Home>Finance>How To Buy Rental Property With Bad Credit And No Money

Finance

How To Buy Rental Property With Bad Credit And No Money

Published: January 8, 2024

Learn how to finance your rental property purchase even with bad credit and no money down. Get expert tips and strategies to make your investment dreams a reality.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Rental Property Investment

- Evaluating Your Financial Situation

- Researching Real Estate Markets and Properties

- Finding Financing Options for Bad Credit and No Money

- Creative Strategies for Acquiring Rental Property

- Building a Strong Application for Financing

- Negotiating and Closing the Purchase

- Managing and Maintaining the Rental Property

- Conclusion

Introduction

Investing in rental property can be a lucrative venture, providing a steady stream of passive income and long-term wealth building opportunities. However, if you have bad credit and no money, you may believe that purchasing rental property is out of reach. The good news is that it is still possible to buy rental property even with these financial obstacles. This article will guide you through the process of buying rental property with bad credit and no money, offering tips and strategies to help you achieve your investment goals.

Before diving into the specifics of buying rental property, it’s important to understand the benefits of this type of investment. Rental property offers several advantages over other types of investments, such as stocks or bonds. Firstly, rental property provides a consistent and reliable source of income. With tenants paying rent each month, you can generate a steady cash flow, which can help cover mortgage payments and expenses while also providing you with extra income.

Additionally, rental property is a tangible asset that can appreciate in value over time. As the property market grows, the value of your investment can increase, allowing you to build equity. This can provide you with a strong financial foundation for the future.

Moreover, rental property offers tax benefits. Expenses related to your rental property, such as mortgage interest, property taxes, and maintenance costs, can be deducted from your rental income, reducing your overall tax liability.

Now that you understand the potential benefits of investing in rental property, let’s explore how to overcome the challenges of bad credit and limited funds when purchasing real estate.

Understanding Rental Property Investment

Before diving into buying rental property with bad credit and no money, it’s essential to have a clear understanding of the fundamentals of rental property investment. This will help you make informed decisions and set realistic expectations for your investment journey.

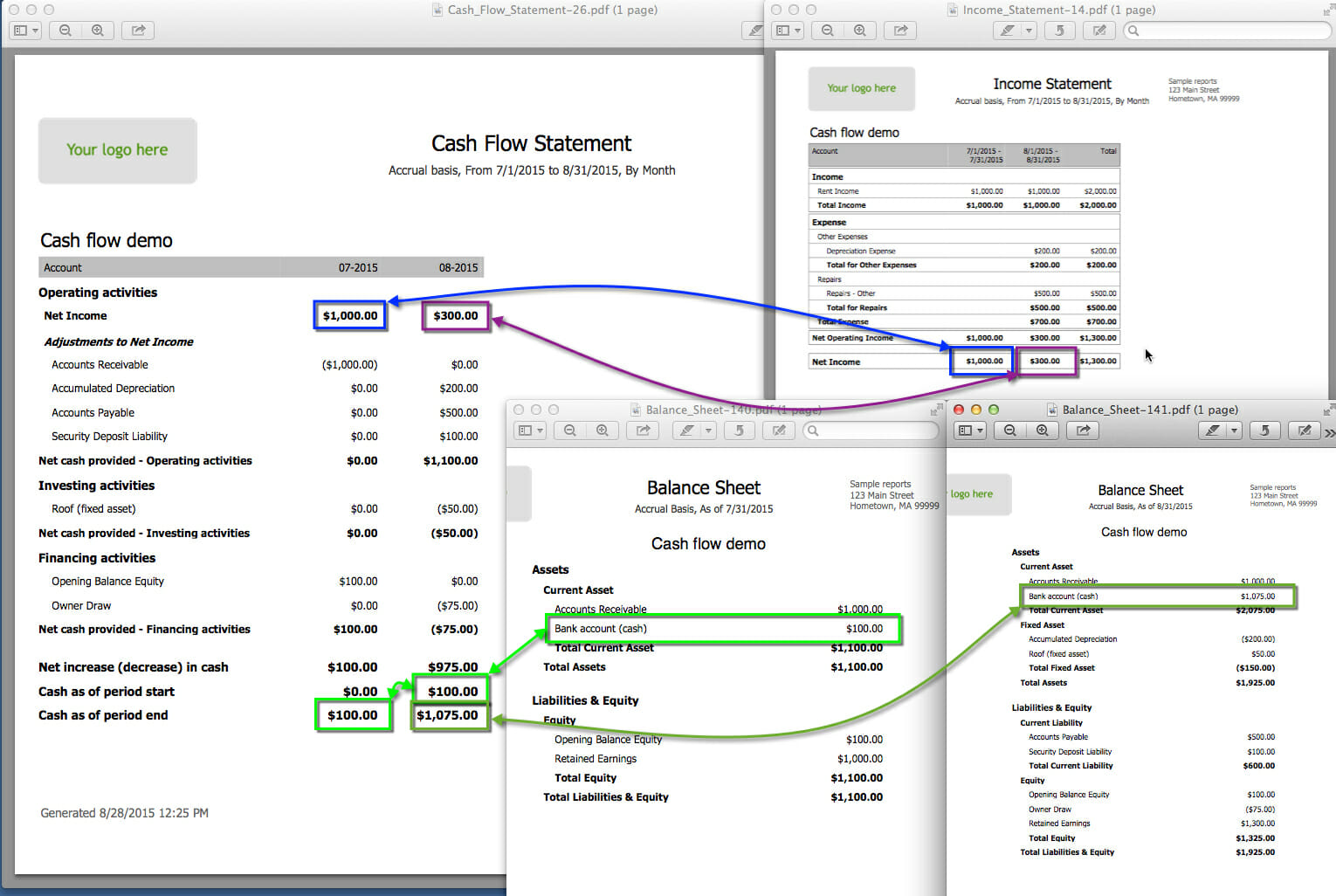

Rental property investment involves purchasing a property with the intention of leasing it out to tenants in exchange for rent payments. The ultimate goal is to generate a positive cash flow, where the rental income exceeds the expenses associated with the property, such as mortgage payments, taxes, insurance, and maintenance costs.

When considering rental property investment, it’s important to conduct thorough research on the real estate market and identify areas with high demand for rentals. Look for locations with strong job markets, good schools, and amenities that attract potential tenants. Pay attention to trends and forecasts to ensure that your investment will be in a profitable market.

There are different types of rental properties to consider, such as single-family homes, multi-unit properties, condominiums, and even commercial properties. Each type has its own advantages and disadvantages, so it’s crucial to evaluate your goals and financial capabilities to determine which option is most suitable for you.

It’s also important to assess your risk tolerance and investment strategy. Consider whether you want to focus on long-term buy-and-hold investments or engage in property flipping to generate quick returns. Understanding your investment strategy will help you make decisions regarding property selection and financing options.

Don’t forget to factor in the costs associated with owning and maintaining rental property. In addition to mortgage payments, you’ll need to account for property taxes, insurance, regular maintenance, repairs, and vacancy periods. It’s crucial to have a thorough understanding of these costs to accurately evaluate the financial viability of an investment.

Lastly, consider the legal aspects of being a landlord. Familiarize yourself with local laws and regulations regarding rental properties, tenant rights, eviction procedures, and property management responsibilities. Being knowledgeable in these areas will help you avoid legal issues and ensure a smooth operation of your rental business.

By understanding the fundamentals of rental property investment, you’ll be better equipped to navigate the process of buying rental property with bad credit and no money. The next steps involve evaluating your financial situation and identifying potential financing options tailored to your circumstances.

Evaluating Your Financial Situation

Before embarking on the journey of buying rental property with bad credit and no money, it’s crucial to assess your financial situation honestly. Understanding your financial standing will help you determine the feasibility of purchasing rental property and identify the necessary steps to overcome any obstacles.

Start by examining your credit score. Bad credit can make it challenging to secure traditional financing, but it doesn’t mean you’re completely out of options. Knowing your credit score will help you understand your position and explore alternatives that may be available to you.

Next, evaluate your income and existing debts. Calculate your monthly income, including any additional sources such as part-time jobs or passive income from investments. Subtract your monthly expenses, such as rent, utilities, and existing debts, to determine your disposable income. This will give you an idea of how much you can allocate towards a rental property.

Consider your savings or available funds for a down payment. While we focus on buying rental property with no money, having some savings can provide you with more flexibility and options. Assess how much you can comfortably allocate towards a down payment or initial investment.

It’s also vital to evaluate your financial stability and ability to manage the financial responsibilities of owning rental property. Consider factors such as job security, emergency funds, and potential future expenses. Rental property ownership comes with unexpected costs, and it’s crucial to be financially prepared.

After evaluating your financial situation, you may realize that you need to improve your credit or increase your savings before pursuing rental property investment. That’s perfectly normal and can be a valuable step towards your long-term financial goals. Take the time to work on repairing your credit, reducing debt, and saving money. This will not only improve your chances of securing financing but also enhance your overall financial health.

If your credit situation and available funds are not ideal, don’t be discouraged. There are creative strategies and financing options specifically designed for individuals with bad credit and limited funds. These options will be discussed in the upcoming sections of this article.

Remember, the key is to evaluate your financial situation honestly and determine the best course of action for your specific circumstances. Taking the time to assess your financial health will set you up for success as you move forward in the process of buying rental property.

Researching Real Estate Markets and Properties

Once you have evaluated your financial situation, it’s time to dive into researching real estate markets and properties. Doing thorough market research is crucial to finding the right investment opportunity and maximizing your chances of success.

Start by identifying markets that show potential for rental property investments. Look for areas with a high demand for rentals and a low vacancy rate. Consider factors such as population growth, job opportunities, and local amenities that attract tenants.

Explore real estate websites, online forums, and local publications to gather insights about different markets. Pay attention to market trends, rental rates, and property appreciation rates. Look for signs of a thriving real estate market with a positive outlook for the future.

Once you have narrowed down your list of potential markets, dig deeper into specific neighborhoods or areas within those markets. Analyze factors such as crime rates, school districts, proximity to transportation, and other amenities that are important to tenants. This level of research will help you identify areas that are desirable for rental properties and likely to attract good tenants.

After identifying potential markets and neighborhoods, shift your focus to researching individual properties. Use online real estate databases and platforms to search for available properties in your target areas. Pay attention to property features, such as number of bedrooms, bathrooms, and square footage, as well as any unique selling points that may attract tenants.

Consider the condition of the properties and whether any renovations or repairs will be necessary. Factor in the cost of these improvements when evaluating the financial feasibility of the investment.

Researching comparable rental properties in the area will also provide insights into the potential rental income you can expect from your investment. Look for similar properties in terms of size, location, and amenities, and compare their rental rates. This will help you estimate the potential cash flow and return on investment.

Don’t forget to consider the potential for property appreciation in your chosen market. Look at historical data to get an idea of how property values have performed in the past and consult experts or real estate agents familiar with the area for their insights and predictions regarding future growth.

By conducting thorough research on real estate markets and properties, you will be equipped with the knowledge to make informed decisions and identify the best investment opportunities. The next step is to explore financing options that cater to individuals with bad credit and limited funds.

Finding Financing Options for Bad Credit and No Money

Securing financing for rental property can seem daunting, especially if you have bad credit and limited funds. However, there are several financing options available that can help you overcome these challenges and make your investment dreams a reality.

One possible option is to seek out private lenders or hard money lenders. These lenders typically focus less on credit scores and more on the value of the property and the potential for rental income. Private lenders may be more flexible with their lending criteria and may be willing to finance your rental property even with bad credit. Keep in mind, however, that private lenders often charge higher interest rates and fees, so it’s important to thoroughly evaluate the terms and conditions before proceeding.

Another option is to consider seller financing. With seller financing, the property owner acts as the lender, allowing you to make payments directly to them rather than going through a traditional bank. This can be an advantageous option for individuals with bad credit since the seller may be more willing to negotiate terms and overlook credit history. It’s essential to have a clear and detailed agreement in place to protect both parties’ interests.

Exploring lease-to-own or rent-to-own agreements can also be a viable financing option. These agreements allow you to rent a property with the option to buy it at a predetermined price and terms in the future. During the rental period, a portion of your rent payments may be allocated towards a down payment or credited towards the purchase price of the property. This can give you time to improve your credit and save money while still working towards homeownership.

Additionally, consider partnering with someone who has better credit or more funds to invest. A joint venture or partnership can help you access financing options that may not be available to you individually. Keep in mind that entering into a partnership requires clear communication and a shared understanding of responsibilities and expectations.

Lastly, explore government-backed loan programs that are designed to assist individuals with low credit scores or limited funds. Programs such as the Federal Housing Administration (FHA) loans or the Department of Veterans Affairs (VA) loans have more lenient credit requirements and down payment options. Research the eligibility criteria and requirements for these programs to determine if you qualify.

Be prepared to demonstrate to potential lenders or partners your commitment, knowledge, and ability to handle the responsibilities of owning rental property. Presenting a well-prepared business plan, showcasing your research and projected cash flow, and highlighting any relevant experience can help boost your chances of securing financing.

Remember, finding financing options for bad credit and no money requires persistence and creativity. Don’t be discouraged if you face rejections or challenges along the way. Keep exploring different avenues and consider seeking professional advice from a mortgage broker or financial advisor who specializes in real estate investments.

With the right financing option in place, you can move forward with confidence in pursuing your rental property investment.

Creative Strategies for Acquiring Rental Property

When faced with bad credit and limited funds, it’s important to get creative in your approach to acquiring rental property. By thinking outside the box, you can explore alternative strategies that can help you achieve your investment goals. Here are some creative strategies to consider:

1. Partner with an investor: Find an investor who is willing to partner with you on the investment. This can bring in additional funds and expertise to secure financing and manage the property. Be clear on the terms of the partnership and ensure that responsibilities and expectations are properly defined in a legal agreement.

2. House hacking: Consider living in one unit of a multi-unit property while renting out the other units. This can help you offset the mortgage and expenses while building rental income. Look for properties with additional dwelling units, such as duplexes or triplexes, and explore the possibility of renting out the extra units.

3. Wholesaling: Explore the world of real estate wholesaling, where you find discounted properties and assign the contract to another investor for a fee. This can be a way to generate quick cash without the need for traditional financing, allowing you to build up funds for future rental property investments.

4. Crowdfunding: Consider crowdfunding platforms that allow you to pool funds from multiple investors to purchase rental property. This can be an effective way to overcome the challenge of limited funds and tap into a larger pool of capital.

5. Owner financing: Look for property owners who are willing to finance the purchase directly without the need for traditional bank financing. This can provide more flexibility and potentially bypass the strict credit requirements of traditional lenders.

6. Reach out to local landlords: Network with local landlords and real estate investors in your area who may be looking to offload properties or offer creative financing options. Building relationships with experienced investors can open doors to opportunities that may not be publicly advertised.

7. Sweat equity: Consider purchasing a property in need of renovation and put in the time and effort to improve it yourself. By adding value to the property through your own labor, you can build equity and potentially increase your chances of securing financing.

Remember, these creative strategies require careful consideration, research, and due diligence. It’s important to assess the risks and benefits of each strategy and tailor your approach to your specific circumstances.

Additionally, seeking guidance from experienced real estate professionals or mentors can provide valuable insights and help you navigate these creative strategies successfully.

By thinking creatively and exploring alternative approaches, you can overcome the challenges of bad credit and limited funds, opening up possibilities for acquiring rental property and building your real estate investment portfolio.

Building a Strong Application for Financing

When applying for financing to purchase rental property, it’s crucial to present a strong and compelling application that showcases your potential as a borrower. Even with bad credit and limited funds, you can improve your chances of securing financing by focusing on the following areas:

1. Prepare a solid business plan: Outline your investment strategy, including market research, property analysis, and projected cash flow. Demonstrate your understanding of the rental property market and articulate how you plan to generate income and manage expenses. A well-crafted business plan shows lenders that you have a clear vision and a well-thought-out strategy for success.

2. Highlight your strengths: Emphasize any positive aspects of your financial situation, such as stable income, existing assets, or a strong rental history. Showcase your dedication and passion for real estate investment by highlighting any relevant experience or certifications you may have, such as property management or landlord training.

3. Provide a detailed financial statement: Prepare a comprehensive financial statement that presents an accurate picture of your current financial situation. Include information on your income, expenses, assets, and debts. Be transparent about your bad credit, but also emphasize any steps you have taken to improve your credit or any positive changes in your financial circumstances.

4. Offer a larger down payment: If possible, save up for a larger down payment to offset the perceived risk of lending to someone with bad credit. A larger down payment shows lenders that you have a vested interest in the property and are committed to its success. It can also help lower your overall loan-to-value ratio and potentially improve your chances of securing financing.

5. Secure a cosigner or guarantor: If permissible, consider enlisting the help of a cosigner or guarantor with a strong credit history and financial stability. Their involvement can mitigate some of the risk associated with your own credit situation and increase the likelihood of loan approval.

6. Provide additional collateral: If you have other valuable assets, such as equity in another property or financial investments, you may be able to offer them as collateral to secure the loan. This can provide lenders with an additional layer of security and confidence in your application.

7. Seek out specialized lenders: Research lenders who specialize in working with individuals with bad credit or provide alternative financing options for real estate investors. These lenders may have more lenient credit requirements and a deeper understanding of the rental property market.

8. Be responsive and prepared: When approaching lenders, be prompt in providing requested documents and information. Prepare all necessary paperwork in advance, including tax returns, bank statements, and proof of income. Demonstrating your organization and preparedness will instill confidence in lenders.

Remember, building a strong application for financing requires effort and attention to detail. Present yourself as a serious and responsible borrower and convey your commitment to the success of the investment. While securing financing with bad credit and limited funds may present some challenges, a well-prepared application can significantly improve your chances of obtaining the necessary funds to acquire your desired rental property.

Negotiating and Closing the Purchase

Once you have found a rental property that fits your investment criteria and secured financing, the next step is negotiating and closing the purchase. This stage requires careful attention to detail and effective communication to ensure a successful transaction. Here are some key considerations:

1. Conduct a thorough property inspection: Before finalizing the purchase, hire a professional inspector to assess the property’s condition. Review the inspection report in detail and negotiate any necessary repairs or adjustments with the seller. This step will help you avoid potential surprises and ensure that you are making an informed decision.

2. Review the purchase agreement: Carefully review the purchase agreement, ensuring that all terms and conditions are clearly defined and aligned with your expectations. Seek legal advice if necessary to fully understand the contract and address any concerns or questions you may have.

3. Negotiate the purchase price: Depending on market conditions and the property’s condition, you may have room for negotiation on the purchase price. Evaluate comparable sales in the area, consider the property’s unique attributes, and leverage this information to negotiate a fair price that aligns with your budget and investment goals.

4. Consider contingencies: Contingencies are conditions that must be met for the transaction to proceed. Common contingencies include financing, inspections, and the sale of another property. Ensure that the purchase agreement includes relevant contingencies to protect your interests and provide an exit strategy if necessary.

5. Coordinate with your financing institution: Work closely with your lender to ensure a smooth closing process. Provide any requested documentation promptly and address any concerns or issues that may arise. Stay in communication with your lender throughout the closing process to avoid any delays or complications.

6. Engage professionals: Consider involving professionals such as real estate agents, attorneys, or title companies to navigate the legal and administrative aspects of the transaction. They can provide guidance, review documents, and facilitate a smooth closing process.

7. Perform a final walkthrough: Prior to closing, schedule a final walkthrough of the property to ensure that it is in the agreed-upon condition and all negotiated repairs have been completed. This step allows you to address any last-minute concerns before finalizing the purchase.

8. Attend the closing: On the day of closing, carefully review all closing documents and verify that the terms align with your expectations and the agreed-upon purchase agreement. Be prepared to sign all necessary paperwork and provide any required funds, such as down payment and closing costs.

Throughout the negotiation and closing process, maintain open lines of communication with the seller, your financing institution, and any professionals involved. Be proactive in addressing any issues or concerns promptly to ensure a smooth and successful closing.

Once the purchase is finalized, take the necessary steps to transfer ownership, set up utilities, and begin the process of managing and maintaining the rental property. With careful negotiation and a well-executed closing, you will be on your way to realizing your rental property investment goals.

Managing and Maintaining the Rental Property

After acquiring your rental property, the next crucial step is effectively managing and maintaining it to maximize your investment returns. Successfully managing a rental property involves several key considerations to ensure a smooth operation and a positive experience for both you and your tenants. Here are some important aspects to focus on:

1. Selecting reliable tenants: Take the time to thoroughly screen tenants by conducting background checks, verifying employment and income, and checking references. By selecting responsible and reliable tenants, you can minimize the risk of late payments, property damage, and other potential issues.

2. Set clear expectations with a rental agreement: Create a comprehensive rental agreement that outlines all the terms and conditions of the tenancy. Clearly communicate expectations regarding rent payments, maintenance responsibilities, pet policies, and any other relevant guidelines. This will help establish a clear understanding between you and your tenants.

3. Maintain open and regular communication: Foster a positive landlord-tenant relationship by maintaining open lines of communication. Respond promptly to tenant inquiries, address maintenance issues in a timely manner, and provide clear channels for reporting concerns. Good communication can help prevent misunderstandings and cultivate a respectful and cooperative relationship.

4. Implement a thorough maintenance plan: Regularly inspect the property to identify any maintenance or repair needs. Develop a maintenance plan that includes routine tasks, such as landscaping, HVAC system servicing, and regular property inspections. Promptly address any repairs to ensure tenant satisfaction and preserve the condition of the property.

5. Manage finances and expenses: Keep detailed records of rental income, expenses, and other financial transactions. Implement a system for tracking rental payments and issue timely rent reminders. Stay on top of property-related expenses, such as insurance, property taxes, and maintenance costs, to ensure smooth financial management.

6. Stay compliant with local laws and regulations: Familiarize yourself with landlord-tenant laws and regulations in your jurisdiction. Ensure compliance with requirements such as providing proper notice for property entry, adhering to fair housing laws, and properly handling security deposits. Staying informed and compliant will protect both you and your tenants and prevent potential legal issues.

7. Consider professional property management: If managing the rental property becomes overwhelming or you lack the necessary expertise, you may want to consider hiring a professional property management company. Property managers can handle tenant screening, rent collection, maintenance coordination, and other day-to-day responsibilities, allowing you to focus on other aspects of your investment.

Remember, efficient management and regular maintenance are crucial in maintaining the long-term profitability of your rental property. By prioritizing tenant satisfaction, establishing clear communication, and staying proactive with maintenance and financial matters, you can create a positive rental experience for your tenants and ensure the success of your investment.

Conclusion

Investing in rental property with bad credit and limited funds may initially seem challenging, but with the right strategies and careful planning, it is possible to achieve your real estate investment goals. Throughout this article, we have explored various steps and considerations to guide you on this journey.

Understanding the fundamentals of rental property investment, researching real estate markets and properties, and evaluating your financial situation are essential starting points. By conducting comprehensive market research, identifying potential financing options, and exploring creative strategies, you can overcome the obstacles posed by bad credit and limited funds.

Building a strong application for financing, negotiating and closing the purchase, and effectively managing and maintaining the rental property are crucial steps for long-term success. By demonstrating your credibility as a borrower, effectively negotiating the purchase, and proactively managing the property, you can generate steady cash flow and build wealth through rental property investment.

Remember, persistence, creativity, and ongoing education are keys to navigating the challenges of real estate investment. Seek guidance from professionals, stay informed about market trends, and continuously evaluate your investment strategy to adapt to changing circumstances.

Investing in rental property offers numerous benefits, including passive income, potential property appreciation, and tax advantages. With diligence, patience, and a commitment to providing quality housing, you can overcome credit limitations and financial constraints and build a successful rental property portfolio.

Now armed with the knowledge and strategies outlined in this article, take the first step towards purchasing your rental property. So, go forth, evaluate opportunities, secure financing, and take action. Your journey towards financial success and wealth-building through rental property investment starts now!