Finance

How To Calculate 18% Per Annum Late Fee

Published: February 22, 2024

Learn how to calculate an 18% per annum late fee and manage your finances effectively with this comprehensive guide. Understanding finance made simple!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Late fees are charges imposed on individuals or businesses for failing to make a payment by the specified due date. These fees serve as a deterrent to encourage timely payments and compensate the creditor for the inconvenience caused by the delay. One common type of late fee is the 18% per annum late fee, which is often applied to outstanding balances on loans, credit cards, or invoices.

Understanding how to calculate the 18% per annum late fee is crucial for both creditors and debtors. Creditors need to know how to apply the fee accurately, while debtors benefit from understanding the potential financial implications of late payments. In this article, we will delve into the intricacies of the 18% per annum late fee, exploring its calculation and providing practical examples to illustrate its impact.

By gaining insight into the mechanics of this late fee, individuals and businesses can make informed decisions regarding their financial obligations and better comprehend the significance of timely payments. Whether you are a creditor seeking to enforce late payment penalties or a debtor striving to avoid accruing excessive charges, mastering the calculation of the 18% per annum late fee is a valuable skill that can contribute to sound financial management.

Understanding the 18% Per Annum Late Fee

Before delving into the specifics of calculating the 18% per annum late fee, it’s essential to grasp the fundamental concept behind this financial penalty. The term “per annum” indicates that the fee is calculated on an annual basis. In the context of late fees, it signifies that the 18% charge is applied to the outstanding balance each year that the payment remains overdue.

The 18% per annum late fee is a significant penalty that can substantially increase the total amount owed over time. This fee structure is commonly employed in various financial agreements, such as loan contracts, credit card terms, and commercial invoices. Creditors utilize this mechanism to incentivize prompt payments and mitigate the impact of delayed remittances on their cash flow.

It’s important to note that the 18% per annum late fee is typically compounded, meaning that the fee is calculated not only on the original overdue amount but also on any previously accrued late fees. As a result, the total late fee can escalate rapidly if the payment remains outstanding for an extended period.

Understanding the implications of the 18% per annum late fee empowers debtors to appreciate the potential financial repercussions of delayed payments. By recognizing the compounding nature of this penalty, debtors can make informed decisions regarding the urgency of settling their outstanding balances to minimize the impact of accruing additional fees.

Furthermore, creditors must ensure that the application of the 18% per annum late fee complies with relevant laws and regulations governing late payment penalties. Adhering to legal requirements and clearly communicating the terms of late fees to debtors is crucial for maintaining transparency and fostering trust in financial transactions.

Having a comprehensive understanding of the 18% per annum late fee sets the stage for effectively calculating and managing this financial penalty. In the following section, we will explore the step-by-step process of determining the amount of the late fee and examine practical examples to illustrate its real-world application.

Calculating the 18% Per Annum Late Fee

Calculating the 18% per annum late fee involves a straightforward yet crucial process that enables creditors to determine the additional amount owed due to late payments. The formula for computing this late fee is relatively simple, comprising the overdue amount and the applicable interest rate.

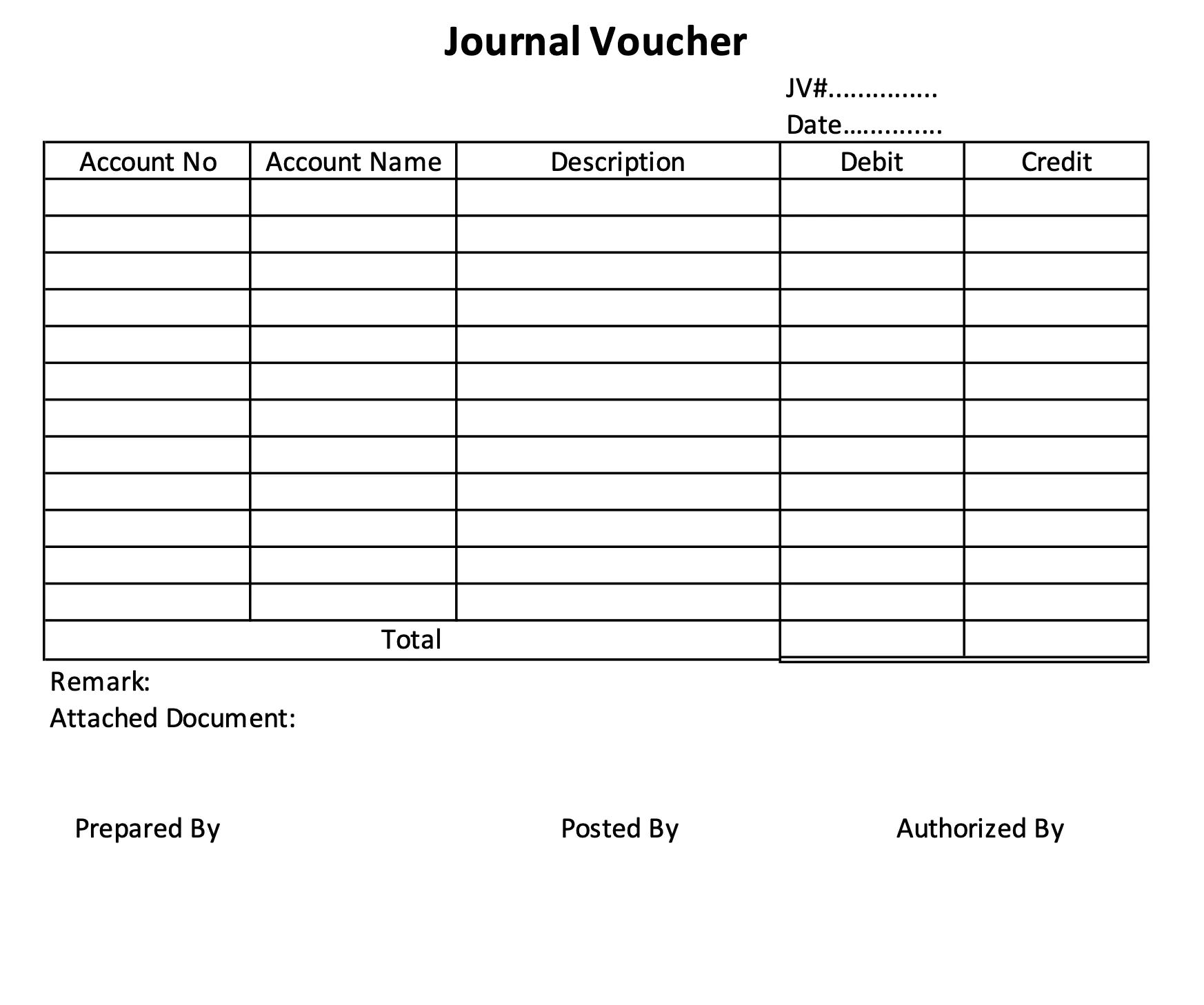

To calculate the 18% per annum late fee, the following formula is utilized:

Late Fee = Principal Amount × Rate × Time

Where:

- Principal Amount: The outstanding balance that has not been paid by the due date.

- Rate: The annual interest rate, which in this case is 18% or 0.18 when expressed as a decimal.

- Time: The duration for which the payment remains overdue, typically expressed in years for annual calculations.

By applying this formula, creditors can ascertain the specific amount of the late fee attributable to the delayed payment. It’s important to note that the time component in the formula is crucial for determining the cumulative impact of the late fee over extended periods of non-payment.

Additionally, as the 18% per annum late fee is often compounded, creditors may need to factor in the previously accrued late fees when recalculating the total amount owed. This compounding nature amplifies the financial consequences of prolonged delinquency, emphasizing the importance of promptly addressing outstanding balances to mitigate escalating late fees.

Understanding the calculation process empowers both creditors and debtors to navigate late fee assessments with clarity and precision. For creditors, proficiency in computing the 18% per annum late fee ensures accurate and transparent imposition of penalties, fostering responsible financial practices. Debtors, on the other hand, benefit from comprehending the methodology behind late fee calculations, enabling them to make informed decisions regarding the prioritization of overdue payments and the mitigation of accruing additional charges.

Armed with the knowledge of how to calculate the 18% per annum late fee, individuals and businesses can navigate financial transactions with heightened awareness of the potential implications of delayed payments. In the subsequent section, we will elucidate the application of this calculation through practical examples, shedding light on its real-world impact.

Example Scenarios

Illustrating the application of the 18% per annum late fee through practical scenarios provides valuable insight into its real-world impact on outstanding balances. The following examples showcase how this late fee is calculated and its cumulative effect over time, shedding light on the financial consequences of delayed payments.

Scenario 1: Credit Card Late Payment

John has an outstanding credit card balance of $1,000, and the due date for the payment was 30 days ago. If the credit card company imposes an 18% per annum late fee, the calculation would be as follows:

Late Fee = $1,000 × 0.18 × (30/365) ≈ $14.79

In this scenario, the late fee for a 30-day delinquency amounts to approximately $14.79. However, it’s important to note that this fee will continue to accrue and compound if the payment remains overdue in subsequent months, leading to a substantial increase in the total amount owed over time.

Scenario 2: Loan Repayment Default

Sarah has defaulted on a loan repayment, resulting in an outstanding balance of $5,000. With an 18% per annum late fee, the calculation for the late fee after 90 days of non-payment would be:

Late Fee = $5,000 × 0.18 × (90/365) ≈ $219.18

In this instance, the late fee for a 90-day delinquency amounts to approximately $219.18. As with the credit card scenario, the compounding nature of the late fee means that this amount will escalate significantly if the overdue payment persists, underscoring the financial impact of prolonged delinquency.

These examples vividly demonstrate the tangible consequences of the 18% per annum late fee on overdue balances. By comprehending the calculation process and witnessing its application in practical scenarios, individuals and businesses gain a deeper appreciation of the imperative of timely payments and the potential financial burden incurred through delayed remittances.

Understanding these implications can inform responsible financial decision-making, prompting proactive measures to address overdue payments and minimize the accumulation of substantial late fees. In the subsequent section, we will summarize the key insights gleaned from the exploration of the 18% per annum late fee and its calculation, encapsulating its significance in the realm of financial management.

Conclusion

The 18% per annum late fee is a consequential aspect of financial transactions, serving as a mechanism to incentivize timely payments and compensate creditors for the impact of delayed remittances. By delving into the intricacies of this late fee and elucidating its calculation, we have unveiled the pivotal role it plays in shaping responsible financial behavior and managing outstanding balances.

Understanding the 18% per annum late fee empowers both creditors and debtors to navigate financial obligations with clarity and foresight. Creditors equipped with the knowledge of accurately computing this late fee can uphold transparent and equitable practices in imposing penalties for late payments. Meanwhile, debtors armed with an awareness of the potential financial implications of delayed payments can make informed decisions to prioritize settling outstanding balances and mitigate the accrual of substantial late fees.

Through practical examples, we have witnessed the tangible impact of the 18% per annum late fee on overdue balances, underscoring the significance of timely payments and the potential financial burden incurred through prolonged delinquency. These insights illuminate the imperative of addressing overdue payments promptly to avert the escalation of late fees and preserve financial well-being.

In essence, mastering the calculation of the 18% per annum late fee is a valuable skill that contributes to sound financial management and fosters responsible financial conduct. By embracing transparency, clarity, and proactive measures in addressing late payments, individuals and businesses can navigate financial transactions with prudence and mitigate the adverse effects of delayed remittances.

Ultimately, the comprehension of the 18% per annum late fee and its calculation engenders a culture of financial responsibility, underpinning the stability and integrity of monetary transactions. Armed with this knowledge, individuals and businesses are better equipped to uphold financial commitments, mitigate the impact of late payments, and cultivate a thriving financial ecosystem built on accountability and foresight.