Finance

How To Extend The Minimum Payment Date

Published: February 27, 2024

Learn how to extend the minimum payment date and manage your finances effectively. Find expert tips and advice on finance management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of personal finance, managing credit card payments is a crucial aspect of maintaining a healthy financial profile. One of the key components of credit card management is the minimum payment date, which plays a pivotal role in avoiding late fees and maintaining a positive credit history. However, there are instances when individuals may encounter financial constraints that make it challenging to meet the minimum payment date. In such circumstances, the ability to extend the minimum payment date can provide much-needed relief and flexibility.

Extending the minimum payment date can be a valuable tool for individuals facing temporary financial hardships or unexpected expenses. It can offer breathing room and prevent the accumulation of late fees, which can exacerbate financial burdens. Understanding the significance of the minimum payment date and the methods available to extend it is essential for individuals seeking to navigate their financial obligations effectively.

In this article, we will delve into the nuances of the minimum payment date, explore its significance in credit card management, and elucidate the various strategies that can be employed to extend this critical deadline. By gaining insights into these aspects, individuals can empower themselves to make informed decisions and take proactive steps to manage their credit card payments more effectively.

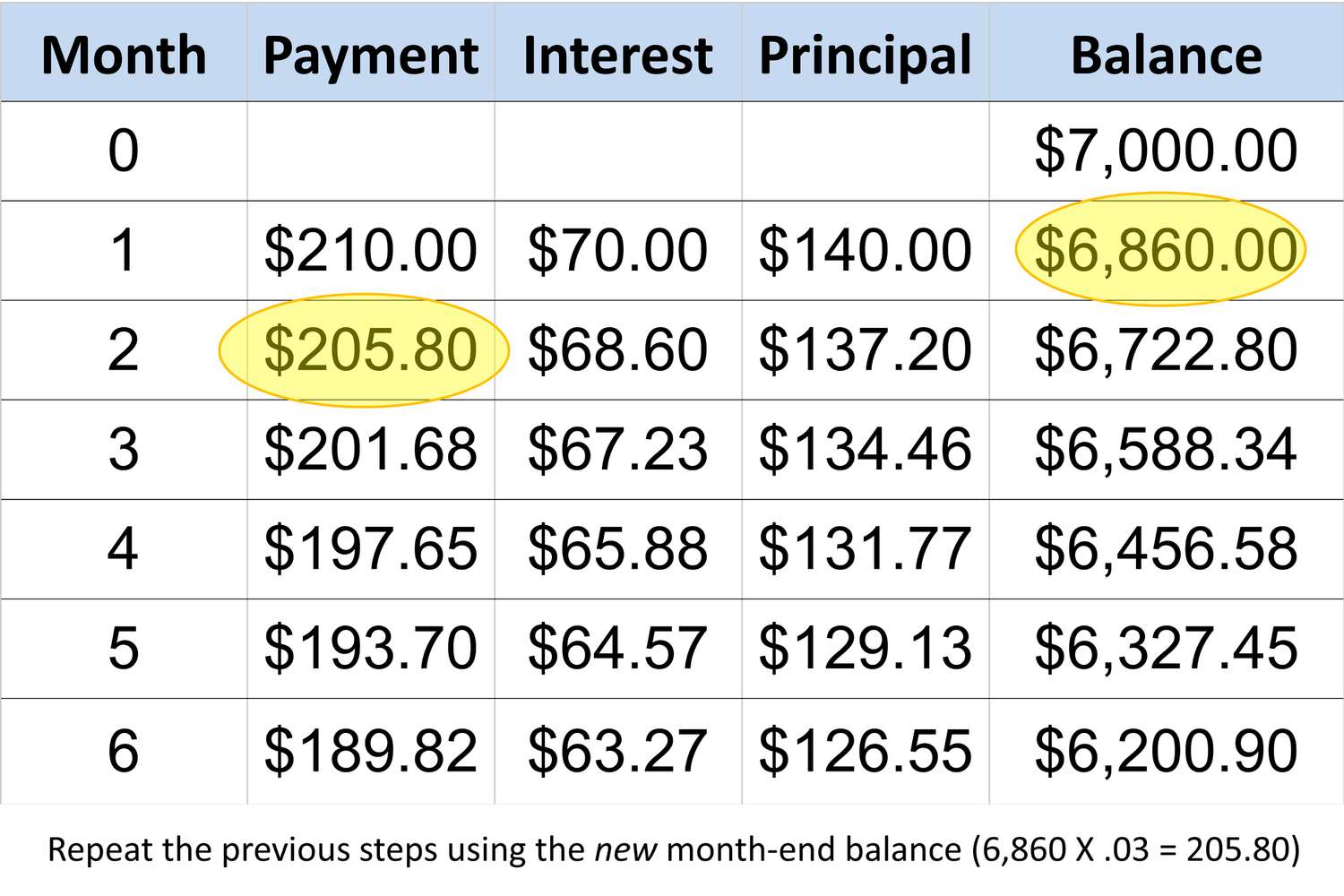

Understanding Minimum Payment Date

The minimum payment date refers to the deadline by which credit card holders are required to make at least the minimum payment specified by their card issuer. This date typically occurs once a month and is a fundamental aspect of responsible credit card management. Failing to meet this deadline can result in late fees, increased interest rates, and negative impacts on the cardholder’s credit score. It is important to note that the minimum payment is a small portion of the outstanding balance, often calculated as a percentage of the total amount owed, along with any interest and fees accrued during the billing cycle.

Furthermore, the minimum payment date is distinct from the statement closing date, which is when the billing cycle ends and the new statement begins. Understanding the relationship between these dates is crucial for effectively managing credit card payments. By comprehending the minimum payment date, cardholders can avoid unnecessary financial penalties and maintain a positive credit standing.

It is essential for individuals to prioritize making at least the minimum payment by the specified due date, as this demonstrates responsible financial behavior and helps to prevent the escalation of debt. Additionally, meeting the minimum payment deadline can contribute to preserving a favorable credit history, which is integral for future financial endeavors such as loan applications and mortgage approvals.

Ultimately, comprehending the significance of the minimum payment date empowers individuals to navigate their credit card obligations with prudence and foresight. By recognizing the implications of this deadline, individuals can take proactive measures to ensure timely payments and mitigate potential financial repercussions.

Importance of Extending Minimum Payment Date

The importance of extending the minimum payment date cannot be overstated, particularly for individuals facing temporary financial challenges or unexpected expenses. By extending this critical deadline, individuals can gain valuable breathing room and alleviate the immediate burden of meeting their credit card obligations. This can be especially beneficial in situations where individuals encounter unforeseen expenses or a temporary reduction in income, making it difficult to meet the original minimum payment date.

Extending the minimum payment date can help individuals avoid the detrimental consequences of missing the deadline, such as incurring late fees and experiencing a negative impact on their credit score. By securing additional time to fulfill their payment obligations, individuals can prevent the accumulation of financial penalties and maintain a more favorable credit standing. This, in turn, can contribute to their overall financial well-being and provide a sense of relief during challenging circumstances.

Moreover, extending the minimum payment date can serve as a strategic tool for managing cash flow and prioritizing essential expenses. It allows individuals to navigate their financial responsibilities in a more balanced manner, especially when faced with competing financial demands. By extending the minimum payment date, individuals can allocate their resources more effectively, ensuring that critical expenses are addressed without compromising their ability to meet their credit card obligations.

Furthermore, extending the minimum payment date can provide individuals with the opportunity to explore alternative financial solutions or seek temporary assistance, thereby mitigating the immediate impact of financial constraints. This additional time can be instrumental in formulating a sound financial strategy and seeking viable options to address the underlying challenges that led to the need for an extended payment date.

Ultimately, the importance of extending the minimum payment date lies in its capacity to offer individuals a reprieve during times of financial strain, enabling them to navigate their credit card obligations with greater flexibility and resilience.

Ways to Extend Minimum Payment Date

Extending the minimum payment date can be achieved through several strategic approaches, each designed to provide individuals with the necessary flexibility to manage their credit card obligations effectively. Understanding these methods empowers individuals to navigate their financial responsibilities with prudence and foresight, particularly during challenging circumstances. Below are several viable ways to extend the minimum payment date:

- Communication with Card Issuer: One of the most direct approaches to extending the minimum payment date is to communicate with the card issuer. Many issuers are willing to work with cardholders facing temporary financial constraints and may offer options to adjust payment deadlines. Initiating a proactive and transparent dialogue with the card issuer can yield viable solutions, such as extending the payment date or negotiating a temporary reprieve from immediate payment obligations.

- Utilizing Grace Periods: Some credit card issuers provide a grace period, typically ranging from a few days to a month, during which cardholders can make payments without incurring late fees or adverse consequences. Leveraging this grace period can effectively extend the minimum payment date, providing individuals with additional time to fulfill their obligations without facing punitive measures.

- Balance Transfer: Another option to extend the minimum payment date is to consider a balance transfer to a credit card with more favorable terms. By transferring the outstanding balance to a card with a later payment due date or lower interest rates, individuals can effectively extend the timeframe within which they need to make their minimum payment, offering greater flexibility in managing their financial commitments.

- Financial Assistance Programs: In some cases, financial institutions and credit card issuers may offer financial assistance programs designed to support individuals facing temporary hardships. These programs may include options to defer payments, restructure outstanding balances, or provide temporary relief from immediate payment obligations, thereby extending the minimum payment date and alleviating immediate financial pressures.

By exploring these methods and understanding the options available, individuals can proactively seek solutions to extend the minimum payment date, thereby gaining valuable flexibility and relief during challenging financial circumstances.

Conclusion

Effectively managing credit card payments is a fundamental aspect of maintaining financial stability and a positive credit standing. Central to this endeavor is the minimum payment date, which represents a critical deadline for fulfilling payment obligations. Understanding the nuances of the minimum payment date and the significance of extending this deadline is essential for individuals seeking to navigate their credit card responsibilities with prudence and foresight.

Extending the minimum payment date can offer individuals much-needed flexibility and relief, particularly during times of financial strain or unexpected expenses. By securing additional time to meet their payment obligations, individuals can avoid the detrimental consequences of missing the deadline, such as incurring late fees and experiencing negative impacts on their credit score. This can contribute to preserving a favorable credit history and mitigating the immediate financial burdens associated with credit card payments.

Exploring various strategies to extend the minimum payment date, such as proactive communication with card issuers, leveraging grace periods, considering balance transfers, and exploring financial assistance programs, empowers individuals to proactively address their financial challenges and navigate their credit card obligations with greater resilience.

In conclusion, the ability to extend the minimum payment date serves as a valuable tool for individuals seeking to manage their credit card payments effectively, especially during periods of financial uncertainty. By understanding the importance of this extension and leveraging the available strategies, individuals can navigate their financial responsibilities with greater flexibility, mitigate immediate financial strains, and maintain a positive credit standing, contributing to their overall financial well-being and peace of mind.