Finance

How To Read Experian Credit Report

Published: October 21, 2023

Learn how to read your Experian credit report and understand the important finance details that affect your credit score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Experian Credit Reports

- Section 1: Personal Information

- Section 2: Credit Accounts

- Section 3: Public Records and Collections

- Section 4: Credit Inquiries

- Section 5: Credit Summary

- Section 6: Dispute Information

- Section 7: Fraud Alerts and Security Freezes

- Section 8: Credit Score

- Conclusion

Introduction

Understanding your credit report is essential for managing your personal finances effectively. Your credit report is a detailed compilation of your credit history, including information about your credit accounts, payment history, and public records. One widely-used credit reporting agency is Experian, which provides credit reports to lenders, creditors, and individuals.

In this article, we will guide you through the process of reading an Experian credit report. We will break down each section of the report and explain the significance of the information provided. By the end, you will have a good understanding of how to interpret your Experian credit report and make informed decisions to improve your credit standing.

It’s important to note that checking your credit report regularly can help you identify any errors or potential fraudulent activity. This empowers you to take the necessary steps to correct inaccuracies and protect your financial well-being.

Now, let’s dive into the world of Experian credit reports and discover how you can become proficient in deciphering the information presented to you.

Understanding Experian Credit Reports

An Experian credit report is a document that summarizes your credit history and serves as a tool for lenders to evaluate your creditworthiness. It provides a comprehensive snapshot of your financial behavior, including your payment history, credit utilization, public records, and more.

Experian gathers information from various sources such as lenders, creditors, public records, and collections agencies to create your credit report. This information is then used to calculate your credit score, which is a numerical representation of your creditworthiness.

When you receive your Experian credit report, you will find several sections that break down different aspects of your credit history. Each section provides valuable insights into your financial habits and can help you identify areas for improvement. Let’s explore these sections in more detail.

1. Personal Information: This section includes your name, address, date of birth, and employment information. It’s important to review this information carefully to ensure its accuracy, as any errors could impact your credit report and subsequent lending decisions.

2. Credit Accounts: Here, you will find a list of your credit accounts, including credit cards, loans, and mortgages. Each account will show details such as the account type, account number, current balance, credit limit, and payment history. Pay close attention to any late payments or accounts in collections as they can have a negative impact on your credit score.

3. Public Records and Collections: This section displays any public records related to your financial history, such as bankruptcies, tax liens, and judgments. It also includes information on any accounts that have been sent to collections. These records can significantly impact your credit score and should be addressed promptly.

4. Credit Inquiries: This section lists the companies or individuals who have requested your credit report within the past two years. There are two types of inquiries: hard inquiries, which occur when you apply for credit, and soft inquiries, which are made by companies for promotional purposes. Multiple hard inquiries within a short period can lower your credit score.

5. Credit Summary: Here, you will find a summary of your overall credit status, including the total number of accounts, the percentage of accounts in good standing, and any delinquencies or public records. This section provides a quick overview of your creditworthiness.

6. Dispute Information: If you have disputed any information on your credit report, this section will provide details of the disputes and their status. It’s important to review this section regularly to ensure that any inaccuracies have been resolved.

7. Fraud Alerts and Security Freezes: If you have placed a fraud alert or security freeze on your credit report, this section will indicate the status and duration of the alert or freeze. These measures provide additional protection against identity theft and unauthorized access to your credit information.

8. Credit Score: While not technically a section in the credit report, your credit score is a critical factor in evaluating your creditworthiness. Experian provides a numerical credit score based on their own scoring model. This score helps lenders determine the likelihood of you repaying your debts on time.

Understanding the various sections of your Experian credit report is crucial in managing your financial health. By reviewing your report regularly and addressing any issues or discrepancies, you can take control of your credit and work towards improving your credit score.

Section 1: Personal Information

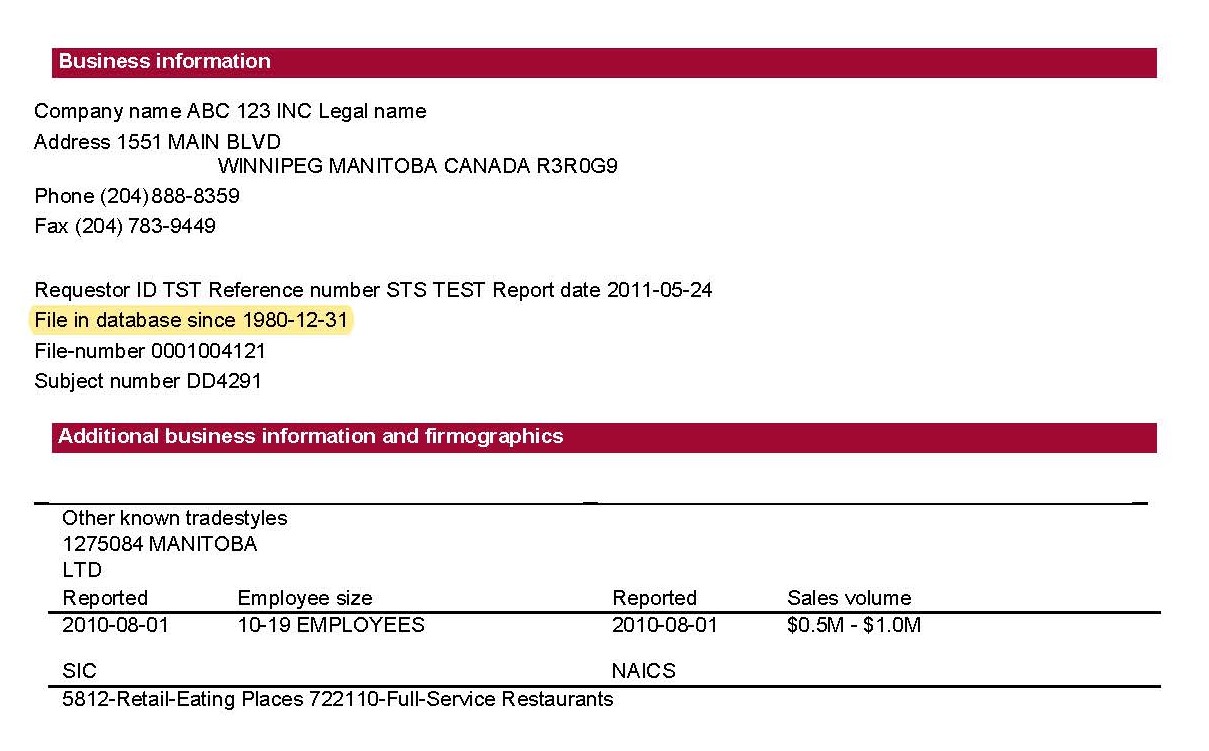

In an Experian credit report, the first section you will encounter is the Personal Information section. This section contains essential details about you and is crucial for verifying your identity and ensuring the accuracy of the report.

The Personal Information section typically includes:

- Name: Your full name, including any aliases or variations that may have been reported.

- Address: Your current address as well as any previous addresses you have been associated with. This information helps lenders confirm your residency history and identity.

- Date of Birth: Your date of birth is recorded to accurately identify you and distinguish you from others with similar names.

- Social Security Number: Your social security number is a unique identifier that helps ensure the report is associated with the correct individual.

- Employment Information: This may include your current employer, job title, and even your employment history. Lenders often use this information to evaluate your stability and ability to repay loans.

It is crucial to review the Personal Information section carefully to ensure its accuracy. Any errors, discrepancies, or outdated information should be reported to Experian immediately to prevent future complications and potential identity theft.

It’s important to note that the Personal Information section does not affect your credit score directly. However, accurate personal information ensures that your credit accounts and payment history are accurately reported on your credit report.

When reviewing your Personal Information, pay close attention to:

- Name Accuracy: Ensure that your name is spelled correctly and there are no variations or misspellings that could lead to confusion.

- Address Accuracy: Verify that your current and previous addresses are accurate. Outdated or incorrect addresses could potentially lead to missed or delayed communications from lenders.

- Date of Birth Accuracy: Double-check that your date of birth is accurate to avoid any confusion or mistaken identity.

- Employment Information Accuracy: Confirm that your current employer and job title are correct. Outdated or incorrect employment information may impact the accuracy of your credit report.

Keep in mind that the Personal Information section may differ slightly depending on the information provided to Experian by your creditors and lenders. If you have recently moved or changed jobs, it may take some time for these updates to reflect in your credit report.

Overall, the Personal Information section of your Experian credit report serves as a foundation for the accuracy and reliability of the entire report. By regularly reviewing and ensuring the correctness of your personal details, you can have greater confidence in the information presented in the subsequent sections of your credit report.

Section 2: Credit Accounts

The Credit Accounts section of an Experian credit report provides a detailed overview of your credit accounts, including credit cards, loans, mortgages, and other lines of credit. This section is crucial for lenders to assess your creditworthiness and evaluate your ability to manage your financial responsibilities.

Within the Credit Accounts section, you will find the following information for each account:

- Account Type: This indicates the type of credit account, such as credit card, auto loan, student loan, or mortgage.

- Account Number: An account-specific number that identifies each credit account.

- Current Balance: The outstanding balance owed on the account at the time the credit report was generated.

- Credit Limit: For credit cards and lines of credit, this represents the maximum amount you can borrow or charge on the account.

- Payment History: This section displays your payment status on the account, including whether you have made payments on time or if any payments are past due.

Reviewing the Credit Accounts section allows you to assess your overall credit utilization, payment history, and account management. Here are a few key factors to consider:

- Payment History: The payment history section reflects whether you have made payments on time for each account. Consistently making payments by the due date can positively impact your credit score, while late payments can have a negative effect.

- Amount Owed: The current balance and credit limit information provide insights into your credit utilization. High credit utilization, where you have utilized a significant portion of your available credit, may indicate a higher risk to lenders.

- Account Status: This section shows whether an account is open, closed, or in collections. Closed accounts are typically displayed with a note indicating that they were closed by the consumer or the creditor.

- Account Age: The credit report may also indicate the date the account was opened. Long-standing accounts with a history of responsible payment can positively impact your credit score by demonstrating a track record of good credit management.

It is crucial to carefully review the Credit Accounts section for any discrepancies or inaccuracies. If you notice any errors, such as accounts that do not belong to you or incorrect payment histories, you should contact Experian and the respective creditors to rectify the errors promptly.

Managing your credit accounts responsibly can significantly impact your credit score and overall financial health. By regularly reviewing your Credit Accounts section and ensuring your payment history is accurate, you can identify areas for improvement and work towards building a stronger credit profile.

Section 3: Public Records and Collections

The Public Records and Collections section of an Experian credit report provides information on any financial events that are a matter of public record, such as bankruptcies, tax liens, civil judgments, and accounts that have been sent to collections. This section is crucial for lenders to assess your creditworthiness and evaluate your financial responsibility.

When reviewing the Public Records and Collections section, you may come across the following types of information:

- Bankruptcies: This includes details of any bankruptcy filings you may have had. Bankruptcy reflects a severe financial setback and can have a significant impact on your credit score and ability to obtain credit.

- Tax Liens: Tax liens indicate that you owe unpaid taxes to the government. These liens are typically filed by local, state, or federal tax authorities and can negatively affect your creditworthiness.

- Civil Judgments: This section may include judgments against you resulting from lawsuits or legal disputes. A civil judgment may require you to pay a specified amount of money in a specified period of time.

- Collections: Accounts that have been sent to collections agencies due to non-payment or default are listed in this section. It is important to note that collections can significantly impact your credit score and make it more challenging to obtain credit in the future.

Reviewing the Public Records and Collections section allows you to assess your financial history and identify any potential red flags that lenders may consider when evaluating your creditworthiness. It is crucial to be aware of the information presented here, as it can have a lasting impact on your financial standing.

In cases where you encounter public records or collections that are inaccurate, outdated, or should no longer be on your credit report, you have the right to dispute the information. Disputing inaccuracies can help ensure the integrity and accuracy of your credit report, as well as prevent any negative consequences.

It is important to note that certain negative public records, such as bankruptcies and tax liens, may remain on your credit report for a specific period of time according to federal or state laws. However, as time progresses, their impact on your credit score may diminish.

Taking proactive steps to address any negative public records or collections is essential for improving your creditworthiness. This may involve working with the appropriate agencies or creditors to resolve outstanding balances or negotiating payment plans.

By regularly reviewing your Public Records and Collections section and taking necessary steps to address any issues, you can work towards improving your credit profile and overall financial health.

Section 4: Credit Inquiries

The Credit Inquiries section of an Experian credit report provides information about the companies or individuals who have accessed your credit report within the past two years. This section is important as it reflects the level of interest in your credit history and may have an impact on your credit score.

There are two types of inquiries that can appear in this section:

- Hard Inquiries: Hard inquiries occur when you apply for credit, such as a loan, credit card, or mortgage. These inquiries are typically initiated by lenders and are recorded on your credit report. Hard inquiries can have a temporary negative impact on your credit score, as they suggest that you are actively seeking new credit.

- Soft Inquiries: Soft inquiries, on the other hand, are initiated by companies for promotional purposes, such as pre-approved credit offers or background checks. Soft inquiries are not visible to lenders and do not impact your credit score.

When reviewing the Credit Inquiries section, it is essential to understand that while hard inquiries may have a temporary negative impact on your credit score, the impact is typically minimal. Multiple hard inquiries within a short period, such as when shopping for a car loan or mortgage, are usually treated as a single inquiry and have a reduced impact on your score.

It is essential to review the Credit Inquiries section and ensure that all inquiries listed are accurate. If you notice any inquiries that you do not recognize or believe to be unauthorized, you should report them to Experian immediately. Unauthorized credit inquiries could be an indication of potential identity theft or fraudulent activity.

It is important to note that when checking your own credit report, it does not result in a hard inquiry. You can review your credit report regularly without worrying about damaging your credit score.

Monitoring the Credit Inquiries section of your Experian credit report allows you to stay informed about the activity surrounding your credit history. It is advisable to be mindful of the number of hard inquiries you have, especially when planning to apply for new credit. Limiting the number of credit applications within a short period can help maintain a positive credit profile.

By understanding the types of inquiries and keeping a close eye on this section of your credit report, you can better manage your credit applications and maintain a healthy credit score.

Section 5: Credit Summary

The Credit Summary section of an Experian credit report provides a high-level overview of your overall credit performance. It offers a snapshot of your credit status and helps lenders quickly evaluate your creditworthiness.

Within the Credit Summary section, you will find the following information:

- Total Accounts: This indicates the total number of credit accounts you currently have open or closed. Lenders often consider the number of accounts you have as a factor in assessing your creditworthiness.

- Accounts in Good Standing: This reflects the percentage of your accounts that are reported as being current and in good standing. A higher percentage indicates a more positive credit profile.

- Accounts Delinquent: This shows the percentage of your accounts that are past due or delinquent. It is important to address any delinquent accounts promptly, as they can have a negative impact on your credit score.

- Public Records: This section provides a summary of any public records, such as bankruptcies, tax liens, or judgments, that are present on your credit report. These records can significantly impact your creditworthiness and should be addressed accordingly.

Reviewing the Credit Summary section allows you to quickly assess your overall credit health. It provides a snapshot of your credit performance and can help you identify areas for improvement. Here are a few key considerations:

- Number of Accounts: Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score. Lenders often prefer to see a healthy mix of accounts rather than relying solely on one type of credit.

- Accounts in Good Standing: The higher the percentage of accounts reported as being in good standing, the better. This indicates that you have a track record of responsible credit management and are meeting your payment obligations on time.

- Accounts Delinquent: If you have accounts that are delinquent, it is crucial to address them promptly. Making payments on time and bringing delinquent accounts up to date can help improve your credit score over time.

- Public Records: Public records, such as bankruptcies or tax liens, can have a significant negative impact on your creditworthiness. It is important to address any public records and work towards resolving them, as they can affect your ability to obtain new credit.

By regularly reviewing the Credit Summary section of your Experian credit report, you can gain valuable insights into your overall credit status. It allows you to identify areas of strength and areas that may require attention. Utilizing this information, you can take proactive steps to improve your credit profile and maintain a healthy financial standing.

Section 6: Dispute Information

The Dispute Information section of an Experian credit report provides details about any disputes you have filed concerning the accuracy of the information on your credit report. This section is important for ensuring the integrity and accuracy of your credit report and resolving any errors or discrepancies.

When you file a dispute with Experian regarding an item on your credit report, the Dispute Information section captures the following details:

- Disputed Item: This specifies the account or specific information that is being disputed, such as a late payment, incorrect balance, or inaccurate personal detail.

- Status: The status of the dispute is indicated, whether it is under investigation, resolved, or closed.

The Dispute Information section helps you keep track of the progress and resolution of any disputes you have submitted. It is important to regularly review this section to ensure that disputes are being handled promptly and accurately.

If you notice any inaccuracies, errors, or discrepancies on your credit report, it is essential to file a dispute with Experian as soon as possible. You can initiate a dispute online, by phone, or by mail, providing supporting documentation and explaining the nature of the dispute. Experian will then investigate the items in question and make any necessary corrections or updates.

Be aware that the investigation process can take some time, and it may be necessary to provide additional documentation or follow up with Experian to ensure a thorough review. During the investigation, Experian will contact the creditors or information providers associated with the disputed items to verify the accuracy of the reported information.

Once the dispute is resolved, the status in the Dispute Information section will be updated accordingly. If the dispute leads to a correction or removal of inaccurate information, it can positively impact your credit report and potentially improve your credit score.

Remember to review the Dispute Information section regularly to ensure that disputed items are being addressed and resolved appropriately. If you do not see any updates or if the status remains unresolved for an extended period, it may be necessary to follow up with Experian to seek further clarification or escalate the issue.

Filing disputes and monitoring the resolution process in the Dispute Information section is an important step in maintaining the accuracy and reliability of your credit report. By promptly addressing any errors, you can have greater confidence in the information presented on your credit report and protect your financial well-being.

Section 7: Fraud Alerts and Security Freezes

The Fraud Alerts and Security Freezes section of an Experian credit report provides information about any measures you have taken to protect yourself against identity theft and unauthorized access to your credit information. This section is crucial for safeguarding your financial well-being and maintaining the security of your credit accounts.

Here are two common security measures covered in this section:

- Fraud Alerts: A fraud alert is a notice that can be added to your credit report to warn lenders and creditors that you may be a victim of identity theft. It alerts them to take extra precautions when verifying your identity before granting credit. The fraud alert can remain on your credit report for a specified period, typically 90 days or longer if you request an extended fraud alert.

- Security Freezes: A security freeze, also known as a credit freeze, restricts access to your credit report. By placing a freeze, you can prevent lenders and creditors from accessing your credit information, making it difficult for identity thieves to open new accounts in your name. A security freeze provides an additional layer of protection and can be lifted temporarily or permanently when you need to apply for new credit.

When reviewing the Fraud Alerts and Security Freezes section, you should ensure that any alerts or freezes listed are accurate and up-to-date. It’s important to remember that fraud alerts and security freezes can help protect your credit information, but they may also impose some limitations and additional steps when accessing credit yourself.

If you believe you are a victim of identity theft or if you wish to implement fraud alerts or security freezes on your Experian credit report, you can do so by contacting Experian directly. They will guide you through the necessary steps to initiate these security measures.

It’s crucial to keep in mind that fraud alerts and security freezes are preventative measures that can enhance the security of your credit report. However, they do not guarantee complete protection against potential fraud. Regularly monitoring your credit report, reviewing your account statements, and exercising caution when sharing personal and financial information are also essential practices in protecting yourself from identity theft and fraud.

By utilizing fraud alerts and security freezes when necessary and remaining vigilant in monitoring your credit activity, you can take proactive steps to safeguard your financial identity and minimize the risk of unauthorized access or fraudulent activities.

Section 8: Credit Score

The Credit Score section of an Experian credit report provides you with a numerical representation of your creditworthiness. It is a valuable tool used by lenders to assess the risk of extending credit to you and to determine the terms and conditions of the credit offer.

Experian calculates your credit score using their own proprietary scoring model, which takes into account various factors from your credit report. These factors may include:

- Payment History: The timeliness of your payments and any past-due accounts can have a significant impact on your credit score. Making consistent, on-time payments demonstrates responsible credit management.

- Credit Utilization: Your credit utilization ratio measures the percentage of your available credit that you are using. Keeping your credit utilization low can positively impact your credit score, as it suggests you are managing your credit responsibly.

- Length of Credit History: The length of your credit history is a factor in determining your credit score. Long-standing credit accounts with a positive payment history can positively affect your score, while a shorter credit history may have a comparatively lesser impact.

- Types of Credit: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively influence your credit score. It demonstrates your ability to manage different types of credit.

- New Credit Inquiries: Applying for multiple lines of credit within a short period can have a temporary negative impact on your credit score. Lenders may view this as an indicator of increased risk.

The numerical credit score provided by Experian helps lenders quickly assess your creditworthiness and make more informed decisions. A higher credit score generally indicates lower credit risk and increases your chances of getting approved for credit at favorable terms.

It’s important to note that credit scores can vary between credit reporting agencies since each agency may use its own scoring model and collect different information. Therefore, your Experian credit score may differ slightly from scores provided by other agencies.

Regularly monitoring your credit score allows you to track your credit health and assess how your financial habits are impacting your creditworthiness. If your credit score is lower than desired, take proactive steps to improve it, such as making on-time payments, reducing credit card balances, and addressing any negative factors on your credit report.

Keep in mind that improving your credit score takes time and responsible credit management. By consistently demonstrating good credit habits, you can gradually improve your credit score over time and enhance your financial opportunities.

Conclusion

Understanding your Experian credit report is essential for managing your personal finances and making informed financial decisions. By familiarizing yourself with the different sections and the information they provide, you can gain insight into your credit history, identify areas for improvement, and take steps to enhance your creditworthiness.

Throughout this article, we have explored the various sections of an Experian credit report, including Personal Information, Credit Accounts, Public Records and Collections, Credit Inquiries, Credit Summary, Dispute Information, Fraud Alerts and Security Freezes, and Credit Score. Each section offers valuable insights that can help you evaluate your credit health and take appropriate actions to maintain or improve it.

Regularly reviewing your Experian credit report allows you to monitor your credit history, identify any errors or discrepancies, and detect potential signs of identity theft. If you find any inaccuracies, it’s critical to take immediate steps to dispute the information and rectify any issues.

Remember that building and maintaining good credit requires responsible financial management. Make on-time payments, keep your credit card balances low, and be mindful of the number of credit applications you submit. By maintaining healthy credit habits, you can work towards achieving a favorable credit profile.

Lastly, maintaining open lines of communication with Experian and other credit reporting agencies is vital. Regularly review your credit report, stay updated on changes in credit reporting laws, and take advantage of the services and tools provided by Experian to help you stay informed and protect your financial well-being.

Understanding your Experian credit report empowers you to make informed financial decisions and work towards your financial goals. By utilizing the information provided in your credit report and taking proactive steps to improve your credit health, you can pave the way for a more secure and prosperous financial future.