Home>Finance>Why Is Investing In The Stock Market Is A Good Idea

Finance

Why Is Investing In The Stock Market Is A Good Idea

Published: November 24, 2023

Discover why investing in the stock market is a brilliant financial move. Learn how to grow your wealth through smart finance strategies and gain long-term financial security.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Benefits of Investing in the Stock Market

- Potential for Higher Returns

- Diversification and Risk Management

- Ownership in Profitable Companies

- Tax Advantages

- Long-Term Wealth Building

- Accessibility and Flexibility

- Factors to Consider Before Investing

- Market Volatility and Risk

- Investor Knowledge and Research

- Financial Goals and Time Horizon

- Market Analysis and Timing

- Conclusion

Introduction

Investing in the stock market is a popular and viable option for individuals looking to grow their wealth and achieve financial goals. It involves purchasing shares or ownership stakes in publicly traded companies, which can potentially generate significant returns over time. While investing in stocks comes with certain risks, it also offers numerous benefits for investors willing to navigate the market with knowledge and patience.

Stock market investing is not only for the wealthy or financial experts – it is accessible to anyone with the desire to build wealth and secure their financial future. Whether you’re a novice investor or an experienced trader, understanding why investing in the stock market is a good idea can help you make informed decisions and maximize your returns.

In this article, we will delve into the various benefits of investing in the stock market and discuss critical factors to consider before taking the plunge. By the end, you’ll have a clearer understanding of why investing in the stock market can be an effective strategy for wealth accumulation and achieving long-term financial goals.

Benefits of Investing in the Stock Market

Investing in the stock market can offer a range of benefits for individuals looking to grow their wealth and secure their financial future. Here are some key advantages of investing in stocks:

- Potential for Higher Returns: The stock market has historically provided higher returns compared to other investment options such as bonds or savings accounts. While there are risks involved, the potential for significant gains over the long term makes stock market investing attractive to many investors.

- Diversification and Risk Management: Investing in a diversified portfolio of stocks allows you to spread your risk across multiple companies and industries. This helps mitigate the impact of potential losses from any individual investment and reduces the overall risk in your portfolio.

- Ownership in Profitable Companies: When you invest in stocks, you become a partial owner of the company. As a shareholder, you have the potential to benefit from the company’s success in the form of dividends, which are a portion of the company’s profits distributed to shareholders. Additionally, if the company’s stock price increases, the value of your shares also increases, allowing you to profit from capital appreciation.

- Tax Advantages: Investing in stocks can provide tax advantages, especially when held within tax-advantaged accounts such as Individual Retirement Accounts (IRAs) or 401(k) plans. Certain investment strategies, such as tax-loss harvesting, can help offset capital gains and minimize your tax liability.

- Long-Term Wealth Building: Investing in the stock market with a long-term perspective can be a powerful wealth-building tool. Over time, the compounding effect allows your investments to grow exponentially, potentially outpacing inflation and creating substantial wealth for retirement or other financial goals.

- Accessibility and Flexibility: Unlike some other investment options that require substantial initial capital, stock market investing can be accessible to individuals with various budgets. You can start with as little as a few hundred dollars and gradually build your portfolio. Moreover, the stock market operates during regular market hours, providing flexibility and ease of buying and selling stocks.

These benefits highlight the potential advantages of investing in the stock market. However, it’s important to note that investing in stocks involves risks, including the potential for loss of capital. It’s vital to conduct thorough research, diversify your investments, and consider your financial goals and risk tolerance before entering the stock market.

Potential for Higher Returns

One of the primary reasons why investing in the stock market is a good idea is the potential for higher returns compared to other investment options. Over the long term, the stock market has historically outperformed other asset classes, such as bonds or savings accounts.

Stocks represent ownership in companies, and as these companies grow and generate profits, the value of their shares can increase. This growth potential can lead to significant returns for investors. While there are no guarantees, historical data has shown that, on average, the stock market has provided an annual return of around 7-10%.

It’s important to note that investing in stocks comes with risks. The stock market is subject to fluctuations, and prices can be volatile in the short term. However, by taking a long-term perspective and staying invested in a diversified portfolio, investors have the potential to ride out market downturns and benefit from the overall upward trajectory of the stock market.

Furthermore, investing in individual stocks can provide opportunities for even higher returns. By carefully choosing companies with strong growth prospects, solid financials, and competitive advantages, investors can participate in the success of these companies and potentially generate significant profits.

However, it’s crucial to approach individual stock investing with caution. It requires thorough research and analysis to identify companies with growth potential. Investors should consider factors such as the company’s industry trends, competitive landscape, management team, and financial performance before making investment decisions.

Another way to potentially increase returns is by investing in index funds or exchange-traded funds (ETFs). These investment vehicles allow you to gain exposure to a diversified basket of stocks representing a specific market index, sector, or theme. By investing in these funds, you can take advantage of the overall performance of a market segment or industry without having to select individual stocks.

While higher returns can be enticing, it’s important to balance the potential rewards with the associated risks. Investing in the stock market always carries the risk of losing capital, especially in the short term. Therefore, it’s essential for investors to have a long-term mindset, diversify their portfolios, and only invest funds they are willing to hold for an extended period.

Diversification and Risk Management

Diversification is a crucial concept in investing, and the stock market provides ample opportunities for investors to diversify their portfolios. By spreading investments across different companies, industries, and asset classes, investors can reduce their overall risk and potential losses.

Investing in a diversified portfolio of stocks helps to mitigate the impact of any individual company’s poor performance or an industry downturn. When some stocks in your portfolio may be experiencing declines, others may be performing well, balancing out the overall performance. Diversification allows you to participate in the potential upside of multiple investments while minimizing the impact of any downside.

There are several ways to achieve diversification in the stock market:

- Investing across industries: Different sectors of the economy perform differently at various stages of the market cycle. By investing in a variety of industries such as technology, healthcare, finance, and consumer goods, you can reduce the vulnerability of your portfolio to the performance of a single sector.

- Investing across company sizes: Companies of different sizes, such as large-cap, mid-cap, and small-cap, have varying growth potential and risk profiles. By investing in a mix of companies with different market capitalizations, you can further diversify your portfolio and capture opportunities across the entire market spectrum.

- Investing in international stocks: Expanding your portfolio beyond domestic stocks and including international stocks can provide geographical diversification. Investing in companies around the world allows you to tap into different economies, industries, and market cycles, potentially reducing the impact of local market volatility.

- Utilizing index funds or ETFs: Investing in index funds or ETFs allows you to gain exposure to a diversified basket of stocks. These funds typically track market indices or specific segments of the market, providing instant diversification and risk management with a single investment.

While diversification helps manage risk, it does not eliminate it entirely. It’s important to recognize that investing in the stock market always carries some level of risk, including the risk of losing your initial investment. It’s essential to conduct thorough research, analyze company fundamentals, and regularly monitor the performance of your investments.

Furthermore, investors should consider their risk tolerance and investment goals when diversifying their portfolios. Some investors may have a higher risk tolerance and be willing to concentrate their portfolio in higher-growth, riskier investments, while others may have a more conservative approach and prefer a more balanced allocation across various asset classes.

By diversifying your stock market investments, you can reduce risk, smooth out volatility, and potentially enhance long-term returns. It’s wise to consult with a financial advisor or investment professional to assess your risk tolerance, develop a diversified investment strategy, and regularly review and rebalance your portfolio based on your changing financial circumstances and objectives.

Ownership in Profitable Companies

Investing in the stock market provides individuals with the opportunity to become partial owners of profitable companies. When you purchase shares of a company’s stock, you acquire a stake in its ownership and become entitled to a share of its profits and growth.

One of the primary benefits of ownership in profitable companies is the potential to receive dividends. Dividends are distributions of a company’s profits to its shareholders, typically paid out on a regular basis. These dividends can provide investors with a steady income stream, which can be especially attractive for those seeking passive income or looking to supplement their regular earnings.

While not all companies pay dividends, many established and mature companies do. Dividends are often seen as a sign of financial stability and reliability, indicating that a company is generating consistent profits and has the capacity to share them with its shareholders.

Another way to benefit from ownership in profitable companies is through capital appreciation. As the company’s profits grow, its stock price may increase. If you own shares in the company, the value of your investment can rise, allowing you to profit from capital appreciation if you choose to sell the shares at a higher price.

Ownership in profitable companies also allows investors to participate in the long-term growth and success of these companies. By investing in companies with strong fundamentals, innovative products or services, and robust market positions, you can align yourself with businesses that have the potential for sustained growth and value creation.

Furthermore, being a shareholder often comes with certain rights and privileges. As a partial owner, you may have the right to vote on important matters, such as the election of board members and major corporate decisions. This allows investors to have a say in the company’s direction and governance, giving them a sense of involvement and influence.

However, it’s essential to note that owning shares in profitable companies also comes with risks. The stock market is influenced by various factors, including market conditions, economic trends, and company-specific events. Share prices can fluctuate, and there is always a risk of losing money if the company’s performance declines or if market conditions turn unfavorable.

To minimize risks and maximize the benefits of owning profitable companies’ shares, it’s crucial to conduct comprehensive research and analysis. Evaluating a company’s financial health, competitive advantages, management team, and growth prospects can help you make informed investment decisions and select companies with the potential for long-term success.

Additionally, it’s wise to maintain a diversified portfolio, spreading your investments across multiple companies and industries. This approach can help mitigate the impact of any individual company’s performance on your overall investment portfolio.

Overall, ownership in profitable companies through stock market investing offers the potential for dividend income, capital appreciation, and participation in long-term growth. By carefully selecting and monitoring your investments, you can take advantage of these benefits and build a portfolio that aligns with your financial objectives.

Tax Advantages

Investing in the stock market can provide several tax advantages for investors, helping them maximize their returns and minimize their tax liability. By understanding and utilizing these tax benefits, investors can potentially enhance the profitability of their stock market investments.

One of the primary tax advantages of stock market investing is the ability to take advantage of tax-advantaged accounts such as Individual Retirement Accounts (IRAs) or 401(k) plans. Contributions to these accounts are often tax-deductible, meaning that you can reduce your taxable income in the year of contribution. Additionally, any earnings or growth within these accounts are tax-deferred, allowing your investments to compound without being subject to annual taxes.

With traditional IRAs and 401(k) plans, you contribute money on a pre-tax basis, reducing your taxable income for the year. This can result in immediate tax savings, as you pay taxes on the withdrawals made during retirement, typically at a lower tax rate due to potential lower income levels in retirement.

Roth IRAs and Roth 401(k) plans offer a different tax advantage. With these accounts, contributions are made with after-tax dollars, meaning you don’t get a tax deduction upfront. However, qualified withdrawals made during retirement are tax-free, including both contributions and growth. This can be highly advantageous, as it allows for tax-free growth over several decades.

Another tax advantage of stock market investing is the ability to offset capital gains with capital losses. If you sell a stock or investment for a profit, it is considered a capital gain, which may be subject to taxes. However, if you have experienced capital losses from other investments, you can use those losses to offset your capital gains, reducing your overall taxable income.

This strategy, known as tax-loss harvesting, can help you manage your tax liability and potentially increase your after-tax returns. However, it’s important to follow the tax regulations and guidelines related to capital gains and losses, as there are specific rules and limitations on the timing and amount of losses you can use to offset gains.

Furthermore, stock market investments held for the long term may qualify for lower tax rates. Investments held for more than one year are typically subject to long-term capital gains tax rates, which are lower than the ordinary income tax rates applied to short-term capital gains (investments held for less than one year). Taking advantage of long-term capital gains rates can be beneficial, especially for investors in higher tax brackets.

It is crucial to consult with a tax professional or financial advisor to understand the specific tax advantages applicable to your situation. The tax laws and regulations can be complex and subject to change, so professional guidance can help you maximize your tax benefits and ensure compliance with the current tax code.

By utilizing tax-advantaged accounts, managing capital gains and losses, and understanding the tax implications of different investment strategies, investors can optimize their stock market returns and minimize the impact of taxes on their investment gains.

Long-Term Wealth Building

Investing in the stock market is a powerful tool for long-term wealth building. By taking a patient and disciplined approach, investors have the potential to accumulate substantial wealth over time.

One of the key advantages of stock market investing for long-term wealth building is the power of compounding. As you earn returns on your initial investment, those returns can be reinvested and generate additional returns. Over time, this compounding effect can significantly accelerate the growth of your investment portfolio.

For example, let’s say you invest $10,000 in the stock market and it generates an average annual return of 8%. After the first year, your investment would grow to $10,800. In the second year, your returns are not just based on the initial $10,000 but also on the $800 in returns from the previous year. This compounding effect continues to snowball, resulting in exponential growth over the long term.

By staying invested in the stock market over several years or decades, investors can benefit from market upswings and recover from market downturns. While the stock market may experience short-term fluctuations, historical data has shown that over the long term, it tends to trend upward, outpacing inflation and providing a higher return compared to other investment options.

Investing in stocks can also offer opportunities for long-term gains through capital appreciation. As companies grow and increase their profits, their stock prices may rise, allowing investors to benefit from the increase in value. By selecting stocks of companies with strong fundamentals, sustainable competitive advantages, and compelling growth prospects, investors can position themselves for the potential of significant capital appreciation over time.

Another advantage of long-term stock market investing is the ability to ride out market volatility and reduce the impact of short-term market fluctuations. While the stock market may experience temporary downturns, taking a long-term perspective allows your investments to recover and potentially grow even stronger. By avoiding knee-jerk reactions to short-term market movements, you can stay focused on your long-term goals and harness the power of compounding for wealth accumulation.

It’s important to note that long-term stock market investing requires patience, discipline, and a well-thought-out investment strategy. Regularly contributing to your investment portfolio, diversifying your holdings, and periodically rebalancing your portfolio to align with your financial goals can help increase your chances of long-term success.

Additionally, it’s essential to consider your risk tolerance, investment horizon, and financial goals when building long-term wealth. Investing in stocks inherently carries some level of risk and may not be suitable for everyone. Consulting with a financial advisor or investment professional can provide guidance and help you develop a personalized investment plan that aligns with your long-term wealth-building objectives.

Overall, stock market investing offers the potential for long-term wealth building through compounding, capital appreciation, and the ability to withstand market volatility. By adopting a long-term perspective, staying disciplined, and making informed investment decisions, investors can set themselves up for significant financial growth and achieve their long-term financial goals.

Accessibility and Flexibility

One of the key advantages of investing in the stock market is its accessibility and flexibility, making it an attractive option for a wide range of investors.

Unlike some other forms of investment, the stock market is highly accessible to individuals with varying levels of financial resources. You don’t need substantial amounts of capital to get started. With as little as a few hundred dollars, you can begin investing in stocks and participate in the potential growth of profitable companies.

Investing in the stock market is also flexible in terms of investment amounts. You have the freedom to decide how much you want to invest, whether it’s a small sum or a larger portion of your savings. This flexibility allows you to tailor your investment strategy according to your financial circumstances, risk tolerance, and investment goals.

The stock market operates during regular market hours, providing flexibility and convenience for investors. You can easily buy and sell stocks through online platforms, brokerage accounts, or mobile applications. This accessibility allows you to stay engaged with your investments, monitor market trends, and make informed investment decisions at your own convenience.

Furthermore, the stock market offers a wide array of investment options. You have the opportunity to invest in individual stocks of specific companies, allowing you to choose businesses you believe in and align with your investment goals. Alternatively, you can invest in index funds or exchange-traded funds (ETFs), which provide instant diversification across a whole market segment or index.

This variety of investment options grants you the flexibility to tailor your portfolio to your preferences and investment objectives. Whether you prefer a hands-on approach to stock picking or prefer a more passive, diversified investment strategy, the stock market offers the flexibility to align with your investing style.

Another aspect of accessibility and flexibility in the stock market is the ability to invest globally. Stock exchanges operate worldwide, providing opportunities to invest and diversify across international markets, industries, and economies. Investing internationally allows you to access a broader range of investment opportunities, potentially enhancing diversification and risk management.

It’s important to note that while the stock market offers accessibility and flexibility, investing still involves risks. Stock prices can be subject to volatility, and there is always the potential for losses. It is advisable to educate yourself, conduct thorough research, and assess your risk tolerance before making investment decisions.

Moreover, it can be beneficial to consult with a financial advisor or investment professional who can provide guidance based on your unique financial circumstances and goals. They can help you navigate the stock market, develop an investment strategy, and make well-informed decisions that align with your objectives.

In summary, the stock market’s accessibility and flexibility make it an appealing option for investors. With low entry barriers, the ability to invest according to your financial means, and a range of investment options, the stock market allows individuals to participate in wealth creation and align their investments with their goals, all within the framework of their own schedule and preferences.

Factors to Consider Before Investing

Before diving into the stock market, it’s crucial to consider several factors to make informed investment decisions and increase your chances of success. Here are some key factors to assess before investing:

- Market Volatility and Risk: The stock market is inherently volatile, and prices can fluctuate significantly in the short term. Understand that investing in stocks comes with risks, including the potential for loss of capital. Assess your risk tolerance and determine how much volatility you can tolerate in your investment portfolio.

- Investor Knowledge and Research: Educate yourself about the fundamentals of investing in stocks. Learn about financial statements, company evaluation techniques, industry analysis, and market trends. Conduct thorough research before making investment decisions, and stay updated with market developments that may impact your investments.

- Financial Goals and Time Horizon: Clarify your financial goals and the time horizon for your investments. Are you investing for retirement, a down payment on a house, or funding your children’s education? Determine how long you can stay invested and the level of risk you are comfortable with to align your investment strategy with your goals.

- Market Analysis and Timing: Consider market conditions and trends before investing. While it is challenging to predict short-term market movements, understanding the broader economic landscape and industry-specific factors can help inform your investment decisions. However, remember that long-term investing is more about time in the market, rather than timing the market.

- Portfolio Diversification: Diversify your investments to manage risk. Spreading your investments across different industries, market segments, and asset classes can help mitigate the impact of a single investment’s poor performance on your overall portfolio. Consider investing in a mix of stocks, bonds, real estate, and other investment vehicles to achieve diversification.

- Costs and Fees: Be aware of investment costs and fees. These can include brokerage fees, account maintenance charges, and expense ratios for mutual funds or ETFs. Lowering costs can help maximize your investment returns over the long term.

- Emotional Control: Emotions can significantly impact investment decisions. Greed and fear can lead to irrational behavior during market fluctuations. Develop a disciplined approach and stick to your investment strategy, avoiding impulsive actions driven by market sentiment.

- Professional Guidance: Consider seeking advice from a financial advisor or investment professional. They can provide personalized guidance based on your financial situation, goals, and risk tolerance. A professional can help you navigate the intricacies of the stock market and provide expertise that can enhance your investment decisions.

Remember, investing in the stock market is a long-term endeavor. It requires patience, discipline, and continuous learning. By carefully considering these factors and taking a systematic approach, you can increase your likelihood of successful stock market investing.

Market Volatility and Risk

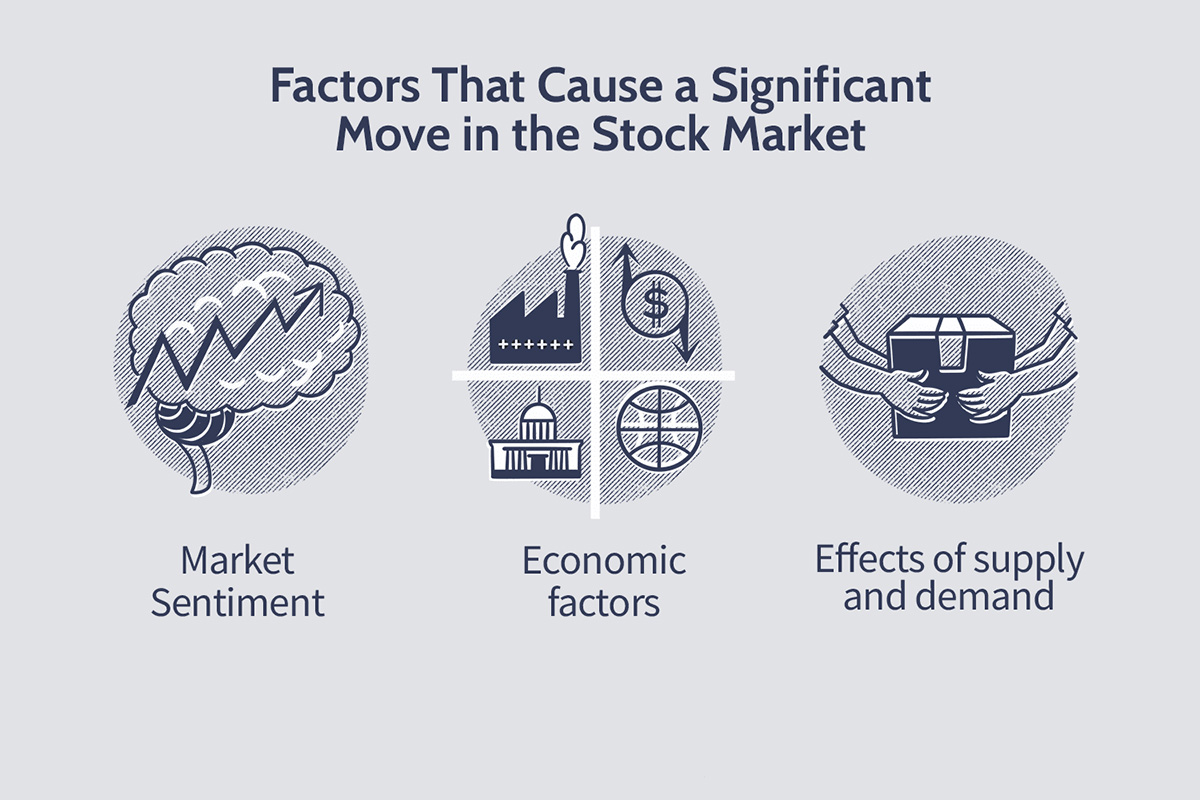

One of the fundamental aspects of investing in the stock market is understanding and accepting the presence of market volatility and risk. The stock market is known for its short-term fluctuations, which can introduce uncertainty and potential losses for investors. Before entering the market, it’s crucial to consider the following factors related to market volatility and risk:

1. Price Volatility: Stock prices can fluctuate significantly in the short term due to various factors, including economic conditions, company news, geopolitical events, and investor sentiment. These price swings can create opportunities but can also result in temporary losses. It’s important to have a long-term perspective and not be swayed by short-term market movements.

2. Economic Factors: Market volatility is closely tied to economic conditions and trends. Economic indicators, such as GDP growth, inflation rates, employment data, and interest rate changes, can significantly impact stock market performance. Keeping an eye on economic developments and understanding their potential influence on the market can help inform investment decisions.

3. Company-Specific Risks: Individual companies face their own set of risks, including competitive pressures, changes in consumer demand, regulatory actions, and management issues. Investing in specific stocks introduces the risk of poor company performance or even bankruptcy. It’s important to research and analyze a company’s financial health, competitive position, track record, and growth prospects before investing.

4. Sector and Industry Risks: Different sectors and industries can experience unique challenges and risks. For example, technology companies may face rapid technological advancements, while consumer staples companies may be influenced by shifts in consumer preferences. Understanding the dynamics and risks associated with specific sectors can help with targeted investment decisions and managing portfolio risk.

5. Global Events: Global events, such as political unrest, economic crises, natural disasters, or public health emergencies, can have a significant impact on the stock market. These events can introduce increased market volatility and may affect specific industries or sectors more than others. Being aware of global events and their potential ramifications can help investors make informed decisions and mitigate risk.

6. Diversification: Diversification is a key strategy to manage risk. By spreading investments across different companies, sectors, and asset classes, investors can reduce the impact of any individual investment’s poor performance. Diversification can help protect against significant losses and provide a more stable overall portfolio performance.

7. Risk Tolerance: Each investor has a unique risk tolerance. Understanding your comfort level with market volatility and potential losses is vital. Assessing your risk tolerance can help determine your investment objectives, asset allocation, and the types of stocks or investments that align with your risk profile.

8. Potential Rewards: It’s important to remember that with greater market volatility and risk comes the potential for higher returns. Investing in the stock market allows for participation in the growth and success of companies, which can lead to significant long-term gains. Balancing risk and potential rewards is a critical aspect of investing.

While market volatility and risk are inherent in stock market investing, it’s essential to approach investing with a long-term mindset, thorough research, and a well-diversified portfolio. Monitoring and managing risk, staying informed, and focusing on your investment goals can help navigate the ups and downs of the market and increase the likelihood of achieving long-term investment success.

Investor Knowledge and Research

Investing in the stock market requires a solid foundation of investor knowledge and ongoing research. Equipping yourself with the necessary understanding and conducting thorough research helps make informed investment decisions and enhances your chances of success. Consider the following aspects of investor knowledge and research:

1. Financial Literacy: Building a strong foundation of financial literacy is essential. Familiarize yourself with key financial concepts, such as understanding financial statements, evaluating company performance, analyzing market trends, and interpreting economic indicators. This knowledge empowers you to make informed investment decisions and navigate the complexities of the stock market.

2. Company Analysis: Conducting detailed research and analysis on companies is crucial before investing. Understand the company’s business model, competitive advantages, revenue streams, and growth prospects. Evaluate financial metrics, such as earnings, revenue, profit margins, and debt levels. This analysis can help assess a company’s overall health and value, aiding in investment decision-making.

3. Industry and Market Analysis: Stay informed about specific industries and broader market trends. Keep an eye on industry-specific factors such as technological advancements, legislative changes, or emerging trends. Regularly monitor market-related news, economic reports, and industry-specific developments that may impact the stocks you are interested in. This knowledge allows you to make well-informed investment decisions and position your portfolio strategically.

4. Fundamental and Technical Analysis: Utilize both fundamental and technical analysis to evaluate investment opportunities. Fundamental analysis focuses on a company’s financial health, growth prospects, industry position, and competitive landscape. Technical analysis, on the other hand, involves analyzing historical price patterns, volume trends, and other market indicators. Combining both approaches provides a comprehensive view of potential investments.

5. Research Resources: Take advantage of various research resources available to you. Utilize financial news outlets, analyst reports, research publications, and online stock screeners. These resources can provide insights, expert opinions, and valuable data to inform your investment decisions. Additionally, be aware of reliable financial websites and forums where you can access real-time market information and engage with other investors.

6. Risk Assessment: Evaluate the risk associated with potential investments. Assess factors such as a company’s debt levels, industry competition, regulatory environment, and macroeconomic factors. This risk assessment helps you weigh the potential rewards against the potential risks and make decisions aligned with your risk tolerance.

7. Continuous Learning: The stock market is dynamic, and investors need to stay updated with market trends, new investment opportunities, and evolving regulations. Engage in continuous learning by reading books, attending seminars or webinars, listening to financial podcasts, and following reputable financial experts. This ongoing education enables you to adapt to changing market conditions and refine your investment strategies.

8. Investment Objectives and Strategy: Define your investment objectives and develop a clear investment strategy. Determine whether you are seeking growth, income, or a combination of both. Establish your risk tolerance, time horizon, and asset allocation strategy. Your investment objectives and strategy serve as guiding principles in your investment journey.

Remember that investor knowledge and research are ongoing processes. While it’s valuable to educate yourself and conduct thorough research before making investment decisions, continue to expand your knowledge and stay informed. Regularly review your investment portfolio and update your research as market conditions and company dynamics change.

Consider consulting with a financial advisor or investment professional to gain additional insights, validate your research, and receive personalized advice based on your unique financial circumstances and goals. Their expertise can help you navigate the complexities of the stock market and make well-informed investment decisions.

Financial Goals and Time Horizon

When investing in the stock market, it is crucial to align your investment strategy with your financial goals and time horizon. Understanding your financial objectives and the timeframe in which you aim to achieve them helps determine the appropriate investment approach and risk tolerance. Consider the following factors related to financial goals and time horizon:

1. Define Your Financial Goals: Take the time to clearly define your financial goals. Are you investing for retirement, purchasing a home, funding your child’s education, or saving for a major life milestone? Each goal may have a different investment time horizon and risk tolerance level. Identifying and prioritizing your financial goals provides a foundation for your investment strategy.

2. Short-term vs. Long-term Goals: Differentiate between short-term and long-term goals to establish the appropriate investment strategy for each. Short-term goals, such as saving for a vacation or a down payment on a house within the next few years, may require a more conservative approach with lower-risk investments. Long-term goals, like retirement planning that may be several decades away, can tolerate more volatility and may benefit from long-term growth-oriented investments.

3. Time Horizon: Consider the time horizon for each financial goal. The time horizon is the period you have available to reach your goals. A longer time horizon allows for a more aggressive investment strategy, as it allows for potential market fluctuations to even out over time, potentially generating higher returns. For shorter time frames, a more conservative investment approach may be advisable to protect capital and ensure the funds are available when needed.

4. Risk Tolerance: Assess your risk tolerance, which reflects your ability to withstand short-term market fluctuations and potential losses. Consider your comfort level with market volatility and the impact of potential downturns on your investment portfolio. Generally, longer time horizons allow for a higher tolerance of risk, as there may be more time to recover from any temporary losses. However, it’s important to find a risk level that you are comfortable with and avoids undue stress or panic during market downturns.

5. Investment Allocation: Allocate your investments based on your financial goals and time horizon. Short-term goals may require a larger portion of your portfolio allocated to lower-risk assets such as bonds or cash equivalents. Long-term goals may allow for a higher allocation to growth-oriented investments, such as stocks, to potentially generate higher returns over time. Balancing risk and reward in your investment allocation is crucial to aligning your investments with your financial goals.

6. Regular Assessment: Regularly review and reassess your financial goals and investment strategy. As your circumstances change or you approach certain milestones, it’s important to evaluate your progress and make adjustments as needed. This may involve rebalancing your portfolio or adjusting your risk tolerance to reflect your evolving financial situation.

7. Seek Professional Advice: Consider seeking advice from a financial advisor or investment professional. Professionals can provide guidance based on their expertise and knowledge of financial markets. They can help you evaluate your financial goals, assess your risk tolerance, and develop an investment strategy tailored to your circumstances.

Remember that financial goals and time horizons are unique to each individual. It is essential to remain focused on your specific goals and avoid comparing your investment journey to others. By aligning your investment strategy with your financial goals and time horizon, you can create a roadmap for success and work towards achieving the financial future you desire.

Market Analysis and Timing

When it comes to investing in the stock market, market analysis and timing play a significant role in making informed investment decisions. While timing the market perfectly is nearly impossible, understanding market dynamics and conducting analysis can provide valuable insights. Consider the following aspects related to market analysis and timing:

1. Economic and Market Trends: Stay informed about economic trends and market conditions. Monitor indicators such as GDP growth, inflation rates, interest rates, and employment data. These economic factors can impact overall market performance. Additionally, observe market trends, such as sector rotation or emerging market opportunities, to identify potential investment prospects.

2. Fundamental Analysis: Engage in fundamental analysis to assess the intrinsic value of companies. Evaluate financial statements, cash flow, revenue growth, profitability, and the competitive landscape. Understanding a company’s financial health and growth potential can help determine if it’s a suitable investment within the current market environment.

3. Technical Analysis: Utilize technical analysis to examine historical price patterns, volume trends, and other market indicators. Technical analysis helps identify potential support and resistance levels, trend reversals, or buy/sell signals. While technical analysis should not be the sole basis for investment decisions, it can complement fundamental analysis to create a more comprehensive market view.

4. Valuation Metrics: Evaluate valuation metrics such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio to assess whether a stock is overvalued or undervalued compared to its peers or historical benchmarks. This analysis can help identify potential investment opportunities or areas of caution.

5. Avoid Timing the Market: Timing the market perfectly is exceedingly difficult, if not impossible. Trying to predict short-term market movements can lead to costly errors and missed opportunities. Instead, focus on long-term investing goals and remain disciplined. Invest regularly over time, benefitting from the power of compounding and reducing the impact of market fluctuations.

6. Dollar-Cost Averaging: Consider using a dollar-cost averaging strategy, particularly for long-term investments. With this approach, you invest a fixed amount of money at regular intervals, regardless of market conditions. This strategy allows you to buy more shares when prices are lower and fewer shares when prices are higher, potentially reducing the impact of market volatility on your investment returns.

7. Regular Portfolio Evaluation: Regularly evaluate the performance of your investment portfolio. This evaluation should involve assessing the alignment of your investments with your financial goals, risk tolerance, and market conditions. Periodically rebalance your portfolio to maintain a diversified asset allocation and adjust investments based on changing circumstances.

8. Long-Term Perspective: Adopt a long-term perspective when investing in the stock market. Rather than attempting to time short-term market fluctuations, focus on the long-term growth potential of your investments. Historically, stocks have shown an upward trend over the long run, despite short-term volatility. By staying invested in quality companies and being patient, you can benefit from long-term wealth accumulation.

While market analysis and timing can provide valuable insights, it’s important to remember that investing is a long-term endeavor. It’s nearly impossible to consistently predict short-term market movements. Therefore, focus on sound investment principles, stay informed, and make decisions based on thorough research, discipline, and alignment with your financial goals.

Conclusion

Investing in the stock market can be an effective strategy for wealth accumulation and achieving long-term financial goals. Through careful consideration of the benefits, factors, and strategies discussed in this article, you can make informed investment decisions and navigate the dynamic world of the stock market.

The stock market provides numerous advantages, including the potential for higher returns, diversification, ownership in profitable companies, tax advantages, long-term wealth building, and accessibility. By understanding and utilizing these benefits, you can position yourself for financial success.

However, investing in the stock market also comes with risks. Market volatility, company-specific factors, and global events can influence stock prices and introduce uncertainty. It’s essential to conduct thorough research, diversify your investments, and regularly assess and adjust your portfolio to manage these risks effectively.

Additionally, factors such as investor knowledge, financial goals, time horizon, market analysis, and emotional control play crucial roles in formulating a successful investment strategy. Continuously expanding your investor knowledge, staying informed about market trends, and seeking professional advice when needed can further enhance your investment journey.

While it may be tempting to time the market or get caught up in short-term fluctuations, it’s important to adopt a long-term perspective. Investing in stocks is a marathon, not a sprint. Stay disciplined, focus on your financial goals, and avoid succumbing to emotional impulses that can lead to poor investment decisions.

Ultimately, the stock market offers the potential for long-term wealth accumulation and financial growth. By aligning your investment strategy with your goals, maintaining a diversified portfolio, and staying informed, you can navigate the ups and downs of the market and work towards achieving your financial aspirations.

Remember, investing in the stock market involves risks, and past performance is not indicative of future results. Consider your financial circumstances, risk tolerance, and consult with a financial advisor or investment professional when necessary. With diligence, patience, and a well-informed approach, investing in the stock market can be a rewarding journey towards financial prosperity.