Finance

How To Lower APR On Apple Card

Published: March 3, 2024

Learn effective strategies to lower the APR on your Apple Card and take control of your finances. Discover tips to reduce interest rates and save money.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Annual Percentage Rate (APR) on your Apple Card plays a pivotal role in determining the cost of borrowing and managing your credit card balance. Understanding how to lower the APR on your Apple Card can lead to significant savings and improved financial well-being. In this comprehensive guide, we will explore actionable strategies to help you achieve a lower APR and take control of your financial future.

Lowering your APR can result in reduced interest expenses, making it easier to pay off your credit card balance and potentially improve your credit score. By implementing the tips and techniques outlined in this article, you can navigate the process of lowering your Apple Card's APR with confidence and clarity.

Whether you're looking to minimize the cost of carrying a balance or seeking to optimize your credit card terms, the following sections will equip you with the knowledge and strategies needed to lower your Apple Card's APR effectively. From understanding the factors that influence your APR to exploring proactive steps such as improving your credit score and leveraging balance transfer options, this guide will provide you with actionable insights to support your financial goals.

Let's delve into the intricacies of Apple Card APR and discover the steps you can take to lower it, empowering you to make informed financial decisions and achieve greater stability and control over your credit card obligations.

Understand Your Apple Card APR

Before embarking on the journey to lower your Apple Card’s Annual Percentage Rate (APR), it’s essential to grasp the fundamental aspects of this crucial financial metric. The APR represents the annualized interest rate applied to outstanding credit card balances, influencing the cost of borrowing and the overall finance charges incurred. Understanding how your Apple Card’s APR is determined can provide valuable insights into potential avenues for reducing this rate.

Apple Card’s APR is influenced by several factors, including your creditworthiness, prevailing market conditions, and the specific terms and conditions outlined by Goldman Sachs, the issuing bank. Your credit score, payment history, and overall financial profile play a significant role in shaping the APR assigned to your Apple Card account. Individuals with higher credit scores and a history of responsible credit management typically qualify for lower APRs, while those with limited credit history or previous credit challenges may face higher APRs.

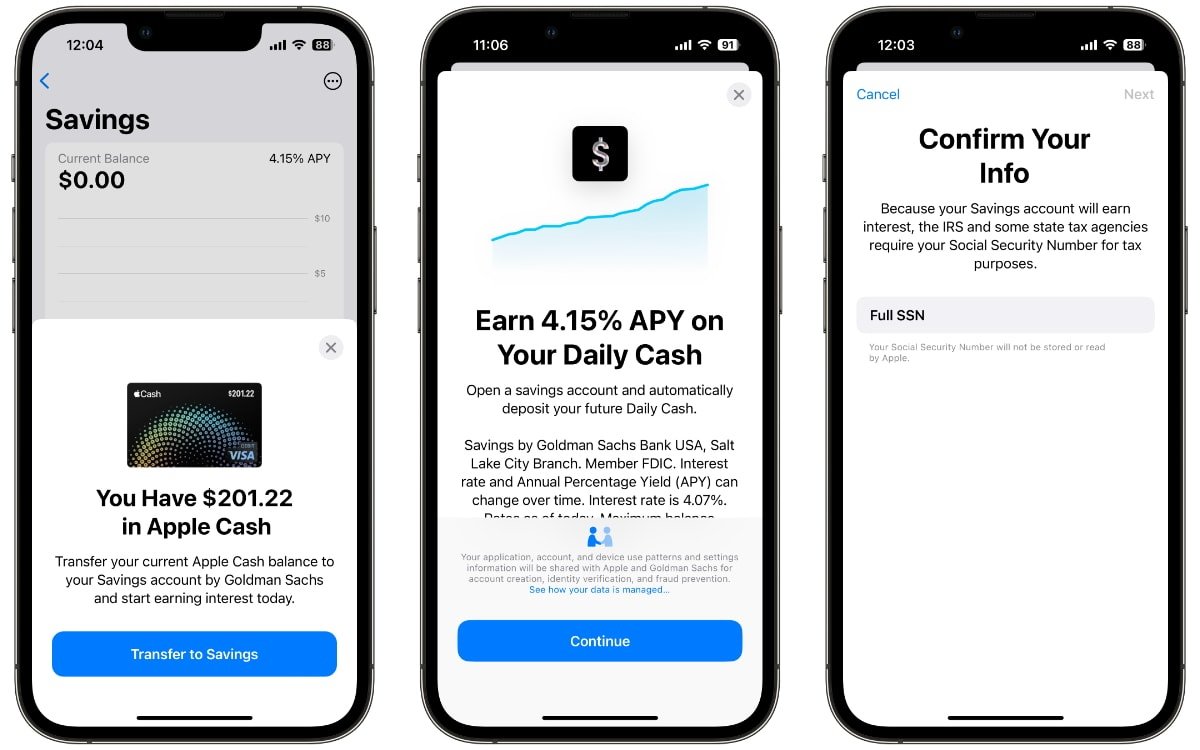

By accessing your Apple Card account through the Wallet app or the Apple Card website, you can review the current APR applicable to your account. It’s important to note that Apple Card offers a range of APRs to accommodate varying credit profiles, and your specific APR may fall within this spectrum based on the aforementioned factors.

Furthermore, familiarizing yourself with the terms and conditions provided by Goldman Sachs for the Apple Card can shed light on the specific criteria and considerations that impact your APR. This can include details regarding promotional APR periods, variable APR structures, and potential adjustments based on market fluctuations or changes in your creditworthiness.

By gaining a comprehensive understanding of your Apple Card’s APR and the underlying factors that influence it, you can lay the groundwork for informed decision-making and strategic actions aimed at lowering this critical aspect of your credit card terms.

Improve Your Credit Score

Enhancing your credit score can serve as a powerful catalyst for securing a lower APR on your Apple Card. Your credit score is a reflection of your creditworthiness and financial responsibility, and it directly influences the terms and conditions offered to you by creditors, including the APR on your credit cards. By taking proactive steps to improve your credit score, you can position yourself for more favorable APRs and enhanced financial flexibility.

Begin by obtaining a copy of your credit report from major credit bureaus such as Equifax, Experian, and TransUnion. Review the report carefully to identify any inaccuracies, discrepancies, or areas for improvement. Addressing errors and rectifying outstanding issues, such as late payments or high credit utilization, can have a positive impact on your credit score over time.

Consistently making on-time payments across all your credit accounts, including loans and other credit cards, is paramount in demonstrating responsible credit management. Timely payments contribute to a positive payment history, a crucial component of your credit score. Additionally, reducing outstanding debt and maintaining a healthy credit utilization ratio— the percentage of available credit being utilized—can further bolster your creditworthiness.

Another strategy to elevate your credit score involves diversifying your credit mix. While responsibly managing credit cards is important, having a mix of credit types, such as installment loans or a mortgage, can showcase your ability to handle various forms of credit responsibly. However, it’s essential to approach new credit applications judiciously, as excessive inquiries or new accounts within a short timeframe can temporarily impact your score.

Patience and persistence are key when pursuing credit score improvements. Positive changes in credit behavior and financial habits may take time to reflect in your credit score, but the long-term benefits, including potential APR reductions on your Apple Card and other credit accounts, make the effort worthwhile.

By actively working to enhance your credit score, you can position yourself for more favorable APR offerings and greater financial opportunities, laying a solid foundation for achieving your long-term financial objectives.

Contact Apple Card Support

When seeking to lower the APR on your Apple Card, engaging directly with Apple Card support can provide valuable insights and potential avenues for addressing this objective. Apple offers dedicated customer support channels, including phone and online assistance, through which cardholders can inquire about their APR, understand available options, and explore potential strategies for securing a lower rate.

Initiating contact with Apple Card support enables you to gain clarity on the specific factors influencing your current APR and the potential pathways for obtaining a reduced rate. By reaching out to the support team, you can inquire about any promotional offers, loyalty programs, or special arrangements that may be available to eligible cardholders seeking improved APR terms.

Additionally, Apple Card support representatives can provide guidance on proactive measures you can take to enhance your credit profile and potentially qualify for a lower APR. This may include insights into credit management best practices, optimizing your credit utilization, and leveraging available resources to bolster your creditworthiness over time.

Furthermore, inquiring about any upcoming changes or enhancements to Apple Card features and benefits can shed light on potential opportunities for securing a more favorable APR. As Apple continues to evolve its financial services offerings, staying informed about new developments and offerings can position you to capitalize on beneficial changes that may impact your APR.

When contacting Apple Card support, it’s beneficial to approach the interaction with a clear understanding of your financial goals and a willingness to explore available options. By articulating your desire to lower your APR and engaging in constructive dialogue with the support team, you can potentially uncover tailored solutions or insights that align with your objectives.

Engaging with Apple Card support reflects a proactive approach to managing your credit card terms and leveraging available resources to optimize your financial outcomes. By leveraging the expertise and support offered by Apple, you can navigate the process of lowering your Apple Card’s APR with confidence and clarity, positioning yourself for improved financial stability and control.

Consider a Balance Transfer

Exploring the option of a balance transfer presents a strategic opportunity to potentially lower the APR on your Apple Card while streamlining your credit card obligations. A balance transfer involves moving existing credit card balances to a new card, often offering an introductory period with a lower or even 0% APR, providing a temporary respite from high interest charges.

When considering a balance transfer, research and compare various credit card offers to identify those with favorable terms, including extended 0% APR promotional periods and competitive balance transfer fees. Many financial institutions and credit card issuers provide promotional incentives to attract new cardholders, making this an opportune time to secure advantageous terms for consolidating and managing your credit card debt.

It’s crucial to assess the overall cost-effectiveness of a balance transfer, factoring in any associated fees, the duration of the promotional APR period, and the post-promotional APR rates. By conducting a comprehensive cost-benefit analysis, you can determine whether a balance transfer aligns with your financial objectives and has the potential to yield long-term savings on interest expenses.

Upon securing a new card with favorable balance transfer terms, initiate the transfer process by providing the necessary details of your Apple Card balance and account. Once the transfer is completed, your Apple Card balance will be paid off by the new card issuer, and you will begin managing the debt under the terms and conditions of the new card, potentially benefiting from a reduced APR during the promotional period.

It’s important to note that responsible credit management is essential when leveraging a balance transfer, as missed payments or failure to repay the transferred balance within the promotional period can lead to accrued interest and potential setbacks in your financial journey. By diligently managing the transferred balance and adhering to the terms outlined by the new card issuer, you can maximize the potential benefits of the balance transfer and work towards lowering your overall interest expenses.

Consideration of a balance transfer presents an opportunity to proactively address high APRs and streamline your credit card debt management, potentially leading to reduced interest costs and enhanced financial flexibility. By strategically evaluating available offers and executing a well-informed transfer, you can position yourself for greater control over your credit card terms and a pathway to lowering the APR on your Apple Card.

Conclusion

Lowering the Annual Percentage Rate (APR) on your Apple Card is a proactive step towards achieving greater financial stability and minimizing the cost of carrying a credit card balance. By understanding the factors that influence your APR and implementing strategic measures, you can work towards securing a lower APR and optimizing your credit card terms.

Understanding your Apple Card’s APR is the first step in navigating the process of lowering it. By familiarizing yourself with the key components that shape your APR, such as creditworthiness and prevailing market conditions, you can gain valuable insights into potential avenues for reducing this critical aspect of your credit card terms.

Improving your credit score serves as a powerful tool in securing a lower APR on your Apple Card. By diligently managing your credit accounts, reducing outstanding debt, and diversifying your credit mix, you can enhance your creditworthiness and position yourself for more favorable APR offerings.

Contacting Apple Card support provides an opportunity to gain clarity on your current APR, explore potential options for securing a lower rate, and engage in constructive dialogue to align your financial goals with available resources and insights.

Considering a balance transfer presents a strategic avenue for potentially lowering the APR on your Apple Card. By researching and comparing balance transfer offers, assessing cost-effectiveness, and diligently managing the transferred balance, you can leverage this option to streamline your credit card obligations and reduce interest expenses.

In conclusion, the quest to lower the APR on your Apple Card is a journey that encompasses financial awareness, proactive credit management, and strategic decision-making. By applying the insights and strategies outlined in this guide, you can navigate this process with confidence and determination, working towards a lower APR and enhanced financial well-being. Empower yourself with knowledge, leverage available resources, and embark on the path to securing a lower APR on your Apple Card, ultimately contributing to improved financial control and long-term success.