Home>Finance>How Often Does First Premier Increase Credit Limit

Finance

How Often Does First Premier Increase Credit Limit

Modified: January 15, 2024

Learn how often First Premier increases credit limits and get valuable finance insights to manage your credit effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on how often First Premier increases credit limits. First Premier is a renowned credit card issuer that has been helping individuals build or rebuild their credit for over 30 years. One common concern among First Premier cardholders is how often they can expect their credit limits to increase.

Understanding credit limit increases is crucial for managing your credit effectively. A higher credit limit not only gives you more financial flexibility but also improves your credit utilization ratio, a vital component in determining your credit score. Therefore, knowing when and how often you can expect a credit limit increase from First Premier can be beneficial in optimizing your credit management strategy.

In this article, we will explore the factors that influence credit limit increases from First Premier, shed light on how often they typically occur, and provide tips on increasing your chances of getting a credit limit increase. So, whether you are a current First Premier cardholder or considering applying for one, this guide will be your go-to resource for understanding First Premier’s credit limit increase process.

Understanding First Premier Credit Limit Increases

First Premier determines credit limit increases based on various factors, including your creditworthiness, payment history, and overall financial profile. Here are some key points to help you understand how First Premier evaluates credit limit increase requests:

- Creditworthiness: First Premier assesses your creditworthiness by reviewing your credit score and credit history. If you consistently make on-time payments and have a positive credit history, you are more likely to be eligible for a credit limit increase.

- Payment history: Your payment history plays a significant role in determining your eligibility for a credit limit increase. First Premier looks at whether you have a record of timely payments and if you have any delinquencies or missed payments.

- Income and financial stability: First Premier takes into consideration your income level and overall financial stability. This helps them assess your ability to manage a higher credit limit responsibly.

- Credit utilization ratio: Your credit utilization ratio, which is the amount of credit you are using compared to your total available credit, is an important factor in credit limit increases. Keeping your credit utilization ratio below 30% demonstrates responsible credit management and can increase your chances of a credit limit increase.

- Length of account history: First Premier also considers the length of your account history. The longer you have been a responsible cardholder, the more likely you are to be eligible for a credit limit increase.

Please note that your credit limit increase is not automatic and is subject to First Premier’s review and approval. They evaluate each request on an individual basis, taking into account the factors mentioned above.

Now that you have a better understanding of how First Premier evaluates credit limit increases, let’s explore how often you can expect these increases to occur.

Factors influencing First Premier Credit Limit Increases

Several factors come into play when determining credit limit increases from First Premier. Understanding these factors can help you navigate the process and increase your chances of a successful credit limit increase. Here are the key factors that influence First Premier’s decision:

- Credit Score: Your credit score is a crucial factor in determining credit limit increases. First Premier typically looks for consistent improvement in your credit score over time. The higher your credit score, the better your chances of receiving a credit limit increase.

- Payment History: Demonstrating a consistent track record of making on-time payments can significantly impact First Premier’s decision. Late payments or missed payments can negatively affect your chances of a credit limit increase, so it is essential to prioritize timely payments.

- Credit Utilization: First Premier considers how much of your available credit you are currently using. Keeping your credit utilization ratio low, ideally below 30%, shows responsible credit management and can increase your likelihood of a credit limit increase.

- Income and Financial Stability: First Premier takes into account your income and overall financial stability. A higher income level and stable financial situation demonstrate your ability to handle a higher credit limit responsibly.

- Account Age: The length of time you have held your First Premier credit card can impact the likelihood of a credit limit increase. A longer account history with a positive payment record indicates your loyalty and responsible credit management.

- Credit Limit Increase Requests: First Premier generally encourages proactive credit limit increase requests from cardholders who have demonstrated responsible credit habits. Submitting a request can prompt them to review your account and consider a credit limit increase.

It’s important to note that while these factors significantly influence credit limit increases, there is no guarantee that you will receive one. First Premier assesses each request on an individual basis and considers various factors in their decision-making process.

In the next section, we will delve into how often First Premier typically increases credit limits for their cardholders.

How often does First Premier increase credit limits?

The frequency of credit limit increases from First Premier can vary depending on several factors, including your creditworthiness, payment history, and overall financial profile. While there is no definitive answer to how often they increase credit limits, First Premier typically reviews accounts every 6 to 12 months to assess eligibility for a credit limit increase.

It’s important to note that First Premier does not automatically increase credit limits for all cardholders. Instead, they evaluate each account individually based on the factors we discussed earlier. If they determine that you meet their criteria for a credit limit increase, they may raise your credit limit accordingly. However, it’s also possible that they may not offer an increase if they deem it not suitable at that time.

To increase your chances of receiving a credit limit increase from First Premier, it’s essential to demonstrate responsible credit management. This includes maintaining a positive payment history, keeping your credit utilization ratio low, and regularly reviewing and improving your overall creditworthiness.

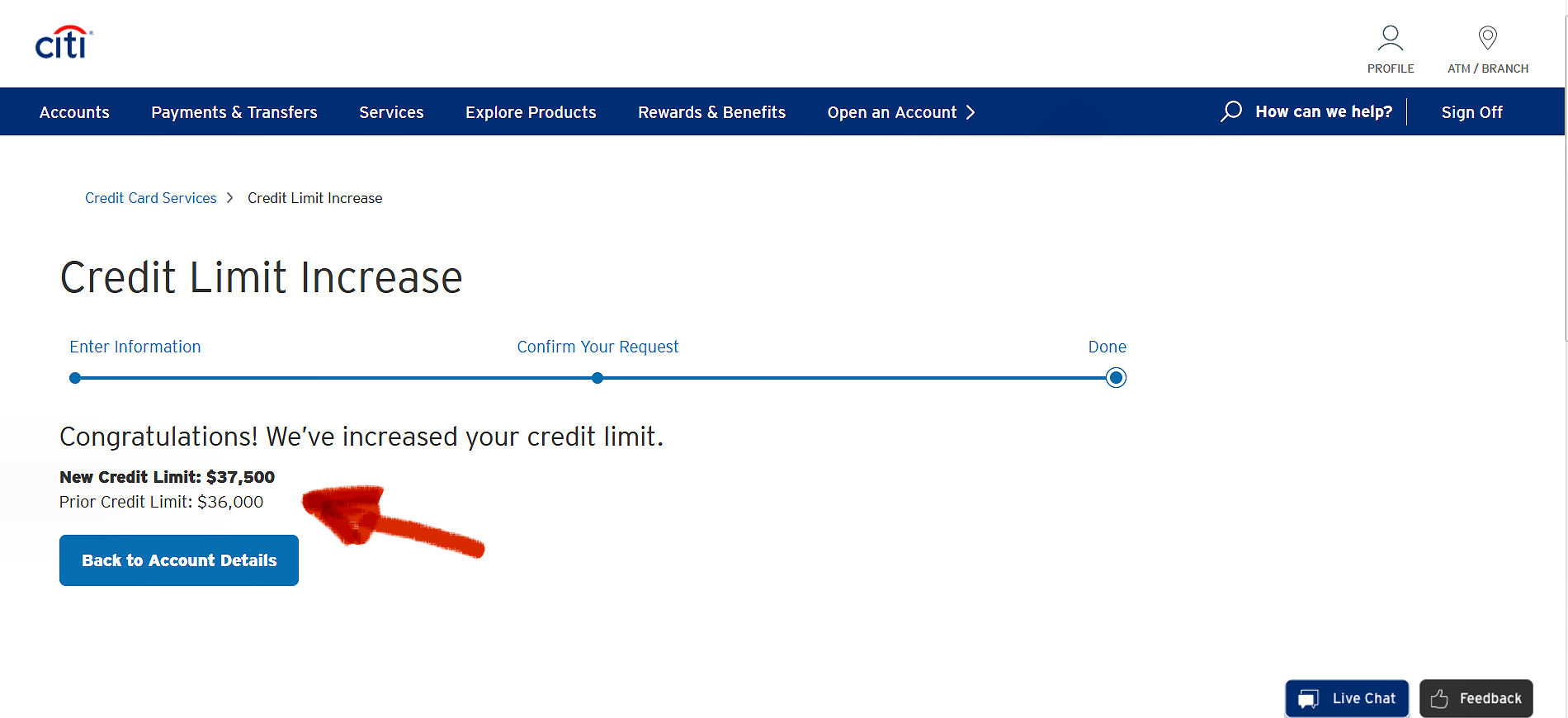

If you believe you are eligible for a credit limit increase and have met the necessary criteria, you can also consider submitting a credit limit increase request to First Premier. While there is no guarantee that your request will be approved, it can prompt First Premier to review your account and consider an increase if they deem it appropriate.

Remember, patience is key when it comes to credit limit increases. Building a strong credit profile and consistently demonstrating responsible credit habits can put you in a better position to receive credit limit increases over time.

In the next section, we will provide you with some tips on how to increase your chances of getting a credit limit increase from First Premier.

First Premier Credit Limit Increase Requests

If you believe you are eligible for a credit limit increase with First Premier, you have the option to submit a credit limit increase request. While there is no guarantee that your request will be approved, following these steps can help increase your chances:

- Check your eligibility: Before submitting a credit limit increase request, assess your financial situation and creditworthiness. Ensure that you meet the criteria discussed earlier, such as having a positive payment history, low credit utilization, and a stable income.

- Review your account: Take a look at your current First Premier credit card account. Evaluate your payment history, credit utilization ratio, and overall creditworthiness. Consider making any necessary improvements before submitting your request.

- Contact First Premier: Reach out to First Premier either through their customer service line or online portal to inquire about their credit limit increase request process. They will provide you with the necessary instructions and any specific requirements for submitting your request.

- Provide accurate information: When submitting your credit limit increase request, ensure that you provide accurate and up-to-date information about your financial situation. This includes details about your income, employment, and any other relevant financial information that can support your request.

- Explain your rationale: Along with your request, provide a clear and concise explanation of why you believe you deserve a credit limit increase. Highlight any positive changes in your credit profile, such as improved credit scores or a history of responsible credit management.

- Follow up: After submitting your request, it’s essential to follow up with First Premier to check the status of your application. This shows your proactive approach and commitment to managing your credit responsibly.

Remember that submitting a credit limit increase request does not guarantee approval. First Premier evaluates each request individually, taking into account various factors. However, by following these steps and demonstrating responsible credit management, you can increase your chances of receiving a credit limit increase from First Premier.

In the next section, we will provide you with additional tips to enhance your chances of getting a credit limit increase from First Premier.

Tips for getting a credit limit increase from First Premier

When it comes to increasing your chances of receiving a credit limit increase from First Premier, there are several strategies you can employ. Here are some helpful tips to enhance your likelihood of success:

- Build a strong credit history: Consistently make on-time payments, minimize your credit utilization, and avoid late payments or defaulting on any obligations. A strong credit history reflects responsible credit management and increases your chances of a credit limit increase.

- Monitor your credit score: Regularly check your credit score and credit report to ensure there are no errors or inconsistencies. Address any issues promptly to maintain a favorable credit profile.

- Request a credit limit increase at the right time: Assess your account’s payment history, credit utilization, and overall financial stability before submitting a credit limit increase request. Waiting until you have demonstrated responsible credit habits for a significant period can improve your chances of approval.

- Pay your balance in full: Aim to pay off your balance in full each month to showcase responsible credit usage. Doing so not only improves your creditworthiness but also indicates to First Premier that you can handle a higher credit limit.

- Keep your income details updated: If your income has significantly increased since you opened your First Premier credit card account, consider updating your income details with First Premier. A higher income can demonstrate your ability to manage a higher credit limit.

- Utilize your card regularly: Show activity on your First Premier credit card by using it for regular purchases and making timely payments. This active usage can help First Premier see your responsible credit management and may increase your chances of a credit limit increase.

- Proactively manage credit obligations: In addition to your First Premier credit card, focus on managing your other credit obligations responsibly. This includes paying bills on time, managing other credit card balances, and keeping debt levels low.

- Engage in financial conversations: Reach out to First Premier periodically to discuss your credit limit and inquire about any potential eligibility for a credit limit increase. Engaging in proactive conversations can demonstrate your commitment to responsible credit management.

Remember, while implementing these tips can enhance your chances of receiving a credit limit increase from First Premier, approval ultimately depends on First Premier’s evaluation of your individual circumstances.

Now that you have a comprehensive understanding of how to increase your chances of a credit limit increase from First Premier, let’s summarize what we’ve covered in this guide.

Conclusion

In conclusion, understanding how often First Premier increases credit limits is important for managing your credit effectively. While the frequency of credit limit increases can vary based on individual factors, First Premier typically reviews accounts every 6 to 12 months to assess eligibility for an increase.

Factors such as creditworthiness, payment history, credit utilization, income, and account age play a significant role in determining credit limit increases from First Premier. By maintaining a positive payment history, keeping credit utilization low, and demonstrating responsible credit management, you can increase your chances of receiving a credit limit increase.

If you believe you are eligible, you can also submit a credit limit increase request to First Premier. However, approval is not guaranteed, and it’s important to provide accurate information and explain why you deserve a credit limit increase. Following up on your request and engaging in proactive financial conversations can further enhance your chances.

Remember to consistently monitor your credit score, build a strong credit history, and responsibly manage your credit obligations. These practices not only increase your chances of a credit limit increase but also contribute to overall financial health.

Ultimately, First Premier’s decision regarding credit limit increases is based on their assessment of your individual circumstances. By following the tips and strategies outlined in this guide, you can put yourself in the best position to receive a credit limit increase from First Premier.

Thank you for reading our guide on how often First Premier increases credit limits. We hope you found this information helpful in managing your credit effectively and optimizing your financial well-being.