Home>Finance>How To A File Tax Return For International Students

Finance

How To A File Tax Return For International Students

Published: October 29, 2023

Learn how international students can file their tax return with ease. Our comprehensive guide covers everything you need to know about finance and taxes as a student studying abroad.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Obligations for International Students

- Determining Your Resident Status for Tax Purposes

- Collecting Required Documents and Information

- Filing Options for International Students

- Completing Form 8843

- Filing Form 1040NR or 1040NR-EZ

- Claiming Tax Treaty Benefits, if applicable

- Tax Filing Deadlines and Extensions

- Common Mistakes to Avoid in Tax Return Filing

- Seeking Professional Help with Tax Return Preparation

- Conclusion

Introduction

As an international student studying in a foreign country, one of the important responsibilities you may have is filing a tax return. Understanding your tax obligations and properly filing your tax return can help you comply with the law and avoid any potential penalties or issues in the future. In this article, we will provide you with a comprehensive guide on how to file a tax return as an international student.

Filing a tax return can seem daunting, especially when you are new to the tax system of a foreign country. However, with some basic knowledge and guidance, you can navigate through the process with ease and ensure that you meet all the necessary requirements.

It is important to note that taxation rules and regulations vary from country to country, so it is essential to familiarize yourself with the specific tax laws of the country where you are studying. In this article, we will primarily focus on the tax obligations for international students studying in the United States.

By the end of this guide, you will have a clear understanding of your tax obligations as an international student, the necessary documents and information you need to collect, the various options for filing your tax return, and common mistakes to avoid. Additionally, we will provide you with information on seeking professional help if needed.

Remember, filing a tax return is not only a legal requirement but also an opportunity for you to potentially claim tax refunds and benefits. So, let’s dive into the world of tax return filing for international students and unravel the mysteries of the tax system.

Understanding Tax Obligations for International Students

As an international student studying in a foreign country, it is important to understand your tax obligations and determine whether you are required to file a tax return. While tax laws can vary depending on the country you are studying in, we will focus on the tax obligations for international students in the United States.

The first step in understanding your tax obligations is determining your resident status for tax purposes. In the United States, international students are usually classified as either nonresident aliens or resident aliens for tax purposes.

- Nonresident aliens: If you are an international student on an F, J, M, or Q visa, you are generally considered a nonresident alien for tax purposes. Nonresident aliens are only required to report and pay taxes on U.S.-sourced income, such as wages earned from U.S. employment or scholarships provided by a U.S. source.

- Resident aliens: If you meet the Substantial Presence Test, which considers the number of days you have been present in the United States over a three-year period, you may be considered a resident alien for tax purposes. Resident aliens are generally subject to the same tax rules as U.S. citizens and must report their worldwide income on their tax return.

It is important to note that even if you are a nonresident alien and not required to file a tax return, you may still need to complete certain forms, such as Form 8843, to establish your nonresident status and comply with immigration requirements.

Understanding your tax residency status is crucial because it determines the tax forms you need to file and the income you need to report.

Next, you need to consider the types of income that are subject to taxation. As an international student, your income may come from various sources, such as employment, scholarships, fellowships, or grants. It is important to determine whether your income is considered taxable or tax-exempt. For example, in the United States, income from a qualified scholarship used for tuition, fees, books, and supplies is generally tax-exempt.

It is also essential to keep in mind any tax treaties that your home country may have with the United States. Tax treaties can provide certain exemptions or reduced tax rates for specific types of income. Understanding the provisions of the tax treaty between your home country and the United States can help you minimize your tax liability.

By understanding your tax obligations and residency status, as well as the types of income subject to taxation and any applicable tax treaties, you will be better prepared to fulfill your tax responsibilities as an international student.

Determining Your Resident Status for Tax Purposes

When it comes to filing your tax return as an international student, determining your resident status for tax purposes is a critical step. Your resident status will determine how you report your income and what tax forms you need to file. In the United States, international students are classified as either nonresident aliens or resident aliens for tax purposes.

There are two main tests used to determine your resident status:

- Substantial Presence Test: This test considers the number of days you have been present in the United States over a specified period. If you meet the substantial presence test, you are generally considered a resident alien for tax purposes. The test is based on a formula that takes into account the days you were present in the current year, plus a portion of the days you were present in the past two years. If your total exceeds a certain threshold, typically 183 days, you meet the substantial presence test.

- Green Card Test: If you are a lawful permanent resident of the United States, also known as a green card holder, you are considered a resident alien for tax purposes. Green card holders generally have the same tax obligations as U.S. citizens.

It’s important to note that being classified as a resident alien for tax purposes means you must report your worldwide income on your U.S. tax return. This includes income earned both inside and outside of the United States. However, there may be certain provisions in tax treaties between your home country and the United States that could exempt certain types of income from taxation.

If you do not meet either the substantial presence test or the green card test, you are considered a nonresident alien for tax purposes. Nonresident aliens only need to report and pay taxes on income from U.S. sources. This typically includes wages earned from U.S. employment, scholarships provided by U.S. sources, and any other U.S.-sourced income. It’s important to keep in mind that the specific rules and regulations can vary depending on your individual circumstances and the tax laws of your home country.

It’s worth noting that even if you are classified as a nonresident alien and are not required to file a tax return, you may still need to complete Form 8843, “Statement for Exempt Individuals and Individuals with a Medical Condition.” This form helps establish your nonresident status for tax purposes and is required for certain immigration and visa-related processes.

Determining your resident status for tax purposes can have significant implications for your tax obligations. It is essential to carefully assess your situation and consult with a tax professional or use tax software specifically designed for international students to ensure you correctly determine your resident status and fulfill your tax obligations.

Collecting Required Documents and Information

When it comes to filing your tax return as an international student, gathering the necessary documents and information is crucial. Having all the required documentation in place will make the tax filing process smoother and ensure that you accurately report your income and deductions. Here are some key documents and information you may need:

- Form W-2: If you worked in the United States, your employer should provide you with Form W-2, Wage and Tax Statement. This form summarizes your annual earnings and the taxes withheld from your paycheck.

- Form 1099: If you received income from sources other than employment, such as scholarships, fellowships, or grants, you may receive Form 1099 to report that income.

- Form 1042-S: If you received income subject to tax withholding, such as a scholarship or grant, the payer should provide you with Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding. This form will outline the amount of income you received and the amount of tax withheld.

- Passport and visa information: You will need your passport and relevant visa information for identification purposes when filing your tax return.

- Form 8843: As an international student, you will likely need to complete Form 8843, “Statement for Exempt Individuals and Individuals with a Medical Condition.” This form confirms your nonresident alien status and is sometimes required even if you do not have any income to report.

- Bank statements: If you received interest income from a U.S. bank account, make sure to have your bank statements to accurately report the interest earned.

- Scholarship and fellowship documentation: If you received scholarships or fellowships, gather any relevant documentation, such as award letters or statements, to determine whether any portion of the income is tax-exempt.

- Receipts and records of deductible expenses: If you incurred any eligible education-related expenses, such as tuition, fees, textbooks, or supplies, keep receipts and records to support any potential deductions or credits you may claim.

It is important to keep these documents and information organized and easily accessible when preparing your tax return. Consider creating digital copies or maintaining a physical folder to store all the necessary paperwork. Having everything in one place will save you time and effort when it’s time to file your tax return.

Additionally, it’s a good practice to keep copies of your past tax returns for reference and to maintain a record of your financial activities during your studies abroad.

It’s worth noting that there may be additional documents or information specific to your individual circumstances or residency status. Therefore, it is advisable to consult with a tax professional or use tax software designed for international students to ensure you have all the necessary documentation and information for your tax return filing.

Filing Options for International Students

When it comes to filing your tax return as an international student, you have several options to choose from. The appropriate filing option will depend on your individual circumstances and the complexity of your tax situation. Here are the common filing options for international students:

- Self-Preparation: If you have a relatively simple tax situation and are comfortable with tax laws and regulations, you can choose to prepare your tax return on your own. There are various tax software programs available specifically designed for international students that can guide you through the process and ensure accurate calculations. Just make sure to familiarize yourself with the tax laws of the country you are studying in and the specific requirements for international students.

- Assisted Software: If you prefer a bit of guidance but still want to prepare your tax return yourself, you can opt for assisted tax software. These programs provide step-by-step instructions and prompts to help you accurately fill out your tax forms. They often include features such as interview-style questionnaires to gather the necessary information and help you claim any applicable deductions or credits. Assisted software is particularly useful for international students who may have unique tax situations or income sources.

- Professional Tax Preparation: If you are unsure about navigating the complexities of tax laws or have a more complicated tax situation, seeking professional tax preparation is a wise choice. A qualified tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA), can ensure that your tax return is prepared accurately and maximize your potential tax benefits. They can help you navigate any tax treaties, exemptions, or deductions that may apply to your specific situation. Professional help is especially recommended if you have multiple sources of income, large amounts of deductions, or any specific tax concerns.

- Volunteer Income Tax Assistance (VITA) Program: The VITA program is a volunteer-based initiative offered by the Internal Revenue Service (IRS) to assist low-income individuals, including international students, in preparing their tax returns for free. Trained volunteers help prepare basic tax returns, ensuring that you meet your tax obligations while minimizing costs. The VITA program is a great option if you have a simple tax situation and prefer face-to-face assistance.

It’s important to choose the filing option that best suits your needs and comfort level. Remember, accuracy in your tax return is crucial, as any mistakes or omissions can lead to penalties or delays in receiving potential refunds.

Regardless of the filing option you choose, it is advisable to familiarize yourself with the tax laws and regulations of the country where you are studying and keep up to date with any changes that may impact your tax obligations.

Before making a decision on how to file your tax return, evaluate your individual circumstances, consider the complexity of your tax situation, and determine the level of assistance you require. By selecting the right filing option, you can ensure compliance with tax laws and potentially maximize your tax benefits as an international student.

Completing Form 8843

For international students studying in the United States, completing Form 8843, “Statement for Exempt Individuals and Individuals with a Medical Condition,” is an essential step in the tax filing process. This form is used to establish your nonresident status for tax purposes and is required even if you did not have any income to report.

Form 8843 consists of two parts: Part I and Part II. Here is a breakdown of what each part entails:

Part I: Personal Information

In Part I, you will provide your personal information, including your name, social security number or individual taxpayer identification number (if applicable), and your U.S. visa type and number. This section will also require you to indicate your residency status for tax purposes (nonresident alien) and the calendar year for which you are filing the form.

Part II: Closer Connection Exception Statement

In Part II, you will provide a closer connection exception statement. This section is where you explain your ties to your home country and demonstrate that you have a closer connection to your home country than to the United States. It is crucial to provide sufficient details and evidence to support your claim.

You will need to explain your purpose for being in the United States, such as studying at a university, and demonstrate that your primary purpose is temporary. You can include information about your family, property, employment, social and cultural ties, and future plans in your home country. It is important to be thorough in your explanation to establish a strong case for the closer connection exception.

Keep in mind that the requirements for the closer connection exception may vary depending on your individual circumstances and the tax laws of your home country. Make sure to review the instructions provided with Form 8843 and consult with a tax professional if you have any questions or concerns.

Once you have completed all the necessary information in Form 8843, make sure to sign and date it before submitting it along with your other tax documents. It’s important to note that Form 8843 has a separate filing deadline from your tax return. Generally, it should be submitted by the due date of your income tax return, including any extensions.

Completing Form 8843 is crucial for international students to establish and maintain their nonresident alien status for tax purposes. Make sure to carefully fill out the form, provide detailed information, and submit it in a timely manner to stay compliant with tax regulations.

Filing Form 1040NR or 1040NR-EZ

When filing your tax return as an international student in the United States, you will generally need to use either Form 1040NR or Form 1040NR-EZ. These forms are specifically designed for nonresident aliens and are used to report your income and claim any applicable deductions or credits.

Here is an overview of each form:

Form 1040NR-EZ:

- This is the simplified version of Form 1040NR, designed for those with less complex tax situations.

- You can use Form 1040NR-EZ if you meet certain criteria, such as having no dependents, no income other than wages, salaries, tips, refunds of state and local income taxes, or scholarship or fellowship grants, and no adjustments to income.

- Form 1040NR-EZ has fewer lines to fill out, making it quicker and easier to complete.

- However, it does not allow you to claim certain deductions or credits, such as the education credits or itemized deductions.

Form 1040NR:

- This is the standard form for nonresident aliens and allows for more comprehensive reporting of income and expenses.

- You must use Form 1040NR if you do not meet the criteria for Form 1040NR-EZ or if you need to claim deductions or credits not allowed on the simplified form.

- Form 1040NR requires you to provide more detailed information, including additional schedules if necessary, to accurately report your income, deductions, and credits.

- You may need to attach supporting documents, such as Form W-2, Form 1099, or Form 1042-S, to verify the income you are reporting.

When completing Form 1040NR or 1040NR-EZ, you will need to include your personal information, such as your name, address, and taxpayer identification number (TIN), which may be your social security number (SSN) or individual taxpayer identification number (ITIN).

You will also need to report your income from U.S. sources, such as wages, salaries, tips, scholarships, fellowships, or grants. Be sure to gather all the necessary forms and documents that reflect your income accurately.

If you are eligible for any deductions or credits, such as the standard deduction or education credits, ensure that you complete the appropriate sections or attach the relevant schedules.

It’s essential to review the instructions for Form 1040NR or 1040NR-EZ provided by the Internal Revenue Service (IRS) to ensure you are filling out the form correctly and including all the required information.

Once you have completed the form, don’t forget to sign it before mailing it to the appropriate IRS address indicated in the instructions. It’s recommended to make copies of all the documents you are submitting for your own records.

Whether you are using Form 1040NR or 1040NR-EZ, accurately completing the form and including all the necessary information is crucial to meet your tax obligations as an international student in the United States.

Claiming Tax Treaty Benefits, if applicable

If you are an international student studying in the United States and your home country has a tax treaty with the U.S., you may be eligible to claim certain tax treaty benefits. Tax treaties are agreements designed to prevent double taxation and provide tax relief for individuals who are residents of one country but earn income in another.

Here are a few important points to consider when claiming tax treaty benefits:

- Determine eligibility: The first step is to determine if your home country has a tax treaty with the United States. You can find this information in IRS Publication 901, “U.S. Tax Treaties.” Review the specific provisions of the tax treaty that apply to your situation to determine if you meet the eligibility criteria for claiming tax treaty benefits.

- Identify the specific benefits: Tax treaties may provide various benefits, such as exemption from tax on certain types of income, reduced tax rates, or eligibility for certain deductions or credits. Familiarize yourself with the specific benefits available under the tax treaty between your home country and the United States.

- Submit the required documentation: To claim tax treaty benefits, you will typically need to submit certain forms or documentation to the IRS. This may include Form 8233 or Form W-8BEN, which declare your eligibility for tax treaty benefits and provide information about your residency status and income. Follow the instructions provided with these forms and ensure that you complete them accurately.

- Keep records: It is important to maintain records of your tax treaty documentation and any correspondence with the IRS. This will help support your claim if you are ever audited or need to provide further evidence of your eligibility for treaty benefits.

- Review home country requirements: It’s important to note that claiming tax treaty benefits in the United States may have implications for your tax obligations in your home country. Familiarize yourself with the tax laws and requirements of your home country to ensure you are in compliance with all relevant tax regulations.

Claiming tax treaty benefits can significantly impact your tax liability as an international student. It is crucial to carefully review the provisions of the tax treaty, understand the eligibility criteria, and follow the proper procedures for claiming these benefits.

If you are unsure about navigating the complexities of tax treaties or need assistance in determining your eligibility and completing the necessary forms, consider consulting with a tax professional who specializes in international taxation. They can provide guidance and ensure that you are maximizing your potential tax benefits while staying compliant with tax laws and regulations.

Remember, tax treaty benefits can help reduce your tax burden and ensure that you are not subject to double taxation. Take advantage of these benefits if you are eligible, and always stay informed about changes or updates to tax treaties that may impact your tax obligations.

Tax Filing Deadlines and Extensions

When it comes to filing your tax return as an international student, it is crucial to be aware of the tax filing deadlines and the possibility of requesting filing extensions. Meeting these deadlines ensures that you stay compliant with tax regulations and avoid any penalties or interest charges. Here are some key points to keep in mind:

Filing Deadlines:

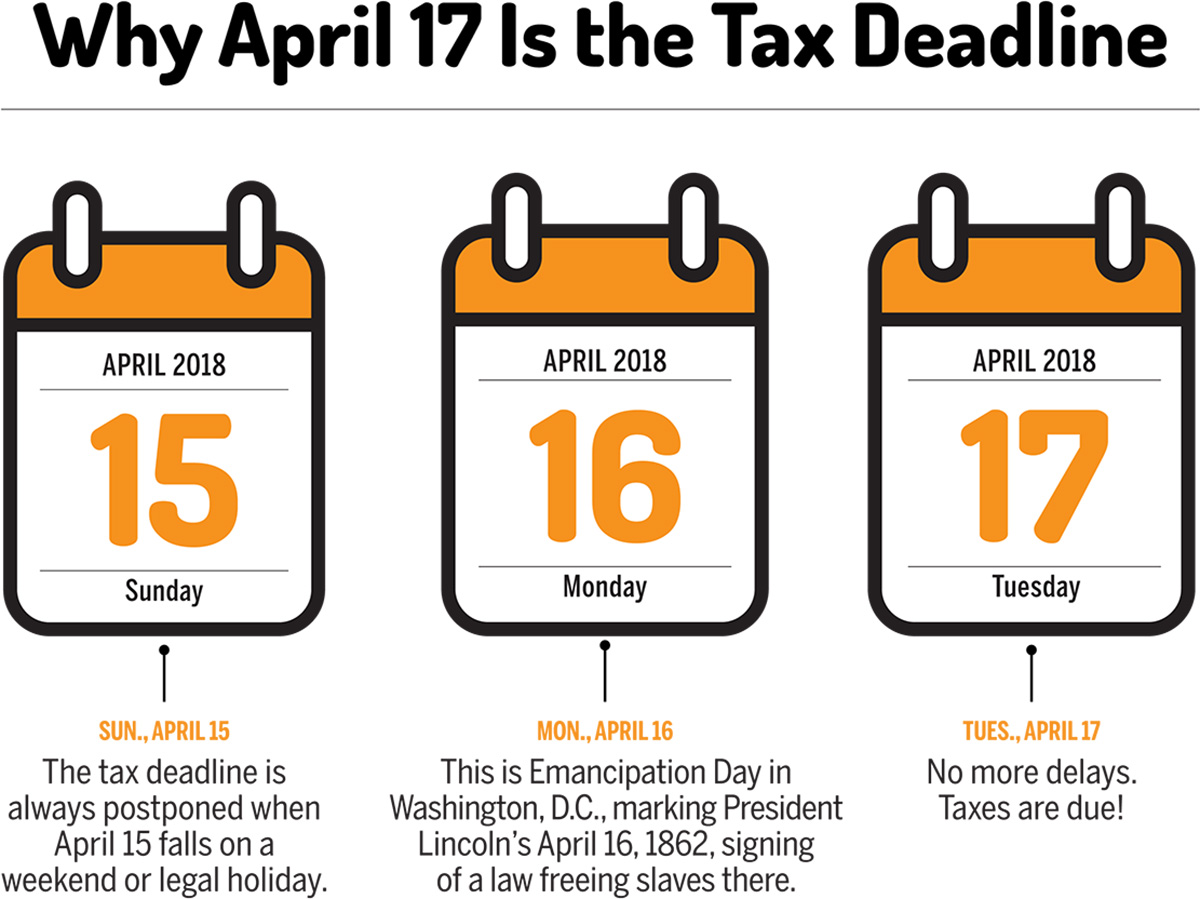

In the United States, the general tax filing deadline for individuals is April 15th. However, if the 15th falls on a weekend or a holiday, the deadline is usually extended to the next business day. It’s important to note that the deadlines may vary depending on the specific circumstances of your tax situation, such as your residency status or any applicable tax treaties.

For international students, the filing deadline will depend on whether you are considered a nonresident alien or a resident alien for tax purposes. Nonresident aliens typically have until June 15th to file their tax returns. However, it is important to keep in mind that any taxes owed must still be paid by the regular April 15th deadline to avoid interest charges.

If you are unable to file your tax return by the deadline, it is essential to request a filing extension to avoid potential penalties. Extension requests must be submitted by the original due date of the tax return.

Filing Extensions:

To request a filing extension, you can use Form 4868, “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.” This form provides an additional six months to file your tax return, extending the deadline to October 15th for most individuals. However, remember that any taxes owed must still be paid by the original due date to avoid interest charges.

It’s important to note that filing an extension only gives you additional time to submit your tax return, not extra time to pay any taxes owed. If you anticipate owing taxes, it’s advisable to make a payment by the original deadline to minimize interest charges.

Keep in mind that the rules and procedures for filing extensions may vary depending on your individual circumstances and residency status. It is crucial to review the instructions provided with Form 4868 or consult with a tax professional to ensure you are following the correct procedures specific to your tax situation.

Staying compliant with tax deadlines and properly managing any extension requests will help you avoid penalties and maintain a good standing with tax authorities. Be sure to mark the relevant deadlines on your calendar, start the tax filing process early, and seek assistance if needed to ensure a smooth and timely filing of your tax return.

Common Mistakes to Avoid in Tax Return Filing

When filing your tax return as an international student, it’s important to be aware of common mistakes that can lead to errors, delays, or potential penalties. Avoiding these mistakes will ensure a smooth and accurate tax filing process. Here are some common pitfalls to watch out for:

- Incorrect or Incomplete Information: One of the most common mistakes is providing incorrect or incomplete information on your tax return. Make sure to double-check all the details, such as your name, social security number or individual taxpayer identification number, and other personal information to ensure accuracy.

- Choosing the Wrong Filing Status: Selecting the correct filing status is crucial as it determines your tax rates and eligibility for certain deductions or credits. Determine if you qualify as a nonresident alien or resident alien for tax purposes based on the substantial presence test or green card test.

- Not Reporting All Income: It’s important to report all your income accurately, including wages, scholarships, fellowships, grants, or any other income received during the tax year. Review all your forms (such as W-2, 1099, or 1042-S) to ensure that you include all sources of income.

- Not Claiming Available Deductions and Credits: Be aware of deductions and credits that you may be eligible for, such as education-related expenses, student loan interest, or certain tax treaty benefits. Missing out on these deductions and credits can result in unnecessary tax liability.

- Failure to Submit Required Forms: Many international students are required to submit additional forms, such as Form 8843, even if they are not required to file a tax return. Neglecting to submit these forms can lead to non-compliance with tax regulations.

- Not Conforming to Deadlines: Failing to adhere to tax filing deadlines can result in penalties and interest charges. Keep track of the due dates for submitting your tax return and any applicable extension requests.

- Mathematical Errors: Make sure to double-check all calculations and use accurate figures when completing your tax return. Simple mathematical errors can lead to incorrect tax liability or delays in processing.

- Not Keeping Adequate Records: It’s important to maintain copies of your tax return, supporting documents, and any receipts or records for deductions claimed. These records will come in handy if you need to refer back to them or if you are audited by tax authorities.

- Misunderstanding Tax Treaty Benefits: If you are eligible for tax treaty benefits, it’s crucial to understand the specific provisions and requirements of the tax treaty between your home country and the United States. Failing to comply with the provisions or not claiming available treaty benefits can result in unnecessary tax liability.

- Not Seeking Professional Assistance when Necessary: If you have a complex tax situation, multiple income sources, or any uncertainties, it is advisable to seek professional tax advice. Tax professionals can provide personalized guidance and ensure that you navigate the tax filing process correctly.

Avoiding these common mistakes will help ensure the accuracy and timeliness of your tax return filing. Take the time to review your tax documents thoroughly, seek clarification when needed, and consider consulting with a tax professional to maximize your tax benefits and stay compliant with tax regulations.

Seeking Professional Help with Tax Return Preparation

When it comes to preparing your tax return as an international student, seeking professional help can provide valuable guidance and ensure accuracy in your filings. Here are some reasons why you may want to consider seeking professional assistance:

- Complex Tax Situations: If you have a complex tax situation, such as multiple sources of income, tax treaty benefits, or itemized deductions, a tax professional can navigate the complexities and ensure that your tax return is prepared correctly.

- Maximizing Tax Benefits: Tax professionals are experienced in identifying all eligible deductions, credits, and tax treaty benefits that you may be entitled to. By working with a professional, you can potentially maximize your tax benefits and reduce your tax liability.

- Compliance with Tax Laws: Tax laws and regulations can be complex, and it’s easy to make errors or miss important deadlines. A tax professional stays up to date with current tax laws and can help you meet your tax obligations while avoiding penalties or interest charges.

- Peace of Mind: By entrusting your tax return preparation to a professional, you can have peace of mind knowing that your tax filing is in capable hands. This allows you to focus on your studies and other priorities.

- Audit Assistance: In the event of an audit or inquiry from tax authorities, having a tax professional who prepared your return can be beneficial. They can provide guidance, represent you, and handle any necessary communication with tax authorities.

- Specialized Knowledge: Tax professionals possess specialized knowledge of international taxation and can provide tailored advice based on your unique circumstances as an international student. They can help you navigate tax treaties, residency status determinations, and other intricacies specific to international taxation.

- Time-Saving: Tax return preparation can be time-consuming, especially if you have complex financial situations or limited knowledge of tax laws. Outsourcing this task to a professional allows you to save time and focus on other aspects of your studies and personal life.

When selecting a tax professional, consider their qualifications, experience with international tax matters, and any relevant certifications such as being a certified public accountant (CPA) or enrolled agent (EA). It’s also a good idea to inquire about their fees and ensure that they have a clear understanding of your specific tax situation as an international student.

While seeking professional help may incur additional costs, the expertise and peace of mind that come with it may outweigh the expenses. Ultimately, the decision whether to seek professional assistance or not depends on the complexity of your tax situation, your comfort level with tax laws, and your desire for accuracy and compliance.

Remember, whether you decide to prepare your tax return on your own or seek professional help, it’s essential to stay informed about tax regulations, keep organized records of your finances, and meet all the required deadlines to fulfill your tax obligations as an international student.

Conclusion

Filing a tax return as an international student can be a complex process, but with the right knowledge and guidance, you can navigate through it successfully. Understanding your tax obligations, determining your residency status, and collecting the necessary documents are crucial steps in the tax filing process.

Choosing the appropriate filing option, whether it be self-preparation, assisted software, professional assistance, or utilizing volunteer programs, will ensure that your tax return is filed accurately and on time. Avoiding common mistakes and being aware of tax treaty benefits, if applicable, can help optimize your tax benefits while maintaining compliance.

Keeping track of tax filing deadlines, requesting extensions when needed, and seeking professional help when necessary are essential in ensuring a smooth and accurate tax filing process. Whether you choose to prepare your tax return on your own or seek professional assistance, staying informed about tax laws, maintaining organized records, and meeting all necessary requirements will help you fulfill your tax obligations as an international student.

Remember, tax compliance is not only a legal requirement but also an opportunity to potentially claim tax refunds and benefits. Take advantage of the resources available to you, stay informed about tax regulations, and seek guidance when needed to ensure a stress-free tax filing experience.

By following the guidelines and suggestions outlined in this comprehensive guide, you will be better equipped to handle your tax obligations, maximize your tax benefits, and have peace of mind knowing that you are in compliance with tax regulations. So, take charge of your tax return as an international student and navigate the tax system confidently.