Finance

What Is An IRS Letter Of Determination?

Modified: February 21, 2024

Learn about IRS letters of determination and how they relate to finance. Understand their significance and implications for tax-exempt status.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finances! In this article, we will delve into the intriguing realm of the IRS Letter of Determination. If you’re not sure what exactly this entails, fear not, for we will guide you through all the essential details. Whether you’re a taxpayer, a financial professional, or simply curious about the inner workings of the IRS, this article is here to shed light on the subject.

As we explore the intricacies of an IRS Letter of Determination, you’ll discover its purpose, who typically receives it, and the various types available. Additionally, we will delve into the importance of this document and the process involved in obtaining it.

Understanding the IRS Letter of Determination is crucial because it can significantly impact a taxpayer’s financial situation. This document may determine their tax-exempt status, charitable contributions, or eligibility for various tax benefits. Therefore, being well-informed about IRS Letters of Determination can help individuals and organizations navigate the complex world of taxation more effectively.

So, without further ado, let’s go on an enlightening journey into the fascinating world of IRS Letters of Determination. Whether you’re a financial enthusiast, a nonprofit organization, or a taxpayer seeking clarity, this article will provide you with the knowledge you need.

Purpose of an IRS Letter of Determination

The purpose of an IRS Letter of Determination is to provide official recognition from the Internal Revenue Service (IRS) regarding a taxpayer’s tax-exempt status or eligibility for certain tax benefits. This letter serves as concrete evidence to confirm an organization’s qualification as a tax-exempt entity under the appropriate section of the Internal Revenue Code.

For nonprofit organizations and charities, an IRS Letter of Determination is vital as it establishes their eligibility to receive tax-deductible donations. It acts as a validation of their nonprofit status, reassuring donors that their contributions will be tax-deductible when filing their tax returns.

In the case of retirement plans, such as employee pension or profit-sharing plans, an IRS Letter of Determination provides assurance that the plan meets the requirements set forth under the Internal Revenue Code. This is crucial because employees who contribute to these plans rely on their tax-favored status to build retirement savings.

Furthermore, an IRS Letter of Determination can also play a significant role in determining an individual’s eligibility for certain tax benefits. This includes eligibility for education-related tax credits or deductions, such as the Lifetime Learning Credit or the American Opportunity Credit, which can help alleviate the financial burden of higher education expenses.

It’s important to note that an IRS Letter of Determination is not a one-time document. While it provides initial recognition of an organization’s tax-exempt status or eligibility for tax benefits, it is subject to periodic review by the IRS.

In summary, the purpose of an IRS Letter of Determination is to provide official confirmation of an organization’s tax-exempt status or eligibility for various tax benefits. This letter serves as crucial documentation for nonprofits, charities, individuals, and retirement plans, ensuring compliance with IRS regulations and offering reassurance to donors and participants alike.

Who Receives an IRS Letter of Determination?

Various entities and individuals can receive an IRS Letter of Determination, depending on their specific circumstances and eligibility for certain tax benefits. Here are the key recipients:

- Nonprofit Organizations: Nonprofit organizations, including charities, foundations, and religious organizations, may receive an IRS Letter of Determination. These organizations must meet certain criteria outlined in the Internal Revenue Code to be recognized as tax-exempt entities. Having this letter is crucial for their operations, as it enables them to solicit tax-deductible donations and qualify for other tax-related benefits.

- Retirement Plans: Employers who sponsor retirement plans, such as pension or profit-sharing plans, can receive an IRS Letter of Determination. This ensures that their plans meet the necessary criteria for favorable tax treatment. Employees who participate in these plans rely on the tax advantages provided, such as tax-deferred contributions and potential tax-free growth, to build their retirement savings.

- Individuals: While not as common as for organizations, individuals may also receive an IRS Letter of Determination. This typically applies to specific tax benefits, such as education-related deductions or credits. For example, individuals may need an IRS Letter of Determination to prove their eligibility for education tax credits, which can help reduce the financial burden of higher education expenses.

- Governmental and Municipal Entities: Government entities, including states, cities, and municipalities, may receive an IRS Letter of Determination confirming their tax-exempt status. This recognition allows them to issue tax-exempt bonds and access other tax advantages when financing public projects or infrastructure development.

It’s important to note that the IRS determines the eligibility and requirements for receiving a Letter of Determination based on specific provisions outlined in the Internal Revenue Code. Each type of eligible recipient must meet the applicable criteria to obtain this official document from the IRS.

Whether you’re a nonprofit organization, an employer sponsoring a retirement plan, an individual seeking tax benefits, or a governmental entity, understanding who can receive an IRS Letter of Determination is essential. Having this letter demonstrates compliance with IRS regulations and establishes eligibility for certain tax-exempt status or benefits.

Types of IRS Letter of Determination

The Internal Revenue Service (IRS) issues various types of Letters of Determination to different entities and individuals based on their specific circumstances. Let’s explore some of the key types:

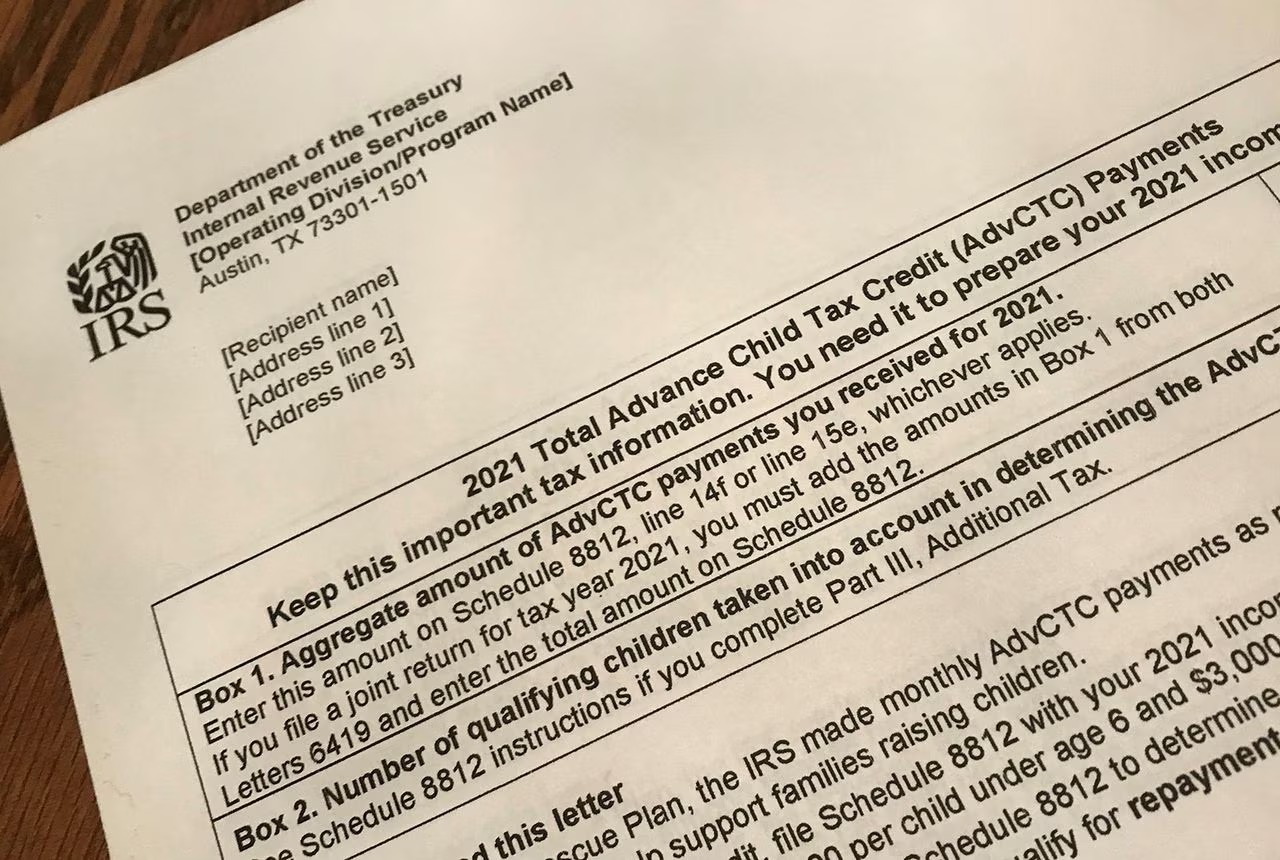

- 501(c)(3) Determination Letter: This is one of the most common types of IRS Letter of Determination and is issued to nonprofit organizations that qualify under section 501(c)(3) of the Internal Revenue Code. It certifies that the organization is exempt from federal income tax and that donors can claim tax deductions for their contributions to the organization.

- Retirement Plan Determination Letter: Employers who sponsor retirement plans, such as pension or profit-sharing plans, can receive a determination letter from the IRS. This letter confirms that the plan meets the necessary requirements under the Internal Revenue Code, ensuring its tax-favored status. It demonstrates that the plan’s participants can enjoy tax benefits such as tax-deferred contributions and potential tax-free growth.

- Private Foundation Determination Letter: Private foundations, which are charitable organizations with a primary focus on making grants to other organizations, may receive a determination letter specific to their status as a private foundation. This letter confirms their tax-exempt status and provides guidance on compliance with additional regulations and limitations applicable to private foundations.

- Education Tax Credit Determination Letter: Individuals who are eligible for education-related tax credits, such as the Lifetime Learning Credit or the American Opportunity Credit, may receive a determination letter from the IRS. This letter confirms their eligibility for these tax credits, which can help offset the costs of higher education expenses.

It’s worth noting that these are just a few examples of the types of IRS Letters of Determination. The IRS issues different letters depending on the specific provisions of the Internal Revenue Code and the unique circumstances of the recipient.

Receiving the appropriate type of IRS Letter of Determination is crucial for the respective entities and individuals. These letters provide official recognition, establish tax-exempt status, confirm eligibility for tax benefits, and offer clear guidance on compliance with IRS regulations. Understanding the different types of IRS Letters of Determination can help taxpayers navigate the complex world of taxation more effectively.

Importance of an IRS Letter of Determination

The IRS Letter of Determination carries significant importance for various entities and individuals due to the following reasons:

- Tax-Exempt Status: For nonprofit organizations, the IRS Letter of Determination is crucial as it establishes their tax-exempt status under the appropriate section of the Internal Revenue Code. This recognition allows them to solicit tax-deductible donations, making it easier to attract donors who can claim tax deductions for their contributions. Without the letter, it would be challenging for nonprofits to demonstrate their eligibility for tax-exempt status and solicit funds effectively.

- Legitimacy and Trust: The IRS Letter of Determination provides legitimacy and builds trust with donors, investors, and stakeholders. Having this official documentation assures them that the organization has undergone rigorous scrutiny by the IRS and meets the necessary requirements for tax-exempt status or eligibility for tax benefits. This transparency increases confidence in the organization’s financial integrity and mission, facilitating greater support and collaboration.

- Compliance with Tax Regulations: The IRS Letter of Determination helps organizations and individuals ensure compliance with IRS regulations. It acts as a guiding document, outlining the specific requirements and limitations related to their tax-exempt status or eligibility for tax benefits. This information helps entities make informed decisions, maintain proper records, and adhere to the necessary reporting obligations to meet IRS standards.

- Tax Deductions and Benefits: For individuals, the IRS Letter of Determination can be vital to claim tax deductions and benefits. It serves as proof of eligibility for specific tax credits or deductions, such as education-related credits, retirement savings contributions, or charitable donations. This letter allows taxpayers to substantiate their claims and maximize their tax savings.

Overall, the IRS Letter of Determination plays a crucial role in enabling organizations and individuals to navigate the complexities of taxation. It provides official recognition, establishes tax-exempt status, builds trust, promotes compliance, and unlocks valuable tax benefits. Understanding the importance of this letter empowers taxpayers to leverage its advantages and ensure smooth interactions with the IRS.

Process of Obtaining an IRS Letter of Determination

The process of obtaining an IRS Letter of Determination can vary depending on the specific circumstances and the type of determination sought. Here are the general steps involved:

- Gather the Necessary Documentation: Start by gathering all the required documentation, such as the organization’s Articles of Incorporation, bylaws, financial statements, and any other relevant supporting documents. These documents will help establish the organization’s eligibility for tax-exempt status or other tax benefits.

- Complete the Application: The next step is to complete the appropriate IRS application form. For example, nonprofit organizations seeking recognition under section 501(c)(3) would complete Form 1023 or Form 1023-EZ. Retirement plans seeking determination would use Form 5300 or Form 5307. Ensure that the application is filled out accurately and provide all necessary details and supporting information.

- Submit the Application: Once the application is complete, it needs to be submitted to the IRS. The submission can be done electronically or through traditional mail, depending on the instructions provided by the IRS. Make sure to include the required fees, if applicable, and follow any specific guidance provided in the application instructions.

- IRS Review and Evaluation: The IRS will review the submitted application and conduct an evaluation to determine if the organization or individual meets the requirements outlined in the Internal Revenue Code. This process includes a thorough examination of the provided documentation and may involve further communication or clarification from the applicant.

- IRS Decision and Letter Issuance: After the review process, the IRS will make a decision and issue the appropriate IRS Letter of Determination. If approved, the letter will confirm the organization’s tax-exempt status or eligibility for tax benefits. In some cases, the IRS may request additional information or make specific recommendations before issuing the letter.

The timeframe for receiving an IRS Letter of Determination can vary depending on the complexity of the application and the workload of the IRS. It is important to note that the process may involve back-and-forth communication with the IRS and can take several months to complete.

It is advisable to consult a tax professional or seek guidance from the IRS website to ensure the proper completion and submission of the application. This will help streamline the process and increase the chances of a successful outcome.

By following these steps and actively engaging with the IRS, organizations and individuals can navigate the process of obtaining an IRS Letter of Determination and reap the benefits of tax-exempt status or eligibility for tax benefits.

Common Issues or Problems with IRS Letters of Determination

While obtaining an IRS Letter of Determination is essential for many organizations and individuals, there are some common issues or problems that can arise during the process. Here are a few examples:

- Application Errors: One common issue is the presence of errors or omissions in the application. Mistakes in providing accurate and complete information, missing supporting documentation, or failing to comply with specific application requirements can delay the review process or result in a denial of the application. It is crucial to carefully review and double-check the application before submission.

- Unfavorable IRS Determination: Sometimes, an organization or individual may receive an unfavorable determination from the IRS, indicating that they do not meet the requirements for tax-exempt status or eligibility for tax benefits. This can be due to various reasons, such as insufficient supporting evidence, failure to meet specific criteria, or the nature of the activities conducted. In such cases, it may be necessary to seek professional guidance and consider appealing the IRS decision.

- Delays in Processing: The process of obtaining an IRS Letter of Determination can be time-consuming, and there may be delays in the review and evaluation phase. This could be due to the volume of applications received by the IRS, staff shortages, or other administrative factors. It is important to be patient and stay in communication with the IRS during this time.

- Incomplete Record-Keeping: Once an organization or individual receives an IRS Letter of Determination, it is crucial to maintain accurate and up-to-date records. This includes proper record-keeping of financial transactions, compliance with reporting requirements, and maintaining records of any changes or updates that may affect the tax-exempt status or eligibility for tax benefits. Failing to maintain complete and organized records can result in complications during audits or subsequent IRS reviews.

- Changes in Circumstances: Organizations and individuals must inform the IRS of any significant changes in their operations, structure, or activities that may impact their tax-exempt status or eligibility for tax benefits. Failure to communicate these changes in a timely manner can lead to issues with the IRS Letter of Determination, as it may no longer accurately reflect the current status or compliance of the entity or individual.

It is crucial to address these common issues or problems proactively to ensure a smoother process and maintain compliance with IRS regulations. Seeking professional advice, engaging in thorough application preparation, and maintaining meticulous record-keeping can help mitigate these potential issues and increase the likelihood of a successful outcome.

Conclusion

The IRS Letter of Determination serves as a vital document for organizations and individuals navigating the complexities of tax-exempt status and eligibility for tax benefits. Understanding its purpose, who receives it, and the types available is crucial for those seeking recognition from the Internal Revenue Service.

Obtaining an IRS Letter of Determination requires careful preparation, accurate documentation, and adherence to IRS guidelines. While there may be common issues or problems that arise during the process, addressing them proactively can help prevent delays or denials.

Once an IRS Letter of Determination is obtained, it provides numerous benefits. For nonprofit organizations, it establishes their tax-exempt status and builds trust with donors, ensuring the legitimacy of their operations. Employers sponsoring retirement plans can rely on the letter to demonstrate compliance with IRS requirements, offering employees the assurance of tax-favored benefits. Individuals can utilize the letter to claim tax deductions or benefits related to education expenses and other eligible circumstances.

However, it is important to remember that the IRS periodically reviews tax-exempt organizations, retirement plans, and other entities to ensure ongoing compliance. Timely communication with the IRS regarding any changes or significant events affecting tax-exempt status or eligibility is crucial to maintain accurate records and avoid complications down the line.

In conclusion, the IRS Letter of Determination plays a vital role in establishing tax-exempt status, confirming eligibility for tax benefits, and fostering transparency and compliance. By understanding its purpose, following the necessary steps, and addressing any potential issues, entities and individuals can successfully navigate the process and harness the advantages conferred by this important document.