Finance

How To Get A Large Business Loan

Modified: February 21, 2024

Looking for a large business loan? Learn how to secure the financing you need with our expert financial advice and strategies. Finance your business growth today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Requirements

- Preparing your Business Plan

- Gathering Financial Documents

- Building a Relationship with the Lender

- Exploring Financing Options

- Applying for the Loan

- Negotiating the Terms and Conditions

- Submitting Collateral and Personal Guarantees

- Finalizing the Loan Agreement

- Conclusion

Introduction

Securing a large business loan can be a crucial step towards expanding your business, funding new projects, or overcoming financial challenges. However, the process of obtaining a substantial loan can be complex and daunting. It requires careful planning, strategic preparation, and a thorough understanding of the requirements and criteria set by lenders.

Before you begin the journey of applying for a large business loan, it’s essential to educate yourself about the process and what lenders look for in potential borrowers. This article will guide you through the steps involved in obtaining a substantial loan and provide insights into the factors that can increase your chances of success.

It’s important to note that while the specific requirements and procedures may vary from lender to lender, having a solid foundation of knowledge can help you navigate the loan application process more effectively. Whether you’re seeking funds to expand your operations, invest in new assets, or meet cash flow needs, understanding the key steps involved in securing a large business loan is crucial.

In this comprehensive guide, we will discuss the various aspects of obtaining a substantial loan for your business. This includes understanding the requirements set by lenders, preparing a strong business plan, gathering the necessary financial documents, exploring different financing options, applying for the loan, negotiating the terms and conditions, and finalizing the loan agreement. By following these steps, you can increase your chances of securing the funding your business needs.

So, if you’re ready to embark on the journey of obtaining a large business loan, let’s dive into the world of finance and explore the strategies and tactics that can lead you to success!

Understanding the Requirements

Before diving into the process of obtaining a large business loan, it’s crucial to understand the requirements set by lenders. Each lender may have specific criteria and guidelines that borrowers must meet to qualify for a substantial loan. By familiarizing yourself with these requirements, you can determine if your business is eligible and take the necessary steps to meet the lender’s expectations.

One of the primary factors that lenders consider is the creditworthiness of the borrowing company. This includes evaluating the business’s credit history, payment records, and overall financial health. Lenders typically prefer businesses with a strong credit profile and a track record of timely payments. If your business has a less-than-stellar credit history, it may be beneficial to work on improving your credit score before applying for a large loan.

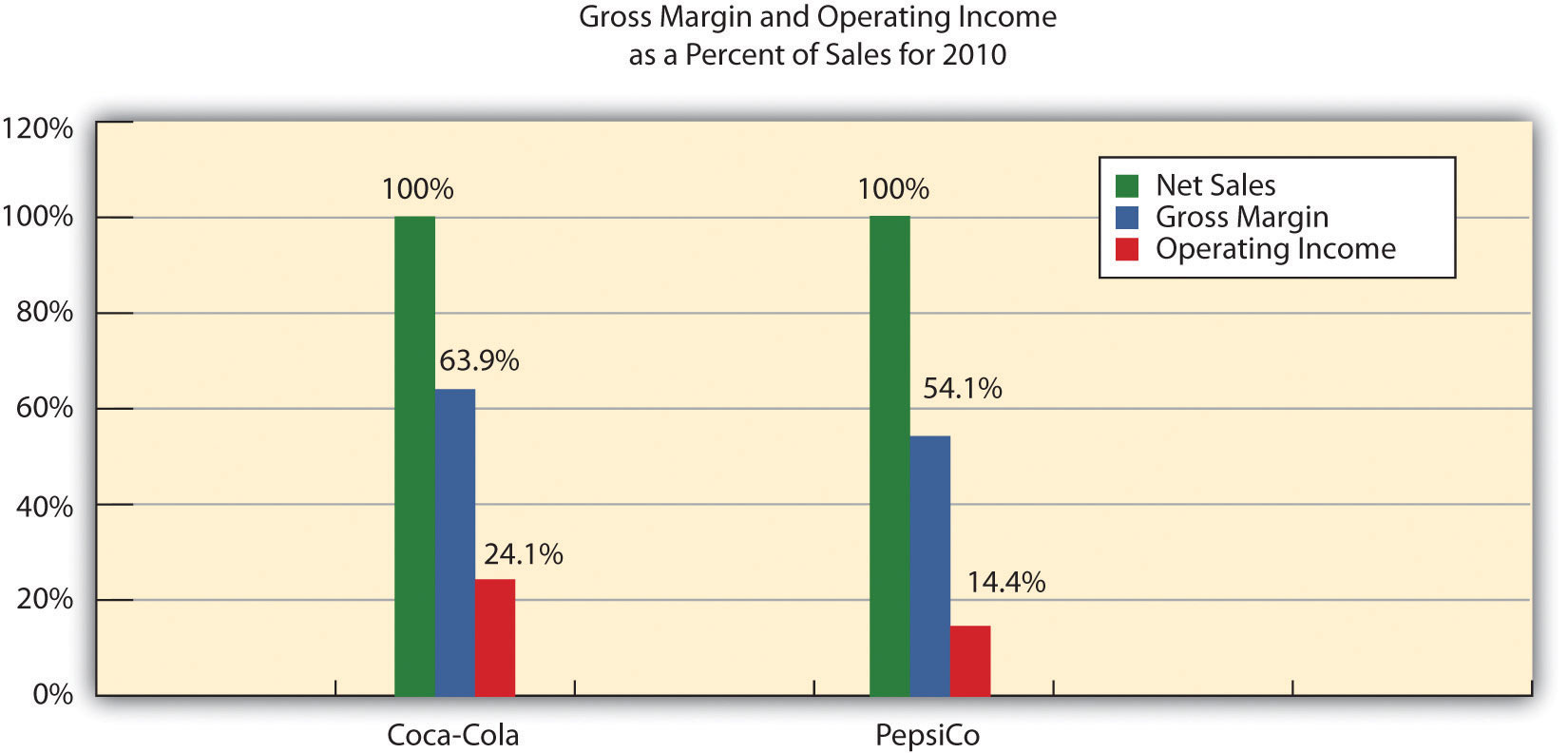

Another essential requirement is providing proof of revenue and profitability. Lenders want to ensure that the borrowing company has a steady stream of income to repay the loan. They will assess your financial statements, including profit and loss statements, balance sheets, and cash flow statements to evaluate the financial viability of your business. Demonstrating consistent revenue growth and profitability over the years can significantly increase your chances of qualifying for a large loan.

In addition to financial documents, lenders may also consider other factors such as the industry in which your business operates, the collateral you can offer, and your management team’s experience. Some industries may be seen as high-risk by lenders, making it more challenging to secure a substantial loan. However, if you can demonstrate industry expertise and a solid business plan, you can alleviate their concerns and increase your chances of approval.

Furthermore, lenders will assess the debt-to-income ratio of your business, which measures the proportion of your monthly debt payments to your monthly income. A low debt-to-income ratio indicates a healthier financial position and better repayment capacity, making you a more attractive borrower.

It’s crucial to understand that meeting the minimum requirements does not guarantee loan approval. Lenders will evaluate each application on multiple factors, including your business’s overall risk profile, industry trends, and economic conditions. It’s essential to be transparent in your application, provide accurate and up-to-date information, and showcase the strengths and potential of your business.

By understanding the requirements set by lenders, you can assess your business’s eligibility for a large loan and take the necessary steps to meet or exceed those requirements. This will not only increase your chances of approval but also help you prepare a strong loan application that showcases your business’s potential to succeed.

Preparing your Business Plan

One of the crucial steps in obtaining a large business loan is to prepare a comprehensive and compelling business plan. A well-crafted business plan not only helps you articulate your vision and purpose but also demonstrates to the lender that your business has a clear roadmap for success.

Your business plan should provide a detailed overview of your company, including its mission statement, core values, target market, and unique selling proposition. It should outline your business’s competitive advantage and how you plan to capitalize on opportunities in the market. Additionally, your plan should include a thorough analysis of the industry, including market trends, potential risks, and growth projections.

When preparing the financial section of your business plan, it’s essential to be realistic and present accurate projections. Include historical financial data, such as income statements, balance sheets, and cash flow statements, to showcase your business’s financial performance. Project future revenues, expenses, and cash flows based on reasonable assumptions and provide explanations for any significant changes or deviations from historical trends.

Furthermore, lenders are interested in understanding how the loan proceeds will be utilized and how it will contribute to the growth and success of your business. Outline the specific projects or initiatives you plan to undertake using the loan funds and provide a detailed budget for each. This will help the lender assess the viability of your plans and ensure that the loan amount is being applied towards activities that will generate a return on investment.

In addition to financial projections, your business plan should also include a comprehensive marketing and sales strategy. This should outline your target market, customer acquisition strategies, distribution channels, and pricing considerations. Demonstrating a solid understanding of your customers and how you plan to attract and retain them can greatly enhance your credibility with the lender.

Lastly, ensure that your business plan is well-structured, organized, and free of grammatical or spelling errors. It should be visually appealing, with appropriate charts, graphs, and images to support your key points. Remember, your business plan is your opportunity to showcase the potential of your business to the lender, so it’s essential to invest time and effort into creating a compelling document.

By preparing a strong and comprehensive business plan, you can show the lender that you have a clear vision for your business, a solid understanding of the market, and a well-thought-out strategy for growth. This, in turn, will increase your chances of securing a large business loan to fuel your expansion and success.

Gathering Financial Documents

When applying for a large business loan, it’s crucial to gather and organize all the necessary financial documents that lenders typically require. These documents provide an overview of your business’s financial health and demonstrate your ability to repay the loan. Having these documents prepared and readily available will streamline the application process and increase your chances of approval.

One of the key financial documents you’ll need to provide is your business’s financial statements. These typically include income statements (also known as profit and loss statements), balance sheets, and cash flow statements. These statements provide a snapshot of your business’s financial performance, showing the revenue generated, expenses incurred, and the resulting profitability.

In addition to financial statements, lenders will also require tax returns for your business for the past few years. These tax returns verify the accuracy of the financial statements and provide further insight into your business’s financial position.

Another vital document is the business’s bank statements. These statements show the cash flow activity of your business’s bank accounts, including incoming and outgoing funds. Lenders will review these statements to assess your business’s cash flow history and liquidity.

Furthermore, lenders may require a detailed breakdown of your accounts payable and accounts receivable. These documents show the amount of money owed to your business by customers (accounts receivable) and the amount your business owes to suppliers and vendors (accounts payable). It’s important to keep these records organized and up-to-date as they give lenders an understanding of your business’s financial obligations and the ability to manage cash flow.

Depending on the nature of your business, lenders may also require additional documents. These may include contracts with key clients or suppliers, leases or mortgage agreements for your business premises, licenses and permits, and partnership or shareholder agreements.

Lastly, it’s important to ensure that all the financial documents are current and accurate. Double-check for any errors or inconsistencies and make any necessary adjustments before submitting them to the lender. Present the documents in an organized manner, preferably in electronic format, so that they can be easily reviewed by the loan officer.

By gathering and preparing all the necessary financial documents in advance, you demonstrate professionalism, preparedness, and a commitment to transparency. This not only streamlines the loan application process but also instills confidence in the lender that you can manage your business’s financial affairs effectively.

Building a Relationship with the Lender

When seeking a large business loan, it’s important to establish a strong relationship with the lender. Building rapport and trust with the lender can significantly increase your chances of loan approval and potentially lead to more favorable loan terms. Here are some strategies to help you build a positive relationship with the lender:

1. Research and choose the right lender: Take the time to research different lenders and select the one that aligns with your business’s needs and objectives. Look for lenders that specialize in large business loans and have experience working with companies similar to yours. Choosing the right lender from the beginning can save you time and increase the chances of a successful loan application.

2. Communicate clearly and transparently: Open and honest communication is key to building trust with your lender. Clearly explain your business’s goals, financial needs, and how the loan will be utilized. Be prepared to answer any questions or concerns the lender may have and provide any additional information they request in a timely manner.

3. Establish a personal connection: Building a personal relationship with the lender can help humanize the loan application process. Attend networking events, industry conferences, or business associations where you can meet and connect with potential lenders on a personal level. This can make the loan application process feel less transactional and increase the lender’s confidence in your ability to repay the loan.

4. Be proactive and responsive: Show the lender that you are serious about the loan application by being proactive and responsive throughout the process. Return phone calls and emails promptly, provide requested documents in a timely manner, and stay engaged in the loan application process. By demonstrating your commitment and professionalism, you can strengthen the lender’s confidence in your ability to manage the loan.

5. Seek guidance and advice: Don’t hesitate to ask the lender for guidance and advice throughout the loan application process. They have expertise in evaluating loan applications and can provide valuable insights to help you improve your application. By showing a willingness to learn and adapt, you can further establish trust and credibility with the lender.

6. Maintain a good credit relationship: If you have an existing relationship with the lender through previous loans or business accounts, maintain a positive credit history and fulfill your financial obligations. Pay your bills on time and manage your business’s credit reputation in a responsible manner. A strong credit relationship with the lender can enhance your credibility and increase the likelihood of loan approval.

Building a relationship with the lender is not just about securing a loan; it’s about fostering mutual trust and understanding. By following these strategies, you can establish a positive rapport with the lender, increase your chances of loan approval, and potentially access more favorable loan terms for your business.

Exploring Financing Options

When seeking a large business loan, it’s important to explore various financing options to find the most suitable solution for your business. Different lenders and financing methods have their own advantages and considerations. Here are some common financing options to consider:

1. Traditional Bank Loans: Traditional bank loans are a common option for large business financing. These loans typically have competitive interest rates and longer repayment terms. However, they often require a lengthy application process, strict eligibility criteria, and collateral or personal guarantees. Prepare a strong loan application and financial documentation to increase your chances of approval.

2. Small Business Administration (SBA) Loans: SBA loans are government-backed loans designed to support small businesses. While these loans have lower interest rates and longer repayment terms, the application process can be time-consuming, and stricter eligibility criteria and documentation requirements apply. Consult with an SBA-approved lender to explore this financing option.

3. Alternative Lenders: Alternative lenders, such as online lenders and peer-to-peer lending platforms, provide financing options outside of traditional banks. These lenders often have faster approval processes and more flexible eligibility requirements. However, interest rates may be higher, and repayment terms may be shorter. Compare different alternative lenders to find the best fit for your business.

4. Equipment Financing: If you need funds to purchase or upgrade equipment, considering equipment financing may be a viable option. Equipment loans and leases allow you to borrow funds specifically for equipment purchases, with the equipment serving as collateral. This option can be beneficial if you want to preserve cash flow and avoid tying up capital for equipment purchases.

5. Venture Capital and Private Equity: If your business is in the growth phase and requires substantial funds, you may consider seeking capital from venture capitalists or private equity firms. These investors typically provide capital in exchange for equity or ownership stakes in the business. However, be prepared for more stringent due diligence and a potentially higher level of involvement from investors.

6. Crowdfunding: Crowdfunding platforms allow you to raise funds for your business by obtaining small contributions from a large number of individuals. This option can be particularly effective if your business has a unique or compelling proposition that resonates with a broader audience. However, success in crowdfunding requires a carefully planned campaign and engaging marketing efforts.

7. Grants and Government Programs: Research local, regional, and national grants or government programs that may provide financial assistance to businesses in your industry or location. These programs often have specific eligibility criteria, but they can provide non-repayable funds or low-interest loans to support business growth and innovation.

Consider the unique needs and circumstances of your business when exploring financing options. Evaluate the pros and cons of each option, including interest rates, repayment terms, eligibility criteria, and collateral requirements. It may be helpful to consult with financial advisors or experts who can provide guidance on selecting the most appropriate financing option for your business.

Remember, thorough research and preparation are essential to finding the financing option that aligns best with your business goals and financial needs. Take the time to understand each option, compare terms and conditions, and select the one that optimally supports your business’s growth and success.

Applying for the Loan

After researching and evaluating different financing options, the next step is to apply for the loan that best suits your business’s needs. The loan application process can vary depending on the lender and the type of loan you’re seeking. Here are some essential steps to follow when applying for a large business loan:

1. Review the lender’s requirements: Before you begin the application process, carefully review the lender’s requirements and eligibility criteria. This will help you understand what documents, information, and qualifications are necessary to proceed. It’s essential to ensure that your business meets these requirements before submitting an application.

2. Prepare a complete loan application: Complete the required application form, providing accurate and up-to-date information about your business. Be prepared to provide financial statements, tax returns, bank statements, and any other supporting documents as per the lender’s requirements. Pay attention to detail and ensure all sections of the application are properly filled out.

3. Craft a compelling loan proposal: Along with the application form, prepare a loan proposal that highlights your business’s unique strengths, financial viability, and growth potential. This should include a cover letter explaining why you’re seeking the loan, how the funds will be used, and how the loan will benefit your business. Use this document to make a persuasive case for why the lender should approve your loan application.

4. Present financial projections: Include financial projections for your business that demonstrate its ability to generate revenue, manage expenses, and repay the loan. Provide realistic projections based on market analysis, industry trends, and the proposed use of funds. Show the lender that you have a clear understanding of your business’s financial outlook and a strategy for achieving growth and profitability.

5. Gather supporting documents: In addition to the loan application and proposal, gather any supporting documents required by the lender. This may include legal documents, licenses, contracts, or other relevant materials. Ensure that all documents are well-organized and easily accessible for submission.

6. Submit the loan application: Submit the completed loan application, loan proposal, and supporting documents as per the lender’s instructions. Follow any guidelines regarding submission method (online, in-person, etc.) and ensure that you meet any specified deadlines. Keep a copy of your submitted documents for your records.

7. Follow up with the lender: After submitting your loan application, stay in touch with the lender to stay informed about the progress of your application. Inquire about the expected timeline for a decision and ask if any additional information or clarification is needed. Be proactive and responsive to any requests from the lender.

Remember, the loan application process can take time, and there may be additional steps beyond the initial application. Be patient and prepared to provide any additional information or documentation that the lender may require. Keep track of all communication and document any verbal agreements in writing.

By carefully preparing and submitting a comprehensive loan application, you increase the likelihood of approval. Present your business in the best possible light, demonstrate its financial stability, and articulate how the loan will contribute to its growth and success. With a well-prepared application, you’re one step closer to securing the large business loan your business needs.

Negotiating the Terms and Conditions

Once you receive a loan offer from a lender, it’s important to carefully review the terms and conditions before accepting. While the lender’s initial terms may be favorable, there is often room for negotiation. Negotiating the terms and conditions of your loan can help you secure more favorable terms that align with your business’s financial needs and goals.

Here are some key factors to consider when negotiating the terms and conditions of a large business loan:

Interest Rate: The interest rate is one of the most critical aspects of any loan. Negotiating a lower interest rate can significantly reduce your overall borrowing costs. Research prevailing interest rates for similar loans and use this information as leverage in negotiations. If you have a strong credit history and relationship with the lender, you may have more room to negotiate a lower rate.

Loan Repayment Term: The repayment term determines how long you have to repay the loan. Evaluating your business’s cash flow and projections, consider whether a longer or shorter repayment term would best suit your needs. Negotiate for a term that provides sufficient time to repay the loan without excessively burdening your cash flow.

Repayment Schedule: Discuss and negotiate the repayment schedule that aligns with your cash flow cycles and revenue streams. It’s crucial to ensure that the repayment schedule corresponds to your business’s ability to generate sufficient funds to meet the repayment obligations.

Prepayment Penalties: Some lenders include prepayment penalties, which are fees charged for repaying the loan before the agreed-upon term. Negotiate for the elimination or reduction of prepayment penalties. This will provide the flexibility to pay off the loan early without incurring additional costs.

Covenants: Loan covenants are terms that outline specific obligations and restrictions placed on borrowers. These may include financial ratios, reporting requirements, or restrictions on business activities. Carefully review these covenants and negotiate any terms that may be overly restrictive or burdensome to your business’s operations.

Collateral and Personal Guarantees: If the loan requires collateral or personal guarantees, negotiate the terms related to these requirements. Seek to limit the collateral required or explore alternative forms of collateral. Additionally, negotiate the extent of personal guarantees to protect your personal assets.

Fees and Charges: Review any additional fees and charges associated with the loan, such as origination fees, closing costs, or ongoing maintenance fees. Negotiate to minimize or eliminate unnecessary fees, ensuring that you’re aware of all costs associated with borrowing.

Additional Flexibility: Depending on your business’s unique circumstances, negotiate for additional flexibility in the loan agreement. This can include provisions for loan modifications, payment holidays, or other accommodations that may help your business better navigate unforeseen challenges or capitalize on future opportunities.

When negotiating, be prepared with strong supporting evidence, such as financial projections, market research, or industry trends, to demonstrate the legitimacy of your requests. Approach negotiations with a collaborative mindset, seeking a win-win outcome where both parties benefit.

Remember, the negotiation process requires open communication and a willingness to compromise. Be prepared to give and take on different terms to reach a mutual agreement. Consult with legal and financial advisors who can provide insights and guidance throughout the negotiation process to ensure that your interests are protected.

By effectively negotiating the terms and conditions of your loan, you can secure a financing arrangement that meets your business’s needs, reduces costs, and provides the flexibility required for growth and success.

Submitting Collateral and Personal Guarantees

When applying for a large business loan, it’s common for lenders to require collateral and personal guarantees as a form of security. Collateral is a valuable asset that is pledged to the lender, and personal guarantees are a commitment from the business owner or other individuals to repay the loan in the event of default. Understanding and carefully considering these requirements is essential before submitting collateral and personal guarantees.

Collateral: Collateral serves as an added layer of security for the lender. It can be in the form of real estate, equipment, inventory, accounts receivable, or other valuable assets. By pledging collateral, you provide the lender with a tangible asset that they can seize and sell if your business is unable to repay the loan. The value of the collateral should typically match or exceed the loan amount. When submitting collateral, ensure that the assets are properly appraised and documented according to the lender’s requirements.

Personal Guarantees: Personal guarantees are commitments from the business owner or other individuals associated with the business to repay the loan in the event of default. By signing a personal guarantee, you assume personal liability for the loan, putting your personal assets at risk. The lender can pursue legal action to recover the outstanding loan balance from the guarantor’s personal assets, such as their home, savings, or investments. Carefully consider the implications before signing a personal guarantee and assess your ability to fulfill the obligation if required.

When submitting collateral and personal guarantees, it’s important to:

Understand the Risk: Evaluate the potential consequences of pledging collateral and signing personal guarantees. Consider the impact on your personal finances and the implications for your business in the event of default.

Negotiate Terms: Discuss the terms and conditions related to collateral and personal guarantees with the lender. Seek to limit the amount of collateral required or explore alternatives. Negotiate the extent of personal guarantees, such as limiting the liability to a specific amount or duration.

Protect Assets: If providing collateral, ensure that the assets are properly protected and insured. Maintain accurate records and documentation related to the collateral, including appraisal reports and insurance policies.

Seek Legal Advice: Consult with legal advisors to understand the legal implications and potential risks associated with collateral and personal guarantees. They can provide guidance tailored to your specific situation and help protect your interests.

It’s important to note that not all loans require collateral and personal guarantees. If securing a large loan without these requirements is a priority, explore alternative lenders or financing options that may be more flexible.

Before submitting collateral and personal guarantees, carefully evaluate the potential risks and benefits. Assess the importance of the loan to your business’s growth and consider alternative funding options if the risks outweigh the benefits.

Ultimately, the decision of whether to submit collateral and personal guarantees rests with you as the business owner. It’s crucial to make an informed decision that aligns with your business’s best interests and risk tolerance.

Finalizing the Loan Agreement

Once your loan application has been approved and the terms and conditions have been negotiated and agreed upon, the final step in obtaining a large business loan is to finalize the loan agreement. The loan agreement is a legally binding contract that outlines the rights and responsibilities of both the borrower and the lender.

When finalizing the loan agreement, here are some important steps to consider:

Review the Terms: Take the time to carefully review all the terms and conditions stated in the loan agreement. Ensure that they accurately reflect what was agreed upon during the negotiation process. Pay close attention to loan amount, interest rate, repayment terms, fees, and any additional provisions or covenants included in the agreement.

Seek Professional Advice: Engage the services of legal and financial professionals who can review the loan agreement on your behalf. They can help identify any potential risks, clarify complex terms, and ensure that your interests are protected. Seek advice from professionals who specialize in business law and finance to ensure a comprehensive review.

Clarify Ambiguities: If you come across any unclear or ambiguous language in the loan agreement, seek clarification from the lender. It’s important to have a clear understanding of all terms and obligations before signing the agreement. Ask for written explanations of any terms or provisions that require further clarification.

Consider Future Scenarios: Anticipate potential future scenarios and their implications on the loan agreement. Consider factors such as early repayment options, penalties for late payments, and conditions for loan modifications or refinancing. Ensure that the agreement accounts for any possible changes in your business’s circumstances down the line.

Execute the Agreement: Once you are satisfied with the terms and have received appropriate advice, proceed to sign the loan agreement. Depending on the lender’s requirements, this can be done electronically or in-person. Make sure to follow the prescribed process for execution, including obtaining any necessary witnesses or notarization, if required.

Retain a Copy: After signing the loan agreement, retain a copy for your records. It’s crucial to have a readily accessible copy should any questions or disputes arise in the future. File the agreement securely and keep it in a safe place along with other important business documents.

Finalizing the loan agreement marks the culmination of the loan application process. It establishes a legal framework for the loan and ensures both parties are bound to their agreed-upon obligations. By meticulously reviewing, seeking professional advice, and carefully executing the agreement, you can confidently move forward with the loan, knowing that all terms and conditions are well-understood and agreed upon.

Remember, a loan agreement is a legally binding contract, and it’s crucial to approach the process with diligence and care. Seek appropriate guidance and ensure that you have a clear understanding of the terms and conditions before finalizing the loan agreement.

Conclusion

Securing a large business loan can be a significant milestone for your business, providing the financial resources needed for growth, expansion, or overcoming challenges. However, the process of obtaining a substantial loan requires careful planning, thorough preparation, and a comprehensive understanding of the requirements and steps involved.

In this guide, we’ve covered key aspects of obtaining a large business loan, from understanding the lender’s requirements to finalizing the loan agreement. We discussed the importance of preparing a strong business plan, gathering necessary financial documents, building a positive relationship with the lender, and exploring different financing options.

Remember that each lender may have specific criteria, and the loan application process may vary. It’s vital to thoroughly research lenders, compare financing options, and tailor your loan application to meet their specific requirements. By demonstrating your business’s financial stability, potential for growth, and ability to repay the loan, you can increase your chances of approval.

Throughout the process, open communication, transparency, and professionalism are key. Engage with lenders, seek guidance from experts, and negotiate terms that align with your business’s needs and goals. Even after securing the loan, maintain a strong relationship with the lender and fulfill your financial obligations to ensure a positive borrowing experience.

Finally, be mindful of the risks and responsibilities associated with obtaining a large business loan. Consider the impact on your business’s cash flow, the appropriateness of collateral and personal guarantees, and the implications of default. Plan for the loan’s repayment and continuously monitor your business’s financial health to ensure you can meet your obligations.

In conclusion, obtaining a large business loan requires strategic planning, thorough preparation, and effective execution. By following the steps outlined in this guide, you can increase your chances of securing the financing your business needs to achieve its growth and success. Remember, with careful research, diligent preparation, and a well-crafted loan application, you can navigate the loan application process with confidence and secure the funding necessary to propel your business forward.