Home>Finance>When Do I Need To Pay My Balance If My Minimum Payment Is 0

Finance

When Do I Need To Pay My Balance If My Minimum Payment Is 0

Published: February 26, 2024

Learn when you need to pay your balance if your minimum payment is 0. Get finance advice and tips to manage your payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing credit card payments can be a complex task, especially when navigating the nuances of minimum payments. Understanding the implications of different minimum payment amounts is crucial for maintaining financial health and making informed decisions. This article aims to shed light on a specific scenario: when the minimum payment on a credit card statement is 0. By delving into this topic, we can grasp the implications, consequences, and strategies associated with this situation.

Many credit card users are familiar with the concept of minimum payments – the smallest amount that must be paid by the due date to keep the account in good standing. However, encountering a minimum payment of 0 can be perplexing and may raise questions about the implications of such a scenario. This article will explore the circumstances under which a 0 minimum payment might occur and how individuals should approach this situation to manage their finances effectively.

By gaining insights into this topic, readers can make informed decisions about their credit card payments and understand the potential impact on their credit score and financial well-being. Let’s delve into the intricacies of minimum payments and discover the implications of encountering a 0 minimum payment on a credit card statement.

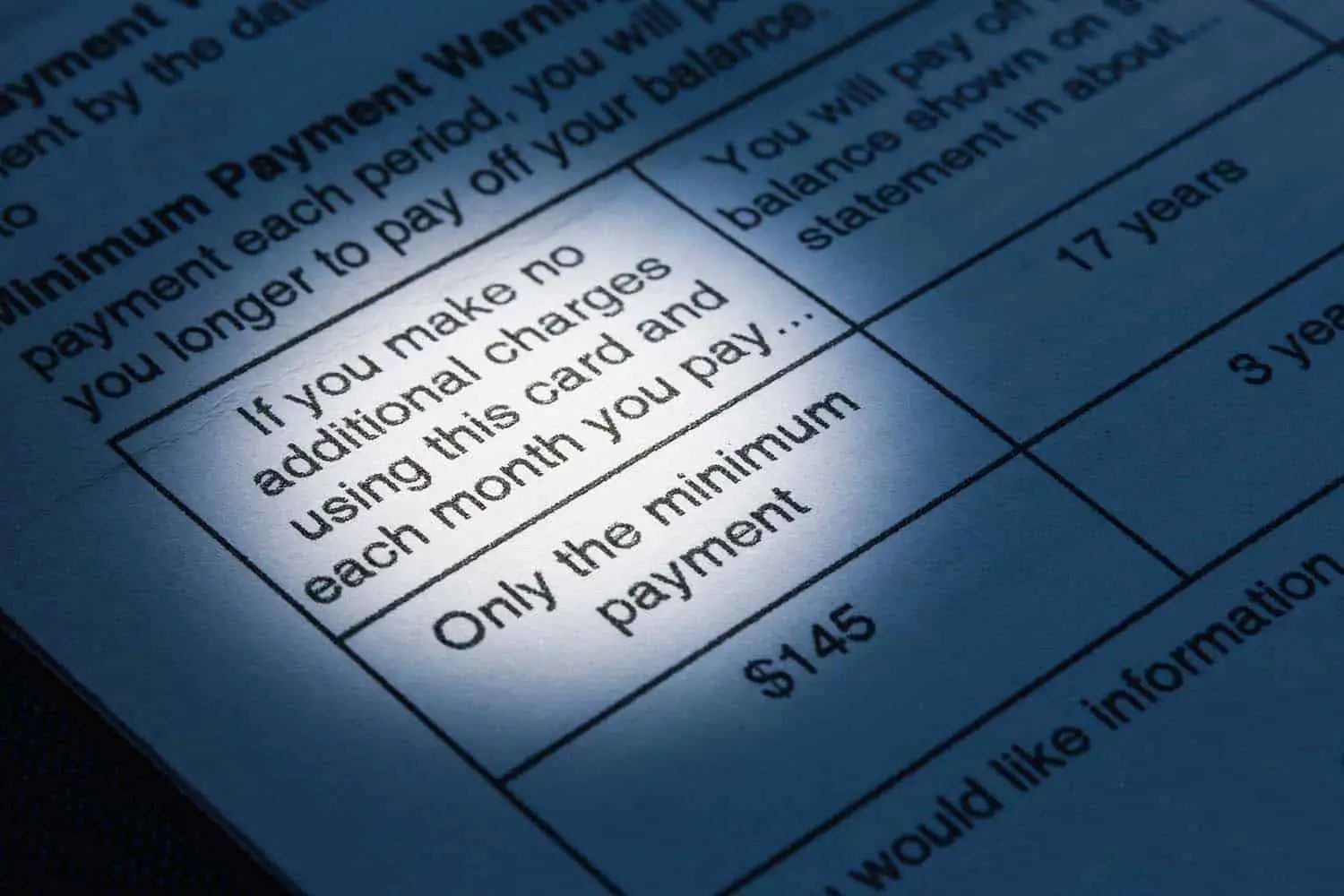

Understanding Minimum Payments

Minimum payments are the smallest amount of money that credit card holders must pay by the due date to maintain their accounts in good standing. These payments are typically calculated as a percentage of the total balance or a fixed amount, whichever is higher. It’s important to note that while making the minimum payment keeps the account current and prevents late fees, it does not prevent interest from accruing on the remaining balance.

For example, if a credit card statement shows a total balance of $1,000 and the minimum payment is 3% of the balance, the cardholder would need to pay at least $30 to meet the minimum payment requirement. However, the remaining balance of $970 would continue to accrue interest, potentially leading to long-term debt if only the minimum payment is made each month.

Understanding the implications of minimum payments is crucial for responsible financial management. While making at least the minimum payment is essential to avoid negative consequences, paying more than the minimum can significantly reduce interest charges and help clear the debt more efficiently.

It’s important for credit card users to carefully review their statements to understand how minimum payments are calculated and how they impact the overall balance. By gaining a clear understanding of minimum payments, individuals can make informed decisions about their financial obligations and work towards managing their debts effectively.

When the Minimum Payment Is 0

Encountering a minimum payment of 0 on a credit card statement can be both surprising and puzzling for cardholders. This scenario typically occurs when the calculated minimum payment amount is lower than a predetermined threshold set by the credit card issuer. It’s important to understand that a 0 minimum payment does not absolve the cardholder from their outstanding balance; rather, it signifies that no immediate payment is required to keep the account in good standing for that particular billing cycle.

There are several reasons why a credit card statement might show a 0 minimum payment. For instance, if the calculated minimum payment based on the balance and interest falls below a certain threshold, the issuer may opt to set the minimum payment at 0 for that billing cycle. This can happen when the outstanding balance is minimal or when the interest accrued is lower than the predetermined threshold set by the issuer.

When faced with a 0 minimum payment, cardholders should not interpret it as an indication to neglect their outstanding balance. Instead, it presents an opportunity to proactively manage the debt by considering options such as paying off the entire balance, making a voluntary payment, or exploring strategies to reduce interest charges. It’s crucial for individuals to remain vigilant about their overall debt and not view a 0 minimum payment as an excuse to defer addressing their financial obligations.

Understanding the implications of a 0 minimum payment empowers cardholders to make informed decisions about managing their credit card debt. Rather than viewing it as a free pass, individuals should use this opportunity to take control of their financial responsibilities and work towards reducing their outstanding balances to achieve greater financial stability.

Impact on Credit Score

When a credit card statement reflects a 0 minimum payment, it can raise questions about the potential impact on the cardholder’s credit score. It’s important to understand that while a 0 minimum payment does not directly harm the credit score, the underlying factors contributing to this scenario can have implications for creditworthiness.

From a credit scoring perspective, the utilization ratio – the amount of credit being used compared to the total available credit – plays a significant role. When a credit card statement shows a 0 minimum payment, it may indicate a low utilization ratio, which can positively influence the credit score. A lower utilization ratio demonstrates responsible credit management and can contribute to an improved credit score over time.

However, it’s essential for cardholders to recognize that a 0 minimum payment does not alleviate the responsibility of addressing the outstanding balance. Failing to manage the overall debt effectively can lead to increased utilization ratios in subsequent billing cycles, potentially impacting the credit score negatively. Therefore, while a 0 minimum payment itself may not directly impact the credit score, the underlying financial behaviors and debt management practices are crucial factors in determining creditworthiness.

Furthermore, if the 0 minimum payment is a result of financial hardship or an inability to make payments, it can lead to delinquency and ultimately harm the credit score. It’s imperative for individuals to assess their financial situation holistically and seek proactive solutions to manage their debts effectively, even when a 0 minimum payment appears on their credit card statement.

Understanding the relationship between a 0 minimum payment and credit score implications empowers cardholders to make informed decisions about managing their debts and maintaining strong creditworthiness. By proactively addressing outstanding balances and practicing responsible credit management, individuals can navigate the complexities of credit scoring and work towards achieving and sustaining a healthy credit profile.

Consequences of Non-Payment

While encountering a 0 minimum payment on a credit card statement may initially seem inconsequential, it’s crucial for cardholders to recognize the potential consequences of non-payment and the importance of addressing outstanding balances. Failing to manage credit card debts effectively can lead to a range of negative repercussions that can impact financial stability and creditworthiness.

One significant consequence of non-payment is the accrual of interest on the outstanding balance. Even when a 0 minimum payment is indicated, interest continues to accrue on the remaining balance, potentially leading to increased debt over time. This can result in higher overall repayment amounts and prolonged debt if not addressed promptly.

Furthermore, non-payment can lead to late fees and penalties, exacerbating the financial burden for cardholders. Credit card issuers may impose late fees and penalties for missed payments, adding to the total amount owed and creating additional financial strain. These fees can further contribute to the escalation of debt and financial difficulties for individuals.

From a credit standpoint, non-payment can lead to derogatory marks on the cardholder’s credit report. Delinquencies and defaults resulting from non-payment can significantly impact the individual’s credit score and overall creditworthiness. These negative marks can hinder future access to credit, impact loan approvals, and result in higher interest rates on future credit products.

In some cases, persistent non-payment and delinquency can lead to collection efforts by the credit card issuer or third-party collection agencies. This can result in increased stress and financial pressure for individuals, potentially leading to legal actions and further complications if the debts remain unresolved.

Understanding the potential consequences of non-payment is essential for individuals to proactively manage their credit card debts and maintain financial stability. By addressing outstanding balances, making timely payments, and seeking assistance if facing financial hardship, cardholders can mitigate the negative impact of non-payment and work towards achieving long-term financial well-being.

Conclusion

Navigating the complexities of credit card payments, including the nuances of minimum payments, is a fundamental aspect of responsible financial management. Encountering a 0 minimum payment on a credit card statement can prompt individuals to consider the implications, consequences, and strategies associated with this scenario.

Understanding that a 0 minimum payment does not absolve the cardholder from their outstanding balance is crucial. It signifies an opportunity to proactively manage the debt and explore strategies to reduce interest charges and overall debt burden. Rather than viewing it as a free pass, individuals should use this opportunity to take control of their financial responsibilities and work towards achieving greater financial stability.

From a credit scoring perspective, the impact of a 0 minimum payment on creditworthiness is nuanced. While it may indicate a low utilization ratio, which can positively influence the credit score, the underlying financial behaviors and debt management practices play a significant role in determining creditworthiness. Proactively addressing outstanding balances and practicing responsible credit management are essential for sustaining a healthy credit profile.

The consequences of non-payment, including the accrual of interest, late fees, negative marks on credit reports, and potential collection efforts, underscore the importance of managing credit card debts effectively. By addressing outstanding balances, making timely payments, and seeking assistance if facing financial hardship, individuals can mitigate the negative impact of non-payment and work towards achieving long-term financial well-being.

In conclusion, encountering a 0 minimum payment on a credit card statement serves as a reminder for individuals to approach their financial obligations with diligence and foresight. By understanding the implications, consequences, and strategies associated with this scenario, cardholders can make informed decisions about managing their credit card debts, maintaining strong creditworthiness, and achieving greater financial stability in the long run.