Finance

How To Find Credit Sales

Published: January 10, 2024

Looking for finance tips on how to find credit sales? Learn valuable strategies to boost your sales and improve your financial management skills with our helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit sales, where businesses provide products or services to customers with the promise of payment at a later date. Understanding and analyzing credit sales is crucial for financial management and planning. In this article, we will delve into the concept of credit sales, explore its importance, and provide practical steps to find and analyze credit sales data.

Credit sales are a common practice in many industries, allowing customers to make purchases on credit while giving businesses the opportunity to increase their sales and expand their customer base. However, managing credit sales effectively requires careful monitoring and analysis to ensure that businesses maintain a healthy cash flow and minimize the risk of bad debts.

By leveraging credit sales data, businesses can gain insights into their customer purchasing patterns, identify potential credit risks, and develop strategies to optimize their sales performance. Whether you are a small business owner or a financial professional, understanding how to find and analyze credit sales can significantly improve your decision-making process and profitability.

In the following sections, we will explore the importance of credit sales, provide step-by-step guidance on how to find credit sales, discuss the analysis of credit sales data, and offer strategies to track and increase credit sales. By the end of this article, you will have a comprehensive understanding of credit sales and the tools necessary to drive success in your business.

Understanding Credit Sales

Credit sales refer to transactions in which goods or services are sold to customers on credit, allowing them to defer payment to a later date. Unlike cash sales, where customers make immediate payment, credit sales offer flexibility and convenience to customers, resulting in increased sales opportunities for businesses.

When a business engages in credit sales, it essentially becomes a creditor, extending credit to its customers. This means that the business is taking on the risk of not receiving payment in exchange for the potential to generate higher revenue. To mitigate this risk, businesses often establish credit policies, conduct credit checks, and set specific terms and conditions for credit sales.

Credit sales are typically documented through sales invoices or agreements that outline the goods or services provided, the payment terms, and other relevant information. The payment terms may vary, depending on the agreement between the business and the customer, but common terms include net 30, net 60, or even longer payment periods.

It’s important to note that credit sales are not guaranteed sources of revenue. There is always a risk that customers may default on their payment obligations, leading to bad debts. To mitigate this risk, businesses employ credit management strategies, such as regularly monitoring customer payment history, setting credit limits, and pursuing collections when necessary.

Understanding credit sales is crucial for businesses to effectively manage their cash flow and maintain a healthy financial position. By analyzing credit sales data, businesses can gain insights into their sales performance, customer behavior, and credit risk levels. This information allows businesses to make informed decisions regarding credit policies, pricing strategies, and sales targets.

In the next section, we will explore the importance of credit sales and why businesses need to pay close attention to this aspect of their operations.

Importance of Credit Sales

Credit sales play a significant role in the finance and operations of businesses across various industries. They offer a range of benefits that contribute to revenue growth and customer satisfaction. Let’s explore the importance of credit sales in more detail:

1. Increased Sales Opportunities: By offering credit sales options to customers, businesses can attract a wider range of buyers who may not have immediate funds but are willing to make purchases on credit. This expands the customer base and boosts sales potential.

2. Customer Loyalty and Satisfaction: Credit sales can build strong relationships with customers by providing them with the convenience of deferred payments. This not only increases customer satisfaction but also fosters loyalty, encouraging repeat business and driving long-term customer relationships.

3. Competitive Advantage: In markets where credit sales are common, offering credit options can give businesses a competitive edge. It differentiates them from competitors, making their products or services more accessible and attractive to potential customers.

4. Cash Flow Management: Although credit sales may postpone immediate revenue, they contribute to steady cash flow in the long run. This is particularly beneficial for businesses that have seasonal fluctuations or longer production cycles, as they can maintain stable operations without relying solely on upfront cash payments.

5. Improved Sales Forecasting: Analyzing credit sales data provides insights into revenue trends, customer behavior, and product performance. This knowledge enables businesses to make accurate sales forecasts and plan inventory management effectively, minimizing stock-outs and optimizing supply chain operations.

6. Financial Flexibility: Credit sales allow businesses to access working capital without resorting to external financing options such as loans. This financial flexibility can support growth initiatives, fund business expansion, and provide the necessary resources for research and development.

7. Credit Risk Management: While credit sales come with the risk of non-payment or bad debts, businesses can implement credit risk management strategies to mitigate these concerns. This includes conducting credit checks, setting credit limits, and monitoring customer payment behavior to minimize the risk of default.

Understanding the importance of credit sales empowers businesses to make informed decisions regarding their credit policies, pricing strategies, and customer management. Now, let’s move on to the next section, where we will discuss the steps to find credit sales and effectively track this essential financial metric.

Steps to Find Credit Sales

Tracking credit sales is crucial for businesses to monitor their revenue streams, evaluate customer purchasing behavior, and assess the overall financial health of their operations. Here are the essential steps to find credit sales:

1. Gather Relevant Data: Start by collecting all the necessary financial data related to sales transactions. This includes sales invoices, sales reports, and any other documentation that records credit sales.

2. Identify Credit Sales: Review the gathered data and identify transactions where goods or services were sold on credit. Look for specific indicators, such as payment terms, credit periods, or any signs that indicate deferred payment.

3. Separate Cash and Credit Sales: Differentiate between cash sales and credit sales in your data. This will help in isolating credit transactions and accurately analyzing credit sales performance.

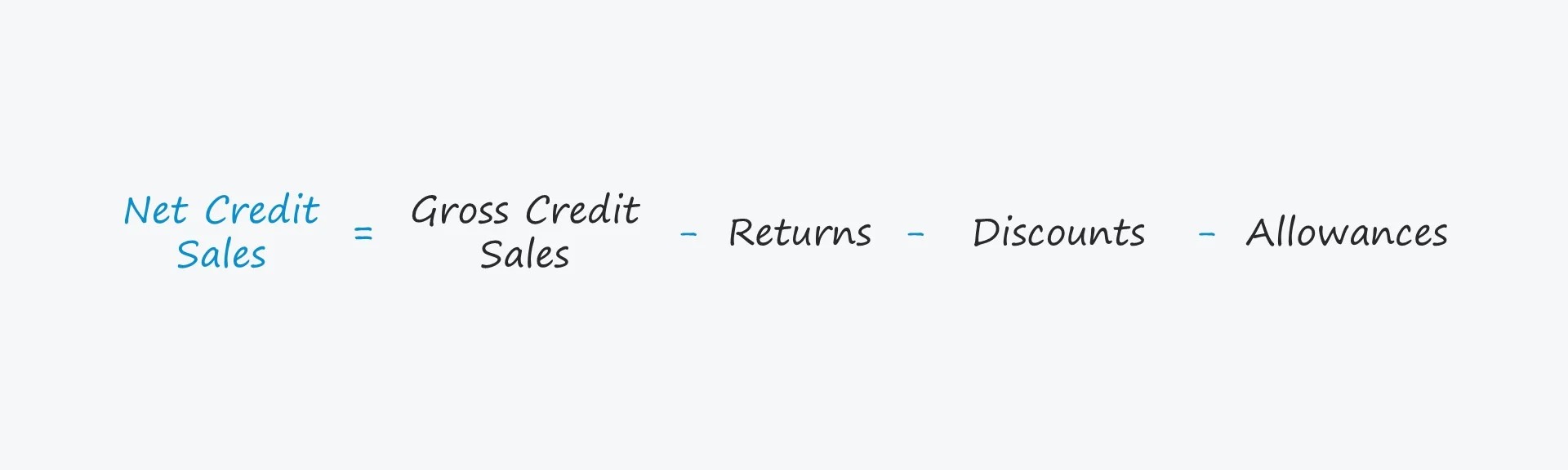

4. Calculate Total Credit Sales: Sum up all the amounts from the identified credit sales transactions. This will give you the total value of revenue generated through credit sales during a specific period.

5. Consider Sales Returns and Allowances: Take into account any sales returns or allowances related to credit sales. These adjustments may impact the final revenue figure derived from credit sales.

6. Calculate Average Credit Days: Determine the average number of days it takes for customers to make payments on credit sales. This metric helps assess the efficiency of credit collections and sets a benchmark for managing credit terms.

7. Track Outstanding Balances: Keep track of outstanding balances from credit sales. This allows businesses to monitor the overall credit risk exposure and take proactive measures to ensure timely payments.

8. Utilize Accounting Software: Implement an accounting software system that can streamline the process of tracking credit sales. This software can automate calculations, generate detailed reports, and provide real-time insights into credit sales performance.

9. Regularly Reconcile Accounts: Reconcile credit sales accounts with customer payments and follow up on any discrepancies. This ensures that all credit sales and subsequent payments are accurately recorded.

10. Conduct Periodic Analysis: Analyze credit sales data periodically to identify trends, patterns, and potential areas for improvement. This analysis can help in developing sales strategies, setting credit policies, and detecting any irregularities.

By following these steps, businesses can effectively find and track credit sales, enabling better financial management and informed decision-making. In the next section, we will discuss how to analyze credit sales data to gain valuable insights into sales performance and customer behavior.

Analyzing Credit Sales Data

Once you have gathered and organized credit sales data, it’s essential to analyze it effectively to gain valuable insights into your sales performance, customer behavior, and credit risk levels. Here are key steps to analyze credit sales data:

1. Identify Key Metrics: Determine the key metrics you want to analyze, such as total credit sales, average credit days, customer payment patterns, or product-specific sales performance. These metrics will vary depending on your business goals and industry.

2. Track Sales Trends: Identify trends in credit sales over time. Analyze sales data by month, quarter, or year to understand seasonal fluctuations, identify growth patterns, and evaluate the impact of marketing campaigns or external factors on credit sales.

3. Segment Customers: Divide your customer base into segments based on their credit payment behavior, buying patterns, or demographics. This segmentation will help you identify high-value customers, assess credit risk, and tailor marketing and sales strategies to specific customer groups.

4. Calculate Average Collection Period: Determine the average collection period by dividing accounts receivable by the average daily credit sales. This helps assess the efficiency of credit collections and identifies if there are any delays in receiving payments.

5. Monitor Customer Payment Behavior: Analyze how customers are adhering to the agreed-upon payment terms. Identify customers who consistently make late payments or have a higher probability of defaulting. This analysis will help you manage credit risk and adjust credit limits accordingly.

6. Identify Product Performance: Analyze credit sales data to identify the performance of different products or services. Determine which products have higher credit sales, identify any seasonal or promotional trends, and make informed decisions on product pricing, marketing strategies, and inventory management.

7. Assess Bad Debt Provisions: Evaluate the adequacy of your bad debt provisions by comparing the historical credit sales default rates with the actual bad debts incurred. This analysis will help ensure that you have appropriate provisions to cover potential bad debts.

8. Track Aging Receivables: Monitor the aging of receivables from credit sales. Categorize outstanding balances based on the number of days overdue, and take appropriate actions to follow up on overdue payments and minimize the risk of bad debts.

9. Utilize Visualization Tools: Utilize data visualization tools to create charts, graphs, and dashboards that present credit sales data in a clear and visually appealing way. Visual representations make it easier to identify trends, patterns, and outliers within the data.

10. Regularly Review and Adjust Strategies: Continuously review your credit sales analysis and insights to refine your sales strategies, credit policies, and customer management approaches. Regularly monitor changes in customer behavior and market dynamics to adapt and optimize your credit sales strategies.

Analyzing credit sales data empowers businesses to make data-driven decisions, identify opportunities for growth, and mitigate credit risk. It provides a comprehensive picture of sales performance, customer behavior, and the overall financial health of your business. In the next section, we will discuss strategies to track credit sales performance and optimize your credit sales efforts.

Tracking Credit Sales Performance

Tracking credit sales performance is essential for businesses to assess the effectiveness of their credit sales strategies, identify areas for improvement, and ensure a healthy cash flow. Here are the key strategies to track credit sales performance:

1. Set Clear Objectives: Define specific and measurable goals for your credit sales, such as increasing total credit sales volume, reducing average collection period, or improving customer payment rates. Clear objectives provide a benchmark for tracking and evaluating performance.

2. Monitor Key Metrics: Continuously monitor key metrics related to credit sales, such as total credit sales revenue, average credit days, collection rates, and aging of receivables. Regularly track these metrics and compare them against your established targets and historical data.

3. Implement a CRM System: Utilize a Customer Relationship Management (CRM) system to effectively track customer credit information, purchase history, and payment behavior. A CRM system can help automate credit sales tracking, generate reports, and provide a centralized platform for managing customer relationships.

4. Conduct Aging Receivables Analysis: Regularly review the aging of receivables to identify any overdue accounts and take appropriate actions to follow up on late payments. This analysis allows you to track outstanding balances, assess credit risk, and prioritize collections efforts.

5. Monitor Collection Efficiency: Track the efficiency of your credit collections process by measuring the average collection period, the percentage of accounts receivable collected on time, and the number of days it takes to resolve payment issues. This helps identify bottlenecks and optimize collection efforts.

6. Conduct Credit Risk Assessments: Regularly assess the credit risk associated with your customer base. Evaluate their payment history, credit scores, financial stability, and any changes in their business circumstances. This analysis allows you to identify high-risk customers and adjust credit limits accordingly.

7. Analyze Sales by Customer Segments: Segment your customer base based on credit history, purchasing behavior, industry, or other relevant factors. Analyze credit sales performance for each segment to identify trends, customer preferences, and opportunities for targeted marketing and sales strategies.

8. Review Sales and Receivables Reports: Regularly review sales reports and accounts receivable reports to gain insights into credit sales patterns, seasonal trends, and any shifts in customer payment behavior. These reports help identify areas where credit sales performance can be optimized.

9. Seek Customer Feedback: Engage with customers to gather feedback on their credit purchasing experience. This can be done through surveys, reviews, or direct communication. Customer feedback helps identify pain points, improve credit policies, and enhance customer satisfaction.

10. Continuously Improve Credit Sales Strategies: Utilize the insights gained from tracking credit sales performance to refine your credit sales strategies. Make adjustments to credit policies, pricing structures, customer segmentation, and collection procedures based on data-driven decision-making.

By tracking credit sales performance, businesses can spot trends, make informed decisions, and optimize their credit sales efforts. Regular monitoring and analysis enable timely responses to changes in customer behavior, credit risk levels, and market dynamics. In the next section, we will discuss effective strategies to increase credit sales and drive business growth.

Strategies to Increase Credit Sales

Increasing credit sales is a key objective for many businesses as it can drive revenue growth, expand customer reach, and improve cash flow. Here are effective strategies to boost your credit sales:

1. Offer Flexible Payment Terms: Provide customers with a range of payment options and flexible credit terms. This could include offering extended payment periods, installment plans, or customized payment arrangements based on individual customer needs. Flexibility in payment terms can attract customers who may be hesitant to make immediate purchases.

2. Streamline Credit Application Process: Simplify and expedite the credit application process to make it easier for customers to apply for credit. Ensure that the necessary documentation is clear, the process is efficient, and provide prompt responses to credit applications to minimize delays in approving credit accounts.

3. Implement a Customer Loyalty Program: Create a customer loyalty program that rewards customers for making repeat purchases on credit. This can include discounts, exclusive offers, or special benefits for loyal customers. A loyalty program incentivizes customers to choose credit options and encourages them to continue doing business with your company.

4. Conduct Targeted Marketing Campaigns: Develop targeted marketing campaigns to promote credit sales. Customize your messaging to emphasize the benefits and convenience of purchasing on credit. Use channels such as email marketing, social media, and targeted advertisements to reach potential customers who may be more inclined to make credit purchases.

5. Provide Excellent Customer Service: Exceptional customer service can build trust and confidence in your credit sales process. Promptly respond to inquiries, provide clear and transparent information about credit terms, and offer assistance throughout the credit application and purchase process. Positive customer experiences can lead to increased credit sales and customer loyalty.

6. Collaborate with Financing Partners: Partner with financial institutions or third-party financing providers to offer competitive financing options. This can include installment plans or deferred payment programs that enable customers to make purchases on credit without burdensome interest rates or fees. Collaborations with financing partners expand your credit offering capabilities and attract new customers.

7. Upsell and Cross-Sell: Leverage your existing customer base by using upselling and cross-selling techniques. Encourage customers to explore additional products or services related to their credit purchases. This strategy not only increases the value of individual sales but also strengthens customer relationships and boosts overall credit sales volume.

8. Invest in Sales Training: Provide comprehensive sales training to your team to enhance their knowledge and skills in selling credit options. Equip them with the ability to effectively communicate the benefits of credit sales and address any customer concerns or objections. Well-trained sales professionals can increase conversion rates and drive credit sales growth.

9. Leverage Influencer Marketing: Collaborate with influencers or industry experts who have a significant online presence and a relevant audience. Their endorsements and recommendations of your credit sales offerings can generate awareness and credibility, attracting new customers who trust the influencer’s opinion.

10. Continuously Monitor and Optimize: Regularly analyze your credit sales data to identify performance gaps and areas for improvement. Test different strategies, offers, and marketing campaigns to see what resonates best with your target audience. Continuously monitor results and make data-driven optimizations to maximize credit sales performance.

By implementing these strategies, businesses can enhance their credit sales efforts, attract new customers, and create long-term customer relationships. Remember to track the effectiveness of these strategies through careful monitoring and analysis. In the concluding section, we will recap the importance of credit sales and highlight the key takeaways.

Conclusion

Credit sales are an integral component of many businesses, offering customers the flexibility to make purchases on credit and providing businesses with increased sales opportunities. Understanding, tracking, and analyzing credit sales data is crucial for financial management, decision-making, and business growth.

In this article, we explored the concept of credit sales and highlighted its importance in driving revenue, customer satisfaction, and competitive advantage. We discussed the steps to find credit sales, emphasizing the need to gather relevant data, identify credit sales transactions, and calculate the total credit sales amount.

We also delved into the significance of analyzing credit sales data, illustrating how it can help assess sales performance, customer behavior, and credit risk levels. By monitoring key metrics, implementing a CRM system, and conducting regular analysis, businesses can gain valuable insights, make data-driven decisions, and optimize their credit sales efforts.

Moreover, we explored strategies to increase credit sales, such as offering flexible payment terms, implementing customer loyalty programs, and collaborating with financing partners. By leveraging targeted marketing campaigns, exceptional customer service, and upselling techniques, businesses can attract more customers and drive credit sales growth.

Finally, we highlighted the importance of continuously monitoring credit sales performance and refining strategies based on data-driven optimizations. By regularly reviewing sales reports, tracking aging receivables, and seeking customer feedback, businesses can adapt and improve their credit sales practices to foster long-term success.

In conclusion, credit sales are an essential aspect of financial management and business growth. By understanding credit sales, tracking performance metrics, and implementing effective strategies, businesses can unlock the potential of credit sales, optimize revenue streams, and build strong customer relationships. Embracing the power of credit sales can propel businesses toward sustainable success in today’s competitive marketplace.