Home>Finance>How To List Credit Card Minimum Payment Amount On Mint

Finance

How To List Credit Card Minimum Payment Amount On Mint

Published: February 27, 2024

Learn how to easily list your credit card minimum payment amount on Mint to better manage your finances. Discover effective tips and strategies for organizing your finances with Mint.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing credit card payments can be a daunting task, especially when juggling multiple cards with varying due dates and minimum payment amounts. Mint, a popular personal finance management tool, offers a convenient solution to streamline this process by allowing users to track their credit card minimum payment amounts in one centralized location. With Mint, individuals can gain a comprehensive overview of their financial obligations, empowering them to make informed decisions and avoid missed payments.

In this guide, we will walk you through the process of listing your credit card minimum payment amounts on Mint, providing you with the necessary steps to ensure that you stay on top of your credit card obligations and maintain a healthy financial standing. By leveraging the capabilities of Mint, you can simplify the management of your credit card payments, ultimately contributing to your overall financial well-being.

Whether you are a seasoned Mint user or are considering integrating your credit card accounts for the first time, this article will equip you with the knowledge and confidence to effectively utilize Mint's features to monitor and manage your credit card minimum payments. Let's embark on this journey to optimize your financial management with Mint's intuitive tools and features.

Creating a Mint Account

Before delving into the specifics of adding your credit card accounts and tracking minimum payments on Mint, you need to create a Mint account if you haven’t done so already. The process is straightforward and begins with visiting the Mint website or downloading the Mint app from the App Store or Google Play Store.

Once you have accessed the Mint platform, you will be prompted to create an account by providing essential details such as your email address, a secure password, and basic personal information. This step is crucial as it lays the foundation for integrating your financial accounts and gaining access to Mint’s array of financial management tools.

After completing the account creation process, you will have the option to link your bank accounts, credit cards, loans, and other financial accounts to Mint. This integration enables Mint to aggregate and categorize your financial transactions, providing you with a holistic view of your financial standing. Additionally, Mint employs bank-level security measures to ensure the confidentiality and safety of your financial data, offering peace of mind as you leverage its features to optimize your financial management.

By setting up a Mint account and linking your financial accounts, you pave the way for a comprehensive and centralized approach to managing your credit card minimum payments. With your Mint account established, you are now ready to proceed to the next steps of adding your credit card accounts and harnessing Mint’s capabilities to track and display your credit card minimum payment amounts.

Adding Credit Card Accounts

Once your Mint account is set up, the next step is to add your credit card accounts to the platform. This process allows Mint to retrieve and display your credit card transactions, balances, due dates, and, most importantly, minimum payment amounts. Adding your credit card accounts to Mint is a seamless process that enhances your ability to monitor and manage your financial obligations effectively.

To add a credit card account, navigate to the “Accounts” or “Add Accounts” section within the Mint platform. Here, you will find the option to link a new account, where you can search for your credit card provider or bank. Mint supports a wide range of financial institutions, making it likely that your credit card issuer is compatible with the platform. Once you have located your credit card provider, you will be prompted to enter your login credentials for that account.

It is important to note that Mint utilizes bank-level encryption and security protocols to safeguard your login information and financial data. By entering your credentials, you authorize Mint to securely access your credit card account information, including your minimum payment amounts. This access enables Mint to retrieve real-time data and display it within the platform, granting you a comprehensive overview of your credit card accounts alongside your other financial accounts.

After successfully linking your credit card accounts, Mint will begin retrieving and organizing the relevant financial data, including minimum payment amounts. This integration empowers you to conveniently monitor your credit card minimum payments within the Mint interface, eliminating the need to log in to multiple accounts or navigate through various banking platforms to access this critical information.

By adding your credit card accounts to Mint, you position yourself to leverage the platform’s capabilities to track, manage, and display your credit card minimum payment amounts seamlessly. This integration streamlines your financial management, providing a centralized hub for overseeing your credit card obligations alongside your broader financial portfolio.

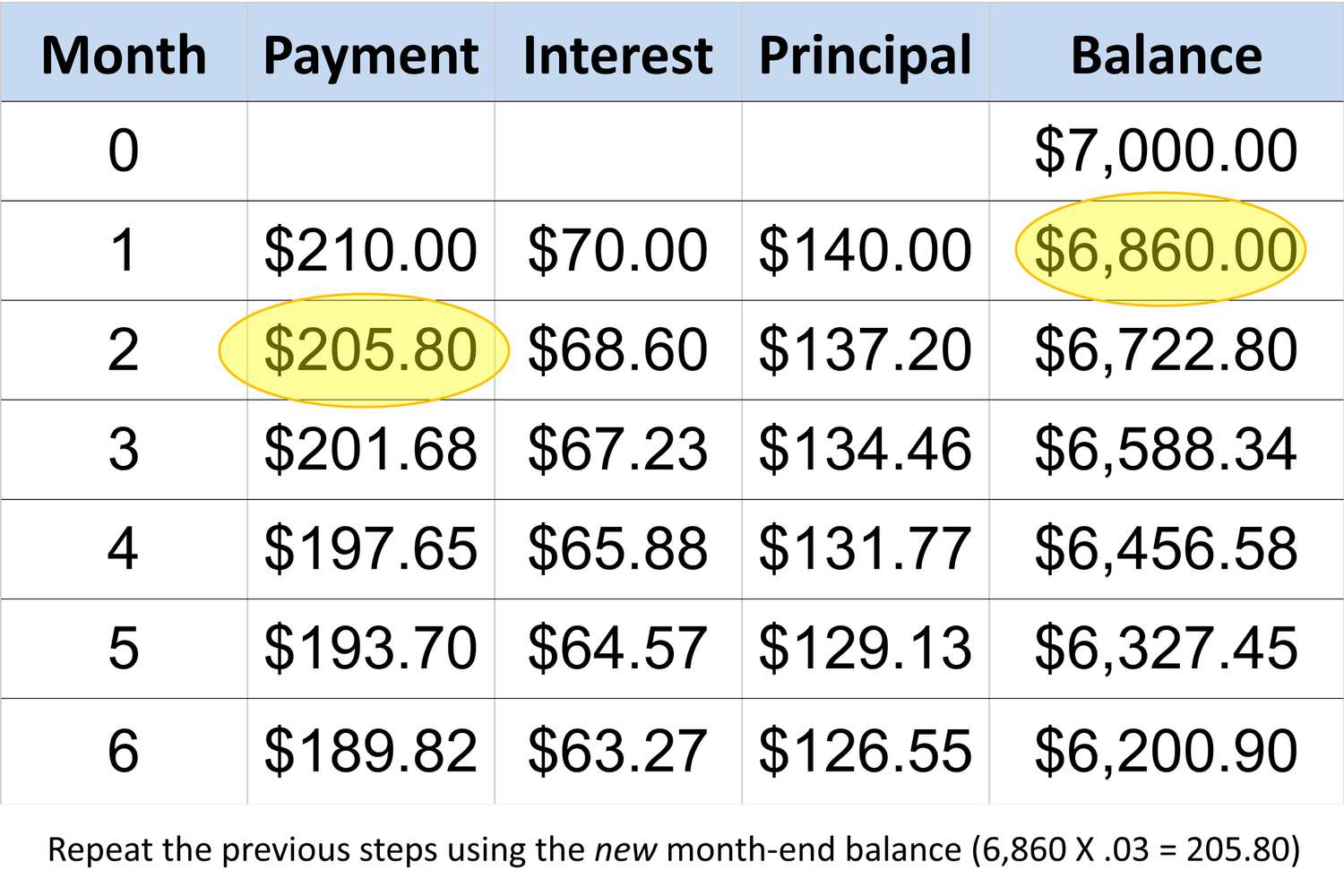

Finding Minimum Payment Amount

Once your credit card accounts are successfully linked to your Mint account, locating the minimum payment amounts becomes a straightforward process. Mint’s intuitive interface and robust financial tracking features enable you to effortlessly access and monitor your credit card minimum payments, empowering you to stay informed and proactive in managing your financial responsibilities.

To find the minimum payment amount for a specific credit card within Mint, navigate to the “Accounts” or “Transactions” section, where you will encounter a comprehensive overview of your linked financial accounts. Within this interface, locate the credit card account for which you wish to view the minimum payment amount.

Upon selecting the specific credit card account, you will be presented with a detailed summary of the account’s transactions, balances, due dates, and, crucially, the minimum payment amount. Mint’s user-friendly design and categorization allow you to identify and isolate the minimum payment figure swiftly, ensuring that you are well-informed about the immediate financial obligation associated with the respective credit card.

Furthermore, Mint’s customizable alerts and notifications feature empowers you to set reminders for upcoming minimum payments, providing an added layer of proactive financial management. By configuring these alerts, you can receive timely notifications regarding approaching due dates and minimum payment requirements, mitigating the risk of overlooking or missing these essential financial commitments.

By leveraging Mint’s interface to locate and monitor your credit card minimum payment amounts, you gain valuable insights into your financial obligations, fostering a proactive and informed approach to managing your credit card accounts. This visibility and accessibility to critical financial data contribute to a comprehensive and streamlined financial management experience, ultimately enhancing your overall financial well-being.

Displaying Minimum Payment on Mint

Once you have successfully located the minimum payment amounts for your credit card accounts within Mint, the platform offers various methods for displaying and organizing this critical financial data. Mint’s interface is designed to provide users with a clear and comprehensive overview of their financial obligations, including minimum payment amounts, ensuring that you can effectively track and manage these essential payments.

Within the Mint dashboard or account summary, you will find a dedicated section that showcases your credit card accounts alongside their respective minimum payment amounts. This layout allows for quick and convenient access to the minimum payment figures associated with each credit card, enabling you to monitor and prioritize these payments effectively.

Mint’s customization options further enhance the display of minimum payment amounts, offering users the flexibility to categorize, label, and prioritize their credit card obligations based on individual preferences. By leveraging Mint’s customizable features, you can tailor the display of minimum payment amounts to align with your financial management priorities, ensuring that you have a clear and organized view of these critical financial commitments.

Furthermore, Mint’s reporting and analysis tools enable users to generate detailed insights into their credit card minimum payments over specific periods, facilitating a deeper understanding of their financial trends and obligations. By accessing these reports, you can gain valuable perspectives on your minimum payment patterns, empowering you to make informed financial decisions and optimize your payment strategies.

By effectively displaying the minimum payment amounts on Mint, you can harness the platform’s capabilities to streamline your financial management, prioritize your credit card obligations, and maintain a proactive approach to meeting these essential payments. This visibility and organization of minimum payment data within Mint contribute to a comprehensive and informed financial management experience, empowering you to stay on top of your credit card responsibilities with ease and confidence.

Conclusion

In conclusion, integrating your credit card accounts and tracking minimum payment amounts on Mint offers a transformative approach to managing your financial obligations. By creating a Mint account and seamlessly adding your credit card accounts to the platform, you gain access to a centralized hub for monitoring and organizing your credit card minimum payments alongside your broader financial portfolio.

Mint’s user-friendly interface and robust financial tracking capabilities empower you to effortlessly locate, display, and prioritize your credit card minimum payment amounts, ensuring that you stay informed and proactive in meeting these critical financial obligations. The platform’s customizable features, including alerts, notifications, and reporting tools, further enhance your ability to manage and optimize your credit card payments effectively.

By leveraging Mint’s comprehensive suite of financial management tools, you can cultivate a proactive and informed approach to your credit card obligations, ultimately contributing to your overall financial well-being. The visibility, accessibility, and organization of minimum payment data within Mint enable you to make informed decisions, avoid missed payments, and maintain a healthy financial standing with confidence and ease.

As you embark on your journey to optimize your financial management with Mint, remember that the platform’s capabilities extend beyond credit card tracking, offering a holistic solution for managing your entire financial landscape. By harnessing Mint’s features, you can gain valuable insights, set financial goals, and cultivate a proactive and empowered approach to achieving your long-term financial aspirations.

In essence, integrating your credit card minimum payments into Mint represents a pivotal step toward enhancing your financial management, fostering informed decision-making, and cultivating a proactive and empowered relationship with your finances. Embrace the convenience and empowerment that Mint offers, and embark on a journey toward sustained financial well-being and peace of mind.