Finance

How To Become Authorized IRS E-File Providers

Published: October 31, 2023

Learn how to become authorized IRS e-file providers in the field of finance. Gain credibility and offer tax filing services to individuals and businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Requirements to become an Authorized IRS E-File Provider

- Applying for Authorized IRS E-File Provider status

- Completing the IRS e-file Application

- Passing the Suitability Check

- Enrolling in IRS e-services

- Understanding the Electronic Filing Identification Number (EFIN)

- Obtaining a Transmitter Control Code (TCC)

- Participating in the IRS e-file Program

- Reviewing the IRS e-file Provider Agreement

- Training and Testing Requirements

- Security and Privacy Safeguards

- Maintaining Authorized IRS E-File Provider status

- Renewing your Authorized IRS E-File Provider status

- Conclusion

Introduction

As technology continues to shape the financial landscape, the Internal Revenue Service (IRS) has embraced electronic filing as a more convenient and efficient way for taxpayers to submit their returns. To facilitate this process, the IRS offers individuals and businesses the opportunity to become Authorized IRS E-File Providers.

Becoming an Authorized IRS E-File Provider not only allows you to offer e-filing services to your clients, but it also demonstrates your commitment to staying current in an ever-evolving financial industry. By following the steps outlined in this article, you can successfully become an Authorized IRS E-File Provider and enjoy the benefits that come with it.

Whether you are a tax professional, an accounting firm, or an individual looking to expand your services, obtaining this authorization can open up new opportunities and increase your credibility. As an Authorized IRS E-File Provider, you will have access to the IRS e-file system, enabling you to securely and efficiently transmit tax returns.

Before diving into the application process, it’s important to understand the requirements and steps involved in becoming an Authorized IRS E-File Provider. This article will guide you through these processes, including applying for the status, completing the necessary applications, passing suitability checks, enrolling in IRS e-services, obtaining the Electronic Filing Identification Number (EFIN), and participating in the IRS e-file program.

Additionally, you will learn about the training and testing requirements, security and privacy safeguards, as well as how to maintain your Authorized IRS E-File Provider status and renew it when necessary.

Becoming an Authorized IRS E-File Provider not only streamlines the tax filing process for your clients but also ensures that you are in compliance with IRS regulations. So, let’s dive in and explore how you can become an Authorized IRS E-File Provider and stay ahead in an increasingly digital financial world.

Requirements to become an Authorized IRS E-File Provider

Becoming an Authorized IRS E-File Provider requires meeting certain eligibility criteria set by the IRS. These requirements are designed to ensure that individuals and businesses can meet the standards necessary to handle the sensitive financial information of taxpayers. Here are the key requirements to become an Authorized IRS E-File Provider:

- Valid Preparer Tax Identification Number (PTIN): You must have a valid PTIN issued by the IRS. The PTIN is a unique identifier that demonstrates your authority to prepare federal tax returns.

- Educational Background: Although there are no specific education requirements to become an Authorized IRS E-File Provider, having a strong knowledge of tax laws and regulations is essential. This can be achieved through formal education and professional certifications, such as being a Certified Public Accountant (CPA) or an Enrolled Agent (EA).

- Security & Privacy Measures: As an Authorized IRS E-File Provider, you will be responsible for safeguarding the sensitive financial information of your clients. This requires implementing appropriate security and privacy measures to protect data from unauthorized access or disclosure.

- Professional Conduct: You must adhere to a high standard of professional conduct when assisting clients with their tax returns. This includes conducting yourself with integrity, honesty, and accuracy in all tax-related matters.

It’s worth noting that the requirements to become an Authorized IRS E-File Provider may vary depending on the specific services you wish to offer. For example, if you plan to submit corporate tax returns electronically, you may need to meet additional requirements such as being a licensed attorney or having expertise in business tax matters.

By ensuring that you meet these requirements, you demonstrate your commitment to providing quality tax services and maintaining the trust of your clients. Once you have confirmed your eligibility, you can proceed with the application process to become an Authorized IRS E-File Provider.

Applying for Authorized IRS E-File Provider status

Once you have met the eligibility requirements, the next step in becoming an Authorized IRS E-File Provider is to submit an application to the IRS. This application is submitted through the IRS e-Services platform, which is a secure online portal for tax professionals and authorized individuals.

Here are the steps to apply for Authorized IRS E-File Provider status:

- Create an IRS e-Services Account: If you don’t already have one, you will need to create an IRS e-Services account. This will require providing your personal information, including your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Submit the e-file Application: Once you have an IRS e-Services account, log in and navigate to the “Application” section. From there, select the “e-file Application” option and provide the requested information, such as your PTIN and contact details.

- Choose the Appropriate Provider Type: The application will ask you to select the type of provider you are, such as an individual, a business, a software developer, or a financial institution. Choose the option that best aligns with your role and services.

- Indicate the Type of Returns You Plan to Transmit: In this section, you will specify the types of tax returns you intend to transmit on behalf of clients. This can include individual returns, business returns, or both.

- Provide Background Information: The application will require you to answer questions about your professional background, including any previous experience as an Authorized IRS E-File Provider, if applicable.

It’s important to provide accurate and complete information in the application to avoid any delays or complications with the approval process. Once you have submitted the e-file application, the IRS will review your submission and determine your eligibility as an Authorized IRS E-File Provider. This can take several weeks, so be patient during this waiting period.

After the IRS has reviewed your application, they may request additional documentation or clarification on certain aspects of your application. It’s crucial to promptly respond to any inquiries from the IRS to expedite the approval process.

Once your application has been reviewed and approved, you will receive notification from the IRS confirming your status as an Authorized IRS E-File Provider. This will also include instructions on how to proceed with the next steps, such as enrolling in IRS e-services and obtaining an Electronic Filing Identification Number (EFIN).

By successfully completing the application process, you are one step closer to offering electronic filing services and helping your clients simplify their tax filing process.

Completing the IRS e-file Application

Completing the IRS e-file application is a crucial step in becoming an Authorized IRS E-File Provider. This application provides the IRS with detailed information about your business or individual tax preparation services and ensures that you meet the necessary requirements to participate in the e-file program.

Here are the key components of the IRS e-file application:

- Personal and Contact Information: You will need to provide your personal details, including your name, address, phone number, and email address. This information is used to communicate with you regarding your application status and important updates.

- Business Information: If you are applying as a business entity, you will need to provide the legal name, address, and employer identification number (EIN) for your business. This ensures that the IRS can properly identify and categorize your business.

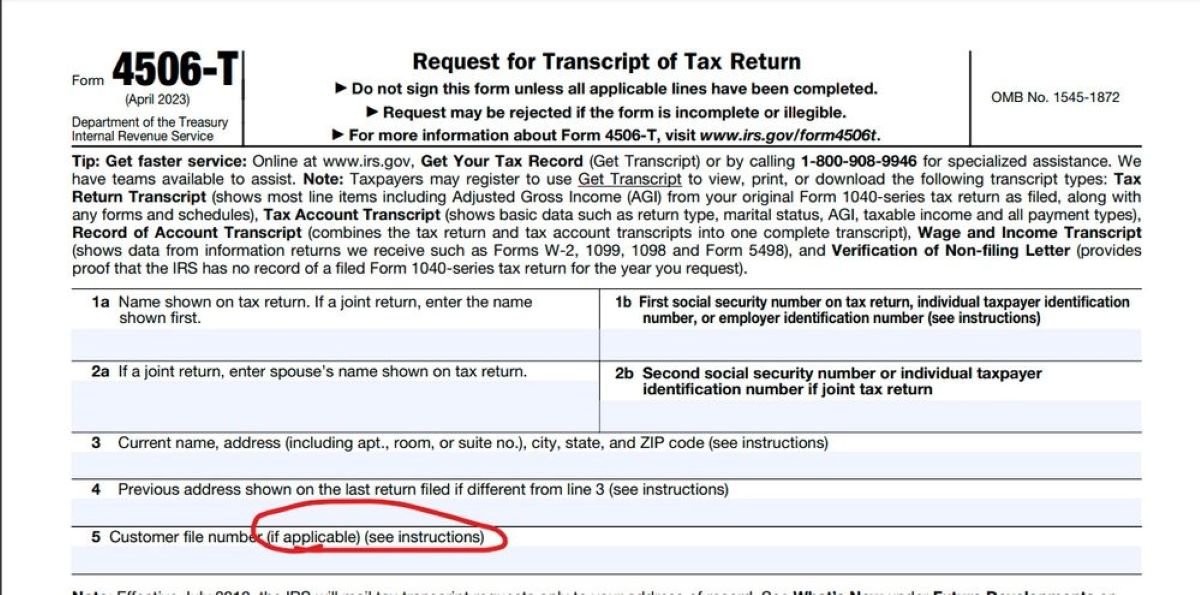

- PTIN Verification: You will need to provide your Preparer Tax Identification Number (PTIN) to validate your status as a tax preparer. The IRS uses the PTIN to track and monitor tax professionals who prepare tax returns for compensation.

- Previous E-File Experience: If you have previously been an Authorized IRS E-File Provider, you will need to provide details about your prior experience, including the tax year(s) in which you participated and your electronic filing volumes.

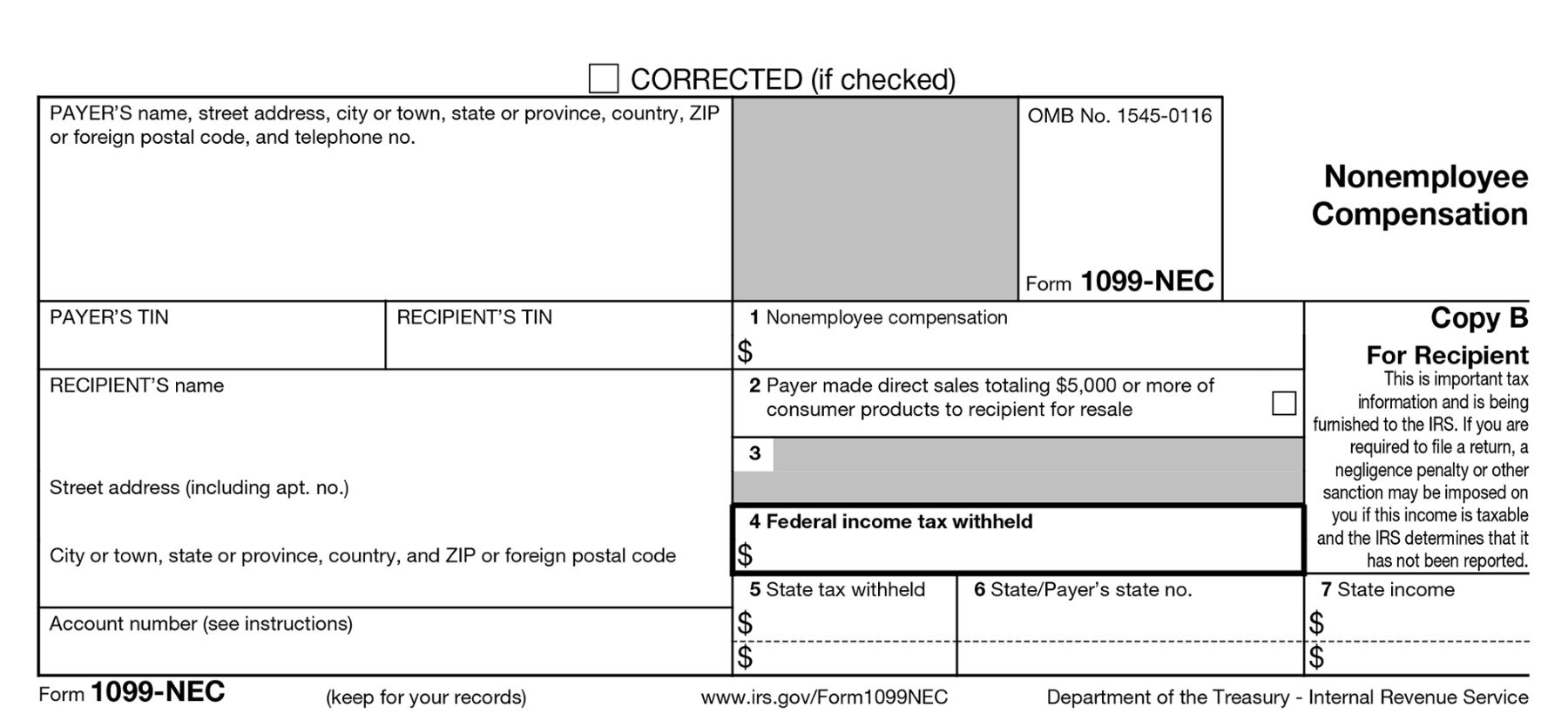

- Return Types: The IRS e-file application will ask you to specify the types of tax returns you plan to transmit, such as individual, business, or both. This ensures that the IRS can accurately categorize your e-filing capabilities.

- Tax Preparation Software: If you plan to use tax preparation software to electronically file tax returns, you will need to provide information about the software provider and the specific software you intend to use.

- Bank Account Information: As an Authorized IRS E-File Provider, you may choose to offer your clients the option of receiving their tax refunds directly into their bank accounts. In this section, you will need to provide your bank account information for processing refund deposits.

Ensure that you provide accurate and up-to-date information in the IRS e-file application. Any discrepancies or incorrect details can lead to delays in the approval process or, in some cases, rejection of your application. It’s also crucial to review the application thoroughly before submission to ensure all sections have been completed accurately.

Once you have completed and submitted the IRS e-file application, the IRS will review your information and determine your eligibility as an Authorized IRS E-File Provider. This review process may take several weeks, and the IRS may request additional documentation or clarification if needed.

By completing the IRS e-file application accurately and providing the necessary information, you are one step closer to becoming an Authorized IRS E-File Provider and gaining access to the e-file system to transmit tax returns for your clients.

Passing the Suitability Check

As part of the application process to become an Authorized IRS E-File Provider, you will be subject to a suitability check conducted by the Internal Revenue Service (IRS). The purpose of this check is to evaluate your character, integrity, and compliance with tax laws.

Here are the important aspects of passing the suitability check:

- Background Investigation: The IRS will conduct a thorough background investigation to assess your suitability for becoming an Authorized IRS E-File Provider. This investigation may include reviewing your criminal history, credit history, and any past tax compliance issues.

- Compliance with Tax Obligations: The IRS will examine your tax filing and payment history to ensure that you have complied with your own tax obligations. It is vital to have a clean tax record by filing your own tax returns accurately and paying any taxes owed in a timely manner.

- Moral and Ethical Standards: The suitability check also involves evaluating your moral and ethical conduct. It is crucial to maintain a high standard of professional conduct, honesty, and integrity when providing tax-related services, as these qualities are essential for an Authorized IRS E-File Provider.

- Professional Reputation: The IRS may consider your professional reputation in the tax community, including any disciplinary actions or complaints filed against you. It is important to uphold a positive reputation in your interactions with clients and colleagues.

To ensure a favorable outcome during the suitability check, it is essential to maintain a strong ethical foundation, comply with tax laws, and uphold professional standards. Keep your tax knowledge up to date, participate in continuing education programs, and stay informed about changes in tax regulations.

If you encounter any issues during the suitability check, such as a previous tax compliance problem or a criminal record, it is crucial to address and resolve these matters before submitting your application. Consulting with a qualified tax professional or legal advisor can help you navigate any challenges and ensure the best possible outcome.

To enhance your chances of passing the suitability check, consider building a track record of ethical behavior, maintaining good standing in the tax community, and cultivating strong relationships with your clients.

Once you pass the suitability check, you can move forward in the application process and proceed with enrolling in IRS e-services and obtaining the necessary credentials to participate fully as an Authorized IRS E-File Provider. The suitability check demonstrates the IRS’s commitment to ensuring the integrity of the e-file program, protecting taxpayers, and maintaining trust in the tax system.

Enrolling in IRS e-services

After successfully passing the suitability check, the next step in becoming an Authorized IRS E-File Provider is to enroll in IRS e-services. IRS e-services is an online platform that provides authorized individuals and businesses with access to various tax-related tools, resources, and services.

Here’s how to enroll in IRS e-services:

- Visit the IRS e-services Website: Go to the IRS e-services website (https://www.irs.gov/e-services) and click on the “Create an Account” button to begin the enrollment process.

- Choose the Appropriate Enrollment Type: Select the enrollment type that matches your role as an Authorized IRS E-File Provider. This could be “Tax Professional” if you are an individual, or “Business” if you are representing a tax preparation business.

- Provide Personal and Business Information: Fill out the enrollment form with your personal information, including your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN). If enrolling as a business, you will also need to provide information about your organization.

- Validate Your Identity: The IRS may require additional validation to confirm your identity. You may be asked to provide specific information related to your tax return history or other personal information to verify your identity.

- Set Up User ID and Password: Create a unique User ID and password for your IRS e-services account. Ensure that your password meets the security requirements specified by the IRS.

- Review and Accept the Terms of Agreement: Carefully review the terms of agreement for IRS e-services and accept them to proceed with the enrollment process.

- Receive Activation Code: Once your enrollment is processed, the IRS will send an activation code to the email address provided during the enrollment process. Follow the instructions to activate your account.

By enrolling in IRS e-services, you gain access to a range of tools and resources that can assist you in your work as an Authorized IRS E-File Provider. These include accessing the e-file system, obtaining an Electronic Filing Identification Number (EFIN), managing your e-file application, and accessing important IRS publications and guidance.

While enrolled in IRS e-services, it is essential to keep your account information up to date and to safeguard your login credentials. Regularly review and update your contact information to ensure that you receive important notifications and updates from the IRS.

Enrolling in IRS e-services is a critical step in becoming an Authorized IRS E-File Provider. It enables you to harness the power of digital tools and resources to better serve your clients and efficiently navigate the tax filing process.

Understanding the Electronic Filing Identification Number (EFIN)

The Electronic Filing Identification Number (EFIN) is a unique identifier assigned to Authorized IRS E-File Providers. It is a crucial component in the electronic filing process as it allows providers to transmit tax returns to the IRS electronically.

Here are the key aspects to understand about the Electronic Filing Identification Number (EFIN):

- Obtaining an EFIN: Once you have been approved as an Authorized IRS E-File Provider, you can apply for an Electronic Filing Identification Number (EFIN) through the IRS e-services platform. The application process requires providing relevant information about your tax preparation business or individual practice.

- Unique Identifier: The EFIN is a unique six-digit number that is assigned exclusively to each Authorized IRS E-File Provider. It serves as a digital signature for electronically filed tax returns, ensuring their authenticity and integrity.

- E-File Transmission: When submitting tax returns electronically, the EFIN is used to identify the filer and link the transmitted returns to the correct provider. This streamlines the processing and review of electronically filed returns.

- Secure Transmission: The EFIN plays a crucial role in maintaining the security and privacy of electronically filed tax returns. Providers must employ appropriate security measures to protect their EFIN and prevent unauthorized access or use.

- Renewal Process: The EFIN must be renewed periodically to ensure continued access to the e-file system. Providers typically receive a notice from the IRS when it is time to renew their EFIN. It is important to follow the instructions provided and complete the renewal process within the specified timeframe.

Having an Electronic Filing Identification Number (EFIN) is essential for Authorized IRS E-File Providers as it grants them the ability to transmit tax returns electronically to the IRS. It simplifies the filing process, improves efficiency, and reduces the need for manual data entry.

It is important to keep your EFIN secure and confidential. Avoid sharing your EFIN with unauthorized individuals and regularly review your security measures to ensure the protection of sensitive information.

By understanding the role of the Electronic Filing Identification Number (EFIN) and actively maintaining its validity, you can leverage the benefits of electronic filing and enhance the client experience by providing a secure and efficient tax filing process.

Obtaining a Transmitter Control Code (TCC)

A Transmitter Control Code (TCC) is a unique identifier that allows Authorized IRS E-File Providers to electronically transmit tax returns to the Internal Revenue Service (IRS). It is an essential component for providers who intend to offer electronic filing services.

Here are the important points to know about obtaining a Transmitter Control Code (TCC):

- Apply for a TCC: To obtain a Transmitter Control Code (TCC), you need to submit an application to the IRS. This application is separate from the application to become an Authorized IRS E-File Provider.

- Valid EFIN Requirement: Before applying for a TCC, ensure that you have a valid Electronic Filing Identification Number (EFIN) issued by the IRS. The EFIN serves as a prerequisite for obtaining a TCC.

- TCC Application Process: The TCC application process involves providing details about your tax preparation business or individual practice. This includes information such as your EFIN, contact information, and the tax return types you plan to transmit.

- Background Check and Suitability Review: The IRS will conduct a background check and suitability review as part of the TCC application process. This ensures that providers meet the necessary criteria to transmit tax returns electronically and maintain the security and integrity of the e-file system.

- Receive TCC Assignment: Once your TCC application is approved, the IRS will assign a unique Transmitter Control Code (TCC) to your authorized entity or business. This code will be used for all electronic transmission of tax returns.

- Protect and Safeguard TCC: It is essential to protect your Transmitter Control Code (TCC) and ensure its confidentiality. Unauthorized access to your TCC can lead to misuse or fraudulent transmission of tax returns.

Having a Transmitter Control Code (TCC) enables you to transmit tax returns securely and electronically to the IRS. It streamlines the process, reduces manual data entry, and minimizes the likelihood of errors or delays associated with paper filing.

Remember to renew your TCC periodically, as it is typically valid for a specific period of time. The IRS will provide instructions on the renewal process and the required actions to maintain an active TCC.

By obtaining a Transmitter Control Code (TCC), you can fully utilize the benefits of electronic filing, providing a faster and more efficient service to your clients while complying with IRS regulations and ensuring the accuracy and security of transmitted tax returns.

Participating in the IRS e-file Program

Participating in the IRS e-file program as an Authorized IRS E-File Provider allows you to offer electronic filing services to taxpayers. This program provides numerous benefits for both providers and taxpayers, including faster processing, increased accuracy, and quicker refunds.

Here are the key aspects to understand about participating in the IRS e-file program:

- Electronic Transmission of Tax Returns: As an Authorized IRS E-File Provider, you can electronically transmit tax returns to the IRS on behalf of your clients. This eliminates the need for paper filing and manual data entry, streamlining the process and reducing errors.

- Enhanced Accuracy and Compliance: Electronic filing reduces the likelihood of errors by applying built-in validation checks. The IRS e-file system automatically reviews returns for common mistakes, missing information, and math errors, increasing the accuracy of filed tax returns.

- Faster Processing and Refunds: E-filed tax returns are processed more quickly compared to paper returns. This means that taxpayers can receive their refunds faster, often within a few weeks, instead of waiting for paper returns to be manually processed.

- Incentives and Acknowledgments: The IRS offers incentives to encourage Authorized IRS E-File Providers to promote e-filing. Providers can receive acknowledgments of receipt for each successfully transmitted return, providing peace of mind and confirmation that the return has been successfully submitted.

- Expanded Services: Participating in the IRS e-file program can open the door to offering additional services to your clients. This includes electronic options for taxpayer payments, electronic signature options, and the ability to submit amended returns electronically.

- Stay Current and Compliant: By participating in the IRS e-file program, you demonstrate your commitment to staying current with technology and industry practices. This helps you maintain your competitive edge and ensures compliance with the latest IRS regulations and requirements.

Participating in the IRS e-file program is not only beneficial for your clients but also for your tax preparation business. It enables you to provide a more efficient and streamlined service while complying with modern tax filing standards.

Remember to stay informed about any updates or changes to the IRS e-file program. The IRS regularly provides guidance and updates to Authorized IRS E-File Providers to ensure ongoing compliance and smooth operation within the program.

By actively participating in the IRS e-file program, you can enhance your tax preparation services, improve the overall client experience, and embrace the advantages of electronic filing for both you and your clients.

Reviewing the IRS e-file Provider Agreement

Before fully participating in the IRS e-file program as an Authorized IRS E-File Provider, it is vital to thoroughly review and understand the IRS e-file Provider Agreement. The agreement outlines the terms, obligations, and responsibilities that you must adhere to as a participant in the program.

Here are the key points to consider when reviewing the IRS e-file Provider Agreement:

- Obligations and Compliance: The agreement highlights your obligations as an Authorized IRS E-File Provider, including complying with all IRS rules, regulations, and security requirements. It also emphasizes the importance of maintaining the confidentiality and integrity of taxpayer information.

- Prohibition on Improper Activities: The agreement restricts certain activities, such as engaging in fraudulent practices, misrepresenting information, or using taxpayer data for unauthorized purposes. It is crucial to understand and abide by these prohibitions to maintain your status as an Authorized IRS E-File Provider.

- Security and Safeguards: The agreement specifies the security measures you must implement to protect taxpayer data. This includes using encryption, maintaining secure systems, and safeguarding access to sensitive information. Understanding and implementing these security measures is essential for maintaining compliance and protecting client data from unauthorized access.

- Recordkeeping Requirements: The agreement outlines the recordkeeping obligations, including the retention of electronic records associated with e-file transactions. Adhering to these requirements ensures that you can provide supporting documentation if necessary and helps with IRS audits or inquiries.

- Reporting Requirements: The agreement specifies your reporting obligations to the IRS, such as transmitting accurate and complete information related to e-filed returns and any suspected or known security incidents. Meeting these reporting requirements demonstrates transparency and compliance with the program.

- Termination of Agreement: Understanding the circumstances under which the IRS may terminate the agreement is crucial. Violations of the agreement, non-compliance with IRS rules, or failure to meet your obligations can lead to termination. Being aware of these terms allows you to take the necessary steps to avoid any breach and maintain your status as an Authorized IRS E-File Provider.

It is essential to review the IRS e-file Provider Agreement carefully to ensure that you fully understand the terms and conditions of participating in the program. If you have any questions or concerns, consult with a legal advisor or tax professional who can provide clarity on any unclear provisions.

By reviewing and complying with the IRS e-file Provider Agreement, you demonstrate your commitment to maintaining the highest standards of professionalism, security, and integrity when handling taxpayer information. This not only safeguards your reputation but also contributes to building trust with your clients and the IRS.

Training and Testing Requirements

As an Authorized IRS E-File Provider, it is essential to stay updated on the latest tax laws, regulations, and electronic filing requirements. The IRS requires providers to complete training and testing to ensure they possess the necessary knowledge and proficiency to accurately and securely transmit tax returns.

Here are the key components of the training and testing requirements for Authorized IRS E-File Providers:

- IRS-approved Training Programs: The IRS offers various training programs and resources to assist providers in acquiring the necessary knowledge and skills for electronic filing. These programs cover topics such as electronic recordkeeping, security measures, privacy safeguards, and applicable tax laws.

- Continuing Education: To maintain your status as an Authorized IRS E-File Provider, it is crucial to engage in regular continuing education. The IRS requires a specified number of continuing education credits each year to ensure providers stay up to date with the latest regulatory changes and industry best practices.

- Annual Testing: Authorized IRS E-File Providers must pass an annual test to confirm their understanding of electronic filing procedures, tax laws, and IRS requirements. The test typically covers topics related to e-file recordkeeping, privacy and security, electronic signature validation, and other relevant areas.

- Review of IRS Publications and Updates: Providers are responsible for regularly reviewing IRS publications, notices, and updates. These resources provide insights into changes in tax regulations, e-file procedures, and any revisions to the IRS requirements for Authorized IRS E-File Providers. Staying informed about these updates is essential for maintaining compliance.

- Internal Training Programs: In addition to IRS-provided training, it is beneficial to establish internal training programs within your tax preparation business or individual practice. These programs can cover specific software usage, client onboarding procedures, customer service best practices, and other areas that enhance your capabilities as an Authorized IRS E-File Provider.

By fulfilling the training and testing requirements, you can ensure that you are equipped with the knowledge and skills necessary to provide accurate, secure, and efficient electronic filing services. This helps maintain the integrity of the e-file system and provides confidence to your clients.

Make sure to allocate dedicated time for training and education, and document your completion of IRS-approved training programs and continuing education credits. This helps demonstrate your commitment to professional development and ongoing learning.

Remember to stay updated on changes in tax laws and regulations, as well as any updates to IRS requirements for Authorized IRS E-File Providers. Adhering to the training and testing requirements is not only a regulatory obligation but also an opportunity to enhance your expertise and credibility as a tax professional.

Security and Privacy Safeguards

As an Authorized IRS E-File Provider, it is crucial to prioritize the security and privacy of taxpayer information. Safeguarding sensitive data not only protects your clients but also ensures compliance with IRS regulations. Implementing robust security measures helps maintain trust in the e-file system and your tax preparation business.

Here are the key security and privacy safeguards to consider:

- Encryption: Utilize encryption techniques to protect electronic communications, both within your organization and when transmitting tax returns to the IRS. Encryption ensures that sensitive information remains confidential and secure.

- Secure Transmission Channels: Use secure transmission channels, such as secure file transfer protocol (SFTP) or virtual private networks (VPNs), for transmitting tax returns. These channels provide a secure pathway for data transfer, minimizing the risk of unauthorized interception.

- User Access Controls: Implement strict access controls within your organization to ensure that only authorized individuals can access taxpayer information. Grant access privileges on a need-to-know basis and regularly review and update user access permissions.

- Multi-Factor Authentication: Consider implementing multi-factor authentication systems to add an extra layer of security. This requires users to provide additional verification, such as a unique code or biometric data, in addition to their passwords.

- Regular System Updates and Patches: Keep your computer systems, software, and security applications up to date with the latest patches and updates. Regularly install updates to protect against known vulnerabilities and security weaknesses.

- Secure Data Storage: Utilize secure data storage methods, including encryption and access controls, to protect taxpayer data during storage. Regularly back up your data and ensure backups are also encrypted and securely stored.

- Employee Training and Awareness: Train your employees on security best practices and educate them about the importance of privacy and data protection. Implement ongoing security awareness programs to keep employees informed about emerging threats and safe browsing habits.

- Secure Disposal of Sensitive Data: Establish protocols for the secure disposal of physical and electronic records that contain taxpayer information. This includes shredding physical documents and using secure methods to delete electronic files.

It is essential to maintain a comprehensive security and privacy policy that outlines these safeguards and ensures adherence to best practices. Regularly review and update your policy to address evolving cybersecurity threats and changes in regulatory requirements.

By prioritizing security and privacy safeguards, you enhance client trust, protect sensitive information, and safeguard your reputation as an Authorized IRS E-File Provider.

Maintaining Authorized IRS E-File Provider status

Once you have obtained Authorized IRS E-File Provider status, it is important to actively maintain your status to continue offering electronic filing services to taxpayers. This involves ongoing compliance with IRS regulations and requirements, as well as fulfilling certain obligations to uphold the integrity of the e-file system.

Here are the key factors to consider for maintaining your Authorized IRS E-File Provider status:

- Ongoing Compliance: Adhere to all IRS rules, regulations, and guidelines related to electronic filing. Stay updated on changes to tax laws, filing procedures, and security protocols to ensure ongoing compliance.

- Continuing Education: Engage in regular continuing education to stay up to date with tax laws, industry best practices, and IRS requirements. Fulfill the annual continuing education credits mandated by the IRS as part of your ongoing professional development.

- Renewals and Updates: Timely renew your Electronic Filing Identification Number (EFIN) and Transmitter Control Code (TCC) as required by the IRS. Stay informed about renewal deadlines and ensure all updates, including changes in contact information, are promptly submitted.

- Recordkeeping and Reporting: Maintain accurate and complete records of e-filed returns, acknowledgments, and any supporting documentation. Comply with IRS recordkeeping requirements and promptly respond to any reporting obligations, such as transmitting error reports or responding to IRS inquiries.

- Security and Privacy Measures: Continuously assess and enhance your security and privacy safeguards to protect taxpayer information. Regularly update your systems, apply patches, and educate your employees about security best practices and the importance of privacy in tax preparation.

- Professional Conduct: Conduct yourself with professionalism and integrity when interacting with clients and the IRS. Handle taxpayer information with care, maintain confidentiality, and promptly address any concerns or complaints related to your services.

- Stay Informed: Regularly review IRS publications, notices, and updates related to e-file procedures and requirements. Attend webinars, seminars, or conferences to stay informed about current developments in electronic filing and tax preparation.

By maintaining your Authorized IRS E-File Provider status, you continue to offer the benefits of electronic filing to your clients, promote accurate tax preparation, and uphold the standards of excellence associated with being an Authorized IRS E-File Provider.

Remember that non-compliance with IRS requirements, violations of the agreement, or failure to meet your obligations can lead to the loss of your Authorized IRS E-File Provider status. It is crucial to prioritize ongoing compliance and professionalism to retain your status and ensure the trust of your clients and the IRS.

Regularly evaluate your procedures, review your security protocols, and seek opportunities for professional growth and development within the tax preparation field. By doing so, you can continue to provide high-quality services and maintain your Authorized IRS E-File Provider status for years to come.

Renewing your Authorized IRS E-File Provider status

To continue offering electronic filing services as an Authorized IRS E-File Provider, it is important to renew your status periodically. The renewal process ensures that you stay up to date with the latest IRS requirements and maintain your eligibility to participate in the e-file program.

Here are the key steps to renew your Authorized IRS E-File Provider status:

- Stay Informed: Keep abreast of IRS updates and notifications regarding the renewal process. The IRS typically communicates renewal instructions and deadlines through email, mail, or through the IRS e-services platform.

- Gather Required Information: Collect the necessary information and documentation required for renewal. This may include current contact information, tax preparer details, and proof of compliance with continuing education requirements.

- Renew EFIN and TCC: If applicable, ensure that you renew your Electronic Filing Identification Number (EFIN) and Transmitter Control Code (TCC) during the renewal process. Verify that your EFIN and TCC are active and valid for the upcoming tax filing season.

- Update Contact Information: Review and update your contact information as necessary. It is crucial to provide accurate and current contact details to receive important notifications, updates, and renewal information in a timely manner.

- Confirm Compliance: Verify that you have fulfilled all IRS requirements to maintain your Authorized IRS E-File Provider status throughout the previous year. This includes compliance with continuing education credits, recordkeeping obligations, and adherence to security and privacy measures.

- Renewal Application: Complete and submit the renewal application by the specified deadline. The renewal application form will gather information related to your business or individual practice, changes in ownership or organizational structure, and any other relevant details required by the IRS.

- Pay Renewal Fees (If Applicable): Some IRS e-file provider renewals may entail a fee. Ensure that you review the renewal instructions to determine if any fees are applicable and submit payment accordingly.

It is crucial to adhere to the prescribed renewal timeframe specified by the IRS. Late renewals or failure to renew your Authorized IRS E-File Provider status can result in the temporary suspension or revocation of your e-file privileges.

By renewing your Authorized IRS E-File Provider status, you demonstrate your commitment to staying current with IRS requirements and serving your clients with the benefits of electronic filing. Make sure to track your renewal deadline and complete the process promptly to continue providing efficient and secure tax filing services to your clients.

Remember to regularly check your email, IRS e-services account, and any other designated communication channels for updates and correspondence related to the renewal process. By staying proactive and attentive throughout the renewal process, you can effectively maintain your status as an Authorized IRS E-File Provider and contribute to a smooth tax filing experience for your clients.

Conclusion

Becoming an Authorized IRS E-File Provider opens up a world of opportunities for tax professionals and businesses alike. It allows you to offer electronic filing services, streamline the tax return process, and provide your clients with faster, more accurate tax filings.

Throughout this article, we have explored the requirements and steps involved in becoming an Authorized IRS E-File Provider. From the application process to passing suitability checks, enrolling in IRS e-services, and obtaining the necessary identification numbers, each step is crucial in establishing your credibility and compliance as a tax professional.

We have also discussed the importance of ongoing training, security measures, and professional conduct in maintaining your Authorized IRS E-File Provider status. Continuing education and staying up to date with tax regulations are vital in providing the best service to your clients and meeting IRS requirements.

As you progress in this journey, it is crucial to prioritize security and privacy safeguards to protect sensitive taxpayer information. By implementing encryption, secure transmission channels, and user access controls, you can ensure the confidentiality and integrity of data.

Remember, renewal of your Authorized IRS E-File Provider status is essential for uninterrupted participation in the e-file program. Stay informed, gather the required information, and submit your renewal application on time to continue offering electronic filing services.

By adhering to IRS regulations, acquiring the necessary knowledge and skills, maintaining professional conduct, and regularly reviewing security measures, you can thrive as an Authorized IRS E-File Provider. This status not only enhances your professional reputation but also provides convenience and peace of mind to your clients.

Embrace the benefits of electronic filing, leverage technology, and continuously enhance your tax preparation services. By doing so, you can contribute to a more efficient, accurate, and secure tax filing process for your clients and strengthen your position in the ever-evolving field of finance and taxation.