Finance

How To Analyze A Businesss Capital Structure

Published: December 24, 2023

Learn how to analyze the capital structure of a business and understand its financial health. Explore the key aspects of finance and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Capital Structure

- Importance of Analyzing Capital Structure

- Steps to Analyze a Business’s Capital Structure

- Identify the Components of Capital Structure

- Calculate the Weighted Average Cost of Capital (WACC)

- Analyze Debt-to-Equity Ratio

- Evaluate Financial Leverage

- Assess Liquidity and Solvency Ratios

- Examine Interest Coverage Ratio

- Consider Market Capitalization

- Conclusion

Introduction

In the world of finance, understanding a business’s capital structure is essential for investors, lenders, and financial analysts. The capital structure refers to the way a company finances its operations and growth through a combination of debt and equity. Analyzing a business’s capital structure can provide valuable insights into its financial health, risk profile, and potential for growth.

By scrutinizing the capital structure, investors can make informed decisions about whether to invest in a company’s stock or bonds. Lenders assess the capital structure to evaluate a borrower’s creditworthiness and determine appropriate interest rates. Financial analysts use capital structure analysis to assess a company’s risk and make recommendations to clients.

The goal of analyzing a business’s capital structure is to evaluate the proportion of debt and equity financing, assess the risk associated with the debt level, and understand the impact on the company’s financial performance. This analysis involves examining various financial ratios and metrics that provide insights into a company’s ability to meet its financial obligations and generate returns for its shareholders.

In this article, we will delve into the importance of analyzing capital structure and outline the steps involved in conducting a comprehensive analysis. Whether you are an investor looking to make sound investment decisions or a financial professional seeking to evaluate a company’s financial health, understanding how to analyze a business’s capital structure is crucial.

Understanding Capital Structure

Capital structure refers to the way a business finances its operations and investments by utilizing a combination of debt and equity. It represents the proportion of various sources of funding that a company employs to support its activities. The two primary components of capital structure are debt and equity.

Debt:

Debt financing involves borrowing funds from lenders, such as banks or bondholders, and promising to repay the borrowed amount along with interest over a specified period. Debt can take the form of loans, bonds, or lines of credit. It enables businesses to access additional funds to support their operations or make investments without diluting ownership.

Equity:

Equity represents the ownership share in a business. Equity financing involves raising funds by selling shares of stock in the company. Investors who purchase these shares become partial owners and have a claim on the company’s assets and profits. Equity financing can come from various sources, including individual investors, institutional investors, and venture capitalists.

Capital structure decisions are essential to a company’s financial management and can significantly impact its risk profile, cost of capital, and overall value. The mix of debt and equity financing depends on several factors, including the company’s industry, growth prospects, profitability, and risk tolerance.

The choice between debt and equity financing involves trade-offs. Debt financing offers the advantage of tax-deductible interest payments and allows businesses to leverage their operations, potentially amplifying returns for shareholders. However, excessive debt can increase financial risk, as companies must make regular interest payments and repay the principal amount at maturity.

Equity financing, on the other hand, does not require regular interest payments or the repayment of principal. However, shareholders expect a return on their investment through dividends and capital appreciation, which can dilute the ownership stake of existing shareholders.

It is crucial for businesses to find the optimal balance between debt and equity financing to maximize their value and minimize financial risk. This involves considering factors such as the cost of capital, financial flexibility, cash flow requirements, and the ability to meet debt obligations.

Importance of Analyzing Capital Structure

Analyzing the capital structure of a business is of utmost importance for various stakeholders, including investors, lenders, and financial analysts. It provides valuable insights into the financial health, risk profile, and long-term viability of a company. Let’s explore why capital structure analysis is crucial:

1. Assessing Financial Health:

By analyzing the capital structure, investors can evaluate a company’s financial health and determine its ability to generate profits and meet its financial obligations. A well-balanced capital structure ensures that a company has the necessary funds to support its operations and investments while maintaining profitability.

2. Evaluating Risk Profile:

Capital structure analysis helps assess the risk associated with a business’s financing decisions. A high proportion of debt in the capital structure indicates higher financial risk due to the obligation to make regular interest payments and repay the principal amount. On the other hand, a higher proportion of equity funding indicates lower financial risk but may result in dilution of ownership.

3. Estimating Cost of Capital:

Capital structure analysis enables the calculation of the weighted average cost of capital (WACC), which represents the average rate of return required by investors to invest in the company. By determining the WACC, businesses can make informed decisions regarding the feasibility of new projects or investments.

4. Identifying Growth Potential:

Analyzing the capital structure can provide insights into a company’s growth potential. Capital raised through equity financing indicates investor confidence and suggests that the company has the resources to fund future expansion and take advantage of new opportunities. It also signals the company’s ability to attract investors who believe in its long-term growth prospects.

5. Comparing Competitors:

Capital structure analysis allows for a comparison of a company’s financial structure with its competitors. By benchmarking against industry peers, investors and analysts can gain a better perspective on a company’s performance and competitiveness. This information can aid in making informed investment or lending decisions.

6. Guiding Investment and Lending Decisions:

For investors and lenders, analyzing a business’s capital structure is crucial for making informed investment or lending decisions. By understanding the risk-reward profile associated with a company’s financing mix, investors can assess the potential return on investment and make more confident investment decisions. Lenders can evaluate the company’s ability to repay debt and determine appropriate interest rates.

Overall, capital structure analysis is a fundamental aspect of financial analysis. It provides insights into a company’s financial health, risk exposure, growth potential, and establishes a foundation for strategic decision-making by investors, lenders, and financial analysts.

Steps to Analyze a Business’s Capital Structure

Analyzing a business’s capital structure involves a systematic approach to evaluate the composition and implications of its debt and equity financing. Below are the key steps to conduct in-depth analysis:

- Identify the Components of Capital Structure: Start by identifying the various sources of financing used by the company. This includes debt instruments such as loans, bonds, and lines of credit, as well as equity financing through stocks or other ownership interests. Determine the proportion of debt and equity in the capital structure.

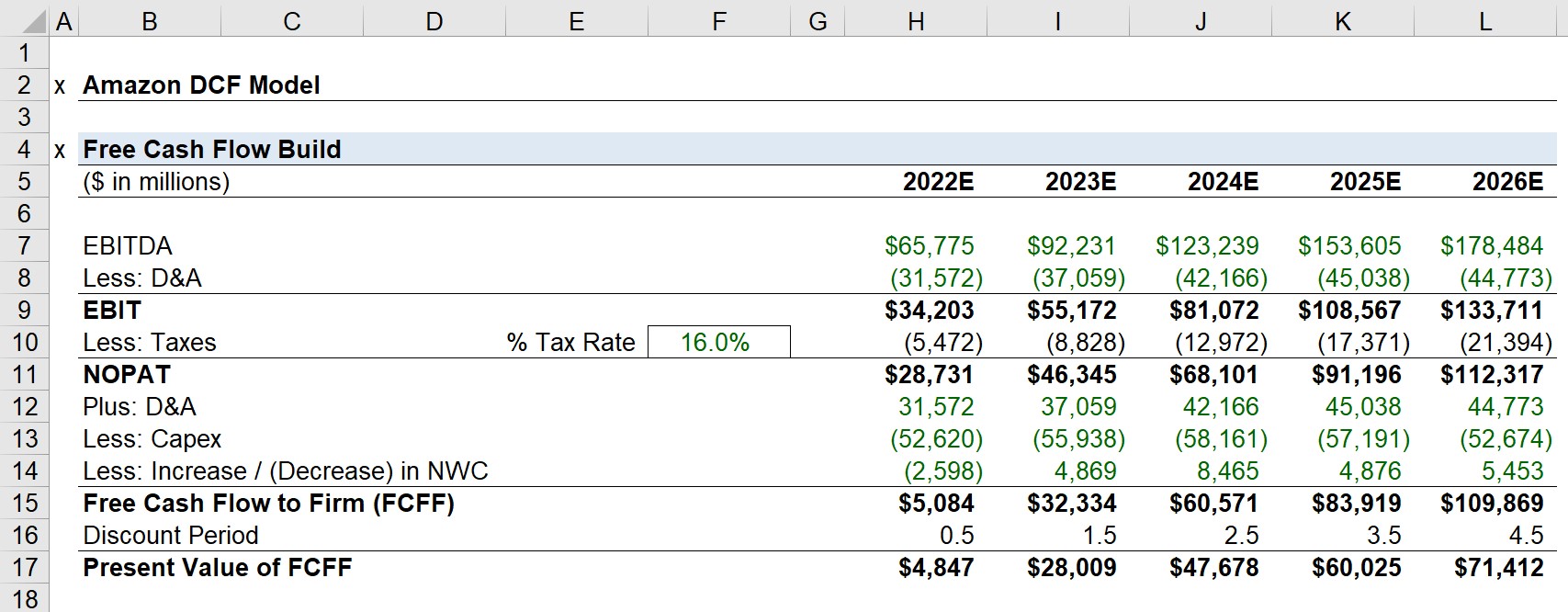

- Calculate the Weighted Average Cost of Capital (WACC): The WACC is the average rate of return a company must earn on its investments to satisfy both equity shareholders and debt investors. Calculate the WACC by assigning appropriate weights to the cost of debt and cost of equity, based on their respective proportions in the capital structure. This metric indicates the company’s overall cost of capital.

- Analyze Debt-to-Equity Ratio: The debt-to-equity ratio is a commonly used financial ratio that compares a company’s total debt to its total equity. Assessing this ratio helps in understanding the level of financial risk associated with a business. Higher ratios indicate greater reliance on debt financing, potentially increasing the company’s financial vulnerability.

- Evaluate Financial Leverage: Financial leverage measures the extent to which a company uses debt to finance its assets. It is determined by the debt-to-equity ratio and provides insights into how changes in debt levels can impact the company’s profitability and return on investment. Higher financial leverage amplifies returns for shareholders but also increases financial risk.

- Assess Liquidity and Solvency Ratios: Liquidity ratios, such as the current ratio and quick ratio, assess a company’s ability to meet short-term obligations. Solvency ratios, such as the debt ratio and equity ratio, measure the long-term financial stability of a business. By evaluating these ratios, analysts can determine if a company has sufficient resources to cover its liabilities and maintain financial stability.

- Examine Interest Coverage Ratio: The interest coverage ratio helps evaluate a company’s ability to meet its interest payment obligations. It compares the company’s earnings before interest and taxes (EBIT) to the total interest expense. A higher ratio indicates a greater ability to service debt and suggests lower financial risk.

- Consider Market Capitalization: Market capitalization reflects the total value of a company’s outstanding shares in the stock market. Analyze the market capitalization in relation to the capital structure to understand the market’s perception of the company’s value. A higher market capitalization may indicate investor confidence and optimism about the company’s future prospects.

By following these steps, analysts can gain a comprehensive understanding of a business’s capital structure and its implications. This analysis helps investors, lenders, and financial analysts make informed decisions regarding investment, lending, and strategic planning.

Identify the Components of Capital Structure

When analyzing a business’s capital structure, the first step is to identify the components or sources of funding that the company utilizes to finance its operations and investments. The capital structure typically consists of two main components: debt and equity.

Debt: Debt financing involves borrowing funds from external sources with the promise of repayment over a specified period, typically with interest. It can take various forms such as bank loans, bonds, lines of credit, or lease financing. Debt provides a company with immediate capital while spreading the cost of the investment over time. It is a contractual obligation that the company must fulfill by making regular interest payments and repaying the principal amount at maturity.

Equity: Equity financing, on the other hand, represents the ownership interest or the shareholders’ stake in the company. Equity is raised by selling shares of stock to investors, who become partial owners and have a claim on the company’s assets and earnings. Equity financing does not require regular interest payments or the repayment of principal. However, shareholders expect returns on their investment through dividends and capital appreciation.

Other components of the capital structure may include preferred stock, convertible securities, or hybrid instruments that have characteristics of both debt and equity.

Identifying the components of the capital structure is necessary to understand the proportion of debt and equity financing utilized by the company. This breakdown provides insights into the company’s financial structure and the risk associated with its financial obligations. A company with a higher proportion of debt financing may face higher interest expenses and financial vulnerability, while a higher proportion of equity financing may indicate a lower risk but dilution of ownership.

Companies have the flexibility to determine the optimal mix of debt and equity financing based on factors such as industry norms, cost of capital, risk tolerance, growth prospects, and availability of funding sources. By identifying the specific components of a company’s capital structure, analysts can assess the sources of funding and their implications on the company’s financial performance and risk profile.

In summary, identifying the components of a business’s capital structure is the first step in analyzing its financial structure. It lays the foundation for further examination of debt and equity ratios, cost of capital calculations, and overall financial health assessment. This understanding helps investors, lenders, and financial professionals make informed decisions regarding investment, lending, and strategic planning.

Calculate the Weighted Average Cost of Capital (WACC)

The weighted average cost of capital (WACC) is a crucial metric used in capital structure analysis to determine the overall cost of financing for a company. It represents the average rate of return that a company needs to generate from its investments to satisfy both equity shareholders and debt investors. To calculate the WACC, several steps are involved:

- Determine the Cost of Debt: The first step is to determine the cost of debt, which represents the interest rate or yield that the company pays to its lenders. It can be calculated by taking an average of the interest rates on the company’s outstanding debts, including loans, bonds, and other forms of debt instruments.

- Estimate the Cost of Equity: The cost of equity is the return required by equity shareholders to invest in the company. It represents the opportunity cost of investing in a particular company’s stock. Various methods can be used to estimate the cost of equity, such as the dividend discount model (DDM), capital asset pricing model (CAPM), or earnings-based models.

- Determine the Proportion of Debt and Equity: Next, determine the proportion of debt and equity financing in the company’s capital structure. This is done by calculating the debt-to-equity ratio, which compares the total debt to the total equity of the company. The weights are assigned based on the respective proportions.

- Calculate the Weighted Average Cost of Debt: Multiply the cost of debt by the proportion of debt in the capital structure. This determines the weighted average cost of debt, which represents the cost of financing through debt sources.

- Calculate the Weighted Average Cost of Equity: Multiply the cost of equity by the proportion of equity in the capital structure. This determines the weighted average cost of equity, which represents the cost of financing through equity sources.

- Calculate the Overall WACC: Finally, add the weighted average cost of debt and the weighted average cost of equity to obtain the overall WACC. The formula for calculating WACC is: WACC = (Wd * Rd) + (We * Re), where Wd represents the proportion of debt, Rd is the cost of debt, We represents the proportion of equity, and Re is the cost of equity.

The WACC is a critical metric as it represents the minimum return a company must achieve on its investments to satisfy its investors. It serves as a benchmark for evaluating the feasibility of new projects or investments. A company’s WACC also reflects its risk profile – a higher WACC indicates higher risk, while a lower WACC suggests lower risk. Investors and financial analysts use the WACC to assess the potential return on investment and compare it with the company’s performance and industry averages.

It is important to note that the WACC calculation involves making assumptions and using estimates. The accuracy of the WACC calculation depends on the accuracy of the input parameters, such as the cost of debt, cost of equity, and the proportional weights assigned to debt and equity sources.

By calculating the weighted average cost of capital (WACC), analysts can gain a better understanding of the company’s overall cost of financing and its implications on profitability and investment decisions. The WACC provides a valuable tool for assessing the financial health, risk, and investment potential of a company.

Analyze Debt-to-Equity Ratio

The debt-to-equity ratio is a key financial metric used to evaluate a company’s capital structure and its financial risk. It compares the total amount of debt a company has to its total equity. The ratio is calculated by dividing total debt by total equity and is expressed as a decimal or a percentage.

A high debt-to-equity ratio suggests that a company relies heavily on debt financing, indicating a higher degree of financial risk. On the other hand, a low debt-to-equity ratio indicates a more conservative capital structure with a greater proportion of equity financing.

Analysts and investors analyze the debt-to-equity ratio to assess the company’s ability to meet its financial obligations and evaluate its financial risk profile. Here’s how analyzing the debt-to-equity ratio can provide valuable insights:

1. Financial Risk Assessment:

The debt-to-equity ratio helps gauge the financial risk associated with a company’s capital structure. Higher ratios indicate a greater reliance on debt, which can increase financial vulnerability. A heavily indebted company may face challenges in repaying its debts, especially during economic downturns or when interest rates rise. It also indicates that a larger portion of the company’s earnings is allocated to servicing debt, potentially limiting its ability to invest in growth opportunities or distribute dividends to shareholders.

2. Industry Comparison:

Comparing a company’s debt-to-equity ratio with industry peers can provide insights into its financial performance and competitiveness. Each industry has its own typical debt levels, influenced by factors such as industry norms, business model, and capital-intensive nature. By benchmarking against peers, investors and analysts can gain a better understanding of a company’s relative financial strength and risk profile.

3. Influence on Cost of Capital:

The debt-to-equity ratio can affect a company’s cost of capital. A higher debt-to-equity ratio may result in a higher cost of debt, reflecting the increased risk perceived by lenders. This can impact the company’s overall cost of financing and profitability. Conversely, a lower debt-to-equity ratio may result in a lower cost of debt, lowering the company’s overall cost of capital and potentially enhancing profitability.

4. Impact on Creditworthiness:

Debt-to-equity ratio analysis is crucial for lenders as it helps evaluate a company’s creditworthiness. Lenders assess the ratio to determine the company’s ability to repay its debts and to determine the level of risk associated with lending. Companies with higher debt-to-equity ratios may face challenges in accessing credit or higher interest rates, while those with lower ratios may enjoy more favorable borrowing terms.

5. Long-Term Outlook:

Analyzing the trend of a company’s debt-to-equity ratio over time can provide insights into its long-term financial health. A consistent increase in the ratio may indicate a growing reliance on debt financing or poor management of capital structure. Conversely, a decreasing ratio may suggest effective debt management, improved financial stability, and a more conservative approach to funding operations and investments.

It is crucial to consider industry and company-specific factors when analyzing the debt-to-equity ratio. Industries such as utilities and real estate tend to have higher debt-to-equity ratios compared to technology or healthcare sectors. Additionally, it’s important to compare the ratio with historical data for the company and industry benchmarks to gain a comprehensive perspective on the company’s financial risk.

By analyzing the debt-to-equity ratio, investors, lenders, and financial analysts can evaluate a company’s capital structure, assess its financial risk, and make informed decisions regarding investment, lending, and strategic planning.

Evaluate Financial Leverage

Financial leverage refers to the extent to which a company utilizes debt financing to fund its operations and investments. It measures how changes in debt levels can impact a company’s financial performance and the returns earned by its shareholders. Evaluating financial leverage is essential for understanding a company’s risk profile and financial stability. Here are the key aspects to consider when evaluating financial leverage:

1. Debt-to-Equity Ratio:

The debt-to-equity ratio provides a measure of financial leverage. A higher ratio suggests that the company relies heavily on debt financing, indicating greater financial risk. Companies with high financial leverage may face challenges in meeting debt obligations during difficult economic periods, as a significant portion of their earnings may be allocated to debt repayment.

2. Impact on Profitability:

Financial leverage can magnify a company’s profitability. When a firm can earn a higher rate of return on its investments than the cost of borrowing, it amplifies the returns for shareholders. This is known as positive financial leverage. However, if the rate of return on investments falls below the cost of borrowing, it leads to negative financial leverage, which can decrease profitability and pose risks to the company’s financial health.

3. Return on Equity (ROE):

Return on equity is a financial ratio that represents the profitability generated by a company’s shareholders’ investments. Financial leverage can impact ROE significantly. By taking on debt, a company can increase its return on equity, as long as the returns earned on borrowed funds exceed the interest expense. However, excessive financial leverage can result in a decline in ROE when the cost of debt surpasses the returns generated on investments.

4. Interest Coverage Ratio:

The interest coverage ratio measures a company’s ability to meet its interest payment obligations. It is calculated by dividing earnings before interest and taxes (EBIT) by interest expenses. A higher interest coverage ratio indicates a company’s ability to easily cover its interest payments and suggests lower financial risk. Conversely, a lower interest coverage ratio may indicate a higher risk of defaulting on interest payments and reflects a higher degree of financial leverage.

5. Flexibility and Financial Stability:

A balance must be struck between debt and equity financing to maintain financial stability. Excessive financial leverage can limit a company’s financial flexibility, as it may have less room to maneuver during challenging economic conditions or when unexpected expenses arise. Evaluating financial leverage helps assess a company’s ability to withstand financial shocks and maintain its long-term financial stability.

It is essential to consider industry norms and company-specific factors when evaluating financial leverage. Industries with stable cash flows, such as utilities or consumer staples, can typically handle higher financial leverage compared to sectors with greater volatility, such as technology or commodities. Additionally, comparing financial leverage with industry peers and historical data provides a comprehensive view of a company’s leverage position.

By evaluating financial leverage, investors, lenders, and financial analysts gain insights into a company’s risk profile, profitability, and financial stability. This analysis helps make informed investment decisions, assess creditworthiness, and monitor a company’s long-term financial health.

Assess Liquidity and Solvency Ratios

Assessing liquidity and solvency ratios is crucial when analyzing a company’s capital structure. These ratios provide insights into a company’s ability to meet its short-term and long-term financial obligations. By evaluating liquidity and solvency, investors, lenders, and financial analysts can gauge a company’s financial health, solvency, and overall risk profile. Here are the key factors to consider:

1. Liquidity Ratios:

Liquidity ratios measure a company’s ability to meet its short-term financial obligations. They assess the adequacy of a company’s current assets to cover its current liabilities. Common liquidity ratios include the current ratio and the quick ratio. A higher ratio indicates greater short-term liquidity and suggests a company is better positioned to meet its immediate payment obligations. However, excessively high liquidity ratios may indicate poor utilization of assets or an inability to generate optimal returns for shareholders.

2. Current Ratio:

The current ratio compares a company’s current assets to its current liabilities. It is calculated by dividing current assets by current liabilities. A ratio above 1 indicates potential short-term liquidity, as current assets are sufficient to cover current liabilities. However, a very high current ratio may suggest inefficiencies in managing working capital or underutilization of assets.

3. Quick Ratio:

Also known as the acid-test ratio, the quick ratio is a more stringent measure of liquidity. It excludes inventory from current assets as inventory may not be readily convertible to cash. The quick ratio considers only the most liquid assets, such as cash, marketable securities, and accounts receivable, compared to current liabilities. A higher quick ratio indicates a company’s ability to cover short-term obligations without relying on the sale of inventory. However, a low quick ratio may suggest potential difficulties in meeting immediate payment obligations.

4. Solvency Ratios:

Solvency ratios focus on a company’s long-term financial stability and ability to meet its long-term obligations. They assess the proportion of a company’s total assets financed by debt and its ability to generate sustainable income. The debt ratio and the equity ratio are common solvency ratios.

5. Debt Ratio:

The debt ratio compares a company’s total debt to its total assets. It indicates the proportion of assets funded by debt and reflects the company’s financial risk. A higher debt ratio suggests higher leverage and potentially greater financial risk. A lower debt ratio indicates a more conservative capital structure with a greater proportion of equity financing, which may imply less financial risk.

6. Equity Ratio:

The equity ratio compares a company’s total equity to its total assets. It measures the proportion of assets funded by equity and is an indicator of financial stability and the level of risk borne by shareholders. A higher equity ratio suggests a more stable financial position, as a greater proportion of assets is funded by equity. Conversely, a lower equity ratio indicates a higher reliance on debt financing and potential financial vulnerability.

When assessing liquidity and solvency ratios, it is essential to consider industry norms and company-specific factors. Industries with highly capital-intensive operations, such as manufacturing or infrastructure, may have higher debt ratios compared to service-based industries. Additionally, comparing ratios over time and benchmarking against industry peers provides a broader understanding of a company’s financial health.

Evaluating liquidity and solvency ratios helps stakeholders gain insights into a company’s ability to meet its short-term and long-term financial obligations, assess its financial health and stability, and make informed decisions regarding investment, lending, and strategic planning.

Examine Interest Coverage Ratio

The interest coverage ratio is a financial metric used to evaluate a company’s ability to meet its interest payment obligations. It provides insights into the company’s ability to service its debt and reflects its financial health and stability. By examining the interest coverage ratio, investors, lenders, and financial analysts can assess the company’s ability to generate sufficient earnings to cover its interest expenses. Here’s how the interest coverage ratio is analyzed:

1. Calculation of the Interest Coverage Ratio:

The interest coverage ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses. EBIT represents the earnings generated by the company before deducting interest and taxes. Interest expenses include the regular interest payments made by the company on its outstanding debts. The resulting ratio indicates how many times the company’s earnings cover its interest expenses.

2. Interpretation of the Interest Coverage Ratio:

A higher interest coverage ratio indicates that a company generates sufficient earnings to comfortably cover its interest expenses. It suggests a lower risk of defaulting on interest payments and reflects the company’s ability to manage its debt obligations. Conversely, a lower interest coverage ratio indicates a higher risk of default on interest payments and suggests potential financial difficulties.

3. Financial Stability and Risk Assessment:

The interest coverage ratio is an important indicator of a company’s financial stability. A higher ratio provides confidence to lenders that the company can service its debt regularly. It also signals a reduced risk of financial distress or bankruptcy. On the other hand, a lower interest coverage ratio raises concerns about the company’s capacity to meet its debt obligations. It indicates a higher level of financial risk and may lead to increased borrowing costs or limited access to credit.

4. Industry Comparison and Benchmarks:

When examining the interest coverage ratio, it is important to consider industry standards and benchmarks. Different industries have varying levels of financial risk and profitability. Comparing a company’s interest coverage ratio to its industry peers can provide useful insights into its relative financial performance and risk profile. Benchmarking the ratio against historical data for the company can also help identify trends and assess the company’s financial stability over time.

5. Impact on Investment and Lending Decisions:

The interest coverage ratio is a critical factor for investors and lenders when making decisions regarding investment or lending. For investors, a higher interest coverage ratio indicates a lower risk of default on interest payments and a higher likelihood of receiving regular interest income or dividends. Lenders use the interest coverage ratio to assess the creditworthiness of a company and determine the interest rates or loan terms. A stronger interest coverage ratio increases a company’s ability to negotiate more favorable lending terms.

It is important to note that the interest coverage ratio provides an overall snapshot of a company’s ability to meet interest expenses. However, it does not consider other financial obligations, such as principal repayments or upcoming debt maturities. Therefore, it is crucial to analyze the interest coverage ratio in conjunction with other financial ratios and consider the company’s overall financial position and cash flow generation ability.

Examining the interest coverage ratio provides valuable insights into a company’s ability to meet its interest payment obligations and evaluates its financial stability and risk profile. This analysis aids in making informed investment decisions, assessing creditworthiness, and understanding the company’s financial health and viability.

Consider Market Capitalization

When analyzing a company’s capital structure, it is important to consider its market capitalization. Market capitalization, or market cap, is the total value of a company’s outstanding shares of stock in the stock market. It provides insights into the market’s perception of a company’s value and the size of the company in relation to other companies in the market. Consideration of market capitalization can provide valuable information when assessing a company’s capital structure and financial position. Here’s why market capitalization matters:

1. Indicator of Company Size:

Market capitalization is a measure of a company’s size in relation to its peers. It reflects the aggregate value placed on the company by market participants. Companies with larger market capitalizations are generally perceived as larger and more established compared to smaller companies. Market capitalization allows investors, lenders, and analysts to gauge the scale and significance of a company within its industry.

2. Investor Confidence and Perceived Value:

Market capitalization reflects market participants’ confidence and perception of a company’s value. A higher market capitalization suggests that investors have confidence in the company’s financial performance, growth prospects, and overall market position. It indicates that the company is viewed favorably and has gained investor trust, which can lead to increased demand for its shares.

3. Capital Structure Decision-Making:

Market capitalization influences a company’s capital structure decisions. Companies with larger market capitalizations often have a wider range of financing options available to them. They may have better access to capital markets, enabling them to raise funds at more favorable terms. Conversely, smaller companies with lower market capitalizations may face challenges in accessing capital or may need to rely on different sources of financing.

4. Implications for Investment Returns:

Market capitalization can also impact investment returns. Large-cap stocks, generally associated with companies with higher market capitalizations, tend to be more stable and less volatile compared to small-cap stocks. They often offer more modest but potentially more consistent returns. On the other hand, small-cap stocks, associated with companies with lower market capitalizations, have the potential for higher growth rates but are often subject to greater market volatility.

5. Relative Valuation:

Comparing market capitalizations among companies within the same industry can provide insights into relative valuations. It allows for comparisons of companies’ financial structures based on their perceived market values. This information can aid investors and analysts in evaluating whether a company’s capital structure and market value align with its financial performance and growth potential.

It is important to note that market capitalization alone does not provide a comprehensive picture of a company’s financial health or future performance. It should be considered together with other fundamental factors, such as earnings, growth prospects, industry dynamics, and risk factors when assessing a company’s capital structure and investment potential.

By considering market capitalization, investors, lenders, and analysts can gain insights into a company’s size, perceived value, and market positioning. It helps in evaluating a company’s capital structure decisions, understanding investment returns, and assessing relative valuations within the industry. However, it is important to conduct a thorough analysis alongside other financial metrics to form a comprehensive assessment of a company’s financial situation.

Conclusion

Analyzing a business’s capital structure is a critical undertaking for investors, lenders, and financial analysts. By understanding the composition and implications of a company’s debt and equity financing, stakeholders can gain valuable insights into its financial health, risk profile, and long-term viability.

Throughout this article, we have explored the importance of capital structure analysis and outlined the steps involved. By identifying the components of a company’s capital structure, analyzing the weighted average cost of capital (WACC), and evaluating debt-to-equity ratios, financial leverage, liquidity and solvency ratios, interest coverage ratios, and market capitalization, stakeholders can make more informed decisions regarding investments, lending, and strategic planning.

Capital structure analysis provides a comprehensive view of a company’s financial structure, risk exposure, and growth potential. It helps stakeholders assess a company’s ability to meet its financial obligations, determine its financial stability, and understand its risk-return profile. By analyzing liquidity and solvency ratios, stakeholders can monitor a company’s short-term liquidity and long-term solvency, while the interest coverage ratio indicates its ability to cover interest payments.

Furthermore, considering market capitalization provides insights into a company’s market value, size, and investor confidence. It influences a company’s capital structure decisions, potential access to capital, and relative valuations within the industry. Evaluating all these factors together contributes to a more comprehensive understanding of a company’s financial situation.

In conclusion, capital structure analysis plays a crucial role in assessing a company’s financial health, risk profile, and potential for growth. It equips stakeholders with the necessary tools to evaluate investment opportunities, make lending decisions, and understand the overall financial stability of a company. By conducting a thorough analysis and considering various financial ratios and market factors, stakeholders can make informed decisions that align with their investment objectives and risk tolerance.