Finance

How To Delete Online Banking Account

Published: November 27, 2023

Learn how to delete your online banking account in just a few simple steps. Take control of your finances and safeguard your information with our easy-to-follow guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the digital era, where online banking has become an integral part of our financial lives. With the convenience and accessibility it offers, online banking has revolutionized the way we manage our money. However, there might come a time when you decide to delete your online banking account. Whether it is due to switching to a new bank, concerns about security, or simply no longer needing the service, deleting your online banking account is a straightforward process.

In this article, we will guide you through the step-by-step process of deleting your online banking account. We will ensure that you have a clear understanding of each step involved so that you can confidently take control of your financial information.

Please note that the steps outlined in this article are general guidelines and may vary slightly depending on your specific bank or financial institution. It is always a good idea to consult your bank’s website or contact their customer support for the most accurate and up-to-date information regarding account closure.

Before proceeding with the steps, it is important to consider a few things. First, make sure to withdraw or transfer any funds in your account to another bank account before initiating the account closure. You don’t want to leave any loose ends or risk losing any money during the process. Second, if you have any recurring payments or direct deposits linked to your account, you should update those with the new account information to avoid any disruptions.

Once you’ve taken these precautions, let’s dive into the step-by-step process of deleting your online banking account.

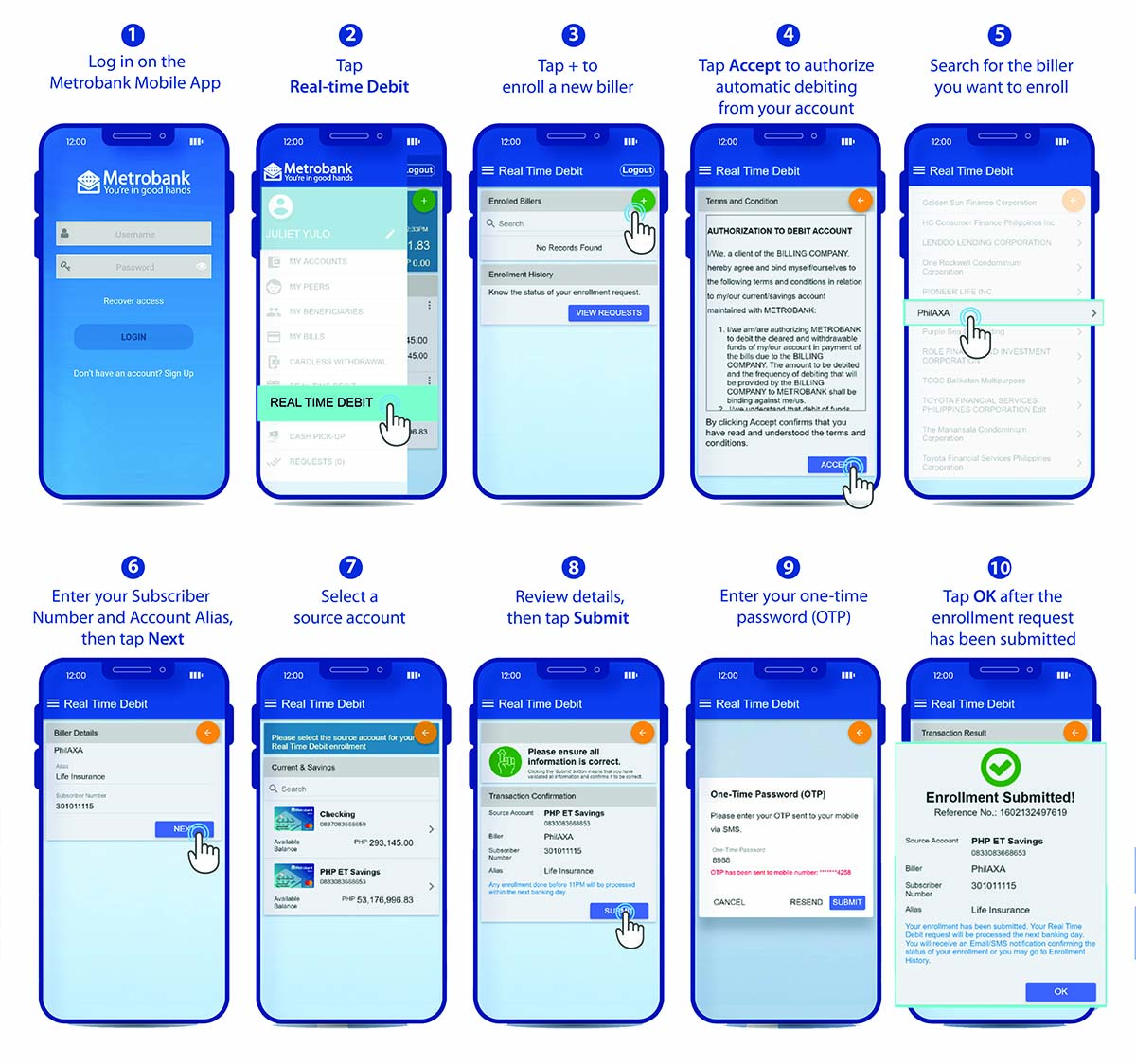

Step 1: Login to your online banking account

The first step in deleting your online banking account is to log in to your account. This ensures that you have access to all the necessary tools and settings required for closing your account.

Open your preferred web browser and visit your bank’s website. Look for the login button or link, which is usually located prominently on the homepage. Click on it to proceed to the login page.

Enter your username and password in the provided fields. If you have forgotten your login credentials, most banks have a “Forgot Password” or “Forgot Username” feature that you can use to reset your information. Follow the prompts and verify your identity to regain access to your account.

After successfully logging in, you will be directed to your online banking dashboard. This is the main page where you can view your account balances, transaction history, and other relevant information. Take a moment to ensure that you have completed any pending transactions and have all the necessary information on hand before proceeding to the next step.

It is important to note that some banks may require additional verification steps, such as entering a one-time password (OTP) sent to your registered mobile number or email address. These security measures are in place to protect your account from unauthorized access, so make sure to follow any instructions provided during the login process.

Once you have successfully logged in and confirmed all the necessary details, you are ready to move on to the next step in deleting your online banking account.

Step 2: Navigate to account settings

After logging in to your online banking account, the next step is to navigate to the account settings section. This is where you will find the options to modify your account preferences, update personal information, and ultimately delete your account.

The location and labeling of the account settings may vary depending on your bank’s website layout, but it is typically found in the main menu or a separate “Settings” tab. Look for any links or buttons with labels such as “Account Settings,” “Profile,” or “Manage Account.”

Click on the appropriate link or tab to access the account settings section. You may be required to re-enter your password or perform additional security verifications to access this section.

Once you have successfully accessed the account settings, take a moment to familiarize yourself with the available options. This section usually contains various subcategories or tabs that allow you to manage different aspects of your account, such as personal information, security settings, and account preferences.

Look for any specific options related to account closure, deletion, or deactivation. These options may be labeled as “Close Account,” “Delete Account,” or something similar. Keep in mind that different banks may use different terminology, so carefully read through the available options and descriptions to ensure you are selecting the correct one.

If you are unable to locate the account deletion option in the account settings, it is recommended to consult your bank’s website or contact their customer support for guidance. They can provide you with specific instructions on how to proceed with closing your account.

Once you have identified the account deletion option in the account settings, you are ready to proceed to the next step of deleting your online banking account.

Step 3: Find the option to close/delete account

Now that you have accessed the account settings section, the next step is to locate the option to close or delete your online banking account. This option is usually found within the account settings menu, allowing you to initiate the closure process.

Scan through the different tabs or categories within the account settings section and look for any options related to closing or deleting your account. Common labels for this option include “Close Account,” “Delete Account,” “Deactivate Account,” or something similar. Keep in mind that the specific wording may vary depending on your bank’s terminology.

If you’re unable to find the account closure option, don’t panic. Some banks may have a dedicated “Help” or “Support” section where you can search for instructions on how to delete your online banking account. Alternatively, you can contact your bank’s customer support for assistance.

Once you have located the account closure option, click on it to proceed. In some cases, you may be redirected to a separate page or prompted to confirm your decision. Read any instructions or warnings provided carefully to ensure that you understand the implications of closing your account.

Keep in mind that some banks may have specific requirements or conditions for closing your account. For example, if you have outstanding loans or credit balances, you may be required to settle them before closing the account. It’s important to review any terms and conditions associated with the closure process to comply with any necessary requirements.

If you have any concerns or questions about the account closure process, don’t hesitate to reach out to your bank’s customer support for clarification. They can provide you with the necessary guidance to smoothly complete the account closure.

Once you are ready and have understood the implications of closing your online banking account, you can proceed to the next step to confirm your decision.

Step 4: Confirm your decision

After accessing the account closure option in your online banking account settings, the next step is to confirm your decision to close or delete your account. This confirmation step ensures that you are fully aware of the consequences and have chosen to proceed with the account closure.

When you choose the account closure option, you may be directed to a confirmation page or prompted to provide additional information. Read through the instructions and options carefully to proceed with the closure process.

Some banks may require you to select a reason for closing your account from a dropdown menu. Common reasons include switching banks, no longer needing the account, or concerns about security. This information is valuable to banks for improving their services and understanding customer needs.

Once you have selected the appropriate reason (if required), review any terms and conditions or warnings provided before proceeding. Pay attention to any potential fees or implications associated with closing your account, such as the loss of interest or penalties for early account closure.

If you are fully confident in your decision to close your online banking account and understand all the terms and conditions, take the necessary steps to confirm your choice. This may involve clicking a “Confirm” button, entering your password again, or following any additional prompts provided.

It is important to note that once you confirm the closure of your online banking account, you may no longer have access to your account information, transaction history, or funds held in the account. Make sure to review and download any necessary statements or transaction records before proceeding with the closure.

If you have any doubts or second thoughts about closing your account, pause and reconsider before confirming your decision. It’s always a good idea to double-check any potential consequences or discuss your concerns with your bank’s customer support.

Once you have confirmed your decision to close your online banking account, move on to the final step to ensure the closure is verified.

Step 5: Verify closure of your online banking account

After confirming the closure of your online banking account, it is essential to verify that the account closure process has been successfully completed. This final step ensures that your account is no longer active and that any associated services or features have been terminated.

Typically, your bank will send you a confirmation email or notification stating that your account closure request has been received and processed. This email may contain additional information or instructions regarding any remaining balances, outstanding transactions, or further steps you need to take.

It is important to read this confirmation email thoroughly and follow any additional instructions provided. If there are any remaining funds in your account, the bank will provide guidance on how to withdraw or transfer them to another account.

Additionally, the bank will inform you of any actions required on your part to fully close the account. This may include returning any physical cards or devices associated with the account, such as debit cards or online banking tokens.

After receiving the confirmation email, take a moment to review your bank statements or transaction history to ensure there are no unauthorized or unexpected transactions. If you notice any discrepancies, contact your bank’s customer support immediately to address the issue.

Keep in mind that the verification process may take some time, depending on the policies and procedures of your bank. If you have not received a confirmation email within a reasonable timeframe, consider reaching out to your bank’s customer support for assistance and to ensure that your account closure request was processed successfully.

Once you have received the confirmation and ensured the closure of your online banking account, it is important to remove any saved login information or bookmarks related to the account. This ensures that you do not accidentally access the closed account and helps maintain your online security.

With the closure of your online banking account successfully verified, you have completed the process of deleting your account. Congratulations on taking control of your financial information and making the necessary changes to suit your needs.

Remember, if you ever decide to open a new online banking account in the future, you can follow a similar process to establish a new account with your chosen bank.

Thank you for following this step-by-step guide on how to delete your online banking account. We hope this information has been helpful in navigating the account closure process.

If you have any further questions or need assistance, don’t hesitate to reach out to your bank’s customer support for personalized guidance.

Stay informed and in control of your financial affairs as you move forward. Best of luck with your future banking endeavors!

Conclusion

Deleting your online banking account is a simple yet important step in managing your financial information and maintaining control over your online presence. By following the step-by-step guide outlined in this article, you can confidently navigate the closure process and ensure the protection of your personal and financial data.

Remember to carefully review your bank’s website or contact their customer support for any specific instructions or requirements related to closing your online banking account. It’s always better to be well-informed and prepared before initiating any account closure.

During the process, make sure to withdraw or transfer any remaining funds in your account to avoid any potential complications. Update any recurring payments or direct deposits with your new account information to ensure a smooth transition.

Once you have successfully closed your online banking account, verify the closure through the confirmation email or notification from your bank. Take the necessary steps to remove any saved login information or bookmarks related to the closed account for better security.

Deleting your online banking account grants you greater control over your financial data and ensures that your personal information remains secure. However, it is essential to stay vigilant and monitor your account statements regularly to address any suspicious activities or discrepancies.

If you ever decide to open a new online banking account in the future, remember that the process may vary from bank to bank. It is always advisable to review the specific requirements and steps provided by your chosen bank to create a new account.

Now that you have completed the steps to delete your online banking account, you can move forward with confidence, knowing that you have taken control of your financial information. If you have any further questions or need assistance during the account closure process, don’t hesitate to reach out to your bank’s customer support for guidance.

Thank you for following this guide, and we wish you the best in your financial endeavors!