Finance

How To Invest On The Canadian Stock Market

Published: November 3, 2023

Learn how to invest in the Canadian stock market and optimize your finance with expert tips and strategies for a successful investment journey.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Canadian Stock Market

- Setting Investment Goals

- Choosing a Brokerage Account

- Researching Stocks and ETFs

- Evaluating Fundamental Analysis

- Utilizing Technical Analysis

- Strategies for Investing in the Canadian Stock Market

- Diversification and Portfolio Management

- Risk Management and Exit Strategies

- Conclusion

Introduction

Welcome to the world of investing in the Canadian stock market! Whether you are a seasoned investor or just starting out, understanding the ins and outs of the Canadian stock market can be a valuable skill that can potentially generate impressive returns on your investments. In this article, we will guide you through the process of investing in the Canadian stock market, from understanding the basics to implementing effective investment strategies.

The Canadian stock market offers a diverse range of investment opportunities across various sectors, including finance, energy, technology, and healthcare, among others. With a strong economy and stable political environment, Canada has become an attractive market for both local and international investors.

Before diving into the exciting world of stock trading, it is crucial to gain a solid understanding of how the Canadian stock market operates. This includes familiarizing yourself with key terms, such as stocks, indices, and exchanges, as well as understanding the factors that can influence stock prices, such as company earnings, economic indicators, and market sentiment.

Setting clear investment goals is another important step in starting your journey in the Canadian stock market. Do you aim for long-term growth, short-term gains, or a combination of both? By defining your investment objectives, you can tailor your investment strategy accordingly.

Choosing a brokerage account that suits your needs is essential for executing trades in the Canadian stock market. Consider factors such as fees, customer service, trading platforms, and research tools when selecting a brokerage. It is also important to ensure that the brokerage account offers access to the Canadian stock market, including major stock exchanges such as the Toronto Stock Exchange (TSE) and the Canadian Securities Exchange (CSE).

Researching stocks and exchange-traded funds (ETFs) is a crucial step in successful stock market investing. By analyzing a company’s financials, growth prospects, competitive position, and industry trends, you can make informed investment decisions. Fundamental analysis involves assessing the intrinsic value of a stock, while technical analysis focuses on analyzing price patterns and market trends to predict future stock price movements.

Implementing effective investment strategies is key to maximizing returns and managing risks. Different strategies, such as value investing, growth investing, dividend investing, and momentum investing, can be employed depending on your investment goals and risk tolerance.

Understanding the Canadian Stock Market

Before diving into the world of investing in the Canadian stock market, it is important to have a solid understanding of how it operates. The Canadian stock market is composed of various stock exchanges, with the Toronto Stock Exchange (TSE) being the largest and most well-known. Other notable exchanges include the Canadian Securities Exchange (CSE) and the NEO Exchange.

The Canadian stock market allows investors to buy and sell shares of publicly traded companies, providing an avenue for individuals to become partial owners of these companies. When you buy a stock, you essentially become a shareholder, giving you the opportunity to benefit from the company’s potential growth and earnings.

Stocks in the Canadian stock market are categorized into different sectors, such as financials, energy, technology, healthcare, and consumer goods. Each sector represents companies with similar business activities. It is important to understand the dynamics and trends within these sectors when considering investment opportunities.

The performance of the Canadian stock market is influenced by various factors, including economic indicators, government policies, global events, and investor sentiment. Economic indicators such as GDP growth, employment rates, and inflation can impact the overall market sentiment and stock prices. Government policies and regulations can also have a significant impact on specific sectors or industries.

Canadian listed companies are required to disclose their financial information periodically, allowing investors to assess the financial health and performance of these companies. Key financial statements include the balance sheet, income statement, and cash flow statement. Analyzing these financial statements can provide valuable insights into a company’s profitability, liquidity, and solvency.

In addition to individual stock investing, the Canadian stock market offers the option to invest in exchange-traded funds (ETFs). ETFs are investment funds that trade on stock exchanges, tracking the performance of a specific index or sector. They allow investors to gain exposure to a diversified portfolio of stocks with a single investment.

Overall, understanding the Canadian stock market involves familiarizing yourself with key stock exchanges, sectors, economic indicators, and financial statements. It is important to stay informed about market trends, news, and developments that could impact your investment decisions. By acquiring this knowledge, you can make informed investment choices and navigate the Canadian stock market with confidence.

Setting Investment Goals

Setting clear investment goals is a fundamental step in creating a successful investment strategy in the Canadian stock market. Your investment goals will shape your investment approach, risk tolerance, and time horizon. Whether you are investing for retirement, saving for a specific financial goal, or looking to grow your wealth, defining your investment goals is paramount.

When setting investment goals, it is important to consider both the short-term and long-term objectives. Short-term goals may involve saving for a down payment on a house or funding a vacation, while long-term goals could be focused on building a retirement nest egg or creating generational wealth.

It is crucial to be specific and measurable when setting investment goals. Instead of just aiming to “make more money,” quantify your targets by setting a desired rate of return or a target amount of capital appreciation. This will help you track your progress and hold yourself accountable along the way.

Another factor to consider when setting investment goals is your risk tolerance. Some individuals are comfortable with higher risk and volatility in pursuit of higher potential returns, while others prefer a more conservative approach to protect their capital. Assess your tolerance for market fluctuations and volatility to determine the level of risk you are willing to take.

Time horizon is also a critical factor in setting investment goals. The longer your investment horizon, the more time you have to ride out market fluctuations and potentially benefit from the compounding effect of your investments. If you have a short time horizon, such as saving for a down payment on a house in the near future, you may need to be more conservative with your investments to protect your capital.

Lastly, it is important to align your investment goals with your personal values and priorities. Consider what matters most to you and how your investments can support those values. For example, if sustainability and environmental responsibility are important to you, you may prefer to invest in companies that have strong ESG (Environmental, Social, and Governance) practices.

By setting clear investment goals, you can tailor your investment strategy accordingly. Your goals will inform your asset allocation, investment selection, and risk management approach. Keep your goals in mind as you make investment decisions and periodically review and adjust them as necessary based on your changing circumstances.

Choosing a Brokerage Account

When it comes to investing in the Canadian stock market, choosing the right brokerage account is crucial. A brokerage account is an essential tool that allows you to buy and sell stocks, manage your investments, and access valuable research and analysis tools. Here are some key factors to consider when selecting a brokerage account.

Fees and Commissions: One of the first aspects to consider is the fee structure of the brokerage account. Different brokerages have different fee models, including trading commissions, account maintenance fees, and fees for additional services. It’s important to understand the fee structure and assess whether it aligns with your investment needs and budget.

Trading Platform: The trading platform provided by the brokerage is where you will execute your trades. It should be user-friendly, intuitive, and equipped with essential features such as real-time market data, order types, and customization options. Test out different trading platforms to find one that suits your trading style and preferences.

Research and Analysis Tools: Access to quality research and analysis tools can significantly enhance your investment decision-making. Look for a brokerage that offers comprehensive market research, company profiles, financial data, and analyst reports. These tools can assist you in conducting in-depth research on stocks and making informed investment decisions.

Customer Service: A responsive and helpful customer service team is essential when you need assistance with your brokerage account. Verify the availability and responsiveness of the customer service representatives. It’s important to have prompt support when encountering issues or facing challenges with your account.

Mobile App: In today’s fast-paced world, having a robust mobile app can be a game-changer. Look for a brokerage that offers a mobile app with features such as easy trade execution, real-time market data, account monitoring, and portfolio management. The ability to trade on the go can provide flexibility and convenience in managing your investments.

Account Types: Consider the different account types offered by the brokerage. Depending on your investment goals and circumstances, you may need a regular cash account, a tax-free savings account (TFSA), a registered retirement savings plan (RRSP), or a margin account for borrowing to invest. Ensure the brokerage offers the account types that suit your needs.

Educational Resources: For novice investors or those looking to expand their knowledge, educational resources offered by the brokerage can be invaluable. Look for brokerages that provide educational materials, webinars, tutorials, and investment resources to support your learning and investment journey.

Security: Prioritize the security measures implemented by the brokerage to safeguard your personal and financial information. Look for brokerages that offer secure encryption, two-factor authentication, and other security features to protect your account.

By carefully considering these factors, you can choose a brokerage account that aligns with your investment needs, preferences, and budget. Remember, it’s important to periodically reassess your brokerage account and consider switching if other options better suit your requirements as your investment goals evolve.

Researching Stocks and ETFs

One of the key aspects of investing in the Canadian stock market is conducting thorough research on the stocks and exchange-traded funds (ETFs) you intend to invest in. This research is crucial for making informed investment decisions and maximizing the potential returns on your investments. Here are some essential steps to effectively research stocks and ETFs.

Company Analysis: Start by reviewing the company’s financial statements, including the balance sheet, income statement, and cash flow statement. These documents provide insights into the company’s profitability, revenue growth, and cash flow generation. Assess the company’s financial health, its competitive position in the industry, and any potential risks or challenges it may face.

Industry and Market Analysis: Next, analyze the industry and market in which the company operates. Look for growth prospects, market trends, and potential risks and opportunities within the industry. Consider factors such as market demand, competitive landscape, regulatory environment, and technological advancements that might impact the company’s future prospects.

Management Evaluation: Assess the strength and track record of the company’s management team. Review their experience, qualifications, and past performance. Determine if the management team has successfully navigated challenges and created shareholder value in the past. Strong and capable management is often a positive indicator of a company’s potential for success.

Company News and Developments: Stay up to date with the latest news and developments about the company. Monitor press releases, financial reports, and industry news that might impact the company’s stock price. Significant events such as mergers and acquisitions, new product launches, or regulatory changes can significantly impact a company’s stock performance.

Analyst Reports: Read analyst reports from reputable sources. Analyst reports provide detailed insights and recommendations on specific stocks, including target prices, earnings projections, and investment ratings. While it’s important to consider multiple sources and conduct your own analysis, analyst reports can provide valuable information to guide your investment decisions.

ETF Research: When researching ETFs, focus on understanding the underlying index or sector that the ETF is tracking. Analyze the composition of the ETF’s holdings, the performance of the index it tracks, and any associated fees or expenses. ETFs are designed to provide exposure to a diversified portfolio, so evaluating the index or sector is essential to assess the potential returns and risks.

Financial Data and Ratios: Analyze various financial ratios and performance metrics to evaluate the company’s profitability, efficiency, liquidity, and solvency. Common ratios to consider include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, return on equity (ROE), and debt-to-equity (D/E) ratio. These ratios provide insights into the company’s valuation and financial health.

Market Sentiment: Consider the overall market sentiment and investor sentiment towards the stock or ETF you are researching. Sentiment can influence stock prices, so understanding how the market perceives a company or sector can provide insights into its potential performance.

By conducting thorough research on stocks and ETFs, you can make informed investment decisions and increase your chances of success in the Canadian stock market. Remember to regularly review and update your research to stay up to date with market trends and factors that may impact your investments.

Evaluating Fundamental Analysis

Fundamental analysis is a crucial tool for evaluating stocks in the Canadian stock market. It involves analyzing a company’s financials, industry position, and future prospects to determine its intrinsic value and potential for growth. Here are key factors to consider when evaluating fundamental analysis.

Financial Statements: Start by analyzing the company’s financial statements, including the balance sheet, income statement, and cash flow statement. Evaluate the company’s revenue, profitability, expenses, and cash flow. Look for trends in revenue growth, profit margins, and cash flow generation over time. Assess the company’s liquidity, solvency, and overall financial health.

Revenue and Earnings Growth: Analyze the company’s revenue and earnings growth over multiple periods, typically three to five years. Consistent and sustainable revenue and earnings growth can indicate a strong and well-managed company. Look for companies that have a track record of increasing their earnings per share and have a positive outlook for future growth.

Clear Competitive Advantage: Consider whether the company has a clear competitive advantage or unique selling proposition that differentiates it from its competitors. Companies with a strong competitive position are more likely to generate sustainable profits and maintain a market-leading position, which can contribute to long-term success.

Industry Analysis: Evaluate the company’s position within its industry. Assess the competitiveness of the industry, barriers to entry, and potential growth opportunities. Analyze industry trends, market share, and any factors that could impact the company’s future performance. A thorough understanding of the industry dynamics is crucial in evaluating a company’s potential for success.

Management Team: Assess the company’s management team, including their experience, track record, and alignment with shareholder interests. Look for a management team that has a history of effective decision-making, strategic planning, and strong corporate governance. A capable and shareholder-focused management team can significantly impact a company’s long-term success.

Valuation Ratios: Analyze various valuation ratios, such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio. Compare these ratios to industry peers to determine if the stock is overvalued or undervalued. A lower valuation ratio relative to peers may indicate a potentially attractive investment opportunity.

Dividends and Return on Investment: Consider whether the company pays dividends and the consistency of dividend payments. Dividends can provide a source of income for investors and indicate a company’s stability and financial strength. Additionally, assess the company’s return on invested capital (ROIC) and return on equity (ROE) to evaluate its ability to generate returns for shareholders.

Macroenvironmental Factors: Take into account macroenvironmental factors that could impact the company’s performance. These factors include economic conditions, regulatory changes, geopolitical events, and technological advancements. Understanding how external factors can affect the company’s operations and industry is important for evaluating its future prospects.

Remember, fundamental analysis is just one aspect of evaluating a stock, and it should be complemented by other forms of analysis, such as technical analysis and market sentiment. By conducting a comprehensive fundamental analysis, you can gain insights into a company’s financial health, growth potential, and overall investment attractiveness in the Canadian stock market.

Utilizing Technical Analysis

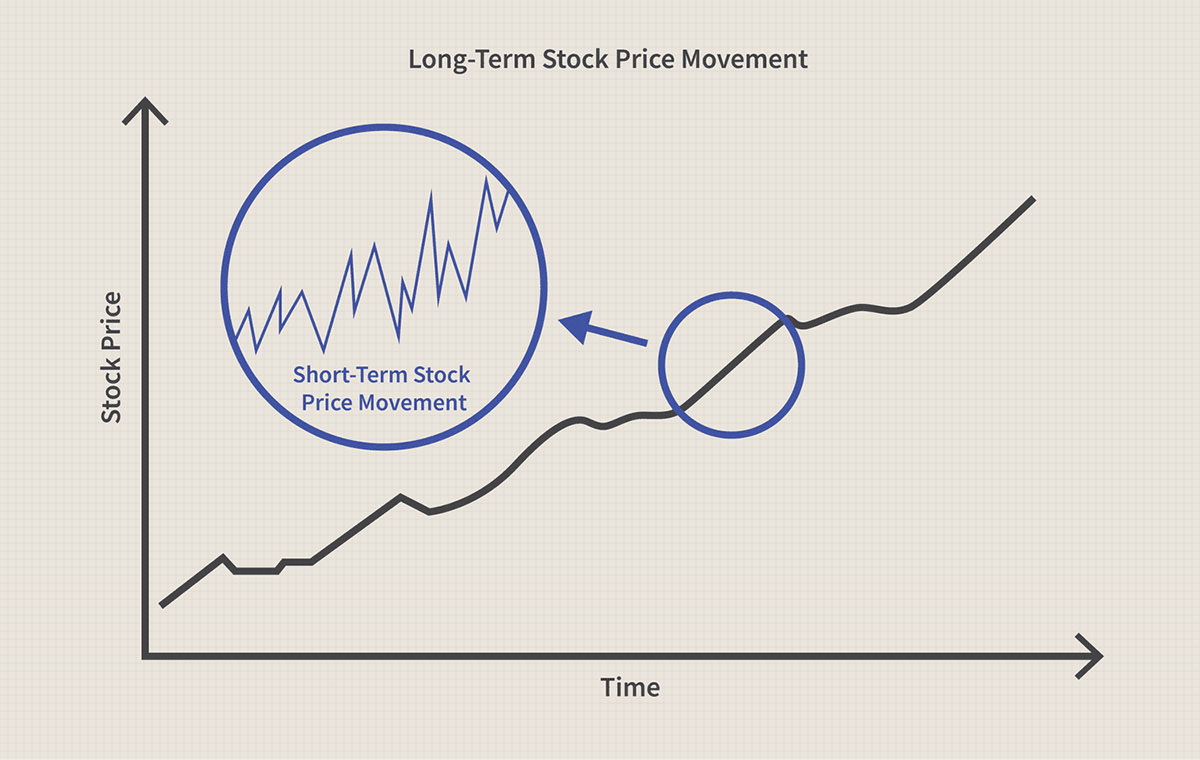

Technical analysis is a popular approach for evaluating stocks in the Canadian stock market. It involves analyzing historical price and volume data to identify patterns, trends, and potential future price movements. Technical analysis focuses on the premise that historical price and volume patterns can provide insights into a stock’s future performance. Here are key principles to consider when utilizing technical analysis.

Chart Patterns: Chart patterns are formations that appear on stock price charts and can provide insights into future price movements. Examples of chart patterns include support and resistance levels, trendlines, head and shoulders patterns, and triangles. By recognizing these patterns, investors can make informed decisions about buying or selling a stock.

Support and Resistance Levels: Support levels are price levels at which a stock has historically shown a strong buying interest, preventing it from falling further. Resistance levels, on the other hand, are price levels at which a stock has historically encountered selling pressure, preventing it from rising further. These levels can serve as indicators of where a stock’s price may bounce back or encounter selling pressure.

Moving Averages: Moving averages are calculated by averaging a stock’s price over a specific time period. Commonly used moving averages include the 50-day moving average and the 200-day moving average. Moving averages can help identify the overall trend of a stock. When the stock price is above the moving average, it may indicate a bullish trend, while a price below the moving average may suggest a bearish trend.

Indicators and Oscillators: Technical analysis also involves using various indicators and oscillators to derive insights from stock price and volume data. Examples of popular indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator. These indicators can provide signals of overbought or oversold conditions, divergence, and potential trend reversals.

Volume Analysis: Volume refers to the number of shares traded in a stock. By analyzing the volume along with price movements, investors can gain insights into the strength and conviction of buyers and sellers. Higher volume during price advances or declines may suggest that the trend is strong and likely to continue.

Pattern Recognition: In addition to specific chart patterns, technical analysis involves recognizing recurring patterns and trends in stock price movements. These patterns can include uptrends, downtrends, consolidations, and breakouts. Recognizing these patterns can help investors make decisions about entering or exiting a stock position.

Timeframes: Technical analysis can be conducted on various timeframes, from short-term intraday charts to long-term monthly charts. It is important to consider the appropriate timeframe for your investment horizon and trading style. Short-term traders may focus on shorter timeframes, while long-term investors may consider broader trends and patterns.

While technical analysis can provide valuable insights into stock price movements, it is important to recognize its limitations. Technical analysis is based solely on historical price and volume data and does not consider fundamental factors. Therefore, it is recommended to use technical analysis in combination with fundamental analysis and other forms of analysis to make well-rounded investment decisions.

Strategies for Investing in the Canadian Stock Market

Investing in the Canadian stock market requires a well-thought-out strategy to help you achieve your investment goals. While there are numerous strategies to choose from, here are a few popular ones that investors commonly utilize:

Value Investing: Value investing involves identifying undervalued stocks that have the potential to deliver long-term growth. Value investors focus on finding stocks that are trading below their intrinsic value. This strategy often involves analyzing financial statements, evaluating company fundamentals, and considering factors such as price-to-earnings (P/E) ratios and price-to-book (P/B) ratios.

Growth Investing: Growth investing focuses on identifying companies with fast-growing earnings and revenue. Growth investors look for stocks of companies that show strong potential for expanding their operations, entering new markets, or introducing innovative products or services. The goal is to invest in companies that have the potential for substantial long-term capital appreciation.

Dividend Investing: Dividend investing involves selecting stocks of companies that regularly distribute a portion of their profits as dividends to shareholders. Dividend investors seek stable and reliable dividend-paying companies, as well as those with a history of increasing dividend payments over time. This strategy can provide investors with a steady stream of income.

Index Investing: Index investing, also known as passive investing, involves investing in index funds or exchange-traded funds (ETFs) that track broad market indexes like the S&P/TSX Composite Index. This strategy aims to replicate the performance of the overall market rather than focusing on individual stock selection. Index investing offers diversification and may be suitable for investors who prefer a hands-off approach.

Sector Rotation: Sector rotation involves strategically allocating investments across different sectors based on the economic cycle. The idea is to identify sectors that are expected to outperform in different phases of the business cycle, such as healthcare during recessionary periods or technology during periods of economic growth. This strategy aims to take advantage of the cyclical nature of different sectors.

Momentum Investing: Momentum investing involves identifying stocks that have shown strong recent price momentum. The strategy is based on the belief that stocks that have recently performed well are likely to continue performing well in the short term. Investors using this strategy aim to buy stocks that are rising in price and sell those that are declining.

It’s important to remember that investing strategies should align with your investment goals, risk tolerance, and time horizon. Consider consulting with a financial advisor to determine which strategy is best suited for your individual needs and circumstances.

Regardless of the strategy you choose, it’s important to conduct thorough research, diversify your portfolio, and regularly monitor your investments. Keeping up with market trends, staying informed about the companies you invest in, and reviewing your investment strategy periodically can help optimize your performance in the Canadian stock market.

Diversification and Portfolio Management

Diversification and portfolio management are essential components of successful investing in the Canadian stock market. These strategies aim to minimize risk, maximize returns, and maintain a well-balanced investment portfolio. Here are key considerations when it comes to diversification and portfolio management.

Diversification: Diversification involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying, you reduce the risk associated with holding a single investment. Diversification helps protect against losses in any one particular investment, as gains in some investments may offset losses in others. Consider including a mix of stocks from different industries, as well as adding other asset classes such as bonds or real estate investments to your portfolio.

Asset Allocation: Asset allocation is the process of determining the percentage of your portfolio that will be allocated to different asset classes, such as stocks, bonds, and cash. The allocation should be based on your investment goals, risk tolerance, and time horizon. Younger investors with a longer time horizon may have a higher allocation to stocks, while those nearing retirement may have a greater allocation to bonds and cash for capital preservation.

Risk Management: Managing risk is an important aspect of portfolio management. Assess your risk tolerance and determine an acceptable level of risk for your investments. Consider the potential risks associated with individual stocks, such as market risk, industry-specific risk, and company-specific risk. Use tools like stop-loss orders or diversifying within sectors and market caps to mitigate risk. Regularly review and adjust your portfolio as necessary to maintain an appropriate risk level.

Portfolio Rebalancing: Over time, the performance of different investments within your portfolio may fluctuate, leading to an imbalance in your original asset allocation. Periodically rebalance your portfolio by selling some investments that have appreciated and buying more of the investments that have fallen behind. This helps ensure your portfolio remains aligned with your desired asset allocation and risk profile.

Regular Monitoring and Review: Stay updated with market trends, news, and developments that may impact your investments. Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Evaluate the performance of individual stocks and asset classes within your portfolio and make adjustments as necessary. Avoid making impulsive decisions based on short-term market fluctuations, but rather focus on long-term trends.

Consider Professional Advice: Managing a portfolio requires time, knowledge, and expertise. Consider seeking advice from a financial advisor who can provide guidance on diversification, asset allocation, and risk management strategies. They can help customize an investment plan based on your individual needs, goals, and risk tolerance.

Remember, diversification and portfolio management are ongoing processes. Regularly review and adjust your portfolio as your financial circumstances, investment objectives, and market conditions change. By implementing these strategies, you can aim for a well-balanced and resilient investment portfolio in the dynamic Canadian stock market.

Risk Management and Exit Strategies

Risk management and exit strategies are critical elements of investing in the Canadian stock market. While investing comes with inherent risks, having a well-defined risk management plan and exit strategies can help protect your investments and optimize your returns. Here are key considerations for risk management and exit strategies:

Setting Risk Parameters: Define your risk tolerance and establish risk parameters for your investments. Assess how much loss you are willing to tolerate and adjust your portfolio accordingly. By setting clear risk limits, you can avoid excessive exposure to volatile investments and make informed decisions about when to enter or exit a position.

Diversification: Diversifying your investment portfolio across different asset classes, sectors, and geographic regions can help mitigate risk. Spreading your investments reduces the impact of a single investment’s poor performance on your overall portfolio. Diversification can help ensure that losses in one investment are offset by gains in others, providing a buffer against market fluctuations.

Stop-Loss Orders: A stop-loss order is a risk management tool that can help protect against substantial losses. It is an order placed with your broker to automatically sell a stock if its price drops to a specified level. By setting a stop-loss order, you limit potential losses by selling the stock before it falls further. This strategy can help protect your capital and minimize the impact of adverse market conditions.

Trailing Stop-Loss Orders: Trailing stop-loss orders are similar to stop-loss orders but with an additional feature that allows the level at which the order is triggered to move with the stock’s price. As the stock price rises, the trailing stop-loss level adjusts upward, locking in profits while still protecting against a significant downturn. This strategy enables you to capture potential gains while also limiting downside risk.

Investment Time Frame: Determine your investment time frame and align your investments accordingly. Short-term investments may carry higher risks due to market volatility, while long-term investments can withstand short-term fluctuations. Matching your investment time frame with the appropriate investment strategy can help manage risk and avoid making panicked decisions based on short-term market movements.

Regular Monitoring: Stay vigilant by monitoring your investments on a regular basis. Keep track of market trends, company news, and other factors that may impact your investments. Regularly review and assess the performance of your portfolio, making adjustments as needed to align with your risk tolerance and investment goals.

Profit-Taking Strategies: Have clear profit-taking strategies to lock in gains. Consider implementing trailing stop orders or selling a portion of your holdings when a stock reaches a predetermined profit target. This allows you to secure profits while still participating in further potential upside.

Exit Strategies: Establish clear exit criteria for your investments. Determine under what circumstances you would consider selling a stock, such as changes in the company’s fundamentals, a significant decline in the stock’s price, or a specific profit or loss threshold being reached. Having predefined exit strategies helps you make rational decisions based on your predetermined criteria rather than succumbing to emotional impulses.

Stay Informed: Constantly stay informed about market trends, economic indicators, and events that may impact your investments. Keep up with industry news, company developments, and changes in market conditions. Being well-informed allows you to make proactive decisions and adjust your risk management and exit strategies accordingly.

Remember, risk management and exit strategies are vital components of a well-rounded investment plan. By setting risk parameters, diversifying your portfolio, implementing stop-loss orders, and having well-defined exit criteria, you can help protect your investments and make informed decisions based on your risk tolerance and investment goals in the Canadian stock market.

Conclusion

Investing in the Canadian stock market offers a wealth of opportunities for investors to grow their wealth and achieve their financial goals. By understanding the dynamics of the stock market, setting clear investment goals, and conducting thorough research, you can make informed decisions and maximize your chances of success. Whether you choose to pursue value investing, growth investing, dividend investing, or other investment strategies, it is important to diversify your portfolio, manage risks effectively, and regularly review your investments.

When investing in the Canadian stock market, it is crucial to stay informed about market trends, industry developments, and company news. Continuously monitoring your investments allows you to make timely adjustments and take advantage of opportunities that arise. Alongside fundamental analysis, technical analysis can provide valuable insights into price patterns and trends, helping you make more informed trading decisions.

Risk management and exit strategies are essential elements of successful investing. By setting risk parameters, implementing stop-loss orders, and having predefined exit strategies, you can protect your investments and make rational decisions based on predetermined criteria rather than emotional impulses.

Remember that investing carries inherent risks, and past performance is not necessarily indicative of future results. It is always recommended to seek advice from a financial advisor to align your investment strategy with your specific circumstances, goals, and risk tolerance.

In conclusion, investing in the Canadian stock market requires patience, discipline, and a comprehensive understanding of market dynamics. By employing sound investment strategies, conducting thorough research, and staying informed, you can navigate the Canadian stock market with confidence and work towards achieving your financial aspirations.