Finance

How To Invest In The Philippine Stock Market

Published: October 20, 2023

Learn how to invest in the Philippine stock market and make smart financial decisions. Start growing your wealth with our expert finance tips and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Philippine Stock Market

- Benefits of Investing in the Philippine Stock Market

- Getting Started with Investing in the Philippine Stock Market

- Choosing the Right Stockbroker

- Opening a Stock Trading Account

- Types of Investment Instruments in the Philippine Stock Market

- Fundamental and Technical Analysis

- Building an Investment Portfolio

- Managing Risks in the Philippine Stock Market

- Monitoring and Tracking Your Investments

- Tips for Successful Investing in the Philippine Stock Market

- Conclusion

Introduction

Investing in the Philippine stock market can be a lucrative opportunity for individuals looking to grow their wealth and achieve their financial goals. With its robust economy and thriving business landscape, the Philippine stock market offers a wide array of investment options for both experienced investors and beginners.

The Philippine Stock Exchange (PSE) serves as the primary platform for buying and selling stocks of publicly listed companies in the country. This market provides investors the chance to participate in the growth of various industries, such as banking, real estate, telecommunications, and consumer goods.

However, before diving into the world of stock market investing, it is important to gain a basic understanding of how the Philippine stock market works and the potential benefits it can bring. By equipping yourself with the necessary knowledge and skills, you can navigate the market more confidently and make informed investment decisions.

This comprehensive guide will walk you through the essential steps to get started with investing in the Philippine stock market. From understanding the basic concepts to building an investment portfolio and managing risks, you will learn valuable insights that will help you on your journey to financial success.

Whether you are a seasoned investor or a novice looking to explore the world of stock market investing, this guide will provide you with practical tips and strategies to make the most of your investments in the Philippine stock market.

Understanding the Philippine Stock Market

The Philippine Stock Market is where investors can buy and sell shares of publicly listed companies. It is operated by the Philippine Stock Exchange (PSE), which is regulated by the Securities and Exchange Commission (SEC). The PSE is divided into several sectors, including the Main Board, the Small, Medium, and Emerging (SME) Board, and the Philippine Dealing and Exchange Corporation (PDEx).

One important aspect to understand is that the stock market operates on the principle of supply and demand. When you buy shares of a company, you become a part-owner of that company and have the potential to earn profits through capital appreciation and dividends. On the other hand, when you sell shares, it means that you are selling your ownership stake in the company.

The stock market is influenced by various factors, including macroeconomic indicators, market sentiment, company performance, and global events. Investors need to stay updated on these factors to make informed investment decisions.

There are different types of stocks that you can invest in. Common stocks give shareholders voting rights and entitlement to dividends, while preferred stocks provide higher dividend yields but may not have voting rights. Blue-chip stocks are shares of established, financially stable companies, while growth stocks belong to companies with high potential for future expansion.

It’s important to note that investing in stocks comes with risks. The value of stocks can fluctuate based on market conditions and company performance. Stock prices can be influenced by factors such as economic downturns, changes in government policies, market speculation, and even natural disasters.

To mitigate risks in stock market investing, it is crucial to conduct thorough research and analysis. This can be done through fundamental analysis, which involves studying a company’s financial statements, management, and competitive advantage, or through technical analysis, which examines price patterns and market trends.

Having a good understanding of the Philippine stock market and its dynamics will help investors navigate the market more effectively and make well-informed investment decisions.

Benefits of Investing in the Philippine Stock Market

Investing in the Philippine stock market offers a range of benefits for individuals looking to grow their wealth and achieve their financial goals. Here are some key advantages of investing in the stock market:

- Potential for High Returns: One of the main attractions of the stock market is its potential to provide high returns on investment. While stocks do come with risks, they also offer the opportunity for significant capital appreciation over the long term. Historically, the Philippine stock market has shown positive growth, and investors who have made well-informed choices and stayed invested for the long term have reaped the benefits.

- Dividend Income: Dividends are a portion of a company’s profits that are distributed to shareholders. Many of the publicly listed companies in the Philippine stock market pay regular dividends to their shareholders, providing a steady income stream for investors. Dividend payments can be reinvested or used as additional income, depending on the investor’s preference and financial goals.

- Diversification: Investing in the stock market allows for portfolio diversification. By spreading investments across different companies and sectors, investors can reduce their exposure to risk. This diversification can help cushion the impact of market fluctuations and improve the overall stability of an investment portfolio.

- Liquidity: The Philippine stock market provides high liquidity, meaning that investors can easily buy and sell shares at any time during market hours. This allows investors to convert their investments into cash quickly if needed. Compared to other investment options such as real estate or fixed deposits, which can take longer to convert into cash, the stock market offers greater flexibility.

- Ownership and Influence: When you invest in stocks, you become a part-owner of the company. This ownership gives you certain rights, including the ability to vote on important company decisions during annual general meetings. By owning shares in a company, investors have the opportunity to influence the direction and strategy of the companies they invest in.

While these benefits make the Philippine stock market an attractive investment avenue, it is important to note that investing in stocks also carries risks. Market fluctuations, company-specific risks, and other external factors can impact the value of investments. Therefore, it is crucial to conduct thorough research, stay updated on market trends, and diversify your portfolio to manage risks effectively.

Overall, investing in the Philippine stock market can be a rewarding endeavor for individuals looking to build wealth and achieve their financial goals. By understanding the benefits and effectively managing risks, investors can take advantage of the growth opportunities in the market and potentially generate attractive returns over time.

Getting Started with Investing in the Philippine Stock Market

Getting started with investing in the Philippine stock market is an exciting venture that can potentially pave the way for financial growth. Here are the key steps to help you kick-start your investment journey:

- Educate Yourself: Before diving into the stock market, it is crucial to educate yourself about the basics of investing. Familiarize yourself with investment terms, concepts, and strategies. There are numerous online resources, books, and courses available that can help you understand the fundamentals of stock market investing in the Philippine context.

- Define Your Investment Goals: Determine your investment goals and risk tolerance. Are you investing for long-term wealth accumulation, retirement, or short-term gains? Understanding your goals will shape your investment strategy and help you make informed decisions.

- Assess Your Financial Capability: Take stock of your financial situation. Evaluate your income, expenses, debts, and savings to determine how much you can comfortably allocate towards investing. It’s important to have a clear understanding of your financial capability to ensure that you invest within your means.

- Consult with a Financial Advisor: If you feel overwhelmed or uncertain, consider seeking guidance from a financial advisor. A professional can help assess your financial goals, analyze your risk profile, and provide personalized investment advice based on your unique circumstances.

- Start Small and Diversify: Begin with a small investment amount and gradually build your portfolio. Diversify your investments across different sectors and companies to spread the risk. This can help protect your investments from individual company downturns or market fluctuations.

- Stay Informed: Stay updated on market news, trends, and company updates. Regularly read financial news, follow reputable market analysts, and track the performance of companies you are interested in. This will help you make informed investment decisions based on the latest information.

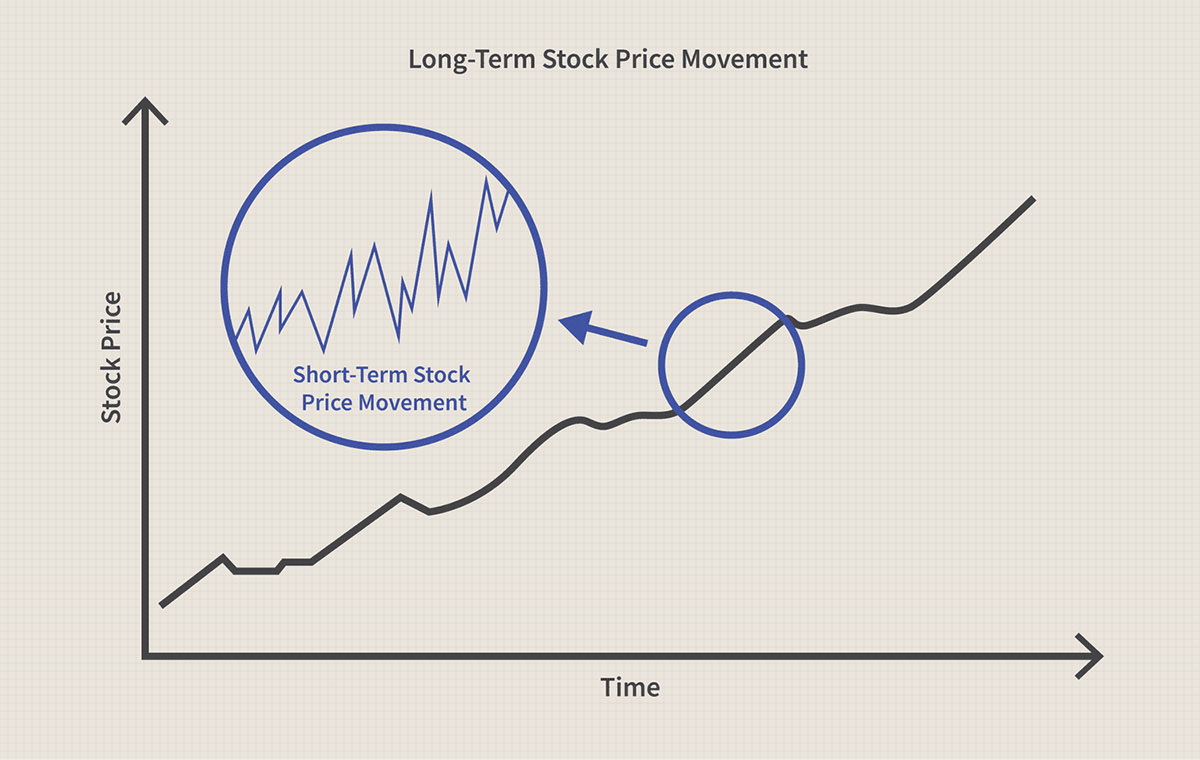

- Employ a Long-Term Approach: Investing in the stock market requires patience and a long-term perspective. Avoid being swayed by short-term market volatility and focus on the overall performance of your investments. Stick to your investment strategy and resist the urge to make impulsive decisions based on short-term market movements.

By following these steps, you can lay a solid foundation for your investment journey in the Philippine stock market. Remember, investing is a continuous learning process, and it’s essential to stay disciplined, informed, and adaptable as you navigate the exciting world of stock market investing.

Choosing the Right Stockbroker

Choosing the right stockbroker is a crucial step in your journey to invest in the Philippine stock market. Stockbrokers act as intermediaries between investors and the stock market, facilitating the buying and selling of stocks on your behalf. Here are key factors to consider when selecting a stockbroker:

- Regulation and Reputation: Ensure that the stockbroker you choose is regulated by the Philippine Stock Exchange (PSE) and the Securities and Exchange Commission (SEC). Check for any disciplinary actions or complaints filed against the stockbroker to ensure their credibility and integrity.

- Trading Platform: Evaluate the stockbroker’s trading platform or online trading system. It should be user-friendly, reliable, and provide real-time market data and analytics. A good trading platform should offer features like order placement, account monitoring, and access to research reports.

- Brokerage Fees and Charges: Compare the brokerage fees and charges of different stockbrokers. Look for transparent fee structures and consider the overall cost of trading, including commission rates, account maintenance fees, and transaction charges. However, be cautious of brokers offering unusually low fees, as this may reflect a compromise in service quality.

- Research and Investment Advice: Consider the stockbroker’s research capabilities and the quality of their investment advice. Look for brokers that provide comprehensive and timely research reports, market analysis, and investment recommendations. This will assist you in making informed investment decisions.

- Customer Service and Support: Check the stockbroker’s customer service and support offerings. They should have a responsive customer service team that can address your concerns and provide assistance when needed. Look for brokers that offer various contact channels, such as phone support, email support, and online chat.

- Additional Services: Consider any additional services offered by the stockbroker, such as educational resources, investment seminars, or portfolio management services. These services can provide added value and support for your investment journey.

- Accessibility: Assess the convenience and accessibility of the stockbroker’s services. Consider factors such as their office locations, mobile trading apps, and online account access. It’s important to choose a stockbroker that aligns with your preferences and provides easy access to your investment account.

Take your time to research and compare different stockbrokers based on these factors. Consider your investment needs, preferences, and long-term goals when making your decision. It may also be helpful to seek recommendations from experienced investors or consult with a financial advisor.

Remember, selecting the right stockbroker is crucial, as it can greatly impact your investment experience. By choosing a reputable and reliable stockbroker, you can have a smoother and more efficient trading experience in the Philippine stock market.

Opening a Stock Trading Account

Opening a stock trading account is a necessary step to start investing in the Philippine stock market. A stock trading account allows you to buy and sell stocks through a licensed stockbroker. Here’s a guide to help you navigate the process:

- Choose a Stockbroker: Select a licensed stockbroker that meets your requirements and preferences. Consider factors such as reputation, trading platform, fees, and customer service. You can visit different stockbroker websites or contact them directly to gather information and compare their offerings.

- Gather Required Documents: Before proceeding, gather the necessary documents to open a stock trading account. These typically include valid identification documents, proof of address, and a Tax Identification Number (TIN) from the Bureau of Internal Revenue (BIR). The specific requirements may vary depending on the stockbroker, so it’s best to inquire beforehand.

- Complete the Application Form: Fill out the stockbroker’s application form, providing accurate and up-to-date personal information. Make sure to read the terms and conditions carefully and ask any questions you may have before submitting your application.

- Submit the Required Documents: Prepare copies of the required documents and submit them along with your completed application form. You may need to submit the documents physically at the stockbroker’s office or digitally through their online submission system.

- Account Approval and Funding: After submitting your application and documents, the stockbroker will review and process your application. Once your account is approved, you will receive your account login details. You can then fund your account through various means, such as electronic bank transfers or cash deposits, as specified by your stockbroker.

- Orientation and Trading Platform Familiarization: Some stockbrokers may provide an orientation session or training on how to use their trading platform effectively. Take advantage of these opportunities to familiarize yourself with the features, tools, and functions of the trading platform.

- Begin Trading: Once your account is funded and you are familiar with the trading platform, you can start buying and selling stocks. Research, analyze, and monitor the market to make informed investment decisions. Execute trades through the trading platform, specifying the stock, quantity, and price at which you wish to buy or sell.

Opening a stock trading account is a relatively straightforward process, but it’s important to carefully review the terms and conditions of the stockbroker you choose. Familiarize yourself with their fees, trading policies, and any other relevant information to avoid any surprises or misunderstandings.

Remember, investing in the stock market involves risk, and it’s essential to approach it with a well-thought-out investment plan. Seek guidance from knowledgeable professionals and continue to educate yourself to make sound investment decisions.

Types of Investment Instruments in the Philippine Stock Market

The Philippine stock market offers a variety of investment instruments that cater to different investment styles, risk appetites, and financial goals. Understanding these investment instruments will help you make informed decisions when building your investment portfolio. Here are some of the common types:

- Stocks: Stocks, also known as shares or equities, represent ownership in a company. By investing in stocks, you become a part-owner of the company and have the potential to benefit from its success through capital appreciation and dividends. Stocks offer the highest potential returns but also carry higher risks.

- Exchange-Traded Funds (ETFs): ETFs are investment funds that trade like stocks on the stock exchange. These funds aim to replicate the performance of a specific index or sector, providing investors with diversified exposure to a basket of stocks. ETFs offer flexibility, diversification, and lower transaction costs compared to individually buying stocks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professional fund managers. These funds can invest in a combination of stocks, bonds, and other securities. Mutual funds offer convenience and professional management, making them suitable for investors seeking broad market exposure.

- Bonds: Bonds are debt instruments issued by companies or the government to raise capital. Investors who purchase bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are considered lower-risk investments compared to stocks and can provide a steady stream of income.

- Real Estate Investment Trusts (REITs): REITs are investment vehicles that pool funds from investors to invest in income-generating real estate properties. By investing in REITs, investors can gain exposure to the real estate sector without the need to directly own and manage properties. REITs offer the potential for regular income through dividends and capital appreciation.

- Preferred Shares: Preferred shares are a type of stock that offers a higher claim on the company’s earnings and assets compared to common shares. Preferred shareholders have priority in receiving dividends and capital repayment. However, they generally do not have voting rights in company matters. Preferred shares provide a more stable income stream but may offer limited growth potential.

- Derivative Instruments: Derivatives are financial instruments whose value is derived from an underlying asset, such as stocks or commodities. Examples of derivatives in the Philippine stock market include futures contracts and options. Derivatives can be used for hedging, speculation, or arbitrage purposes but involve higher risk and complexity.

Before investing in these instruments, it is important to understand their characteristics, risks, and potential returns. Consider your investment goals, risk tolerance, and time horizon when selecting the appropriate investment instruments for your portfolio. Diversification across different types of instruments can help mitigate risks and optimize potential returns.

Consult with a financial advisor or conduct thorough research to gain deeper insights into each investment instrument’s features and suitability for your investment strategy. It’s essential to have a clear understanding of each instrument’s potential rewards and risks to make informed investment decisions in the Philippine stock market.

Fundamental and Technical Analysis

Fundamental and technical analysis are two primary methods used by investors to analyze and evaluate stocks in the Philippine stock market. Each approach provides valuable insights into different aspects of a company’s performance, helping investors make more informed investment decisions. Here’s an overview of fundamental and technical analysis:

Fundamental Analysis:

Fundamental analysis involves evaluating a company’s financial health, competitive position, and growth prospects to determine its intrinsic value. Key factors analyzed in fundamental analysis include:

- Financial Statements: The analysis of a company’s financial statements, including the balance sheet, income statement, and cash flow statement, helps assess its profitability, liquidity, and overall financial stability.

- Industry Analysis: Examining the industry dynamics, competition, and market trends can provide insights into a company’s growth potential and its ability to navigate market conditions.

- Management: Assessing the competence and track record of a company’s management team is crucial in evaluating its ability to execute its strategic objectives and create shareholder value.

- Valuation: Estimating the intrinsic value of a stock by comparing its current price to its intrinsic value helps determine whether the stock is undervalued or overvalued.

By conducting fundamental analysis, investors can gain a deeper understanding of the financial health and growth prospects of a company, enabling them to make long-term investment decisions.

Technical Analysis:

Technical analysis, on the other hand, focuses on analyzing historical price and volume data to forecast future stock price movements. Key aspects of technical analysis include:

- Charts and Patterns: Technical analysts use stock charts and patterns to identify trends, support and resistance levels, and potential price reversals or breakouts.

- Indicators and Oscillators: Various technical indicators and oscillators, such as moving averages, relative strength index (RSI), and moving average convergence divergence (MACD), are utilized to assess the momentum and strength of price movements.

- Volume Analysis: Volume analysis helps gauge the strength and confirmation of price movements. High trading volumes often accompany significant price changes.

- Market Sentiment: Technical analysis considers market sentiment and investor psychology, as reflected in price patterns and trading volume, to identify potential shifts in market direction.

By employing technical analysis, investors seek to identify short-term trading opportunities and make timely buy or sell decisions based on price trends and patterns.

Both fundamental and technical analysis play important roles in investment decision-making. While fundamental analysis provides insights into the long-term viability and value of a company, technical analysis helps identify short-term trading opportunities. Some investors use a combination of both approaches to gain a holistic view of a stock’s potential.

It’s important to note that both approaches have limitations and may not always predict stock price movements accurately. Therefore, it is advisable to conduct thorough research, consult with professionals, and use these analyses as tools to support well-informed investment decisions in the Philippine stock market.

Building an Investment Portfolio

Building a well-diversified investment portfolio is essential for long-term success in the Philippine stock market. A carefully constructed portfolio can help manage risk, optimize returns, and align with your investment goals. Here are key steps to consider when building your investment portfolio:

- Define Your Investment Objectives: Clearly articulate your investment objectives, whether they are growth, income, or a combination of both. This will guide your asset allocation decisions and the types of investments you select.

- Determine Your Risk Tolerance: Assess your risk tolerance by considering factors such as age, financial goals, time horizon, and personal comfort with market volatility. This will help you determine the proportion of high-risk and low-risk investments in your portfolio.

- Allocate Your Assets: Allocate your assets across different asset classes, such as stocks, bonds, and cash. The exact allocation will depend on your risk tolerance and investment objectives. Diversifying your portfolio across various asset classes can help reduce the impact of market fluctuations on your overall portfolio performance.

- Select Investments: Research and choose individual investments within each asset class. Consider factors such as company fundamentals, valuation, growth prospects, and risk factors. Aim for a mix of different stocks, bonds, and other investment instruments to achieve diversification.

- Regularly Monitor and Rebalance: Regularly review and monitor your investment portfolio to ensure it remains aligned with your goals. Rebalance your portfolio periodically to maintain the desired asset allocation. This involves selling overperforming investments and buying underperforming ones to bring your portfolio back in line with your target allocation.

- Consider Dollar-Cost Averaging: Dollar-cost averaging involves regularly investing a fixed amount of money into your portfolio, regardless of market conditions. This approach helps reduce the impact of market volatility and allows you to buy more shares when prices are low and fewer shares when prices are high.

- Stay Informed: Continue to stay informed about market trends, economic indicators, and company news. Stay updated on the performance and prospects of the companies in your portfolio. This will enable you to make informed investment decisions and take appropriate action when needed.

It’s important to note that building an investment portfolio is a dynamic process. As your financial situation and goals evolve, you may need to adjust your asset allocation and make changes to your portfolio. Regularly reassess your investment strategy and seek advice from financial professionals if needed.

Lastly, be mindful that investing in the stock market involves risks, and past performance is not indicative of future results. It’s advisable to consult with a financial advisor and conduct thorough research before making any investment decisions in the Philippine stock market.

Managing Risks in the Philippine Stock Market

Managing risks is a crucial aspect of investing in the Philippine stock market. While investing in stocks provides opportunities for growth and wealth accumulation, it also carries inherent risks. Here are strategies to help manage risks effectively:

- Diversify Your Portfolio: Diversification is key to managing risk. Spread your investments across different sectors, industries, and asset classes. By diversifying, you reduce exposure to the performance of a single company or sector, minimizing the impact of adverse events on your portfolio.

- Set Realistic Expectations: Understand that the stock market is subject to volatility and fluctuations. Avoid unrealistic expectations of consistently high returns and be prepared for temporary declines. Setting realistic expectations will help you stay focused on your long-term investment goals.

- Perform Thorough Research: Conduct comprehensive research and analyze the companies you are considering investing in. Look at their financials, competitive position, industry trends, and management track record. The more informed you are, the better equipped you are to make sound investment decisions.

- Stay Informed: Continuously stay updated on market and economic news. Be aware of events that may impact the stock market and the companies you have invested in. Monitoring market trends and staying informed will help you identify potential risks and make timely adjustments to your portfolio.

- Manage Emotions: Emotions can cloud judgment and lead to impulsive investment decisions. Avoid making spur-of-the-moment decisions based on fear or greed. Stick to your investment plan and avoid being swayed by short-term market fluctuations.

- Consider Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps mitigate the impact of market volatility and reduces the risk of making investment decisions based on short-term market movements.

- Set Stop-Loss Orders: A stop-loss order is a predetermined price at which you are willing to sell a particular stock. This order helps protect against large losses by automatically triggering a sale if the stock price falls below the specified level. Stop-loss orders help limit potential losses and provide a disciplined approach to risk management.

- Manage Position Sizes: Carefully consider the size of your positions in individual stocks. Avoid investing an overly large portion of your portfolio in a single stock. By managing your position sizes, you can control the potential impact of any negative performance on your overall portfolio.

- Regularly Review and Rebalance: Regularly review your portfolio to ensure it remains aligned with your goals and risk tolerance. Rebalance your portfolio by selling overperforming investments and buying underperforming ones to maintain your desired asset allocation. This helps reduce risk and optimize returns.

- Consider Professional Advice: If you are new to investing or feel overwhelmed by the complexities of risk management, consider seeking advice from a qualified financial advisor. A professional can provide personalized guidance and help create an investment plan that aligns with your financial goals and risk tolerance.

Remember that investing inherently involves risk, and it is not possible to eliminate all risks entirely. However, by implementing these risk management strategies and staying informed, you can navigate the Philippine stock market with greater confidence and minimize the potential impact of adverse events on your investment portfolio.

Monitoring and Tracking Your Investments

Monitoring and tracking your investments in the Philippine stock market is essential to stay informed about the performance of your portfolio and make timely decisions. Here are key steps to help you effectively monitor and track your investments:

- Regularly Review Portfolio Performance: Set a routine to review the performance of your portfolio. This can be done on a quarterly, semi-annual, or annual basis, depending on your preferences. Assess the overall performance, individual stock performance, and any changes in the market or economic conditions that may impact your investments.

- Stay Informed: Stay updated on market news, company announcements, and economic indicators that may affect your investments. Read financial news, follow reputable sources, and monitor the performance of the companies in your portfolio. Being informed will help you make informed decisions and identify any necessary adjustments to your portfolio.

- Track Key Investment Metrics: Monitor key financial metrics of the companies you have invested in. These may include earnings per share (EPS), price-to-earnings (P/E) ratio, dividend yield, and debt levels. Tracking these metrics can help you assess the financial health and performance of the companies and identify potential investment opportunities or risks.

- Utilize Stock Market Tools: Take advantage of stock market tools and resources available to track your investments. Many stockbrokers provide online platforms with features such as real-time portfolio tracking, customizable watchlists, and stock alerts. These tools can help you stay organized, monitor the market, and track your investments effectively.

- Set Investment Goals and Targets: Define your investment goals and set targets for each investment. This could include target prices for selling or adding to positions, profit targets, or dividend income goals. Review and reassess these goals regularly based on changing market conditions or personal circumstances.

- Use Performance Benchmarks: Compare the performance of your investments against relevant benchmarks, such as the Philippine Stock Exchange index (PSEi) or sector-specific indices. This allows you to assess how your portfolio is performing relative to the broader market or industry and make necessary adjustments if needed.

- Keep Detailed Records: Maintain a record of your investment transactions, including purchase dates, prices, and quantities. This will help you track your cost basis, calculate capital gains or losses for tax purposes, and provide an overview of your overall investment history.

- Review and Rebalance: Regularly review your portfolio’s asset allocation and make adjustments if necessary. Rebalance your portfolio by selling overperforming assets and adding to underperforming ones to maintain your desired asset allocation. This helps ensure that your investments align with your risk tolerance and investment objectives.

- Periodically Reassess Investment Strategy: Review and assess your investment strategy periodically. As market conditions and personal circumstances change, your strategy may need adjustments. Periodically reassess your investment approach, goals, risk tolerance, and make any necessary modifications to keep your portfolio aligned with your long-term objectives.

By regularly monitoring and tracking your investments, you can stay on top of market trends, make informed decisions, and take appropriate actions to optimize your investment performance in the Philippine stock market.

Tips for Successful Investing in the Philippine Stock Market

Investing in the Philippine stock market can be a rewarding endeavor if approached with a well-thought-out strategy and disciplined approach. Here are some tips to help you navigate the market and increase your chances of successful investing:

- Set Clear Investment Goals: Define your investment goals and align them with your risk tolerance and time horizon. Establishing clear objectives will guide your investment decisions and help you stay focused.

- Do Your Research: Conduct thorough research and due diligence before making any investment decisions. Examine financial statements, company news, industry trends, and analyst reports to gain insights into the potential growth and risks associated with specific investments.

- Practice Diversification: Diversify your portfolio by spreading your investments across different sectors, industries, and asset classes. This will help mitigate risks associated with individual stocks or sectors and provide a balance of potential returns.

- Invest for the Long Term: Stock market investing is a long-term endeavor. Avoid getting swayed by short-term market fluctuations and focus on the long-term performance of your investments. Patience and a long-term perspective are key to successful investing.

- Stay Disciplined: Develop an investment plan and stick to it. Avoid making impulsive investment decisions based on market emotions. Stay disciplined with your investment strategy and resist the temptation to deviate from your plan.

- Regularly Review Your Portfolio: Review your portfolio periodically to ensure it remains aligned with your goals. Rebalance your portfolio when needed to maintain your desired asset allocation and adjust to changing market conditions.

- Learn from Mistakes: Mistakes are inevitable in investing. Use them as learning opportunities rather than dwelling on them. Analyze your investment decisions, identify the lessons learned, and apply them to future investment strategies.

- Utilize Stop-Loss Orders: Consider using stop-loss orders to protect against significant losses. Setting pre-determined price levels at which to sell can help limit potential downside risks and protect your portfolio from significant declines.

- Stay Updated on Market News: Stay informed about market news, economic indicators, and company updates. This will enable you to make informed investment decisions and adapt your strategy to current market conditions.

- Don’t Time the Market: Trying to time the market by predicting short-term price movements is extremely difficult. Instead, focus on long-term investment trends and fundamental analysis to make informed investment decisions.

- Seek Professional Advice: If you are new to investing or feel uncertain about your investment decisions, consider seeking advice from a qualified financial advisor. They can provide personalized guidance based on your financial situation and investment goals.

Successful investing requires patience, perseverance, and continuous learning. By following these tips, maintaining a disciplined approach, and staying committed to your long-term investment strategy, you can increase your chances of success in the Philippine stock market.

Conclusion

Investing in the Philippine stock market provides individuals with the opportunity to grow their wealth and achieve their financial goals. By understanding the dynamics of the stock market, conducting thorough research, and implementing effective strategies, investors can navigate the market with confidence.

In this comprehensive guide, we have covered the fundamental aspects of investing in the Philippine stock market. We explored the benefits of investing, the process of opening a stock trading account, and the different types of investment instruments available. We also discussed the importance of fundamental and technical analysis in making informed investment decisions and building a well-diversified investment portfolio.

Furthermore, we highlighted the significance of managing risks, monitoring and tracking investments, and following essential tips for successful investing. By applying these principles, investors can enhance their chances of achieving long-term growth, managing their portfolios effectively, and making sound investment decisions.

However, it’s important to remember that investing involves risks, and past performance does not guarantee future results. It is advisable to consult with financial professionals, continuously educate yourself, and stay informed about market trends and economic indicators.

With the right knowledge, discipline, and a long-term perspective, investing in the Philippine stock market can be a fulfilling journey towards financial independence and prosperity. Start building your investment strategy today and embark on the path to achieving your financial goals.