Finance

Where To Find An IRS Customer File Number

Published: October 30, 2023

Looking for your IRS customer file number? Learn where to find it and manage your finances effectively with our helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an IRS Customer File Number?

- When do you need an IRS Customer File Number?

- How to Retrieve an IRS Customer File Number

- Option 1: Check Previous Tax Forms and Documents

- Option 2: Contact the IRS

- Option 3: Check Notices and Correspondence from the IRS

- Option 4: Sign up for an Online IRS Account

- FAQ about IRS Customer File Numbers

- Conclusion

Introduction

Welcome to the world of tax season, where numbers and forms abound. When dealing with the Internal Revenue Service (IRS), it’s essential to have all the necessary information at your fingertips. One such piece of information is the IRS Customer File Number. But what exactly is it, and why is it important?

An IRS Customer File Number is a unique identifier assigned to individuals or organizations by the IRS. It is used to track and manage taxpayer accounts, ensuring accurate record-keeping and efficient communication between taxpayers and the IRS. Think of it as your personal ID number with the IRS, which allows them to access your tax history and provide relevant assistance.

As a taxpayer, there may arise situations where you’ll need your IRS Customer File Number. Whether you’re inquiring about your tax refund status, resolving tax disputes, or accessing specific tax documents, having this number on hand can save you time and expedite the process.

In this article, we will explore various methods to retrieve your IRS Customer File Number, should you find yourself in need of it. From checking previous tax forms to reaching out directly to the IRS, we will guide you through the process step-by-step.

What is an IRS Customer File Number?

An IRS Customer File Number is a unique identifier assigned to individuals or organizations by the Internal Revenue Service (IRS). It is a reference number that the IRS uses to track and manage taxpayer accounts. This number is essential for maintaining accurate records and facilitating communication between taxpayers and the IRS.

The IRS Customer File Number serves as a key piece of information that allows the IRS to access your tax history, process tax returns, and provide assistance when needed. It is similar to a personal identification number that provides the IRS with a way to identify and locate your specific tax records.

Each taxpayer’s Customer File Number is unique and can be used to retrieve a wide range of tax-related information. This includes details about tax returns filed, payments made or owed, and any correspondence or notices received from the IRS.

It’s worth noting that the IRS Customer File Number is different from the Social Security Number (SSN) or Employer Identification Number (EIN). While the SSN and EIN are used for individual and business identification respectively, the Customer File Number specifically refers to the identification number assigned by the IRS.

Understanding your IRS Customer File Number and knowing how to retrieve it is crucial when dealing with the IRS. It ensures that you have access to your tax records and facilitates efficient communication with the IRS, whether you are requesting a transcript, tracking your refund, or resolving a tax issue.

When do you need an IRS Customer File Number?

Having your IRS Customer File Number handy can be beneficial in various situations when dealing with the IRS. Here are some instances where you may need your Customer File Number:

- Tax Return Inquiries: When you have questions or need to inquire about the status of your tax return, having your Customer File Number can help the IRS locate and provide specific information about your return.

- Requesting Transcripts: If you need copies of your past tax returns or other tax documents, providing your Customer File Number will enable the IRS to process your request promptly and accurately.

- Tax Account Resolution: When resolving issues related to your tax account, such as disputes over unpaid taxes or discrepancies in reported income, having your Customer File Number will help the IRS access your account details and provide appropriate assistance.

- Correspondence with the IRS: If you have received any notices, letters, or other correspondence from the IRS, providing your Customer File Number will help them identify your specific account and address any concerns or inquiries more effectively.

Having your IRS Customer File Number readily available can save you time and facilitate smoother interactions with the IRS. It ensures that your inquiries are directed to the correct account and helps the IRS provide you with accurate and timely information related to your tax matters.

If you are unsure whether you need your Customer File Number for a particular situation, it is generally advisable to have it on hand as a precautionary measure. Being prepared with this information can help expedite any interactions with the IRS and ensure a smoother process overall.

How to Retrieve an IRS Customer File Number

If you find yourself in need of your IRS Customer File Number, there are several methods you can try to retrieve this important identifier. Here are four options you can consider:

- Option 1: Check Previous Tax Forms and Documents: One of the easiest ways to find your Customer File Number is to search through your past tax forms and documents. Look for any forms or correspondences you have received from the IRS, such as tax returns, notices, or transcripts. Your Customer File Number may be printed somewhere on these documents.

- Option 2: Contact the IRS: If you cannot locate your Customer File Number through your own records, you can reach out to the IRS directly for assistance. You can contact the IRS Taxpayer Assistance Center by phone and provide them with your personal information to retrieve your Customer File Number. Please note that identity verification may be required.

- Option 3: Check Notices and Correspondence from the IRS: If you have received any notices or letters from the IRS in the past, your Customer File Number may be included in the correspondence. Check the top or bottom of the letter for any reference to your Customer File Number.

- Option 4: Sign up for an Online IRS Account: Another way to access your IRS Customer File Number is by signing up for an online IRS account. By creating an account on the IRS website, you can gain access to various online services and retrieve your Customer File Number. Visit the IRS website and follow the instructions to create your account.

Remember, your IRS Customer File Number is a sensitive piece of information, so it’s important to keep it secure and only share it when necessary. Store it in a safe place or use password-protected digital storage for easy access when needed.

If you are still unable to locate your Customer File Number using these methods, it’s best to contact the IRS directly for further guidance. They will be able to provide you with the necessary assistance to retrieve your Customer File Number.

Option 1: Check Previous Tax Forms and Documents

One of the simplest ways to retrieve your IRS Customer File Number is by checking your previous tax forms and documents. Your Customer File Number may be listed on various forms and correspondences you have received from the IRS. Here’s how you can go about finding it:

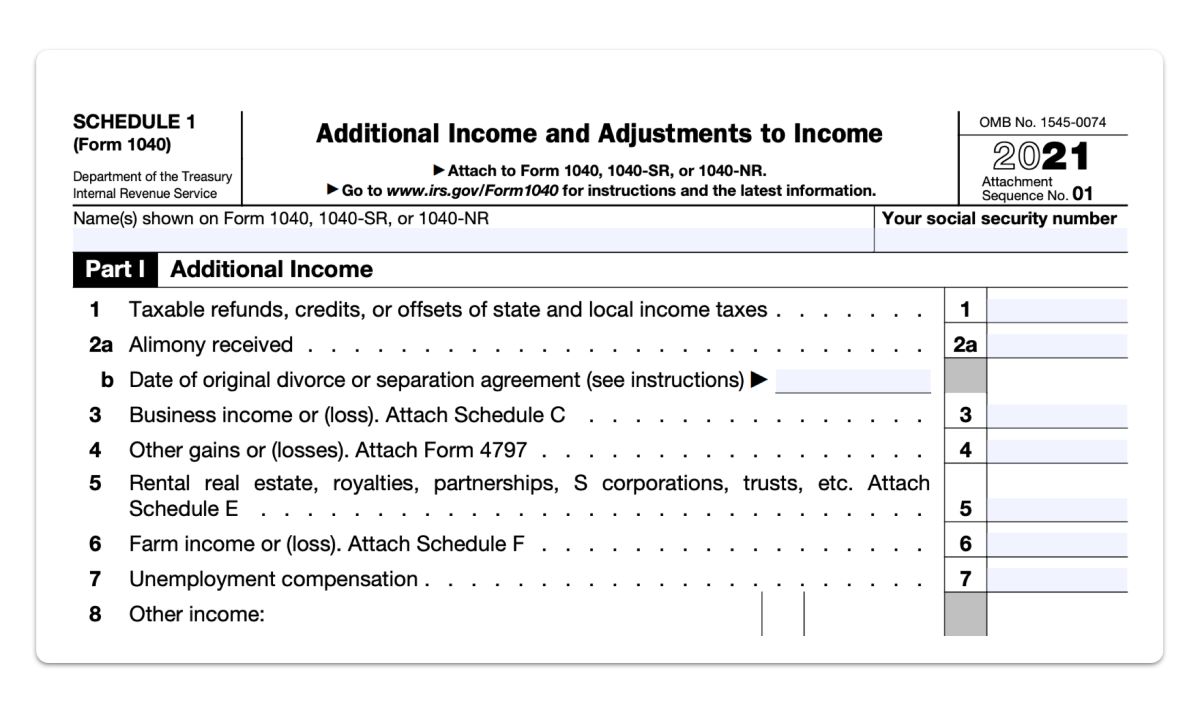

- Tax Returns: Start by reviewing your previous tax returns, including both federal and state returns. Look for any references to your Customer File Number on the forms. In some cases, it may be labeled as “Customer File Number” or “CFN”.

- Notice and Letters: If you have received any notices or letters from the IRS, these documents may also contain your Customer File Number. Examine the top or bottom of the correspondence for any mention of the number. It may be listed alongside your personal information.

- Tax Transcripts: If you have requested tax transcripts in the past, check the transcripts themselves as they may include your Customer File Number. Transcripts are detailed records of your tax-related activities and can be obtained from the IRS website or by contacting the IRS directly.

- Other Correspondences: Any other forms or letters you have received from the IRS, such as penalty notices or refund information, may have your Customer File Number printed on them. Take a careful look through your records and keep an eye out for any mention of the number.

If you discover your Customer File Number on any of these documents, make sure to note it down and keep it in a secure location. This will save you time in the future when you need to provide the number for any IRS-related inquiries or requests.

If you are unable to locate your Customer File Number through this method or have any difficulties in identifying it on the forms, you can consider alternative options like contacting the IRS directly or checking online IRS accounts for further assistance.

Option 2: Contact the IRS

If you are unable to find your IRS Customer File Number through your own records, don’t worry. You can directly contact the IRS for assistance in retrieving your Customer File Number. Here’s how you can go about it:

- IRS Taxpayer Assistance Center: The IRS operates multiple Taxpayer Assistance Centers throughout the country. You can locate the nearest center by visiting the IRS website or referring to IRS publications. Contact the center via phone to speak with a representative who can help you retrieve your Customer File Number. Be prepared to provide your personal information for identity verification.

- IRS Telephone Assistance: If you are unable to visit a Taxpayer Assistance Center in person, you can contact the IRS by phone. Call the IRS toll-free helpline at 1-800-829-1040 and explain that you need assistance in retrieving your Customer File Number. The representative will guide you through the process and may require some personal information to confirm your identity.

- Identity Verification: When contacting the IRS, it is important to have proper identification documents on hand. The representative may ask for details such as your full name, Social Security Number (SSN), date of birth, and address. This is to ensure the security of your personal information and prevent unauthorized access to your tax records.

By contacting the IRS directly, you can receive personalized assistance in retrieving your Customer File Number. The IRS personnel are trained to handle such requests and will guide you through the necessary steps to obtain the information you need.

Please note that due to the high volume of calls received by the IRS, wait times may be longer during peak tax seasons. It is advisable to plan ahead and allocate sufficient time for the call, or consider alternative methods of retrieval if time is a constraint.

Remember to keep any information obtained from the IRS secure and confidential, as it pertains to your personal tax records. Once you have retrieved your Customer File Number, make sure to save it in a secure location for future reference.

Option 3: Check Notices and Correspondence from the IRS

If you’re searching for your IRS Customer File Number and can’t find it in your records or by contacting the IRS directly, another option is to check any notices and correspondence you have received from the IRS in the past. Here’s how you can go about doing this:

- Gather Your IRS Correspondence: Collect any letters, notices, or other forms of communication you have received from the IRS. This includes important documents such as tax refund notices, payment reminders, or audit notices.

- Examine the Documents: Carefully review each document and look for any reference to the IRS Customer File Number. The number is typically mentioned at the top or bottom of the letter, alongside your personal information. It may be labeled as “Customer File Number” or “CFN”.

- Focus on Recent Notices: Pay closer attention to more recent notices, as older documents may not have included the Customer File Number. If you have kept a record of all your IRS correspondence, start with the most recent and work your way back.

By thoroughly examining your IRS notices and correspondence, you may be able to locate your Customer File Number. Once you find it, make sure to note it down and keep it in a secure place for future reference.

If you have multiple correspondences from the IRS and are unable to find your Customer File Number in any of them, consider reaching out to the IRS directly or exploring alternative options such as checking online IRS accounts for further assistance.

Remember to handle any IRS correspondence with care and keep it secure. These documents contain important information relating to your tax matters and should not be shared with unauthorized individuals.

Option 4: Sign up for an Online IRS Account

If you’re having difficulty retrieving your IRS Customer File Number through other methods, another option to consider is signing up for an online IRS account. Creating an online account can provide you with access to various IRS services, including the retrieval of your Customer File Number. Here’s how you can proceed:

- Visit the IRS Website: Start by visiting the official website of the Internal Revenue Service. The IRS website provides a wealth of resources and services for taxpayers.

- Find the Online Account Registration: Look for the section on the IRS website dedicated to creating an online account. This section may be labelled as “Login” or “Account Creation”.

- Follow the Registration Process: Click on the appropriate link to begin the registration process. You will be asked to provide personal information, such as your name, Social Security Number (SSN), and date of birth. Follow the prompts and fill in the required details accurately.

- Retrieve Your Customer File Number: Once your online account is created and verified, log in to your account. Navigate to the profile or account settings section, where you should be able to view and retrieve your Customer File Number. It may be listed as “Customer File Number” or “CFN”.

Signing up for an online IRS account offers several benefits beyond accessing your Customer File Number. It allows you to manage your tax-related information, make payments, and track the status of your tax returns, all from the convenience of your computer or mobile device.

Keep in mind that creating an online IRS account will require you to provide personal information and go through an identity verification process. This is to ensure that your account remains secure and that only authorized individuals have access to your tax information.

Once you have retrieved your Customer File Number from your online IRS account, be sure to keep it in a secure location for future reference. Regularly update and maintain the security of your online account by choosing a strong password and taking necessary precautions to protect your login credentials.

FAQ about IRS Customer File Numbers

Here are some frequently asked questions (FAQ) about IRS Customer File Numbers:

-

What if I cannot locate my IRS Customer File Number?

If you cannot find your IRS Customer File Number through your tax forms, correspondence, or online accounts, consider contacting the IRS directly for further assistance. They will be able to guide you on how to retrieve the number or provide alternative options to address your specific situation.

-

Is the IRS Customer File Number the same as the Social Security Number (SSN) or Employer Identification Number (EIN)?

No, the IRS Customer File Number is different from the Social Security Number (SSN) and Employer Identification Number (EIN). The SSN is assigned to individuals by the Social Security Administration and is used for various purposes, including tax identification. The EIN, on the other hand, is assigned to businesses by the IRS. The IRS Customer File Number is a unique identifier specific to your tax account with the IRS.

-

Can I change my IRS Customer File Number?

No, the IRS Customer File Number is assigned by the IRS and cannot be changed or modified. It is a permanent identifier linked to your tax account, and it helps the IRS maintain accurate records.

-

Is the IRS Customer File Number confidential?

Yes, the IRS Customer File Number is considered confidential information. It should be kept secure and only shared with authorized individuals or when required by the IRS. Treat your Customer File Number with the same level of confidentiality as other sensitive personal information, such as your Social Security Number.

-

Is the IRS Customer File Number required for every interaction with the IRS?

No, the Customer File Number is not required for every interaction with the IRS. However, having your Customer File Number can expedite and streamline certain processes, such as requesting transcripts, resolving tax account issues, or obtaining specific information related to your tax history. It’s always helpful to have this number on hand when communicating with the IRS.

It’s important to consult with the IRS or a tax professional if you have specific questions or concerns about your IRS Customer File Number or any other tax-related matters. They can provide tailored guidance based on your unique situation.

Conclusion

Understanding and having access to your IRS Customer File Number is essential when it comes to navigating your tax obligations and interacting with the Internal Revenue Service. Whether you’re seeking information about your tax return, requesting documents, or resolving tax issues, having your Customer File Number can save you time and ensure smoother communication with the IRS.

In this article, we explored the significance of the IRS Customer File Number and discussed various methods to retrieve it. From checking your previous tax forms and documents to contacting the IRS directly or signing up for an online IRS account, there are multiple avenues to obtain your Customer File Number.

Remember to keep your Customer File Number secure and confidential, as it contains sensitive information related to your tax records. Store it in a safe place or use secure digital storage for easy access when needed.

If you’re unable to locate your Customer File Number or have specific questions or concerns, it’s advisable to contact the IRS for further assistance. They have trained professionals who can provide guidance and address any inquiries you may have.

Having your IRS Customer File Number readily available empowers you to manage your tax affairs efficiently and effectively. By being proactive and staying organized, you’ll be better equipped to navigate the complexities of the tax system and ensure compliance with IRS requirements.

Now that you understand the importance of your IRS Customer File Number and know how to retrieve it, you’re well on your way to maintaining accurate tax records and engaging with the IRS with confidence.