Finance

How To File A Hardship With The IRS

Published: October 31, 2023

Learn how to file a hardship with the IRS and navigate through financial challenges. Get expert advice and guidance on managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with financial hardship can be overwhelming, especially when you find yourself in a situation where you’re unable to meet your tax obligations. Whether it’s due to a sudden job loss, unexpected medical expenses, or other unforeseen circumstances, struggling to pay your taxes can lead to stress and worry. However, it is important to remember that the Internal Revenue Service (IRS) understands that financial difficulties can arise, and they have provisions in place to help individuals facing hardships.

In this article, we will guide you through the process of filing a hardship request with the IRS. We will explain what a hardship is, who is eligible for a hardship, the different types of hardship situations recognized by the IRS, and the necessary steps to take when filing a hardship request. We will also provide insights on how to navigate the process and work with the IRS to reach a resolution.

While the prospect of dealing with the IRS may seem daunting, it is important to remember that they are willing to work with taxpayers who are experiencing financial hardships. By understanding the steps involved and being prepared with the necessary documentation, you can take control of your situation and find a resolution that allows you to overcome your financial difficulties while fulfilling your tax obligations.

So if you’re facing financial hardship and need assistance with your tax payments, let’s dive into the process of filing a hardship request with the IRS and explore the options available to you.

Understanding IRS Hardship

Before delving into the process of filing a hardship request with the IRS, it’s essential to have a clear understanding of what a hardship is in the context of tax payments. In simple terms, a hardship refers to a situation where an individual or business is facing significant financial obstacles that prevent them from meeting their tax obligations.

The IRS recognizes that life can throw unexpected challenges our way, and it acknowledges that these challenges can impact a taxpayer’s ability to pay their taxes on time. Hardships can arise due to various factors, including job loss, debilitating illness or injury, natural disasters, or even divorce. These circumstances can lead to a sudden and drastic change in a taxpayer’s financial situation, making it difficult for them to fulfill their tax responsibilities.

It’s important to note that the IRS does not take hardship requests lightly. They require substantial evidence and documentation to verify the existence and severity of the hardship. This is done to ensure that hardship requests are genuine and not used as a means to evade tax payments. Therefore, it’s crucial to provide accurate and detailed information to support your case.

In order to determine eligibility for a hardship, the IRS considers several factors, including your income, living expenses, assets, and liabilities. This information helps them assess the extent of your financial hardship and determine an appropriate course of action.

It’s worth mentioning that demonstrating a financial hardship does not automatically absolve you from your tax obligations. However, it may qualify you for various IRS programs that provide temporary relief or alternative payment arrangements that are more manageable given your current financial circumstances.

Now that we have a clear understanding of what an IRS hardship entails, let’s explore who is eligible for a hardship and the various types of hardship situations recognized by the IRS.

Eligibility for Hardship with the IRS

Not everyone facing financial difficulties qualifies for a hardship with the IRS. To be eligible, you must meet certain criteria and provide evidence to support your claim. Here are the key factors the IRS considers when assessing eligibility for a hardship:

- Financial Hardship: You must be able to demonstrate that you are experiencing a genuine financial hardship that prevents you from paying your taxes in full. This could include situations such as job loss, medical emergencies, or other unexpected circumstances that have significantly impacted your income and ability to meet your tax obligations.

- Ability to Pay: The IRS will assess your financial situation, including your income, assets, expenses, and liabilities, to determine if paying your taxes would cause undue financial hardship. They will consider factors such as your current and projected income, monthly expenses, and any available assets that could be used to meet your tax obligations.

- Compliance: You must be up-to-date with your tax filings. If you have unfiled tax returns or outstanding tax debt from previous years, it may negatively impact your eligibility for a hardship with the IRS. It’s crucial to ensure that all necessary tax returns are filed before initiating a hardship request.

Once you have determined that you meet the eligibility criteria, you can proceed with filing a hardship request with the IRS. It’s important to note that qualifying for a hardship does not absolve you from your tax obligations. It provides you with options to manage your tax debt more effectively given your current financial circumstances.

In the next section, we will delve into the different types of hardship situations recognized by the IRS. Understanding these categories will help you identify the specific hardship you’re experiencing and provide the necessary documentation to support your case.

Types of Hardship

The IRS recognizes several types of hardships that individuals or businesses may face when it comes to paying their taxes. Understanding these different hardship categories will help you accurately identify the type of hardship you’re experiencing and provide the necessary documentation to support your case. Here are some common types of hardships recognized by the IRS:

- Job Loss or Income Reduction: If you have recently lost your job or experienced a significant reduction in income, you may qualify for a hardship. This could be due to factors such as layoffs, company closures, or a decrease in business profits. You will need to provide documentation such as termination letters, pay stubs, or financial statements to demonstrate the impact on your financial situation.

- Medical Expenses: Costly medical bills can quickly accumulate, leaving individuals or families struggling to make ends meet. If you’re facing substantial medical expenses that have exceeded your ability to pay, you may be eligible for a hardship. Medical records, insurance statements, and bills can serve as evidence of the financial burden caused by healthcare costs.

- Natural Disasters: Disasters such as hurricanes, earthquakes, wildfires, or floods can cause extensive damage and financial hardship. If you have suffered significant losses or incurred expenses due to a natural disaster, you may qualify for a hardship. Documentation such as insurance claims, repair estimates, or disaster assistance applications can support your case.

- Divorce or Separation: Going through a divorce or separation can lead to significant financial challenges, especially when it comes to tax obligations. If you’re facing financial hardship as a result of divorce-related expenses or changes in your income, you may be eligible for a hardship. Documents such as divorce decrees, alimony agreements, or child support orders can demonstrate the impact on your finances.

- Other Unforeseen Circumstances: The IRS recognizes that hardships can arise from various unexpected situations. These could include accidents, legal fees, unexpected home repairs, or other financial burdens that make it difficult to meet tax obligations. Provide any relevant documentation that supports your claim for a hardship in these circumstances.

It’s important to remember that each hardship situation is unique, and the evidence required may vary depending on your specific circumstances. Additionally, the IRS may have additional criteria or guidelines for different types of hardships. Familiarize yourself with the requirements and consult with a tax professional if you need assistance in determining and documenting your eligibility for a hardship.

In the next section, we will discuss the necessary steps to gather the required documentation to support your hardship request with the IRS.

Gathering Required Documentation

When filing a hardship request with the IRS, it is essential to provide thorough and accurate documentation to support your claim. The documentation you gather will help demonstrate the existence and severity of your financial hardship. Here are some key documents you may need to gather:

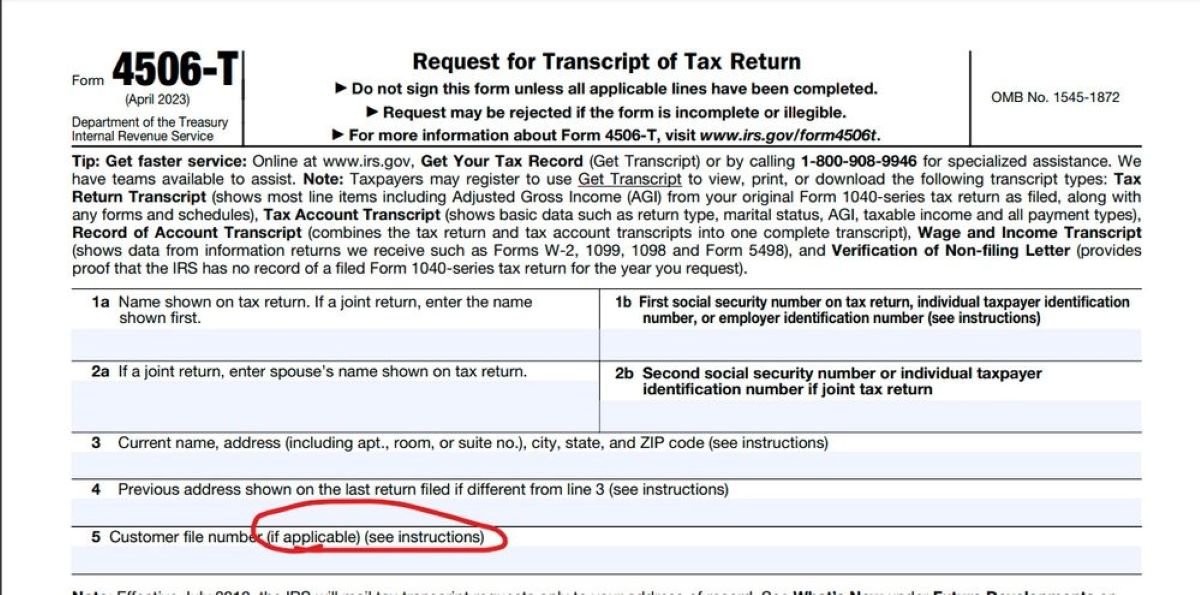

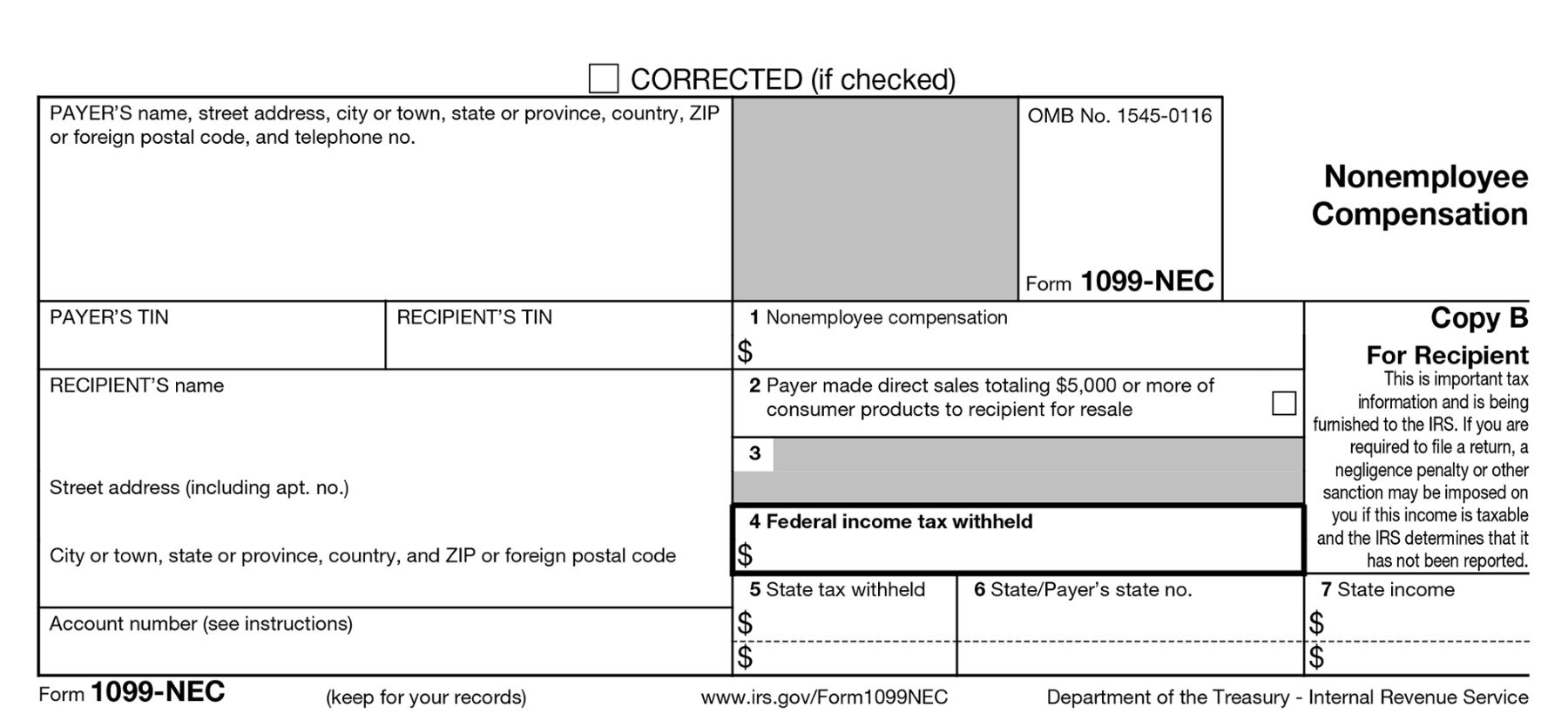

- Proof of Income: Gather documents that accurately reflect your current income and financial situation. This may include pay stubs, W-2 forms, 1099 forms, or any other income-related documentation.

- Expense Documentation: Keep track of your monthly expenses, including rent or mortgage payments, utility bills, transportation costs, medical expenses, and other necessary living expenses. This could involve gathering receipts, bills, bank statements, and other relevant financial records.

- Bank Statements: Provide bank statements that detail your financial transactions, including deposits, withdrawals, and balances. This will help the IRS assess your financial situation and determine if paying your taxes would create a substantial hardship.

- Tax Returns: Ensure that you have filed all necessary tax returns for the relevant tax years. If you have unfiled returns, it’s crucial to address this before proceeding with your hardship request. Gather copies of your filed tax returns as documentation.

- Hardship Documentation: Depending on the nature of your hardship, you may need to provide specific documentation to support your claim. For example, if you lost your job, provide termination letters or unemployment compensation documents. If you incurred significant medical expenses, gather medical bills, insurance statements, or doctor’s notes. Collect any relevant documentation that validates your hardship.

It is important to be organized and keep copies of all the documentation you submit to the IRS. Make sure your documentation is clear, legible, and up-to-date. If you have any doubts about the specific documents you need to include with your hardship request, consider consulting with a tax professional who can guide you through the process.

Once you have gathered all the necessary documentation, you are ready to move forward with filing a hardship request with the IRS. In the next section, we will outline the steps involved in submitting your hardship request and provide tips on working effectively with the IRS.

Filing a Hardship Request

When you have gathered all the required documentation and are ready to submit your hardship request to the IRS, there are a few important steps to follow. Here’s a guideline to help you navigate the process:

- Review Your Documentation: Before filing your hardship request, review all the documentation you have gathered to ensure it is complete, accurate, and well-organized. Make sure you have supporting evidence for your financial hardship and that your income, expenses, and other relevant details are clearly documented.

- Complete the Necessary Forms: The IRS typically requires specific forms to be completed when filing a hardship request. The most common form is Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) or Form 433-F (Collection Information Statement). These forms provide detailed information about your financial situation, including income, expenses, assets, and liabilities. Read the instructions carefully, fill out the forms accurately, and provide any additional information or documentation as requested.

- Include a Detailed Hardship Letter: Along with the required forms, it is essential to compose a hardship letter that explains your situation in detail. The hardship letter should be concise yet thorough, outlining the circumstances that have led to your financial hardship and providing any relevant supporting information. Be honest, clear, and persuasive in describing the impact of the hardship on your ability to pay your taxes. The letter should accompany your forms and other documentation in your hardship request submission.

- Submit Your Hardship Request: Once you have completed the necessary forms and written your hardship letter, gather all the documents and mail them to the appropriate IRS address. Make sure to keep copies of everything you submit for your records. Alternatively, you may be able to electronically submit your request using the IRS’s online platform. Check the IRS website or consult with a tax professional to determine the best method for submitting your hardship request.

After you have submitted your hardship request, it is important to follow up with the IRS to ensure they have received your documentation and to stay informed about the status of your request. Keep copies of all correspondence with the IRS and maintain open lines of communication if they require additional information or have further questions regarding your hardship request.

In the next section, we will discuss how to work effectively with the IRS during the hardship resolution process.

Working with the IRS

Once you have filed your hardship request with the IRS, it’s important to effectively navigate the process and work collaboratively with them to reach a resolution. Here are some tips for working with the IRS during the hardship resolution process:

- Keep Open Lines of Communication: Respond promptly and thoroughly to any communication from the IRS regarding your hardship request. This will help avoid unnecessary delays in the resolution process. If you are unsure about any instructions or requirements, don’t hesitate to seek clarification from the IRS or consult with a tax professional.

- Provide Additional Information as Requested: The IRS may require additional documentation or information to evaluate your hardship request thoroughly. Cooperate with any requests for more details and provide the necessary documents promptly. This will demonstrate your willingness to work with the IRS in resolving your tax obligations.

- Consider Hiring a Tax Professional: If the process becomes complex or if you find it challenging to navigate the hardship resolution process on your own, consider seeking assistance from a tax professional. Tax professionals can provide valuable guidance, ensure accuracy in your documentation, and help you navigate the process more efficiently.

- Explore Available IRS Programs: The IRS offers various programs designed to assist taxpayers facing financial hardship. These programs may include installment agreements, which allow you to make monthly payments over a set period of time, or offers in compromise, which may enable you to settle your tax debt for less than the full amount owed. Research and understand the options available to you and discuss them with the IRS to determine the best course of action.

- Stay Committed to Compliance: While going through the hardship resolution process, it’s crucial to remain compliant with your current and future tax obligations. Continuously file your tax returns on time and make any necessary estimated tax payments. Demonstrating your commitment to compliance will positively impact your relationship with the IRS and strengthen your case for hardship resolution.

Working with the IRS may require patience and persistence, but it is essential to maintain a cooperative and proactive approach throughout the process. Remember to keep copies of all correspondence and maintain a record of important dates and conversations for your reference.

In the next section, we will briefly touch upon the appeals process should your hardship request be denied or if you disagree with the resolution proposed by the IRS.

Appeals Process

In some cases, the IRS may deny a hardship request or propose a resolution that you disagree with. If this happens, you have the right to appeal their decision. Here’s an overview of the appeals process:

- Review the IRS Decision: Carefully review the letter or notice from the IRS that explains their decision or proposed resolution. Understand the specific reasons for their decision and the steps you need to take to initiate an appeal.

- File a Formal Appeal: If you believe the IRS decision is incorrect or unfair, you can file a formal appeal. This involves submitting a written statement detailing the reasons for your disagreement and any supporting documentation. Follow the instructions provided by the IRS in their decision letter regarding the appeals process and deadlines.

- Engage in the Appeal Conference: After filing your appeal, the IRS will schedule an appeal conference where you or your authorized representative can present your case. During the conference, provide any additional documentation or evidence that supports your position. Be prepared to articulate your arguments clearly and concisely.

- Consider Mediation or Alternative Dispute Resolution: In certain circumstances, the IRS may offer mediation or alternative dispute resolution options to help resolve your case. These processes can facilitate negotiations between you and the IRS to reach a mutually acceptable resolution.

- Review the Appeals Decision: After the appeal conference, the IRS will issue a written decision based on the information presented during the appeal. Review this decision carefully and assess whether it aligns with your desired outcome. If you are satisfied with the decision, follow the instructions provided to implement any agreed-upon resolution. If you still disagree, you may have additional options, such as pursuing litigation or seeking further review.

It’s worth noting that the appeals process can be time-consuming, and it’s advisable to consult with a tax professional or seek legal advice if you decide to pursue an appeal. They can help you navigate the complexities of the process, advocate on your behalf, and provide expert guidance.

While it’s always preferable to resolve tax issues amicably with the IRS, the appeals process ensures that you have a recourse if you believe the initial decision or proposed resolution does not adequately address your financial hardship.

Finally, let’s conclude our discussion about hardship filings with the IRS in the next section.

Conclusion

Filing a hardship request with the IRS can provide much-needed relief for individuals and businesses facing financial difficulties. By understanding the concept of IRS hardship, determining eligibility, gathering required documentation, and submitting a comprehensive request, you can effectively navigate the process and work towards a resolution that accommodates your financial circumstances.

Remember, hardships can come in various forms, such as job loss, medical expenses, natural disasters, or divorce. It’s critical to provide accurate documentation that supports your claim and demonstrates the severity of your financial situation. Additionally, staying compliant with your tax obligations and maintaining open lines of communication with the IRS are essential components of the process.

In the event that your hardship request is denied or if you disagree with the proposed resolution, you have the right to appeal. The appeals process allows for a review of the decision and provides an opportunity to present your case in further detail.

Throughout the entire process, consider seeking guidance from a tax professional who can provide expert advice tailored to your specific situation. They can assist you in understanding your options, completing necessary forms, and advocating on your behalf during appeals if required.

Dealing with financial hardship and tax obligations can be challenging, but by leveraging the options and resources available through the IRS, you can take steps towards resolving your tax debt while navigating your financial difficulties. Remember, the IRS is willing to work with taxpayers who are experiencing genuine hardships, so don’t hesitate to explore these avenues for assistance.

With the right approach and documentation, you can move forward with confidence, knowing that you are actively taking control of your financial situation and working towards a brighter future.