Finance

How To Change Your Business Name With The IRS

Published: October 31, 2023

Learn how to change the name of your business with the IRS and ensure compliance with finance regulations and requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understand the Implications of Changing Your Business Name

- Step 2: Update Your Business Name with the Appropriate State Agencies

- Step 3: Update Your Business Name with the IRS

- Step 4: File the Required Forms and Documents with the IRS

- Step 5: Update Your Employer Identification Number (EIN)

- Step 6: Notify the IRS of the Name Change

- Step 7: Update Your Business Name on Tax Forms and Documents

- Step 8: Update Your Business Name with Other Government Agencies

- Step 9: Notify Customers, Vendors, and Business Partners

- Step 10: Update Your Business Name on Marketing Materials and Online Platforms

- Conclusion

Introduction

Changing your business name can be an exciting milestone for your company. Whether you are rebranding, expanding your services, or simply aiming for a fresh start, a new business name can help you make a bold statement in the market. However, it is important to understand that changing your business name involves more than just updating your signage and marketing materials. There are certain legal and administrative steps you need to take to ensure a smooth transition, especially when it comes to notifying the Internal Revenue Service (IRS).

The IRS is the governing body responsible for collecting federal taxes and regulating tax-related matters for businesses in the United States. As such, it is crucial to inform the IRS of your business name change to avoid any complications or disruptions in your tax filings and other financial obligations. In this article, we will provide you with a step-by-step guide on how to change your business name with the IRS, ensuring that you comply with all necessary regulations and maintain a sound financial standing.

Please note that the processes mentioned in this article are specific to businesses operating in the United States. If you are located in a different country, it is important to consult with your local tax authorities and legal professionals to ensure that you follow the correct procedures for changing your business name.

Step 1: Understand the Implications of Changing Your Business Name

Before embarking on the process of changing your business name with the IRS, it is crucial to fully grasp the implications and impacts of this decision. Changing your business name can have legal, financial, and branding implications, so careful consideration is required.

Firstly, evaluate the legal aspects of changing your business name. Research whether there are any legal restrictions or requirements for changing the name of your business in your jurisdiction. This may involve checking with your local county clerk’s office or consulting an attorney experienced in business law.

Next, consider the financial implications of the name change. Calculate the costs associated with updating your business name on legal documents, licenses, permits, and marketing materials. Moreover, assess the potential impact on your brand’s reputation and customer base. A name change may require you to invest in rebranding and marketing efforts to ensure a smooth transition and maintain customer loyalty.

Furthermore, review any contracts, agreements, or partnerships that may be affected by the name change. It is essential to inform all relevant parties and update any legal documents to reflect the new business name. Failing to do so could result in confusion, legal disputes, or the nullification of existing agreements.

Finally, evaluate the potential impact on your search engine visibility and online presence. Changing your business name may require updating your website domain, social media handles, and online listings. It is important to plan and execute a comprehensive online strategy to ensure a seamless transition and maintain your online credibility.

By understanding the implications of changing your business name, you can make informed decisions and take appropriate steps to mitigate any potential challenges or negative consequences. Once you have a clear understanding of the implications, you can proceed with confidence to update your business name with the appropriate state agencies and the IRS.

Step 2: Update Your Business Name with the Appropriate State Agencies

Once you have decided to change your business name, you need to update it with the appropriate state agencies. This step is essential to ensure that your business name is legally recognized and reflected accurately in official records. The specific agencies and requirements may vary depending on your state, so it is crucial to research and identify the necessary steps. Here are some general guidelines to help you through the process:

1. Secretary of State: Start by contacting your state’s Secretary of State office or equivalent agency responsible for business entity filings. They will provide guidance on the required forms and procedures to update your business name on state records. In most cases, you will need to fill out a Name Change Amendment form and submit it along with the necessary fees.

2. Business Licenses and Permits: Check if your business name change requires updating your licenses and permits. Contact the respective licensing agencies or regulatory bodies to understand their specific requirements and procedures. Depending on the nature of your business, this may include licenses such as professional licenses, health and safety permits, or liquor licenses.

3. Fictitious Business Name (DBA): If you operate your business under a fictitious name or “Doing Business As” (DBA), you will need to update this registration as well. Contact the county clerk’s office or the appropriate agency responsible for DBA registrations to file the necessary forms and pay any applicable fees.

4. Professional Associations and Industry-Specific Registries: If your business is a member of any professional associations or industry-specific registries, ensure to update your business name with them as well. This will help maintain your standing within the industry and ensure accurate representation in their membership directories.

5. Insurance Providers and Financial Institutions: Notify your insurance providers, including liability insurance, property insurance, and business bank accounts, about the name change. They may require updated documentation, such as a revised policy or account information, reflecting your new business name.

By updating your business name with the appropriate state agencies, you will ensure that your new name is legally recognized, and your business records are accurately updated. This step is crucial for maintaining compliance and avoiding any legal issues in the future. Once you have completed the necessary state agency updates, you are ready to move on to the next step: updating your business name with the IRS.

Step 3: Update Your Business Name with the IRS

After updating your business name with the appropriate state agencies, the next important step is to inform the Internal Revenue Service (IRS) about the name change. This ensures that your tax filings and other financial obligations are properly attributed to your new business name. Here’s how you can update your business name with the IRS:

1. Obtain your Employer Identification Number (EIN): If you haven’t already done so, ensure that you have an active and valid EIN for your business. The EIN is a unique identification number assigned by the IRS and is used to identify your business for tax purposes. If you already have an EIN, proceed to the next step.

2. Complete and submit Form SS-4: The Form SS-4, also known as the Application for Employer Identification Number, is used to apply for or update your EIN. On the form, you will need to provide the new business name and indicate that it is a name change. You can submit the form online through the IRS website or by mail. Follow the instructions provided by the IRS to ensure accurate and timely submission.

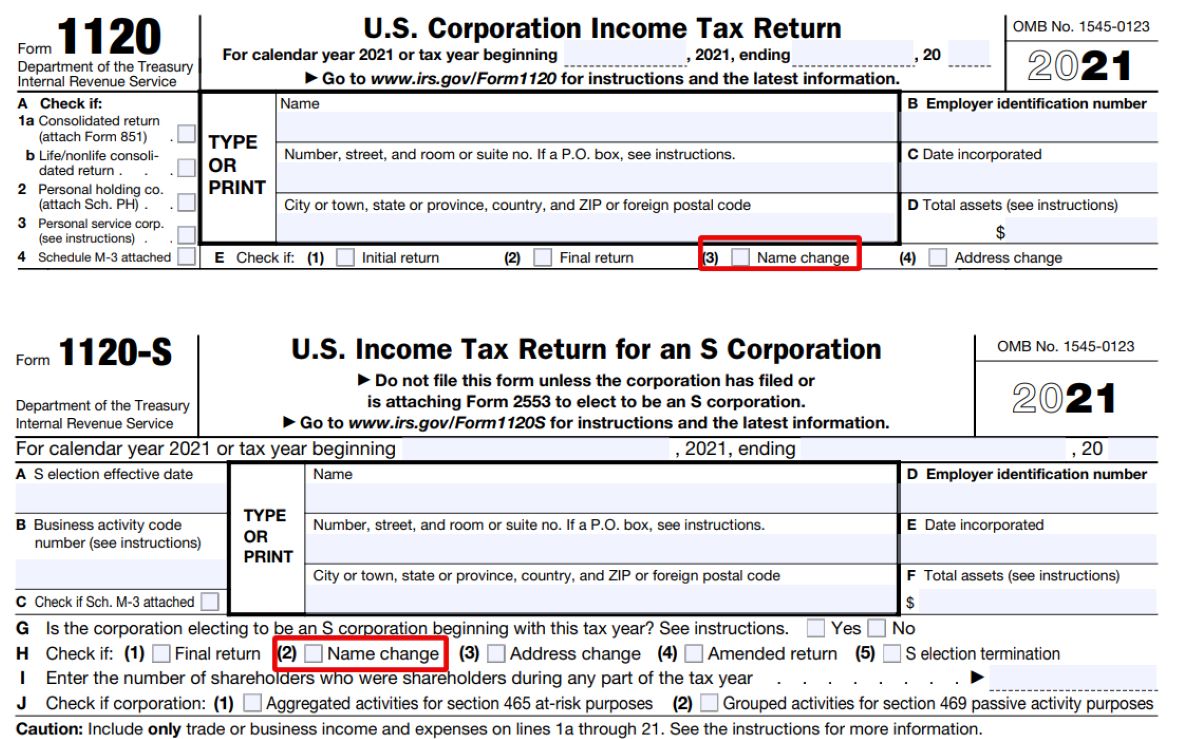

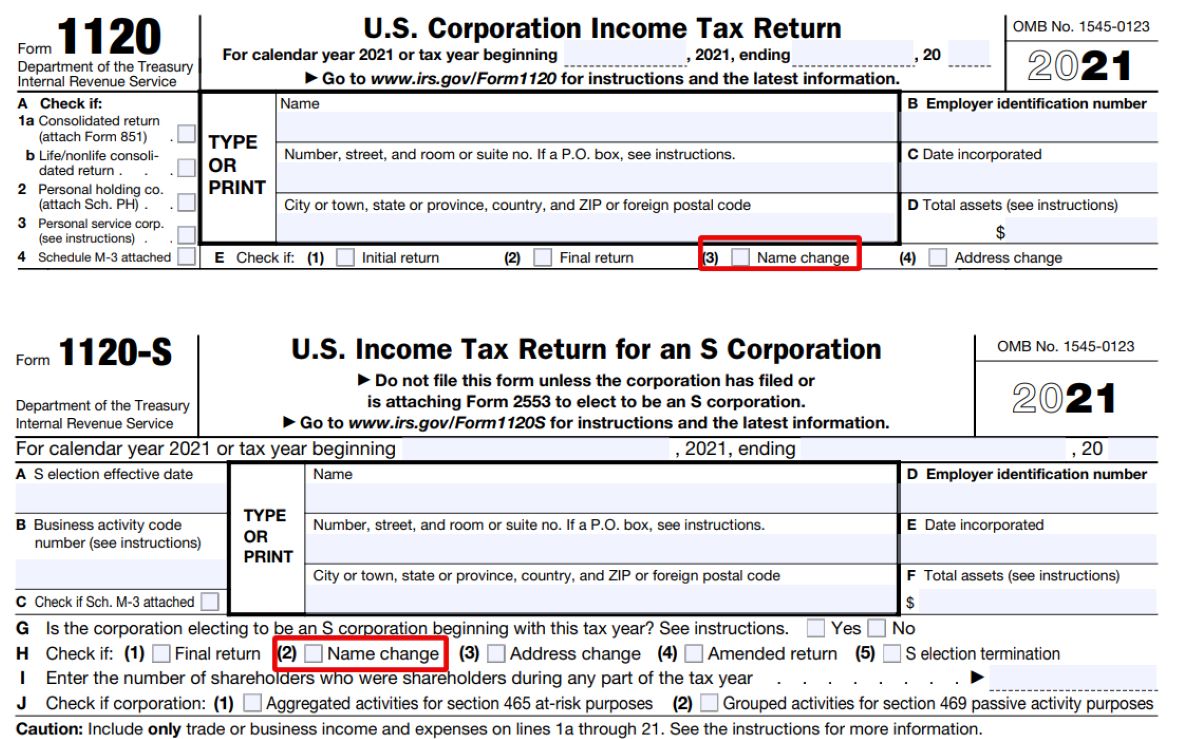

3. Update your business name on tax forms: Review the various tax forms that your business may use, such as the Form 1040 (individual tax return) or Form 1120 (corporate tax return). Update the business name field on these forms to reflect your new name. If you use tax preparation software or have an accountant, notify them about the name change to ensure the proper updates are made.

4. Maintain accurate records: It is important to keep proper documentation related to your name change, including copies of any forms or correspondence submitted to the IRS. This will help you demonstrate compliance and provide evidence of the name change if needed in the future.

5. Verify the name change with the IRS: Once you have submitted the necessary forms and updated your tax records, it is advisable to verify the name change directly with the IRS. You can do this by contacting the IRS Business and Specialty Tax Line or through their online services. This will help ensure that the IRS has correctly processed your name change and that it is reflected in their records.

By following these steps, you can successfully update your business name with the IRS and ensure that your tax filings are associated with your new name. It is essential to complete this process promptly to avoid any confusion or delays in your tax obligations. Once you have updated your business name with the IRS, it is time to move on to the next step: filing any required forms and documents.

Step 4: File the Required Forms and Documents with the IRS

Once you have updated your business name with the IRS, the next step is to file any required forms and documents to ensure that your records are accurately updated. The specific forms and documents you need to file may vary depending on your business structure and the nature of the name change. Here are some key considerations to keep in mind:

1. Business Entity Type: The type of business entity you have will determine the forms and documents you need to file with the IRS. For example, if you operate as a sole proprietorship, you may only need to update your individual tax return and the necessary schedules. On the other hand, if you have a partnership, corporation, or LLC, you may need to file additional forms such as the Form 1065 (Partnership Return), Form 1120 (Corporate Return), or Form 1120-S (S Corporation Return).

2. Required Forms and Schedules: Consult the IRS website or seek guidance from a tax professional to determine the specific forms and schedules you need to file. These forms will typically include the appropriate sections for updating your business name, such as the name and identification sections. Ensure that you accurately input your new business name to avoid any discrepancies or confusion.

3. Deadlines and Filing Methods: Be mindful of the deadlines for filing the required forms and documents with the IRS. The filing due dates can vary depending on your business structure and the tax year. It is recommended to file well in advance to avoid any penalties or late fees. In addition, familiarize yourself with the available filing methods, which may include e-filing or mailing paper forms.

4. Additional Documentation: The IRS may request additional documentation to support the name change, especially if you have changed your business structure or if it is a significant change. Be prepared to provide any necessary supporting documents, such as articles of amendment, legal name change certificates, or partnership agreements.

5. Review and Double-Check: Before submitting the forms and documents to the IRS, review them thoroughly to ensure accuracy and completeness. Mistakes or omissions could result in delays or complications with your tax filings. Consider seeking assistance from a tax professional or accountant to ensure that all necessary information is included and correctly entered.

By diligently filing the required forms and documents with the IRS, you can ensure that your records are updated and reflect your new business name. This step is crucial for maintaining compliance with tax regulations and avoiding any potential issues during tax audits or assessments. Once you have filed the necessary forms, you can move forward to update your Employer Identification Number (EIN) with the IRS as the next step in the process.

Step 5: Update Your Employer Identification Number (EIN)

After successfully filing the required forms and documents with the IRS to update your business name, it is important to ensure that your Employer Identification Number (EIN) is also updated. The EIN is a unique identification number assigned by the IRS to identify your business for tax purposes. Here’s how you can update your EIN with the IRS:

1. Determine if an EIN update is necessary: Assess whether your business name change warrants an update to your EIN. In most cases, a name change alone does not require an EIN update. However, if your business structure has changed, such as converting from a sole proprietorship to an LLC, or if you have received a new EIN when changing the entity type, an EIN update may be necessary.

2. Contact the IRS: Reach out to the IRS to inquire about updating your EIN. You can do this by contacting the IRS Business and Specialty Tax Line or visiting the IRS website for guidance. Explain that you have changed your business name and discuss any changes to your business structure or entity type that may require an EIN update.

3. Provide necessary documentation: The IRS may request specific documentation to support the change in your business name or structure. Be prepared to provide any requested documents, such as updated articles of organization or any legal name change certificates. Follow the instructions provided by the IRS to ensure accurate and timely submission.

4. Update your business records: Once the IRS has confirmed the update to your EIN, ensure that you update your business records accordingly. This includes updating your accounting systems, payroll records, and employee documents, as well as notifying any relevant parties such as financial institutions or insurance providers. It is important to keep accurate records to avoid any confusion or discrepancies in the future.

5. Verify the EIN update: After completing the EIN update process, verify with the IRS that your EIN has been successfully updated. You can do this by contacting the IRS directly or through their online services. This step will help ensure that your new business name is properly associated with your EIN and recorded accurately in the IRS system.

Updating your Employer Identification Number (EIN) with the IRS is crucial to maintain proper tax reporting and compliance. By following these steps, you can ensure that your EIN reflects your new business name and any changes to your business structure. Once your EIN update is complete, you can proceed to the next steps, which involve notifying the IRS of the name change and updating your business name on tax forms and documents.

Step 6: Notify the IRS of the Name Change

After updating your business name and Employer Identification Number (EIN) with the IRS, it is essential to officially notify the IRS of the name change. This step ensures that the IRS has accurate information on file and avoids any potential confusion or issues with your tax filings. Here’s how you can notify the IRS of the name change:

1. Write a letter to the IRS: Begin by writing a formal letter to the IRS to inform them of the name change. In the letter, include your business’s previous name, new name, EIN, and a brief explanation of the name change. Be concise but provide enough information for the IRS to properly identify your business. It is advisable to keep a copy of this letter for your records.

2. Include supporting documents: Along with the letter, include any necessary supporting documents to verify the name change. This may include articles of amendment, legal name change certificates, or any other official documents that validate the change. If you changed your business structure, include documents such as revised formation documents or a new partnership agreement.

3. Send the letter to the appropriate IRS department: It is important to send the letter to the correct IRS department to ensure that it is received and processed promptly. The IRS provides specific addresses for various types of tax returns and related correspondence. Refer to the IRS website or contact the IRS directly to obtain the correct mailing address for your specific situation.

4. Keep track of your correspondence: Maintain a record of the letter and any related communications with the IRS. This includes the date you sent the letter, the method of delivery used, and any confirmation or response received from the IRS. These records will be valuable in case there are any future inquiries or issues regarding the name change.

5. Review your tax filings: After notifying the IRS of the name change, review your tax filings to ensure that your new business name is correctly reflected. Check all tax forms, schedules, and documents to verify that the new name appears consistently throughout. If you notice any discrepancies or errors, contact the IRS for guidance on how to rectify the situation.

By officially notifying the IRS of the name change, you proactively ensure that your business’s updated name is recognized and recorded accurately in their system. This step contributes to maintaining a seamless and compliant tax-filing process in the future. With the name change notification complete, you can proceed to update your business name on tax forms and other relevant documents.

Step 7: Update Your Business Name on Tax Forms and Documents

Now that you have notified the IRS of your business name change, it is important to update your business name on all relevant tax forms and documents. This step ensures consistency and accuracy in your tax filings and helps avoid any confusion or delays with the IRS. Here’s how you can update your business name on tax forms and documents:

1. Review your tax forms: Start by reviewing all tax forms that your business typically uses for tax filing purposes. This may include forms such as Form 1040 (individual tax return), Form 1120 (corporate tax return), or Form 1065 (partnership tax return). Assess the sections where your business name appears and note the necessary updates.

2. Update your business name on tax forms: Carefully input your new business name in the appropriate sections on the tax forms. Double-check for accuracy to ensure that it matches the updated name you have filed with the IRS and other relevant agencies. If you use tax preparation software or work with an accountant, notify them of the name change to ensure proper updates are made.

3. Update your tax identification numbers: Along with updating your business name, make sure to review and update any associated tax identification numbers, such as your Employer Identification Number (EIN) or Social Security Number (SSN). These numbers should also reflect the updated business name for proper identification and record-keeping.

4. Keep track of deadlines: Stay mindful of the deadlines for filing your tax forms. Failure to submit your forms by the designated due dates can result in penalties or interest charges. Mark the deadlines on your calendar and make sure you have enough time to complete the necessary updates before filing.

5. Maintain accurate records: As you update your tax forms and documents, keep detailed records of the changes made. This includes documenting the date of the updates, the specific forms that were updated, and any reference numbers or confirmation notices received from the IRS. These records will be valuable for future reference or in case of any inquiries or audits.

By updating your business name on tax forms and documents, you ensure that your tax filings accurately reflect your new name. This step contributes to seamless tax compliance and helps avoid any confusion or discrepancies in your tax records. Once you have completed this step, you can move forward to update your business name with other government agencies as the next part of the process.

Step 8: Update Your Business Name with Other Government Agencies

In addition to updating your business name with the IRS, it is crucial to update your business name with other relevant government agencies. This step ensures that all government entities are aware of your new business name and can accurately update their records. Here’s how you can update your business name with other government agencies:

1. State and Local Government Agencies: Start by contacting the state and local government agencies where your business is registered or operates. This may include the Department of Revenue, Department of Licensing, or any other agencies responsible for overseeing specific business activities or licenses. Inquire about their specific requirements and procedures for updating your business name. Typically, you will need to submit a name change amendment or similar form, along with supporting documentation such as your updated articles of organization or legal name change certificates.

2. State and Local Tax Authorities: Notify your state and local tax authorities of the name change. This may involve updating your tax registration or account information with the appropriate departments. Failure to update your business name with these authorities may result in delays or complications with tax filings and payments.

3. Social Security Administration (SSA): If your business has employees, ensure that you update your business name with the Social Security Administration (SSA). This includes updating your records with the SSA for payroll tax purposes and ensuring that employee W-2 forms reflect the new business name.

4. Department of Labor: If you have registered with the Department of Labor for purposes such as unemployment insurance or workplace safety, inform them of your business name change. This will help ensure that their records are accurate and up to date.

5. Other Government Agencies: Depending on the nature of your business and its activities, there may be other government agencies that require notification of your business name change. Research and identify any relevant agencies in your industry or sector, such as regulatory bodies or licensing boards, and update your business name with them accordingly.

By updating your business name with other government agencies, you ensure that your records are consistent across various entities and avoid any potential discrepancies or confusion. This step contributes to maintaining compliance with government regulations and helps establish a unified and updated identity for your business. Once you have completed this step, move on to the next step, which involves notifying customers, vendors, and business partners of your name change.

Step 9: Notify Customers, Vendors, and Business Partners

Once you have updated your business name with government agencies, it is critical to notify your customers, vendors, and business partners of the name change. This step ensures transparency and helps maintain strong business relationships. Here’s how you can effectively communicate the name change to key stakeholders:

1. Notify your customers: Reach out to your existing customers through various communication channels, such as emails, newsletters, or social media. Clearly state the reason for the name change and emphasize that it is a positive development for your business. Assure them that your products or services remain the same, and highlight any improvements or benefits associated with the name change. Provide clear instructions on how they should address your business moving forward and update their records.

2. Update your online presence: Make sure to update your business name across all online platforms, including your website, social media profiles, and business listings. This will help ensure consistency and prevent confusion among potential customers. Update your logo, banners, and other visual elements as needed to reflect the new name.

3. Inform your vendors and suppliers: Reach out to your vendors and suppliers to inform them of the name change. Update your business name with them on records, contracts, and any communication channels. This will help ensure a seamless transition in your business relationships and prevent any disruptions in the supply chain or payment processing.

4. Update business documentation: Review and update all essential business documents to reflect the new name. This includes contracts, agreements, invoices, purchase orders, and any other legal or financial documents. Notify your legal counsel and accounting team about the name change to ensure that the necessary updates are made promptly.

5. Update marketing materials: Update your marketing materials, such as brochures, business cards, and promotional materials, with the new business name. Ensure that all online and offline marketing efforts reflect the updated name accurately and consistently. This will help maintain brand consistency and professionalism.

6. Train customer-facing staff: Properly train your customer-facing staff, such as sales representatives and customer service agents, to inform customers about the name change confidently. Equip them with updated talking points and any relevant information to address customer inquiries or concerns effectively.

By notifying your customers, vendors, and business partners of your name change, you ensure a smooth transition and maintain trust and credibility in your relationships. Consistent communication and transparency play a crucial role in ensuring that all stakeholders are aware of the change and can properly update their records. With this step completed, you can proceed to the final step: updating your business name on marketing materials and online platforms.

Step 10: Update Your Business Name on Marketing Materials and Online Platforms

The final step in the process of changing your business name is to update your marketing materials and online platforms. This step is essential for maintaining consistency and ensuring that your brand is accurately represented across all channels. Here’s how you can effectively update your business name on marketing materials and online platforms:

1. Website: Begin by updating your website with the new business name. This includes changing the domain name if necessary and updating the logo, headers, and footers to reflect the new name. Review all pages of your website and update any mentions of the old business name to the new one. Verify that all contact information and links are updated with the new name as well.

2. Social media profiles: Update your social media profiles with the new business name. Change your username, handle, and display name to reflect the updated name. Update the profile description and any other relevant sections to ensure consistency across all platforms. Additionally, inform and engage with your followers about the name change through posts or announcements.

3. Online directories and business listings: Update your business name on online directories and business listings, such as Google My Business, Yelp, and industry-specific directories. Update your profile information, including business name, address, phone number, and website URL. This will help customers searching for your business find the most accurate and up-to-date information.

4. Email signatures and templates: Update your email signatures to include the new business name. This includes any email templates or automated responses that you use regularly. Ensure that all communication from your business reflects the updated name.

5. Marketing collateral: Review and update all marketing collateral, such as brochures, flyers, business cards, and promotional materials. Replace the old business name with the new one and, if necessary, update any visuals or design elements to support the rebrand.

6. Advertising campaigns: If you are running any advertising campaigns, such as Google Ads or social media ads, update the business name associated with those campaigns. Ensure that the landing pages or destination URLs match the new business name to maintain a cohesive brand experience.

7. Offline advertising: If you have any offline advertising efforts, such as billboards or print advertisements, coordinate with the respective vendors to update your business name on these materials. This includes contacting media outlets, printing companies, or any other relevant parties involved in your offline marketing initiatives.

By updating your business name on marketing materials and online platforms, you ensure that your brand is consistently represented and avoid any confusion among your target audience. Maintaining a cohesive and updated online presence enhances your brand’s credibility and allows potential customers to easily find and recognize your business. With this final step completed, your transition to the new business name is complete.

Conclusion

Changing your business name is a significant decision that can impact various aspects of your operations. Throughout the process, it is crucial to ensure that you update your business name with the IRS and other relevant government agencies to maintain compliance and avoid any legal or financial implications. By following the ten steps outlined in this guide, you can navigate through the intricacies of the name change process effectively.

Understanding the implications, updating your business name with the appropriate state agencies, notifying the IRS, and updating your EIN are all crucial steps in this journey. Filing the necessary forms, notifying other government agencies, and informing customers, vendors, and business partners of your name change are equally important in maintaining strong business relationships and a consistent brand identity. Lastly, updating your business name on marketing materials and online platforms solidifies your rebranding efforts and ensures a polished transition.

Remember to maintain accurate records throughout the process and seek assistance from professionals when needed. By adhering to these steps, you can confidently navigate the process of changing your business name with the IRS and smoothly transition to a new chapter for your business.

Keep in mind that the specific requirements and procedures may vary depending on your location and business structure. It is always advisable to consult with legal and accounting professionals familiar with your jurisdiction to ensure full compliance during the name change process.