Finance

The Key To Budgeting For Large Expenses

Published: October 11, 2023

Learn the key to budgeting for large expenses in finance and take control of your financial future. Discover expert tips and strategies to save money and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of budgeting for large expenses! Whether it’s a dream vacation, a new car, or a home renovation, saving up for significant purchases can be both exciting and daunting. It’s essential to have a strategic plan in place to manage these expenses effectively and avoid any financial strain.

In this article, we will explore the importance of budgeting for large expenses and provide you with practical steps to navigate this process with ease. By implementing these strategies, you can make your financial dreams a reality while maintaining a strong financial foundation.

Large expenses can often catch us off guard if we haven’t planned for them. Without proper budgeting, we may find ourselves dipping into our emergency fund or relying on credit cards to cover these expenses. This haphazard approach can lead to financial stress and may hinder our long-term financial goals.

However, by adopting a proactive approach and dedicating specific funds to these expenses, we can mitigate financial strain and maintain financial stability. Budgeting for large expenses helps us allocate funds over time, ensuring that we have enough saved when the time comes to make the purchase or undertake the project.

As we delve into the intricacies of budgeting for large expenses, we will explore the steps involved in creating a budget, tracking and adjusting it as needed, and offer tips for saving effectively. With the right tools and mindset, you can take control of your finances and achieve your desired goals without jeopardizing your financial well-being.

So, let’s dive in and discover the key to budgeting for large expenses!

Understanding Large Expenses

Before we begin budgeting for large expenses, it’s crucial to have a clear understanding of what constitutes a “large expense.” Large expenses are significant financial obligations that typically require a substantial amount of money. These can include purchasing a house, buying a car, funding a wedding, going on a dream vacation, or even paying for higher education.

Large expenses differ from regular monthly expenses, such as utility bills or groceries, in terms of their scale and impact on our finances. They often require careful planning and saving over an extended period. Understanding the nature of these expenses will help us develop a more realistic budget and ensure we are adequately prepared to meet these financial milestones.

It’s important to note that large expenses can be both planned and unplanned. Planned large expenses are those that we have control over and can anticipate in advance. For example, saving for a down payment on a house or setting aside money for a child’s education. Unplanned large expenses, on the other hand, are unforeseen financial burdens that may arise suddenly, such as a medical emergency or unexpected home repairs.

Regardless of whether the large expense is planned or unplanned, budgeting plays a critical role in managing these financial obligations effectively. By allocating funds specifically for these expenses, we can avoid unnecessary stress and make informed and confident decisions when the time comes to make the purchase or address the financial need.

Understanding the nature of large expenses allows us to prioritize and strategize our financial goals. It enables us to set realistic timelines for achieving our desired purchases or financial milestones. By familiarizing ourselves with the factors that contribute to these expenses, such as market trends, interest rates, or the cost of living in a specific area, we can ensure that our budget aligns with our financial objectives.

Now that we have a better understanding of what large expenses entail, it’s time to explore the importance of budgeting for these significant financial obligations. Budgeting is the key to effectively managing the funds required to achieve our financial goals without compromising our overall financial well-being.

Importance of Budgeting for Large Expenses

When it comes to large expenses, budgeting is more than just a financial tool – it’s a strategic approach that empowers us to take control of our finances, make informed decisions, and achieve our goals. Here are some key reasons why budgeting for large expenses is of utmost importance:

- Financial Preparedness: Budgeting allows us to prepare for large expenses in advance. By setting aside funds and creating a plan, we can avoid financial strain and the need to rely on credit cards or loans to cover these expenses. This helps us maintain a healthy financial position and reduces the risk of falling into debt.

- Goal Achievement: Budgeting for large expenses aligns our financial priorities and goals. Setting aside money specifically for these expenses ensures that we are actively working towards achieving our desired milestones, such as owning a home, buying a car, or taking a dream vacation. It keeps us focused, motivated, and on track to accomplish our financial objectives.

- Financial Discipline: Budgeting requires discipline and responsible money management. It encourages us to evaluate our spending habits, make necessary adjustments, and differentiate between wants and needs. By practicing mindful spending and adhering to a budget, we develop healthy financial habits that can benefit us in all areas of life.

- Reduced Stress: Financial stress can take a toll on our mental health and overall well-being. By budgeting for large expenses, we can reduce anxiety and uncertainty, knowing that we have a plan in place to cover these costs. It provides a sense of control, peace of mind, and allows us to enjoy our financial milestones without worrying about the financial aftermath.

- Opportunity for Savings: Budgeting for large expenses encourages us to save regularly. By allocating a portion of our income towards these goals, we develop a savings habit that extends beyond the specific expense. It creates an opportunity for long-term financial growth and opens doors to future opportunities.

Overall, budgeting for large expenses plays a vital role in our financial well-being and goal achievement. It empowers us to take charge of our finances, make sound financial decisions, and create a solid financial foundation for the future. As we move forward, let’s explore the practical steps involved in budgeting for large expenses.

Steps for Budgeting for Large Expenses

Creating a budget for large expenses requires careful planning and attention to detail. Follow these essential steps to effectively budget for your significant financial obligations:

- Identify the Expense: Start by identifying the specific large expense you want to budget for. Clearly define the cost and timeline associated with the purchase or project. This will help you set a realistic savings goal and create a budget that aligns with your financial objectives.

- Analyze Your Current Financial Situation: Take a close look at your current financial standing. Evaluate your income, savings, and monthly expenses. Understanding your financial situation will enable you to determine how much you can allocate towards your goal without compromising your daily needs and emergency fund.

- Calculate the Savings Period: Determine the length of time you have to save for the expense. Divide the cost of the large expense by the number of months or years until the target date. This will help you establish a realistic monthly savings goal.

- Review and Modify Your Budget: Assess your current budget and identify areas where you can cut back or reduce expenses. Look for opportunities to free up money that can be put towards your savings goal. Consider reducing discretionary spending, negotiating bills, or finding ways to increase your income through side hustles or freelancing.

- Create a Separate Savings Account: Open a dedicated savings account specifically for the large expense. This will help you track your progress and prevent you from dipping into the funds for other purposes. Consider automating regular transfers from your main account to your savings account to ensure consistent contributions.

- Track Your Progress: Regularly monitor your savings progress. Keep a close eye on your budget and track your monthly contributions to ensure you are on track to meet your savings goal. Use budgeting apps or spreadsheets to make tracking easier and more efficient.

- Adjust as Needed: Life is unpredictable, and financial circumstances can change. Be flexible with your budget and make adjustments as necessary. If you experience unexpected financial changes, such as a pay cut or increase in expenses, review your budget and make the necessary modifications to stay on track with your savings goal.

- Celebrate Milestones: Acknowledge and celebrate your progress along the way. When you reach certain savings milestones, reward yourself with small celebrations, such as a nice meal or a small treat. This will help you stay motivated and committed to your budgeting journey.

By following these steps, you can create a solid roadmap for budgeting for your large expenses. Remember that budgeting is a dynamic process, and it’s important to be adaptable and reevaluate your strategy as your financial situation evolves.

Next, we’ll explore how to effectively track and adjust your budget to ensure you stay on the right path towards your savings goal.

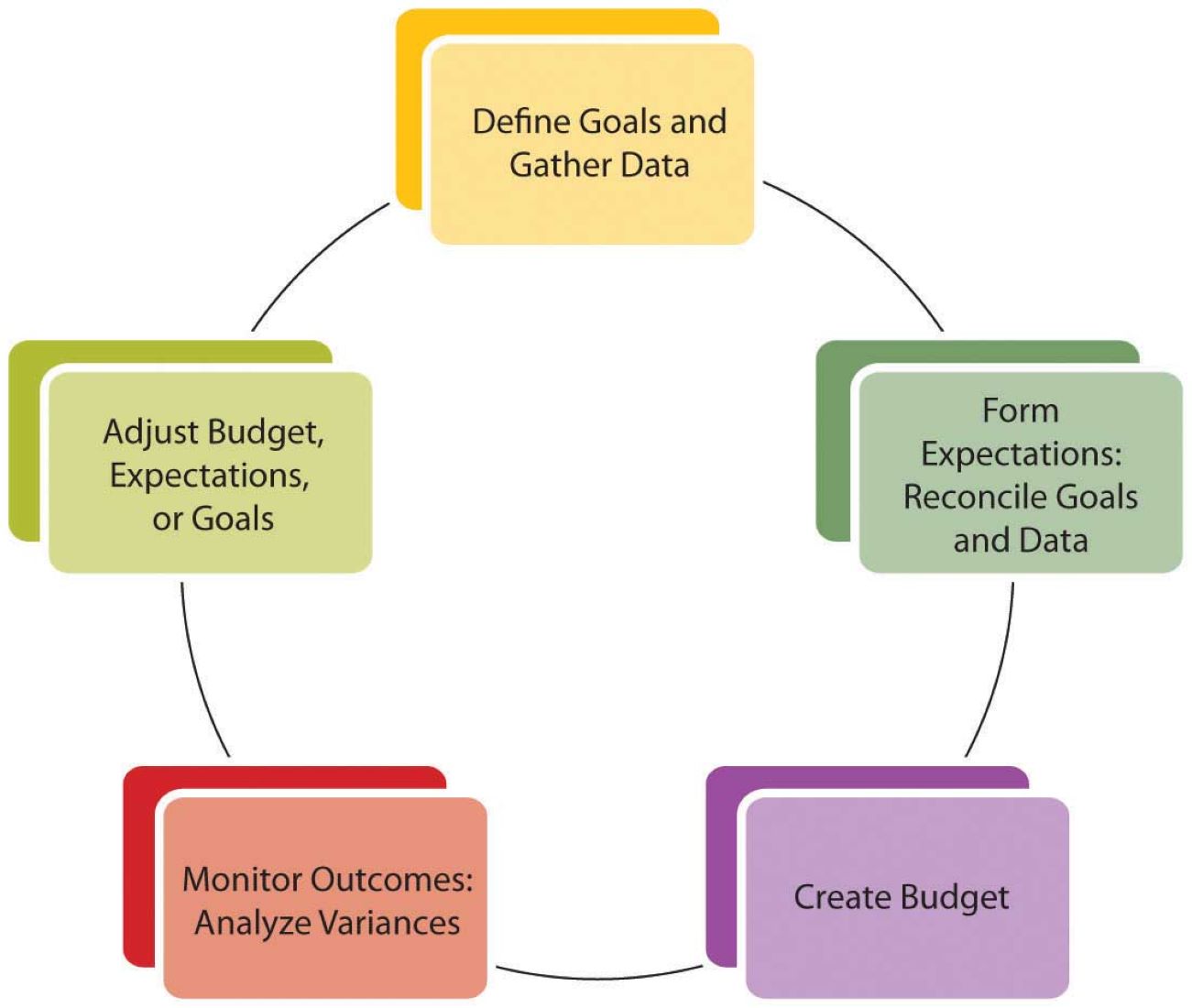

Tracking and Adjusting Your Budget

Once you’ve set up a budget for your large expenses, it’s crucial to regularly track your progress and make any necessary adjustments along the way. Tracking and adjusting your budget ensures that you stay on track towards your savings goal. Here are some steps to help you effectively monitor and modify your budget:

- Record and Categorize Expenses: Keep a detailed record of all your expenses, both large and small. Categorize them into different budget categories, such as housing, transportation, groceries, entertainment, etc. This will enable you to see where your money is going and identify areas where you can potentially cut back.

- Use Budgeting Apps or Spreadsheets: Take advantage of technology by using budgeting apps or spreadsheets to aid you in tracking your expenses. These tools can automatically sync with your bank account and categorize transactions, making it easier to see your spending patterns and identify areas for adjustment. Alternatively, you can create a simple spreadsheet to manually track your expenses.

- Compare Actual Spending to Budgeted Amounts: Regularly compare your actual spending with the budgeted amounts for each expense category. This will give you a clear picture of how well you are sticking to your budget. If you notice that you are consistently overspending in certain areas, it may be necessary to reevaluate those categories and adjust your budget accordingly.

- Identify Opportunities to Cut Back: Analyze your spending patterns and identify areas where you can cut back without sacrificing your basic needs. Look for subscriptions or services you no longer use, unnecessary impulse purchases, or luxuries that can be temporarily eliminated. Redirect those savings towards your large expense savings account.

- Reallocate Funds: As you identify areas to cut back, reallocate those funds towards your savings goal. Adjust your budget by reducing the budgeted amounts for certain categories and increasing the allocation for your large expense savings. By consciously redirecting funds, you can accelerate your savings and reach your goal faster.

- Monitor Savings Progress: Regularly review the progress of your savings. Keep an eye on the balance in your dedicated savings account. Celebrate milestones and take pride in the progress you have made so far. Staying engaged with your savings journey will motivate you to continue adhering to your budget and making smart financial decisions.

- Be Flexible: Life is dynamic and circumstances may change. It’s essential to remain flexible with your budget. If unexpected expenses arise or your financial situation shifts, be prepared to adjust your budget accordingly. Adaptability is key to maintaining financial stability while working towards your financial goals.

Regularly tracking and adjusting your budget ensures that you are actively managing your finances, staying accountable to your goals, and making necessary modifications along the way. It allows you to maintain control of your spending habits and make informed decisions about your large expenses.

Next, let’s explore effective tips for saving for large expenses to help you maximize your savings potential.

Tips for Saving for Large Expenses

Saving for large expenses requires discipline and a strategic approach. Here are some helpful tips to maximize your savings potential and reach your financial goals:

- Set Clear and Realistic Goals: Define your savings goal for the large expense and establish a specific timeline. Make sure your goal is achievable and aligns with your financial situation. Breaking it down into smaller milestones can help you stay motivated and track your progress along the way.

- Create a Detailed Budget: Develop a comprehensive budget that outlines all your income and expenses. This will give you a clear understanding of your financial capabilities and identify areas where you can cut back and allocate more funds towards your savings goal.

- Automate Your Savings: Set up an automatic transfer from your primary account to your dedicated savings account for the large expense. By automating your savings, you ensure consistent contributions without the temptation to spend the money elsewhere.

- Reduce Unnecessary Expenses: Evaluate your monthly expenses and identify areas where you can cut back. Consider reducing discretionary spending, such as eating out or unnecessary subscriptions. Redirect those savings towards your large expense savings.

- Find Ways to Increase Your Income: Explore additional income streams or side hustles to boost your savings. It could be freelancing, taking on part-time work, or monetizing a hobby. The extra income can significantly accelerate your savings progress.

- Negotiate Bills and Expenses: Contact service providers to negotiate lower rates for bills such as cable, internet, or insurance. Even a small reduction in monthly expenses can add up over time and contribute to your savings goal.

- Monitor Your Progress: Regularly review your savings progress and track how close you are to reaching your goal. Celebrate milestones along the way to stay motivated and reinforce your commitment to saving.

- Plan and Prioritize Purchases: If your large expense involves multiple purchases or projects, prioritize them based on importance and urgency. Allocate funds to the most critical items first and save for the less essential ones over a more extended period.

- Research and Take Advantage of Deals: Before making any significant purchases, do thorough research to find the best deals or discounts available. Look for sale events or compare prices between different vendors to ensure you get the best value for your money.

- Avoid Impulse Buying: Be mindful of impulsive purchases that can derail your savings progress. Before making a purchase, give yourself a cooling-off period to evaluate if it aligns with your financial goals and if it’s truly necessary.

Remember, saving for large expenses is a journey that requires patience and determination. By implementing these tips and staying focused on your goal, you can build a strong financial foundation and achieve your aspirations without compromising your financial well-being.

Now, let’s wrap up with a summary of what we’ve covered so far.

Conclusion

Budgeting for large expenses is a crucial aspect of financial planning that allows us to achieve our goals without sacrificing our financial well-being. By understanding the nature of large expenses and the importance of budgeting for them, we can take control of our finances and make informed decisions about our financial future.

Through the steps outlined in this article, including identifying the expense, analyzing our financial situation, creating a budget, tracking our progress, and adjusting as needed, we can successfully navigate the journey of budgeting for large expenses. By implementing tips such as setting clear goals, automating savings, reducing unnecessary expenses, and finding ways to increase income, we maximize our savings potential and expedite our progress.

It’s important to remember that budgeting for large expenses is not a one-time task but a continuous process. As our financial circumstances evolve, we must remain flexible and adapt our budget to align with our changing needs and goals.

By following these practices, we can alleviate financial stress, achieve our desired purchases or projects, and build a strong financial foundation for the future. Budgeting for large expenses empowers us to take control of our financial journey, enabling us to enjoy our milestones without compromising our long-term financial stability.

So, take that first step today and start budgeting for those large expenses that will bring you closer to your dreams. With careful planning, discipline, and commitment, you can make your financial goals a reality and create a brighter financial future for yourself and your loved ones.