Home>Finance>When To Begin Tax Planning Activities – What Age?

Finance

When To Begin Tax Planning Activities – What Age?

Published: January 20, 2024

Learn when is the best age to start tax planning activities and secure your financial future. Get expert advice on finance and tax strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Age 18-22: Entering the workforce and managing basic deductions

- Age 23-34: Maximizing tax-advantaged accounts and investments

- Age 35-49: Optimizing tax strategies for career growth and family planning

- Age 50-64: Preparing for retirement and managing tax implications

- Age 65 and above: Navigating retirement tax strategies and benefits

- Conclusion

Introduction

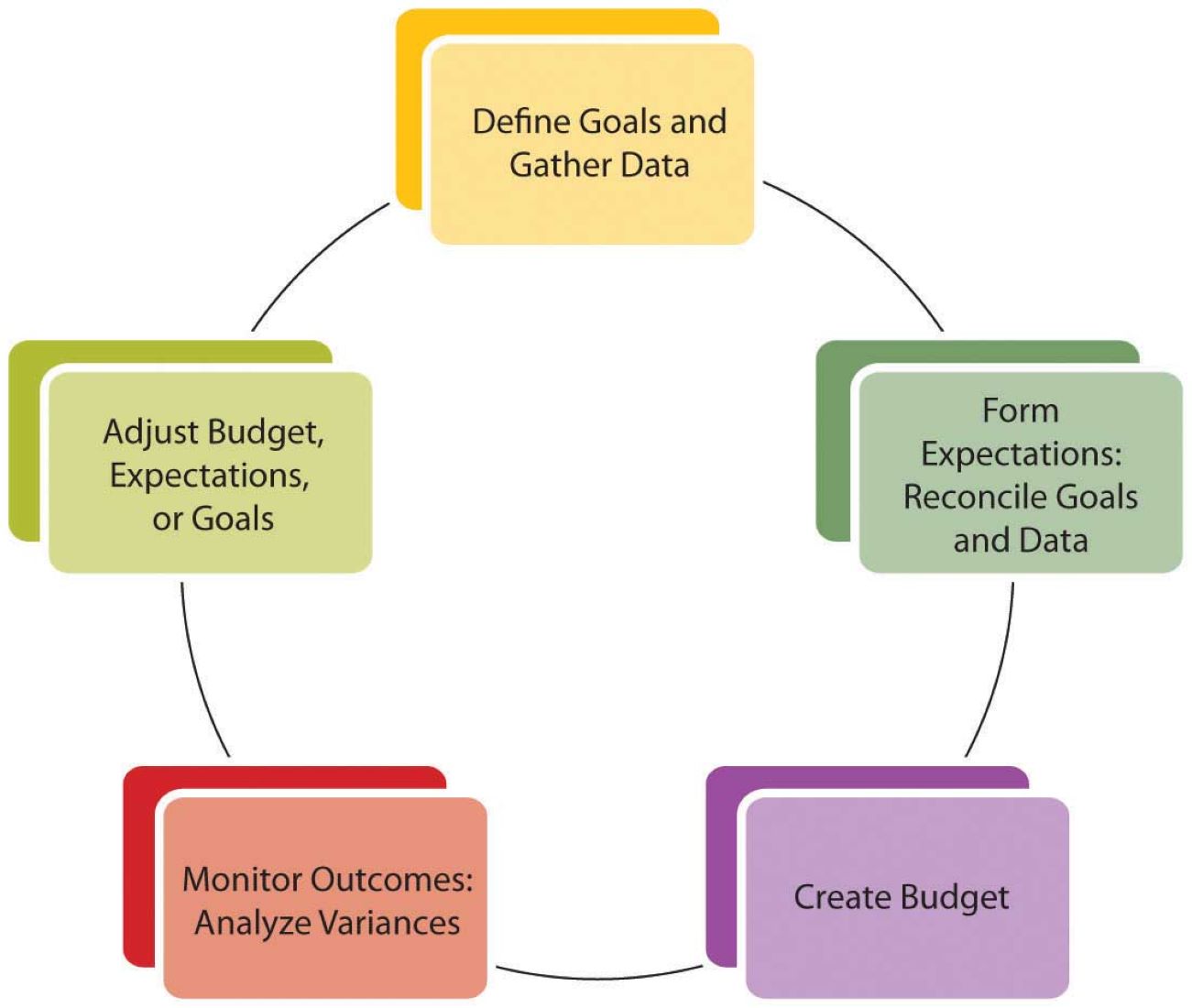

When it comes to tax planning, it’s never too early or too late to start. However, the optimal time to begin tax planning activities can vary depending on your age and life stage. By understanding the different tax implications and strategies applicable at each age range, you can make informed decisions to minimize your tax liabilities and maximize your financial well-being.

Effective tax planning involves taking advantage of deductions, credits, and tax-advantaged accounts to legally reduce the amount of tax you owe. It also entails strategically managing your income, investments, and financial decisions to optimize your tax situation.

This article will guide you through the recommended age ranges for initiating tax planning activities and highlight the key considerations at each stage of life. Whether you’re just entering the workforce, raising a family, planning for retirement, or already enjoying your golden years, there are valuable tax strategies available to help you achieve your financial goals.

It’s important to note that tax laws are subject to change, so it’s always essential to consult with a qualified tax professional before implementing any tax planning strategies.

Age 18-22: Entering the workforce and managing basic deductions

As you embark on your journey into the workforce, it’s crucial to start building a solid foundation for your financial future, including understanding basic tax concepts and utilizing available deductions. While your income may be relatively low during this stage, there are still important considerations to keep in mind.

First and foremost, make sure to file your tax return each year, even if you don’t owe any taxes. Filing allows you to potentially receive a refund if you had any taxes withheld from your paycheck. It also helps establish a positive tax history.

Since you’re likely starting with a limited income, take advantage of deductions that can help reduce your taxable income. For example, if you’re attending college or university, you may be eligible for education-related tax benefits such as the American Opportunity Credit or Lifetime Learning Credit.

If you’re working part-time or have a summer job, consider opening an Individual Retirement Account (IRA). Despite your young age, contributing to an IRA can provide valuable tax advantages. Traditional IRAs offer tax-deferred growth, meaning you won’t pay taxes on the earnings until you withdraw the money in retirement.

Additionally, it’s essential to keep track of any work-related expenses that you incur, such as uniforms or tools. These expenses may be deductible, reducing your taxable income. However, be sure to familiarize yourself with the specific rules and limitations on deductions for your particular situation.

Lastly, if you have student loans, you may be eligible for the student loan interest deduction. This deduction allows you to deduct up to $2,500 of the interest paid on qualified student loans, potentially reducing your tax liability.

In summary, during this stage, focus on understanding basic tax concepts, filing your tax return, and taking advantage of deductions and tax-advantaged accounts available to you. These steps will lay the groundwork for effective tax planning as you progress through different life stages.

Age 23-34: Maximizing tax-advantaged accounts and investments

Between the ages of 23 and 34, you’re likely experiencing significant career growth and financial milestones. This is an ideal time to focus on maximizing tax-advantaged accounts and investments to optimize your tax situation and build long-term wealth.

One of the most powerful tax planning tools available during this stage is the employer-sponsored retirement plan, such as a 401(k) or 403(b). Contributing to these plans can offer multiple benefits. First, your contributions are made on a pre-tax basis, meaning they reduce your taxable income for the year. Second, the earnings in these accounts grow tax-free until you withdraw them in retirement. Lastly, some employers offer matching contributions, which can provide an instant boost to your retirement savings.

Consider contributing enough to your employer-sponsored plan to take full advantage of any matching contributions. This is essentially free money that can significantly accelerate your retirement savings. Additionally, aim to increase your contributions over time as your income rises.

Another tax-advantaged account to consider is a Health Savings Account (HSA), if you have a high-deductible health plan (HDHP). HSAs offer a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. HSAs can help you save for current and future medical expenses while reducing your taxable income.

Investing in a Roth IRA is another effective tax planning strategy during this life stage. While contributions to a Roth IRA are made with after-tax dollars, qualified withdrawals in retirement are tax-free. This can be especially advantageous if you anticipate being in a higher tax bracket in the future.

In addition to tax-advantaged accounts, it’s important to consider tax-efficient investment strategies. For example, focus on holding investments that generate long-term capital gains, as these are generally taxed at lower rates than short-term gains. Also, explore tax-efficient investment vehicles like index funds or ETFs, which tend to have lower turnover and generate fewer taxable events.

Lastly, if you’re considering homeownership, be aware that mortgage interest and property tax deductions can significantly reduce your taxable income. Additionally, recent tax law changes have increased the standard deduction, making it more valuable for some individuals and reducing the need for itemizing deductions.

Overall, during this stage, take advantage of tax-advantaged retirement and health savings accounts, explore Roth IRA contributions, and implement tax-efficient investment strategies. These steps can help you maximize your savings potential and minimize your tax burden, setting you up for a financially secure future.

Age 35-49: Optimizing tax strategies for career growth and family planning

Between the ages of 35 and 49, many individuals experience significant career growth, establish families, and navigate important financial decisions. This life stage presents opportunities to optimize tax strategies that align with your changing circumstances and goals.

As your income increases, it’s essential to evaluate your tax withholding to ensure you’re not overpaying or underpaying your taxes. The goal is to find the right balance to avoid penalties and make the most of your cash flow throughout the year.

If you or your spouse have a stay-at-home parent, consider taking advantage of the spousal IRA contribution. This allows a non-working spouse to contribute to an IRA based on the working spouse’s income. It’s a smart way to boost retirement savings and potentially reduce taxable income.

Another tax planning consideration during this stage is maximizing your eligible deductions and credits. For instance, if you’re paying for child care expenses to enable you and your spouse to work, you may be eligible for the Child and Dependent Care Credit. Additionally, explore the Earned Income Tax Credit (EITC), which can provide a sizable tax credit for qualified lower-income individuals or families.

As your family grows, it’s essential to review your health insurance options. Evaluate whether a flexible spending account (FSA) or a dependent care FSA could help you save on qualifying medical and child care expenses by using pre-tax dollars.

Furthermore, if you’re considering saving for your child’s education, explore tax-advantaged college savings plans such as 529 plans. Contributions to these plans grow tax-free, and qualified withdrawals are not subject to federal income tax, providing a valuable opportunity to save for education expenses while minimizing tax liabilities.

If you’re self-employed or have a side gig, take advantage of business-related deductions to reduce your taxable income. These may include home office expenses, business travel, and professional development costs. Keep meticulous records to support your deductions and consult a tax professional to ensure compliance.

Lastly, consider reviewing your estate planning documents, such as wills and trusts, to ensure they reflect your current wishes and objectives. This is an opportune time to engage in tax planning strategies that can minimize estate taxes and provide for the smooth transition of your assets.

In summary, during this life stage, focus on optimizing your tax strategies by reviewing your withholding, maximizing deductions and credits, exploring tax-advantaged savings plans, and taking advantage of business-related deductions if applicable. By implementing these strategies, you can minimize your tax liabilities and make the most of your hard-earned money, both for your family’s current needs and your future financial security.

Age 50-64: Preparing for retirement and managing tax implications

Between the ages of 50 and 64, retirement is on the horizon, and managing tax implications becomes increasingly important. This life stage presents opportunities to make strategic financial decisions that can optimize your retirement savings while minimizing your tax burden.

One key consideration during this stage is taking advantage of catch-up contributions to retirement accounts. If you’re eligible, you can contribute additional funds to your employer-sponsored retirement plan, such as a 401(k) or 403(b). Catch-up contributions allow you to accelerate your retirement savings and potentially reduce your taxable income.

Consider reviewing your investment portfolio to ensure it aligns with your retirement goals and risk tolerance. As you approach retirement, you may want to rebalance your investments to reduce risk and optimize tax efficiency. Keep in mind that certain types of investment income, such as qualified dividends and long-term capital gains, may be taxed at lower rates.

If you’re self-employed at this stage, explore retirement plan options specifically designed for small business owners, such as a Simplified Employee Pension (SEP) IRA or a solo 401(k). These plans offer tax advantages and allow you to save for retirement while potentially reducing your taxable income.

Another important consideration is managing your distributions in retirement. Once you reach age 59½, you can withdraw funds from your retirement accounts without incurring early withdrawal penalties. However, it’s important to be mindful of the tax implications of these distributions.

If you have a traditional IRA or 401(k), withdrawals are generally taxed as ordinary income. Planning your withdrawals strategically can help minimize the impact on your tax bracket. In some cases, it may be advantageous to consider a Roth IRA conversion, which allows you to convert traditional retirement account funds into a Roth IRA and potentially reduce future tax liabilities.

Additionally, if your health insurance coverage is through a high-deductible health plan (HDHP), you may qualify for a Health Savings Account (HSA). HSAs offer triple tax advantages, providing a tax deduction on contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. HSAs can be a valuable tool to save for healthcare costs in retirement while reducing your taxable income.

Consider reviewing your estate plan and beneficiary designations during this stage. Ensuring that your assets are properly structured and your beneficiaries are up to date can help minimize potential estate taxes and ensure your wishes are carried out.

In summary, during this life stage, maximize catch-up contributions to retirement accounts, review your investment portfolio for tax efficiency, and strategically plan withdrawals from retirement accounts. Explore retirement plan options for self-employed individuals and utilize strategies such as Roth IRA conversions to manage tax implications. Lastly, consider the benefits of HSAs and review your estate plan to minimize taxes and streamline asset distribution.

Age 65 and above: Navigating retirement tax strategies and benefits

Entering the age of 65 and beyond marks a significant milestone as you transition into retirement. At this stage, understanding retirement tax strategies and maximizing benefits become essential to ensure a secure and financially sound future.

One of the key considerations during this life stage is managing your retirement account withdrawals. Required Minimum Distributions (RMDs) typically begin at age 72 for traditional IRAs and employer-sponsored retirement plans. It’s crucial to carefully plan these distributions to avoid penalties and minimize the impact on your taxable income. Consult with a tax professional to determine the optimal withdrawal strategy for your specific situation.

When it comes to Social Security benefits, you become eligible to receive them as early as age 62, but delaying the benefits can significantly increase your monthly payments. Consider the trade-offs between receiving early benefits versus waiting until your Full Retirement Age (FRA) or even further until age 70. Additionally, keep in mind that a portion of your Social Security benefits may be subject to income tax based on your total income.

If you have invested in a Health Savings Account (HSA) during your working years, it can continue to be a valuable tool in retirement. HSAs provide tax advantages, allowing you to pay for qualified medical expenses with tax-free funds. Additionally, after age 65, you can withdraw money from your HSA penalty-free for non-medical expenses, although withdrawals would be subject to income tax.

Avoiding the trap of potential taxes on your Social Security benefits and managing other sources of income can be crucial at this stage. Be mindful of the impact that additional income, such as distributions from retirement accounts, pensions, or annuities, can have on your overall tax liability. Carefully plan these income streams to minimize your taxable income and potentially qualify for tax breaks and credits specifically available to seniors.

If you own a home, it may be beneficial to explore property tax relief or exemption programs available to seniors. Many states offer tax breaks, deferrals, or freezes based on age, income, or residency status. Research the options in your state and take advantage of any benefits you may be eligible for.

Lastly, consider reviewing and updating your estate plan during this life stage. Consult an estate planning attorney to ensure your wishes are reflected in your will, trusts, and beneficiary designations. Proper estate planning can help minimize taxes and ensure a smooth distribution of your assets.

In summary, at age 65 and beyond, navigating retirement tax strategies and benefits becomes paramount. Plan your retirement account withdrawals and Social Security benefits strategically, be aware of potential tax implications, and take advantage of available tax breaks for seniors. Explore property tax relief options and review your estate plan to ensure a seamless transition of assets while minimizing tax liabilities.

Conclusion

Tax planning is a critical component of financial success regardless of your age. By understanding the tax implications and implementing strategic tax strategies, you can minimize your tax liabilities, optimize your savings, and achieve your financial goals. Here’s a recap of the key considerations at each life stage:

- Age 18-22: Focus on understanding basic tax concepts, filing your tax return, and taking advantage of deductions and tax-advantaged accounts available to you.

- Age 23-34: Maximize contributions to tax-advantaged accounts, such as employer-sponsored retirement plans and HSAs. Consider Roth IRA contributions and invest in a tax-efficient manner.

- Age 35-49: Optimize tax strategies by maximizing deductions and credits, exploring college savings plans, reviewing health insurance options, and taking advantage of business-related deductions.

- Age 50-64: Make catch-up contributions to retirement accounts, rebalance investments, strategically plan retirement account withdrawals, and consider estate planning implications.

- Age 65 and above: Manage retirement account distributions, understand the tax implications of Social Security benefits, leverage HSAs, be mindful of income sources, explore property tax relief, and review estate planning.

Remember that tax laws can change, and it’s crucial to consult with a qualified tax professional who can guide you through the intricacies of the tax code and help tailor strategies to your specific financial situation.

By proactively managing your taxes at each life stage, you can maximize your resources, protect your financial well-being, and pave the way for a successful and fulfilling financial future.