Finance

What Is The IRS Master File?

Published: October 31, 2023

Discover what the IRS Master File means for your financial situation and gain insight into its significance in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where the intricacies of money management and taxation govern our daily lives. As we navigate through the complex landscape of financial regulations, one entity that plays a crucial role is the Internal Revenue Service (IRS). Established in 1862, the IRS is responsible for administering and enforcing the federal tax laws in the United States.

Within the vast system of the IRS, there is a key component known as the IRS Master File. This comprehensive database holds a wealth of information related to individual and business taxpayers. From personal information to tax filing history, the IRS Master File serves as a reliable repository for essential data that aids in tax administration and compliance.

In this article, we will delve into the world of the IRS Master File to understand its significance, the types of information it contains, how to access it, and the challenges it faces. So, let’s explore the depths of this vital database and gain a better understanding of its importance in the financial landscape.

Overview of the IRS Master File

The IRS Master File can be described as the central database that stores all taxpayer-related information. It is essentially a digital repository that consolidates data from various sources and compiles it in a structured manner. This repository contains both individual and business taxpayer records.

For individuals, the IRS Master File includes personal information such as name, social security number, address, and other identifying details. It also contains details about income, tax payments, refunds, and any tax credits or deductions claimed by the taxpayer.

Business taxpayers’ records in the IRS Master File cover a broad range of information. It includes the Employer Identification Number (EIN), business name, address, type of entity, and details of income and expenses reported on tax returns. It also contains information on payroll taxes, retirement plans, and any other specific filings related to the business.

The IRS Master File is crucial for the IRS to efficiently administer and enforce tax laws. It acts as a central repository that allows the IRS to easily access and update taxpayer information. This ensures accuracy and reliability in tax administration and helps the IRS determine tax responsibilities, investigate potential fraud, and resolve discrepancies.

In addition to facilitating tax administration, the IRS Master File also plays a vital role in providing data for statistical analysis and research purposes. It helps policymakers and economists gain insights into trends in tax compliance, revenue collection, and economic activity.

Overall, the IRS Master File is the backbone of the IRS operations, providing the foundation for effective tax administration and compliance. Its comprehensive nature and continuous updates make it a valuable resource for taxpayers, tax professionals, and the IRS itself.

Types of Information Contained in the IRS Master File

The IRS Master File contains a wealth of information that is critical for tax administration and compliance. Let’s explore the various types of information that can be found in this comprehensive database:

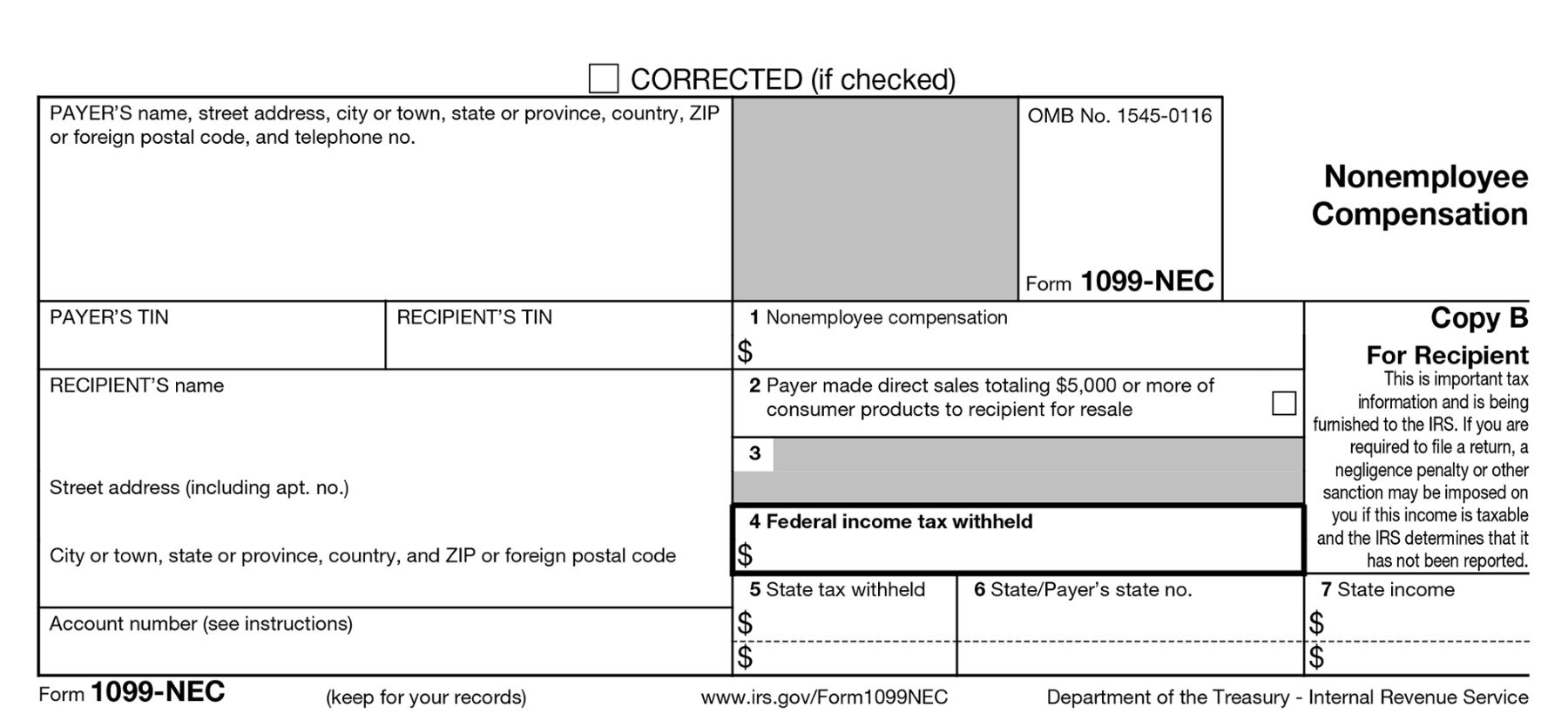

- Personal Information: The IRS Master File stores personal details of individual taxpayers, such as their name, social security number, date of birth, and address. This information serves as a unique identifier for each taxpayer and is crucial for maintaining accurate records.

- Tax Filing History: The IRS Master File maintains a record of an individual’s tax filing history, including the specific tax year, filing status, and any changes or amendments made to the return. This history provides a snapshot of the taxpayer’s compliance with their tax obligations.

- Income and Deductions: The IRS Master File stores data related to a taxpayer’s income, including wages, salary, self-employment income, and investment income. It also tracks deductions claimed, such as those for mortgage interest, student loan interest, medical expenses, and charitable contributions.

- Tax Payments and Refunds: Information on tax payments made by the taxpayer throughout the year, including estimated tax payments and withholding amounts, can be found in the IRS Master File. It also keeps records of any tax refunds issued to the taxpayer.

- Tax Credits: The database includes details of tax credits claimed by the taxpayer, such as the Child Tax Credit, Earned Income Tax Credit, or education-related credits. These credits serve to reduce the taxpayer’s overall tax liability.

- Business Information: For business taxpayers, the IRS Master File contains data about the business entity, such as the Employer Identification Number (EIN), business name, address, and type of entity (e.g., sole proprietorship, partnership, corporation).

- Payroll and Employment Taxes: The IRS Master File captures information regarding payroll taxes, including withholdings for Social Security, Medicare, and federal income tax. It also maintains records of employment tax deposits made by employers.

- Additional Filings: The IRS Master File may include details of additional filings specific to certain businesses, such as information related to retirement plans, excise taxes, or foreign financial accounts.

These are just a few examples of the types of information contained in the IRS Master File. Its comprehensive nature is a testament to the vast amount of data that the IRS manages to ensure effective tax administration and compliance.

Importance of the IRS Master File

The IRS Master File plays a crucial role in the overall functioning of the Internal Revenue Service (IRS) and is of significant importance in the realm of taxation. Here are some key reasons why the IRS Master File is so important:

- Effective Tax Administration: The IRS Master File serves as a centralized database that provides essential information on individual and business taxpayers. This wealth of data enables the IRS to efficiently administer and enforce tax laws, ensuring that taxpayers meet their obligations and contribute to the nation’s revenue.

- Accurate Reporting and Compliance: The IRS Master File contains comprehensive records of taxpayers’ personal information, income, deductions, tax payments, and credits. This level of detail allows the IRS to verify that taxpayers are accurately reporting their income and claiming eligible deductions and credits. It helps promote tax compliance and reduces the risk of fraudulent or erroneous filings.

- Enhanced Taxpayer Services: By maintaining a centralized repository of taxpayer information, the IRS Master File enables efficient customer service. It allows taxpayers to access their tax history, view their filing status, and resolve any inquiries or issues promptly. This contributes to a smoother and more streamlined experience for taxpayers when interacting with the IRS.

- Statistical Analysis and Research: The IRS Master File contains a vast amount of data that can be used for statistical analysis and research purposes. This data provides valuable insights into tax collection trends, taxpayer behavior, and economic activity. It helps policymakers and economists make informed decisions and develop strategies to enhance tax policy and national economic growth.

- Fraud Detection and Investigation: The IRS Master File’s comprehensive nature makes it a crucial tool for detecting and investigating potential tax fraud. By cross-referencing data and identifying discrepancies, the IRS can identify patterns or anomalies that may indicate fraudulent activity. This helps safeguard the integrity of the tax system and ensures that all taxpayers comply with the law.

In summary, the IRS Master File plays a vital role in facilitating effective tax administration, promoting compliance, enhancing taxpayer services, enabling data-driven decision-making, and combating tax fraud. Its centralized nature and wealth of information contribute to the smooth functioning of the IRS and the fair enforcement of tax laws.

Accessing the IRS Master File

Access to the IRS Master File is strictly controlled and limited to authorized individuals and entities. The IRS has implemented a secure system to ensure the confidentiality and integrity of taxpayer information. Here are the primary methods through which authorized parties can access the IRS Master File:

- IRS Employees: Authorized IRS employees have direct access to the IRS Master File through internal systems and software. These employees undergo rigorous training and background checks to ensure the responsible handling of taxpayer data.

- Tax Professionals: Certified tax professionals, such as enrolled agents, Certified Public Accountants (CPAs), and tax attorneys, can access the IRS Master File on behalf of their clients. They use authorized tax software and tools that are integrated with the IRS’s e-Services platform, allowing them to securely retrieve relevant taxpayer information.

- Authorized Third-Party Providers: Certain entities, such as financial institutions, payroll service providers, and software vendors, can access limited taxpayer information for specific purposes. These providers need to meet strict security and privacy requirements set forth by the IRS and must obtain necessary authorization.

- Taxpayers: Individual taxpayers can access their own information in the IRS Master File through the IRS’s online portal, known as “Where’s My Refund?” or by creating an account on the IRS website. This allows taxpayers to view their tax history, check the status of refunds, and address any concerns related to their tax filings.

- Legal Requests: In certain circumstances, law enforcement agencies, through appropriate legal channels and with proper authorization, can access taxpayer information from the IRS Master File as part of their investigations.

It is important to note that access to the IRS Master File is subject to strict regulations and safeguards to protect taxpayer privacy and prevent unauthorized use of the data. The IRS has implemented robust security measures, including encryption, authentication protocols, and audit trails, to ensure that only authorized individuals have access to the information stored in the IRS Master File.

By controlling access and adhering to stringent security protocols, the IRS maintains the confidentiality of taxpayer data and ensures that it is utilized solely for legitimate purposes concerning tax administration and compliance.

IRS Master File Updates and Maintenance

Maintaining the accuracy and integrity of the IRS Master File is a top priority for the Internal Revenue Service (IRS). Regular updates and meticulous maintenance activities are crucial to ensure that the information contained in the database is current and reliable. Here are some key aspects of IRS Master File updates and maintenance:

- Timely Updates: The IRS Master File undergoes regular updates to incorporate changes in taxpayer information. These updates include new tax filings, amended returns, changes in personal details, updates on income and deductions, and changes to business information. These updates are vital for keeping taxpayer records up to date and ensuring the accuracy of tax calculations.

- Data Validation: Before updates are applied to the IRS Master File, the data goes through a rigorous validation process. The IRS has sophisticated algorithms and validation procedures that check for data accuracy, consistency, and compliance with tax laws. This validation process helps maintain the integrity of the data stored in the Master File.

- Security Measures: As part of maintenance activities, the IRS continuously enhances the security measures surrounding the IRS Master File. This involves implementing robust encryption protocols, access controls, and monitoring systems to protect the data from unauthorized access or breaches. The IRS also conducts regular security audits and risk assessments to identify and mitigate potential vulnerabilities. These measures ensure that taxpayer information remains confidential and secure.

- System Enhancements: The IRS Master File is a dynamic system that evolves to meet the changing needs and requirements of tax administration. The IRS constantly evaluates the system’s performance and functionality to identify areas for improvement. Enhancements may include streamlining processes, improving user interfaces, or integrating new technologies to enhance efficiency and accuracy.

- Cross-System Integration: The IRS Master File is connected to various other systems and databases within the IRS. This integration allows for seamless data sharing and coordination between different IRS functions, such as tax return processing, collections, and taxpayer services. Cross-system integration ensures that taxpayer information is consistent across different IRS platforms, promoting accuracy and smooth operation.

Through regular updates, rigorous data validation, robust security measures, system enhancements, and cross-system integration, the IRS maintains the integrity and reliability of the information stored in the Master File. These efforts ensure that taxpayers’ records are accurate, up to date, and sufficiently safeguarded, enabling the IRS to effectively fulfill its mission of tax administration and compliance.

Challenges and Limitations of the IRS Master File

While the Internal Revenue Service (IRS) Master File is an essential tool for tax administration and compliance, it is not without its challenges and limitations. Here are some of the key challenges and limitations associated with the IRS Master File:

- Data Accuracy: The IRS heavily relies on taxpayers to provide accurate information when filing their tax returns. However, errors, omissions, and intentional misreporting can lead to inaccurate data in the IRS Master File. Despite validation processes, there is always a risk of inconsistencies, potentially impacting tax calculations and compliance activities.

- Data Timeliness: The IRS collects information from taxpayers at various times throughout the year, resulting in a time lag between when the data is received and when it is updated in the IRS Master File. This can lead to delays in processing and may affect the accuracy of the information available to both taxpayers and the IRS.

- Limited Integration: While the IRS Master File is interconnected with several IRS systems, there are still limitations in terms of cross-system integration. Not all aspects of taxpayer information are seamlessly integrated, which can result in inconsistencies or discrepancies between different IRS databases. This can pose challenges in maintaining accurate and up-to-date taxpayer records.

- System Capacity: The vast volume of taxpayer data managed by the IRS Master File presents challenges in terms of system capacity. As the number of taxpayers and the complexity of tax laws continue to grow, there is a need for ongoing investments in infrastructure to ensure the system can handle the increasing data load without compromising performance.

- Data Privacy and Security: Safeguarding taxpayer information is a top priority for the IRS. However, the IRS Master File, like any digital system, is susceptible to potential security breaches, hacking attempts, or unauthorized access. The IRS must continuously monitor and enhance its security measures to protect taxpayer data from potential threats.

- Technological Advancements: Technology is advancing at a rapid pace, and the IRS needs to adapt to leverage new tools and systems effectively. This poses a challenge in terms of integration, training, and ensuring seamless compatibility with legacy systems. It requires a proactive approach to keep pace with technological advancements and maintain the effectiveness of the IRS Master File.

It is important to note that the IRS is continually working to address these challenges and limitations. Efforts are being made to enhance data accuracy, improve data timeliness, strengthen system capacities, and enhance security measures. As technology continues to evolve, the IRS is also exploring ways to leverage new capabilities to address these limitations and improve the functionality and efficiency of the IRS Master File.

Conclusion

The IRS Master File serves as the backbone of tax administration and compliance in the United States. It is a centralized database that stores a wealth of taxpayer information, from personal details to tax filing history, income, deductions, and more. This comprehensive repository enables the Internal Revenue Service (IRS) to effectively administer and enforce tax laws, ensure compliance, and accurately calculate tax liabilities.

Access to the IRS Master File is strictly controlled, with authorized IRS employees, tax professionals, and specific third-party providers being granted access to the necessary information. Taxpayers themselves can also access their own data through the IRS’s online portal.

While the IRS Master File provides numerous benefits, it is not without challenges and limitations. Data accuracy, timeliness, limited integration, system capacity, data privacy, and technological advancements present ongoing challenges for the IRS. However, the IRS is committed to addressing these issues and continuously improving the functionality and security of the Master File.

Despite these challenges, the IRS Master File plays a critical role in tax administration, compliance, and taxpayer services. It helps ensure the accuracy of tax calculations, facilitates statistical analysis and research, enhances fraud detection, and provides valuable information for policymaking. The IRS Master File is an invaluable resource that enables the IRS to fulfill its mission of fair and efficient tax administration.

In conclusion, the IRS Master File is a vital component of the tax system, providing a centralized repository of taxpayer data. Through careful updates, maintenance activities, and diligent security measures, the IRS aims to maintain the accuracy and integrity of the information stored in the Master File. As technology advances and data management practices improve, the IRS continues to evolve the Master File to meet the changing needs of tax administration.