Finance

Where To File Tax Return 1040

Modified: February 21, 2024

Looking for the easiest way to file your tax return? Discover where to file your 1040 form with our comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on where to file your tax return using Form 1040. Filing your taxes is an important part of every individual’s financial responsibilities, and it’s crucial to understand the various options available to ensure a smooth and accurate filing process.

Form 1040 is the standard tax form used by millions of Americans to report their annual income and calculate their tax liability. It is used to disclose all sources of income, deductions, credits, and ultimately determine the amount of tax owed or the refund due.

In this article, we will explore the different filing options for both federal and state tax returns using Form 1040. Whether you prefer the convenience of e-filing, the traditional approach of mailing your tax return, or the assistance of filing in person, we’ve got you covered. We will also touch on state-specific filing requirements to provide a comprehensive guide for taxpayers across the United States.

While filing taxes can sometimes feel overwhelming, it’s important to approach it with the right information and resources to make the process as smooth and efficient as possible. So, let’s dive in and explore the various options for filing your tax return using Form 1040!

Understanding Form 1040

Form 1040 is the main tax form used by individuals to report their income, deductions, and credits for the year. It is also known as the “U.S. Individual Income Tax Return” and is used to calculate the amount of tax owed or the refund due to the taxpayer.

The form is divided into several sections, each requiring specific information. Here are the key sections you need to be familiar with:

- Identification: This section requires your personal information, including your name, address, Social Security Number, and filing status.

- Income: In this section, you report your various sources of income, such as wages, self-employment income, rental income, investments, and retirement distributions.

- Deductions: Here, you can claim deductions to reduce your taxable income, including expenses like mortgage interest, state and local taxes, qualified medical expenses, and charitable contributions.

- Credits: This section allows you to claim tax credits that can directly reduce your tax liability. Some common credits include the Child Tax Credit, Earned Income Credit, and Lifetime Learning Credit.

- Taxes and Payments: This section calculates your total tax liability and determines whether you owe additional taxes or are eligible for a refund. It takes into account any taxes already withheld from your income throughout the year.

- Other Taxes: If you have any additional taxes to report, such as self-employment tax or household employment taxes, you would include them in this section.

- Refund: This section is for you to provide your bank account information if you choose to receive your refund through direct deposit.

It’s important to thoroughly review and understand each section of Form 1040 to ensure accuracy and completeness in reporting your financial information. If you’re unsure about certain sections or have complex tax situations, it may be beneficial to seek the help of a tax professional or utilize tax software that can guide you through the process.

Now that we have a basic understanding of Form 1040, let’s explore the different options for filing your tax return using this form.

Federal Filing Options

When it comes to filing your federal tax return using Form 1040, you have three main options to choose from. Let’s take a closer look at each option:

- Filing Taxes Online: E-filing your tax return has become increasingly popular due to its convenience and efficiency. There are several online tax preparation software and service providers that offer user-friendly interfaces to guide you through the filing process. These platforms typically have built-in checks to help you identify potential errors and maximize your deductions and credits. Additionally, e-filing allows for faster processing and the option to receive your refund via direct deposit.

- Filing Taxes by Mail: If you prefer the traditional route, you can choose to print and mail your completed Form 1040 to the appropriate IRS address. It’s crucial to double-check the mailing address provided by the IRS based on your location and the type of return you are filing. Mailing your tax return may take longer to process compared to e-filing, and you may also want to consider sending it via certified mail or with a return receipt for proof of delivery.

- Filing Taxes In Person: Some individuals may choose to visit an IRS Taxpayer Assistance Center or a Volunteer Income Tax Assistance (VITA) site for in-person assistance with their tax return. These locations offer free tax preparation help and e-file services for eligible taxpayers, including those with low to moderate incomes, disabilities, or limited English proficiency.

It’s important to note that regardless of the filing method you choose, you must ensure the accuracy and completeness of your tax return. Review all the information you provide, including your income, deductions, credits, and any supporting documentation.

When it comes to determining which filing option is best for you, consider your personal preferences, level of comfort with technology, and the complexity of your tax situation. If you have a straightforward return with minimal deductions and credits, e-filing may be the most efficient option. However, if you have more complex tax circumstances or prefer face-to-face assistance, in-person filing or mailing your tax return could be the better choice.

Now that we’ve explored the federal filing options, let’s dive into each option in more detail to help you make an informed decision.

Filing Taxes Online

Filing your tax return online has become increasingly popular due to its convenience, accuracy, and speed. There are several reputable online tax preparation software and service providers available, making it easier than ever to file your taxes from the comfort of your own home. Here are a few key points to consider when filing your taxes online:

- Choose a reputable online tax filing service: There are numerous options available, such as TurboTax, H&R Block, and TaxAct. These platforms offer step-by-step guidance and support to help you accurately complete your tax return. Take the time to research and choose the service that best fits your needs.

- Accuracy checks and error prevention: Online tax filing software typically includes built-in checks to help you identify errors and potential audit triggers. These checks ensure that you don’t miss any important information and can help minimize the risk of errors or omissions.

- Maximize deductions and credits: Online tax filing software often includes tools and prompts to help you identify deductions and credits that you may be eligible for. This can help you maximize your tax savings and potentially increase your refund.

- E-filing and direct deposit: When you file your taxes online, you have the option to e-file your return, which allows for faster processing and reduces the risk of errors associated with manual data entry. Additionally, you can choose to receive your refund via direct deposit, which is typically faster and more secure than receiving a paper check in the mail.

- Availability of customer support: Online tax filing services often provide customer support through various channels, such as chat, email, or phone. If you encounter any questions or issues while preparing your return, you can reach out to their support team for assistance.

When using online tax filing software, it’s important to gather all relevant tax documents and have them on hand before starting the process. This includes forms such as W-2s, 1099s, and any supporting documentation for deductions or credits you plan to claim.

Another benefit of online tax filing is the ability to save your progress and return to it later if you need more time to gather or review your information. This flexibility can help reduce the stress associated with filing your taxes, especially if you have a complex financial situation.

Overall, online tax filing offers a convenient and efficient way to file your taxes. However, it’s important to review your completed tax return for accuracy and ensure that all information is entered correctly before submitting it.

Now that we’ve covered filing taxes online, let’s explore the option of filing taxes by mail.

Filing Taxes by Mail

If you prefer the traditional approach or are unable to file your taxes online, you can choose to file your tax return by mail. Here are some important points to consider when filing taxes by mail:

- Print the necessary forms: Start by downloading and printing a copy of Form 1040 and any additional schedules or forms that apply to your tax situation. You can find these forms on the official IRS website or access them through tax preparation software.

- Complete the forms: Fill out Form 1040 and any supporting schedules accurately and legibly. Ensure that your personal information, such as your name, address, and Social Security Number, is correct. Double-check all calculations and ensure you’ve included all necessary information and documentation.

- Sign and date your tax return: Make sure to sign and date your tax return in the appropriate sections. Failure to sign your return can delay its processing and may require the IRS to contact you for a signed copy.

- Include necessary documentation: If you’re claiming deductions or credits that require supporting documentation, such as receipts or forms from other tax documents, make sure to include them in your mailing. It’s recommended to keep copies of all documents for your records.

- Check the correct mailing address: The IRS has different mailing addresses depending on which state you live in and whether you’re enclosing a payment or not. It’s crucial to use the correct mailing address to ensure your tax return reaches the right destination.

- Consider certified mail or return receipt: To ensure the safe arrival and delivery of your tax return, you may want to consider sending it via certified mail or with a return receipt. This will provide proof of mailing and delivery, protecting you in case it gets lost in transit.

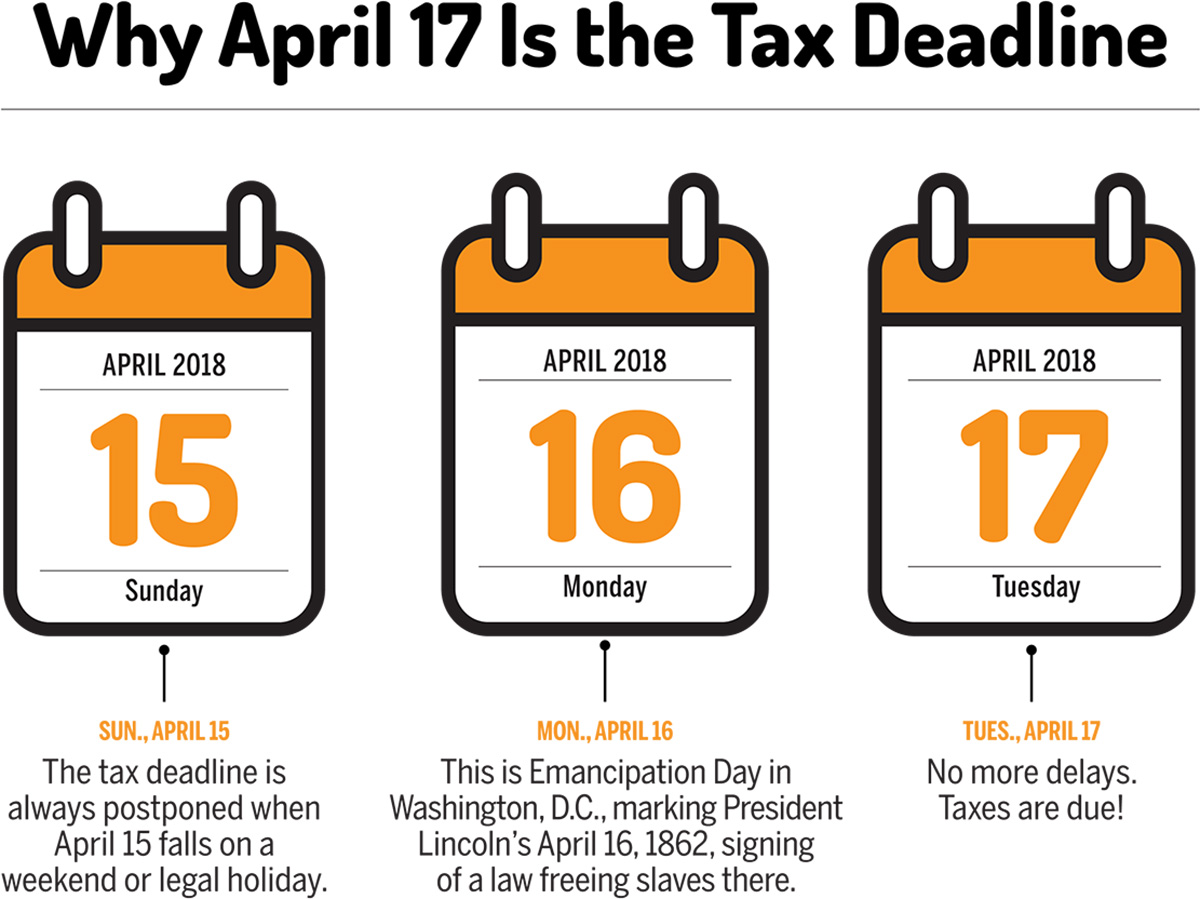

When mailing your tax return, it’s important to allow for enough time for it to reach the IRS before the filing deadline. The deadline for filing your federal tax return is typically April 15th, but it may be extended in certain years or for specific circumstances. Make sure to verify the current year’s filing deadline to avoid any penalties or late filing fees.

While filing taxes by mail may take longer to process compared to e-filing, it is still a valid and accepted method. Just ensure that you follow the instructions provided by the IRS, accurately complete the required forms, and include any necessary documentation.

Next, let’s explore the option of filing your tax return in person, for those taxpayers who prefer or require additional assistance.

Filing Taxes In Person

If you prefer face-to-face assistance or have a more complex tax situation, filing your tax return in person might be the best option for you. The Internal Revenue Service (IRS) offers two programs that provide free tax preparation help: Taxpayer Assistance Centers and Volunteer Income Tax Assistance (VITA) sites.

Taxpayer Assistance Centers: These centers are IRS offices where you can receive in-person assistance with your tax return. IRS employees can help answer questions, provide guidance, and even help you complete your tax forms. To locate the nearest Taxpayer Assistance Center, you can use the IRS’s online locator tool on their website.

Volunteer Income Tax Assistance (VITA) sites: VITA sites are community-based locations staffed by IRS-certified volunteers who can help prepare and file tax returns for eligible individuals. VITA sites generally cater to taxpayers with low to moderate incomes, individuals with disabilities, and those with limited English proficiency. These services are typically provided free of charge.

When visiting a Taxpayer Assistance Center or a VITA site, it’s important to come prepared with all the necessary documents and information. This may include your Social Security Number, identification documents, W-2 forms, 1099s, and any other relevant income and deduction records. Be sure to check the IRS’s website or contact the specific location beforehand to inquire about the required documentation.

Filing your tax return in person offers the advantage of having knowledgeable experts available to answer any questions you may have. They can help ensure that your tax return is accurate and complete, especially if you have complex circumstances such as self-employment income, rental properties, or investment income.

It’s worth noting that in-person tax filing services may have limited availability and may require an appointment. Therefore, it’s advisable to plan ahead and schedule your appointment in advance to avoid any potential delays or last-minute rush.

Whether you choose to visit a Taxpayer Assistance Center or a VITA site, it’s important to bring all necessary documents, be prepared to answer questions about your financial situation, and have a basic understanding of your tax obligations.

Now that we’ve covered the options for filing your federal tax return, let’s shift our focus to state filing options.

State Filing Options

When it comes to filing your state tax return, the options available to you may vary depending on the state in which you reside. In general, there are three common filing options for state tax returns:

- E-filing: Many states offer the option to electronically file your state tax return, similar to the federal e-filing option. Most state tax agencies have their own online portals or partner with tax preparation software providers to offer e-filing services. This option provides the same benefits as federal e-filing, including faster processing and the option for direct deposit of any refund.

- Mailing your tax return: Like with federal tax returns, you can choose to print and mail your state tax return to the relevant state tax agency. Each state will have its own specific mailing address, so make sure to verify the correct address before sending your return. It is recommended to send it via certified mail or with a return receipt for your records.

- In-person filing: Some states may offer in-person tax filing assistance through local government offices or designated taxpayer service centers. These locations can provide guidance and help you file your state tax return in person. Availability and services offered may vary by state, so check with your state’s tax agency for more information.

It’s important to note that not all states require a separate state tax return. Some states have an agreement with the IRS where they use the federal tax return as the basis for calculating state taxes. These states typically only require a few additional forms or information to supplement the federal tax return.

Each state may have its own specific requirements and deadlines for filing state tax returns. It’s essential to consult your state’s tax agency or visit their official website to ensure you have the most up-to-date information regarding state tax filing requirements.

Additionally, it’s worth mentioning that state tax laws and regulations can differ significantly from federal tax laws. Therefore, if you have complex tax situations or significant state-specific deductions or credits, it may be beneficial to consult a tax professional or use specialized state tax preparation software to ensure accuracy.

Now that we have explored the options for filing both federal and state tax returns, let’s summarize the state-specific filing requirements for a handful of states.

State-by-State Filing Requirements

Note: This section provides a brief overview of state filing requirements for a few selected states. It’s essential to consult your state’s tax agency or visit their official website for the most accurate and up-to-date information regarding your specific state’s filing requirements.

1. California: California requires its residents to file a state tax return if they meet certain income thresholds or have income sourced from California. The California Franchise Tax Board (FTB) offers e-filing options, as well as the option to mail your tax return if you prefer.

2. New York: New York residents must file a state tax return if they meet certain income requirements or have income sourced from New York. The New York State Department of Taxation and Finance provides online e-filing services, or you can choose to mail your tax return.

3. Texas: Texas is one of the few states that does not impose personal income tax. Therefore, most Texas residents do not need to file a state tax return for individual income taxes.

4. Florida: Similar to Texas, Florida also does not have a state income tax, so most residents do not need to file a state tax return for individual income taxes. However, it’s important to check for any other applicable taxes or required filings depending on individual circumstances.

5. Illinois: Illinois residents are required to file a state tax return if they meet certain income thresholds or have income sourced from Illinois. The Illinois Department of Revenue offers e-filing options on their website, along with traditional mail-in filing methods.

Remember, each state has its own specific filing requirements and deadlines. It’s crucial to consult your state’s tax agency or visit their official website for the most accurate and up-to-date information.

Additionally, it’s worth noting that some states may offer specific tax credits or deductions that differ from the federal tax provisions. It’s important to review your state’s tax forms and instructions to ensure you are capturing all eligible deductions and credits.

Lastly, if you have income from multiple states or have relocated during the tax year, you may need to file multiple state tax returns. In this case, it may be beneficial to seek professional tax advice or use specialized state tax software to ensure compliance with the various state tax laws.

Now that we have covered federal and state filing options, as well as state-specific requirements, let’s conclude our guide to filing your tax return using Form 1040.

Conclusion

Filing your tax return using Form 1040 may seem daunting at first, but with the right knowledge and resources, you can navigate the process smoothly. In this guide, we have explored the various options available for filing your federal and state tax returns.

For federal filing options, you can choose to file your taxes online, by mail, or in person. Online tax filing offers convenience, accuracy checks, and faster processing. Mailing your tax return provides a traditional approach, while in-person filing allows for face-to-face assistance if needed.

When it comes to state filing options, most states offer electronic filing (e-filing) similar to the federal process. However, specific requirements and deadlines vary by state, so it’s crucial to consult your state’s tax agency for accurate information.

Throughout the filing process, be sure to gather all necessary documents, review your tax forms for accuracy, and consider seeking professional assistance if you have complex tax situations or are unsure about certain aspects of your return.

Remember, filing your tax return accurately and on time is crucial to avoid penalties and ensure compliance with tax laws. Always consult the appropriate tax authorities or a qualified tax professional to obtain the most accurate and up-to-date information regarding your specific tax situation.

We hope this guide has provided you with valuable insights into where and how to file your tax return using Form 1040. By utilizing the available options and resources, you can confidently fulfill your tax obligations and navigate the tax-filing process with ease.

Remember to stay informed, keep track of important tax deadlines, and maintain good recordkeeping practices for your future tax filings. With diligence and attention to detail, you can successfully complete your tax return and minimize any potential stress or complications that may arise.

Thank you for reading our comprehensive guide, and we wish you a successful and stress-free tax filing season!