Home>Finance>How To Cancel Experian Credit Tracker Membership

Finance

How To Cancel Experian Credit Tracker Membership

Modified: February 21, 2024

Looking to cancel your Experian Credit Tracker membership? Learn how to do it hassle-free with our step-by-step guide. Finance made easy!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Experian Credit Tracker is a popular credit monitoring service that provides individuals with up-to-date information about their credit score, credit reports, and identity theft protection. While many people find value in utilizing this service, there may be instances where you decide to cancel your Experian Credit Tracker membership. Whether it’s due to financial constraints, finding an alternative credit monitoring service, or simply no longer needing the service, it’s important to know the steps to take to cancel your membership.

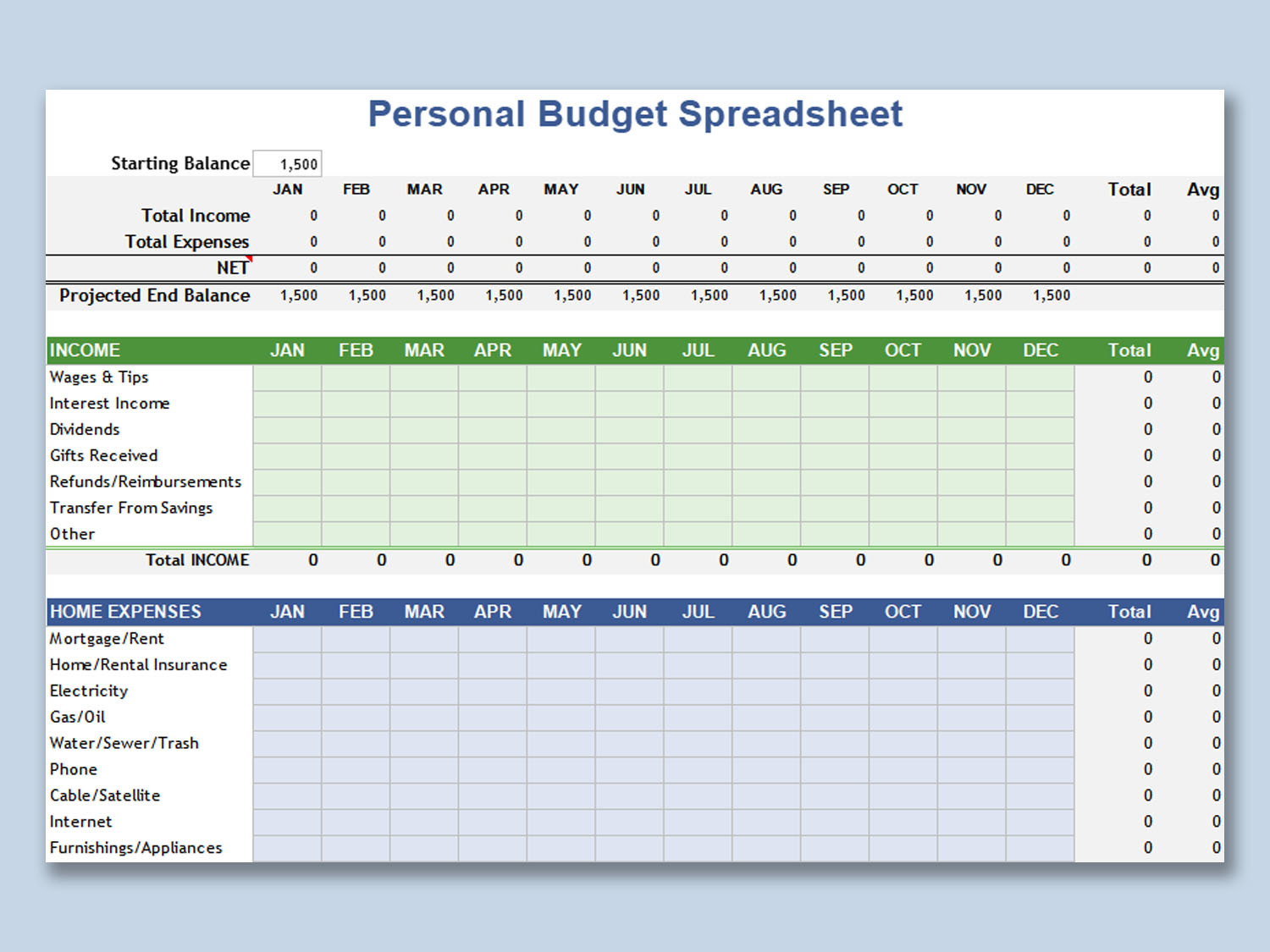

Cancelling your Experian Credit Tracker membership can help you save money by eliminating the monthly fee associated with the service. It’s also essential to ensure that you are consistently monitoring your credit and taking proactive steps to protect your identity. By cancelling your membership, you may explore other options that suit your needs or consider managing your credit on your own.

While cancelling your Experian Credit Tracker membership is a relatively straightforward process, it’s important to understand the steps involved and any potential consequences of canceling. This comprehensive guide will walk you through the process of cancelling your Experian Credit Tracker membership to ensure a smooth transition and answer any questions or concerns you may have in regard to the cancellation process.

Reasons for Canceling Experian Credit Tracker Membership

There can be various reasons why you may decide to cancel your Experian Credit Tracker membership. Understanding these reasons can help you make an informed decision about whether or not to continue with the service. Here are some common reasons why individuals choose to cancel their membership:

- Financial Constraints: One of the most common reasons for canceling any subscription is financial constraints. If you are facing a budgetary crunch or looking to cut down on expenses, canceling your Experian Credit Tracker membership can help you save money every month.

- Switching to a Different Service: Another reason for cancellation is switching to a different credit monitoring service. It could be that you have found a service that offers more comprehensive features or a better pricing structure. Assessing your credit monitoring needs and finding a service that aligns with your requirements and budget can be a valid reason to cancel your Experian Credit Tracker membership.

- No Longer Needed: Some individuals choose to cancel their Experian Credit Tracker membership because they feel they no longer need the service. Perhaps you have achieved your credit goals, cleared your debts, or don’t foresee any immediate need for credit monitoring. In such cases, it might be more practical to cancel the membership and explore other options as and when the need arises.

- Redundancy with Other Credit Monitoring Services: If you already have multiple credit monitoring services and find the features provided by Experian Credit Tracker redundant or unnecessary, it may be a good idea to cancel your membership. Consolidating your credit monitoring efforts can streamline your credit management and simplify the process.

- Difficulty With Usage or Ineffective Service: If you encounter any difficulties with using Experian Credit Tracker or if you feel that the service isn’t meeting your expectations in terms of accuracy, reliability, or features, it may be a valid reason to cancel your membership. It’s important to feel confident and satisfied with the credit monitoring service you choose, and if Experian Credit Tracker falls short in any aspect, cancellation might be the appropriate course of action.

Ultimately, the decision to cancel your Experian Credit Tracker membership depends on your individual circumstances and needs. Evaluating your financial situation and assessing your credit monitoring requirements will help you determine if canceling the service is the right choice for you.

Steps to Cancel Experian Credit Tracker Membership

If you have decided to cancel your Experian Credit Tracker membership, follow these steps to ensure a smooth and hassle-free process:

- Review Your Membership Details: Before initiating the cancellation process, take a moment to review your membership details. Take note of your membership ID, the payment plan you are on, and any other relevant information you may need during the cancellation process.

- Visit the Experian Website: Access the Experian website and navigate to the customer support or account management section. Look for the option to manage your membership or cancel your subscription.

- Log In to Your Account: If you haven’t already logged into your Experian account, you will need to do so to proceed with the cancellation. Enter your login credentials, including your username and password.

- Locate the Membership Cancellation Option: Once you are logged in, locate the membership cancellation option. This could be a button or link that says “Cancel Membership,” “Manage Subscription,” or something similar.

- Follow the Cancellation Process: Click on the membership cancellation option and follow the prompts to begin the cancellation process. You may be asked to provide a reason for cancellation or confirm your decision to cancel.

- Verify Your Cancellation: After confirming your cancellation, Experian may ask you to verify your decision. This is a security measure to ensure that the cancellation is authorized by the account holder.

- Follow Any Additional Steps: Depending on your specific Experian Credit Tracker membership, there may be additional steps or information required for the cancellation process. Follow any instructions provided by Experian to complete the cancellation successfully.

- Keep Confirmation Documentation: Once your cancellation is processed, ensure that you receive confirmation of the cancellation. It’s a good practice to keep this documentation for your records, as it serves as proof of cancellation in case of any discrepancies or future billing issues.

It’s important to note that the steps mentioned above are general guidelines, and the specific cancellation process for Experian Credit Tracker may vary. It’s recommended to refer to the Experian website or contact their customer support for detailed instructions on cancelling your membership.

By following these steps, you can successfully cancel your Experian Credit Tracker membership and discontinue any future billing or access to the service.

Contact Experian Customer Service

If you encounter any difficulties or have additional questions regarding the cancellation process of your Experian Credit Tracker membership, it is advisable to reach out to Experian’s customer service. Their dedicated support team is available to assist you and provide the necessary guidance. Here are some ways to contact Experian customer service:

- Phone: One of the most efficient ways to get in touch with Experian customer service is by phone. Experian provides a toll-free customer support hotline that you can call to discuss your concerns or queries. Check the official Experian website or your membership documentation for the correct phone number to reach their customer service team.

- Email: If you prefer written communication, you can send an email to Experian’s customer support team. Look for the designated email address for customer service on their website or in your membership information. Provide a detailed explanation of your query or issue, and Experian’s customer service representatives will respond to your inquiry.

- Live Chat: Experian also offers live chat support, allowing you to engage in real-time messaging with a customer service representative. This option can be convenient if you prefer instant responses and assistance. Visit the Experian website and look for the live chat feature to initiate a conversation with a customer service representative.

- Help Center: Experian’s website features a comprehensive help center that provides answers to frequently asked questions and detailed explanations of various topics. Before contacting customer service directly, it’s worth checking the help center to see if your query has already been addressed. The help center may have the information you need to resolve your concerns without the need for direct contact.

- Social Media: Experian is active on various social media platforms, such as Twitter and Facebook. Consider reaching out to their customer service team through these channels by sending a message or mentioning them in a post. While response times may vary, social media can be an effective way to get in touch with Experian and receive assistance.

When contacting Experian customer service, it’s important to have relevant information readily available, such as your membership details, any previous communication you have had with Experian, and any supporting documents related to your query. This will help the customer service team understand your situation better and provide accurate and efficient assistance.

Remember to remain patient and respectful when communicating with customer service representatives. They are there to help and guide you through the process, and a courteous and cooperative approach will often yield the best results.

By utilizing these contact methods, you can seek the necessary help and information from Experian’s customer service team and address any concerns or queries you may have regarding your Experian Credit Tracker membership cancellation or any other related matters.

Considerations and Potential Consequences of Cancellation

Before finalizing your decision to cancel your Experian Credit Tracker membership, it is essential to consider some important factors and potential consequences of cancellation. These considerations can help you make an informed decision and ensure that you are fully aware of the impact of canceling your membership:

- Lack of Credit Monitoring: By canceling your Experian Credit Tracker membership, you will no longer have access to the credit monitoring services and benefits it provides. This means that you will not receive regular credit score updates, alerts for changes on your credit report, or identity theft protection features.

- Loss of Credit Education Resources: Experian Credit Tracker offers educational resources and tools to help you understand and improve your credit score. If you cancel your membership, you will lose access to these resources, which can be valuable in managing and building your credit.

- Impact on Credit Monitoring History: If you cancel your Experian Credit Tracker membership, it may impact your credit monitoring history. Some lenders and institutions may consider the duration and consistency of your credit monitoring when evaluating your creditworthiness. Therefore, consider this potential consequence before canceling.

- Potential Interruption in Fraud Detection: Experian Credit Tracker includes identity theft protection features that can help detect fraudulent activity. By canceling your membership, you may lose this layer of protection, making it crucial to be vigilant and monitor your own credit for any signs of fraud.

- Exploring Other Credit Monitoring Options: Before canceling, evaluate other credit monitoring options to ensure that you have a suitable alternative in place. Research and compare different services to determine which one aligns with your needs and provides the features you require.

- Considerations for Future Credit Needs: Assess your future credit needs and goals. If you anticipate applying for loans, mortgages, or credit cards in the near future, having access to credit monitoring services can be beneficial for monitoring your progress and ensuring favorable creditworthiness.

- Budgetary Constraints: Take into account your financial situation and whether the monthly cost of the Experian Credit Tracker membership aligns with your budget. If you are facing financial constraints, canceling the membership can free up some funds.

Ultimately, the decision to cancel your Experian Credit Tracker membership should be based on a careful consideration of the factors mentioned above. Take the time to weigh the potential consequences and evaluate your credit monitoring needs to make the best choice for your situation.

Conclusion

Cancelling your Experian Credit Tracker membership is a personal decision that should be based on your individual circumstances and credit monitoring needs. Whether you are looking to save money, switch to a different service, or feel that the service is no longer necessary, it’s important to be aware of the steps involved in the cancellation process.

By following the outlined steps, you can navigate the cancellation process smoothly and effectively. Remember to review your membership details, log in to your account, locate the cancellation option, and complete any additional steps required. Keeping confirmation documentation of your cancellation is also recommended for future reference.

Before canceling, consider the potential consequences. Understand that you may lose access to credit monitoring services, educational resources, and fraud detection features provided by Experian Credit Tracker. Evaluate other credit monitoring options to ensure a suitable alternative and assess your future credit needs.

If you have any queries or encounter difficulties during the cancellation process, do not hesitate to reach out to Experian customer service. They are available to provide support and guidance through phone, email, live chat, and other channels.

Ultimately, the decision to cancel your Experian Credit Tracker membership rests with you. Prioritize your financial situation, credit monitoring needs, and future goals to make the best choice. Remain proactive in monitoring your credit and taking steps to protect your identity even if you decide to cancel your Experian Credit Tracker membership.

Remember, credit monitoring is an important aspect of managing your financial well-being. Review your options, consider the consequences, and make a decision that aligns with your goals and circumstances.