Finance

How To Check Lowe’s In-Store Credit Card

Modified: February 21, 2024

Learn how to check your Lowes in-store credit card balance and keep track of your finance easily. Manage your expenses efficiently with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Lowes In-Store Credit Card?

- Benefits of a Lowes In-Store Credit Card

- How to Apply for a Lowes In-Store Credit Card

- Qualifications and Requirements for a Lowes In-Store Credit Card

- Checking the Balance of your Lowes In-Store Credit Card

- Ways to Check Lowes In-Store Credit Card Balance

- Online Method

- Phone Method

- In-Store Method

- Important Tips and Reminders for Using a Lowes In-Store Credit Card

- Conclusion

Introduction

Welcome to our comprehensive guide on how to check your Lowes In-Store Credit Card balance. In this article, we will walk you through the process of monitoring your credit card balance and highlight the benefits of having a Lowes In-Store Credit Card.

Lowes is a well-known home improvement retailer that offers a range of products and services to help you enhance your living space. With a Lowes In-Store Credit Card, you can enjoy exclusive perks and rewards, making your shopping experience even more rewarding.

Monitoring your credit card balance is essential to ensure you have enough funds available for your purchases and to keep track of your spending. Whether you’re considering applying for a Lowes In-Store Credit Card or already have one, checking your balance regularly will help you manage your finances and plan your future purchases.

In the following sections, we will delve into the specifics of Lowes In-Store Credit Cards, the benefits they offer, and the various methods you can use to check your credit card balance. By the end of this guide, you’ll have all the information you need to conveniently keep track of your Lowes In-Store Credit Card balance.

What is a Lowes In-Store Credit Card?

A Lowes In-Store Credit Card is a store-specific credit card that is issued by Lowes, one of the largest home improvement retailers in the United States. It is designed to provide customers with a convenient way to finance their purchases at Lowes stores.

With a Lowes In-Store Credit Card, you can enjoy various benefits and rewards that are exclusive to cardholders. This credit card allows you to access special financing options, such as 6, 12, or 18 months of interest-free payments on qualifying purchases, making it easier to manage larger home improvement projects or unexpected expenses.

In addition to the financing options, a Lowes In-Store Credit Card provides you with access to exclusive discounts, promotions, and rewards. Cardholders can take advantage of special offers, such as discounts on select products or additional savings during seasonal sales events. These perks make a Lowes In-Store Credit Card a valuable tool for homeowners, DIY enthusiasts, and professionals in the construction industry.

It’s important to note that a Lowes In-Store Credit Card can only be used for purchases made at Lowes physical stores. It cannot be used for online purchases or at other retailers. This card is specifically designed to cater to the needs of customers shopping in-store and offers unique benefits tailored to the Lowes shopping experience.

Having a Lowes In-Store Credit Card can not only provide you with financial flexibility but also enhance your shopping experience by unlocking exclusive discounts and rewards. Now that you have a better understanding of what a Lowes In-Store Credit Card is, let’s explore the benefits it offers in the next section.

Benefits of a Lowes In-Store Credit Card

A Lowes In-Store Credit Card offers a range of benefits and rewards that can enhance your shopping experience and provide you with valuable savings. Here are some key advantages of having a Lowes In-Store Credit Card:

1. Discounts and Special Offers: As a Lowes In-Store Credit Card holder, you gain access to exclusive discounts and promotions. This includes special pricing on select products, limited-time offers, and additional savings during seasonal sales events. These discounts can help you save money on your home improvement projects. 2. Special Financing Options: One of the main benefits of a Lowes In-Store Credit Card is the availability of special financing options. Depending on your purchase amount, you may be eligible for 6, 12, or 18 months of interest-free payments. This allows you to spread out the cost of larger purchases over time without incurring any extra charges. 3. Rewards Program: Lowes offers a rewards program specifically for their credit card holders. With every purchase made using your Lowes In-Store Credit Card, you can earn points that can be redeemed for future discounts and rewards. This loyalty program provides additional incentives for using your Lowes credit card for your home improvement needs. 4. Convenience and Flexibility: Having a Lowes In-Store Credit Card allows you to shop conveniently at any Lowes physical store location. You don’t need to worry about carrying cash or remembering to bring your wallet, as your credit card acts as your payment method. This provides a hassle-free and secure way to make purchases for your home improvement projects. 5. Personalized Offers and Recommendations: As a Lowes In-Store Credit Card holder, you may receive personalized offers and recommendations based on your purchase history and preferences. This can help you discover new products, get tailored recommendations for your projects, and make informed decisions. 6. Online Account Management: With a Lowes In-Store Credit Card, you can easily manage your account online. This includes checking your credit card balance, viewing your transaction history, and making payments. Online account management provides convenient access to your credit card information and helps you stay on top of your finances. Having a Lowes In-Store Credit Card can significantly enhance your shopping experience at Lowes. The exclusive discounts, flexible financing options, rewards program, and convenient account management make it a valuable financial tool for homeowners and DIY enthusiasts. Now that you know the benefits of having a Lowes In-Store Credit Card, let’s explore how you can apply for one in the next section.

How to Apply for a Lowes In-Store Credit Card

Applying for a Lowes In-Store Credit Card is a straightforward process. Here is a step-by-step guide to help you through the application process:

1. Visit a Lowes Store or Apply Online: You can apply for a Lowes In-Store Credit Card either in-person at your nearest Lowes store or online through the Lowes website. Choose the method that is most convenient for you. 2. Gather Required Information: Before you begin the application process, make sure you have the necessary information at hand. This typically includes your personal details such as name, address, social security number, and employment information. 3. Fill out the Application Form: Whether you’re applying in-store or online, you will need to complete the application form. Provide accurate and up-to-date information to ensure a smooth application process. 4. Submit the Application: Once you’ve filled out the application form, review it for any errors or omissions. If you’re applying in-store, hand over the completed application to a store associate. If you’re applying online, simply click the submit button to send your application electronically. 5. Wait for Approval: After submitting your application, it will undergo a review process by the Lowes credit department. This typically takes a few minutes if you apply online or a few days if you apply in-store. You will receive notification of your application status, whether it’s approved, denied, or requires additional information. 6. Activate Your Card: If your application is approved, you will receive your Lowes In-Store Credit Card in the mail. Once you receive your card, follow the instructions provided to activate it before using it for purchases. It’s important to note that approval for a Lowes In-Store Credit Card is subject to creditworthiness and other factors determined by the issuing bank. If your application is denied, you can contact the Lowes credit department to inquire about the specific reasons for the denial. Applying for a Lowes In-Store Credit Card is a simple process that can open up a world of benefits and rewards. By following the steps outlined above, you can get on your way to enjoying exclusive discounts, special financing options, and the convenience of managing your account online.

Qualifications and Requirements for a Lowes In-Store Credit Card

Before applying for a Lowes In-Store Credit Card, it’s important to understand the qualifications and requirements set by the issuing bank. Here are the key factors to consider:

1. Credit Score: The primary factor that determines your eligibility for a Lowes In-Store Credit Card is your credit score. The issuing bank will review your credit history and assess your creditworthiness. Generally, a good to excellent credit score is preferred, although Lowes also offers credit cards for individuals with fair credit. 2. Proof of Identity: You will need to provide valid identification documents, such as a driver’s license or passport, to prove your identity during the application process. These documents are necessary for the bank to verify your identity and establish your eligibility for a credit card. 3. Employment and Income: The issuing bank may require information about your employment status and income. This helps them assess your ability to make timely payments on your credit card balance. You may be asked to provide proof of employment, such as pay stubs or tax forms, to support your application. 4. Age Requirement: To qualify for a Lowes In-Store Credit Card, applicants must be at least 18 years old. This is a standard requirement for most credit card applications. 5. Address Verification: The bank may ask for proof of your residential address. This can be in the form of utility bills, lease agreements, or other official documents that clearly display your name and address. Address verification is necessary to ensure accurate communication and billing. It’s essential to note that meeting these qualifications and requirements does not guarantee approval for a Lowes In-Store Credit Card. The final decision is at the discretion of the issuing bank based on their assessment of your creditworthiness and other factors. If you do not meet the requirements for a Lowes In-Store Credit Card, you may still be eligible for alternative financing options such as a store-branded credit card with different terms or a Lowes consumer credit card. These options may have different eligibility criteria and benefits. Before applying for any credit card, it’s advisable to review your own financial situation, consider your ability to make timely payments, and ensure that you understand the terms and conditions of the credit card agreement. This will help you make an informed decision and avoid unnecessary debt or financial strain.

Checking the Balance of your Lowes In-Store Credit Card

Keeping track of your Lowes In-Store Credit Card balance is important to ensure that you have sufficient funds available for your purchases. Fortunately, Lowes provides multiple convenient methods to check your credit card balance. Here are the ways you can easily monitor your balance:

1. Online Method: The most convenient way to check your Lowes In-Store Credit Card balance is through the online platform. Simply visit the official Lowes website and log in to your account. Once logged in, navigate to the credit card section, where you will find your current balance, transaction history, and available credit limit. Online balance checking provides real-time information and allows you to manage your credit card account from the comfort of your own home. 2. Phone Method: If you prefer a more personalized approach, you can call the Lowes credit card customer service hotline to inquire about your balance. The phone number is usually located on the back of your credit card. Follow the prompts to connect with a customer service representative who will assist you with your balance inquiry. Be sure to have your credit card details ready, as the representative may need to verify your identity before providing you with the information. 3. In-Store Method: If you happen to be at a Lowes store, you can also check your credit card balance at the customer service desk. Simply approach a staff member and provide them with your credit card. They will be able to assist you in checking your balance and providing you with any necessary information. With these convenient methods, you can easily stay informed about your Lowes In-Store Credit Card balance. Regularly checking your credit card balance is crucial for effective budgeting, managing your expenses, and avoiding over-limit fees or declined transactions. It allows you to make informed decisions when planning your purchases and ensures that you stay within your available credit limit. In addition to checking your balance, it’s also important to review your transaction history regularly. This helps you keep track of your spending, identify any discrepancies or unauthorized charges, and maintain a clear understanding of your credit card activity. By utilizing the online, phone, or in-store methods provided by Lowes, you can easily stay on top of your Lowes In-Store Credit Card balance and effectively manage your finances.

Ways to Check Lowes In-Store Credit Card Balance

Monitoring your Lowes In-Store Credit Card balance is essential to ensure you have enough funds available for your purchases and to manage your finances effectively. Lowes offers multiple convenient methods for checking your credit card balance. Here are the different ways you can stay updated on your balance:

1. Online Method: The easiest and most convenient way to check your Lowes In-Store Credit Card balance is through the online platform. Simply visit the official Lowes website and log in to your account. Once logged in, navigate to the credit card section, where you will find your current balance, available credit, recent transactions, and other relevant details. 2. Mobile App: Lowes also provides a mobile app for iOS and Android devices that allows you to manage your credit card account on the go. Download the Lowes app from your respective app store, log in to your account, and access the credit card section. You can view your current balance, available credit, and transaction history right from your mobile device. 3. Phone Method: If you prefer a more personalized approach, you can call the Lowes credit card customer service hotline to inquire about your balance. The phone number is typically located on the back of your credit card. Dial the number and follow the prompts to connect with a customer service representative. They will assist you in checking your balance and provide any additional information you may need. 4. In-Store Method: When visiting a Lowes store, you can inquire about your credit card balance at the customer service desk. Simply approach a staff member, provide them with your Lowes In-Store Credit Card, and ask for help in checking your balance. They will be able to access your account information and provide you with your current balance. By utilizing these various methods, you can conveniently check your Lowes In-Store Credit Card balance wherever and whenever you need to. It is important to note that the online method and mobile app provide real-time balance information, while the phone and in-store methods may have a slight delay in updating your balance. Regularly checking your credit card balance ensures that you have accurate information about your available credit, making it easier to manage your expenses and avoid going over your credit limit. By staying informed, you can make informed purchasing decisions and maintain control over your finances. Remember to keep your credit card information secure and report any unauthorized transactions immediately. By taking advantage of the different ways to check your Lowes In-Store Credit Card balance, you can stay on top of your finances and make the most of your credit card benefits.

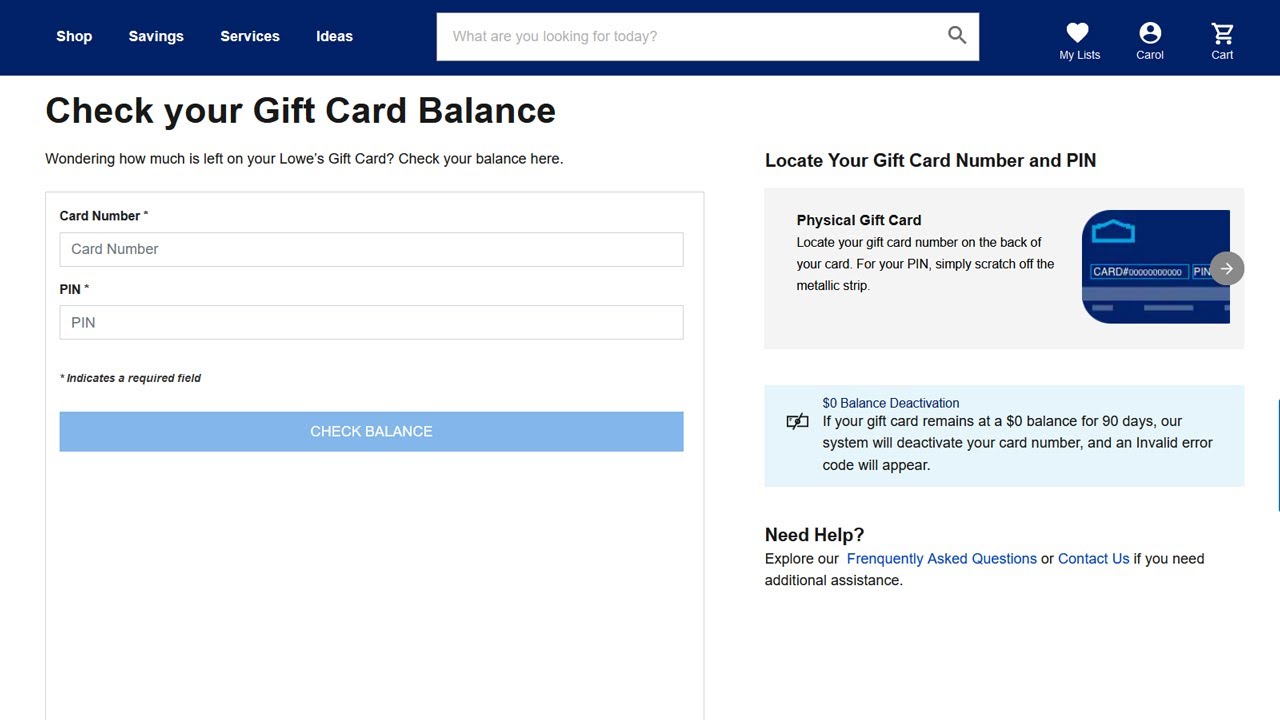

Online Method

The online method is the most convenient and efficient way to check your Lowes In-Store Credit Card balance. Here’s a step-by-step guide on how to check your balance online:

1. Visit the Lowes Website: Open your web browser and navigate to the official Lowes website (www.lowes.com). 2. Log in to Your Account: Locate the “Sign In” or “My Account” section on the website. Click on it to access the login page. Enter your username and password to log in to your account. If you haven’t created an online account, you will need to register and set up your credentials. 3. Go to the Credit Card Section: Once you’ve logged in to your account, look for the credit card section. This section may be labeled as “My Credit Card,” “Manage My Account,” or a similar name. Click on the appropriate link to access your credit card details. 4. Check Your Balance: In the credit card section, you will find your current balance, available credit, payment due dates, recent transactions, and other relevant information. Take note of your balance to ensure you have a clear understanding of your available credit. 5. Additional Online Features: In addition to checking your balance, the online platform may offer other useful features. You may be able to make payments, set up automatic payments, view statements, and update your personal information. Explore these additional features to fully manage your Lowes In-Store Credit Card account online. 6. Log Out: Once you have checked your balance and completed any other tasks, remember to log out of your account to ensure the security of your information. The online method allows you to check your Lowes In-Store Credit Card balance conveniently from the comfort of your own home. It provides real-time information, allowing you to stay on top of your credit card finances and make informed purchasing decisions. One key advantage of the online method is that it allows you to access your credit card details 24/7. Whether it’s the middle of the day or late at night, you can log in and check your balance whenever it’s most convenient for you. This convenience extends to mobile devices as well, as most online platforms are mobile-friendly and accessible through smartphones and tablets. By regularly checking your Lowes In-Store Credit Card balance online, you can keep track of your spending, monitor your available credit, and maintain control over your financial well-being.

Phone Method

The phone method provides a personalized way to check your Lowes In-Store Credit Card balance. Here’s how you can use the phone method to inquire about your balance:

1. Locate the Customer Service Hotline: Flip your Lowes In-Store Credit Card and locate the customer service hotline number. It is typically printed on the back of your card. Take note of the number or save it in your phone contacts for easy access. 2. Dial the Hotline: Use your phone to dial the customer service hotline number. Listen to the automated prompts or instructions until you reach the appropriate menu option for credit card services. Follow the instructions provided. 3. Speak with a Customer Service Representative: Once connected, you will be connected to a customer service representative specializing in Lowes credit cards. They will ask you some security questions to verify your identity, such as your name, address, and potentially your Social Security number or account number. Provide the requested information accurately and securely. 4. Request Your Balance: Inform the representative that you would like to check your Lowes In-Store Credit Card balance. They will access your account details and provide you with the most up-to-date balance information. Take note of the balance or ask any additional questions you may have about your credit card account. 5. Thank the Representative and End the Call: Once you have obtained your balance and addressed any other inquiries, thank the customer service representative for their assistance. End the call once you have received the information you need. The phone method offers a personalized touch and allows you to get your Lowes In-Store Credit Card balance information directly from a customer service representative. It is especially useful if you have specific questions or concerns about your credit card account, as the representative can provide more detailed assistance. Keep in mind that the phone method is subject to customer service hours. Make sure to check the hours of operation for the Lowes credit card customer service hotline before dialing to ensure that you reach a representative during their working hours. The phone method is particularly beneficial for individuals who prefer direct human interaction or have difficulty accessing their account online. It provides a reliable and efficient way to obtain your Lowes In-Store Credit Card balance, giving you the information you need to manage your credit card finances effectively.

In-Store Method

If you prefer a face-to-face interaction, you can inquire about your Lowes In-Store Credit Card balance through the in-store method. Here’s how you can check your balance while visiting a Lowes store:

1. Locate the Customer Service Desk: When you arrive at a Lowes store, find the customer service desk. It is typically located near the entrance or in a central area of the store. Look for signage or ask a store associate for assistance if needed. 2. Approach the Customer Service Desk: Approach the customer service desk and inform the staff that you would like to check your Lowes In-Store Credit Card balance. They may ask you to provide your credit card or other forms of identification to verify your account. 3. Provide Necessary Information: The staff at the customer service desk will request the necessary information to access your credit card account. They might ask for your credit card, personal identification, or any other details required to confirm your identity. 4. Check Your Balance: Once your identity has been verified, the staff will retrieve your Lowes In-Store Credit Card account information and provide you with your current balance. Take note of the balance or ask any additional questions you may have regarding your credit card account. 5. Thank the Staff: Express your gratitude and appreciation to the staff for their assistance. If you have any further inquiries or need additional help, feel free to ask before leaving the customer service desk. Checking your Lowes In-Store Credit Card balance in-store gives you the opportunity to personally interact with a customer service representative. It can be particularly helpful if you have specific questions about your credit card or need assistance with other account-related matters. While the in-store method provides a face-to-face experience, it’s important to note that it may take some time to complete the process depending on customer service availability and the number of customers present at the desk. Therefore, it’s recommended to visit the customer service desk when you have enough time available. The in-store method allows you to acquire your Lowes In-Store Credit Card balance and address any concerns or inquiries directly with a knowledgeable staff member. It provides a reliable and convenient way to get the information you need while you are in the store.

Important Tips and Reminders for Using a Lowes In-Store Credit Card

Using a Lowes In-Store Credit Card can be a great way to finance your home improvement purchases and take advantage of exclusive benefits. To make the most of your credit card and ensure a positive experience, here are some important tips and reminders to keep in mind:

1. Pay on Time: It is crucial to make your credit card payments on time to maintain a good credit score and avoid incurring late fees. Set up reminders or enroll in automatic payments to ensure that you never miss a payment deadline. 2. Utilize Special Financing: Take advantage of the special financing options offered by Lowes. These interest-free payment plans can help you manage larger purchases and spread out the cost over time without incurring additional charges. However, be sure to pay off the balance within the promotional period to avoid interest charges. 3. Stay Within your Budget: Having a credit card can make it tempting to overspend. Stick to your budget and only make purchases that you can comfortably afford to pay off in a reasonable timeframe. Remember that your credit card balance is not free money; it’s a loan that needs to be repaid. 4. Regularly Check your Balance and Transactions: Stay on top of your credit card balance by checking it regularly through the online platform, phone method, or in-store. Keep track of your transactions to ensure that there are no unauthorized charges and to monitor your spending habits. 5. Monitor Rewards and Offers: Stay updated on the rewards and special offers available to Lowes In-Store Credit Card holders. Keep an eye out for discounts, promotions, and exclusive deals that can help you save money on future purchases. 6. Protect your Credit Card Information: Keep your credit card information safe and secure. Memorize or store your PIN code and never share it with anyone. Be cautious while making online purchases and only provide your credit card details on secure and trusted websites. 7. Review Terms and Conditions: Take the time to read and understand the terms and conditions of your Lowes In-Store Credit Card. Familiarize yourself with the interest rates, fees, and any limitations or restrictions associated with its use. 8. Contact Customer Service for Assistance: If you have any questions, concerns, or issues related to your Lowes In-Store Credit Card, don’t hesitate to reach out to customer service. They can provide guidance and solutions to address your inquiries or resolve any problems that may arise. By following these tips and reminders, you can make the most of your Lowes In-Store Credit Card and ensure a positive credit card experience. Use your credit card responsibly, stay within your means, and take advantage of the benefits and rewards offered to maximize your savings and improve your home improvement projects.

Conclusion

Managing your Lowes In-Store Credit Card balance is essential for staying on top of your finances and making informed purchasing decisions. Through various methods such as online, phone, and in-store, you have convenient ways to check your balance and track your transactions. The benefits of a Lowes In-Store Credit Card, including exclusive discounts, special financing options, and a rewards program, make it a valuable financial tool for homeowners and DIY enthusiasts.

When applying for a Lowes In-Store Credit Card, ensure that you meet the qualifications and requirements set by the issuing bank. Responsible use of your credit card, such as paying on time and staying within your budget, will help you maintain good credit and avoid unnecessary fees. Regularly checking your balance, monitoring rewards and offers, and protecting your credit card information are important habits to cultivate for a positive credit card experience.

Whether you choose to check your balance online, use the phone method, or visit an in-store customer service desk, make it a regular habit to stay informed about your credit card balance. By doing so, you can effectively manage your finances, take advantage of the benefits offered by your Lowes In-Store Credit Card, and make the most out of your home improvement projects.

Remember that while a Lowes In-Store Credit Card can provide convenience and financial flexibility, it’s essential to use it responsibly and within your means. By following the important tips and reminders provided, you can enjoy the advantages of your credit card while maintaining control over your financial well-being.

We hope this comprehensive guide has provided you with the necessary information to check your Lowes In-Store Credit Card balance and use your credit card effectively. Make smart financial decisions, enjoy the benefits of your credit card, and have a successful home improvement journey with Lowes!