Home>Finance>Reconciliation In Accounting: Definition, Purposes, And Types

Finance

Reconciliation In Accounting: Definition, Purposes, And Types

Published: January 17, 2024

Learn about the definition, purposes, and types of reconciliation in accounting and how it relates to finance. Enhance your understanding of financial management with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Reconciliation in Accounting: Definition, Purposes, and Types

Welcome to our Finance category blog post! Today, we will dive deeper into the fascinating world of accounting and explore the concept of reconciliation. Have you ever wondered why reconciliation is crucial in financial management? What are the purposes behind this practice, and what are the different types of reconciliations used by accounting professionals? Let’s find out!

Key Takeaways:

- Reconciliation is a vital practice in accounting to ensure financial accuracy and identify discrepancies between various financial records.

- The primary purposes of reconciliation are to verify the accuracy of financial statements, detect fraudulent activities, and provide an audit trail for internal and external stakeholders.

Now, let’s delve into the details of reconciliation and what it means in the world of accounting. Simply put, reconciliation in accounting refers to the process of comparing two sets of financial records to ensure they match and reflect the same information accurately. It involves comparing different sources of financial data, such as bank statements and company records, to identify any discrepancies, errors, or fraudulent activities.

There are several types of reconciliations applied in accounting. Let’s take a closer look at some of the most common ones:

1. Bank Reconciliation:

Bank reconciliation is a regular practice carried out by businesses to match their internal financial records with their bank statement. This process helps identify any discrepancies, such as unauthorized transactions, bank errors, or timing differences between recorded and cleared transactions.

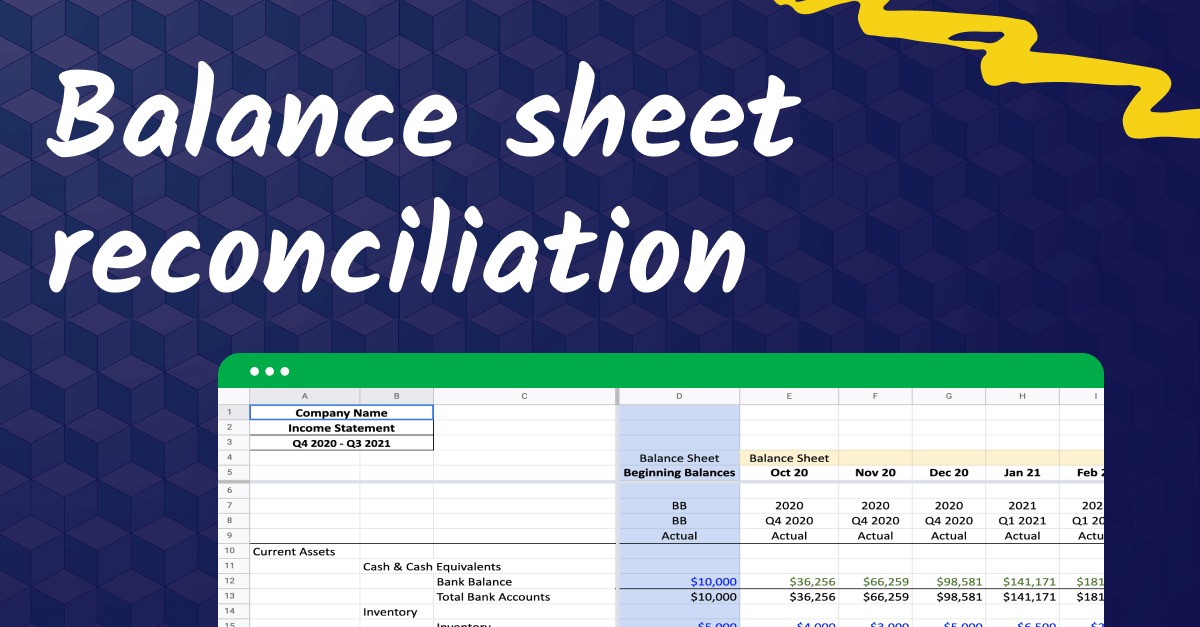

2. Balance Sheet Reconciliation:

Balance sheet reconciliation involves comparing the balances listed on a company’s balance sheet with the corresponding accounts in the general ledger. This type of reconciliation is essential for detecting errors, misclassifications, or omissions in financial statements, which could impact the overall accuracy of the balance sheet.

3. Accounts Receivable/Payable Reconciliation:

Accounts receivable and accounts payable reconciliations ensure that the records of incoming and outgoing transactions accurately reflect the actual amounts owed or owed by a company. This reconciliation helps identify any discrepancies in payments, incorrect calculations, or delays in receiving or making payments.

4. Inventory Reconciliation:

Inventory reconciliation is crucial for businesses that deal with physical inventory. It involves comparing the physical count of inventory with the amounts recorded in the accounting system. This type of reconciliation helps detect any discrepancies, such as theft, damaged goods, or inaccuracies in recording inventory transactions.

Now that we have a better understanding of the different types of reconciliations, let’s explore the purposes behind this practice:

Purposes of Reconciliation:

- Verification of Financial Statements: Reconciliation ensures that the information presented in financial statements accurately reflects the company’s financial position.

- Fraud Detection: By comparing various financial records, reconciliation helps identify any fraudulent activities, such as unauthorized transactions or falsified information.

- Audit Trail: Reconciliation provides a clear and transparent audit trail that allows internal and external stakeholders to track and verify financial transactions.

- Financial Accuracy: Through reconciliation, errors, discrepancies, or inaccuracies in financial records can be detected and corrected, leading to more accurate financial reporting.

- Compliance: Many industries and regulatory bodies require regular reconciliation to ensure compliance with accounting standards and regulations.

In conclusion, reconciliation plays a critical role in maintaining financial accuracy and integrity in the world of accounting. By comparing different financial records, businesses can identify discrepancies, detect fraudulent activities, and ensure the accuracy of financial statements. With various types of reconciliations available, accounting professionals can address specific areas of concern and provide reliable financial information to stakeholders.

We hope this blog post has provided you with valuable insights into the importance of reconciliation in accounting. Stay tuned for more informative posts in our Finance category!