Finance

How Often Does Lowe’s Increase Credit Limit

Modified: January 15, 2024

Learn how often Lowe's increases credit limits and improve your financial management. Discover valuable finance tips and tricks to maximize your credit potential.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, having a credit card with a reasonable credit limit can provide flexibility and peace of mind. Lowe’s, one of the largest home improvement retailers in the United States, offers credit cards to its customers that can be used to make purchases at their stores or online. If you are a proud owner of a Lowe’s credit card, you may be wondering how often the company increases credit limits and what factors they consider when making these decisions.

In this article, we will explore the factors that can affect Lowe’s credit limit increases and discuss the criteria the company uses to determine whether or not to grant an increase. Additionally, we will provide tips to help you increase the likelihood of getting a credit limit increase from Lowe’s.

Understanding how often Lowe’s increases credit limits can be valuable information for credit card holders, as it allows them to plan their financial strategies effectively. Whether you are looking to make a large purchase for a home renovation project or simply want to have a higher credit limit for emergencies, knowing when to expect a credit limit increase can be advantageous.

So, let’s delve into the factors that impact Lowe’s credit limit increases and uncover the criteria they use to decide who gets an increase and when.

Factors Affecting Lowe’s Credit Limit Increases

Before we dive into how often Lowe’s increases credit limits, it’s important to understand the factors that can influence their decision-making process. While the specific details may vary, there are several common factors that can impact the likelihood of receiving a credit limit increase from Lowe’s:

- Credit history: One of the key factors that Lowe’s considers when determining credit limit increases is your credit history. They will review factors such as your payment history, credit utilization, and the length of your credit history. A strong credit history, with timely payments and responsible credit management, can greatly improve your chances of receiving a credit limit increase.

- Income and financial stability: Lowe’s may also take into account your income and financial stability. A higher income and more stable financial situation can signal to lenders that you are capable of managing a higher credit limit. Be prepared to provide proof of income or financial documentation if requested.

- Payment behavior with Lowe’s: Your payment behavior specifically with Lowe’s can also play a role in determining your credit limit increase eligibility. If you have consistently made on-time payments and have a positive payment history with Lowe’s, it can demonstrate your creditworthiness and increase your chances of receiving an increase.

- Overall credit utilization: In addition to considering your payment behavior with Lowe’s, they may also take into account your overall credit utilization across all your credit accounts. If your credit cards are consistently maxed out or you have a high level of debt compared to your available credit, it may decrease your likelihood of receiving a credit limit increase.

- Recent credit inquiries: Applying for additional credit cards or loans in a short period of time can have a negative impact on your credit score and decrease the probability of receiving a credit limit increase. Be mindful of your recent credit inquiries and avoid unnecessary credit applications.

These are some of the common factors that can affect Lowe’s credit limit increases. Understanding these factors can help you assess your own eligibility and take steps to improve your chances of receiving a credit limit increase.

Now that we have explored the factors that influence Lowe’s credit limit increases, let’s move on to the criteria they use to determine who gets an increase and when.

Criteria for Lowe’s Credit Limit Increase

Lowe’s follows a set of criteria when evaluating whether to grant a credit limit increase to their customers. While the specific details may not be publicly disclosed, there are a few key factors that are generally considered in their decision-making process:

- Payment history: Your payment history is one of the most important factors that Lowe’s considers. They will assess whether you have consistently made on-time payments and have a positive payment record. Late payments or a history of missed payments may decrease your chances of receiving a credit limit increase.

- Account activity: Lowe’s evaluates the activity on your credit card account. This includes factors such as how frequently you use your card, the average monthly spend, and whether you pay off the balance in full or carry a balance from month to month. Regular usage and responsible repayment can positively influence your eligibility for a credit limit increase.

- Creditworthiness: Your overall creditworthiness plays a significant role in determining if you meet the criteria for a credit limit increase. Lowe’s will consider factors such as your credit score, credit utilization ratio, and length of credit history. A higher credit score, lower credit utilization, and a longer credit history can improve your chances of receiving an increase.

- Income and financial stability: Lowe’s may also consider your income and financial stability as part of their criteria. They want to ensure that you have the means to manage a higher credit limit responsibly. If you can demonstrate a stable income and a healthy financial situation, it can strengthen your case for a credit limit increase.

It’s important to note that meeting the criteria for a credit limit increase does not guarantee that you will receive one. Each customer’s situation is evaluated on a case-by-case basis, and Lowe’s will make the final decision based on their internal policies and guidelines.

Now that we understand the criteria that Lowe’s uses to determine credit limit increases, let’s explore how often they typically increase credit limits for their cardholders.

How Often Does Lowe’s Typically Increase Credit Limits?

The frequency of credit limit increases by Lowe’s can vary based on several factors, including your creditworthiness, payment history, and overall account activity. While there is no specific timeline for when Lowe’s may increase credit limits, they generally evaluate accounts periodically to assess eligibility for a credit line increase.

Lowe’s typically conducts reviews of credit card accounts every six to twelve months. During these reviews, they assess factors such as your payment history, credit utilization, and overall creditworthiness. If you meet their criteria and demonstrate responsible credit management, you may be considered for a credit limit increase.

It is important to note that not all cardholders will receive a credit limit increase during these periodic evaluations. Lowe’s evaluates accounts based on their internal policies and guidelines, and the decision to grant a credit limit increase ultimately depends on your individual circumstances and credit profile.

If you have been consistently making on-time payments, keeping your credit utilization low, and maintaining a good credit score, your chances of receiving a credit limit increase from Lowe’s could be higher. Additionally, demonstrating a positive payment history with Lowe’s specifically can increase the likelihood of an increase.

While there is no guarantee that your credit limit will be increased, it is worth noting that taking steps to improve your creditworthiness and maintaining a good payment history can enhance your probability of receiving an increase. Being patient and demonstrating responsible credit management are key to increasing your chances over time.

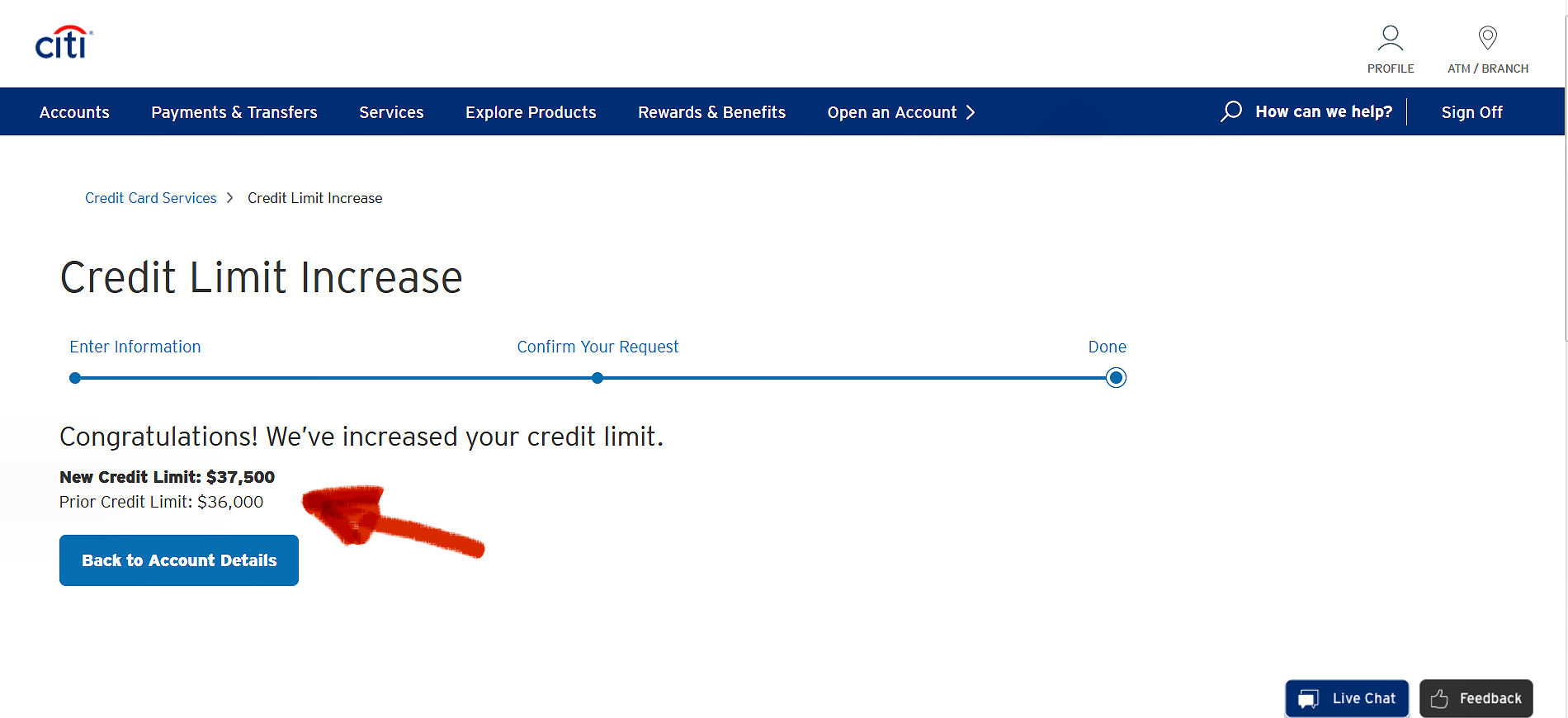

If you believe that you are eligible for a credit limit increase from Lowe’s or if it has been more than six months since your last evaluation, you can contact their customer support or access your account online to inquire about a potential increase.

Now that we understand how frequently Lowe’s typically increases credit limits, let’s explore some tips to increase the likelihood of getting a credit limit increase from Lowe’s.

Tips to Increase the Likelihood of Getting a Credit Limit Increase from Lowe’s

If you’re interested in obtaining a credit limit increase from Lowe’s, there are several strategies you can employ to improve your chances. While there’s no guaranteed method, the following tips can enhance the likelihood of a credit limit increase:

- Maintain a positive payment history: Consistently paying your Lowe’s credit card bill on time is crucial. Late payments or missed payments can negatively impact your creditworthiness and reduce your chances of receiving a credit limit increase. Set up payment reminders or consider enrolling in automatic payments to ensure you never miss a due date.

- Manage overall credit utilization: Lowe’s evaluates your overall credit utilization, not just your card with them. Aim to keep your credit card balances low in proportion to your credit limits across all your accounts. Lower credit utilization ratios convey responsible credit management and may improve your eligibility for a credit limit increase.

- Regularly use your Lowe’s credit card: To demonstrate your creditworthiness to Lowe’s, it’s important to use your credit card regularly. Make small purchases and ensure that you pay off the balance in a timely manner. Regular activity on your card can show responsible credit usage and may lead to a credit limit increase.

- Monitor and improve your credit score: Your credit score is a significant factor considered by Lowe’s when determining credit limit increases. Monitor your credit report regularly and take steps to improve your credit score, such as paying bills on time, keeping credit card balances low, and disputing any errors on your report.

- Request a credit limit increase: If you believe you are eligible for a credit limit increase from Lowe’s, it doesn’t hurt to ask. Contact Lowe’s customer support or log in to your account online to inquire about the possibility of a credit limit increase. Be prepared to provide any necessary documentation, such as proof of income, to support your request.

- Be patient: Credit limit increases are not guaranteed and may take time. Continue to exhibit responsible credit behavior, maintain a positive payment history, and manage your overall credit utilization. With time, as your creditworthiness improves, you may become eligible for a credit limit increase.

Remember, each individual’s credit profile is unique, and the decision to grant a credit limit increase ultimately lies with Lowe’s. By following these tips, you can optimize your chances of receiving a credit limit increase and enjoy the benefits of a higher credit limit for your home improvement needs.

Now that we’ve explored these tips, let’s conclude our discussion on credit limit increases from Lowe’s.

Conclusion

Understanding how often Lowe’s increases credit limits and the factors they consider is essential for effectively managing your Lowe’s credit card. While there is no specific timeline for credit limit increases, Lowe’s generally conducts periodic evaluations of accounts to assess eligibility. Factors such as payment history, credit utilization, creditworthiness, and account activity play a crucial role in determining whether you receive a credit limit increase.

To increase the likelihood of getting a credit limit increase from Lowe’s, it is important to maintain a positive payment history, manage your overall credit utilization, regularly use your Lowe’s credit card, monitor and improve your credit score, request a credit limit increase when appropriate, and be patient as you build your creditworthiness over time.

Remember that credit limit increases are not guaranteed, and Lowe’s evaluates each account individually based on their internal policies. However, by following these tips and exhibiting responsible credit habits, you can improve your chances of receiving a credit limit increase and enjoy the benefits of a higher credit limit for your home improvement needs.

If you believe you meet the criteria for a credit limit increase or have questions about your Lowe’s credit card, it’s always a good idea to reach out to Lowe’s customer support or access your account online for more information. They can provide guidance specific to your situation and help you navigate the process.

Ultimately, responsible credit management, a positive payment history, and maintaining good financial habits not only increase your chances of getting a credit limit increase but also contribute to a healthy financial future. By staying on top of your credit and managing your Lowe’s credit card wisely, you can make the most of your purchasing power and enjoy the benefits of a higher credit limit.