Home>Finance>How Old Do You Have To Be To Invest In Stock Market

Finance

How Old Do You Have To Be To Invest In Stock Market

Published: November 24, 2023

Discover the age limit for investing in the stock market and explore the world of finance. Start your financial journey today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Minimum Age Requirement

- Age Requirements for Different Types of Investments

- Legal Considerations for Young Investors

- Choosing the Right Investment Approach for Your Age

- Importance of Financial Education for Young Investors

- Benefits and Risks of Investing at a Young Age

- Tips for Getting Started as a Young Investor

- Conclusion

Introduction

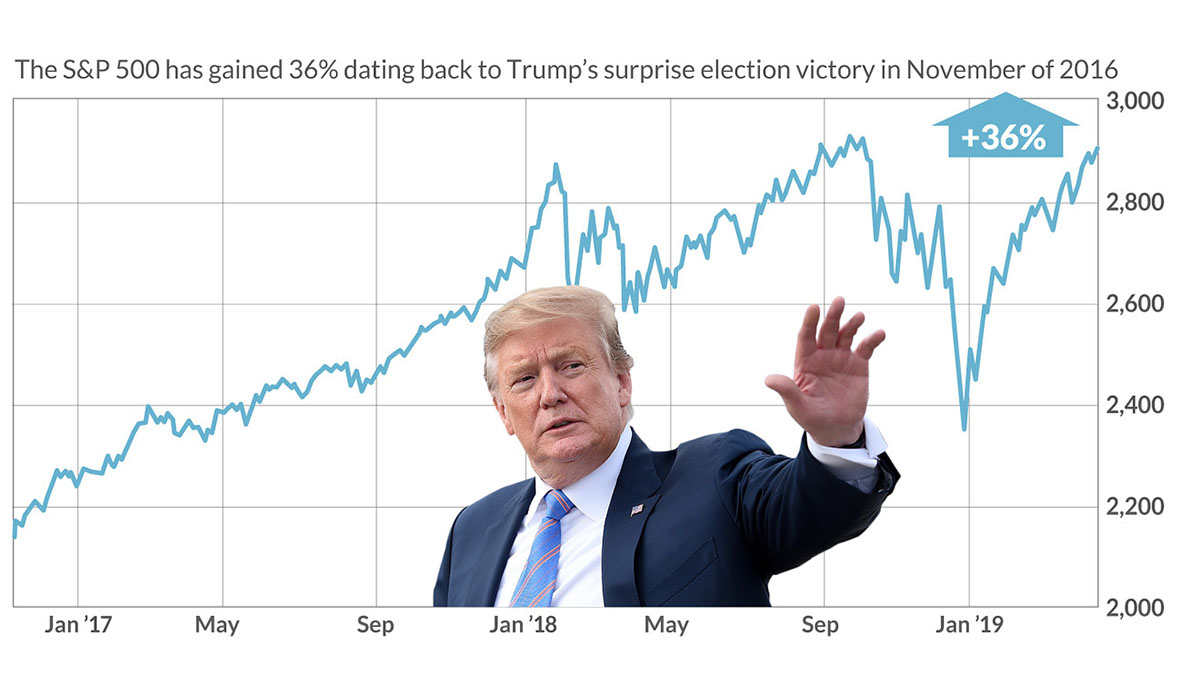

Investing in the stock market is a powerful tool for building wealth and securing financial future. It’s not only reserved for seasoned investors or those with a significant amount of money to spare. In fact, individuals of all ages can participate and benefit from the stock market, including young investors.

But how old do you have to be to invest in the stock market? The answer to this question is not set in stone, as rules and regulations vary from country to country and even within different jurisdictions. In most cases, the minimum age requirement to invest in the stock market is 18. This is the age at which individuals are considered legal adults and are granted the ability to enter into contracts, including investment agreements.

However, for young individuals who are eager to dip their toes into the world of investing, there are still opportunities to get started even before turning 18. In some countries, there are mechanisms in place that allow minors to invest in the stock market under the guidance of a parent or guardian.

Understanding the minimum age requirement for investing in the stock market is just the first step. Young investors also need to be aware of the age requirements for different types of investments, as well as the legal considerations that come into play when investing at a young age.

In this article, we will delve into the various aspects of age requirements for investing and provide valuable insights for young investors looking to enter the stock market. Whether you are a teenager eager to start investing right away or a young adult exploring your options, this article aims to equip you with the knowledge and understanding necessary to make informed investment decisions.

Understanding the Minimum Age Requirement

When it comes to investing in the stock market, there is generally a minimum age requirement in place to ensure that individuals have the legal capacity to enter into investment contracts. This requirement is typically set at 18 years old, as this is the age at which individuals are considered adults in most jurisdictions.

However, it’s important to note that the minimum age requirement can vary depending on the country or region you are in. Some countries may have a higher age requirement, such as 21, while others may have a lower age requirement, such as 16. It’s crucial to familiarize yourself with the specific regulations in your jurisdiction to ensure compliance.

For young individuals who are eager to start investing before reaching the minimum age requirement, there may still be options available. In certain countries, there are mechanisms in place that allow minors to invest in the stock market with the guidance and consent of a parent or guardian.

One common approach is the establishment of a custodial account. A custodial account is set up by an adult on behalf of a minor and is governed by specific rules and regulations. The adult acts as the custodian and manages the account until the minor reaches the age of majority. This allows young investors to begin their investment journey under the supervision and guidance of a responsible adult.

It’s worth noting that while custodial accounts provide an avenue for young investors to participate in the stock market, they still need to comply with any additional regulations or restrictions that may be in place. It’s essential to consult with a financial advisor or legal professional to fully understand the rules and requirements pertaining to custodial accounts in your jurisdiction.

Ultimately, the minimum age requirement for investing in the stock market serves to protect the interests of individuals and ensure they have the necessary legal capacity to make informed investment decisions. By understanding and adhering to these requirements, young investors can begin their investment journey on the right foot and pave the way for a financially secure future.

Age Requirements for Different Types of Investments

When it comes to investing, it’s not just about the minimum age requirement set by the regulatory authorities. Different types of investments may have their own specific age requirements as well. Understanding these requirements is crucial for young investors looking to diversify their investment portfolio.

1. Stock Market: As mentioned earlier, the minimum age requirement to invest in the stock market is typically 18 years old. This requirement ensures that individuals have the legal capacity to enter into investment contracts and make informed decisions. However, some countries may allow minors to invest under the guidance of a parent or guardian through custodial accounts or other similar mechanisms.

2. Mutual Funds: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The age requirement for investing in mutual funds generally aligns with the minimum age requirement for investing in the stock market. Investors under the age of 18 may need to have a custodian or guardian to open and manage the account.

3. Bonds: Bonds are debt securities that are issued by governments, municipalities, or corporations to raise capital. The age requirements for investing in bonds can vary depending on the issuer and the type of bond. Some bonds may have a minimum age requirement of 18, while others may allow minors to invest with parental consent or through custodial accounts.

4. Real Estate: Investing in real estate, whether through direct property ownership or real estate investment trusts (REITs), can also have age requirements. These requirements can vary depending on the country or region and the specific regulations in place. In some cases, individuals may need to be of legal age (usually 18 or 21) to enter into property transactions or invest in REITs.

5. Cryptocurrencies: With the rise of digital currencies like Bitcoin and Ethereum, investing in cryptocurrencies has become increasingly popular. Age requirements for investing in cryptocurrencies can vary, but in general, individuals are required to be of legal age (usually 18) to open a cryptocurrency exchange account and make investments.

It’s important for young investors to be aware of these age requirements for different types of investments. By understanding the specific regulations and guidelines, young investors can navigate the investment landscape more effectively and make informed decisions that align with their financial goals.

Legal Considerations for Young Investors

While young individuals may be eager to start investing in the stock market and other investment vehicles, there are certain legal considerations that they need to be aware of. Understanding these considerations is essential to ensure compliance with the law and protect their rights as investors.

1. Age Requirements: The first and most important legal consideration is the minimum age requirement for investing in different types of assets. As mentioned earlier, the minimum age requirement to invest in the stock market is typically 18. However, there may be exceptions or mechanisms in place for minors to invest under the guidance of a parent or guardian. It’s crucial to research and understand the specific regulations in your jurisdiction.

2. Legal Capacity: Apart from meeting the age requirements, young investors need to have the legal capacity to enter into investment contracts. This means they must have the mental capacity to understand the risks and obligations associated with investing. If a court determines that an individual lacks legal capacity, any investment contracts entered into may be deemed void or unenforceable.

3. Parental or Guardian Consent: In many jurisdictions, if an individual is under the age of majority, they may need to have parental or guardian consent to invest in the stock market or other investment vehicles. This is particularly relevant for custodial accounts or accounts opened on behalf of minors. It’s important to consult with a legal professional or financial advisor to ensure that all necessary consents are obtained.

4. Financial Regulations: Young investors also need to be aware of financial regulations that govern investing activities. These regulations vary from country to country and may impose restrictions on certain types of investments or trading practices. It’s important to stay up to date with the regulatory environment and understand any restrictions or obligations that may apply.

5. Tax Implications: Investing can have tax implications, and young investors should be aware of their tax obligations. This includes understanding how investment gains or income are taxed, as well as any reporting requirements. Consulting with a tax professional can help ensure compliance with tax laws and prevent any potential issues down the line.

It’s critical for young investors to educate themselves about the legal considerations surrounding investing to protect their rights and interests. Seeking advice from legal professionals, financial advisors, or experienced investors can provide valuable guidance and help young investors navigate the complex legal landscape associated with investing.

Choosing the Right Investment Approach for Your Age

When it comes to investing, one size doesn’t fit all. The right investment approach depends on various factors, including your age, financial goals, risk tolerance, and time horizon. As a young investor, it’s important to choose an investment approach that aligns with your age and allows you to maximize the potential for growth while managing risks effectively.

1. Time Horizon: One of the biggest advantages of starting to invest at a young age is the long time horizon ahead. Young investors have the luxury of time to weather market fluctuations and benefit from the power of compounding. With a longer time horizon, young investors can afford to take on more risk and invest in assets with higher growth potential, such as stocks or equity ETFs. The longer the investment horizon, the more you can potentially benefit from market cycles and the growth of your investments.

2. Risk Tolerance: Risk tolerance refers to your ability and willingness to handle market volatility and potential investment losses. As a young investor, you generally have a higher risk tolerance since you have more time to recover from any setbacks in the market. This allows you to consider investments with higher volatility, such as growth stocks or emerging markets. However, it’s important to assess your risk tolerance objectively and ensure that you are comfortable with the level of risk you are taking on.

3. Diversification: Diversification is key to reducing risk in your investment portfolio. As a young investor, you have the opportunity to take a long-term approach to diversification. Consider spreading your investments across different asset classes, sectors, and geographical regions. This can help mitigate the impact of a single investment or sector downturn and capture opportunities for growth in different markets.

4. Retirement Savings: Since you have more time ahead of you, it’s crucial to prioritize retirement savings as a young investor. Consider investing in retirement accounts such as a 401(k) or an Individual Retirement Account (IRA). These accounts offer tax advantages and allow your investments to grow tax-deferred or tax-free until retirement. Starting to save and invest for retirement early can have a significant impact on your financial future.

5. Education and Research: As a young investor, take advantage of the abundance of information and resources available to educate yourself about different investment strategies and approaches. Stay informed about market trends, economic indicators, and company fundamentals. Additionally, consider seeking advice from financial advisors or experienced investors who can provide guidance based on their expertise and experience.

Remember, investment decisions should be based on your personal circumstances and financial goals. Regularly evaluate and reassess your investment approach as you grow older and your financial situation evolves. What may be suitable for you now may need adjustment as you progress through different stages of life.

By choosing the right investment approach for your age, you can set yourself up for long-term financial success and make the most of the opportunities the stock market offers.

Importance of Financial Education for Young Investors

Financial education plays a crucial role in empowering young investors to make informed decisions, navigate the complexities of the stock market, and achieve their financial goals. Here are several reasons why financial education is important for young investors:

1. Building a Strong Foundation: Financial education provides a solid foundation of knowledge and skills necessary for successful investing. It helps young investors understand basic financial concepts, such as budgeting, saving, and investing, and equips them with the tools to develop a comprehensive financial plan. With a strong foundation, young investors can make more informed decisions, evaluate investment opportunities, and effectively manage their financial resources.

2. Empowering Financial Independence: Financial education empowers young investors to take control of their financial future. By understanding the principles of investing, risk management, and personal finance, young investors can develop financial independence and make sound decisions that align with their goals. Financial education helps them navigate the investment landscape, avoid common pitfalls, and confidently make choices that contribute to their long-term financial well-being.

3. Developing Responsible Financial Habits: Financial education instills the importance of responsible financial habits from an early age. It teaches young investors about the benefits of saving, budgeting, and living within means. By developing responsible financial habits, young investors can avoid unnecessary debt, build an emergency fund, and allocate their resources wisely, setting a strong foundation for a secure financial future.

4. Understanding Risk Management: Investing inherently involves risk, and financial education helps young investors understand, evaluate, and manage risk effectively. It emphasizes the importance of diversification, asset allocation, and risk tolerance assessment. By understanding these concepts, young investors can make informed decisions, balance risk and reward, and create a well-diversified investment portfolio that aligns with their goals and risk tolerance.

5. Taking Advantage of Opportunities: The stock market presents numerous opportunities for wealth creation, but it’s crucial to seize these opportunities with knowledge and prudence. Financial education provides young investors with the tools to analyze market trends, evaluate investment strategies, and identify potential investment opportunities. With a solid understanding of the financial landscape, young investors can capitalize on market opportunities and maximize their returns.

6. Adapting to Changing Markets: Financial markets are dynamic and subject to constant change. Financial education equips young investors with the skills to adapt to changing market conditions. It teaches them how to research investment options, analyze market data, and stay informed about economic trends. By continuously learning and staying updated, young investors can respond to market fluctuations and adjust their investment strategies accordingly.

Overall, financial education empowers young investors with the knowledge, skills, and mindset needed to navigate the complex world of investing. It lays the foundation for responsible financial decision-making, helps build financial independence, and sets young investors on a path towards long-term financial success.

Benefits and Risks of Investing at a Young Age

Investing at a young age offers a range of benefits and opportunities for long-term financial growth. However, it also comes with its own set of risks and considerations. Understanding both the benefits and risks is crucial for young investors as they embark on their investment journey:

Benefits of Investing at a Young Age:

1. Time for Compounding: By starting to invest at a young age, investors have a significant advantage—time. The power of compounding allows investments to grow exponentially over time, as earnings from investments generate additional returns. Starting early gives investments more time to compound, potentially resulting in substantial wealth accumulation over the long term.

2. Higher Risk Tolerance: Young investors typically have a longer time horizon before needing to access their investment funds, allowing them to take on more risk in pursuit of higher returns. They can afford to invest in assets with greater volatility and potential growth, such as stocks, which tend to outperform other asset classes over the long term.

3. Ability to Learn from Mistakes: Investing at a young age provides valuable learning opportunities. Young investors have the ability to learn from any mistakes they make and adjust their strategies accordingly. Over time, they can refine their investment skills, develop a stronger investment approach, and make more informed decisions.

Risks and Considerations:

1. Market Volatility: Investing in the stock market inherently involves risk, and young investors must be prepared for market volatility. Prices of stocks and other securities can fluctuate dramatically, which may result in short-term losses. It’s important for young investors to have a long-term perspective and stay focused on their investment goals despite short-term market fluctuations.

2. Limited Financial Resources: Young investors may have limited financial resources compared to more established investors. It’s essential to allocate funds wisely and avoid overextending financially. Diversification is key, as it helps spread risk and protects against significant losses in a single investment.

3. Lack of Experience and Knowledge: Investing requires a certain level of financial knowledge and experience. Young investors may have limited experience in navigating the investment landscape and may be more susceptible to making impulsive decisions or falling victim to investment scams. It’s crucial for young investors to continually educate themselves, seek guidance from professionals, and make well-informed investment choices.

4. Opportunity Cost: Investing at a young age may require tying up funds for the long term, potentially limiting other financial opportunities. It’s important for young investors to strike a balance between investing for the future and managing their current financial obligations and goals.

By understanding the benefits and risks associated with investing at a young age, investors can make informed decisions, develop a long-term investment approach, and take advantage of the opportunities available to them. It’s crucial to continually evaluate and adapt investment strategies as financial circumstances evolve.

Tips for Getting Started as a Young Investor

Starting your journey as a young investor can be both exciting and daunting. To help you get started on the right track, here are some tips to consider:

1. Educate Yourself: Knowledge is the key to successful investing. Take time to educate yourself about different investment options, risk management strategies, and financial concepts. Read books, attend seminars, follow reputable financial websites, and consider taking online courses on investing and personal finance.

2. Set Clear Financial Goals: Define your financial goals and understand why you want to invest. Are you saving for a specific purchase, like a home or car? Are you investing for retirement? Setting clear goals will help guide your investment decisions and keep you motivated.

3. Start with a Small Amount: You don’t need a large sum of money to start investing. Begin with a small amount that you are comfortable with and can afford to invest. As you gain experience and confidence, you can gradually increase your investment contributions.

4. Diversify Your Portfolio: Diversification is the key to reducing risk in your investment portfolio. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to minimize the impact of any specific investment’s performance on your overall portfolio.

5. Invest for the Long Term: Investing is a long-term game. Resist the urge to make impulsive decisions based on short-term market fluctuations. Stay focused on your long-term financial goals and take a disciplined approach to investing over time.

6. Consider Low-Cost Index Funds and ETFs: As a young investor, low-cost index funds and exchange-traded funds (ETFs) can be a great starting point. These funds offer broad market exposure, diversification, and often have low management fees, making them an affordable and easy way to invest in the stock market.

7. Take Advantage of Retirement Accounts: If your employer offers a retirement account, such as a 401(k) or a similar plan, take advantage of it. Contribute as much as you can, especially if your employer offers matching contributions. These accounts provide tax advantages and allow your investments to grow tax-deferred until retirement.

8. Don’t Be Afraid to Ask for Help: If you’re unsure about investing or need guidance, seek help from a financial advisor. A professional can provide personalized advice based on your circumstances and help you develop an investment plan that aligns with your goals and risk tolerance.

9. Stay Informed: Stay updated with financial news, market trends, and economic indicators. Keep abreast of any regulatory changes that may affect your investments. This knowledge will empower you to make informed decisions and adjust your investment strategy as needed.

10. Monitor and Rebalance: Regularly review your investment portfolio to ensure it still aligns with your financial goals and risk tolerance. Consider rebalancing your portfolio periodically to maintain the desired asset allocation and adjust for changes in market conditions.

Remember, investing is a journey that requires patience and continuous learning. By following these tips and staying committed to your financial goals, you can set yourself up for long-term financial success as a young investor.

Conclusion

Investing in the stock market and other investment vehicles at a young age can have significant benefits for your financial future. By starting early, you can harness the power of compounding, take advantage of a longer investment horizon, and develop valuable investing skills. However, it’s important to navigate the investment landscape with knowledge, prudence, and a focus on long-term goals.

Understanding the minimum age requirement for investing, the age requirements for different types of investments, and the legal considerations that come into play is crucial. This ensures that you comply with applicable regulations and protect your rights as an investor.

Choosing the right investment approach for your age involves considering factors such as time horizon, risk tolerance, diversification, and retirement savings. By aligning your investment strategy with your age and financial goals, you can maximize the potential for growth and create a secure financial future.

Financial education plays a vital role in empowering young investors. It provides the knowledge and skills needed to make informed decisions, develop responsible financial habits, and adapt to changing market conditions. Continually educating yourself, seeking guidance, and staying informed about economic trends are key to achieving long-term success.

While investing at a young age offers many benefits, it’s important to be aware of the potential risks and challenges. Market volatility, limited financial resources, and the need to balance current and future financial opportunities are factors to consider. Adhering to a long-term perspective, managing risk effectively, and continually evaluating your investment strategy can help mitigate these risks.

As a young investor, taking the first step and getting started is often the most challenging part. However, with proper knowledge, a clear plan, and the determination to achieve your financial goals, you can set yourself on a path to financial independence and success. Remember to start small, diversify your investments, seek guidance when needed, and stay committed to your long-term goals.

In conclusion, investing at a young age provides a platform for building wealth and securing a bright financial future. With careful planning, continuous learning, and a disciplined approach, you can unlock the potential of the stock market and achieve your financial aspirations.