth stringent guidelines to ensure the prudent management and fiduciary responsibility of these funds. ERISA imposes fiduciary standards on those responsible for managing and overseeing pension assets, requiring them to act in the best interests of the plan participants and beneficiaries.

Additionally, regulatory bodies such as the Pension Benefit Guaranty Corporation (PBGC) play a crucial role in overseeing and insuring certain pension plans, providing a safety net for participants in the event of plan termination or financial distress. The PBGC operates as a government corporation, offering protection for defined benefit pension plans and stepping in to assume responsibility for these plans if they are unable to meet their obligations.

Furthermore, pension fund regulations often entail strict reporting and disclosure requirements, ensuring transparency and accountability in the management of these funds. Plan administrators are typically obligated to provide participants with comprehensive information regarding plan features, investment options, and funding status, empowering beneficiaries to make informed decisions about their retirement savings.

Internationally, regulatory frameworks for pension funds vary by jurisdiction, with many countries implementing stringent guidelines to govern the management and protection of these critical financial assets. By upholding these regulatory standards, governments strive to mitigate the risks associated with pension funds and uphold the financial security of retirees and employees.

Risks to Pension Funds

Pension funds are exposed to a myriad of risks that can potentially impact their financial stability and the security of retirement benefits for employees. Understanding and mitigating these risks is essential to safeguarding the long-term viability of pension funds.

Market Risk: Fluctuations in financial markets can significantly impact the value of pension fund investments. Market risk arises from volatility in asset prices, interest rates, and currency exchange rates, potentially leading to diminished fund performance and investment returns.

Longevity Risk: With increasing life expectancies, pension funds face the challenge of providing income for retirees over longer periods. Longevity risk pertains to the potential for retirees to outlive their retirement savings, necessitating careful planning and risk management to ensure the adequacy of pension benefits.

Regulatory and Compliance Risk: Pension funds are subject to evolving regulatory requirements and compliance standards. Failure to adhere to these regulations can result in legal and financial repercussions, underscoring the importance of robust governance and compliance measures.

Interest Rate Risk: Fluctuations in interest rates can impact the value of fixed-income investments held within pension funds. Interest rate risk poses challenges in managing the fund’s asset-liability matching and can influence funding levels and future pension obligations.

Operational Risk: The operational complexities of managing pension funds introduce the potential for operational risk, including errors in financial reporting, inadequate internal controls, and cybersecurity threats. Mitigating operational risk requires robust governance structures and stringent internal controls.

Inflation Risk: The erosion of purchasing power due to inflation poses a significant risk to pension funds, potentially diminishing the real value of future pension payments. Addressing inflation risk entails prudent investment strategies and inflation-hedging measures.

By identifying and comprehensively addressing these risks, pension funds can enhance their resilience and fortify the financial security of retirees and employees, ensuring the sustained delivery of retirement benefits.

Protection of Pension Funds

Ensuring the protection of pension funds is paramount in safeguarding the retirement security of employees and retirees. Several measures are in place to mitigate risks and fortify the stability of these critical financial assets.

Diversification of Investments: Pension funds employ diversification strategies to mitigate investment risk. By allocating assets across a range of investment classes, including stocks, bonds, and alternative investments, funds aim to reduce exposure to market volatility and enhance long-term returns.

Prudent Risk Management: Rigorous risk management practices are integral to protecting pension funds. This includes conducting thorough risk assessments, implementing robust governance structures, and adhering to stringent compliance and regulatory standards to mitigate operational, market, and regulatory risks.

Fiduciary Responsibility: Those entrusted with managing pension funds bear fiduciary responsibility, obligating them to act in the best interests of plan participants and beneficiaries. Upholding fiduciary standards ensures that fund managers prioritize the long-term financial well-being of employees and retirees.

Transparency and Disclosure: Providing clear and comprehensive information to plan participants regarding the features, performance, and funding status of pension plans is crucial. Transparency and disclosure empower beneficiaries to make informed decisions about their retirement savings and cultivate trust in the management of pension funds.

Government Guarantees and Insurance: In many jurisdictions, government entities offer guarantees and insurance programs to protect pension benefits in the event of plan termination or financial distress. These safeguards provide a safety net for retirees and employees, bolstering confidence in the security of pension funds.

Stress Testing and Scenario Analysis: Conducting stress tests and scenario analyses enables pension funds to assess their resilience to adverse market conditions, interest rate fluctuations, and other potential risks. By identifying vulnerabilities and proactively addressing them, funds can enhance their ability to withstand economic uncertainties.

By implementing these protective measures, pension funds strive to fortify their resilience, uphold the financial security of retirees, and fulfill their crucial role in providing stable and reliable retirement benefits to employees.

Conclusion

In conclusion, the protection of company pension funds is a multifaceted endeavor that encompasses regulatory oversight, risk management, and fiduciary responsibility. These critical financial assets play an indispensable role in securing the retirement futures of employees, underpinning their long-term financial well-being and providing a sense of security as they transition into retirement.

By navigating the intricate regulatory framework governing pension funds, companies and plan administrators can ensure compliance with stringent standards aimed at safeguarding the interests of plan participants and beneficiaries. The implementation of robust risk management practices, including diversification of investments and stress testing, serves to fortify the stability of pension funds and mitigate potential vulnerabilities.

Transparency, disclosure, and fiduciary responsibility are foundational pillars in the protection of pension funds, fostering trust and confidence among employees and retirees. The assurance of government guarantees and insurance programs further bolsters the security of pension benefits, offering a safety net in the face of unforeseen challenges.

Ultimately, the protection of company pension funds is not only a regulatory imperative but a moral obligation to honor the dedication and contributions of employees throughout their careers. By upholding the integrity and security of these funds, companies demonstrate a commitment to the financial well-being of their workforce and contribute to the resilience of the broader economy.

As we continue to navigate the evolving landscape of retirement planning and financial security, the protection of pension funds remains a cornerstone of corporate responsibility and employee empowerment. By embracing the measures outlined to safeguard these vital financial assets, companies can uphold their commitment to the long-term prosperity and security of their employees, ensuring that retirement remains a period of fulfillment and financial stability.