Finance

Advance Funded Pension Plan Definition

Published: October 2, 2023

Learn about the definition and benefits of an advance funded pension plan in the world of finance. Set yourself up for a secure financial future with this valuable retirement tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Advance Funded Pension Plan Definition: Securing Your Financial Future

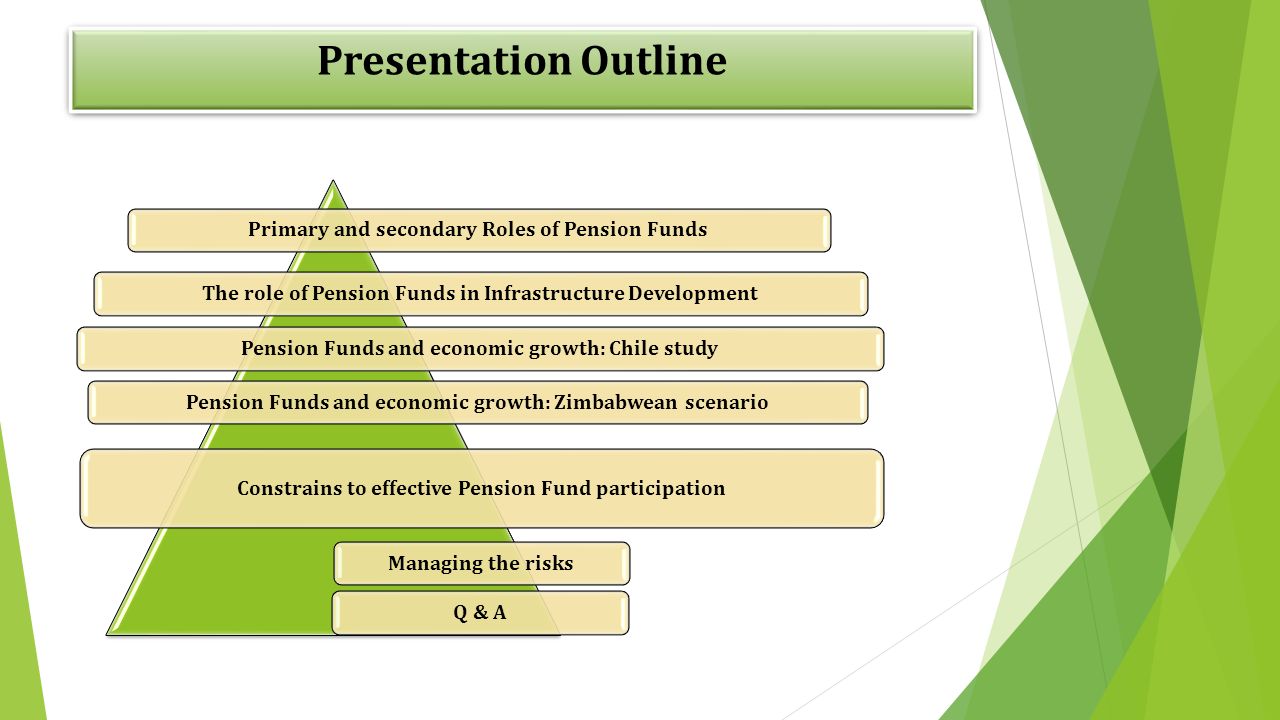

Welcome to our finance category, where we dive deep into all things related to managing your money and securing a prosperous future. Today, we are delving into the world of Advance Funded Pension Plans, an essential topic for anyone looking to plan for retirement. In this blog post, we will define this concept, explore its benefits, and provide expert insights into why you should consider incorporating it into your financial strategy.

Key Takeaways:

- An Advance Funded Pension Plan is a retirement savings vehicle where contributions are made in advance and invested to generate income for future retirement benefits.

- This type of pension plan offers individuals greater control over their retirement funds, increased flexibility for investment choices, and potential tax advantages.

What is an Advance Funded Pension Plan?

An Advance Funded Pension Plan is a specific type of pension plan that seeks to secure retirement funds in advance, empowering individuals to proactively mitigate future financial uncertainties. Unlike traditional pension plans where contributions are made throughout an individual’s working years, in an advance funded plan, contributions are made in advance.

These contributions are then invested in various financial instruments with the intention of generating income and growth over time. The investment returns are accumulated and utilized to fund the future retirement benefits of the plan participants.

Advance funded pension plans provide individuals with greater control over their retirement finances and the opportunity to make investment choices aligned with their risk tolerance and financial goals. Participants can choose from a wide range of investment options, such as stocks, bonds, mutual funds, and more. This flexibility allows individuals to tailor their retirement portfolio to align with their financial objectives.

Benefits of an Advance Funded Pension Plan

Now that we have defined what an advance funded pension plan is, let’s explore some of its key benefits:

- Financial Security: By participating in an advance funded pension plan, individuals can secure a stable income stream during their retirement years, reducing the risk of financial hardship.

- Flexibility: Unlike traditional pension plans, advance funded pension plans offer participants greater flexibility in choosing investment options, enabling them to customize their portfolio based on their risk tolerance and financial goals.

- Control: Individuals have more control over their retirement savings, empowering them to actively manage and monitor their investment performance.

- Tax Advantages: Advance funded pension plans commonly offer potential tax advantages, such as tax-deferred growth on investment earnings, tax deductions on contributions, or tax-free withdrawals during retirement.

- Long-Term Growth: The advance funding approach allows for long-term compounding of investment returns, potentially leading to significant growth in retirement savings.

It’s important to note that every individual’s financial situation is unique, and it’s recommended to consult with a financial advisor or pension plan specialist to determine if an advance funded pension plan is the right choice for you.

In conclusion, an advance funded pension plan can be a vital tool in securing your financial future. By taking a proactive approach to retirement planning, you can enjoy the benefits of increased control, flexibility, and potential tax advantages. Start exploring your options today and empower yourself to build a solid foundation for a prosperous retirement.