Finance

How The Rich Use Life Insurance

Modified: February 21, 2024

Discover how the wealthy leverage life insurance to optimize their financial strategies and secure their future. Uncover the secrets of finance and wealth creation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Life Insurance

- Benefits of Life Insurance for the Rich

- Strategies for the Rich to Maximize Life Insurance

- Types of Life Insurance Policies for the Wealthy

- Case Studies: How Successful Individuals Use Life Insurance

- Considerations for the Rich When Purchasing Life Insurance

- Conclusion

Introduction

Life insurance is often associated with individuals looking to protect their loved ones financially in the event of their untimely demise. However, life insurance can also serve as a powerful financial tool for the wealthy. In fact, the rich have been using life insurance strategies for generations to enhance their financial portfolios and leave a lasting legacy.

Unlike traditional investments, life insurance offers unique advantages that make it an attractive option for the affluent. Not only does it provide a death benefit that can provide for heirs, but it also offers tax advantages and a range of investment opportunities. Understanding how the rich utilize life insurance can provide valuable insights for individuals looking to maximize their own wealth.

In this article, we will delve into the world of life insurance for the wealthy and explore the various strategies and benefits that come with it. We will also examine different types of life insurance policies that cater specifically to the needs of the affluent. Additionally, we will provide case studies showcasing how successful individuals have effectively used life insurance to achieve their financial goals.

It’s important to note that while life insurance can be a powerful financial tool, it is not without its complexities. The wealthy should approach life insurance with careful consideration and seek the guidance of financial professionals who specialize in this area. By understanding the intricacies of life insurance, the rich can create comprehensive wealth management plans that align with their long-term objectives.

Now, let’s dive deep into the world of life insurance for the affluent and explore the strategies and benefits that can pave the way for financial success.

Understanding Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums to the insurer, and in return, the insurer promises to provide a designated sum of money, known as the death benefit, to the policy’s beneficiaries upon the death of the insured.

There are several types of life insurance policies, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If the insured person dies during the term, the death benefit is paid out to the beneficiaries. However, if the insured survives the term, no benefit is paid.

Permanent life insurance, on the other hand, provides coverage for the entire lifetime of the insured. These policies typically combine a death benefit with a cash value component. The premiums paid for permanent life insurance not only provide a death benefit but also contribute to the cash value, which grows over time on a tax-deferred basis.

One of the key advantages of life insurance is its ability to provide a lump sum payment to beneficiaries quickly and efficiently, allowing them to cover immediate financial needs such as funeral expenses or outstanding debts. Additionally, life insurance proceeds are generally income tax-free for beneficiaries, making it an attractive estate planning tool.

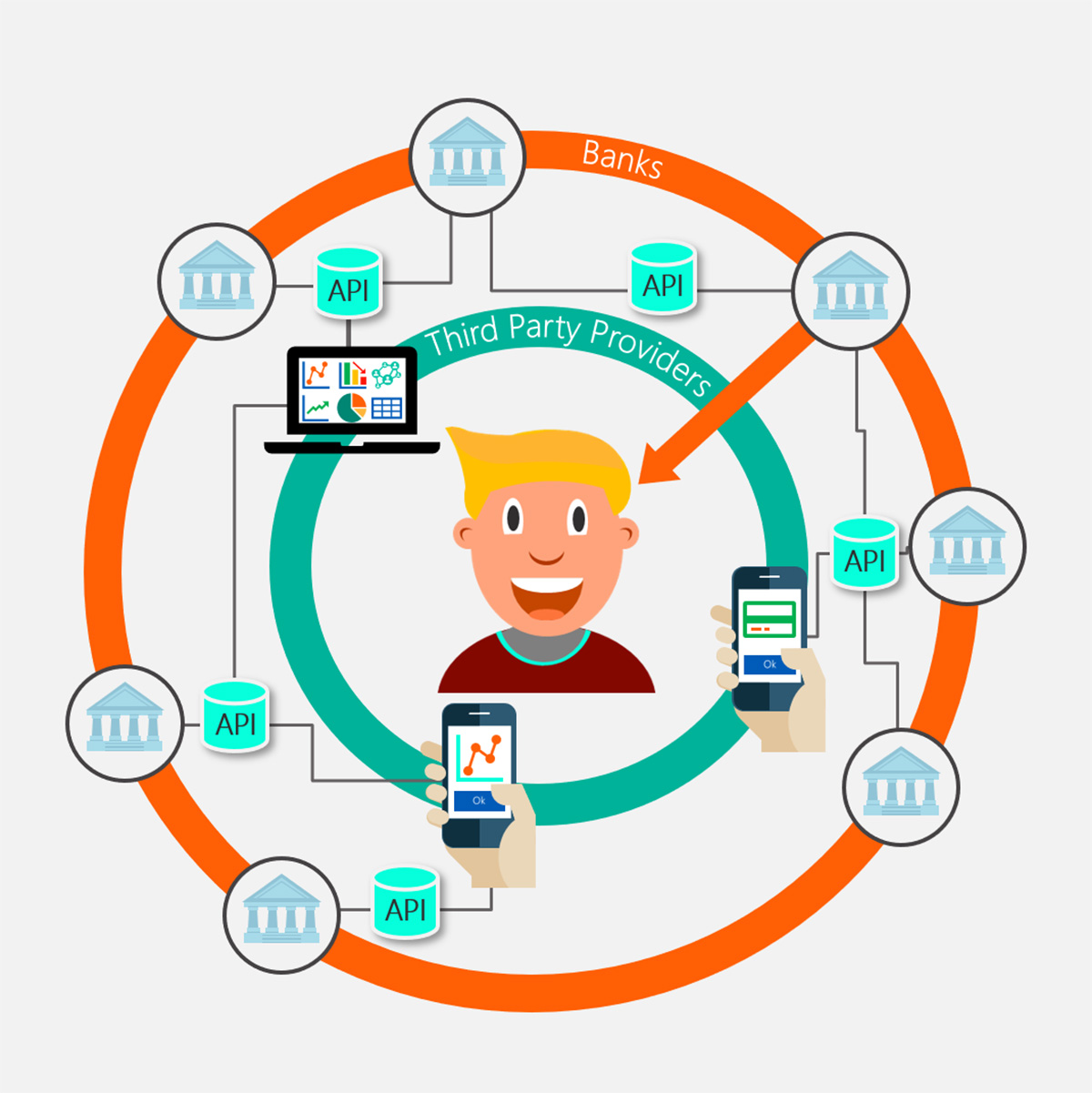

Life insurance can also be utilized to fund buy-sell agreements for businesses, providing a mechanism for smooth ownership transitions in the event of a partner’s death. Additionally, it can serve as collateral for loans or help protect against loss of income due to disability or critical illness, depending on the policy’s provisions.

Understanding the basics of life insurance is crucial for individuals looking to leverage it as a financial tool. By having a clear comprehension of the various types of policies and their benefits, the wealthy can make informed decisions when formulating their wealth management strategies.

Benefits of Life Insurance for the Rich

Life insurance offers a range of unique benefits for the rich that can help enhance their overall financial strategies. Let’s explore some of the key advantages that make life insurance an attractive option for the affluent:

- Estate Planning: Life insurance can play a crucial role in estate planning for the wealthy. By utilizing life insurance policies, individuals can provide a tax-efficient method of passing on their wealth to future generations. The death benefit from life insurance can help cover estate taxes, allowing heirs to receive their inheritance without liquidating assets.

- Tax Advantages: Life insurance policies can offer significant tax advantages for the rich. The growth of cash value within permanent life insurance policies is tax-deferred, meaning that policyholders can accumulate wealth without immediate tax consequences. Additionally, the death benefit is usually income tax-free for beneficiaries, making it a valuable tax-efficient tool.

- Asset Protection: Life insurance can offer protection against financial risks. Policies often provide creditor protection, meaning that the cash value and death benefit are shielded from potential creditors. This can be particularly beneficial for individuals with substantial assets who want to safeguard their wealth for future generations.

- Charitable Giving: Many wealthy individuals have a philanthropic mindset and want to leave a lasting impact. Life insurance can be an effective way to support charitable causes, allowing individuals to designate a charity as the beneficiary of their policy. This ensures that their charitable goals are met, even after they pass away.

- Business Succession: Life insurance can be instrumental in ensuring a smooth transition of business ownership for the rich. By utilizing life insurance, business owners can structure agreements that provide funding for the purchase of shares or interests from the deceased owner’s estate. This helps maintain the continuity of the business and protects the interests of all stakeholders.

These are just a few of the many benefits that life insurance can offer to the rich. By incorporating life insurance into their financial plans, affluent individuals can maximize their wealth, protect their assets, and leave a lasting legacy for their loved ones and charitable endeavors.

Strategies for the Rich to Maximize Life Insurance

For the rich, life insurance can serve as a powerful financial tool when implemented strategically. Here are some effective strategies that the affluent can employ to maximize the benefits of life insurance:

- Policy Structuring: Properly structuring life insurance policies is crucial for the wealthy. By utilizing irrevocable life insurance trusts (ILITs), individuals can remove the death benefit proceeds from their taxable estate, reducing potential estate taxes. This strategy allows for greater wealth preservation and ensures that the intended beneficiaries receive the maximum benefit.

- Using Cash Value: Permanent life insurance policies accumulate cash value over time. The rich can take advantage of this by using the cash value to supplement their retirement income or provide liquidity when needed. Policyholders can also access the cash value through policy loans or withdrawals, often on a tax-free or tax-advantaged basis.

- Combining Policies: Rather than relying on a single life insurance policy, the wealthy can use a combination of policies to diversify their coverage. This approach allows them to tailor the death benefit and cash value accumulation to meet specific financial objectives. By diversifying policies, the rich can optimize their overall life insurance portfolio.

- Charitable Planning: Life insurance can be an effective vehicle for charitable planning. Wealthy individuals can designate a charity as the owner and beneficiary of a policy, receiving tax benefits for their generous contributions. This strategy allows the rich to support causes they are passionate about while potentially reducing their taxable income.

- Insurance as Collateral: The affluent can leverage their life insurance policies as collateral for loans or lines of credit. The cash value and death benefit act as security, allowing individuals to access capital for various purposes such as real estate investments or business expansion. This can potentially provide liquidity without liquidating other assets.

These strategies highlight the versatility and flexibility of life insurance for the rich. By working with experienced financial advisors and insurance professionals, the affluent can tailor these strategies to meet their specific needs and objectives. It is important to note that implementing these strategies requires careful consideration and expert guidance to ensure they align with the individual’s overall financial plan and goals.

Types of Life Insurance Policies for the Wealthy

Life insurance policies for the wealthy are designed to cater to their unique needs and objectives. Let’s explore some of the main types of life insurance policies that are commonly utilized by affluent individuals:

- Universal Life Insurance: Universal life insurance offers flexibility and customization. Policyholders can adjust their premium payments and death benefit to meet changing financial circumstances. This type of policy also accumulates cash value on a tax-deferred basis, allowing the wealthy to access funds when needed.

- Variable Life Insurance: Variable life insurance allows policyholders to allocate a portion of their premiums into investment accounts, typically known as sub-accounts. These sub-accounts fluctuate in value based on the performance of underlying investment options, such as stocks or bonds. This type of policy offers potential for growth but also carries investment risk.

- Indexed Universal Life Insurance: Indexed universal life insurance allows for a combination of death benefit protection and the potential for cash value growth based on the performance of a specific stock market index. This type of policy provides an opportunity to participate in market gains while offering downside protection in the event of a market downturn.

- Survivorship Life Insurance: Survivorship life insurance, also known as second-to-die insurance, covers two individuals under a single policy and pays out the death benefit after the second insured person passes away. This type of policy is often used in estate planning to provide liquidity for estate taxes and protect the wealth being transferred to the next generation.

- Private Placement Life Insurance: Private placement life insurance policies are custom-designed policies that are offered to high-net-worth individuals and accredited investors. These policies often have larger death benefits and specialized investment options, catering specifically to the unique needs of the wealthy.

It’s important for the wealthy to carefully evaluate their financial goals and preferences when considering the type of life insurance policy that best suits their needs. Working with experienced insurance professionals and financial advisors is crucial to pinpointing the right policy and ensuring it aligns with their overall wealth management strategies.

Case Studies: How Successful Individuals Use Life Insurance

Real-life case studies provide valuable insights into how successful individuals have effectively utilized life insurance to achieve their financial goals. Let’s take a look at a few examples:

Case Study 1: The Wealthy Business Owner

John, a wealthy business owner, wanted to ensure the seamless transfer of his business to his children upon his retirement or passing. He purchased a survivorship life insurance policy, naming his two children as beneficiaries. The policy’s death benefit would provide liquidity to cover estate taxes and facilitate the smooth transition of the business to the next generation, ensuring its continued success.

Case Study 2: The High-Net-Worth Investor

Sarah, a high-net-worth investor, sought to maximize her wealth while maintaining flexibility and control. She turned to private placement life insurance (PPLI), which offered customized policies with specialized investment options. By utilizing PPLI, Sarah could invest in alternative assets such as hedge funds and private equity funds, all within a tax-advantaged structure. The policy’s cash value growth was tax-deferred, allowing Sarah to accumulate wealth while maintaining control over her investments.

Case Study 3: The Philanthropic Entrepreneur

Michael, a successful entrepreneur with a passion for philanthropy, wanted to leave a lasting impact. He used life insurance to support his favorite charitable causes. Michael structured his life insurance policy as a charitable remainder trust (CRT), designating the charity of his choice as the beneficiary. The policy’s death benefit would eventually transfer to the charity, allowing Michael to support his philanthropic endeavors even after he was gone.

These case studies highlight the diverse applications of life insurance for the wealthy. Whether it’s preserving wealth for future generations, optimizing investment opportunities, or supporting charitable endeavors, life insurance can be a powerful tool in achieving financial goals.

It’s important to note that these case studies are for illustrative purposes only, and individual results may vary. The best approach for utilizing life insurance will depend on an individual’s specific circumstances, goals, and risk tolerance.

Considerations for the Rich When Purchasing Life Insurance

When it comes to purchasing life insurance, the affluent have unique considerations that must be taken into account. Here are some key factors for the wealthy to consider when selecting a life insurance policy:

- Estate Tax Planning: High net worth individuals should carefully assess their estate tax obligations and how life insurance can help mitigate those taxes. Proper policy structuring, such as utilizing irrevocable life insurance trusts (ILITs), can remove the death benefit from the taxable estate and preserve more wealth for future generations.

- Wealth Preservation: Life insurance can play a crucial role in wealth preservation for the rich. By protecting against estate taxes, providing liquidity, and offering potential tax advantages, life insurance policies can help ensure that the wealth accumulated over a lifetime is properly safeguarded and transferred to heirs.

- Cash Flow Management: The wealthy have unique cash flow situations that must be taken into consideration. When purchasing life insurance, it’s important to evaluate the premium payment structure and ensure it aligns with cash flow needs. Some policies offer flexibility in premium payments, allowing policyholders to adjust their payments based on changing circumstances.

- Investment Opportunities: The affluent may seek life insurance policies that offer the potential for cash value growth through investment options. Policies such as variable life insurance or indexed universal life insurance can allow policyholders to allocate funds into investment accounts. However, it’s important to carefully evaluate the associated risks and expenses of these types of policies.

- Insurance Company Selection: The financial strength and reputation of the insurance company are essential considerations for the wealthy when purchasing life insurance. It’s crucial to work with stable and reputable insurers with a history of fulfilling their obligations and providing reliable customer service.

- Policy Review and Adjustments: The financial landscape and personal circumstances of the wealthy can change over time. Regular policy reviews are essential to ensure that the chosen life insurance policy aligns with current objectives and needs. Adjustments may be necessary to reflect changes in wealth, family situation, or estate planning goals.

Considering these factors and working closely with experienced insurance professionals and financial advisors is crucial for the wealthy when purchasing life insurance. By carefully examining their unique circumstances, goals, and risk tolerance, the affluent can select the right life insurance policies that fit their individual needs and enhance their overall financial strategies.

Conclusion

Life insurance is not only a means of protecting loved ones, but it is also a powerful financial tool that the wealthy can leverage to enhance their overall financial strategies. By understanding and utilizing life insurance effectively, the affluent can maximize their wealth, protect their assets, and leave a lasting legacy for future generations.

Throughout this article, we have explored various aspects of life insurance for the rich. We discussed the benefits of life insurance, including its role in estate planning, tax advantages, asset protection, charitable giving, and business succession. We also delved into different types of life insurance policies tailored for the wealthy, such as universal life insurance, variable life insurance, indexed universal life insurance, survivorship life insurance, and private placement life insurance.

Furthermore, we examined real-life case studies that showcase how successful individuals have effectively used life insurance to accomplish their financial goals. These examples highlighted the diverse applications of life insurance, including business succession planning, investment optimization, and philanthropic endeavors.

When purchasing life insurance, the wealthy must consider various factors, such as estate tax planning, wealth preservation, cash flow management, investment opportunities, insurance company selection, and regular policy reviews. Working closely with experienced insurance professionals and financial advisors is crucial to navigating these considerations and making informed decisions.

In conclusion, life insurance is a valuable tool that can offer a range of advantages for the rich. By understanding the intricacies of life insurance and tailoring it to their specific needs and objectives, the affluent can take steps towards maximizing their wealth, protecting their assets, and leaving a lasting legacy. With careful planning and expert guidance, life insurance can be an integral part of a comprehensive wealth management strategy for the wealthy.