Finance

How To Calculate Student Loan Payments For FHA

Published: October 20, 2023

Calculate your student loan payments for FHA with this step-by-step guide. Get a handle on your finances and plan ahead for a brighter future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding FHA Student Loans

- Factors Affecting Student Loan Payments

- Calculating Student Loan Payments for FHA

- Step 1: Gather Information

- Step 2: Determine Loan Type

- Step 3: Calculate Monthly Payment

- Step 4: Adjust for Income-Driven Repayment Plans

- Step 5: Consider Loan Forgiveness Programs

- Step 6: Review and Refine Your Calculation

- Conclusion

Introduction

Student loans can be a significant financial burden for many individuals, hindering their ability to achieve their goals, such as buying a home. However, if you have an FHA loan, there are specific guidelines and calculations that can help you determine your student loan payments and ultimately qualify for a mortgage.

Understanding how to calculate student loan payments for an FHA loan is crucial, as it allows you to have a clear idea of your debt-to-income ratio and determine your eligibility for a mortgage. This article will guide you through the process of calculating your student loan payments and provide insights into important factors to consider.

When it comes to FHA loans, the Federal Housing Administration (FHA) provides mortgage insurance to lenders, allowing them to offer loans with lower down payments and more flexible qualification criteria. However, the presence of outstanding student loans can significantly impact your ability to qualify for an FHA loan.

Calculating your student loan payments is essential for two reasons: firstly, it helps you understand your ongoing financial obligations and plan your budget accordingly, and secondly, it helps determine your eligibility for an FHA loan based on your debt-to-income (DTI) ratio. The DTI ratio compares your monthly debt payments to your gross monthly income and is a crucial factor in the mortgage approval process.

In the following sections, we will delve deeper into the specifics of calculating student loan payments for an FHA loan, including the factors that affect these payments and the steps you need to follow to calculate them accurately.

Understanding FHA Student Loans

Before diving into calculating student loan payments for FHA loans, it’s important to have a solid understanding of what FHA student loans are and how they differ from other types of loans.

FHA student loans are loans that are backed by the Federal Housing Administration (FHA) and are specifically designed to assist individuals in financing their education. These loans come with certain benefits, such as lower interest rates, more flexible repayment options, and potential loan forgiveness programs. However, they can also have a significant impact on your financial obligations, especially when it comes to qualifying for a mortgage.

Unlike traditional student loans, which have a fixed repayment schedule, FHA student loans offer several repayment options, including income-driven repayment plans. These plans base your monthly payments on your income and family size, making them more manageable for borrowers who may have lower incomes or other financial obligations.

It’s important to note that FHA student loans are considered part of your debt-to-income ratio when applying for an FHA loan. This means that lenders will take into account your monthly student loan payments when determining your ability to make mortgage payments in addition to your other financial obligations.

Additionally, if you are enrolled in an income-driven repayment plan, lenders may use either your actual monthly payment or a calculated payment based on a percentage of your outstanding student loan balance, depending on which option best represents your financial situation.

Understanding the intricacies of FHA student loans is crucial as you navigate the process of calculating your student loan payments for an FHA loan. By having a clear understanding of how these loans impact your financial obligations and your overall eligibility for a mortgage, you can better plan and prepare for homeownership.

Factors Affecting Student Loan Payments

When calculating student loan payments for FHA loans, there are several factors that can influence the amount you are required to pay each month. Understanding these factors is essential in accurately determining your monthly student loan payment and assessing your eligibility for an FHA loan.

1. Loan Balance: The total amount of your student loan balance directly impacts your monthly payment. Typically, a higher loan balance will result in larger monthly payments.

2. Interest Rate: The interest rate on your student loan affects how much interest accrues each month. Higher interest rates will result in higher monthly payments.

3. Repayment Plan: The repayment plan you choose can significantly impact your monthly student loan payments. Standard repayment plans have a fixed monthly payment amount, while income-driven repayment plans calculate your payment based on your income and family size.

4. Loan Term: The length of your repayment period can affect your monthly payment. Longer repayment terms generally result in smaller monthly payments, but you may end up paying more interest over the life of the loan.

5. Income: If you are on an income-driven repayment plan, your income will play a crucial role in determining your monthly payment. Generally, your payment will be a percentage of your discretionary income.

6. Family Size: Some income-driven repayment plans take into account your family size when calculating your monthly payment. A larger family size may result in a lower monthly payment.

It’s important to note that these factors can vary depending on the specific terms of your student loan and the repayment plan you are enrolled in. It’s crucial to review your loan documents and consult with your loan servicer to ensure you have the most accurate information when calculating your student loan payments.

By considering these factors and understanding how they impact your monthly student loan payments, you can more accurately determine your debt-to-income ratio and assess your eligibility for an FHA loan. This knowledge will also help you plan your budget and make informed decisions about your finances.

Calculating Student Loan Payments for FHA

Calculating student loan payments for FHA loans requires attention to detail and accurate information to ensure an accurate assessment of your financial obligations. The steps outlined below will guide you through the process:

Step 1: Gather Information: Start by gathering all the necessary information about your student loans, including the loan balance, interest rate, and repayment plan details. Collecting this information will help you make precise calculations.

Step 2: Determine Loan Type: Identify the type of student loan you have, as different loan types may have distinct requirements and repayment plans. For example, federal loans and private loans may have different terms and repayment options.

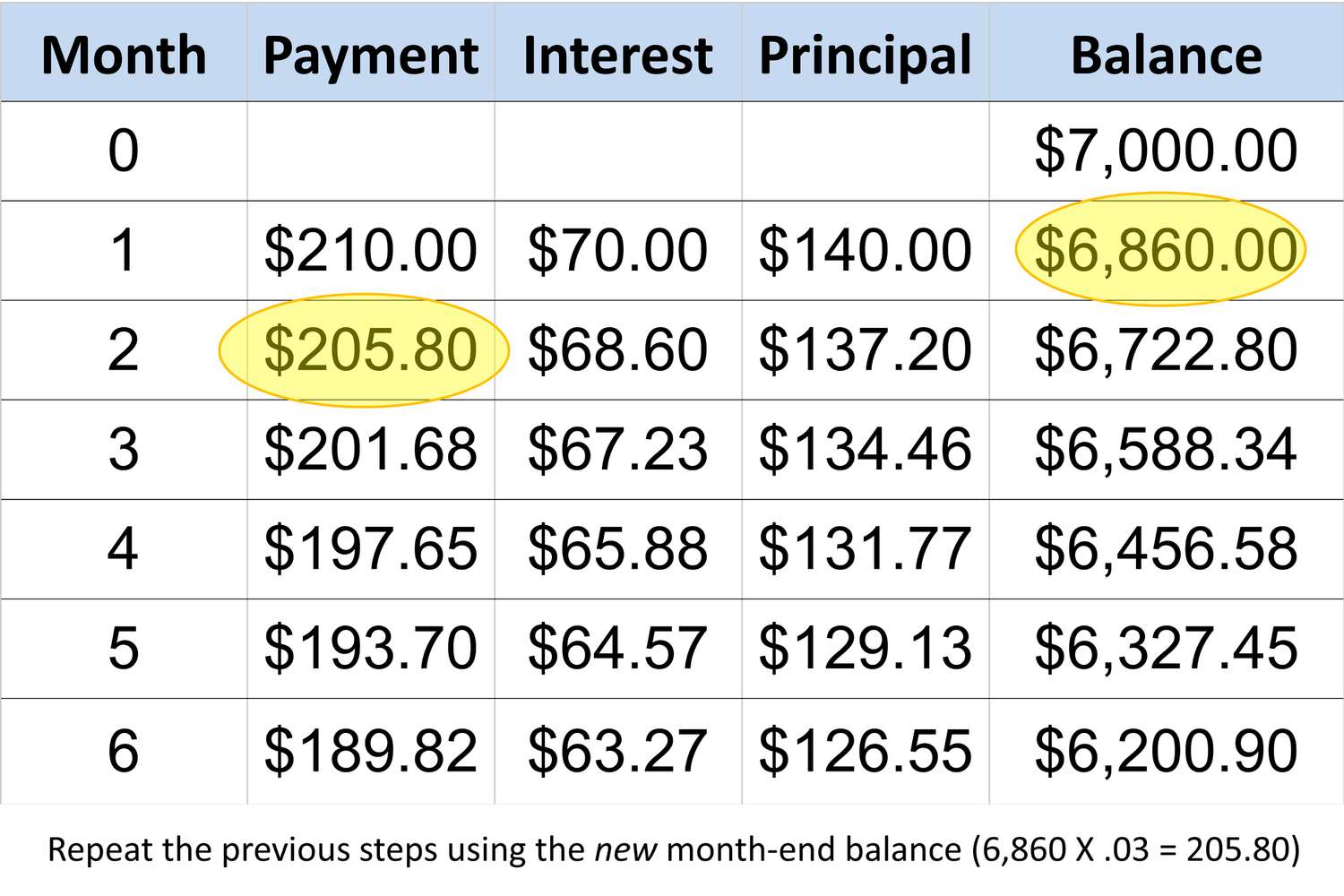

Step 3: Calculate Monthly Payment: Use the loan balance, interest rate, and loan term to calculate the monthly payment amount. Consult online calculators or use the loan servicer’s website to accurately determine this figure.

Step 4: Adjust for Income-Driven Repayment Plans: If you are on an income-driven repayment plan, your monthly payment amount may be based on a percentage of your discretionary income. Consult with your loan servicer or use online calculators specific to income-driven repayment plans to determine the exact amount.

Step 5: Consider Loan Forgiveness Programs: If you are eligible for any loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness, take them into account when calculating your student loan payments. Loan forgiveness can significantly impact your long-term financial obligations.

Step 6: Review and Refine Your Calculation: Double-check all the calculations, ensuring that you have accounted for all factors, including interest rates, repayment plans, and loan forgiveness programs. It’s essential to have accurate figures to assess your eligibility for an FHA loan.

By following these steps, you can calculate your student loan payments accurately for an FHA loan. Keep in mind that these calculations are a crucial aspect of determining your debt-to-income ratio, which is a vital factor for FHA loan qualification. Understanding your student loan payments will help you plan your budget and make informed decisions regarding your homeownership goals.

Step 1: Gather Information

The first step in calculating your student loan payments for an FHA loan is to gather all the necessary information about your student loans. Having accurate and up-to-date information is essential for making precise calculations and assessing your financial obligations.

Here’s a checklist of the information you need to collect:

- Loan Balance: Determine the total outstanding balance on your student loans. This information can typically be found on your loan servicer’s website or by contacting them directly.

- Interest Rate: Note the interest rate on your student loans. This information is crucial as it directly affects the amount of interest that accumulates monthly and, in turn, impacts your monthly payment.

- Repayment Plan: Identify the repayment plan you are currently enrolled in. Different repayment plans may have varying monthly payment calculations, so be sure to know which plan you are on.

- Loan Term: Determine the length of your repayment period. This can vary depending on the type of loan and repayment plan you have chosen.

- Income: If you are on an income-driven repayment plan, gather information about your current income. This includes your gross monthly income and any additional sources of income you may have.

- Family Size: Some income-driven repayment plans consider your family size when calculating your monthly payment amount. Ensure you have an accurate count of your household members.

By gathering this information, you will have a comprehensive overview of your student loans and the necessary details to proceed with calculating your student loan payments for an FHA loan. Remember to verify the accuracy of the information provided and keep it easily accessible for future reference.

It is also helpful to be aware of any changes in your loan terms or repayment plans. Loan servicers may periodically update interest rates or offer options for changing repayment plans. Staying informed about any modifications can help you plan your finances more effectively and accurately calculate your student loan payments.

Step 2: Determine Loan Type

Once you have gathered all the necessary information about your student loans, the next step in calculating your student loan payments for an FHA loan is to determine the type of loan you have. Different loan types may have specific requirements and repayment options that will impact your overall calculations.

Here are some common loan types you may come across:

- Federal Loans: These loans are provided by the U.S. Department of Education and include Direct Stafford Loans, Direct PLUS Loans, and Perkins Loans. Federal loans often offer various repayment plans, such as standard repayment, graduated repayment, income-driven repayment, and more.

- Private Loans: These loans are offered by private lenders, such as banks, credit unions, or online lending platforms. Private loans may have different terms and repayment options compared to federal loans. It’s important to review the loan terms and contact your lender for specific repayment details.

- Consolidated Loans: If you have consolidated your student loans, either through a federal loan consolidation program or with a private lender, you will need to consider the terms and repayment options specific to the consolidated loan.

Understanding the type of loan you have is crucial because each loan type may have different requirements for calculating student loan payments. For example, federal loans offer income-driven repayment plans, which may result in lower monthly payments based on your income and family size. Private loans, on the other hand, may have fixed repayment plans with set monthly payment amounts.

Review your loan documents or contact your loan servicer to determine the specific loan type and any relevant details. This information will guide you in accurately calculating your student loan payments and assessing your eligibility for an FHA loan.

It’s important to note that while FHA loans generally have specific guidelines for calculating student loan payments, the loan type itself does not disqualify you from obtaining an FHA loan. However, factors such as the monthly payment amount and your overall debt-to-income ratio will be considered during the mortgage approval process.

By determining your loan type, you can gain a clear understanding of the repayment options available to you and proceed with calculating your student loan payments for an FHA loan more accurately.

Step 3: Calculate Monthly Payment

After gathering information about your student loans and determining the loan type, the next step in calculating your student loan payments for an FHA loan is to determine the monthly payment amount. This calculation will give you an idea of the financial obligation you have towards your student loans.

To calculate the monthly payment, you will need to consider the loan balance, interest rate, and loan term. There are several methods you can use to calculate the monthly payment:

- Loan Servicer: Check with your loan servicer. They may provide you with the exact monthly payment amount. This is often the most accurate method, as they have the most up-to-date information regarding your loan terms.

- Online Calculators: Utilize online calculators that are specifically designed to calculate student loan payments. These calculators typically require you to input your loan balance, interest rate, and loan term to generate the monthly payment amount. There are many reliable calculators available on financial websites and loan servicer websites.

- Manual Calculation: If you prefer a more hands-on approach, you can calculate the monthly payment manually using loan payment formulas. This requires knowledge of mathematical formulas and can be time-consuming. However, it allows you to have full control over the calculation process.

Regardless of the method you choose, make sure to input accurate information to obtain an accurate monthly payment amount. Small errors or incorrect numbers can lead to significant discrepancies in the calculated payment amount.

Keep in mind that if you have multiple student loans, you may need to calculate the monthly payment for each loan separately and then sum them up to determine your total student loan payment.

Calculating your monthly payment gives you a clear understanding of your financial commitment and helps you assess your ability to manage your student loan payments alongside other expenses. This information is crucial for determining your debt-to-income ratio, which is a vital factor when applying for an FHA loan.

Remember to regularly review your student loan statements and loan terms, as interest rates or repayment plans may change over time. Stay informed about any modifications that may affect your monthly payment amount and adjust your calculations accordingly.

Step 4: Adjust for Income-Driven Repayment Plans

If you are enrolled in an income-driven repayment plan for your student loans, it’s important to adjust your calculations to account for these specific repayment terms. Income-driven repayment plans base your monthly payment amount on a percentage of your discretionary income, making them more manageable for borrowers with lower incomes or significant financial obligations.

Here’s how you can adjust your calculations for income-driven repayment plans:

- Identify Your Repayment Plan: Determine which income-driven repayment plan you are enrolled in. Common plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

- Understand The Payment Calculation: Each income-driven repayment plan has a unique calculation method for determining the monthly payment amount. For example, IBR typically calculates the monthly payment as 10 to 15% of your discretionary income, while PAYE and REPAYE may calculate it as 10% or 10% of your discretionary income, respectively.

- Factor In Your Income and Family Size: To calculate the monthly payment accurately, you will need to consider your income and family size. If your income or family size changes, this will have an impact on your monthly payment calculation. Consult the guidelines specific to your repayment plan or use online calculators provided by loan servicers to determine your revised monthly payment amount.

By adjusting your calculations for income-driven repayment plans, you can get a more accurate picture of your monthly student loan payment amount. This is crucial for determining your debt-to-income ratio, which is an essential factor in qualifying for an FHA loan.

Keep in mind that income-driven repayment plans, while helpful in managing your monthly payment amount, may result in longer repayment periods and potentially higher overall interest payments. Evaluate the trade-offs and consider your long-term financial goals when opting for an income-driven repayment plan.

It’s important to stay informed about any changes to your income-driven repayment plan, such as annual recertification requirements or adjustments to payment calculations. Review your loan servicer’s guidelines and reach out to them if you have any questions or need further clarification about your payment calculation.

By accounting for income-driven repayment plans in your calculations, you can accurately assess your financial obligations and your eligibility for an FHA loan.

Step 5: Consider Loan Forgiveness Programs

When calculating student loan payments for an FHA loan, it’s important to consider any loan forgiveness programs for which you may be eligible. Loan forgiveness programs offer relief by canceling or reducing a portion of your student loan debt, which can significantly impact your long-term financial obligations.

Here are a few loan forgiveness programs to consider:

- Public Service Loan Forgiveness (PSLF): If you work in the public sector or for a qualifying non-profit organization, you may be eligible for PSLF. This program forgives the remaining balance on your federal Direct Loans after you make 120 qualifying payments while working full-time in a qualifying job.

- Teacher Loan Forgiveness: This program is specifically designed for teachers working in low-income schools or educational service agencies. Under this program, you may be eligible for loan forgiveness of up to $17,500 on your Direct Subsidized and Unsubsidized Loans or Subsidized and Unsubsidized Federal Stafford Loans.

- Income-Driven Repayment Plan Forgiveness: Certain income-driven repayment plans offer loan forgiveness after a specific period. For example, for borrowers on the PAYE or REPAYE plans, any remaining balance after making qualifying payments for 20 or 25 years (depending on the plan and when you borrowed) may be eligible for forgiveness.

When calculating your student loan payments, take into account the potential impact of loan forgiveness programs on your overall repayment. If you anticipate qualifying for a forgiveness program, it may lower the total amount you will need to repay over time.

It’s crucial to review the specific eligibility criteria, requirements, and limitations of each loan forgiveness program. Understand the timeline, payment requirements, and any documentation needed to qualify for forgiveness. Keep in mind that some forgiveness programs may have tax implications, so it’s essential to consult a tax professional to fully understand the potential consequences.

Considering loan forgiveness programs in your calculations will help you determine the long-term financial impact of your student loans and assess your eligibility for an FHA loan. It’s important to weigh the benefits of potential loan forgiveness against other factors, such as the monthly payment amount and overall debt-to-income ratio.

Remember to stay informed about any updates or changes to loan forgiveness programs as legislation and regulations can evolve over time. Regularly review the requirements and guidelines to ensure you are maximizing the potential benefits of loan forgiveness.

Step 6: Review and Refine Your Calculation

The final step in calculating your student loan payments for an FHA loan is to review and refine your calculation. This step is crucial to ensure the accuracy of your calculations and to make any necessary adjustments based on changing circumstances or new information.

Here are some key considerations for reviewing and refining your calculation:

- Double-check Your Numbers: Review all the figures and calculations you have made thus far. Verify that you have entered the correct loan balance, interest rate, loan term, and other relevant details. Small errors can significantly impact your calculated monthly payment.

- Consider Changing Circumstances: Take into account any changes in your income, family size, or repayment plan. If any of these factors have changed since your initial calculation, adjust your numbers accordingly to ensure the accuracy of your monthly payment amount.

- Update Payment Calculation: If you are enrolled in an income-driven repayment plan, periodically update your payment calculation based on changes in your income or family size. This will help you stay on top of any adjustments to your monthly payment as your financial situation evolves.

- Account for Loan Forgiveness Programs: If you qualify for any loan forgiveness programs, ensure that your calculation reflects the potential impact of loan forgiveness on your student loan payments. Adjust the projected payment amounts and consider how loan forgiveness might affect your long-term financial obligations.

- Seek Professional Guidance: If you are uncertain about any aspect of your calculation or have complex circumstances, consider consulting a student loan counselor or financial advisor who specializes in student loans. They can offer expert guidance and help refine your calculation based on your specific needs.

Regularly reviewing and refining your calculation is important for staying informed about your student loan obligations and assessing your eligibility for an FHA loan. By keeping your calculations up-to-date and accurate, you can make informed decisions regarding your financial goals and budgeting strategies.

Remember that your monthly student loan payment is just one aspect of your overall financial picture. It’s crucial to assess your debt-to-income ratio, budget, and long-term financial goals holistically. This will give you a comprehensive understanding of your financial situation and help you make informed decisions regarding homeownership and loan eligibility.

Conclusion

Calculating student loan payments for an FHA loan is a crucial step in understanding your financial obligations and determining your eligibility for a mortgage. By following the steps outlined in this guide, you can accurately calculate your monthly student loan payments and make informed decisions about your homeownership goals.

Throughout the process, it’s important to gather all the necessary information about your student loans, determine the loan type, and consider factors such as income-driven repayment plans and loan forgiveness programs. These factors can significantly impact your monthly payment amount and overall debt-to-income ratio.

Remember to review your calculations periodically and make any necessary refinements based on changing circumstances or new information. Stay informed about potential modifications to your repayment plan, loan terms, or loan forgiveness programs, as these can impact your long-term financial obligations.

Additionally, seeking professional guidance from student loan counselors or financial advisors can provide expert insights and help tailor your calculation to your specific circumstances. They can assist in understanding the intricacies of your student loans and guide you towards the best financial decisions.

Calculating student loan payments for an FHA loan gives you a clear understanding of your financial commitments. This knowledge will enable you to plan your budget effectively and make informed decisions about your homeownership goals.

Remember, achieving financial stability is a journey, and student loans are just one aspect of your overall financial picture. By managing your student loan payments responsibly and exploring the various options available, you can work towards a bright financial future and achieve your homeownership dreams.