Finance

How To Calculate Monthly Interest From APR

Published: March 2, 2024

Learn how to calculate monthly interest from APR in finance. Discover the formula and steps for accurate interest calculations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Monthly Interest Calculation

When it comes to managing personal finances, understanding how interest works is crucial. Whether you’re considering a loan, mortgage, or credit card, the concept of Annual Percentage Rate (APR) plays a pivotal role in determining the total amount you’ll repay. APR represents the annual cost of borrowing and includes both the interest and any additional fees associated with the loan. However, to gain a comprehensive understanding of how APR impacts your finances, it’s essential to delve into the specifics of calculating monthly interest from the APR.

By grasping the methodology behind this calculation, individuals can make informed decisions regarding their financial commitments. Whether you’re planning for a major purchase, seeking a loan, or aiming to manage existing debt more effectively, knowing how to calculate monthly interest from APR empowers you to assess the true cost of borrowing and plan your finances strategically.

Throughout this article, we will explore the intricacies of APR and guide you through the process of calculating monthly interest. By the end, you’ll have a clear understanding of how this calculation can impact your financial decisions and the overall management of your monetary resources.

Understanding APR

Deciphering the Significance of Annual Percentage Rate

Annual Percentage Rate (APR) serves as a vital metric when evaluating the cost of borrowing. It encompasses not only the interest accrued on a loan but also any additional fees, making it a comprehensive indicator of the total cost of credit over a year. Understanding APR is essential for individuals navigating the realm of personal finance, as it directly influences the affordability and feasibility of various borrowing options.

APR is expressed as a percentage and provides a standardized platform for comparing the costs of different loan products. By law, lenders are mandated to disclose the APR associated with their offerings, enabling consumers to make informed decisions when selecting financial products. This transparency empowers individuals to assess the true cost of borrowing and make comparisons across various loan options, ultimately aiding them in securing the most favorable terms.

It’s important to note that while APR offers valuable insights into the overall cost of credit, it may not fully capture the nuances of certain lending arrangements. For instance, variable-rate loans or those with promotional introductory rates may present complexities that warrant additional scrutiny beyond the APR. Nevertheless, for standard fixed-rate loans, the APR serves as a reliable benchmark for evaluating the long-term financial implications of borrowing.

Furthermore, understanding the components that contribute to the APR is paramount. In addition to the interest rate, the APR encompasses various fees, such as origination fees, points, and mortgage insurance. By factoring in these additional costs, the APR provides a holistic representation of the financial commitment associated with a loan, offering a more accurate assessment of the borrower’s obligations.

By comprehending the significance of APR, individuals can navigate the borrowing landscape with confidence, armed with the knowledge to assess the true cost of credit and make informed financial decisions.

Calculating Monthly Interest from APR

Unveiling the Methodology

When it comes to understanding the financial implications of borrowing, calculating the monthly interest from the Annual Percentage Rate (APR) is a fundamental aspect. This calculation provides clarity on the ongoing cost of borrowing and aids in budgeting and financial planning. To demystify this process, it’s essential to comprehend the formula for deriving the monthly interest from the APR.

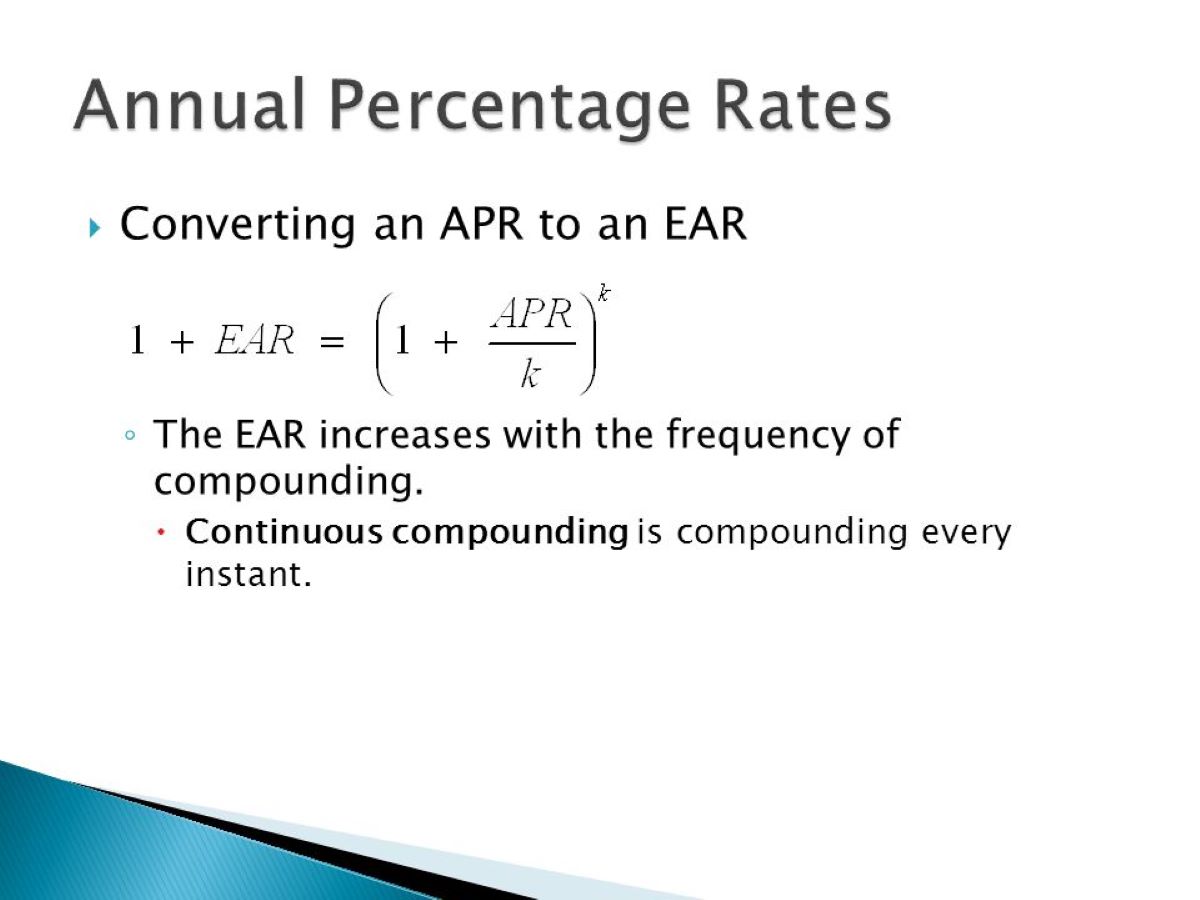

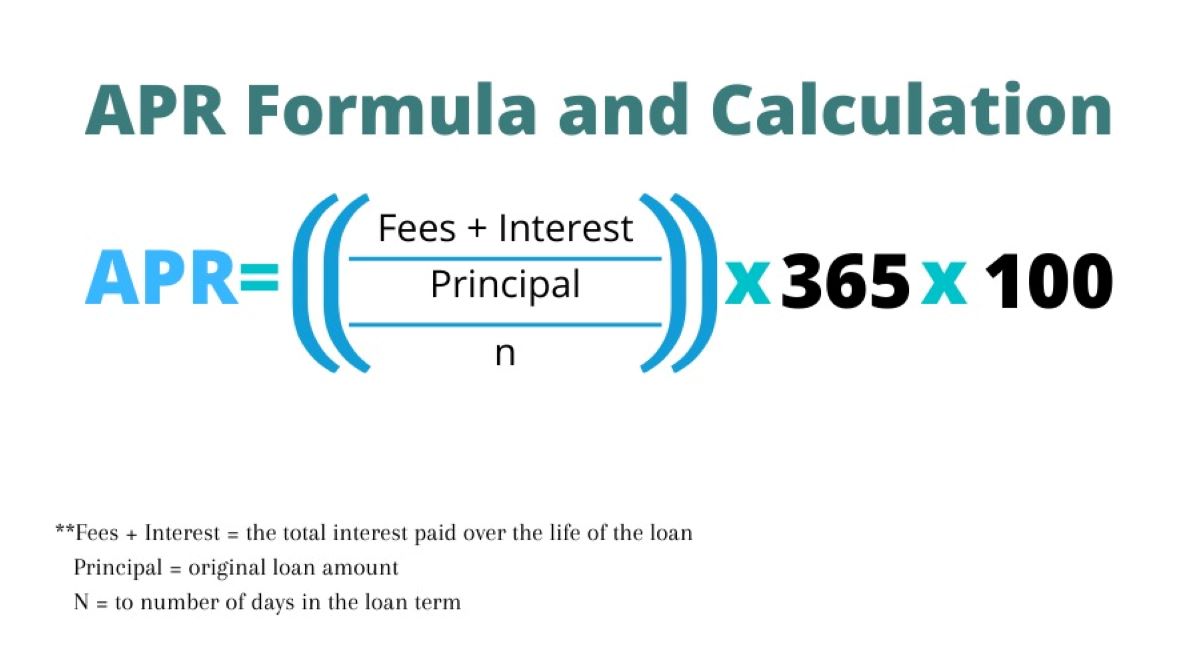

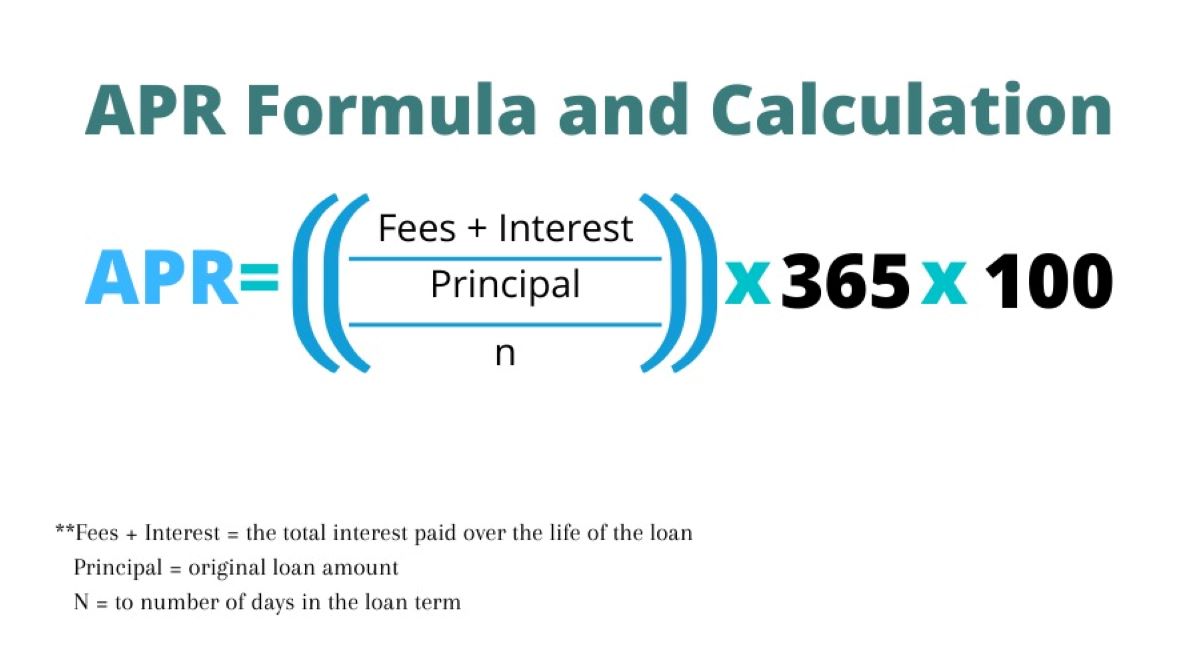

The first step in this calculation involves converting the APR from an annual percentage to a monthly rate. This is achieved by dividing the APR by 12, as there are 12 months in a year. The resulting figure represents the monthly interest rate, which serves as the basis for subsequent calculations.

Once the monthly interest rate is determined, it is applied to the outstanding balance of the loan or credit amount to ascertain the interest accrued for that specific month. This simple interest calculation involves multiplying the monthly interest rate by the outstanding principal amount, yielding the monthly interest due.

It’s important to note that as the outstanding balance decreases over time, the amount of interest accrued each month also diminishes. This is a pivotal aspect of loan repayment, as it signifies progress in reducing the overall interest burden and moving closer to debt freedom.

By gaining proficiency in this calculation, individuals can gain insights into the ongoing financial obligations associated with their borrowing, enabling them to make informed decisions and manage their resources effectively. Moreover, this knowledge empowers borrowers to assess the impact of varying loan terms and interest rates, facilitating the selection of the most favorable financial arrangements.

Understanding how to calculate monthly interest from APR equips individuals with a valuable tool for evaluating the true cost of borrowing and navigating the intricacies of personal finance with confidence.

Example Calculation

Illustrating the Application of Monthly Interest Calculation

To elucidate the process of calculating monthly interest from the Annual Percentage Rate (APR), let’s consider a hypothetical scenario. Suppose an individual has obtained a loan with an APR of 5% and a principal amount of $10,000. By applying the formula for deriving the monthly interest, we can gain a clear understanding of the monthly financial implications of this borrowing arrangement.

Firstly, to convert the APR to a monthly interest rate, we divide the annual percentage rate by 12. In this case, 5% divided by 12 yields a monthly interest rate of approximately 0.4167%.

Subsequently, to calculate the monthly interest accrued on the $10,000 principal, we multiply the outstanding balance by the monthly interest rate. This results in a monthly interest amount of approximately $41.67.

As the loan is repaid, the outstanding balance decreases, leading to a reduction in the monthly interest accrued. For instance, if the outstanding balance decreases to $9,000, the monthly interest would amount to approximately $37.50, reflecting the diminishing interest burden as the principal is gradually repaid.

This example underscores the practical application of the monthly interest calculation, offering insight into the ongoing cost of borrowing and the dynamics of interest accrual over the course of loan repayment. By comprehending this process, individuals can make informed financial decisions and gain clarity on the true cost of credit, thereby fostering effective financial planning and management.

Conclusion

Empowering Financial Decision-Making

Understanding how to calculate monthly interest from the Annual Percentage Rate (APR) is a pivotal skill that equips individuals with the knowledge to assess the true cost of borrowing and make informed financial decisions. By unraveling the methodology behind this calculation, borrowers gain valuable insights into the ongoing financial obligations associated with their loans, mortgages, or credit cards.

Through the process of converting the APR to a monthly interest rate and applying it to the outstanding balance, individuals can gauge the monthly interest accrued, fostering a deeper comprehension of the financial implications of their borrowing arrangements. This proficiency empowers borrowers to budget effectively, plan for the long-term financial impact of their loans, and strategically manage their resources.

Moreover, the ability to calculate monthly interest from APR facilitates the comparison of various loan options, enabling individuals to select the most favorable terms and minimize the overall cost of credit. By leveraging this knowledge, borrowers can navigate the complex landscape of personal finance with confidence, ensuring that their financial decisions align with their long-term goals and aspirations.

Ultimately, mastering the calculation of monthly interest from APR empowers individuals to take control of their financial well-being, fostering a proactive approach to managing debt, making informed borrowing decisions, and optimizing their overall financial health.

By arming themselves with this essential knowledge, individuals can embark on their financial journeys with clarity and confidence, equipped to navigate the intricacies of borrowing and make choices that align with their broader financial objectives.