Finance

How To Buy General Electric Stocks

Published: January 17, 2024

Looking to buy General Electric stocks? Find out all you need to know about investing in finance and explore opportunities in the financial market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Background on General Electric (GE) Stocks

- Evaluating GE Stock Performance

- Understanding GE’s Financials and Valuation Metrics

- Analyzing GE’s Competitive Position

- Assessing GE’s Growth Potential

- Considering Risks and Challenges in Investing in GE Stocks

- Steps to Buy General Electric Stocks

- Choosing a Brokerage Platform

- Setting Up a Trading Account

- Researching and Analyzing GE Stock

- Placing an Order to Buy GE Stocks

- Monitoring and Managing Your GE Stock Investment

- Conclusion

Introduction

Investing in stocks can be a rewarding way to grow your wealth over time. With the right knowledge and strategy, you can make informed decisions and potentially earn significant returns. If you’re considering investing in the stock market, one company that you may want to explore is General Electric (GE).

General Electric is a multinational conglomerate that operates in various industries, including aviation, healthcare, renewable energy, and power. It is known for its innovative technology and long-standing presence in the market. Investing in GE stocks can offer an opportunity to gain exposure to different sectors and potentially earn a favorable return on investment.

Before diving into the specifics of buying GE stocks, it’s important to have a thorough understanding of the company’s performance, financials, and growth potential. This article will guide you through the process of evaluating GE stocks and the steps involved in purchasing them.

Disclaimer: Investing in stocks carries risks, and it’s essential to do your own research and consult with a financial advisor before making any investment decisions.

Background on General Electric (GE) Stocks

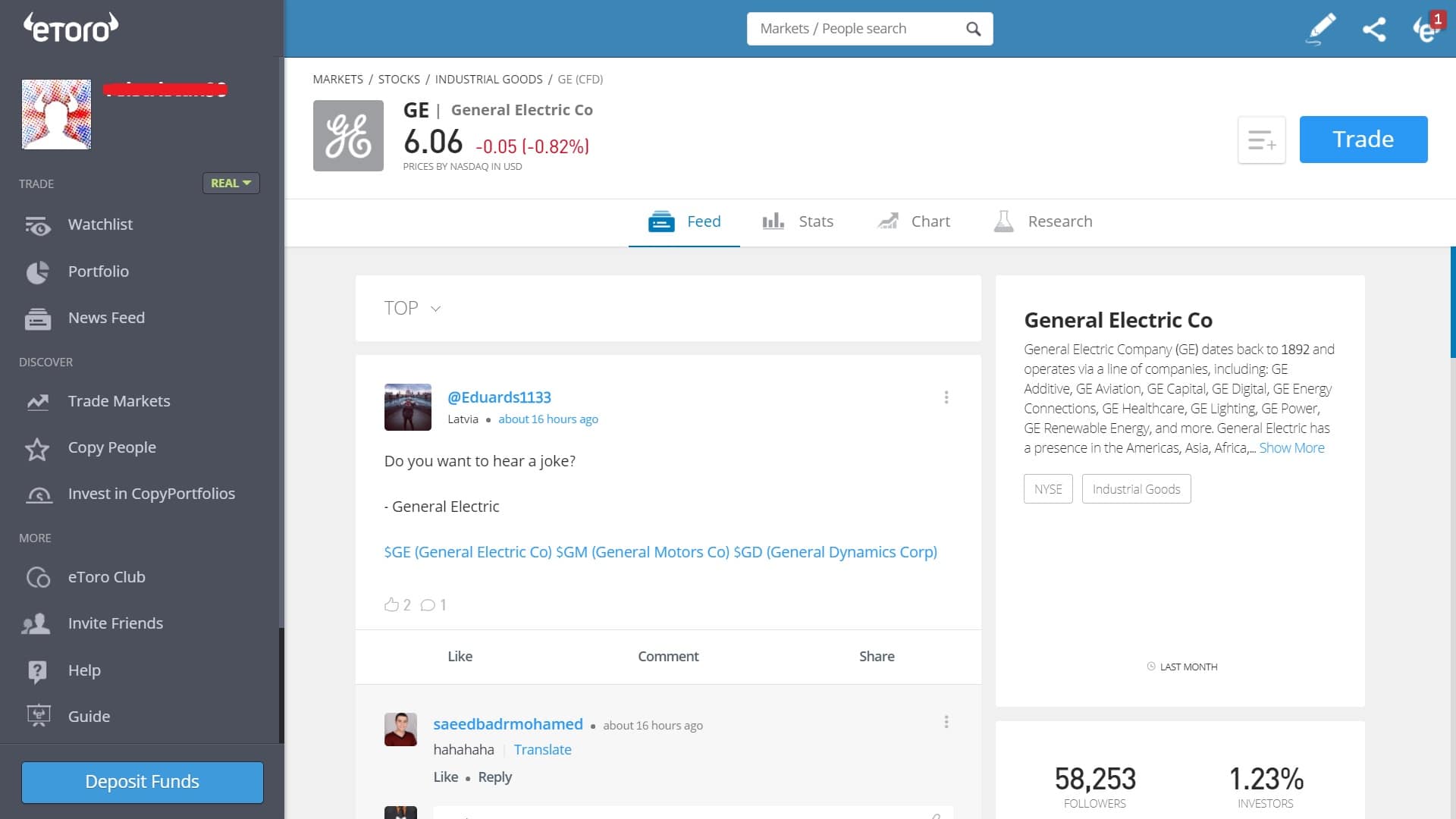

General Electric (GE) is one of the most renowned and influential companies in the world. Founded in 1892, GE has since become a global conglomerate that operates across various industries, including aviation, healthcare, renewable energy, and power. Over the years, GE has established a strong track record of innovation, bringing cutting-edge technology and solutions to the market.

GE stocks represent shares of ownership in the company. When you invest in GE stocks, you become a shareholder and have the potential to benefit from the growth and success of the company.

For many years, GE has been considered a bellwether stock, reflecting the overall health and performance of the global economy. Its stocks have been a staple in many investors’ portfolios due to the company’s historical stability and potential for long-term growth.

However, in recent years, GE has faced significant challenges, including a decline in its stock price and financial instability. The company has implemented several restructuring measures and strategic initiatives to turn its performance around and restore investor confidence.

It’s crucial to consider these factors when evaluating GE stocks as an investment opportunity. Understanding the company’s background, including its historical performance and recent challenges, can help you make informed decisions about whether to invest in GE stocks and, if so, when and how much.

It’s important to note that past performance is not indicative of future performance, and investing in stocks always carries a degree of risk. Therefore, thorough research and analysis are essential before making any investment decisions.

Evaluating GE Stock Performance

When considering investing in General Electric (GE) stocks, it’s crucial to evaluate their performance over time. By analyzing historical stock data, you can gain insights into the company’s trends, volatility, and potential for future growth.

One of the first factors to consider is the stock price movement. Look at how GE stocks have performed over the past few years and identify any notable trends. Has the stock price been on an upward trajectory, indicating consistent growth? Or has it experienced significant fluctuations or a declining trend?

Another important aspect to consider is the stock’s performance relative to market benchmarks such as the S&P 500. Comparing GE’s stock performance to the broader market can provide a sense of how the company is faring against its industry peers.

Additionally, assessing the company’s earnings per share (EPS) can provide valuable insights into its financial health. Has GE consistently reported positive earnings, or have there been periods of losses? Analyzing the trend in EPS can help you understand the company’s profitability and potential for generating shareholder returns.

Furthermore, examining dividend payments is essential for investors seeking income from their investments. Dividends are a portion of a company’s earnings that are distributed to shareholders. GE has a history of paying dividends, but the amount and sustainability of these payments can vary. Analyzing the dividend yield, which is the dividend payment relative to the stock price, can give you an idea of the income potential of GE stocks.

It’s worth noting that past performance is not a guarantee of future results. Therefore, it’s important to supplement historical analysis with comprehensive research on GE’s current financials, growth strategy, and industry outlook to make a well-rounded assessment of its stock performance.

Overall, evaluating GE’s stock performance involves analyzing historical price movement, comparing it to market benchmarks, assessing earnings per share, and considering dividend payments. By examining these factors, you can gain insights into GE’s financial health, potential for growth, and suitability as an investment option.

Understanding GE’s Financials and Valuation Metrics

Before investing in General Electric (GE) stocks, it’s important to have a clear understanding of the company’s financials and valuation metrics. These metrics can provide insights into GE’s overall health, profitability, and value relative to its stock price.

One key financial indicator to consider is the company’s revenue growth. Analyzing GE’s historical revenue trends can help you assess its ability to generate consistent income and support future growth. Look for steady or increasing revenue over time, as this indicates a healthy and resilient business model.

Another important metric to evaluate is the company’s profitability. Assessing GE’s net profit margin, which is the percentage of revenue that remains as profit after deducting expenses, can provide insights into its operational efficiency. A higher net profit margin indicates that GE is generating more profits from its operations.

In addition, examining GE’s balance sheet is crucial to understand its financial position. This includes analyzing the company’s assets, liabilities, and shareholder equity. A healthy balance sheet with strong assets and manageable debt can suggest financial stability and resilience.

Valuation metrics help determine the potential value of GE stocks based on various factors. One commonly used metric is the price-to-earnings (P/E) ratio, which compares the stock price with the company’s earnings per share (EPS). A lower P/E ratio usually suggests that the stock may be undervalued, while a higher P/E ratio may indicate the stock is overvalued relative to its earnings potential. However, it’s important to compare the P/E ratio to industry peers to get a more accurate perspective.

Other valuation metrics to consider include the price-to-sales (P/S) ratio, which measures the company’s market value relative to its revenue, and the price-to-book (P/B) ratio, which compares the stock price to the company’s book value per share. These metrics can provide additional context in evaluating the value of GE stocks.

Understanding GE’s financials and valuation metrics is vital in assessing the company’s financial health, profitability, and the potential value of its stocks. Combined with a thorough analysis of industry trends and future growth prospects, these metrics can help you make informed investment decisions.

Analyzing GE’s Competitive Position

When considering investing in General Electric (GE) stocks, it’s essential to analyze the company’s competitive position in the market. Understanding how GE’s products and services compare to those of its competitors can provide insights into its potential for growth and success.

One way to evaluate GE’s competitive position is by examining its market share. Look at the company’s presence in various industries, such as aviation, healthcare, and renewable energy. Has GE been able to maintain or increase its market share over time? A growing market share can indicate that GE is successfully capturing a larger portion of the market relative to its competitors.

Another aspect to consider is GE’s research and development (R&D) efforts. Review the company’s investment in R&D and the development of new technologies. GE’s ability to innovate and bring disruptive solutions to the market can give it a competitive advantage. Analyze how well GE is positioned to adapt to changing industry trends and technological advancements.

Additionally, assessing the quality and reputation of GE’s products and services is crucial. Look for customer reviews, industry awards, and feedback on the reliability, performance, and efficiency of GE’s offerings. Positive feedback and a strong reputation indicate that GE is satisfying customer needs and staying competitive.

Moreover, understanding the competitive landscape in which GE operates is essential. Research and identify key competitors in each industry. Analyze their strengths, weaknesses, market share, and product offerings. This analysis can help you compare GE’s position in the market and assess its ability to differentiate itself and stand out against competitors.

Consider also the regulatory environment and any potential threats or opportunities that may arise. Changes in regulations can significantly impact companies in certain industries, and staying ahead of these changes can be critical for maintaining a competitive position.

By thoroughly analyzing GE’s competitive position, including its market share, R&D efforts, product quality, industry reputation, and the competitive landscape, you can gain valuable insights into its potential for growth and success. This analysis, combined with other factors, can help you make informed investment decisions when considering GE stocks.

Assessing GE’s Growth Potential

When assessing an investment in General Electric (GE) stocks, one important aspect to consider is the company’s growth potential. Evaluating GE’s ability to generate sustained growth can help you determine its long-term prospects and the potential for returns on your investment.

One factor to analyze is GE’s expansion into new markets and industries. Assess whether GE is actively seeking growth opportunities in emerging sectors or if it is focused on expanding its presence in its existing markets. A company that is successfully diversifying its offerings and entering new markets may have a higher growth potential.

Another aspect to consider is GE’s investment in research and development (R&D). Review the company’s innovation pipeline and the development of new technologies. Companies that prioritize R&D often have a higher potential for growth as they introduce new products and services that can capture market share and drive revenue growth.

Furthermore, understanding GE’s international presence is crucial. Assess the company’s operations in different regions and its ability to capitalize on growth opportunities in global markets. A well-established global presence can contribute to GE’s growth potential by tapping into diverse customer bases and accessing emerging economies.

Additionally, evaluate GE’s ability to adapt to market trends and technological advancements. Consider the company’s strategy for embracing digital transformation and its integration of new technologies like artificial intelligence, machine learning, and the Internet of Things. A company that embraces innovation and stays ahead of industry trends is more likely to have a higher growth potential.

Lastly, it’s important to analyze GE’s financial projections and forecasts. Look for indications of growth in revenue, earnings, and profitability. However, it’s crucial to interpret these projections in the context of the company’s historical performance and the industry’s overall outlook.

Assessing GE’s growth potential requires a comprehensive analysis of its expansion strategies, R&D efforts, international presence, ability to adapt to market trends, and financial projections. By considering these factors, you can gain valuable insights into GE’s potential for sustained growth and make more informed investment decisions.

Considering Risks and Challenges in Investing in GE Stocks

As with any investment, there are risks and challenges to consider when investing in General Electric (GE) stocks. Understanding these risks can help you make more informed decisions and manage your investment effectively.

One significant risk is the volatile nature of the stock market. Stock prices can fluctuate based on various factors, including global economic conditions, industry trends, and investor sentiment. GE stocks are not exempt from market volatility and can experience significant price swings. Therefore, it’s important to be prepared for potential short-term fluctuations and have a long-term investment horizon.

Another risk to consider is GE’s financial instability. In recent years, GE has faced challenges related to its balance sheet, high levels of debt, and difficulties in certain business segments. These factors can affect the company’s financial performance and stock price. It’s crucial to closely monitor GE’s financial health and strategy for addressing its financial challenges.

The company’s exposure to various industries also poses risks. GE operates in sectors such as aviation, healthcare, and renewable energy, which have their own unique challenges and dynamics. Economic downturns, regulatory changes, and competitive pressures within these industries can impact GE’s performance and stock price.

Furthermore, industry-specific risks, such as technological disruption and market competition, need to be considered. GE operates in sectors that are subject to rapid advancements in technology, and failure to adapt to these changes can pose a significant risk to its growth potential.

It’s important to note that past performance is not indicative of future results. Assessing GE’s historical stock performance and financials is essential, but it does not guarantee similar performance in the future. GE’s ability to execute its business strategy, navigate industry challenges, and adapt to changing market conditions are critical to its future performance.

Lastly, investors should be aware of the potential for dividend cuts or suspensions. GE has a history of paying dividends, but during challenging times, the company may reduce or suspend dividend payments to conserve cash. This can impact the income-generating potential of GE stocks.

Considering the risks and challenges associated with investing in GE stocks requires a comprehensive analysis of market volatility, GE’s financial stability, industry-specific risks, and the potential for dividend cuts. By being aware of these risks, you can make more informed investment decisions and implement risk management strategies to protect your investment.

Steps to Buy General Electric Stocks

If you have decided to invest in General Electric (GE) stocks, here are the steps to follow in order to make your purchase:

- Educate Yourself: Before buying any stocks, it’s important to understand the basics of investing and the stock market. Familiarize yourself with key financial terms and concepts, and research about GE’s performance, industry trends, and potential risks and opportunities.

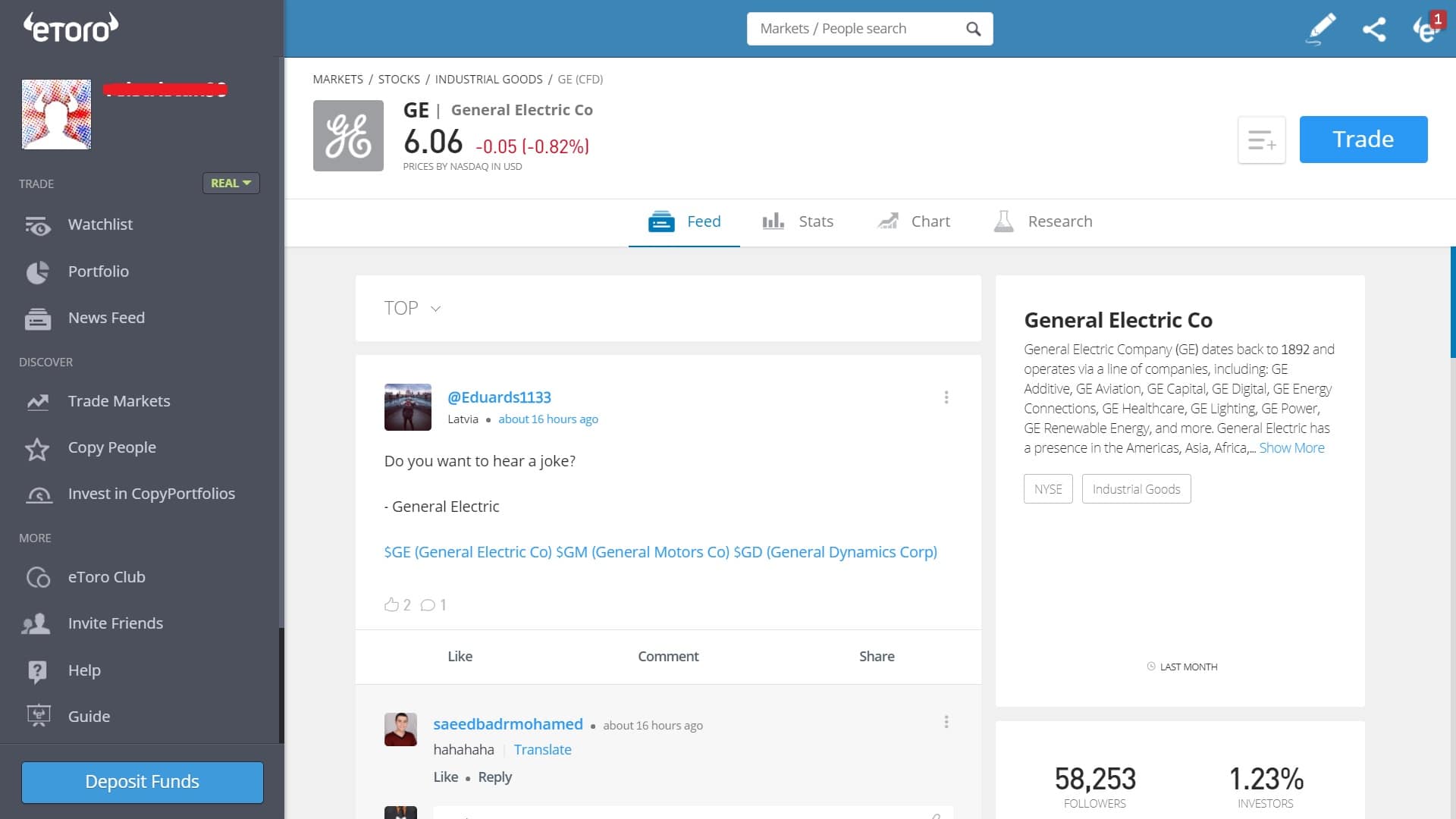

- Choose a Brokerage Platform: Select a reputable brokerage platform that suits your investment needs. Consider factors such as fees, available research tools, customer support, and user-friendly interfaces. Some popular brokerage platforms include TD Ameritrade, E-Trade, and Charles Schwab.

- Set Up a Trading Account: Follow the instructions on your chosen brokerage platform to open a trading account. You will typically need to provide personal information, such as your name, address, and social security number. This process may involve some paperwork and verification.

- Research and Analyze GE Stock: Utilize the research tools provided by your brokerage platform to analyze GE’s stock performance, financials, and market trends. Consider factors such as earnings, revenue growth, valuation metrics, and industry competition. This research will help you make an informed investment decision.

- Place an Order: Once you have decided to buy GE stocks, log into your trading account and navigate to the trading platform. Look for the option to place a new order and specify that you want to buy shares of General Electric (GE). Choose the type of order (e.g., market order or limit order) and enter the quantity of shares you wish to purchase.

- Review and Confirm: Before finalizing your order, carefully review the details to ensure accuracy. Check the price, quantity, and any additional fees associated with the transaction. Once you are satisfied, confirm the order and submit it for processing.

- Monitor and Manage Your Investment: After buying GE stocks, it’s important to monitor your investment regularly. Stay informed about GE’s performance, industry news, and any relevant developments. Consider setting up notifications or alerts on your brokerage platform to stay updated.

Remember that investing in stocks comes with risks, and the value of your investment can fluctuate. It’s important to diversify your portfolio, continually assess your investment strategy, and consult with a financial advisor if needed.

By following these steps and staying informed, you can successfully purchase GE stocks and begin your investment journey in the stock market.

Choosing a Brokerage Platform

Choosing the right brokerage platform is a crucial step when buying General Electric (GE) stocks or any other investments. The brokerage platform you select will serve as your gateway to the stock market, providing you with the tools and services needed to execute your trades. Here are some factors to consider when choosing a brokerage platform:

Fees: Take into account the fees charged by the brokerage platform. This can include commission fees for each trade, account maintenance fees, and fees for additional services such as access to research or real-time market data. Compare the fee structures of different platforms to ensure they align with your investment strategy and budget.

Trading Interface: Evaluate the trading interface provided by the brokerage platform. Look for a user-friendly and intuitive platform that allows you to easily place trades, access account information, and monitor your portfolio. Consider whether the platform offers customizable features and advanced order types that align with your trading style.

Research Tools: Assess the research tools and resources offered by the brokerage platform. Look for platforms that provide comprehensive market research, including analyst reports, financial statements, and news updates. Access to these tools can be valuable in analyzing GE stocks and making informed investment decisions.

Customer Support: Consider the level of customer support offered by the brokerage platform. Determine if they provide multiple channels of communication, such as phone, email, or live chat. Responsive and knowledgeable customer support can be beneficial if you encounter any issues or have questions regarding your account or trades.

Account Types: Take into account the types of accounts offered by the brokerage platform. They may provide individual brokerage accounts, retirement accounts (such as IRAs), or other specialized accounts. Choose a platform that aligns with your specific investment needs and goals.

Mobile Accessibility: If you prefer to trade on-the-go, consider the availability of a mobile app offered by the brokerage platform. A well-designed and functional mobile app can allow you to monitor your investments and execute trades conveniently from your smartphone or tablet.

Reputation and Security: Research the reputation and track record of the brokerage platform. Look for platforms that are well-established, regulated by reputable financial authorities, and have a history of reliable and secure operations. Reading reviews and seeking recommendations can provide insight into the platform’s reliability.

Comparing different brokerage platforms based on these factors will help you find the one that best fits your investment needs and preferences. Additionally, consider your investment strategy, level of experience, and the specific features that are most important to you. Taking the time to choose the right brokerage platform can enhance your investing experience and set you up for success when investing in GE stocks.

Setting Up a Trading Account

Setting up a trading account is an essential step in buying General Electric (GE) stocks or any other investments. This account will serve as your platform for executing trades and managing your portfolio. Here’s a step-by-step guide on how to set up a trading account:

- Choose a Brokerage Platform: Research and select a reputable brokerage platform that suits your investment needs and preferences. Consider factors such as fees, trading features, research tools, customer support, and user interface.

- Visit the Brokerage Platform’s Website: Once you have chosen a brokerage platform, visit their website to begin the account opening process. Look for a “Sign Up” or “Open an Account” button to get started.

- Select Account Type: Choose the type of account that suits your investment goals. Options may include individual brokerage accounts, retirement accounts (such as IRAs), or other specialized accounts. Consider your long-term objectives and consult with a financial advisor if needed.

- Provide Personal Information: Fill out the necessary forms with accurate personal information. This typically includes your full name, address, phone number, date of birth, social security number, and employment information.

- Verify Your Identity: The brokerage platform will require you to verify your identity to comply with regulatory requirements. This may involve providing a copy of your government-issued ID, such as a passport or driver’s license, and possibly additional documentation as needed.

- Complete Account Setup: Follow the steps provided by the brokerage platform to complete the account setup process. This may include agreeing to the terms and conditions, setting up security measures such as a username and password, and selecting your preferred communication preferences.

- Fund Your Account: Once your trading account is set up, you will need to deposit funds to start investing. Follow the instructions provided by the brokerage platform to transfer money into your trading account. Options typically include bank transfers, wire transfers, or linking your bank account.

- Set Up Security Measures: Prioritize the security of your trading account by enabling additional security measures such as two-factor authentication (2FA) and choosing a strong password. These measures help protect your account from unauthorized access.

- Read and Understand Account Policies: Familiarize yourself with the brokerage platform’s policies regarding fees, trading rules, account maintenance requirements, and any other relevant terms and conditions. Understanding these policies will help you make informed decisions and manage your account effectively.

- Review Account Information: Take the time to review all the information provided during the account setup process to ensure accuracy. Contact the brokerage platform’s customer support if you notice any discrepancies or have any questions.

Setting up a trading account is a straightforward process that typically involves providing personal information, verifying your identity, completing account setup, funding your account, and setting up security measures. Once your trading account is set up, you can proceed to research, analyze, and buy GE stocks or any other investments in accordance with your investment strategy.

Researching and Analyzing GE Stock

Researching and analyzing General Electric (GE) stock is a crucial step in making informed investment decisions. By conducting thorough research and analysis, you can gain insights into GE’s performance, financial health, and growth prospects. Here’s how to approach researching and analyzing GE stock:

- Review GE’s Financials: Start by examining GE’s financial statements, including its annual reports, quarterly reports, and SEC filings. Analyze key metrics such as revenue, net income, and earnings per share (EPS) to understand the company’s financial performance over time.

- Analyze Industry Trends: Evaluate the broader industry trends that impact GE’s business. Consider factors such as technological advancements, regulations, and market dynamics. Understanding industry trends can provide insights into GE’s competitive position and growth potential.

- Assess GE’s Competitive Landscape: Analyze GE’s competitors in each of its target markets, such as the aviation, healthcare, and renewable energy sectors. Compare GE’s products, services, market share, and financial performance against its competitors to gauge its relative strength in the market.

- Consider Fundamental Analysis: Use fundamental analysis to evaluate GE’s intrinsic value. This involves assessing its valuation metrics, such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio. Compare these metrics to industry averages and historical trends to determine if the stock is undervalued or overvalued.

- Read Analyst Reports: Consult analyst reports from reputable financial institutions to gather insights from industry experts. Analyst reports often provide opinions, recommendations, and price targets for the stock. Consider different analysts’ perspectives and evaluate their track records to make an informed decision.

- Stay Informed with News and Events: Keep up to date with the latest news, events, and announcements related to GE. Monitor news sources, financial news platforms, and the company’s official press releases. Significant news, such as product launches, partnerships, or regulatory changes, can have a significant impact on GE’s stock price.

- Consider Technical Analysis: Incorporate technical analysis into your research by studying GE’s stock price charts and identifying patterns, trends, and support/resistance levels. Technical analysis can provide insights into potential entry or exit points for your investment.

- Utilize Research Tools: Take advantage of research tools and platforms provided by your brokerage or financial services provider. These tools often include financial data, charts, and screening capabilities to help you analyze GE’s stock and compare it with other investment options.

- Consult with Financial Advisors: Consider seeking advice from a financial advisor or investment professional with expertise in the stock market and GE’s industry. They can provide personalized insights and guidance based on your investment goals and risk tolerance.

Remember that the research and analysis process should be ongoing as market conditions and the company’s performance may change over time. By conducting thorough research and analysis, you can make more informed decisions when considering whether to invest in GE stock and how it aligns with your investment strategy and goals.

Placing an Order to Buy GE Stocks

Once you have conducted your research and analysis on General Electric (GE) stock and decided to move forward with your investment, it’s time to place an order to buy GE stocks. Here’s a step-by-step guide on how to place an order:

- Access Your Trading Account: Log in to your trading account through the brokerage platform you have selected.

- Navigate to the Trading Platform: Once logged in, locate the trading platform or section within your account interface. This is where you can place your stock orders.

- Select “Buy” or “Trade”: Within the trading platform, choose the option to buy or trade stocks. Look for a button or tab that allows you to initiate a new order.

- Specify the Stock: Enter General Electric (GE) as the stock you want to buy. You may need to enter the stock symbol, which is typically “GE”.

- Enter Order Details: Specify the details of your order. This includes the type of order, such as a market order or limit order:

- Market Order: With a market order, you are requesting to buy GE stocks at the current market price. The order will be executed at the prevailing price in the market.

- Limit Order: A limit order allows you to set a specific price at which you want to buy GE stocks. The order will only be executed if the stock reaches or falls below the specified limit price.

- Specify the Quantity: Enter the quantity of GE stocks you want to purchase. You can specify the number of shares or the dollar amount you want to invest.

- Review and Confirm: Double-check the details of your order to ensure accuracy. Verify that you have selected the correct stock, order type, quantity, and price. Take note of any fees or commissions associated with the order as well.

- Place the Order: Once you are satisfied with the order details, click on the “Place Order” or similar button to submit your order. The order will now be processed by the brokerage platform.

- Monitor Order Execution: After placing the order, monitor its execution. Depending on the type of order and market conditions, the order may be executed immediately or take some time to be filled. Keep an eye on your account to see when the GE stocks are reflected in your portfolio.

It’s important to note that market conditions can change, which may potentially impact the order execution price. Additionally, brokerage platforms may have additional order options and features, so familiarize yourself with their specific trading platform for more customization.

By following these steps, you can successfully place an order to buy GE stocks and be on your way to becoming a shareholder of General Electric.

Monitoring and Managing Your GE Stock Investment

Once you have purchased General Electric (GE) stocks, it’s essential to actively monitor and manage your investment to make informed decisions and maximize your returns. Here are some key aspects to consider when managing your GE stock investment:

Monitor GE’s Performance: Stay informed about GE’s performance by regularly reviewing its financial reports, earnings announcements, and news updates. Monitor key financial metrics, such as revenue, earnings per share (EPS), and profit margins, to assess the company’s financial health and track its progress.

Keep Up with Industry and Market Trends: Stay updated on industry trends, regulatory changes, and market conditions that may impact GE’s business. Monitor news sources, industry publications, and analyst reports to gain insights into the broader market landscape and identify potential risks or opportunities.

Set Investment Goals and Review Regularly: Determine your investment goals for your GE stocks, whether it’s long-term growth, income generation, or a specific target price. Regularly review your goals and assess whether they are still aligned with your investment strategy.

Consider Diversification: Evaluate your overall investment portfolio and ensure it is well-diversified. Diversification can help spread risk and potentially enhance returns. Consider investing in a variety of sectors and asset classes to mitigate exposure to any single company or industry.

Implement Risk Management Strategies: Assess your risk tolerance and establish risk management strategies accordingly. Consider using stop-loss orders or trailing stop orders to automatically sell your GE shares if they reach a predetermined price level. This can help protect your investment from significant downside risk.

Stay Disciplined and Avoid Emotional Decision-Making: Remain disciplined in your investment approach and avoid making impulsive decisions based on short-term market fluctuations. Emotions can cloud judgment, leading to irrational investment decisions. Focus on the long-term prospects of GE and stick to your investment strategy.

Stay Informed About Dividends: GE has a history of paying dividends. Monitor dividend announcements and understand the dividend policy of the company. Regularly review the dividend payments and consider reinvesting them to potentially enhance your returns through compounding.

Review Tax Implications: Understand the tax implications of owning GE stocks. Consult with a tax professional to ensure you are aware of any tax obligations associated with your investment and to explore potential tax-efficient strategies to optimize your returns.

Periodically Review and Rebalance: Periodically review your investment portfolio and assess the performance of your GE stocks. Consider rebalancing your portfolio if necessary to maintain the desired asset allocation and risk profile. This involves selling or buying additional shares of GE or other investments to realign your portfolio with your intended strategy.

Seek Professional Advice: If you are unsure about managing your GE stock investment on your own or if you need personalized guidance, consider consulting a financial advisor. They can provide expertise and assist you in optimizing your investment strategy based on your individual goals and risk tolerance.

By actively monitoring and managing your GE stock investment, you can stay informed about the company’s performance, adapt to changing market conditions, and make informed decisions to optimize your returns over time.

Conclusion

Investing in General Electric (GE) stocks can be an exciting opportunity to participate in the growth and success of a renowned multinational conglomerate. However, it is important to approach this investment with careful consideration and thorough research.

In this article, we discussed the steps involved in buying GE stocks, including choosing a brokerage platform, setting up a trading account, and conducting research and analysis. It is crucial to evaluate GE’s financials, competitive position, growth potential, and the risks associated with investing in the company.

Once you have made the decision to invest, it is important to actively monitor and manage your GE stock investment. Stay informed about the company’s performance, industry trends, and market conditions. Set clear investment goals, diversify your portfolio, and implement risk management strategies to protect your investment.

While this article provides a comprehensive guide, it is important to remember that investing in stocks always carries risks. Past performance is not indicative of future results, and the market can be unpredictable. Therefore, it is recommended to consult with a financial advisor or investment professional and conduct your own due diligence before making any investment decisions.

By following the steps outlined in this article and staying informed about GE’s performance and market trends, you can make informed decisions to maximize your potential returns and manage the risks associated with investing in GE stocks.

Remember, investing requires patience, discipline, and a long-term perspective. With proper research, analysis, and active management, investing in GE stocks can potentially contribute to your overall financial growth and help you achieve your investment goals.