Finance

How To Activate A Secured Card

Published: March 2, 2024

Learn how to activate a secured card and start building your credit with our step-by-step guide. Improve your financial future today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Secured credit cards are a valuable financial tool that can help individuals build or rebuild their credit. Whether you're new to credit, recovering from past financial challenges, or looking to establish a positive credit history, a secured card can be an excellent starting point. In this comprehensive guide, we'll explore the process of activating a secured credit card and provide essential insights into using it responsibly to enhance your credit profile.

Understanding the nuances of secured cards and how they differ from traditional credit cards is crucial for making informed financial decisions. By delving into the intricacies of secured cards, you can gain a deeper understanding of their benefits and how they can serve as a stepping stone towards achieving your financial goals.

Applying for a secured card is often the initial step in the journey to building or repairing your credit. Navigating the application process with confidence and understanding the key factors that lenders consider can significantly impact your success in obtaining a secured card that aligns with your needs.

Once you've received your secured card, the activation process is simple, yet it's essential to follow the necessary steps to ensure that your card is ready for use. Moreover, using your secured card responsibly is paramount for leveraging its benefits to improve your credit score and overall financial well-being.

Throughout this guide, we'll provide actionable tips and insights on activating your secured card and using it judiciously to foster positive credit habits. By adopting these practices, you can pave the way for a more secure financial future and access an array of opportunities that come with a healthy credit profile.

Understanding Secured Cards

Secured credit cards are specifically designed for individuals who are new to credit or are working to rebuild their credit history. Unlike traditional credit cards, secured cards require a security deposit, which serves as collateral and determines the card’s credit limit. This deposit reduces the risk for the card issuer, making secured cards an accessible option for those with limited or damaged credit.

One of the fundamental differences between secured and unsecured (traditional) credit cards is that secured cards require an initial deposit, while unsecured cards do not. The deposit amount typically determines the credit limit, providing a level of control and predictability for the cardholder.

Secured cards function similarly to traditional credit cards in that they can be used for everyday purchases, online transactions, and bill payments. By using a secured card responsibly, cardholders can demonstrate their creditworthiness and establish a positive payment history, which is a crucial factor in building a solid credit foundation.

It’s important to note that while secured cards require a deposit, they are not prepaid cards. The security deposit is held by the card issuer as collateral and does not directly cover purchases made with the card. Cardholders are still required to make monthly payments on their secured card balance, and any missed payments can negatively impact their credit score.

When considering a secured card, it’s essential to review the terms and conditions, including the annual fees, interest rates, and any potential rewards or benefits. While secured cards may have higher fees and interest rates compared to traditional credit cards, they offer a valuable opportunity to establish or rebuild credit when used responsibly.

Overall, understanding the unique features and requirements of secured cards is pivotal in making informed decisions about your credit journey. By leveraging the benefits of a secured card and managing it prudently, you can lay a solid groundwork for achieving your long-term financial aspirations.

Applying for a Secured Card

When applying for a secured credit card, it’s essential to approach the process with careful consideration and a clear understanding of the requirements. The first step is to research and compare secured card offers from reputable financial institutions. Look for cards that align with your financial goals and offer favorable terms, such as low annual fees and competitive interest rates.

Before submitting an application, it’s important to review your credit report to assess your current standing. While secured cards are designed for individuals with limited or damaged credit, reviewing your credit report can provide valuable insights into your financial history and help you identify areas for improvement.

Once you’ve selected a secured card that suits your needs, the application process typically involves providing personal information, such as your name, address, contact details, and social security number. Additionally, you’ll be required to submit the initial security deposit, which will determine your credit limit.

Some secured card issuers may perform a credit check as part of the application process, while others may offer secured cards without a credit check. Understanding the issuer’s credit evaluation process can help you anticipate the likelihood of approval and choose the most suitable option for your circumstances.

After submitting your application and security deposit, the card issuer will review your information and determine whether to approve your secured card application. Upon approval, you will receive your secured card along with instructions for activation and usage.

It’s important to note that while secured cards are accessible to individuals with limited credit history or past credit challenges, responsible financial management remains crucial. By using your secured card prudently and making timely payments, you can lay the groundwork for improving your credit score and transitioning to unsecured credit options in the future.

Applying for a secured card is a proactive step towards building or rebuilding your credit, and by approaching the process with diligence and informed decision-making, you can set a positive trajectory for your financial journey.

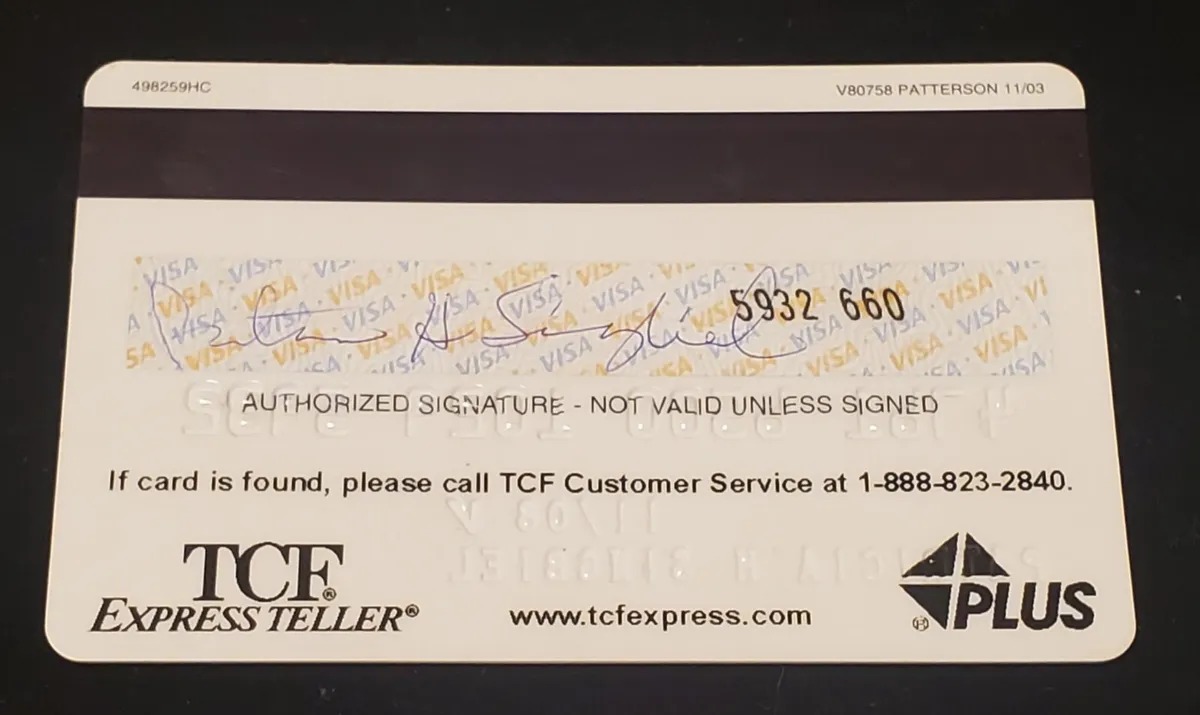

Activating Your Secured Card

Upon receiving your secured credit card, the next crucial step is activating it to start utilizing the available credit. The activation process is typically straightforward and can be completed through various channels offered by the card issuer.

1. Review the Activation Instructions: When you receive your secured card, carefully review the accompanying materials, including the activation instructions provided by the issuer. These instructions may outline the available activation methods, such as online activation, phone activation, or activation through a mobile app.

2. Online Activation: Many secured card issuers offer online activation portals, allowing cardholders to activate their cards through a secure website. To activate your card online, you may need to create an online account or log in using the credentials provided by the issuer. Follow the prompts to verify your identity and complete the activation process.

3. Phone Activation: Some card issuers provide a dedicated phone number for card activation. By calling the specified activation line, you can follow the automated prompts or speak with a representative to activate your secured card. Be prepared to provide the necessary personal information to validate your identity during the phone activation process.

4. Mobile App Activation: If the card issuer offers a mobile app, you may have the option to activate your secured card through the app. Download the issuer’s mobile application from the app store, if available, and follow the in-app instructions to activate your card securely.

5. Security Deposit Confirmation: In some cases, the activation process may involve confirming the security deposit amount or providing additional details related to the initial deposit. Ensure that you have the necessary information at hand to complete this step, as it is integral to finalizing the activation of your secured card.

6. Verification and Confirmation: Regardless of the activation method chosen, the issuer may require verification of your identity and confirmation of receipt of the secured card. This may involve providing personal details, such as your social security number, to validate your identity and ensure a seamless activation process.

By following the activation instructions provided by the card issuer and completing the necessary steps, you can activate your secured card efficiently and begin using it for everyday transactions, thereby initiating the process of building or rebuilding your credit history.

Activating your secured card marks the transition from receiving the card to leveraging its benefits responsibly. With your secured card activated, you can embark on a journey of financial empowerment and credit improvement, laying the groundwork for a brighter financial future.

Using Your Secured Card Responsibly

Using a secured credit card responsibly is pivotal for establishing positive credit habits and maximizing the benefits of this financial tool. By adhering to prudent practices and mindful financial management, you can leverage your secured card to build a solid credit history and pave the way for future financial opportunities.

1. Timely Payments: Making timely payments on your secured card balance is paramount for demonstrating responsible credit behavior. By paying at least the minimum amount due by the due date each month, you can showcase your commitment to managing credit responsibly and avoid potential late fees or negative impacts on your credit score.

2. Credit Utilization: As with traditional credit cards, maintaining a low credit utilization ratio on your secured card is advisable. Aim to keep your card balance well below the credit limit, ideally utilizing no more than 30% of the available credit. This practice can contribute to a positive credit profile and demonstrate prudent credit management to potential lenders.

3. Regular Monitoring: Stay vigilant about monitoring your secured card transactions and statements. Reviewing your account activity regularly can help you detect any unauthorized charges or errors, allowing for prompt resolution and safeguarding your financial well-being.

4. Budgeting and Planning: Incorporate your secured card payments into your budgeting and financial planning. By allocating funds for your secured card payments and ensuring that they are accounted for in your overall financial strategy, you can maintain consistency in managing your credit obligations.

5. Avoiding Cash Advances: While some secured cards may offer cash advance capabilities, it’s advisable to refrain from using this feature whenever possible. Cash advances often incur additional fees and higher interest rates, which can detract from your overall financial stability.

6. Building a Payment History: Your payment history plays a significant role in shaping your credit profile. By consistently making on-time payments and managing your secured card responsibly, you can lay the groundwork for a positive payment history, which is a crucial factor in credit scoring models.

7. Communication with the Issuer: In the event of financial challenges or unexpected circumstances, maintaining open communication with the card issuer can be beneficial. If you anticipate difficulty in making a payment, reaching out to the issuer proactively can sometimes lead to alternative arrangements or assistance.

By embracing these responsible credit practices and integrating them into your financial routine, you can harness the potential of your secured card to cultivate a robust credit foundation. Over time, these habits can contribute to improved credit scores and expanded access to financial products and services.

Using your secured card responsibly is not only a means of managing your current credit obligations but also an investment in your financial future. By exercising prudence and discipline, you can harness the power of your secured card to propel your credit journey forward.

Building Credit with Your Secured Card

A secured credit card serves as a valuable tool for building or rebuilding credit, offering a structured pathway to establishing a positive credit history. By leveraging your secured card effectively, you can lay the groundwork for improved credit scores and expanded financial opportunities.

1. Payment History: Your secured card usage directly influences your payment history, a critical component of credit scoring models. Making timely payments on your secured card balance demonstrates responsible credit management and contributes to a positive payment history, which can enhance your creditworthiness over time.

2. Credit Utilization: Maintaining a low credit utilization ratio on your secured card is essential for optimizing your credit-building efforts. By utilizing a modest portion of your available credit and avoiding maxing out your card, you can convey prudent credit management to credit bureaus and potential lenders.

3. Credit Monitoring: Regularly monitoring your credit report and score allows you to track your progress and address any discrepancies or inaccuracies promptly. As you use your secured card and manage your credit responsibly, you can observe the positive impact on your credit profile over time.

4. Transition to Unsecured Credit: With consistent, responsible use of your secured card, you may position yourself for a transition to an unsecured credit card in the future. Some card issuers offer opportunities to upgrade to an unsecured card based on your credit performance, providing a pathway to expanded credit options.

5. Credit Score Improvement: Over time, the positive credit habits cultivated through the use of your secured card can lead to tangible improvements in your credit score. As your payment history strengthens and your credit utilization remains low, you may observe an upward trajectory in your credit score, reflecting your commitment to responsible credit management.

6. Financial Discipline: Using a secured card fosters financial discipline and mindfulness in managing credit. By adhering to prudent credit practices and budgeting for your secured card payments, you cultivate enduring habits that contribute to long-term financial stability and credit health.

7. Credit Building Resources: Some secured card issuers offer educational resources and tools to support cardholders in building credit knowledge and skills. Leveraging these resources can enhance your understanding of credit management and empower you to make informed decisions regarding your financial well-being.

By harnessing the credit-building potential of your secured card and integrating responsible credit practices into your financial routine, you can chart a course toward a stronger credit profile and enhanced financial prospects. Your diligent efforts with your secured card can yield lasting benefits, positioning you for greater financial empowerment and flexibility in the future.

Building credit with your secured card is not merely a short-term endeavor; it’s an investment in your financial future. By embracing the opportunities presented by your secured card and maintaining steadfast commitment to responsible credit management, you can pave the way for enduring credit success and enhanced financial well-being.

Conclusion

In conclusion, secured credit cards offer a gateway to financial empowerment and credit improvement for individuals navigating the complexities of credit building and repair. By understanding the nuances of secured cards and approaching the application process with informed decision-making, individuals can access a valuable tool for establishing a positive credit history.

Activating a secured card marks the commencement of a journey toward responsible credit management and credit score enhancement. Through prudent usage and adherence to responsible credit practices, cardholders can leverage their secured cards to build a solid credit foundation and pave the way for future financial opportunities.

Using a secured card responsibly entails making timely payments, managing credit utilization, and embracing financial discipline. These practices not only contribute to credit score improvement but also foster enduring habits that promote long-term financial stability.

Building credit with a secured card is a transformative process that extends beyond immediate credit enhancement. It embodies an investment in one’s financial future, offering the potential to transition to unsecured credit options and access a broader spectrum of financial products and services.

As individuals harness the credit-building potential of their secured cards, they embark on a journey of financial empowerment, credit growth, and enhanced financial well-being. By integrating the insights and practices outlined in this guide, individuals can navigate their credit journeys with confidence, leveraging the benefits of secured cards to achieve lasting credit success.

Ultimately, the activation and responsible usage of a secured credit card represent a pivotal step toward realizing financial goals and cultivating a resilient credit profile. By embracing the opportunities presented by secured cards and committing to sound credit management principles, individuals can lay a robust groundwork for a brighter financial future.