Home>Finance>What Do The Insurance Companies And Pension Funds Do With The Money You Pay Them?

Finance

What Do The Insurance Companies And Pension Funds Do With The Money You Pay Them?

Published: January 23, 2024

Discover how insurance companies and pension funds manage the money you contribute. Explore the finance industry's investment strategies and practices.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Utilization of Your Payments

Have you ever wondered what happens to the money you diligently pay to insurance companies and pension funds? It's a question that often lingers in the minds of many individuals who contribute to these financial entities. Whether it's the premiums you allocate to your insurance coverage or the regular contributions toward your pension, comprehending the destination and utilization of these funds is crucial. In this comprehensive guide, we'll delve into the intricate mechanisms behind the allocation and management of your payments by insurance companies and pension funds.

As we embark on this exploration, it's important to recognize the significant role that insurance companies and pension funds play in safeguarding and growing your financial well-being. These entities serve as custodians of your hard-earned money, providing a safety net for unforeseen circumstances and paving the way for a secure retirement. By gaining insight into the inner workings of these financial institutions, you'll not only elevate your financial literacy but also develop a deeper appreciation for the mechanisms that underpin the management of your contributions.

Throughout this article, we'll unravel the journey of your payments, from the moment they leave your hands to their deployment in a myriad of investment avenues. By shedding light on the intricate processes governing the utilization of your funds, we aim to empower you with a comprehensive understanding of how insurance companies and pension funds operate. Let's embark on this enlightening journey to demystify the destination and utilization of the money you entrust to these vital financial entities.

Insurance Companies: Where Your Money Goes

Protecting Your Finances and Mitigating Risks

When you make payments to an insurance company, a portion of your funds goes towards ensuring that you are protected against unforeseen events. These events could range from medical emergencies and property damage to liability claims and other risks covered by your insurance policy. The allocation of your payments is meticulously structured to fulfill the primary objective of insurance – providing financial security and peace of mind to policyholders.

One significant portion of your payments is directed towards the operational expenses of the insurance company. This encompasses administrative costs, underwriting expenses, and the development of innovative insurance products and services. Additionally, a portion of your funds is allocated to the company’s reserves, which serve as a financial cushion to meet future claim obligations and maintain solvency.

Another vital destination for your payments is the investment portfolio of the insurance company. These funds are strategically deployed in a diverse array of investment vehicles, including bonds, stocks, real estate, and other financial instruments. The returns generated from these investments contribute to the company’s revenue and, in turn, influence the premiums and benefits offered to policyholders.

Furthermore, a portion of your payments is channeled into a risk pool, which functions as a collective reserve to cover the claims of policyholders who encounter insurable events. This pooling mechanism ensures that the financial burden of individual claims is distributed across a broad base, thereby safeguarding the stability of the insurance company and the continuity of coverage for all policyholders.

Understanding the utilization of your payments by insurance companies provides valuable insight into the multifaceted nature of the insurance industry. By comprehending the allocation of your funds, you gain a deeper appreciation for the mechanisms that underpin the protection and risk mitigation provided by insurance entities. This knowledge empowers you to make informed decisions regarding your insurance coverage and fosters a greater sense of financial awareness and security.

Pension Funds: How Your Contributions Are Managed

Fostering Financial Security for Retirement

When you contribute to a pension fund, your payments are meticulously managed to secure your financial well-being during retirement. A fundamental aspect of pension fund management involves the prudent allocation of contributions to ensure long-term growth and sustainability. These funds are meticulously invested and diversified to generate returns that will fund your retirement benefits in the future.

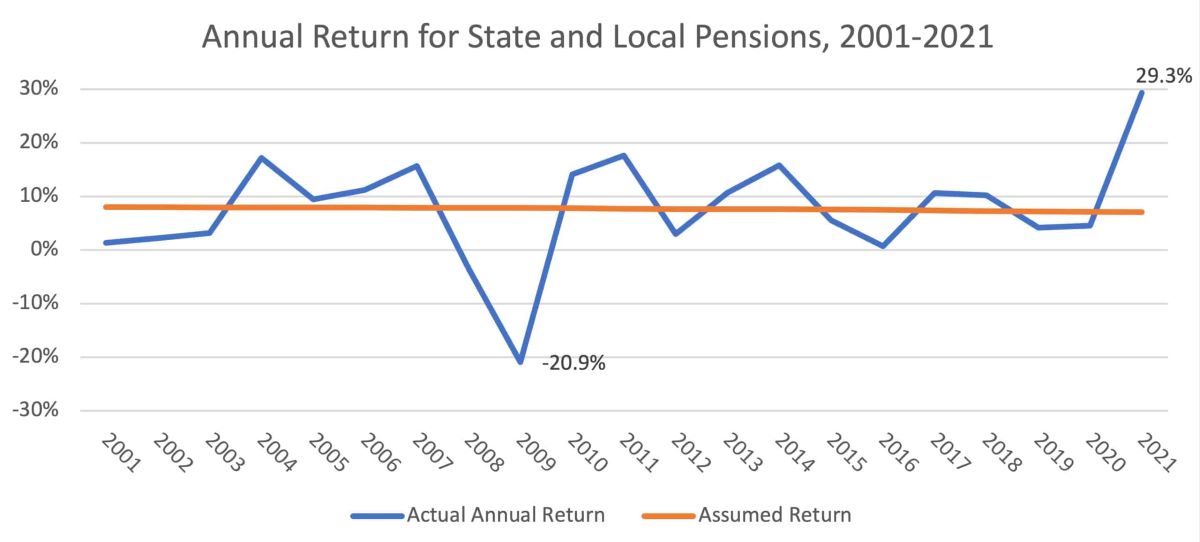

A significant portion of your contributions is directed towards the pension fund’s investment portfolio. These funds are strategically deployed across a spectrum of investment avenues, including stocks, bonds, real estate, and other financial instruments. The goal is to optimize returns while managing risks, thereby bolstering the long-term financial health of the pension fund and ensuring the fulfillment of future pension obligations.

Furthermore, a portion of your contributions is allocated to the administrative and operational expenses of the pension fund. These expenses encompass the costs associated with fund management, regulatory compliance, and the provision of member services. Additionally, a portion of the funds is set aside in reserves to mitigate potential fluctuations in investment returns and ensure the stability of pension benefits.

Another vital destination for your contributions is the pension fund’s actuarial reserve. This reserve is essential for meeting future pension obligations and ensuring that the fund remains solvent and capable of disbursing benefits to retirees. The actuarial calculations underpinning this reserve are meticulously crafted to align with the long-term financial sustainability of the pension fund.

Understanding the meticulous management of your contributions by pension funds provides valuable insight into the mechanisms that underpin retirement planning and financial security. By comprehending the allocation and utilization of your funds, you gain a deeper appreciation for the prudence and foresight embedded in pension fund management. This knowledge empowers you to make informed decisions regarding your retirement planning and cultivates a sense of confidence in your financial future.

Investments and Returns

Driving Financial Growth and Sustainability

The funds accumulated by insurance companies and pension funds are diligently invested in a diverse array of financial instruments to generate returns and foster long-term sustainability. These investments play a pivotal role in shaping the financial health and stability of these entities, ultimately influencing the benefits and security provided to policyholders and pension fund members.

Insurance companies strategically deploy a portion of the funds they receive into investment vehicles such as bonds, stocks, real estate, and other assets. The objective is to generate returns that contribute to the company’s revenue and solvency, enabling the provision of competitive premiums and comprehensive coverage to policyholders. Additionally, the returns from these investments serve as a vital source of income for the insurance company, supporting its operational expenses and claim obligations.

Similarly, pension funds meticulously allocate contributions into a diversified investment portfolio, aiming to optimize returns while managing risks. The income generated from these investments forms the foundation for funding future pension benefits, ensuring that retirees receive financial support during their post-employment years. The prudent management of these investments is essential for sustaining the long-term viability of the pension fund and fulfilling its commitments to members.

Furthermore, the investment strategies employed by insurance companies and pension funds are underpinned by rigorous risk management practices. These entities conduct thorough assessments of potential risks associated with their investment portfolios and employ strategies to mitigate these risks while pursuing favorable returns. The balance between risk and return is a crucial consideration in the investment decisions made by insurance companies and pension funds, as it directly impacts the financial security and stability of their offerings.

By comprehending the investment strategies and returns generated by insurance companies and pension funds, individuals gain insight into the mechanisms that drive financial growth and sustainability. This knowledge empowers policyholders and pension fund members to appreciate the intricate processes governing the utilization of their contributions and the pivotal role of investments in shaping their financial well-being.

Risks and Regulations

Safeguarding Financial Stability and Compliance

Insurance companies and pension funds operate within a framework of regulatory guidelines and risk management practices to ensure the safeguarding of funds and the protection of policyholders and pension beneficiaries.

One of the primary concerns for insurance companies is the management of underwriting and claims risks. Underwriting risk pertains to the assessment of the likelihood of a claim occurring and the pricing of insurance policies to adequately cover potential liabilities. On the other hand, claims risk involves the potential financial impact of fulfilling policyholder claims. To mitigate these risks, insurance companies adhere to stringent underwriting guidelines and maintain robust reserves to meet future claim obligations, thereby ensuring the stability of their operations.

Additionally, insurance companies are subject to regulatory oversight aimed at safeguarding the interests of policyholders and maintaining the financial soundness of the industry. Regulatory authorities impose capital requirements and solvency standards to ensure that insurance companies have adequate financial resources to honor their commitments and withstand adverse economic conditions. Compliance with these regulations is essential for upholding the stability and reliability of insurance offerings.

Similarly, pension funds navigate a landscape of regulatory frameworks and risk management protocols to uphold the long-term sustainability of retirement benefits. Regulatory oversight is geared towards ensuring that pension funds prudently manage contributions, make sound investment decisions, and maintain the financial viability of the fund. This oversight encompasses stringent governance standards, investment diversification requirements, and actuarial assessments to ascertain the fund’s ability to meet future pension obligations.

Risk management within pension funds encompasses the mitigation of investment risks, longevity risks, and market volatility. These entities employ sophisticated risk assessment models to gauge the potential impact of market fluctuations and demographic trends on the fund’s financial health. By diversifying investments and implementing risk mitigation strategies, pension funds strive to uphold the security and stability of retirement benefits for members.

Understanding the regulatory landscape and risk management practices adopted by insurance companies and pension funds is pivotal for individuals entrusting their financial security to these entities. By comprehending the measures in place to mitigate risks and adhere to regulatory standards, policyholders and pension fund members can gain confidence in the stability and reliability of their financial provisions.

Conclusion

Elevating Financial Literacy and Empowerment

Exploring the journey of your payments to insurance companies and pension funds unveils a tapestry of meticulous allocation, prudent management, and regulatory adherence. The funds you contribute play a pivotal role in safeguarding your financial well-being, whether it’s through insurance coverage for unforeseen events or the accumulation of resources for a secure retirement.

By comprehending the intricate utilization of your payments, you gain a deeper appreciation for the mechanisms that underpin the operations of insurance companies and pension funds. The allocation of your funds towards risk management, investments, and regulatory compliance reflects a commitment to financial stability and the fulfillment of long-term obligations.

Furthermore, understanding the investment strategies and risk management practices employed by these entities empowers you to make informed decisions regarding your insurance coverage and retirement planning. It fosters a sense of confidence in the reliability and sustainability of the financial provisions offered by insurance companies and pension funds.

As you continue your financial journey, this knowledge serves as a cornerstone for elevating your financial literacy and cultivating a deeper understanding of the intricate mechanisms that shape your financial well-being. It equips you with the insights needed to navigate the landscape of insurance and retirement planning with confidence and informed decision-making.

In essence, the journey of your payments to insurance companies and pension funds embodies a commitment to safeguarding your financial security, nurturing long-term growth, and upholding regulatory standards. By unraveling this journey, you embark on a path of empowerment and enlightenment, poised to make sound financial choices and embrace the future with confidence.