Finance

Where To File A 940 Tax Return

Published: October 28, 2023

Looking for information on where to file your 940 tax return? Check out our comprehensive guide on finance and find out all you need to know about filing your taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Filing taxes can be a complex process, and it becomes even more daunting when different forms come into play. Form 940, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is an important document that employers need to file to report and pay taxes related to unemployment compensation.

The purpose of Form 940 is to calculate and report the employer’s share of FUTA taxes, which fund unemployment benefits for workers who have lost their jobs. This form helps the Internal Revenue Service (IRS) track and ensure that employers are contributing their fair share toward the unemployment insurance system.

Understanding where to file Form 940 is crucial for employers to fulfill their tax obligations. Whether you’re an experienced small business owner or a first-time filer, knowing where to send your form can save you valuable time and avoid any penalties or delays in processing.

In this article, we will guide you through the process of filing Form 940 and provide clear instructions on where to submit the form, whether you choose to file online or on paper. We will also address any special considerations or deadlines that may apply to certain states. So, let’s dive in and demystify the world of filing Form 940!

Purpose of the 940 Tax Return

The primary purpose of the 940 Tax Return, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is to calculate and report the employer’s share of FUTA taxes. FUTA taxes are funds that go towards state unemployment agencies to provide benefits to workers who have lost their jobs.

Employers are responsible for contributing a portion of the FUTA taxes. The tax rate is based on the amount of wages paid to employees and is subject to specific rules and regulations set by the IRS. By filing Form 940, employers can accurately report and pay their FUTA taxes, ensuring compliance with federal tax laws.

In addition to fulfilling tax obligations, filing Form 940 provides a crucial benefit to employers. It enables them to claim a credit against their FUTA taxes for any state unemployment taxes already paid. This credit, known as the “credit reduction,” can help reduce the employer’s overall tax liability.

Another important purpose of filing Form 940 is to maintain accurate records and documentation for future reference. By submitting this form annually, employers have a clear record of their FUTA tax payments and can provide proof of compliance with IRS regulations if required.

It’s important to note that even if an employer has no taxable wages or owes no FUTA taxes for a particular quarter, they may still need to file Form 940 to ensure all necessary information is properly documented.

Overall, the purpose of the 940 Tax Return is to ensure that employers contribute their fair share of FUTA taxes, claim any applicable credits, and maintain accurate records of their tax payments. By fulfilling these requirements, employers can help support the unemployment insurance system while staying compliant with federal tax regulations.

Eligibility to File Form 940

Not all employers are required to file Form 940. To determine your eligibility, you need to assess the nature of your business and the wages you pay to your employees. Here are the key factors to consider:

- Employer status: If you are an employer engaged in a trade or business, including nonprofit organizations, you are generally required to file Form 940.

- Number of employees: You must file Form 940 if you paid wages of $1,500 or more to employees in any calendar quarter during the current or previous year. This threshold may vary for agricultural employers.

- Agricultural employers: If you are an employer engaged in agricultural labor, you must file Form 940 if you paid cash wages of $20,000 or more to farm workers in any calendar quarter during the current or previous year. Different rules apply if you paid wages up to $150,000 to H-2A visa workers.

- Household employers: If you are a household employer and you paid wages of $1,000 or more in any calendar quarter during the current or previous year, you are required to file Form 940.

It’s essential to review the specific guidelines provided by the IRS to determine your eligibility accurately. If you are uncertain, consult with a tax professional or refer to the official IRS instructions for Form 940.

Once you have confirmed your eligibility to file Form 940, it’s important to understand the filing requirements and deadlines. Failing to meet these obligations can result in penalties, so be sure to stay informed and comply with IRS regulations.

Next, we will delve into the details of Form 940 and help you understand the specific information you need to provide when completing the form.

Understanding Form 940

Form 940, the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is a document that employers file to report their FUTA tax liability. It provides the IRS with essential information about the employer’s wages, employees, and tax payments for the purpose of calculating and collecting unemployment taxes.

Here are the key elements and sections of Form 940:

- Employer Information: This section requires basic information about the employer, including their name, address, and employer identification number (EIN). It is important to double-check this information to ensure accuracy and avoid processing delays.

- Taxable FUTA wages: Employers must report their taxable FUTA wages for the year. These wages include payments made to employees for services performed, bonuses, and certain fringe benefits. It is crucial to accurately calculate and report these wages to ensure compliance with tax regulations.

- Payments and Credits: In this section, employers report their FUTA tax liability for the year, including any payments made and credits claimed. Employers can claim a credit against their FUTA taxes for any state unemployment taxes already paid, known as the credit reduction. It’s important to provide accurate information to calculate the correct tax liability.

- Signature and Date: The form must be signed and dated by an authorized person. By signing, the employer acknowledges that the information provided is true and accurate to the best of their knowledge.

When completing Form 940, it is crucial to carefully review the instructions provided by the IRS. Any errors or omissions can lead to processing delays or penalties. It is also important to keep accurate records of the information reported on Form 940, as well as supporting documentation, in case of any future inquiries or audits.

Now that you have a better understanding of Form 940, let’s explore where you should file this important tax return.

Where to File Form 940

Knowing where to file Form 940 is essential to ensure that your tax return reaches the correct destination and is processed promptly. The filing address for Form 940 depends on whether you choose to file electronically or on paper.

If you decide to file your Form 940 electronically, you have two options:

- E-file services: You can use approved tax preparation software or work with an authorized e-file provider to file your Form 940 electronically. These services will guide you through the process and help you submit your tax return securely.

- IRS Online Filing: The IRS offers an Online Filing section on their official website, where you can electronically file your Form 940. This option is convenient and accessible to employers who prefer to handle their tax filing directly through the IRS website.

If you choose to file your Form 940 on paper, the mailing address will vary depending on your location and whether you are including a payment with your tax return. It’s important to use the correct address to avoid any delays or misrouting of your tax documents.

The IRS provides specific mailing addresses based on each state. It’s essential to refer to the official IRS instructions for Form 940 to find the correct address for your filing. These instructions provide a state-by-state breakdown of addresses and detailed information on any special instructions or considerations that may apply to certain states.

When mailing your Form 940, be sure to include any required payments, such as your FUTA tax liability. It’s recommended to use certified mail or a reputable courier service to track and confirm the delivery of your tax documents to the IRS.

By choosing the appropriate filing method and ensuring that you send your tax return to the correct address, you can streamline the filing process and help ensure that your Form 940 is processed accurately and efficiently.

Next, we will explore the online filing options available for employers who prefer to handle their tax returns electronically.

Online Filing Options

Filing Form 940 online offers a convenient and efficient way for employers to submit their tax returns. The IRS provides several online filing options to accommodate different preferences and needs. Here are the primary online filing options available:

- E-file services: Employers can use approved tax preparation software or work with an authorized e-file provider to file Form 940 electronically. These e-file services simplify the process by guiding employers through the necessary steps and automatically calculating tax amounts. They also offer convenience through features such as electronic payment options and faster processing times.

- IRS Online Filing (Free File): The IRS offers an Online Filing section on their official website, known as Free File. This service allows eligible employers to file their Form 940 electronically at no cost. Employers can access Free File through the IRS website and follow the provided instructions to complete their tax return. This option is ideal for small businesses or employers with straightforward tax situations who prefer to handle the filing directly with the IRS.

- Third-Party Software: Employers can also utilize third-party software to file Form 940 online. Many software providers offer tax filing solutions that integrate with the IRS e-file system, providing a seamless and user-friendly experience. These solutions often provide additional features such as data import from payroll systems and error checking to ensure accurate and compliant filings.

When filing Form 940 electronically, employers benefit from several advantages. Online filing eliminates the need for paper forms and postage, reducing the risk of errors and ensuring faster processing times. Employers can also take advantage of electronic payment options available through e-file services, making it easier to remit any tax liabilities associated with Form 940.

It’s important to note that regardless of the online filing option chosen, employers must still adhere to the IRS guidelines and provide accurate information in their tax returns. It’s recommended to review the instructions provided by the IRS for Form 940, as well as any specific guidelines or requirements associated with the chosen online filing method.

Now that we’ve covered the online filing options, let’s explore the alternative approach of filing Form 940 on paper.

Paper Filing Options

While electronic filing has become increasingly popular and convenient, some employers may still prefer to file their Form 940 on paper. The IRS provides the option for employers to submit their tax return through traditional mail. Here are the paper filing options available:

- Printable Forms: Employers can visit the official IRS website and download Form 940 and the accompanying instructions. These documents are available in PDF format and can be easily printed for manual completion. It’s important to use the most up-to-date version of the form to ensure compliance with current tax regulations.

- Authorized Printers: If you are unable to print the form at your location, you can use an authorized printer to obtain the blank Form 940. These authorized printers are certified by the IRS to produce accurate and compliant forms. You can find a list of authorized printers on the IRS website.

When filing Form 940 on paper, it’s crucial to complete the form accurately and legibly. Triple-check all information, including employer details, taxable wages, and tax liability calculations. Any errors or mistakes may lead to processing delays or potential penalties.

Once the form is completed, employers must mail it to the appropriate IRS address based on their state. To determine the correct mailing address, refer to the official IRS instructions for Form 940. These instructions provide detailed state-specific information, including any special considerations or deadlines that may apply.

It’s important to note that when filing on paper, employers need to include any required payments, such as their FUTA tax liability. Payments should be made by check or money order and attached securely to the tax return. To ensure the delivery of your tax documents, consider using certified mail or a reputable courier service.

Filing Form 940 on paper allows employers to have a physical copy of their tax return and supporting documentation. This may be beneficial for record-keeping purposes or in case of any future inquiries or audits.

Now that we’ve explored the paper filing options, let’s focus on any special instructions that may be applicable to certain states.

Special Instructions for Certain States

When filing Form 940, it’s important to be aware of any special instructions or considerations that may apply to certain states. Each state may have its own requirements or regulations regarding filing, payment, and reporting. Here are a few examples of special instructions for certain states:

- California: Employers in California must also file a separate state unemployment tax return, known as the California DE 9. It’s important to review the specific instructions provided by the California Employment Development Department (EDD) to ensure compliance with both federal and state requirements.

- New York: Employers in New York must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, in addition to Form 940. The New York State Department of Labor provides detailed instructions on how to fulfill state-specific requirements.

- Ohio: Employers in Ohio are required to file Form UCT-101, Unemployment Compensation Tax, in addition to Form 940. The Ohio Department of Job and Family Services provides instructions on how to meet these state-specific obligations.

These are just a few examples, and it’s crucial to review the specific guidelines provided by the IRS for your state of residence or operation. The official IRS instructions for Form 940 include a state-by-state breakdown of addresses, special considerations, and additional forms or requirements that may apply.

Employers should also be mindful of any deadlines that may differ from the federal deadline. Some states may have different due dates for filing and paying state unemployment taxes, so it’s important to stay informed and submit all required forms and payments on time.

Employers with employees working in multiple states may face additional complexities. Each state may have its own rules regarding which wages are subject to unemployment taxes and how tax liabilities are calculated. In such cases, it’s advisable to consult with a tax professional or contact the state’s labor department for further guidance and clarification.

By understanding and adhering to any special instructions or requirements that apply to your state, you can ensure compliance with both federal and state regulations when filing Form 940.

Now that we’ve covered the special instructions, let’s move on to discussing the important deadlines to keep in mind.

Important Deadlines to Remember

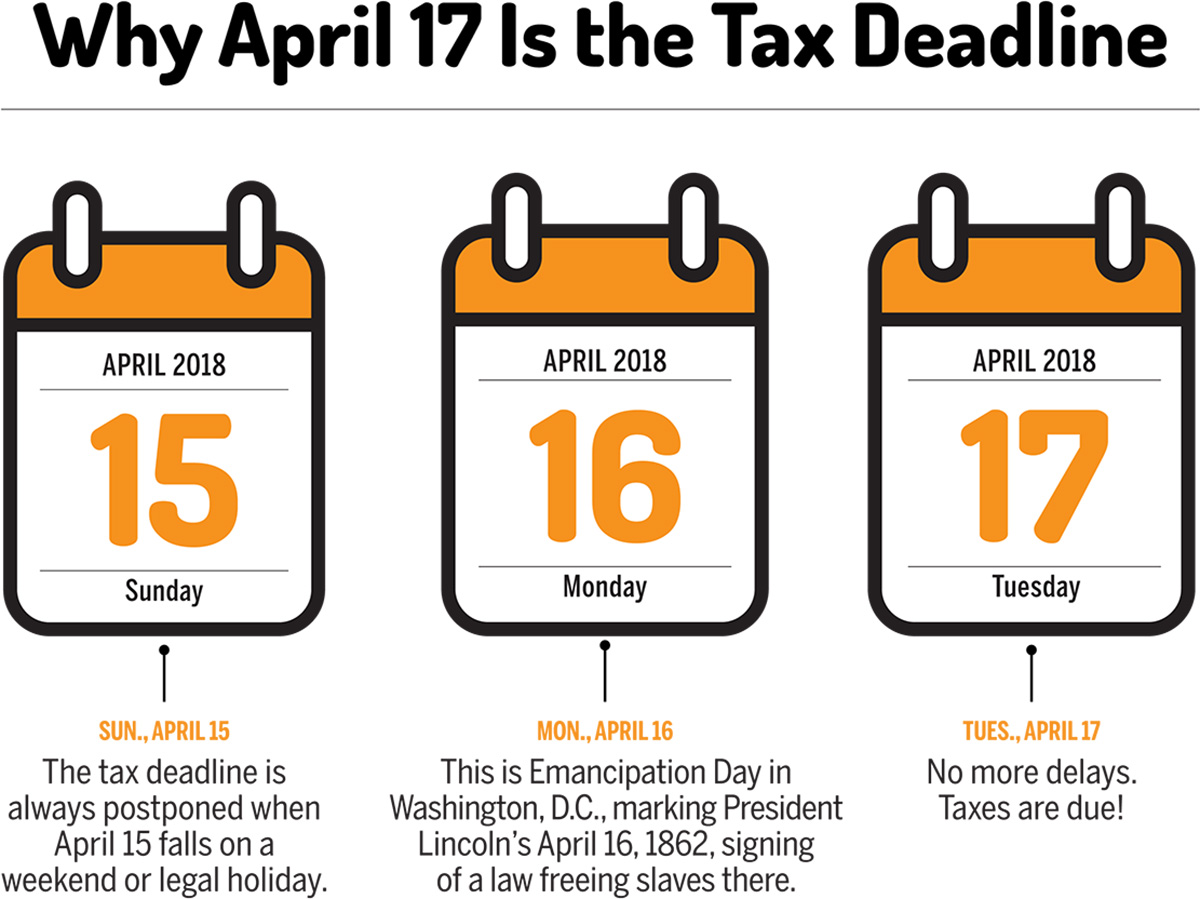

When it comes to filing Form 940, it’s crucial to be aware of the specific deadlines set by the IRS. Missing these deadlines can lead to penalties and unnecessary complications. Here are the important deadlines to remember:

- Annual Deadline: Form 940 is an annual tax return, and it must be filed by January 31 of the following year. For example, for the tax year 2022, the deadline to file Form 940 is January 31, 2023. It’s important to submit your tax return by this date to ensure compliance and avoid any potential penalties.

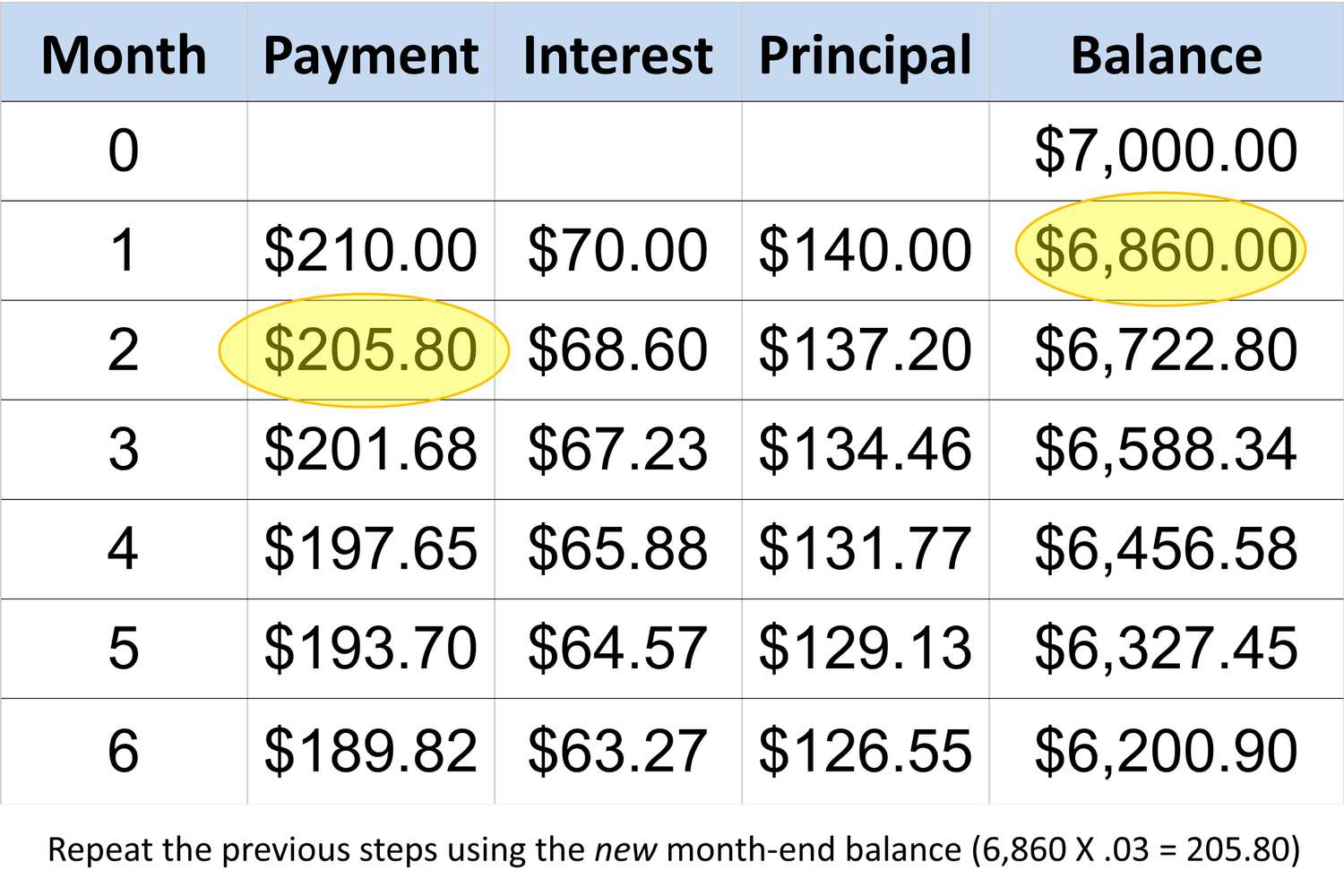

- Quarterly Payments: Employers are required to make quarterly payments of their FUTA taxes throughout the year. The payment due dates are typically tied to the end of each calendar quarter. Payments must be made by the last day of the month following the end of the quarter. For example, the payment for the first quarter (January to March) is due by April 30. Be sure to mark these dates on your calendar to ensure timely payment.

It’s important to note that even if you have no FUTA taxes to pay for a quarter, you may still need to file Form 940 to report this information to the IRS. Failing to file the form when required can result in penalties, even if no taxes are owed.

If you need additional time to file Form 940, you may request an extension. The IRS allows employers to file Form 940 by the extended deadline, which is generally October 15. However, it’s crucial to note that an extension to file does not grant an extension to pay any taxes owed. If you anticipate owing taxes, it’s recommended to make estimated payments to avoid penalties and interest.

To ensure you meet the deadlines and avoid any last-minute stress, it’s advisable to create a system that tracks important dates, sets reminders, and keeps you organized throughout the year. Keep in mind that different states may have their own deadlines for state unemployment tax payments, so it’s important to stay informed and meet all obligations accordingly.

By staying on top of the filing deadlines and making timely payments, you can fulfill your tax obligations and avoid any unnecessary penalties or complications.

Now, let’s conclude our discussion on filing Form 940 and summarize the key points covered in this article.

Conclusion

Filing Form 940, the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is an important responsibility for employers. By understanding the purpose of Form 940 and meeting the eligibility requirements, employers can fulfill their tax obligations and contribute to the unemployment insurance system.

Whether you choose to file Form 940 electronically or on paper, it’s crucial to know where to submit your tax return. Online filing options, such as e-file services and IRS Online Filing, provide convenience and efficiency. On the other hand, paper filing allows for a physical copy of the tax return for record-keeping purposes.

It’s important to be aware of any special instructions or considerations that may apply to certain states. Each state may have its own requirements or forms in addition to Form 940. Staying informed and complying with state-specific guidelines will help ensure compliance with both federal and state regulations.

Remember the important deadlines associated with Form 940. File your tax return by January 31 of the following year and make quarterly payments by the last day of the month following the end of each quarter. Request an extension if needed, but be aware that an extension to file does not extend the deadline for tax payments.

In conclusion, filing Form 940 is a crucial step in fulfilling your tax obligations as an employer. By understanding the purpose of the form, meeting eligibility requirements, and knowing where and when to file, you can navigate the process smoothly and avoid any penalties or delays. Keep accurate records, consult official IRS instructions and state-specific guidelines, and consider seeking professional assistance if needed. By doing so, you can successfully complete your Form 940 and contribute to the unemployment insurance system while complying with tax laws.