Finance

How To Change The NAICS Code With The IRS

Published: October 31, 2023

Find out how to update your NAICS code with the IRS and ensure your business's finance records are accurate and up to date.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the NAICS Code

- Reasons for Changing the NAICS Code

- Eligibility for Changing the NAICS Code with the IRS

- How to Update the NAICS Code with the IRS

- Step-by-Step Guide to Changing the NAICS Code

- Required Documents and Information

- Submitting the Required Forms

- Processing Time and Notification

- Consequences of Changing the NAICS Code

- Conclusion

Introduction

In the world of business, staying ahead of the game often means adapting and evolving. One crucial aspect of this adaptability is aligning your business activities with the right industry classification. The North American Industry Classification System (NAICS) code serves as a standard for classifying businesses in North America based on the type of economic activity they engage in. It is a vital tool used by various government agencies, including the Internal Revenue Service (IRS), for statistical analysis, tax reporting, and business identification purposes.

While selecting the appropriate NAICS code is essential to accurately represent your business activities, there might come a time when you need to change the NAICS code associated with your business. This could be due to changes in your product offerings, expanding into new markets, or simply realizing that your current classification no longer reflects the core of your business.

In this article, we will explore the process of changing the NAICS code with the IRS. We will provide a step-by-step guide, explain the eligibility criteria, and discuss the necessary documents and forms required to make this change. Additionally, we will delve into the implications and consequences of changing the NAICS code, empowering you to make an informed decision for your business.

Understanding the NAICS Code

The North American Industry Classification System (NAICS) code is a hierarchical classification system that assigns unique codes to different industries and economic activities. It was developed to provide a standardized approach for categorizing businesses across North America. Each code consists of six digits, with the first two representing the sector, the third digit representing the subsector, and the remaining digits providing more specific industry details.

The NAICS code system allows businesses, government agencies, researchers, and analysts to classify and compare businesses based on their primary economic activity. It ensures consistency in data collection and analysis, making it easier to track and measure economic trends and performance. This classification system covers all industries, from agriculture and manufacturing to information technology and professional services.

The NAICS code system undergoes periodic updates to reflect changes in the economy and emerging industries. The most recent version, NAICS 2017, introduced several new codes and revised existing ones to account for shifts in technology and market dynamics. It is crucial for business owners to keep their NAICS code up to date to accurately represent their activities and ensure compliance with regulatory and reporting requirements.

Choosing the correct NAICS code for your business is essential, as it determines how your company is classified and grouped with similar businesses. It can impact various aspects, including taxation, regulatory compliance, eligibility for government programs, market research, and statistical reporting. Therefore, it is crucial to understand the system and select the most appropriate code that best reflects your business activities.

It is important to note that the NAICS code classification is distinct from other codes such as the Standard Industrial Classification (SIC) code or the International Standard Industrial Classification (ISIC). While these systems serve similar purposes, the NAICS code is the most widely used and recognized classification system in North America.

Reasons for Changing the NAICS Code

As a business evolves and adapts to changing market conditions, there may be several reasons why you would need to change your NAICS code. Here are some common scenarios that might warrant a change:

- Shift in Business Activities: Your business may have expanded into new products or services that are not accurately represented by your current NAICS code. Changing the code allows you to align your classification with your updated offerings.

- Entering New Markets: If you are seeking to enter a new market or industry, your current NAICS code might not accurately reflect your business operations in the new field. Changing the code helps you establish a more accurate representation of your activities in the target market.

- Rebranding or Repositioning: A company rebrand or a significant change in your core business focus may require a corresponding update to your NAICS code. This ensures that your classification aligns with your new identity and strategic direction.

- Regulatory Compliance: Certain government regulations or programs have specific eligibility criteria based on NAICS codes. If you need to comply with new regulations or take advantage of specific incentives or programs, changing your code to the appropriate classification is necessary.

- Statistical Accuracy: Accurate data is crucial for meaningful statistical analysis. If your current NAICS code does not accurately represent your business activities, changing it ensures that your company’s data is correctly classified and contributes to accurate industry statistics.

It is important to carefully evaluate your reasons for changing the NAICS code to ensure that it is necessary and justified. Thoroughly understanding your business activities and the impact of the code change is crucial in making an informed decision.

Before proceeding with the code change, it is advisable to consult with industry experts, tax professionals, or business advisors who can provide guidance and ensure compliance with regulations and reporting requirements.

Eligibility for Changing the NAICS Code with the IRS

While the ability to change your NAICS code exists, it is important to note that not all businesses are eligible to make this change with the Internal Revenue Service (IRS). The IRS has specific criteria that determine whether a business can update its NAICS code. Here are some key factors to consider:

- Business Entity: Only certain types of business entities are eligible to change their NAICS code with the IRS. This typically includes sole proprietorships, partnerships, limited liability companies (LLCs), and certain types of corporations.

- Tax Filing Status: Your business must have an active tax filing status with the IRS. If your tax status is inactive or your business is currently not required to file taxes, you may not be eligible to change the NAICS code at that time.

- Timeliness: The IRS imposes limitations on the frequency of NAICS code changes. Generally, you can only request a change once every five calendar years. It is important to evaluate the timing of your desired change to ensure compliance with this rule.

- Legitimate Business Reason: The IRS requires a valid and legitimate business reason for changing the NAICS code. This could include business expansion, significant changes in operations, or repositioning in the market. It is important to provide sufficient justification for the requested change.

It is crucial to review IRS guidelines and consult with a tax professional or advisor to determine your eligibility for changing the NAICS code. They can provide personalized guidance based on your specific business circumstances and help navigate any potential challenges.

Additionally, it is essential to ensure that the proposed NAICS code accurately reflects your business activities and maintains consistency with other regulatory requirements. Misclassification or erroneous changes can lead to issues with tax reporting, compliance, and eligibility for certain programs or benefits.

Before proceeding with the code change request, gather all necessary information and documentation to support your eligibility and provide a clear rationale for the requested modification. This will help streamline the process and increase the chances of a successful change.

How to Update the NAICS Code with the IRS

If you meet the eligibility criteria and have a legitimate reason for changing your NAICS code, you can proceed with updating it with the IRS. Here’s a step-by-step guide on how to update the NAICS code:

- Evaluate the Need: Before initiating the change, carefully evaluate the need for updating the NAICS code. Ensure that it accurately reflects your current business activities and aligns with your strategic direction.

- Research the New Code: Identify the new NAICS code that best represents your updated business activities. This can be done by reviewing the NAICS code manual or consulting industry experts to ensure accuracy.

- Gather Documentation: Collect all necessary documentation and information to support your request for the code change. This may include financial statements, business descriptions, recent tax returns, and any other relevant materials.

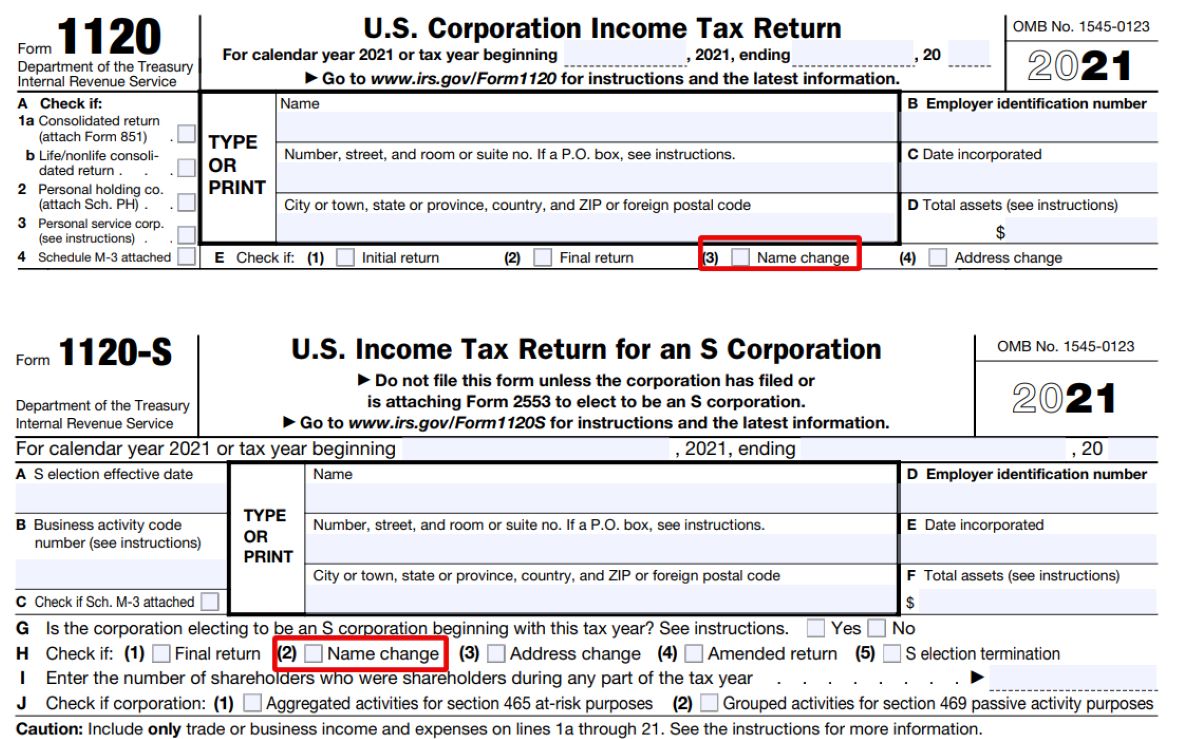

- Form Completion: Fill out the appropriate form for updating the NAICS code. In most cases, you will need to complete Form 8822-B, “Change of Address or Responsible Party-Business.”

- Provide Justification: Clearly state the reason for changing the NAICS code on the form. Provide a detailed explanation and supporting documentation to strengthen your case. It is essential to demonstrate that the change is necessary and legitimate.

- Submit the Form: Send the completed form, along with any required supporting documents, to the IRS. Ensure that you retain a copy of the form for your records.

- Follow Up: After submitting the form, allow the IRS time to process your request. You may receive a notification acknowledging the change, or the IRS may request additional information if necessary.

It is crucial to ensure the accuracy and validity of the information provided on the form. Any errors or omissions can lead to delays or potential complications. Seeking assistance from a tax professional or advisor can help ensure that all necessary steps are followed correctly.

Keep in mind that the process may differ for specific situations or business entities. Consulting with the IRS or seeking professional advice is recommended to ensure you are following the correct procedures and complying with all relevant regulations.

Step-by-Step Guide to Changing the NAICS Code

When changing the NAICS code for your business, it is essential to follow a systematic approach to ensure a smooth transition. Here is a step-by-step guide to help you navigate the process:

- Evaluate the Need: Determine the reason for changing your NAICS code. Assess whether it accurately reflects your current business activities and aligns with your strategic goals.

- Research and Select the New Code: Conduct thorough research to identify the new NAICS code that best represents your updated business activities. Consult the NAICS code manual, review industry standards, and seek expert advice, if needed.

- Review Implications: Understand the potential implications of changing your NAICS code. Consider its impact on taxation, regulatory compliance, reporting requirements, eligibility for government programs, and statistical analysis.

- Update Internal Records: Ensure that all internal records, including financial statements, marketing materials, and website information, reflect the new NAICS code. Update any relevant databases or systems where the code is utilized.

- Notify Partners and Customers: Inform relevant partners, suppliers, clients, and customers about the change in your NAICS code to maintain transparency and avoid any potential confusion or disruptions in business relationships.

- Complete the Required Forms: Fill out the necessary forms to officially change the NAICS code. Depending on your business entity, this may involve submitting Form 8822-B, “Change of Address or Responsible Party-Business,” or other forms as specified by the IRS.

- Include Supporting Documentation: Provide any required supporting documents, such as financial statements, business descriptions, or tax returns, to justify the code change and support your request.

- Submit the Forms: Submit the completed forms and supporting documents to the appropriate entity, such as the IRS. Ensure you follow the correct submission guidelines and retain a copy of all documents for your records.

- Track and Confirm: Keep a record of the date and method of submission for future reference and follow-up. Monitor for any communication or notifications from the IRS regarding the code change.

- Update Business Systems: Once the NAICS code change is approved and confirmed, update your business systems, including tax software, accounting records, and other relevant platforms, to reflect the new code.

Remember, it is important to consult with professionals and experts to ensure compliance with regulations and to navigate any specific requirements or complexities associated with changing the NAICS code for your business.

Required Documents and Information

When changing the NAICS code for your business, there are certain documents and information that you will need to gather and provide as part of the process. These documents and information are necessary to support your request for the code change and ensure compliance with IRS guidelines. Here are some of the key requirements:

- Financial Statements: Prepare recent financial statements, such as balance sheets and income statements, to demonstrate the nature of your business activities and support the need for the NAICS code change.

- Business Description: Provide a detailed business description that highlights your current operations, products, and services. This description should clearly explain how the proposed new NAICS code more accurately reflects your business activities.

- Tax Returns: Include copies of your recent tax returns to substantiate your business activities and establish your tax filing history. This helps validate your eligibility for the code change.

- Form 8822-B: Complete and submit Form 8822-B, “Change of Address or Responsible Party-Business,” as the primary form for updating the NAICS code with the IRS. Ensure that all relevant sections are filled out accurately and completely.

- Supporting Documents: Include any additional supporting documents that further justify the need for the NAICS code change. This may include contracts, invoices, marketing materials, or other relevant documentation that strengthens your case.

- Business Identification Numbers: Provide your Employer Identification Number (EIN) and any other relevant identification numbers associated with your business. These numbers help the IRS validate your business’s identity and tax status.

- Ownership and Organization Documents: Depending on your business entity type, you may need to provide copies of organizational documents, such as articles of incorporation, partnership agreements, or operating agreements.

Ensure that all documents are accurate, up to date, and properly organized before submitting them. It is important to maintain a clear and logical structure when presenting the information to facilitate the review and processing of your NAICS code change request.

Keep copies of all submitted documents for your records, including proof of submission and any correspondence received from the IRS regarding the code change.

Remember to consult with tax professionals or advisors throughout this process to ensure that you are meeting all IRS requirements and providing the necessary documentation to support your request for a NAICS code change.

Submitting the Required Forms

Once you have gathered all the necessary documents and completed the required forms, it is time to submit them to initiate the process of changing the NAICS code with the IRS. Follow these steps to ensure a smooth submission:

- Double-Check Form Completion: Review the completed Form 8822-B or any other relevant forms to ensure that all sections are correctly filled out. Verify that the information provided accurately reflects your business activities and reasons for the NAICS code change.

- Organize Supporting Documentation: Assemble all supporting documents in a logical and organized manner. Make sure they are easily accessible and ready to be submitted along with the forms. Create copies of all documents for your records.

- Select the Correct Submission Method: Determine the appropriate method for submitting the forms and supporting documents. This may include mailing the documents, submitting them electronically through the IRS website, or any other permissible method as outlined by the IRS.

- Include a Cover Letter: Consider including a cover letter that provides an overview of the NAICS code change request. This can help provide context and highlight key points to support your case.

- Address and Mail the Documents: If you choose to mail the documents, ensure that you have the correct address for submission. Use a secure and trackable mailing method to send the forms and supporting documents to the IRS. Keep the tracking number for future reference.

- Submit Electronically (if applicable): If electronic submission is allowed, follow the instructions provided by the IRS to upload the forms and supporting documents securely. Verify that all documents are attached in the correct format and that there are no size restrictions.

- Retain Confirmation and Copies: Once the forms and supporting documents are submitted, keep a record of the confirmation of submission or any receipts provided by the IRS. Retain copies of all submitted documents for your records.

It is important to submit the required forms and supporting documentation within the designated time frame and in accordance with the IRS guidelines. Failure to submit the forms correctly or provide all necessary documentation may result in delays or complications in the NAICS code change process.

It is recommended to consult with tax professionals or advisors to ensure that you are following the correct procedures and meeting all submission requirements. They can provide guidance and assist with any specific questions or concerns related to the submission process.

Processing Time and Notification

After submitting the required forms and supporting documents to change your NAICS code with the IRS, it is important to understand the processing time and how you will be notified of the status of your request. Here is what you can expect:

The processing time for NAICS code change requests can vary depending on various factors, including the volume of requests received by the IRS at any given time. While there is no specific timeframe defined by the IRS, it is advisable to allow for several weeks to several months for your request to be processed.

During the processing period, the IRS will review your submission, verify the information provided, and evaluate the justification for the NAICS code change. They may request additional documentation or clarification if necessary.

If your request is approved, the IRS will update their records with the new NAICS code for your business. You may receive a formal confirmation notification or document indicating the successful change. This notification could be in the form of a letter or an electronic communication, depending on the method of communication chosen during the submission process.

Conversely, if the IRS determines that additional information is required or rejects your NAICS code change request, they will notify you accordingly. They may outline the reasons for the rejection or request further clarification and documentation. It is essential to carefully review any correspondence from the IRS and promptly comply with their requests to resolve any outstanding issues.

Remember to keep a record of all communication and documentation exchanged with the IRS throughout the process. This includes copies of the submitted forms, supporting documents, confirmation of submission, and any correspondence received. These records will be useful for future reference and for addressing any potential issues or discrepancies that may arise.

While waiting for the IRS to process your NAICS code change request, continue using your current NAICS code for tax reporting and regulatory compliance purposes. Once you receive confirmation of the code change, update your records, systems, and any relevant documentation to reflect the new NAICS code.

If you have not received any communication from the IRS within a reasonable timeframe, consider reaching out to them for an update on the status of your NAICS code change request. Be prepared to provide relevant information such as your submission date and any confirmation numbers or tracking information.

It is always advisable to consult with tax professionals or advisors who can guide you through the process, provide insights, and address any concerns or questions you may have regarding the processing time or notification process.

Consequences of Changing the NAICS Code

Changing the NAICS code for your business can have various consequences and implications. While it may be necessary to accurately represent your business activities, it is essential to understand the potential impacts. Here are some key considerations:

- Taxation: Changing your NAICS code may affect how your business is taxed. Different NAICS codes can have different tax rates, deductions, or credits applicable to specific industries. It is important to consult with a tax professional to understand how the code change may impact your tax obligations and potential benefits.

- Regulatory Compliance: Government regulations and compliance requirements can vary based on NAICS codes. By changing your code, you might encounter different regulatory obligations or reporting requirements. Ensure that you understand how the new code affects your compliance obligations and take appropriate measures to meet them.

- Industry Identification: The NAICS code plays a role in how your business is identified within its industry. Changing the code may impact your industry positioning, market visibility, and the perception of your business among customers, partners, and investors. Be prepared to communicate and explain the rationale behind the change to stakeholders.

- Eligibility for Programs and Incentives: Some government programs, incentives, grants, or certifications have specific eligibility criteria based on NAICS codes. Changing your code may affect your eligibility for such programs. Research and review the requirements of the programs you currently participate in or intend to apply for to assess any potential impacts.

- Statistical Analysis: The NAICS code is used for statistical purposes, including economic analysis, industry comparisons, and market research. Changing your code may impact the accuracy and continuity of historical data for your business. Recognize that comparative analysis and trend assessments may need to be adjusted or recalibrated accordingly.

It is crucial to carefully evaluate the consequences and implications of changing your NAICS code and plan accordingly to mitigate any potential challenges. Consulting with industry experts, tax professionals, or business advisors can provide valuable insights and help you navigate the complexities associated with the code change.

Remember to update all relevant records, systems, and documentation to reflect the new NAICS code once the change is approved. Regularly review and monitor any changes in tax regulations, compliance obligations, or industry practices that may impact your business as a result of the NAICS code change.

By being proactive and informed, you can minimize any disruptions and maximize the benefits associated with updating your NAICS code to more accurately reflect your business activities.

Conclusion

Changing the NAICS code for your business is a significant decision that requires careful consideration and understanding of the implications. By accurately reflecting your business activities and aligning with the industry classification, you can ensure compliance with regulations, accurately report your financial information, and take advantage of relevant programs and incentives.

In this article, we have explored the process of changing the NAICS code with the IRS. We discussed the importance of understanding the NAICS code, the reasons that may necessitate a change, and the eligibility criteria for making the change. We also provided a step-by-step guide, highlighting the required documents and information, as well as the submission process.

It is essential to be mindful of the consequences of changing your NAICS code, such as potential tax implications, regulatory compliance adjustments, and the impact on industry identification and statistical analysis. Careful planning and consultation with experts ensure a smooth transition and minimize any disruptions along the way.

Remember, staying informed and up to date with the latest regulations, industry practices, and business trends is crucial for maintaining compliance and making well-informed decisions regarding your NAICS code. Continuously evaluate your business activities and periodically assess whether your current NAICS code accurately represents your operations to ensure ongoing accuracy and relevance.

By understanding the process, eligibility requirements, and implications of changing your NAICS code, you can confidently make the necessary adjustments to position your business for success in the ever-evolving business landscape.