Finance

How To Get Credit Report With ITIN

Modified: February 21, 2024

Learn how to obtain your credit report using an ITIN, an essential step in managing your finances and building a solid credit history.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an ITIN?

- Why is a credit report important?

- How to obtain an ITIN

- Understanding Credit Reporting Agencies

- Steps to Get a Credit Report with an ITIN

- How to Dispute Errors on Your Credit Report

- Tips for Building Credit with an ITIN

- Frequently Asked Questions about Credit Reports with ITINs

- Conclusion

Introduction

Welcome to our comprehensive guide on how to get a credit report with an ITIN. If you are an immigrant or a non-resident alien living in the United States, you may be familiar with an Individual Taxpayer Identification Number (ITIN). This unique nine-digit number is issued by the Internal Revenue Service (IRS) to individuals who are required to file taxes but are not eligible for a Social Security number (SSN).

Having a credit report is an essential part of managing your finances and building a strong financial foundation. It provides a snapshot of your credit history, including your borrowing and repayment habits. Lenders, landlords, and even potential employers often rely on credit reports to evaluate your creditworthiness and determine the level of risk they are willing to take with you.

Obtaining a credit report with an ITIN is crucial for establishing and maintaining good credit. It allows you to track your financial progress, identify any errors or discrepancies, and take necessary actions to improve your credit score. In this guide, we will walk you through the steps to obtain a credit report with an ITIN and provide valuable tips on managing and building credit.

Whether you are a recent immigrant, a student, or a non-resident alien, understanding how to obtain a credit report with an ITIN is key to achieving your financial goals and accessing various financial opportunities. So, let’s dive in and explore the steps you need to take to get your credit report with an ITIN.

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a unique nine-digit number issued by the Internal Revenue Service (IRS) to individuals who are required to file taxes but are not eligible for a Social Security number (SSN). ITINs are primarily used for tax purposes and are not the same as SSNs.

ITINs are issued to individuals who fall into one of the following categories:

- Non-resident aliens who are required to file a U.S. tax return

- Spouses or dependents of U.S. citizens or resident aliens

- Visa holders or students who are not eligible for an SSN

- Foreign nationals conducting business or investing in the U.S.

The purpose of an ITIN is to ensure that individuals who have tax obligations in the United States can comply with the IRS requirements. Having an ITIN allows individuals to file taxes, claim tax benefits and credits, and meet the tax filing obligations associated with living or earning income in the U.S.

It’s important to note that an ITIN is not a form of work authorization or a valid identification document for other purposes. Its sole purpose is for tax-related matters. Therefore, it’s crucial to understand the specific requirements for obtaining an ITIN and how it impacts your tax obligations.

If you are unsure whether you need an ITIN, it’s best to consult with a qualified tax professional or visit the official IRS website for detailed information. The rules around ITINs can vary depending on individual circumstances, so it’s important to ensure you are in compliance with the IRS regulations.

Now that you have a better understanding of what an ITIN is, let’s explore the importance of having a credit report and how it can impact your financial journey.

Why is a credit report important?

A credit report plays a crucial role in your financial life, as it provides a snapshot of your creditworthiness and financial history. Here are several key reasons why a credit report is important:

- Lenders rely on credit reports: When you apply for a loan, credit card, or mortgage, lenders often review your credit report to assess your creditworthiness. They look at factors such as your payment history, credit utilization, and outstanding debts to determine whether you are a responsible borrower.

- Rentals and housing applications: Landlords and property managers may request your credit report when you apply for a rental property. A positive credit history can increase your chances of being approved, while a negative credit report may impact your ability to secure a lease.

- Job applications: Certain employers may review your credit report as part of their hiring process, particularly for positions that require financial responsibility or access to sensitive financial information. Maintaining a good credit report can enhance your employment prospects.

- Insurance premiums: Some insurance companies use credit-based insurance scores to assess risk and determine premiums for auto, home, or rental insurance. A favorable credit report can lead to lower insurance rates and potentially save you money.

- Interest rates: A strong credit report can qualify you for lower interest rates on loans and credit cards. This can result in substantial savings over time, as lower interest rates mean you pay less in interest charges.

By understanding the importance of a credit report, you can take proactive steps to manage your credit responsibly and improve your financial future. Now, let’s move on to the next section, which covers how to obtain an ITIN.

How to obtain an ITIN

If you are not eligible for a Social Security Number (SSN) but need a taxpayer identification number for tax purposes, you can apply for an Individual Taxpayer Identification Number (ITIN). Here are the steps to obtain an ITIN:

- Gather the necessary documents: To apply for an ITIN, you will need to submit the appropriate documentation to verify your identity and foreign status. This may include your passport, national identification card, or other official identification documents.

- Complete the Form W-7: The Form W-7 is the application for an ITIN. You can download the form from the official Internal Revenue Service (IRS) website or obtain it from an IRS office. The form requires you to provide personal information, including your name, address, and date of birth, as well as documentation details.

- Mail your application: After completing the Form W-7, you will need to mail it along with your supporting documents to the IRS. Make sure to check the IRS website for the correct mailing address based on your country of residence.

- Wait for processing: The processing time for an ITIN application can vary, but it typically takes around 7 to 11 weeks. You can check the status of your application on the IRS website using the “Where’s My Refund?” tool.

- Receive your ITIN: Once your application is approved, the IRS will issue you an ITIN. You will receive an ITIN letter that includes your nine-digit identification number. Keep this letter in a safe place, as you will need it for tax filing purposes.

It’s important to note that the ITIN is specifically used for tax-related purposes and does not grant you work authorization or serve as a form of identification for other purposes. However, having an ITIN opens up opportunities for tax compliance and allows you to establish a credit history.

Once you have obtained your ITIN, you can take the necessary steps to obtain a credit report and begin building a positive credit history. In the next section, we will explore credit reporting agencies and their role in providing credit reports.

Understanding Credit Reporting Agencies

Credit reporting agencies, also known as credit bureaus, play a crucial role in the financial ecosystem by collecting and maintaining information about individuals’ credit histories. They gather data from various sources, such as lenders, creditors, and public records, and compile it into credit reports. These reports provide a detailed overview of an individual’s borrowing and payment history, as well as other relevant information that can help lenders assess creditworthiness.

There are three main credit reporting agencies in the United States:

- Experian: Experian is one of the largest credit reporting agencies globally. They collect data from creditors, lenders, and public records to create credit profiles for individuals. Experian provides credit reports, credit scores, and other related services to both consumers and businesses.

- Equifax: Equifax is another prominent credit reporting agency that gathers and manages consumer credit data. They provide credit reports and credit scores to individuals, as well as various credit-related services to businesses.

- TransUnion: TransUnion is a leading global credit reporting agency that collects and maintains information on individuals’ credit history. They offer credit reports, credit monitoring, and other services to both consumers and businesses.

These credit reporting agencies receive information from creditors, such as banks, credit card companies, and lenders, who regularly report individuals’ borrowing and repayment activities. This information includes account balances, payment history, credit limits, and any negative actions, such as late payments or defaults.

It is important to note that credit reporting agencies do not make lending decisions or determine creditworthiness. They simply provide the data that lenders use to make informed decisions. Lenders and creditors rely on credit reports and scores to assess the level of risk associated with lending money or extending credit to individuals.

Understanding how credit reporting agencies operate and the role they play in the credit ecosystem is crucial when it comes to accessing credit and managing your financial health. In the next section, we will discuss the steps involved in obtaining a credit report with an ITIN.

Steps to Get a Credit Report with an ITIN

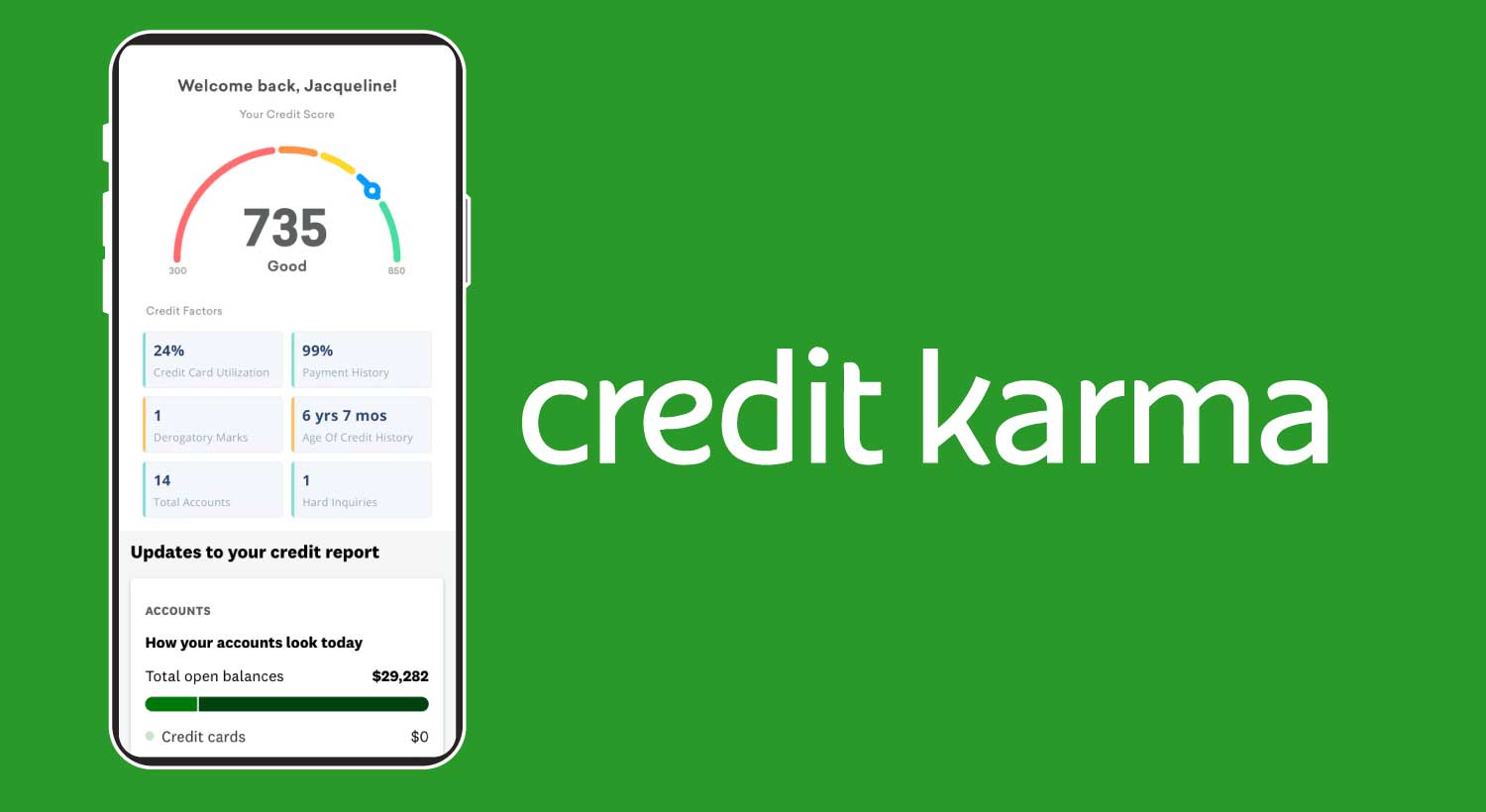

Obtaining a credit report with an Individual Taxpayer Identification Number (ITIN) is an important step in establishing and managing your credit history. Here are the steps to get a credit report with an ITIN:

- Ensure you have an ITIN: Before you can request a credit report, make sure you have obtained an ITIN from the Internal Revenue Service (IRS). If you have not yet obtained an ITIN, refer to the previous section on how to obtain an ITIN.

- Choose a credit reporting agency: Select one or more of the major credit reporting agencies, such as Experian, Equifax, or TransUnion. These agencies collect and maintain credit data, and you should obtain your credit report from each one to ensure accuracy.

- Request your credit report: Visit the website of the chosen credit reporting agency and look for the section that allows you to request your credit report. Provide the necessary information, including your ITIN, personal details, and any other required information.

- Verify your identity: As part of the credit report request process, you may need to verify your identity. This can be done by providing additional information, such as your date of birth, address history, or answering security questions based on your credit history.

- Review your credit report: Once you receive your credit report, carefully review it for accuracy. Check that your personal information is correct and verify that all credit accounts and their associated details are accurate and belong to you.

- Dispute any errors: If you notice any errors or discrepancies in your credit report, promptly inform the credit reporting agency. They have processes in place to investigate and correct any inaccuracies. Disputing errors is important to ensure that your credit report reflects accurate information.

It is recommended that you regularly request and review your credit reports from all three major credit reporting agencies. This allows you to stay informed about your credit health, identify potential issues, and take appropriate actions to improve your credit score.

Understanding the steps involved in obtaining a credit report with an ITIN is vital for immigrants, non-resident aliens, and others who do not have a Social Security Number but still need to build and manage their credit. In the next section, we will delve into how to dispute errors on your credit report.

How to Dispute Errors on Your Credit Report

While credit reporting agencies strive for accuracy, errors can sometimes occur on credit reports. These errors may include incorrect personal information, inaccurate account details, or fraudulent activity. It is crucial to periodically review your credit reports and promptly dispute any errors you find. Here’s how to dispute errors on your credit report:

- Obtain a copy of your credit report: Start by requesting your credit report from the major credit reporting agencies – Experian, Equifax, and TransUnion. You are entitled to receive a free copy of your credit report once every 12 months from each agency through the official Annual Credit Report website.

- Identify the errors: Carefully review your credit report and make note of any errors or discrepancies. This can include incorrect personal information, accounts that don’t belong to you, or fraudulent activity.

- Collect supporting documentation: Gather any documentation that supports your claim of an error. This can include bank statements, payment receipts, or correspondence with the creditor.

- Submit a dispute: Contact the credit reporting agency that issued the credit report and submit a dispute. Many credit reporting agencies provide an online dispute form on their website, making it convenient to file a dispute. Provide clear and concise details about the error and attach any supporting documentation.

- Investigation process: The credit reporting agency will initiate an investigation into your dispute. They will contact the creditor or lender involved and request verification of the disputed information.

- Resolution of the dispute: The credit reporting agency must investigate the dispute within a certain timeframe, typically 30 to 45 days. Once the investigation is complete, they will notify you of the results. If the disputed information is found to be inaccurate or cannot be verified, the credit reporting agency must correct or remove it from your credit report.

- Follow up and monitor: After the dispute is resolved, it’s important to follow up and ensure that the necessary corrections have been made. Continue to monitor your credit reports periodically to ensure accuracy.

Disputing errors on your credit report is crucial to maintain accurate financial information and protect your creditworthiness. By taking action, you can ensure that potential errors or inaccuracies do not negatively impact your credit score or financial future.

Now that you know how to dispute errors on your credit report, let’s move on to the next section, which provides tips for building credit with an ITIN.

Tips for Building Credit with an ITIN

Building credit with an Individual Taxpayer Identification Number (ITIN) is essential for establishing a strong financial foundation and accessing various financial opportunities. Here are some valuable tips to help you build credit with an ITIN:

- Apply for a secured credit card: A secured credit card is a great option for building credit. You provide a security deposit, which becomes your credit limit. Use the card responsibly by making small purchases and paying off the balance in full and on time each month.

- Set up utility and phone bills in your name: Paying utility bills, such as electricity, water, or internet, in your name can contribute positively to your credit history. Make sure to pay these bills on time every month.

- Consider becoming an authorized user: If you have a trusted family member or friend with good credit, ask if they can add you as an authorized user on one of their credit cards. Their positive credit history can be beneficial for your credit profile.

- Apply for a credit-builder loan: Some financial institutions offer credit-builder loans specifically designed to help individuals build credit. These loans require you to make regular payments, and the financial institution reports your payment history to the credit reporting agencies.

- Keep your credit utilization low: Credit utilization refers to the amount of credit you are using compared to your total credit limit. Aim to keep your credit utilization below 30%, as high utilization can negatively impact your credit score.

- Pay your bills on time: Consistently paying your bills on time is crucial for building credit. Late payments can have a significant impact on your credit score, so make it a priority to pay your bills by the due dates.

- Maintain a healthy credit mix: Having a diverse mix of credit accounts, such as credit cards, loans, and lines of credit, can demonstrate your ability to manage various types of debt. However, avoid taking on too much debt and only borrow what you can afford to repay.

- Monitor your credit reports regularly: Keep an eye on your credit reports to ensure accuracy and identify any potential issues. You can request a free credit report from each of the major credit reporting agencies once a year through the Annual Credit Report website.

- Stay patient and consistent: Building credit takes time, and it requires consistent and responsible financial behavior. Be patient and continue practicing good credit habits to achieve positive results over time.

By following these tips, you can steadily build your credit history with an ITIN and pave the way for future financial opportunities. Remember, responsible credit management is key to achieving a strong credit profile and maintaining a healthy financial future.

Now, let’s address some frequently asked questions about credit reports with ITINs in the next section.

Frequently Asked Questions about Credit Reports with ITINs

As an immigrant or non-resident alien building credit with an Individual Taxpayer Identification Number (ITIN), you may have some questions about the process. Here are some frequently asked questions and their answers:

1. Can I get a credit report with an ITIN?

Yes, you can obtain a credit report with an ITIN. ITIN holders have the right to request and receive their credit reports from the major credit reporting agencies, including Experian, Equifax, and TransUnion.

2. Are credit reports with an ITIN different from those with a Social Security Number (SSN)?

No, credit reports obtained with an ITIN contain the same types of information as those obtained with an SSN. However, the credit reporting agencies use your ITIN as the identifier for the credit report instead of an SSN.

3. Will having an ITIN affect my credit score?

An ITIN itself doesn’t have a direct impact on your credit score. Your credit score is based on your credit history and payment behavior. Building a positive credit history with responsible credit management will help improve your credit score over time.

4. How long does it take to build credit with an ITIN?

Building credit takes time and depends on several factors, including your credit activity and payment history. Generally, it takes at least six months of consistent and responsible credit behavior to begin establishing a credit history.

5. Can I use my ITIN for credit applications?

Yes, you can use your ITIN when applying for credit. Lenders and creditors recognize and accept ITINs as a valid taxpayer identification number for credit applications and credit reporting purposes.

6. Can I transfer my credit history from another country to the United States?

Unfortunately, credit histories from other countries typically do not transfer to the United States. When building credit in the U.S., it is necessary to start establishing a new credit history with the major credit reporting agencies.

7. Should I check my credit reports regularly if I have an ITIN?

Yes, it is important to monitor your credit reports regularly, regardless of whether you have an ITIN or an SSN. Regularly checking your credit reports allows you to identify errors, monitor changes, and take necessary actions to improve your credit health.

8. Are there any credit-building programs available for individuals with an ITIN?

Yes, there are credit-building programs specifically designed for individuals with an ITIN. These programs, offered by certain financial institutions, help individuals build credit by reporting their payment history on credit accounts to the credit reporting agencies.

Remember, building credit with an ITIN is a gradual process that requires responsible credit management and patience. By following good credit practices and staying informed, you can establish and maintain a strong credit profile.

Now, let’s conclude our guide to getting a credit report with an ITIN.

Conclusion

Obtaining a credit report with an Individual Taxpayer Identification Number (ITIN) is an important step in managing your finances, building credit, and accessing various financial opportunities. As an immigrant or non-resident alien, having a credit report with an ITIN allows you to track your financial progress, demonstrate creditworthiness to lenders, and make informed financial decisions.

In this comprehensive guide, we’ve covered the process of obtaining an ITIN and the steps involved in requesting a credit report with an ITIN. We’ve also discussed the importance of credit reports, how to dispute errors, and provided valuable tips for building credit with an ITIN.

Remember, building credit takes time and consistency. It’s important to make timely payments, keep your credit utilization low, and establish a positive credit history. Regularly monitoring your credit reports for accuracy and addressing any errors will help you maintain a healthy credit profile.

If you have any questions or concerns, it’s advisable to consult with a qualified tax professional or financial advisor who can provide personalized guidance based on your specific circumstances.

Building credit with an ITIN is a valuable endeavor that can open doors to financial stability and opportunities. By taking the necessary steps outlined in this guide, you can build a solid credit history and pave the way for a brighter financial future.